Professional Documents

Culture Documents

Jose Jose Espinoza Espinoza: Employee's Address and ZIP Code

Uploaded by

Jose EspinozaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jose Jose Espinoza Espinoza: Employee's Address and ZIP Code

Uploaded by

Jose EspinozaCopyright:

Available Formats

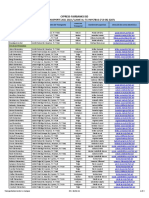

a Employee's SSN 1 Wages, tips, other compensation 2 Federal income tax withheld a Employee's SSN 1 Wages, tips, other

a Employee's SSN 1 Wages, tips, other compensation 2 Federal income tax withheld

644-12-2517 13388.52 983.35 644-12-2517 13388.52 983.35

OMB No. 1545-0008 3 Social security wages 4 Social security tax withheld OMB No. 1545-0008 3 Social security wages 4 Social security tax withheld

13487.06 836.20 13487.06 836.20

b Employer identification number 5 Medicare wages and tips 6 Medicare tax withheld b Employer identification number 5 Medicare wages and tips 6 Medicare tax withheld

02-0650722 13487.06 195.56 02-0650722 13487.06 195.56

c Employer's name, address, and ZIP code c Employer's name, address, and ZIP code

KILGORE INDUSTRIES KILGORE INDUSTRIES

10050 HOUSTON OAKS DRIVE 10050 HOUSTON OAKS DRIVE

HOUSTON, TX 77064 HOUSTON, TX 77064

d Control number 7 Social security tips 8 Allocated tips

e Employee's first name and initial Last name Suff.

JOSE ESPINOZA

e Employee's first name and initial Last name Suff.

15703 CYPRESS MEADOWS DR JOSE ESPINOZA

CHESITO05@GMAIL.COM

15703 CYPRESS MEADOWS DR

CYPRESS, TX 77429 CHESITO05@GMAIL.COM

f Employee's address and ZIP code CYPRESS, TX 77429

d Control number 7 Social security tips 8 Allocated tips

f Employee's address and ZIP code

9 10 Dependent care benefits 11 Nonqualified plans 13 Statutory Retirement Third-party

employee plan sick pay

14 Other 9 10 Dependent care benefits 11 Nonqualified plans

12a

D 98.54

12b 12a 14 Other

D 98.54

12c 12b

12d 12c

13 Statutory Retirement Third-party 12d

employee plan sick pay

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form

W-2 Wage and Tax Statement 2021 Department of the Treasury-Internal Revenue Service Form

W-2 Wage and Tax Statement 2021 Department of the Treasury-Internal Revenue Service

Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Return.

a Employee's SSN 1 Wages, tips, other compensation 2 Federal income tax withheld a Employee's SSN 1 Wages, tips, other compensation 2 Federal income tax withheld

644-12-2517 13388.52 983.35 644-12-2517 13388.52 983.35

OMB No. 1545-0008 3 Social security wages 4 Social security tax withheld OMB No. 1545-0008 3 Social security wages 4 Social security tax withheld

13487.06 836.20 13487.06 836.20

b Employer identification number 5 Medicare wages and tips 6 Medicare tax withheld b Employer identification number 5 Medicare wages and tips 6 Medicare tax withheld

02-0650722 13487.06 195.56 02-0650722 13487.06 195.56

c Employer's name, address, and ZIP code c Employer's name, address, and ZIP code

KILGORE INDUSTRIES KILGORE INDUSTRIES

10050 HOUSTON OAKS DRIVE 10050 HOUSTON OAKS DRIVE

HOUSTON, TX 77064 HOUSTON, TX 77064

e Employee's first name and initial Last name Suff. e Employee's first name and initial Last name Suff.

JOSE ESPINOZA JOSE ESPINOZA

15703 CYPRESS MEADOWS DR 15703 CYPRESS MEADOWS DR

CHESITO05@GMAIL.COM CHESITO05@GMAIL.COM

CYPRESS, TX 77429 CYPRESS, TX 77429

f Employee's address and ZIP code f Employee's address and ZIP code

d Control number 7 Social security tips 8 Allocated tips d Control number 7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 11 Nonqualified plans 9 10 Dependent care benefits 11 Nonqualified plans

12a 14 Other 12a 14 Other

D 98.54 D 98.54

12b 12b

12c 12c

12d 12d

13 Statutory Retirement Third-party 13 Statutory Retirement Third-party

employee plan sick pay employee plan sick pay

15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 15 State Employer's state ID number 16 State wages, tips, etc. 17 State income tax

18 Local wages, tips, etc. 19 Local income tax 20 Locality name 18 Local wages, tips, etc. 19 Local income tax 20 Locality name

Form

W-2 Wage and Tax Statement

2021 Copy C - For EMPLOYEE'S RECORDS. Form

W-2 Wage and Tax Statement

2021 Department of the Treasury-Internal Revenue Service

Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Return.

This information is being furnished to the Internal Revenue Service. If you are required to file a tax

return, a negligence penalty or other sanction may be imposed on you if this income is taxable and

you fail to report it.

You might also like

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- 20212Document2 pages20212carriemccabeNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- 20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeDocument2 pages20306.87 20306.87 IN IN 637.90 637.90: Notice To EmployeeWillie Davis0% (1)

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Income Tax ReturnDocument5 pagesIncome Tax Returnevalle13100% (1)

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- Time For TaxDocument108 pagesTime For TaxCj johnson100% (1)

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- 2021 Tax Return: Prepared ByDocument12 pages2021 Tax Return: Prepared ByRobert James100% (1)

- 2018 Turbo Tax ReturnDocument5 pages2018 Turbo Tax ReturnAnfacNo ratings yet

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Document4 pagesKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonNo ratings yet

- w-2 2019 Form - LOUISA - BOKACHEVADocument1 pagew-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNo ratings yet

- 2021TaxReturnPDF 221003 100736Document18 pages2021TaxReturnPDF 221003 100736Tracy SmithNo ratings yet

- 2021 Tax Return: Prepared ByDocument6 pages2021 Tax Return: Prepared BySolomonNo ratings yet

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocument15 pagesMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programdog dogNo ratings yet

- Electronic Filing Instructions For Your 2019 Federal Tax ReturnDocument31 pagesElectronic Filing Instructions For Your 2019 Federal Tax ReturnJose Miguel Hernandez CarelaNo ratings yet

- 2020 Tax 1040 Form MistyDocument2 pages2020 Tax 1040 Form Mistypatrick11470% (1)

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Loan AppDocument9 pagesLoan Appanon-209253No ratings yet

- Income Tax Return - MHSO - 2022-23Document5 pagesIncome Tax Return - MHSO - 2022-23Mahbub SiddiqueNo ratings yet

- HRBlockDocument7 pagesHRBlocksusu ultra menNo ratings yet

- FTFCS 2023-04-14 1681510273125 PDFDocument17 pagesFTFCS 2023-04-14 1681510273125 PDFIvel RhaenNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- FTF 2023-08-12 1691895826386Document7 pagesFTF 2023-08-12 1691895826386El Guero CastroNo ratings yet

- 2021 - TaxReturn MICHAEL KansasDocument2 pages2021 - TaxReturn MICHAEL Kansasbflames50% (2)

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusKenneth Schackai100% (1)

- Screenshot 2020-03-13 at 4.33.54 PMDocument6 pagesScreenshot 2020-03-13 at 4.33.54 PMJordan Leigh AuriemmaNo ratings yet

- FTF 2022-04-19 1650352670778Document11 pagesFTF 2022-04-19 1650352670778Charles Goodwin100% (3)

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing Statuskenneth kittleson100% (1)

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- 2020FTFCS 2022-02-26 1645943726435Document5 pages2020FTFCS 2022-02-26 1645943726435Mark Bagliani100% (1)

- Final Tax Jose Serpa 2021Document39 pagesFinal Tax Jose Serpa 2021Sarahi Payan100% (1)

- Colon JuniorDocument36 pagesColon JuniorVicmali Papeleria Ciber50% (2)

- Sin TítuloDocument14 pagesSin TítuloTavo MCNo ratings yet

- FTF 2023-02-04 1675555956991Document3 pagesFTF 2023-02-04 1675555956991Brayan Teodoro Santiago Pascual100% (4)

- Federal Electronic Filing Instructions: Tax Year 2018Document13 pagesFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- Prommisary Note USFDocument8 pagesPrommisary Note USFdjduttonNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument9 pagesU.S. Individual Income Tax Return: Filing Statuswalessadone50% (2)

- Federal 2016 :DDocument15 pagesFederal 2016 :DAnguila Angel Anguila AngelNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument8 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramOsayameGaius-ObasekiNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument28 pagesU.S. Individual Income Tax Return: Filing StatusSenae Lopez100% (3)

- Estmt - 2023 02 15Document6 pagesEstmt - 2023 02 15phillip davisNo ratings yet

- Hynum Greg Angela - 20i - CCDocument76 pagesHynum Greg Angela - 20i - CCAdmin OfficeNo ratings yet

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocument10 pagesFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramRhaxma ConspiracyNo ratings yet

- W2 FinalDocument1 pageW2 FinalWaqar Hussain100% (1)

- Tax ReturnDocument15 pagesTax ReturnCristóbal Rodas100% (1)

- 120s Az FormDocument19 pages120s Az FormStacey CanaleNo ratings yet

- FTF 2023-02-11 1676146567403 PDFDocument19 pagesFTF 2023-02-11 1676146567403 PDFJohn100% (3)

- Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Document2 pagesSebastian Desmond PO BOX 1717 West Sacramento Ca 95691 Sebastian Desmond PO BOX 1717 West Sacramento Ca 95691Deborah Beth DarlingNo ratings yet

- 2019 Tax Return Documents (Mollah Ruisul I and Arm)Document8 pages2019 Tax Return Documents (Mollah Ruisul I and Arm)Barney The DinosaurNo ratings yet

- 2019 Turbo Tax ReturnDocument113 pages2019 Turbo Tax Returnjason borneNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- Atla - Adn SplashDocument1 pageAtla - Adn Splashnatali jimenezNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account ActivityJose EspinozaNo ratings yet

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account ActivityJose EspinozaNo ratings yet

- Ez Tag Agreement Terms & ConditionsDocument5 pagesEz Tag Agreement Terms & ConditionsJose EspinozaNo ratings yet

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account ActivityJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account ActivityJose EspinozaNo ratings yet

- Breakfast With Santa Letter - MAPDocument1 pageBreakfast With Santa Letter - MAPJose EspinozaNo ratings yet

- Payment Information Summary of Account ActivityDocument4 pagesPayment Information Summary of Account ActivityJose EspinozaNo ratings yet

- Subtotal Policy Fee Taxes $1,540.00 $125.00 $82.00: Total $1,747.00Document2 pagesSubtotal Policy Fee Taxes $1,540.00 $125.00 $82.00: Total $1,747.00Jose EspinozaNo ratings yet

- Enrollment PackageDocument11 pagesEnrollment PackageJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Type Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Type Current Prior Usage TypeJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Terms TXDocument10 pagesTerms TXJose EspinozaNo ratings yet

- 2021-2022 Kilgore English Brochure 2Document25 pages2021-2022 Kilgore English Brochure 2Jose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- Estatement 2 25 2022Document2 pagesEstatement 2 25 2022Jose EspinozaNo ratings yet

- Adding Header: Electricity PriceDocument1 pageAdding Header: Electricity PriceJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- 2122 Who To Contact in Transportation SpanishDocument3 pages2122 Who To Contact in Transportation SpanishJose EspinozaNo ratings yet

- Jose Espinoza: TX - 4 Hours Ce For Electricians - 2023Document1 pageJose Espinoza: TX - 4 Hours Ce For Electricians - 2023Jose EspinozaNo ratings yet

- 0 Dumpacore 3rd Com - Samsung.android - App.contactsDocument210 pages0 Dumpacore 3rd Com - Samsung.android - App.contactsJose EspinozaNo ratings yet

- Attendee Name Espinoza: Seaworld & Aquatica San Antonio 2022 Season PassDocument5 pagesAttendee Name Espinoza: Seaworld & Aquatica San Antonio 2022 Season PassJose EspinozaNo ratings yet

- Messages: Meter No. Read Date Size Current Prior Usage TypeDocument1 pageMessages: Meter No. Read Date Size Current Prior Usage TypeJose EspinozaNo ratings yet

- 2223 CHILDCARE Facilities Eligible For District Bus Transp 07.26.21 Website SpanishDocument3 pages2223 CHILDCARE Facilities Eligible For District Bus Transp 07.26.21 Website SpanishJose EspinozaNo ratings yet

- Slide 1Document4 pagesSlide 1Jeffrey CardonaNo ratings yet

- Introduciton: Payung Sebelum Hujan" Namely Prevention Is Better Than CureDocument17 pagesIntroduciton: Payung Sebelum Hujan" Namely Prevention Is Better Than CurePutera IRNo ratings yet

- It's Not Business As Usual: Startups in Healthcare, Education, LivelihoodDocument42 pagesIt's Not Business As Usual: Startups in Healthcare, Education, Livelihoodmeghnarao91No ratings yet

- Lockhead Detective and Watchman Agency v. UPDocument3 pagesLockhead Detective and Watchman Agency v. UPSean GalvezNo ratings yet

- Econ Reflective EssayDocument4 pagesEcon Reflective Essayapi-402338485No ratings yet

- A PROJECT REPORT On Ratio Analysis at Haripriya Organic Chemical PVT LTDDocument71 pagesA PROJECT REPORT On Ratio Analysis at Haripriya Organic Chemical PVT LTDBabasab Patil (Karrisatte)No ratings yet

- (HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 7 (Selection and Placement) - 31191022307Document1 page(HRM-DH45ISB-1) Nguyễn Minh Thảo - Mindmap Session 7 (Selection and Placement) - 31191022307Ng. Minh ThảoNo ratings yet

- WTD-0910-006 - MTI Booklet FINAL (Web-Email v2)Document20 pagesWTD-0910-006 - MTI Booklet FINAL (Web-Email v2)Sumit BatraNo ratings yet

- A Feasibility Study For A Cleaning CompanyDocument53 pagesA Feasibility Study For A Cleaning CompanyRogerNo ratings yet

- UMADocument17 pagesUMAMohmmedKhayyumNo ratings yet

- Philippine Air Lines V PALEADocument11 pagesPhilippine Air Lines V PALEAKleurence TateishiNo ratings yet

- KPMG Work-Anywhere-Together-ServiceDocument3 pagesKPMG Work-Anywhere-Together-ServiceNitikaNo ratings yet

- Cultural Awareness Hosp TourismDocument16 pagesCultural Awareness Hosp TourismKrisdaryadiHadisubrotoNo ratings yet

- Pak Suzuki 2003Document18 pagesPak Suzuki 2003Nouman ShahNo ratings yet

- Application Form: Chhandasri MISHRADocument4 pagesApplication Form: Chhandasri MISHRALisa MishraNo ratings yet

- Law On Public Officers: General PrinciplesDocument40 pagesLaw On Public Officers: General PrinciplesCelina GonzalesNo ratings yet

- Bechtel Gets A Grip On Hand ProtectionDocument3 pagesBechtel Gets A Grip On Hand ProtectionKyaw Kyaw AungNo ratings yet

- Assignment. Week 12Document5 pagesAssignment. Week 12ednaNo ratings yet

- Business Studies NSC P1 QP May June 2023 Eng Eastern CapeDocument10 pagesBusiness Studies NSC P1 QP May June 2023 Eng Eastern Cape克莱德No ratings yet

- Standard Costing, Operational Performance Measures, and The Balanced ScorecardDocument60 pagesStandard Costing, Operational Performance Measures, and The Balanced ScorecardqueenfaustineeNo ratings yet

- Philippine Economic SystemDocument1 pagePhilippine Economic SystemShawn BacaniNo ratings yet

- Quality Control ReportsDocument12 pagesQuality Control ReportsIgnacio Luis Reig Mataix100% (1)

- 2.guess Questions - Problems - QuestionsDocument34 pages2.guess Questions - Problems - QuestionsKrishnaKorada67% (9)

- University of Nebraska Lincoln COMM 286 Business and Professional Communication Communicating at Work 12Th Ed by Ronald AdlerDocument62 pagesUniversity of Nebraska Lincoln COMM 286 Business and Professional Communication Communicating at Work 12Th Ed by Ronald AdleralishcathrinNo ratings yet

- CHECKLIST OF REQUIREMENTS Annex CDocument1 pageCHECKLIST OF REQUIREMENTS Annex CLaarni RamirezNo ratings yet

- Seminar 5 Outsourcing at Any CostDocument2 pagesSeminar 5 Outsourcing at Any CostPatricia Idl0% (1)

- Application On Resident Engineer SingaporeDocument4 pagesApplication On Resident Engineer SingaporeIz ShafiNo ratings yet

- Manish Soni - Offer LetterDocument2 pagesManish Soni - Offer LetterMd SharidNo ratings yet

- Chapter 3-OSH-International-Labour-OrganizationDocument20 pagesChapter 3-OSH-International-Labour-OrganizationJosh AlbertoNo ratings yet

- New z102 BabsDocument6 pagesNew z102 BabsZukiswa StholeNo ratings yet