Professional Documents

Culture Documents

Registration of Law Firm

Uploaded by

Madmax Tyrant0 ratings0% found this document useful (0 votes)

7 views3 pagesOriginal Title

REGISTRATION OF LAW FIRM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesRegistration of Law Firm

Uploaded by

Madmax TyrantCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

REGISTRATION OF LAW FIRM

Pre-requisites for registration of law firm:

Min. 21 Years of age.

Law degree from any university of India or foreign recognised by BCI.

Registered with any of the Bar councils.

Registration as LLP:

Limited liability Partnership is a partnership in which all or some of the partners have limited

liabilities. It limits the liabilities of partners to their contributions to the business and also

offers protection to each partner from the negligence, misdeeds or incompetence of other

partners.

Min. Members: 2

Max. Members: No limit (Less than 200)

There can be 2 type of partners in a LLP.

(a) Normal Partners: He is not liable for legal compliances.

(b) Designated Partners: Responsible to manage affairs, take decision, liable for legal

compliances.

PROCEDURE:

Step 1 NAME APPROVAL:

The first step is to check whether the name for LLP is already registered or not. This can be

checked on the official website of MCA (Ministry of Corporate affairs). Visit MCA website,

then click on MCA Services then Master data and then click on View Company or LLP

master data. Check whether the name is already registered or not.

If not then proceed to MCA services and click on LLP e-filing then apply for RUN-LLP

(Reserve Unique name). Also add LLP along with name.

Application Fees: Rs. 200

After name approval you will get SRN (Service Request no.)

Step 2 DSC:

Obtain Digital Signature Certificate of Class 2 category of Min. 2 designated Partners. It can

be obtained from eMudhra website and is usually valid for 1-3 years.

Fees: Max Rs.1500/person

Step 3 DIN/DPIN:

DIN/DPIN(Designated Partner Identification Number) is a unique 8 digit no. required for any

present or future designated partners. It never expires and allotted immediately when

application is filed but in some case, additional documents may be requested.

It can be applied while registration of LLP but if address on aadhar card and bank statement

of any designated partner is not same then it is to be applied separately with an additional

cost of Rs. 500.

Step 4 Rent Agreement:

Rent Agreement for address on which LLP is registered in the name of any one designated

partner which certifies that the designated partners are working in the name of approved LLP

on that address.

Rent Agreement Format:

https://drive.google.com/file/d/1mFKfG4XSf84qE7ocfoaE6kbDa6IlvMkG/view

In addition, a rent receipt on a simple paper made by landlord declaring that rent received

from the designated Partner.

Rent Receipt Format:

https://drive.google.com/file/d/1mivPMZBL55Uz_LBaycage8b6npEW3f5N/view

Step 5 NOC:

NOC from landlord declaring that he had no objection if designated partner do business on

their land.

NOC format:

https://drive.google.com/file/d/1kc3OZB7qUi5ikMLj1n2Sd2Nwt1YX0XbT/view

Step 6 LLP Registration form:

After all the above documents are prepared then download LLP Registration form format

from MCA website available under E-filing tab in MCA Services and fill the same.

LLP registration fees depends upon capital,

Upto 1 lakh: Rs. 500

Upto 5 lakhs: Rs. 2000

Upto 10 lakhs: Rs. 4000

Above 10 lakhs: Rs. 5000

After filling form and paying registration fees, verify it with any CA, CS, CMA or Advocate

who by digital certificate certify this form and that the application is submitted.

Step 7 LLP Agreement:

After receiving certificate of Registration/incorporation, LLP Agreement must be formed and

submitted within 30 days whichi include name, address, rights, liabilities, share of profit and

loss on stamp paper, Stamp duty to be paid on the same which varies from state to state.

LLP Agreement format:

https://drive.google.com/file/d/1BrjlQjz8mfuSuc49aWlcCBXe9lY_-Zhx/view

In Delhi: For capital Upto 1 lakh: Rs. 1000

Upto 5 lakh: Rs 3000

Above 5 lakh: Rs 5000

LLP Stamp duty collection for each state:

https://drive.google.com/file/d/1ho-vpwTJwGYMzqEYldaULv0yuVXVmFVK/view

You might also like

- Guide to Registering an LLP in IndiaDocument12 pagesGuide to Registering an LLP in IndiaananthkalviNo ratings yet

- Limited Liability Partnership (LLP) Registration in IndiaDocument6 pagesLimited Liability Partnership (LLP) Registration in IndiaSOURABH JAINNo ratings yet

- LLP Incorporation ProcedureDocument3 pagesLLP Incorporation ProcedureCorproNo ratings yet

- Meaning of Limited Liability Partnership (LLP)Document8 pagesMeaning of Limited Liability Partnership (LLP)bobby1993 DunnaNo ratings yet

- Limited Liability Partnership in India: Ragini Chokshi & AssociatesDocument27 pagesLimited Liability Partnership in India: Ragini Chokshi & Associatesvivian j thomasNo ratings yet

- PDF of LLPDocument2 pagesPDF of LLPAiman FatimaNo ratings yet

- LLP Conversion ProcedureDocument3 pagesLLP Conversion ProcedureCorproNo ratings yet

- 2) Note On LLP RegistrationDocument2 pages2) Note On LLP Registrationkhan_m_azharNo ratings yet

- Registration of CompanyDocument8 pagesRegistration of CompanySachin PatelNo ratings yet

- Registration of Different CompanyDocument5 pagesRegistration of Different CompanyAusNo ratings yet

- Everything You Need to Know About Forming an LLPDocument4 pagesEverything You Need to Know About Forming an LLPManoj Kumar MannepalliNo ratings yet

- NY Real Estate Broker Application InstructionsDocument13 pagesNY Real Estate Broker Application InstructionskypreonycNo ratings yet

- Registration of Partnership Firm in DelhiDocument7 pagesRegistration of Partnership Firm in DelhiTushar GuptaNo ratings yet

- Procedure of Converting Partnership Firm Into A Private Limited CompanyDocument4 pagesProcedure of Converting Partnership Firm Into A Private Limited CompanylakshaymeenaNo ratings yet

- Business Laws II ADocument38 pagesBusiness Laws II Aashishtomar8171No ratings yet

- Ali Raza Law Assigment 3Document3 pagesAli Raza Law Assigment 3tahleel bashiNo ratings yet

- 1 2Document14 pages1 2Bhagyashree C KNo ratings yet

- Forming an LLP: Key Steps and RequirementsDocument6 pagesForming an LLP: Key Steps and RequirementsRana Gurtej100% (1)

- Unlimited Opportunity: Becoming An LLP Will Help Smes Attract That Much Needed CapitalDocument6 pagesUnlimited Opportunity: Becoming An LLP Will Help Smes Attract That Much Needed Capitaljeevan_v_mNo ratings yet

- WWW - Llp.gov - in WWW - Mca.gov - in WWW - Llp.gov - In: How To Incorporate A New Limited Liability PartnershipDocument3 pagesWWW - Llp.gov - in WWW - Mca.gov - in WWW - Llp.gov - In: How To Incorporate A New Limited Liability Partnershipsagar_asp1904No ratings yet

- LLP Formation RequirementsDocument8 pagesLLP Formation RequirementsShashank JathanNo ratings yet

- Limited Liability Partnership Act, 2008Document9 pagesLimited Liability Partnership Act, 2008BHAVIK RATHODNo ratings yet

- Incorporation of A Private Limited CompanyDocument5 pagesIncorporation of A Private Limited CompanyAnoop KalathillNo ratings yet

- Gr6 SecB Limited Liability PartnershipDocument23 pagesGr6 SecB Limited Liability PartnershipKanika SharmaNo ratings yet

- Blaw AssignmentDocument4 pagesBlaw AssignmentGitan ChopraNo ratings yet

- The Incorporation ProcessDocument5 pagesThe Incorporation ProcessAtif Butt 1179-FMS/MS/S20No ratings yet

- Limited Liability Partnership: Emerging Corporate Form"Document32 pagesLimited Liability Partnership: Emerging Corporate Form"Adv Bhavik A SolankiNo ratings yet

- How To Register A Company (Pvt. LTD.) : Step1: Acquire DIN (Director Identification Number)Document7 pagesHow To Register A Company (Pvt. LTD.) : Step1: Acquire DIN (Director Identification Number)hunky11No ratings yet

- Limited Liability Partenership: A New Corporate Form Under TheDocument14 pagesLimited Liability Partenership: A New Corporate Form Under TheVenkata Naga PratapNo ratings yet

- Business LawDocument10 pagesBusiness LawDharvi SinghalNo ratings yet

- Limited Liability Partnership: A Fair Deal of Corporate SectorDocument8 pagesLimited Liability Partnership: A Fair Deal of Corporate SectorJosef AnthonyNo ratings yet

- LLP RegistrationDocument2 pagesLLP RegistrationLopamudracsNo ratings yet

- Documents Required for GST, Company, Export, MSME & Trademark RegistrationsDocument8 pagesDocuments Required for GST, Company, Export, MSME & Trademark RegistrationsFinance & Health ExpressNo ratings yet

- 2) Business Laws II A July 2022Document38 pages2) Business Laws II A July 2022akash nakkiranNo ratings yet

- Business Law Chapter 20Document11 pagesBusiness Law Chapter 20Dev TandonNo ratings yet

- LLP Presentation by ROCDocument18 pagesLLP Presentation by ROCKalyanKumarNo ratings yet

- IBF Company Registration Assignment 1Document17 pagesIBF Company Registration Assignment 1Sharjeel RafaqatNo ratings yet

- Limited Liability PartnershipDocument32 pagesLimited Liability PartnershipPadmanabha NarayanNo ratings yet

- Formation of CompaniesDocument7 pagesFormation of Companiesmanoranjan838241No ratings yet

- LegalDocument32 pagesLegalAkriti SinghNo ratings yet

- LLP Salient FeaturesDocument51 pagesLLP Salient Featuresmilind MarneNo ratings yet

- How To Procure DPINDocument2 pagesHow To Procure DPINCorproNo ratings yet

- LIMITED LIABILITY PARTNERSHIP VS PRIVATE LIMITED COMPANYDocument2 pagesLIMITED LIABILITY PARTNERSHIP VS PRIVATE LIMITED COMPANYpratyusharaviNo ratings yet

- BSP Project 234567Document11 pagesBSP Project 234567Anjan Kumar SmitNo ratings yet

- How To Register Software Co. in IndiaDocument3 pagesHow To Register Software Co. in IndiahridayNo ratings yet

- Company Formation Application - New - Individual V.1.3Document9 pagesCompany Formation Application - New - Individual V.1.3Dmitriy NosovNo ratings yet

- What Is Incorporation of A CompanyDocument4 pagesWhat Is Incorporation of A CompanyAnshika GuptaNo ratings yet

- Data Management Outsourcing AgreementDocument4 pagesData Management Outsourcing Agreementjatin malikNo ratings yet

- Differences between Companies and LLPsDocument6 pagesDifferences between Companies and LLPscaharshNo ratings yet

- DevaangDev Sem4 CommercialLaw RegistrationOfFirmDocument12 pagesDevaangDev Sem4 CommercialLaw RegistrationOfFirmDeeveegeeNo ratings yet

- Procedure For Public Limited Company FormationDocument4 pagesProcedure For Public Limited Company Formationlalbabu guptaNo ratings yet

- Types of Partnership Firms and Registration ProcessDocument20 pagesTypes of Partnership Firms and Registration ProcessKiranNo ratings yet

- Registration of LLPDocument5 pagesRegistration of LLPMahes KalaNo ratings yet

- LLPARTNERSHIPDocument6 pagesLLPARTNERSHIPAltafMakaiNo ratings yet

- Everything You Need to Know About Private Company Incorporation in IndiaDocument5 pagesEverything You Need to Know About Private Company Incorporation in IndiaSubashini A 21PBA021No ratings yet

- Partnership Firm Registration - Partnership Firm Registration Documents RequiredDocument14 pagesPartnership Firm Registration - Partnership Firm Registration Documents RequireddeAsra Foundation100% (1)

- Documents Required For Company Registration - Taxguru - inDocument6 pagesDocuments Required For Company Registration - Taxguru - inVyom RajNo ratings yet

- Lab Project DraftDocument17 pagesLab Project DraftSAURAV KUMAR GUPTANo ratings yet

- Perjanjian Rakan Kongsi ExnessDocument3 pagesPerjanjian Rakan Kongsi ExnessmyexnessfxNo ratings yet

- List of Advocates with DetailsDocument25 pagesList of Advocates with DetailsMadmax TyrantNo ratings yet

- RJS Sample Law Paper 1 Volume 2Document18 pagesRJS Sample Law Paper 1 Volume 2Madmax TyrantNo ratings yet

- Brochure NG Fest 2022 FinalDocument2 pagesBrochure NG Fest 2022 FinalMadmax TyrantNo ratings yet

- Rules of 13th NG Fest - Moot Court CompetitionDocument7 pagesRules of 13th NG Fest - Moot Court CompetitionMadmax TyrantNo ratings yet

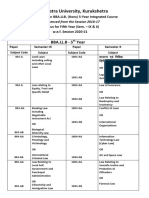

- Kurukshetra University, Kurukshetra: BBA - LL.B - 5 YearDocument45 pagesKurukshetra University, Kurukshetra: BBA - LL.B - 5 YearMadmax TyrantNo ratings yet

- Latest Laws BrochureDocument32 pagesLatest Laws BrochureMadmax TyrantNo ratings yet

- Memo Sanskar and VanshajDocument27 pagesMemo Sanskar and VanshajMadmax TyrantNo ratings yet

- Note - Tribunal System in IndiaDocument6 pagesNote - Tribunal System in IndiaMadmax TyrantNo ratings yet

- (Established by The State Legislature Act XII of 1956) ("A+" Grade NAAC Accredited)Document20 pages(Established by The State Legislature Act XII of 1956) ("A+" Grade NAAC Accredited)Madmax TyrantNo ratings yet

- Secularism in MalistanDocument8 pagesSecularism in MalistanMadmax TyrantNo ratings yet

- Section 1 - Moot Court Locke v. DaveyDocument40 pagesSection 1 - Moot Court Locke v. DaveyMadmax TyrantNo ratings yet

- Display PDFDocument4 pagesDisplay PDFMadmax TyrantNo ratings yet

- B.B.A LL.B Sem V ViDocument23 pagesB.B.A LL.B Sem V ViMadmax TyrantNo ratings yet

- Affiliation Bye Laws 2018 - Chapter WiseDocument1 pageAffiliation Bye Laws 2018 - Chapter WiseMadmax TyrantNo ratings yet

- (Cite As: 2000 WL 33162199 (Mass - Super.) ) : School Committee, No.2000-J-638 (NovemDocument7 pages(Cite As: 2000 WL 33162199 (Mass - Super.) ) : School Committee, No.2000-J-638 (NovemMadmax TyrantNo ratings yet

- B.B.A LL.B Sem Iii IvDocument19 pagesB.B.A LL.B Sem Iii IvMadmax TyrantNo ratings yet

- Moonlighting PolicyDocument3 pagesMoonlighting PolicyAnavi JaitleyNo ratings yet

- Enduring Power of Attorney GuideDocument2 pagesEnduring Power of Attorney GuideAYESHA NAAZ0% (1)

- Obtaining cancellation of counterbondDocument1 pageObtaining cancellation of counterbondElaizza ConcepcionNo ratings yet

- Freewill Act and Deed: This Instrument Was Prepared byDocument20 pagesFreewill Act and Deed: This Instrument Was Prepared byYarod Yisrael100% (2)

- IDFC FIRST Bank Letter of Appointment Along With Model Terms and ConditionsDocument6 pagesIDFC FIRST Bank Letter of Appointment Along With Model Terms and ConditionsSidharth patraNo ratings yet

- Customary Law Insights: UgandaDocument12 pagesCustomary Law Insights: UgandaCynthia Auma50% (2)

- Power of Attorney For Execution and Presentation Before Sub-RegistrarDocument3 pagesPower of Attorney For Execution and Presentation Before Sub-RegistrarOm BhoyarNo ratings yet

- Account Opening Reminders Transaction Date and Time: Wednesday, 2023/01/11 12:00:42 PM Application No.: Valid ID(s) : Supporting Document(s)Document2 pagesAccount Opening Reminders Transaction Date and Time: Wednesday, 2023/01/11 12:00:42 PM Application No.: Valid ID(s) : Supporting Document(s)CE SherNo ratings yet

- Amarjeet Singh Care of Amit NoticeDocument3 pagesAmarjeet Singh Care of Amit NoticeDivyaNo ratings yet

- CA AGRO-INDUSTRIAL DEVELOPMENT CORP. vs. THE HONORABLE COURT OF APPEALS and SECURITY BANK AND TRUST COMPANYDocument2 pagesCA AGRO-INDUSTRIAL DEVELOPMENT CORP. vs. THE HONORABLE COURT OF APPEALS and SECURITY BANK AND TRUST COMPANYCeth GarvezNo ratings yet

- House Construction AgreementDocument2 pagesHouse Construction AgreementMonica Alfonso100% (1)

- Uganda Tenancy Agreement FormDocument7 pagesUganda Tenancy Agreement FormKiberu ibrahimNo ratings yet

- Javellana vs. Department of Interior and Local GovernmentDocument10 pagesJavellana vs. Department of Interior and Local GovernmentPatricia GumpalNo ratings yet

- En Banc Rodolfo C. Fariñas V. The Executive Secretary (G.R. No. 147387, December 10, 2003) Callejo, SR., J. FactsDocument2 pagesEn Banc Rodolfo C. Fariñas V. The Executive Secretary (G.R. No. 147387, December 10, 2003) Callejo, SR., J. FactsVanityHughNo ratings yet

- GE Renewal Parts: Blower and Filter Box ArrangementDocument4 pagesGE Renewal Parts: Blower and Filter Box ArrangementHenriques Vasco MequeNo ratings yet

- Skylark Enclave Apartment Owners Association: 5 Main, Jagadishnagar, Bangalore 560 075Document16 pagesSkylark Enclave Apartment Owners Association: 5 Main, Jagadishnagar, Bangalore 560 075Benitus RajaNo ratings yet

- CONTRACT (Offer and Acceptance)Document3 pagesCONTRACT (Offer and Acceptance)Walker Martineau Saleem100% (1)

- Case No. 5 Union Bank VS DBPDocument2 pagesCase No. 5 Union Bank VS DBPBabes Aubrey DelaCruz AquinoNo ratings yet

- LAWS HIERARCHY GUIDEDocument4 pagesLAWS HIERARCHY GUIDEElviNo ratings yet

- Overview of the Charter of 1726 and establishment of courts in British IndiaDocument10 pagesOverview of the Charter of 1726 and establishment of courts in British IndiaA.SinghNo ratings yet

- DPRM RSD Form 2015 AffidavitDocument1 pageDPRM RSD Form 2015 AffidavitIzan Rinn XanrexNo ratings yet

- Get Your Student Permit or New Driver's LicenseDocument4 pagesGet Your Student Permit or New Driver's LicenseLixam NegroNo ratings yet

- Baroda Home Loan Sanction LetterDocument10 pagesBaroda Home Loan Sanction LetterDivyang TiwariNo ratings yet

- 01 Corpo 1A 2022Document60 pages01 Corpo 1A 2022Jamil Jammy AngNo ratings yet

- Sample of Answer To Show Cause NoticeDocument2 pagesSample of Answer To Show Cause NoticeRakesh Shekhawat80% (64)

- Dina Management Limited V County Government of Mombasa & 5 OthersDocument31 pagesDina Management Limited V County Government of Mombasa & 5 OthersAizux MungaiNo ratings yet

- Elite Daily Paul Kim Lawsuit 2018Document27 pagesElite Daily Paul Kim Lawsuit 2018ny-court100% (2)

- Resident Marine Mammals vs. Reyes - CITIZEN SUITDocument7 pagesResident Marine Mammals vs. Reyes - CITIZEN SUITJona Carmeli CalibusoNo ratings yet

- Diamond Ring Ownership CaseDocument1 pageDiamond Ring Ownership CaseMarvien M. BarriosNo ratings yet

- The Contractarian Basis of The Law of TrustsDocument25 pagesThe Contractarian Basis of The Law of TrustsJack HarbenNo ratings yet

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)