Professional Documents

Culture Documents

Machine Learning Model Generates 479% Profits Trading Gold

Uploaded by

Ahmed Hassan0 ratings0% found this document useful (0 votes)

37 views14 pages1) The document summarizes 6 research papers on trading strategies and algorithms.

2) The papers propose and test various automated trading strategies using techniques like expert advisors, deep reinforcement learning, technical analysis rules and machine learning models.

3) The strategies are backtested on major currency pairs and show profits outperforming simple buy and hold strategies in most cases.

Original Description:

Original Title

Assignment

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document summarizes 6 research papers on trading strategies and algorithms.

2) The papers propose and test various automated trading strategies using techniques like expert advisors, deep reinforcement learning, technical analysis rules and machine learning models.

3) The strategies are backtested on major currency pairs and show profits outperforming simple buy and hold strategies in most cases.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views14 pagesMachine Learning Model Generates 479% Profits Trading Gold

Uploaded by

Ahmed Hassan1) The document summarizes 6 research papers on trading strategies and algorithms.

2) The papers propose and test various automated trading strategies using techniques like expert advisors, deep reinforcement learning, technical analysis rules and machine learning models.

3) The strategies are backtested on major currency pairs and show profits outperforming simple buy and hold strategies in most cases.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 14

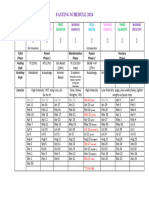

Paper # 1

Journal Name & Paper Title

Finamatrix Journal

Automated Gold Trading with MT4

Domain/Subdomain and Contribution

Domain : Trading Strategy

Subdomain : Expert Advisor

Contribution : Proposed a framework to improve the performance and

accuracy of a strategy by using EA and back test on MT4

Material & Methods

Expert Advisor is an automated trading bot. An algorithm is designed

and it backtested for several months.

Experiment & Result Obtained

The algorithm settings include the following but no limited to risk per

trade, maximum total risk, maximum account risk, stop loss pips, take

profit pips, start hour, end hour etc. A low spread level of less than 10

pips will improve test results while a spread level of more than 30 pips

can reduce test results. A successful expert advisor with short term

intraday trades should be able to be successful during period of lower

spreads

The test result shows the profitability of this strategy, nearly 4 times

profits in 9 months with 479 trades. The result also displays a limited

winning percentage of 45% in total trades

Conclusion

The tests have provided evidence that investors are able to use micro

accounts to create high returns on gold trading with similar EAs. The

low percentage of profit trades does not translate to low returns. Nearly

or less than 50% of profit trades is enough, provided that the average

profit trade is greater than the average loss trade, as well as most of the

profit trades achieve more absolute profit than most of the loss trades.

Paper # 2

Journal Name & Paper Title

Physica A

Short-Term Predictions in Forex Trading

Domain/Subdomain and Contribution

Domain : Forex Trading

Subdomain : Kinetic Equation

Contribution : Trading Algorithm on major 3 pairs

Material & Methods

Forex Currency Pairs EURUSD, EURCHF, USDCHF

Apply a recent model in kinetic theory that is used to model trubelance.

As far as this is the first application of this kinetic approach to a

financial system.

Experiment & Result Obtained

In experiment the kinetic equation used the trading live data pairs like

USDCHF, EURCHF and after successful analysis the model makes the

prediction for the buy. In result model shows much accuracy.

Conclusion

There are more currencies than this model can cope with. Any set of

three currencies may be used, and it is possibl to develop a methodology

that uses many sets of three currencies to cover more ground. There will

be redefined models for the short term evolution of the stock market.

Paper # 3

Journal Name & Paper Title

ABAC Journal Vol. 39

Robust Forex Trading With Deep Q Network

Domain/Subdomain and Contribution

Domain : Forex Trading

Subdomain : Deep Learning, Machine Learning & Q Learning

Contribution : Developing a trading system which have adaptive

capabilities and synchronicity with the market and compare with

traditional trading strategies.

Material & Methods

Forex Trading 6 currency pairs which were EURUSD, GBPUSD,

USDCAD, USDJPY, USDCHF and AUDUSD.

The appropriate method to study how machine learns to trade is to

translate financial trading problems to a reinforcement learning problem

and then train the computer through a Deep Q Learning algorithm.

Experiment & Result Obtained

In experiment it maps reinforcement learning to financial trading. It

performs 4 functions : Set of States, Set of Actions, Reward Function

and Experience Tuple. After performing 2 experiments on 2 currencies

with total historical data of 15 years. The assumptions are

· The initial capital of 100,000USD

· No transaction cost

· The position sizing is 1% for each trade

· One position can be opened at a time

· We enter using the close price of that dayThe AI agent’ s

performance is significantly superior to the buy and hold performance

Conclusion

This study makes several contributions to academics, such as the

application of artificial intelligence in algorithmic trading systems

development. It is a desirable method to replace the human

decisionmaking system because the computer can read hidden profitable

price patterns better than a human and a computer can execute the trade

swiftly and accurately, compared to a human who tends to perform a

suboptimal decision-making process when they trade. The AI is the best

candidate to replace humans in this situation.

Paper # 4

Journal Name & Paper Title

Managerial Finance

Investigating the Profitability of Technical Analysis System on FX

Domain/Subdomain and Contribution

Domain : Forex Trading

Subdomain : Technical Trading Analysis and Rules

Contribution : Profit Testing System

Material & Methods

Data series for this paper consists of daily spot exchange rates for

USD/DM and USD/BP. Short-term, monthly Eurodollars, Euromark, and

Eurosterling interest rates are also used. The technical analysis software

used is “Windows on WallStreet (version 2.1.2)”. Data analysis is

carried in two steps. First, the profitability of specific technical systems

is calculated for the whole period.Then, these profits are compared to

“buy and hold” trading strategy.

Experiment & Result Obtained

In considering the USD/DM exchange rate over the whole period, all

technical rules used were profitable. More specifically, all variants of the

MACD system were profitable while, from the momentum rules only,

one had losses. For the USD/BP rate, over the whole period and for fifty

technical rules, 43 were profitable and 7 unprofitable. This time series

shows big losses for the second sub-period, a fact that leads us to

consider more carefully the persistent profitability of technical analysis

Conclusion

Empirical results in this study do not lead to a clear-cut answer regarding

the profitability of using technical analysis in foreign exchange markets.

Firstly, technical rules used were profitable over the whole period of the

investigation. Secondly, by comparing the profitability of these rules

against a simple “buy and hold” strategy, the former still lead to profits.

Paper # 5

Journal Name & Paper Title

Knowledge And Information System

Transferring Trading Strategy Knowledge to DL Models

Domain/Subdomain and Contribution

Domain : Trading Strategies

Subdomain : Deep Learning

Contribution : Transfer the knowledge of real algorithmic trading

strategies to Neural Network models for generating signals.

Material & Methods

Information from the financial market may consist of qualitative

information, sentiment of the news articles and attributes of an asset

price movement. The Quantitative methods are used as the source of

learned trading signals, but the presented methods can be applied on any

source of signals, as long as the information that was taken into

consideration to produce them is contained within the provided input to

the model.

Experiment & Result Obtained

The collected data is implemented on the model by using SMA (Simple

Moving Average) long and short. Whenever short SMA cross the long

SMA it generates the buy signal. The CNN and LSTM model is tested

on both training and test data while both performance are same on

training data but LSTM performs better than CNN on test data.

Conclusion

The knowledge from production strategies that emit trading signals is

successfully transferred to an LSTM model. Although in this instance

the employed strategies can be algorithmically derived from the OHLC

price time series, the presented model can be applied in cases where that

is not true, such as strategies directly generated by human traders. This

can be useful for companies to ensure that a successful trader’s behavior

can be simulated by such model to continue the same trading activity if

they become unavailable. The proposed model is compared to another

deep learning model, namely a convolutional neural network (CNN)

which it surpasses at all performance metrics.

Paper # 6

Journal Name & Paper Title

ETASR(Engineering,Technology and Applied Science Research)

Modeling And Trading the EURUSD Exchange Rate Using Machine

Learning Techniques

Domain/Subdomain and Contribution

Domain : Forex Trading

Subdomain : EURUSD

Subdomain : Machine Learning

Contribute : Producing Trading Strategy using KNN

Material & Methods

The European Central Bank (ECB) publishes a daily fixing for selected

EUR exchange rates.The reference exchange rates are published both by

electronic market information providers and on the ECB’s website

shortly after the concentration procedure has been completed.

The Naive Strategy, MACD Strategy and Machine Learning

Model(KNN)

Experiment & Result Obtained

The currency pair EURUSD data is implemented on all models. But the

KNN shows the most accurate result as compare to traditional trading

strategies.

Conclusion

Implementing a variety of machine learning techniques in the problem

of modeling and trading with the EURUSD exchange rate. From all the

applied machine learning techniques, Random Forests has not been

applied in this problem again while being one of the most accurate

classifiers. The machine learning techniques were benchmarked with

two traditional trading strategies Naïve strategy and MACD strategy.

Paper # 7

Journal Name & Paper Title

Expert System with Applications

A Forex Trading Expert System Based on a new approach to the rule

base evidential reasoning

Domain/Subdomain and Contribution

Domain : Foreign Exchange Market

Subdomain : Technical Analysis System

Contribution : Propose a forex trading expert system based on some new

technical analysis indicators and a new approach to the rule-base

evidential reasoning.

Material & Methods

A proposed system will be implemented on the data collected from the

Foreign Exchange Market.

Experiment & Result Obtained

The proposed Forex trading system was implemented with the use of a

Forex trading platform MetaTrader 4, on the base of data from Investor

online FX.Generally, the developed trading system include such

parameters as Stop Loss, Take profit and special parameters that enhance

the quality of decision. It is well known that even very successful trading

systems providing excellent results at the stage of optimization, usually

produce good or satisfactory results only during some limited (testing)

time after optimization period. The developed Forex trading system

based on the proposed new approach to the rule-base evidential

reasoning may be successfully used in practice for different currency

pairs and time frames.

Conclusion

A new approach to the rule-base evidential reasoning (RBER) is

proposed.Since the combination rules play a key role in RBER, a

comparative analysis of them is provided. A real Forex trading system

was developed. It is shown that this system provides good results and

may be successfully used in practice for different currency pairs and

time frames.

Paper # 8

Journal Name & Paper Title

IEEE Transactions On Neural Networks

Computational Learning Techniques For Intraday FX

Domain/Subdomain and Contribution

Domain : Forex Trading

Subdomain : AI

Contribution : Proposed a trading algorithm

Material & Methods

Genetic Algorithm is the application of artificial intelligence

(AI)techniques to technical trading and finance has experienced

significant growth. Reinforcement learning has so far found only a few

financial applications.

Consider trading rules defined in terms of eight popular technical

indicators used by intraday FX traders. The indicators using are the price

channel breakout, adaptive moving average, relative strength index,

stochastics, moving average convergence/divergence, moving average

crossover, momentum oscillator, and commodity channel index.

Experiment & Result Obtained

The current RL implementation requires about eight minutes CPU time

on a 650 MHz Athlon per single training optimization . The GA is

implemented in the interpreted language Scheme, but evaluation is

parallelised over multiple similar CPUs. It also takes about eight minutes

CPU time per optimization on a single machine. The Markov chain and

heuristic approaches execute in four seconds and approximately four

minutes, respectively

Conclusion

In this paper developed three trading strategies basedon computational

learning techniques and one simple heuristic based on trading thresholds

over a fixed horizon. The strategies based on the genetic (programming)

algorithm (GA) and reinforcement (Q-)learning train at 15-min intervals

on the buy sell signals from eight popular technical trading indicators

some of which require a number of previous observations and current

positions over a one year period of GBPUSD FX data

Paper # 9

Journal Name & Paper Title

Journal Of Computers

Forex Trading Robot With Technical And Fundamental Analysis

Domain/Subdomain and Contribution

Domain : Forex Trading

Subdomain : Trading Bot

Contribution : This paper build forex robot that analyze forex market

based on fundamental analysis. Fundamental news periodically extracted

from a website that provide forex news calendar www.forexfactory.com.

Material & Methods

The data will be collect from the forexfactory through the trading bots

and then they execute trade according it. There are 2 automated trading

bots; Technical Robot and Fundamental Robot. Technical Robot works

based on the crossing of moving average. Robot Rules for buy position

1. Wait for the currency to trade above both the 50 SMA and 100 SMA.

2. Exit trade when the price breaks below the 50 SMA by 10 pips.

Robot Rules for sell positon

1. Once the price has broken below the closest SMA by 10 pips or more.

2. Exit trade when the price breaks above the 50 SMA by 10 pips.

On other side Fundamental Robot the algorithm of the trading robot

works based only on fundamental analysis. This robot analyze news

from a news website (www. forexfactory.com). This robot use the news

to gauge market sentiment that will move the market price. News

influences people’s bullish or bearish sentiment on a particular market,

which in turn creates volatility as those people buy and sell.

Experiment & Result Obtained

Some experiments were conducted to compare the performance attained

by the fundamental robot and the technical robot. To obtained this

purpose, three of the most dynamic currency pairs in forex trading were

used EURUSD, USDJPY, and GBPUSD. The testing duration for all of

these experiments is 30 days.

The performance charts of technical robot form rising linear curve, while

the performance charts of fundamental robot form jagged saw curve.

This means that the performance of technical robot is more likely to be

stable in profiting compared with fundamental robot.

Conclusion

Experiments show that the performance of technical robot is more robust

and stable compare with fundamental robot. The reason is because there

are a lot of factors that affect the news, like market’s sentiments,

multiple news in one time, countinuos effect of the previous news. This

makes fundamental robot can’t depend only on the forecast, previous,

and actual value from the news website, but also other factor such as the

affect of the previous subsequence news. On the same timeframe, the

technical robot result the more profitable balance than fundamental

robot. In this re-search, the technical robot makes trading decision based

on the statistics of the latest market movement.

Paper # 10

Journal Name & Paper Title

Journal Of Risk And Financial Management

Take Profit And Stop Loss Trading Strategies Comparison in

Combination with an MACD Trading System

Domain/Subdomain and Contribution

Domain : Forex Trading

Subdomain : Automated Trading System

Contribution : Implement a combination of an adaptive MACD Expert

Advisor that uses back-tested optimized parameters per asset with price

levels defined by the ATR indicator, used to set limits for Stop Loss. In

this research, the researcher tested and compared six different TP and SL

strategies used in combination with an algorithmic.

Material & Methods

Trading Systems, Automated Trading, Private Investors, Take profit and

Stop loss. Trading System will automatic execute trade with mentioned

tp and sl. It's an intelligent system it create using 6 different strategies.

The system knows when enter into a trade or when exit from a trade.

The system detects which technique to incorporate with an existing

MACD strategy and which to avoid.

Experiment & Result Obtained

Conducted our experiments on the different Take Profit – Stop Loss

strategies for nine assets from the Forex, Metals, Commodities, Energy,

and Cryptocurrencies categories: AUDUSD, EURGBP, EURUSD,

GBPUSD, USDCHF, USDJPY, XAUUSD, OIL, and BTCUSD. Firstly

compared the results for the simple MACD Expert Advisor with the

default parameters and without holding positions over weekends, the

simple MACD Expert Advisor with our selected parameters and without

holding positions over weekends, the simple MACD Expert Advisor

with our selected parameters with holding open positions over the

weekends

It can be concluded that holding open positions over the weekends helps

cut one’s losses, but it also takes away a proportion of the profits for all

the examined assets. Also, using the default parameters almost always

results in losses.

Conclusion

In this research, it is examined that various Take Profit and Stop Loss

strategies added to a simple MACD automated trading system used in

trading 10 assets from the Forex, Metals, Energy, and Cryptocurrencies

categories. In order to make the MACD parameters less important in our

research, we chose parameters based on the characteristics of their

neighborhoods of ±2 and used them for all our experiments.

You might also like

- Trading Tactics in the Financial Market: Mathematical Methods to Improve PerformanceFrom EverandTrading Tactics in the Financial Market: Mathematical Methods to Improve PerformanceNo ratings yet

- RM AssignmentDocument15 pagesRM AssignmentAhmed HassanNo ratings yet

- Algo-Trading Research PaperDocument20 pagesAlgo-Trading Research Papermartinrigan992No ratings yet

- Expert Advisor Programming and Advanced Forex StrategiesFrom EverandExpert Advisor Programming and Advanced Forex StrategiesRating: 5 out of 5 stars5/5 (2)

- Algorithmic Trading Course SingaporeDocument4 pagesAlgorithmic Trading Course SingaporeSuresh Kumar AllaNo ratings yet

- Algorithmic Tradingand StrategiesDocument11 pagesAlgorithmic Tradingand StrategiesStefanoNo ratings yet

- Robust Forex Trading With Deep Q Network (DQN)Document19 pagesRobust Forex Trading With Deep Q Network (DQN)hamed mokhtariNo ratings yet

- Multi-Agent Forex Trading SystemDocument28 pagesMulti-Agent Forex Trading SystemLeon MutambalaNo ratings yet

- Paper 13Document6 pagesPaper 13Lan PishuNo ratings yet

- Fuzzy Trading System for Financial MarketsDocument12 pagesFuzzy Trading System for Financial Marketsjimthegreatone100% (1)

- 10.1007@s11590 020 01546 7Document16 pages10.1007@s11590 020 01546 7aliNo ratings yet

- An Ensembling Architecture Incorporating Machine LDocument25 pagesAn Ensembling Architecture Incorporating Machine LLong Trần QuangNo ratings yet

- Stock Market Prediction Using CNN and LSTMDocument7 pagesStock Market Prediction Using CNN and LSTMJohn BrandNo ratings yet

- Foreign Exchange Trading Using A Learning Classifier SystemDocument17 pagesForeign Exchange Trading Using A Learning Classifier SystemovsalazarNo ratings yet

- MS&E 448 T F: F R: Rend Ollowing Inal EportDocument12 pagesMS&E 448 T F: F R: Rend Ollowing Inal Eportc0ldlimit8345No ratings yet

- An Automatic Stock Trading System Using Particle Swarm OptimizationDocument5 pagesAn Automatic Stock Trading System Using Particle Swarm OptimizationErnesto Delfino AguirreNo ratings yet

- Stock Trading Using Analytics: Chandrika Kadirvel Mani, Carol Anne HargreavesDocument11 pagesStock Trading Using Analytics: Chandrika Kadirvel Mani, Carol Anne HargreavesCom DigfulNo ratings yet

- Evolving Rule-Based Trading Systems: Abstract. in This Study, A Market Trading Rulebase Is Optimised Using Genetic ProDocument10 pagesEvolving Rule-Based Trading Systems: Abstract. in This Study, A Market Trading Rulebase Is Optimised Using Genetic PropostscriptNo ratings yet

- Algorithmic Trading Using Intelligent AgentsDocument7 pagesAlgorithmic Trading Using Intelligent AgentskallbaqiNo ratings yet

- An Automatic Stock Trading System Using Particle Swarm Optimization (2017)Document4 pagesAn Automatic Stock Trading System Using Particle Swarm Optimization (2017)Gonza NNo ratings yet

- WQU - Econometrics - Module - 7 - Compiled Content PDFDocument59 pagesWQU - Econometrics - Module - 7 - Compiled Content PDFKerem SezerNo ratings yet

- USDJPY - USDEGP - EUREGP - EURSAR (No Profit)Document8 pagesUSDJPY - USDEGP - EUREGP - EURSAR (No Profit)teamcuc.hutechNo ratings yet

- Creamer Ee ADocument16 pagesCreamer Ee ApasaitowNo ratings yet

- Algorithmic Trading Using Sentiment Analysis and Reinforcement LearningDocument6 pagesAlgorithmic Trading Using Sentiment Analysis and Reinforcement LearningSimerjot KaurNo ratings yet

- Using Hidden Markov Model For Stock Day Trade ForecastingDocument12 pagesUsing Hidden Markov Model For Stock Day Trade ForecastingPatrick LangstromNo ratings yet

- Evaluation of Pairs Trading Strategy at The Brazilian Financial MarketDocument28 pagesEvaluation of Pairs Trading Strategy at The Brazilian Financial MarketNathan SimmondsNo ratings yet

- Algorithmic Trading Using Reinforcement Learning Augmented With Hidden Markov ModelDocument10 pagesAlgorithmic Trading Using Reinforcement Learning Augmented With Hidden Markov ModelTutor World OnlineNo ratings yet

- Group 5Document30 pagesGroup 5bkNo ratings yet

- FoRex Trading Using Supervised Machine Learning PDFDocument5 pagesFoRex Trading Using Supervised Machine Learning PDFshermanNo ratings yet

- SSRN Id937847Document18 pagesSSRN Id937847Srinu BonuNo ratings yet

- Evaluating Algorithmic Trading Strategies with Machine LearningDocument18 pagesEvaluating Algorithmic Trading Strategies with Machine Learningmichaelguan326No ratings yet

- The Fractal's Edge Basic User's GuideDocument171 pagesThe Fractal's Edge Basic User's Guideamit sharmaNo ratings yet

- Research Paper On ForexDocument4 pagesResearch Paper On Forexsuz1sezibys2100% (1)

- Stock Trading Algorithm Using MACD, ROC, and Stochastic SignalsDocument6 pagesStock Trading Algorithm Using MACD, ROC, and Stochastic Signalski_tsuketeNo ratings yet

- Implementasi Penggunaan Sistem Pakar Pada Trading: Mahavindra Dwi FirmansyahDocument10 pagesImplementasi Penggunaan Sistem Pakar Pada Trading: Mahavindra Dwi FirmansyahRevata Siri AnandaNo ratings yet

- Automated Stock Trading Using Machine LearningDocument14 pagesAutomated Stock Trading Using Machine LearningMarc Alester P. NicolasNo ratings yet

- Algorithmic Trading Using Intelligent AgentsDocument8 pagesAlgorithmic Trading Using Intelligent AgentsRyu UyNo ratings yet

- Deep Learning Financial Forecasting A-TraderDocument8 pagesDeep Learning Financial Forecasting A-TraderthyagosmesmeNo ratings yet

- Computational Intelligence For Evolving Trading RulesDocument23 pagesComputational Intelligence For Evolving Trading Rulesaka2020No ratings yet

- Utilizing Articial Neural Networks and Genetic AlgorithmsDocument35 pagesUtilizing Articial Neural Networks and Genetic AlgorithmsXmd InOutNo ratings yet

- Entropy 18 00435 PDFDocument16 pagesEntropy 18 00435 PDFKarim LaidiNo ratings yet

- Using Deep Learning To Detect Price Change Indications in Financial MarketsDocument5 pagesUsing Deep Learning To Detect Price Change Indications in Financial Marketslijanamano6No ratings yet

- Currency Exchange Prediction using ANNDocument2 pagesCurrency Exchange Prediction using ANNRiddhimaNo ratings yet

- B IRIDocument38 pagesB IRIadmlabraNo ratings yet

- Algo Quant Trading Strategies Beginners MCX BrochureDocument7 pagesAlgo Quant Trading Strategies Beginners MCX Brochurelijanamano6No ratings yet

- Applsci 09 04460 v2Document18 pagesApplsci 09 04460 v2teamcuc.hutechNo ratings yet

- Stock Market Forecasting Techniques: A Survey: G. Preethi, B. SanthiDocument7 pagesStock Market Forecasting Techniques: A Survey: G. Preethi, B. SanthiJames CharoensukNo ratings yet

- Financial Trading As A Game: A Deep Reinforcement Learning ApproachDocument15 pagesFinancial Trading As A Game: A Deep Reinforcement Learning ApproachcroiluNo ratings yet

- COMPDocument13 pagesCOMPVahidNo ratings yet

- Folts PDFDocument6 pagesFolts PDFThe_SunNo ratings yet

- AMFA - Volume 6 - Issue 3 - Pages 653-669Document17 pagesAMFA - Volume 6 - Issue 3 - Pages 653-669algrionNo ratings yet

- Quantitative Trading Using Deep Q LearningDocument10 pagesQuantitative Trading Using Deep Q LearningIJRASETPublicationsNo ratings yet

- Notes on Mean Reversion and Momentum Strategies <40Document9 pagesNotes on Mean Reversion and Momentum Strategies <40Lucas KrennNo ratings yet

- Learning To Trade Using Q-LearningDocument18 pagesLearning To Trade Using Q-LearningsamNo ratings yet

- YudinForex PDFDocument3 pagesYudinForex PDFsoekidNo ratings yet

- Trend Following Algorithms For Technical Trading in Stock MarketDocument10 pagesTrend Following Algorithms For Technical Trading in Stock MarketTristanNo ratings yet

- Sarmento 2020Document13 pagesSarmento 2020Kylian MNo ratings yet

- NTU AlgoProgrammeDocument3 pagesNTU AlgoProgrammerajibmishral7125No ratings yet

- An Intelligent Trading System With Fuzzy Rules and Fuzzy Capital ManagementDocument23 pagesAn Intelligent Trading System With Fuzzy Rules and Fuzzy Capital ManagementayeniNo ratings yet

- TTDS AssignmetnDocument12 pagesTTDS AssignmetnAhmed HassanNo ratings yet

- Version 2Document5 pagesVersion 2Ahmed HassanNo ratings yet

- MatrixDocument1 pageMatrixAhmed HassanNo ratings yet

- Reference BookDocument2 pagesReference BookAhmed HassanNo ratings yet

- Version 1Document3 pagesVersion 1Ahmed Hassan100% (1)

- Forex Trading Strategies ResearchDocument3 pagesForex Trading Strategies ResearchAhmed HassanNo ratings yet

- Final VersionDocument5 pagesFinal VersionAhmed HassanNo ratings yet

- TTDSDocument5 pagesTTDSAhmed HassanNo ratings yet

- Forex Verison 2Document4 pagesForex Verison 2Ahmed HassanNo ratings yet

- Final VersionDocument31 pagesFinal VersionAhmed HassanNo ratings yet

- Forex Version 1Document3 pagesForex Version 1Ahmed HassanNo ratings yet

- Banu Maaruf of The LevantDocument6 pagesBanu Maaruf of The LevantMotiwala AbbasNo ratings yet

- Week 1 Gec 106Document16 pagesWeek 1 Gec 106Junjie FuentesNo ratings yet

- S06 - 1 THC560 DD311Document128 pagesS06 - 1 THC560 DD311Canchari Pariona Jhon AngelNo ratings yet

- Internal Peripherals of Avr McusDocument2 pagesInternal Peripherals of Avr McusKuldeep JashanNo ratings yet

- Business EnvironmentDocument12 pagesBusiness EnvironmentAbhinav GuptaNo ratings yet

- Mad LabDocument66 pagesMad LabBalamurugan MNo ratings yet

- PBS-P100 Facilities Standards GuideDocument327 pagesPBS-P100 Facilities Standards Guidecessna5538cNo ratings yet

- Astm D 664 - 07Document8 pagesAstm D 664 - 07Alfonso MartínezNo ratings yet

- Bhakti Trader Ram Pal JiDocument232 pagesBhakti Trader Ram Pal JiplancosterNo ratings yet

- SeparatorDocument2 pagesSeparatormmk111No ratings yet

- United Airlines Case Study: Using Marketing to Address External ChallengesDocument4 pagesUnited Airlines Case Study: Using Marketing to Address External ChallengesSakshiGuptaNo ratings yet

- Eagle Test ReportDocument25 pagesEagle Test ReportMuhammad FahadNo ratings yet

- Stages of Intimate RelationshipsDocument4 pagesStages of Intimate RelationshipsKrystalline ParkNo ratings yet

- Why Islam Is The True Religion in Light of The Quran and SunnahDocument7 pagesWhy Islam Is The True Religion in Light of The Quran and SunnahAsmau DaboNo ratings yet

- Google Search StringsDocument12 pagesGoogle Search StringsPrashant Sawnani100% (1)

- Organic Chem Diels-Alder Reaction LabDocument9 pagesOrganic Chem Diels-Alder Reaction LabPryanka BalleyNo ratings yet

- Moon Fast Schedule 2024Document1 pageMoon Fast Schedule 2024mimiemendoza18No ratings yet

- X RayDocument16 pagesX RayMedical Physics2124No ratings yet

- Grace Lipsini1 2 3Document4 pagesGrace Lipsini1 2 3api-548923370No ratings yet

- Hanwha Engineering & Construction - Brochure - enDocument48 pagesHanwha Engineering & Construction - Brochure - enAnthony GeorgeNo ratings yet

- LNG Vaporizers Using Various Refrigerants As Intermediate FluidDocument15 pagesLNG Vaporizers Using Various Refrigerants As Intermediate FluidFrandhoni UtomoNo ratings yet

- PedigreesDocument5 pagesPedigreestpn72hjg88No ratings yet

- Icelandic Spells and SigilsDocument16 pagesIcelandic Spells and SigilsSimonida Mona Vulić83% (6)

- SHORT STORY Manhood by John Wain - Lindsay RossouwDocument17 pagesSHORT STORY Manhood by John Wain - Lindsay RossouwPrincess67% (3)

- DNA Affirmative - MSDI 2015Document146 pagesDNA Affirmative - MSDI 2015Michael TangNo ratings yet

- Translation of Japanese Onomatopoeia Into Swedish (With Focus On Lexicalization)Document20 pagesTranslation of Japanese Onomatopoeia Into Swedish (With Focus On Lexicalization)Aldandy OckadeyaNo ratings yet

- Barelwiyah, Barelvi Chapter 1 (Part 2 of 5)Document31 pagesBarelwiyah, Barelvi Chapter 1 (Part 2 of 5)Dawah ChannelNo ratings yet

- 10 Tips To Support ChildrenDocument20 pages10 Tips To Support ChildrenRhe jane AbucejoNo ratings yet

- Operating Manual: Please Read These Operating Instructions Before Using Your FreedomchairDocument24 pagesOperating Manual: Please Read These Operating Instructions Before Using Your FreedomchairNETHYA SHARMANo ratings yet

- Lateral capacity of pile in clayDocument10 pagesLateral capacity of pile in clayGeetha MaNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)