Professional Documents

Culture Documents

Assignment6 DC6

Uploaded by

RUPIKA R GOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment6 DC6

Uploaded by

RUPIKA R GCopyright:

Available Formats

DC 13-4.

1.

Ratios of General Mills for year ending May 31,2009

a) Working capital = current assets – current liabilities

$3,534.9 million -$3,606.0 million = -($71.1 million)

b) Current Ratio = Current Assets / Current Liabilities

$3,534.9/$3,606 = 0.98

c) Acid-test ratio = (Current Assets – Inventory) / Current Liabilities

($3,534.9 – $1,346.8) / $3,606 = 0.6

d) Cash flow from operations to current liabilities = $1,828.2/$3,606 = 0.5

e) Debt to equity ratio = Total Liabilities / Shareholder's Equity

$12,458.3 / $5,172.3 = 2.4

f) Cash flow from operations to capital expenditures

Capital expenditure = net change in Property Plant and Equipment (PP&E) value over a given

period to the depreciation expense for the same year

($562.6-$522) + $453.6 = 493.6

1,828.2 / 493.6 = 3.7

g) Asset turnover = Net Sales/ Total Assets

$14,691.3 / $17,874.8 = 0.8

h) Return on sales = operating profit / net sales

$2,325.0 / $14,691.3 = 0.16

i) Return on assets = operating profit / Total assets

$2,325.0 /$ 17,874.8 = 0.13

j) Return on common stockholders’ equity = operating profit / stockholders’ equity

$2,325 / $5,172.3 = 0.45

Ratios of General Mills for year ending May 30,2010

a) Working capital = current assets – current liabilities

$3,480.0 million -$3,769.1 million = -($289.1 million)

b) Current Ratio = Current Assets / Current Liabilities

3,480/3,769.1 = 0.92

c) Acid-test ratio = Current Assets – Inventory / Current Liabilities

3,480 – 1,344 / 3,769.1 = 0.57

d) Cash flow from operations to current liabilities = 2181.2/3,769.1 = 0.58

e) Debt to equity ratio = Total Liabilities / Shareholder's Equity

12,030.9 / 5,402.9 = 2.2

f) Cash flow from operations to capital expenditures

Capital expenditure = net change in Property Plant and Equipment (PP&E) value over a given

period to the depreciation expense for the same year

(649.9-562.6) + 457.1 = 544.4

2,181.2 / 544.4 = 4

g) Asset turnover = Net Sales/ Total Assets

14,796.5 / 17,678.9 = 0.84

h) Return on sales = operating profit / net sales

2,606.1 / 14,796.5 = 0.18

i) Return on assets = operating profit / Total assets

2,606.1 / 17,678.9 = 0.15

j) Return on common stockholders’ equity = operating profit / stockholders’ equity

2,606.1 / 5,402.9 = 0.48

2. Based on the calculated ration we can conclude that the financial health of the General Mills is

not so good as working capital is in negative & other profitability ratios are too low.

DC 13-7:

1.

Current ratio = current asset / current liabilities

16/10 = 1.6. As the current ratio is more than what Midwest construction company agreed with the

bank, of always maintaining a minimum level of 1.5 to 1.

Debt to equity ratio = Total Liabilities / Shareholder's Equity

25/55 = 0.45. As the Midwest construction company agreed that its debt-to-equity ratio will not

exceed 0.5 to 1.0, so it is still within limits what it had promised.

2.

As of now that 5 million USD is still needed to be paid in 6 months so they should have counted that

amount in current liabilities and not in long term liabilities. $2 million should be accounted as the

deferred expense.

3. Revised Balance sheet

--------------------------------------------------------------------------------------------------------------------------------------

Current assets $ 14 Current liabilities $ 15

Deferred expense $ 2 Long-term debt $ 10

Long term assets $ 64 Stockholders equity $ 55

Total $ 100 Total $ 100

Current ratio = 14/15 = 0.93

Debt to equity ratio = 25/55 = 0.45

Now with the new ratios we can clearly see that Midwest construction company is not in compliance

of the loan agreement as their current ratio is 0.93.

You might also like

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Practice Set 10 FSA 2Document5 pagesPractice Set 10 FSA 2AashiNo ratings yet

- Dwnload Full Corporate Finance Canadian 3rd Edition Berk Solutions Manual PDFDocument36 pagesDwnload Full Corporate Finance Canadian 3rd Edition Berk Solutions Manual PDFgoblinerentageb0rls7100% (13)

- Full Download Corporate Finance Canadian 3rd Edition Berk Solutions ManualDocument36 pagesFull Download Corporate Finance Canadian 3rd Edition Berk Solutions Manualkisslingcicelypro100% (33)

- FIN 571 Final Exam: FIN 571 Final Exam Ansers For Uop - UOP E Tutorsinal ExamDocument17 pagesFIN 571 Final Exam: FIN 571 Final Exam Ansers For Uop - UOP E Tutorsinal ExamUOP E TutorsNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82No ratings yet

- Financial Administration Exercises 1Document8 pagesFinancial Administration Exercises 1ScribdTranslationsNo ratings yet

- Practice Set 10 FSA 2Document5 pagesPractice Set 10 FSA 2sumeet kumarNo ratings yet

- Financial Management and Control - AssignmentDocument7 pagesFinancial Management and Control - AssignmentSabahat BashirNo ratings yet

- Financial Management AssignmentDocument16 pagesFinancial Management AssignmentNishant goyalNo ratings yet

- Chapter 10Document12 pagesChapter 10Ginnie G Cristal50% (2)

- Corporate FinanceDocument11 pagesCorporate FinanceShamsul HaqimNo ratings yet

- Present ValueDocument8 pagesPresent ValueFarrukhsgNo ratings yet

- FIN 571 Final Exam - FIN 571 Final Exam Answers - Transweb E TutorsDocument14 pagesFIN 571 Final Exam - FIN 571 Final Exam Answers - Transweb E Tutorstranswebetutors3No ratings yet

- ACF 103 2015 Revision Qns and SolnsDocument13 pagesACF 103 2015 Revision Qns and SolnsRiri FahraniNo ratings yet

- Case Study 1 Muhammad JanjuaDocument6 pagesCase Study 1 Muhammad JanjuaAmeer Hamza JanjuaNo ratings yet

- Chapter 13Document9 pagesChapter 13Marki MendinaNo ratings yet

- Methods of AnalysisDocument7 pagesMethods of AnalysisjenniferNo ratings yet

- 5ffb Ims03Document32 pages5ffb Ims03Azadeh AkbariNo ratings yet

- Practice Problems, CH 12 SolutionDocument7 pagesPractice Problems, CH 12 SolutionscridNo ratings yet

- FM 11 8 Gbs For Week 10 To 17 1 PDFDocument11 pagesFM 11 8 Gbs For Week 10 To 17 1 PDFvlad vladNo ratings yet

- Accounting For Managers Assignment-2Document9 pagesAccounting For Managers Assignment-2Karan SinghNo ratings yet

- Capital BudgetingDocument75 pagesCapital BudgetingfreshkidjayNo ratings yet

- Name of The Ratio Calculation S 2010-11 Calculations 2011-12 Analysis MiscDocument9 pagesName of The Ratio Calculation S 2010-11 Calculations 2011-12 Analysis MiscYaSh BenGaniNo ratings yet

- Financial Statements & AnalysisDocument36 pagesFinancial Statements & AnalysisMahiNo ratings yet

- Introduction To Financial Statement AnalysisDocument7 pagesIntroduction To Financial Statement AnalysisAJ NovallascaNo ratings yet

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsDocument9 pagesAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsSandraNo ratings yet

- Chapter 3: Financial Statements and Ratio AnalysisDocument5 pagesChapter 3: Financial Statements and Ratio Analysishana osmanNo ratings yet

- Engineering Economy Review III 2010Document4 pagesEngineering Economy Review III 2010Ma Ella Mae LogronioNo ratings yet

- Financial Performance Metrics - Financial RatiosDocument98 pagesFinancial Performance Metrics - Financial RatiosAjmal SalamNo ratings yet

- Chapter 5 SummaryDocument24 pagesChapter 5 SummaryDY CMM GRCNo ratings yet

- Chapter 28Document11 pagesChapter 28Monalisa SethiNo ratings yet

- Report Dairy Milk Management SystemDocument44 pagesReport Dairy Milk Management SystemSathishNo ratings yet

- Ratio Analysis OF: Maruti Suzuki India LimitedDocument13 pagesRatio Analysis OF: Maruti Suzuki India LimitedcoolestguyisgauravNo ratings yet

- Advanced Corporate Finance Lecture 1Document26 pagesAdvanced Corporate Finance Lecture 1superduperexcitedNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunNo ratings yet

- Interpretation of Financial StatementsDocument4 pagesInterpretation of Financial StatementsTinashe MashoyoyaNo ratings yet

- Name Roll No.Document10 pagesName Roll No.Shakeel ShahNo ratings yet

- CH 04Document50 pagesCH 04Akbar LodhiNo ratings yet

- Financial Management: (Wesfarmer's Analysis Ratios For The Annual Report of 2010/2011)Document15 pagesFinancial Management: (Wesfarmer's Analysis Ratios For The Annual Report of 2010/2011)w4w4w4w4w4No ratings yet

- Lecture 2 Tutorial SoluitionDocument3 pagesLecture 2 Tutorial SoluitionEleanor ChengNo ratings yet

- FA1 Chapter 3 EngDocument24 pagesFA1 Chapter 3 EngNicola PoonNo ratings yet

- D23 FM Examiner's ReportDocument20 pagesD23 FM Examiner's ReportEshal KhanNo ratings yet

- Ch06 ProbsDocument7 pagesCh06 ProbsJingxian XueNo ratings yet

- A. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Document6 pagesA. Ratios Caculation. 1. Current Ratio For Fiscal Years 2017 and 2018Phạm Thu HuyềnNo ratings yet

- Financial ManagementDocument48 pagesFinancial Managementalokthakur100% (1)

- Solution Manual For Corporate Finance Canadian 3Rd Edition by Berk Demarzo Stangeland Isbn 0133055299 9780133055290 Full Chapter PDFDocument17 pagesSolution Manual For Corporate Finance Canadian 3Rd Edition by Berk Demarzo Stangeland Isbn 0133055299 9780133055290 Full Chapter PDFkatherine.serrano725100% (10)

- Analysis of Financial StatementsDocument48 pagesAnalysis of Financial StatementsNguyễn Thùy LinhNo ratings yet

- Ratio Analysis - (Fin Statement Analysis)Document2 pagesRatio Analysis - (Fin Statement Analysis)PradeepSringeriNo ratings yet

- Financial Statement AnalysisDocument68 pagesFinancial Statement AnalysisAqib ShahzadNo ratings yet

- Fin322 Week6Document6 pagesFin322 Week6chi_nguyen_100No ratings yet

- Handout 4Document6 pagesHandout 4Xain AliNo ratings yet

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsDocument25 pagesAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsCOLONEL ZIKRIANo ratings yet

- Financial Management in The Sport Industry 2nd Brown Solution ManualDocument10 pagesFinancial Management in The Sport Industry 2nd Brown Solution Manualkimberlyfernandezfgzsediptj100% (46)

- Andi Nur Indah Mentari - Mid Exam SheetsDocument8 pagesAndi Nur Indah Mentari - Mid Exam SheetsAríesNo ratings yet

- Ratio Comparison Yr 11 - 12Document9 pagesRatio Comparison Yr 11 - 12vivekchittoriaNo ratings yet

- Making Investment Decisions With The NPV RuleDocument24 pagesMaking Investment Decisions With The NPV RuleSebine MemmedliNo ratings yet

- Tugas 2 - Dita Sari LutfianiDocument5 pagesTugas 2 - Dita Sari LutfianiDita Sari LutfianiNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Asahi Case Final FileDocument4 pagesAsahi Case Final FileRUPIKA R GNo ratings yet

- Worksheet Campar IndustriesDocument11 pagesWorksheet Campar IndustriesRUPIKA R GNo ratings yet

- Worksheet Master BudgetDocument6 pagesWorksheet Master BudgetRUPIKA R GNo ratings yet

- Book 1Document7 pagesBook 1RUPIKA R GNo ratings yet

- Kamdhenu Dairy Class WorksheetDocument10 pagesKamdhenu Dairy Class WorksheetRUPIKA R GNo ratings yet

- Assignment5 DCDocument4 pagesAssignment5 DCRUPIKA R GNo ratings yet

- Book 3Document9 pagesBook 3RUPIKA R GNo ratings yet

- Assignment5 HW5Document9 pagesAssignment5 HW5RUPIKA R GNo ratings yet

- Assignment5 DC5Document3 pagesAssignment5 DC5RUPIKA R GNo ratings yet

- Book 2Document6 pagesBook 2RUPIKA R GNo ratings yet

- ASSIGNMENT6 Zoom Trend AnalysisDocument7 pagesASSIGNMENT6 Zoom Trend AnalysisRUPIKA R GNo ratings yet

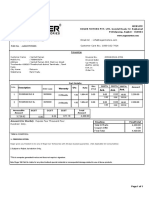

- FT232076 Financial ReportDocument3 pagesFT232076 Financial ReportRUPIKA R GNo ratings yet

- Assignment1 HWDocument10 pagesAssignment1 HWRUPIKA R GNo ratings yet

- Assignment1 DCDocument3 pagesAssignment1 DCRUPIKA R GNo ratings yet

- Assignment6 HW6Document7 pagesAssignment6 HW6RUPIKA R GNo ratings yet

- Assignment4 HWDocument12 pagesAssignment4 HWRUPIKA R GNo ratings yet

- Assignment3 HWDocument21 pagesAssignment3 HWRUPIKA R GNo ratings yet

- Assignment2 HWDocument24 pagesAssignment2 HWRUPIKA R GNo ratings yet

- Assignment3 DCDocument2 pagesAssignment3 DCRUPIKA R GNo ratings yet

- Deal Logic First Data Corp / Fiserv Inc: WHU Finance SocietyDocument6 pagesDeal Logic First Data Corp / Fiserv Inc: WHU Finance SocietySrijanNo ratings yet

- Case Study 2 International Convergence of Taste Questions: 1. What Are The Condition(s) of International Convergence To Taste? Discuss Your AnswerDocument2 pagesCase Study 2 International Convergence of Taste Questions: 1. What Are The Condition(s) of International Convergence To Taste? Discuss Your AnswerJessica Cabanting OngNo ratings yet

- How Can Corruption Influence The Work Practice?Document5 pagesHow Can Corruption Influence The Work Practice?Stacy LieutierNo ratings yet

- Street Vendors ThesisDocument7 pagesStreet Vendors Thesisstephaniebenjaminclarksville100% (2)

- Research Paper - MN559990 - Batch35 - PDFDocument17 pagesResearch Paper - MN559990 - Batch35 - PDFkhushboo sharmaNo ratings yet

- Vouching Export SalesDocument11 pagesVouching Export SalesIrfan KhanNo ratings yet

- A Presentation Account Receivables Management ofDocument16 pagesA Presentation Account Receivables Management ofParamjeet SinghNo ratings yet

- Etisalat Group Capital Markets Day 2021Document144 pagesEtisalat Group Capital Markets Day 2021قحطان القحطانيNo ratings yet

- CB5E45903BDocument1 pageCB5E45903Bkrish tcrNo ratings yet

- Assure9 - Teerth Technospace PDFDocument17 pagesAssure9 - Teerth Technospace PDFneoavi7No ratings yet

- 1915103-Accounting For ManagementDocument22 pages1915103-Accounting For Managementmercy santhiyaguNo ratings yet

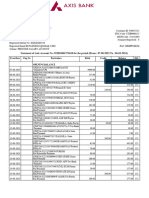

- Statement of Axis Account No:922010061271618 For The Period (From: 07-08-2023 To: 06-02-2024)Document23 pagesStatement of Axis Account No:922010061271618 For The Period (From: 07-08-2023 To: 06-02-2024)vijaypsymaNo ratings yet

- Agri CHAPTER 3 and 4Document22 pagesAgri CHAPTER 3 and 4Girma UniqeNo ratings yet

- Eca Covid 19 Financial Impact On European ClubsDocument1 pageEca Covid 19 Financial Impact On European ClubsMariaStepaniukNo ratings yet

- DocxDocument6 pagesDocxJenn sayongNo ratings yet

- Construction Funds Trust Agreement-CDocument46 pagesConstruction Funds Trust Agreement-CRicardo NavaNo ratings yet

- Paytm Assignment QuestionsDocument7 pagesPaytm Assignment Questionsswati swatiNo ratings yet

- Stoffers BA BMSDocument101 pagesStoffers BA BMSpendejitusNo ratings yet

- Chap 2 - ActivitiesDocument2 pagesChap 2 - ActivitiesDuyên HồNo ratings yet

- Receipt From STC Pay: Transaction ID: 55038609 Amount 388.87 BHD MTCN 9449703971Document1 pageReceipt From STC Pay: Transaction ID: 55038609 Amount 388.87 BHD MTCN 9449703971Imran AliNo ratings yet

- Confirmed Divergence Manual PDFDocument57 pagesConfirmed Divergence Manual PDFDigitsmarterNo ratings yet

- Avenue Product ListDocument1,766 pagesAvenue Product ListLeandro Zenni EstevaoNo ratings yet

- Proceeding The 1ST Apmrc PDFDocument423 pagesProceeding The 1ST Apmrc PDFKnowledge Center PPM Manajemen100% (1)

- ACL Chapter 10 Questions and ProblemsDocument24 pagesACL Chapter 10 Questions and ProblemsUyen NguyenNo ratings yet

- Question Bank 2Document2 pagesQuestion Bank 2pavan kumar tNo ratings yet

- TUTORIAL SOLUTIONS (Week 4A)Document8 pagesTUTORIAL SOLUTIONS (Week 4A)Peter100% (1)

- Meaning of WTO: WTO - World Trade OrganisationDocument13 pagesMeaning of WTO: WTO - World Trade OrganisationMehak joshiNo ratings yet

- Topic 6 OdlDocument19 pagesTopic 6 OdlNur NabilahNo ratings yet

- September 21Document34 pagesSeptember 21AL BURJ AL THAKINo ratings yet

- 2 Accounting For MaterialsDocument13 pages2 Accounting For MaterialsZenCamandangNo ratings yet