Professional Documents

Culture Documents

Strat Tax - Report

Uploaded by

Joshua RamosCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Strat Tax - Report

Uploaded by

Joshua RamosCopyright:

Available Formats

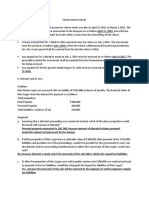

Local Taxes as to imposing authority

PROVINCIAL

-RPT

RPT related taxes

SEF

ILT

Local Trasnfer Tax

Inter vivos or mortis causa

Nature – annual tax

Di need na titulado ang lupa basta ikaw ang occupied sa property kaya may tinatawag tayong tax dec.

It is annual due

Magkakaiba according to classification. Bawal ka magtayo ng sm sa agriculture kase may mavibiolate ka

sac ty zoning rule regulation. Di natin tinitignan yung zoning, actual use ang tinitignan natin. Ano gamit

ng property. Ex, bahay (resiential) ginagawang warehouse. Hindi siya residual kahit na bahay siya,

commercial siya

PROPERTY CLASSIFICATION

Residential – habitation (tirahan)

Agriculture – may biological transformation ex. farm

Commercial – for accrual of profits (pinagkakakitaan) ex. Restaurant

Industrial – phases of production, hindi biological transformation ang nature niya ex. Factory

Mineral – pwede pag minahan

Timberland – puro kahoy and walang agri activity

Boarding house – primarily tulugan ng tao (residential) eh business yon diba? Business iyan sa iisang tao

pero tulugan sa maraming lessee

ALWAYS REMEMBER THE BASIC CLASSIFICATION

Bakit kailangan natin malaman yung basic property classification? Kase meron tayo assessment levels,

ano ito? Ito yung portion of FV of property na authorized ng Local government

Residential – 20% (assess value)

Ang prov tax pwedeng iimpose ng city, ang city cinocollect ang prov and mun tax.

Agriculture – 40%

Commercial – 50%

Assessment level x Fair Market Value

Paano naman ang mga improvements, paano sila tinatax? Dalawa kase ang tinatax sa RPT, Land and

immovable.

Improvements – may sariling assessment level sila (residential, agri and commercial)

Paano yung mga bldgs, May sariling assessment level sila. Sa board, binibigay ng examiner yung table.

House – residential (residential rate)

Restaurant, bldg ng restaurant ay improvement. May tax sila depende sa value.

In practice, we will just look at the table kung magkano ang value niya

Get the fair value of the land then the assessment value ng land

Sa improvement, FV ng improvement multiply to assessment level ng improvement.

San kukunin ang fair value? Dun sa assessor, may record ang mun assessor or prov assessor

WHEN IT COMES TO TAX RATE NAMAN

Magkakaiba ang tax rate ng cities and municipalities AND IT WILL BE DISCUSSED FURTHER NG NEXT

REPORTER

And the deadlines and penalties will be discussed again ng next reporter.

Condonation of unpaid RPT

-general failure of crops

-substantial decrease in price of agri or agri bases products

-calamity

SEF (special education fund tax)

You might also like

- Porter's ForcesDocument5 pagesPorter's ForcesJoshua RamosNo ratings yet

- Template - GE3 Module 1-FDOMEDocument21 pagesTemplate - GE3 Module 1-FDOMEJoshua RamosNo ratings yet

- GUIA DE LEON - GE3 Module 6-FDOMEDocument15 pagesGUIA DE LEON - GE3 Module 6-FDOMEJoshua RamosNo ratings yet

- Template - GE3 Module 3-FDOMEDocument16 pagesTemplate - GE3 Module 3-FDOMEJoshua RamosNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assistant Engineer's Training and Assessment Record Book (TARB) Order FormDocument0 pagesAssistant Engineer's Training and Assessment Record Book (TARB) Order FormSubramanian SaravananNo ratings yet

- Introduction To Partnership AccountingDocument16 pagesIntroduction To Partnership Accountingmachelle franciscoNo ratings yet

- SOAL LATIHAN MK - AKL - FC TransactionsDocument4 pagesSOAL LATIHAN MK - AKL - FC Transactionscaca natalia100% (1)

- Chapter 20 & 21 Final - Audit Flashcards - QuizletDocument20 pagesChapter 20 & 21 Final - Audit Flashcards - QuizletDieter LudwigNo ratings yet

- Final Feasibility Study RevisionDocument6 pagesFinal Feasibility Study Revisionjunar pascuaNo ratings yet

- Vocabulary: Life, Works & Writings of RizalDocument3 pagesVocabulary: Life, Works & Writings of RizalAshley jay PalangNo ratings yet

- Tax 1 NotesDocument37 pagesTax 1 NotesMj BauaNo ratings yet

- 226 Resoluxleaflet2019Document8 pages226 Resoluxleaflet2019Sreejith MullasseryNo ratings yet

- Unit 7-Trade and Environment, Health (Elearning)Document41 pagesUnit 7-Trade and Environment, Health (Elearning)Lương Nguyễn Khánh BảoNo ratings yet

- Wallstreetjournal 20160115 The Wall Street JournalDocument55 pagesWallstreetjournal 20160115 The Wall Street JournalstefanoNo ratings yet

- Buffer StockDocument11 pagesBuffer StockPing LinNo ratings yet

- Brochure For Diya FinalDocument12 pagesBrochure For Diya Finalanshika040592No ratings yet

- 004 - Financial Ratios Part 1 (Lecture)Document32 pages004 - Financial Ratios Part 1 (Lecture)Felix 21No ratings yet

- AMENDED SWIFT GPI 3 PARTNERSHIP AGREEMENT-Ver2ADocument23 pagesAMENDED SWIFT GPI 3 PARTNERSHIP AGREEMENT-Ver2AJamaluddin SaidNo ratings yet

- Sales and LeaseDocument8 pagesSales and LeaseHi Law SchoolNo ratings yet

- Far Drill 3Document16 pagesFar Drill 3ROMAR A. PIGANo ratings yet

- Factor Tilts and Asset Allocation: Javier EstradaDocument14 pagesFactor Tilts and Asset Allocation: Javier EstradaLoulou DePanamNo ratings yet

- Case Study Tax102Document6 pagesCase Study Tax102Edrymae TobiasNo ratings yet

- PPIC HandoutDocument131 pagesPPIC HandoutMuhammad Farrukh Hameed ChaudharyNo ratings yet

- Universiti Teknologi Mara Common Test: Instructions To CandidatesDocument8 pagesUniversiti Teknologi Mara Common Test: Instructions To CandidatesCelyn Anne Jati EkongNo ratings yet

- HRAA Product SheetDocument7 pagesHRAA Product SheetANLE ANLENo ratings yet

- Types of Business OwnershipDocument27 pagesTypes of Business Ownershipmaria cacaoNo ratings yet

- Chapter 5 Limiting Factors and Throughput Accounting: 1. ObjectivesDocument15 pagesChapter 5 Limiting Factors and Throughput Accounting: 1. ObjectivesDanisa NdhlovuNo ratings yet

- Chapter 1 The Role and Environment of Managerial FinanceDocument24 pagesChapter 1 The Role and Environment of Managerial FinancePenantang Doktrin Kekristenan100% (1)

- Strategy Guide CapsimDocument4 pagesStrategy Guide Capsimhummer12345100% (2)

- Level 1 AVERAGEDocument4 pagesLevel 1 AVERAGEJaime II LustadoNo ratings yet

- BBA-MBA - Syllabus - 2021 OnwardsDocument207 pagesBBA-MBA - Syllabus - 2021 OnwardscrazymindNo ratings yet

- Muqeet 1 - MergedDocument8 pagesMuqeet 1 - MergedsafwaanahmedNo ratings yet

- Straight Line, Sinking FundDocument11 pagesStraight Line, Sinking Fundniaz kilamNo ratings yet

- Managerial Accounting and Cost Concepts: Assigning Costs To Cost ObjectsDocument7 pagesManagerial Accounting and Cost Concepts: Assigning Costs To Cost ObjectsGolam Mehbub SifatNo ratings yet