Professional Documents

Culture Documents

ICAB Members Can Gain Global Recognition Through ICAEW, CIPFA, CPA Australia & CA ANZ

Uploaded by

Rumki SarkarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICAB Members Can Gain Global Recognition Through ICAEW, CIPFA, CPA Australia & CA ANZ

Uploaded by

Rumki SarkarCopyright:

Available Formats

ICAB members can join ICAEW

As a member of the Institute of Chartered Accountants of

Bangladesh (ICAB), you can join Institute of Chartered Accountants

of England & Wales (ICAEW) by passing four of ICAEW ACA

Global Recognition of exams, or you may be eligible to apply based on your experience

ICAB Members through ICAEW Pathways route. You can also apply for a practising certificate

and gain audit rights in the UK with ICAEW Audit Qualification.

Membership agreement: Qualified members of the ICAB will need to sit and

• ICAEW

pass four ACA examinations and the ethics module in order to be eligible to

• CIPFA, UK join the ICAEW.

• CPA Australia Pathways to Membership: Fully qualified ICAB member with at least five

• CA ANZ years’ full membership, you may be eligible to join ICAEW based on your

experience through Pathways to Membership route.

Practising certificate: If you intend to practise in the UK or EC you must

apply for a practising certificate. You may only practice as an ICAEW member

if you have been a member of ICAB for at least two years.

Audit rights: ICAEW membership does not automatically grant you audit

rights in the UK, so if you intend to work in audit during your career, then

ICAEW recommend that you apply for the Audit Qualification (AQ) when join

ICAEW.

For details please visit the link:

https://www.icaew.com/membership/becoming-a-member/members-of-other-b

odies/members-of-other-bodies-a-z/icab-members-join-icaew

Members of ICAB can fast-track to CIPFA membership For details, please visit the link:

https://www.cipfa.org/join/joining-from-another-membership-organisation

ICAB member can also become members of the

Chartered Institute of Public Finance and

Pathway to CPA Australia membership

Accountancy (CIPFA), a globally recognised membership body for the public

sector subject to fulfillment of some criteria. CPA Australia has a Member Pathway Agreement (MPA) with the

Institute of Chartered Accountants of Bangladesh (ICAB).

ICAB Members in good standing having five or more years post-qualification

public sector experience are eligible for Full Membership of CIPFA as The following steps demonstrate the pathway to Associate CPA membership

Chartered Public Finance Accountant (CPFA) and the members having fewer for full members of (ICAB) under the conditions of the current mutual pathway

than five years post-qualification public sector experience are eligible for agreement(MPA).

Affiliate member of CIPFA (CIPFA Affiliat). Step 1: Determine your eligibility

ICAB members having CIPFA Affiliate membership, or having no working You may be eligible to apply for CPA Australia membership if you:

experience in public sector can gain CPFA status by successfully completing

• are a member of good standing and not currently subject to any

exams of only two papers i.e.

disciplinary sanctions or investigations and payment of fees

• Public Sector Financial Reporting and

• did not gain entry to ICAB membership through another mutual

• Strategic Public Finance from the CIPFA qualification.

recognition agreement (MRA), any other similar pathway agreements

Build on existing memberships – add CIPFA to your professional recognition or any special member pathway

and gain additional services to support your work in the public services.

• have successfully completed the ICAB examination under the ICAB

Gaining CIPFA membership will give you in many ways: syllabus and the ICAB practical work experience requirements

• globally recognised dual designation and

• specialist public sector benefits

• hold a degree recognised by CPA Australia as being at least

• access to connect with our global public finance network technical equivalent to Australian bachelor degree level’

help

or

• public finance CPD support and resources

• have at least five years’ senior work experience (current at the time of

• event and sector updates

application) in professional accounting.

• outstanding thought leadership articles

• rewards and discounts.

Work experience evidence CA ANZ Membership for ICAB Members through International

Some of our professional body pathways require evidence of professional Pathway Program (IPP)

work experience. ICAB and CA ANZ signed an MOU (memorandum of

Step 2: Apply Understanding) mainly focusing on mutual collaboration and

principles of recognition of professional program,

Complete our online application and submit with the required documentation,

examination and practical experience.

including your application and membership fee.

Now, you can use your ICAB Chartered Accountant qualification to become a

In your application, nominate the Institute of Chartered Accountants of

member of Chartered Accountants Australia and New Zealand (CA ANZ)

Bangladesh (ICAB) as the professional body with whom you studied and hold

under International Pathway Program (IPP) of CA ANZ.

membership.

The International Pathway Program (IPP) of CA ANZ is designed for

Step 3: Verification and outcome of your application

experienced members of designated overseas CA bodies including ICAB who

Your application will take approximately 10 to 15 working days to verify. CPA are living in Australia or New Zealand and are seeking membership of CA

Australia will send you an email advising you of your assessment outcome. ANZ.

Step 4: Advance to CPA status For details please visit :

Once you become an Associate member of CPA Australia you must https://www.charteredaccountantsanz.com/become-a-member/memberships/

successfully complete the following four subjects of the CPA Program: pathway-for-members-of-overseas-accounting-bodies/international-pathway-p

rogram

• Ethics and Governance

• Strategic Management Accounting

• Financial Reporting

• Global Strategy and Leadership

When complete, you will advance to CPA status, receive a CPA certificate and

will then be able to use the letters CPA after your name.

For details please visit the link:

https://www.cpaaustralia.com.au/become-a-cpa/starting-the-cpa-program/me

mbership-pathways-and-arrangements/institute-of-chartered-accountants-of-b

angladesh

You might also like

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- Registering As A CASA If You Are A Member of The BodiesDocument28 pagesRegistering As A CASA If You Are A Member of The BodiesNoel SteamerNo ratings yet

- The Certificate in Corporate Finance: RegulationDocument2 pagesThe Certificate in Corporate Finance: RegulationssNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- IC FAQs For International Trained AccountantsDocument4 pagesIC FAQs For International Trained AccountantsPATRICIA GARCIANo ratings yet

- A Glimpse Into Your Project Management Future: 8 Certifications That Can Work For YouFrom EverandA Glimpse Into Your Project Management Future: 8 Certifications That Can Work For YouNo ratings yet

- ICAP Education Scheme 2013Document21 pagesICAP Education Scheme 2013AhmedAliNo ratings yet

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet

- 2014 Approved Employers Working With ACCADocument8 pages2014 Approved Employers Working With ACCASayem TanzeerNo ratings yet

- Cga Faq v6Document4 pagesCga Faq v6Jennifer BrennanNo ratings yet

- Business Continuity Management Systems: Implementation and certification to ISO 22301From EverandBusiness Continuity Management Systems: Implementation and certification to ISO 22301No ratings yet

- CERT Candidate HandbookDocument36 pagesCERT Candidate HandbookKunal Agrawal100% (1)

- Annual CPD Declaration 2019: X X X X XDocument2 pagesAnnual CPD Declaration 2019: X X X X XMuhammad AdilNo ratings yet

- Reciprocity Policy Document MRADocument10 pagesReciprocity Policy Document MRAbwann77No ratings yet

- Three Letters That You Want People To See: Business and Finance ProfessionalDocument8 pagesThree Letters That You Want People To See: Business and Finance ProfessionalHamza SyedNo ratings yet

- Guide To ICF Credentialing ProcessDocument18 pagesGuide To ICF Credentialing Processnova011No ratings yet

- Become A Cpa Information Session: Ben Hamilton & Reshad AziziDocument29 pagesBecome A Cpa Information Session: Ben Hamilton & Reshad AziziSeebaNo ratings yet

- 2018 CAP Certification HandbookDocument28 pages2018 CAP Certification HandbookDELBOEL - Jennie100% (1)

- Details About CaDocument32 pagesDetails About CaAny KindNo ratings yet

- How to become a CPA member under the CPA-CPA Australia MRADocument2 pagesHow to become a CPA member under the CPA-CPA Australia MRAMubbasher HassanNo ratings yet

- CIA HandbookDocument40 pagesCIA Handbookwrapables79100% (4)

- TheIIA CIA Certification Candidate Handbook 2008Document40 pagesTheIIA CIA Certification Candidate Handbook 2008fay hiNo ratings yet

- BCI Candidate Information PackDocument20 pagesBCI Candidate Information PackMukul KhuranaNo ratings yet

- Cbap HandbookDocument13 pagesCbap Handbookravitejabandhakavi29No ratings yet

- 22 Pages SignDocument110 pages22 Pages SignTien NguyenNo ratings yet

- Recognition Guidelines 1013Document4 pagesRecognition Guidelines 1013Bhutto ShareefNo ratings yet

- Approved Employer HandbookDocument26 pagesApproved Employer HandbookAccountNo ratings yet

- ACCA Accreditation StatusDocument12 pagesACCA Accreditation StatusWilliam GrantNo ratings yet

- Philippine Institute of Certified Quantity Surveyors (PICQS), IncDocument6 pagesPhilippine Institute of Certified Quantity Surveyors (PICQS), IncLuis S Alvarez JrNo ratings yet

- CFA Program Fees and Requirements at AUCDocument2 pagesCFA Program Fees and Requirements at AUCMohamed YehiaNo ratings yet

- Cbap HandbookDocument10 pagesCbap HandbookslavdaniNo ratings yet

- ACCA Qualification (Formal Recognition Overview) 2021Document14 pagesACCA Qualification (Formal Recognition Overview) 2021YidenkachewNo ratings yet

- ACCA Education Recognition StatusDocument16 pagesACCA Education Recognition Statusadilishaq100% (1)

- Faqs For Cgas: Membership Application Form From This PageDocument2 pagesFaqs For Cgas: Membership Application Form From This PageShagufta KashifNo ratings yet

- ACCA 2023 2024 Prospectus 3Document24 pagesACCA 2023 2024 Prospectus 3NyanNo ratings yet

- ACCA Registration Guide For 2014-2015Document16 pagesACCA Registration Guide For 2014-2015Daria MarandiucNo ratings yet

- Amendments To Accountants Act 2018 PresentationDocument27 pagesAmendments To Accountants Act 2018 PresentationREJAY89No ratings yet

- MIA Pathway FAQs PDFDocument4 pagesMIA Pathway FAQs PDFhafis82No ratings yet

- Membership Brochure: Zambia Institute of Chartered AccountantsDocument8 pagesMembership Brochure: Zambia Institute of Chartered AccountantsJeremiahNo ratings yet

- Registration of CASA With Other Professional BodiesDocument24 pagesRegistration of CASA With Other Professional BodiesTawanda NgoweNo ratings yet

- Experienced International (June 2022)Document12 pagesExperienced International (June 2022)Hong MingNo ratings yet

- CII Insurance Quals Brochure 11 14Document22 pagesCII Insurance Quals Brochure 11 14manojvarrierNo ratings yet

- Diploma in International Financial Reporting (Dipifr)Document6 pagesDiploma in International Financial Reporting (Dipifr)Vivek SrinivasanNo ratings yet

- Education Recognition StatusDocument15 pagesEducation Recognition StatusMoosa MuhammadhNo ratings yet

- ACCA Education RecognitionDocument16 pagesACCA Education RecognitionMian BialNo ratings yet

- ACCA CPD Declaration 2018 Title GeneratorDocument2 pagesACCA CPD Declaration 2018 Title GeneratorShureen BaskaranNo ratings yet

- The Qualification That Makes A DifferenceDocument12 pagesThe Qualification That Makes A DifferencekenodidNo ratings yet

- Management Institute MembershipDocument2 pagesManagement Institute MembershipashrafgoNo ratings yet

- Certified Internal Auditor (CIA) Sunway TESDocument6 pagesCertified Internal Auditor (CIA) Sunway TESSunway University50% (4)

- ICAEW CFAB Welcome GuideDocument30 pagesICAEW CFAB Welcome GuideKingsley & HaileyNo ratings yet

- ACCA Education RecognitionDocument15 pagesACCA Education RecognitionStacy LimNo ratings yet

- ACCA Handbook 2018 v7Document16 pagesACCA Handbook 2018 v7TalhaAzamNo ratings yet

- Welcome New SAICA MembersDocument16 pagesWelcome New SAICA MembersHenry Sicelo NabelaNo ratings yet

- AccpacDocument147 pagesAccpacscribdmaterials_abcNo ratings yet

- Accelerated Route To Become CIPFA Qualified: What Will You Gain?Document2 pagesAccelerated Route To Become CIPFA Qualified: What Will You Gain?smarttalksaurabhNo ratings yet

- CA Zambia Program BrochureDocument12 pagesCA Zambia Program Brochuremichelo-kandamaNo ratings yet

- Rat & CapDocument3 pagesRat & CapchandraNo ratings yet

- IIA Certification Candidate HandbookDocument40 pagesIIA Certification Candidate HandbookSindu Senjaya Aji100% (1)

- Mountain & Rain ForestDocument1 pageMountain & Rain ForestRumki SarkarNo ratings yet

- PlanetsDocument2 pagesPlanetsRumki SarkarNo ratings yet

- WQTL Price List2022Document1 pageWQTL Price List2022Rumki SarkarNo ratings yet

- AFZ TafeDocument1 pageAFZ TafeRumki SarkarNo ratings yet

- PostDocument1 pagePostRumki SarkarNo ratings yet

- Megher-Bari-Class-Six - BidyanondoDocument1 pageMegher-Bari-Class-Six - BidyanondoRumki SarkarNo ratings yet

- Top 5 Data Science SkillsDocument1 pageTop 5 Data Science SkillsRumki SarkarNo ratings yet

- Bidyanondo 1Document1 pageBidyanondo 1Rumki SarkarNo ratings yet

- The+80 20+Guide+ExtractDocument2 pagesThe+80 20+Guide+ExtractRumki SarkarNo ratings yet

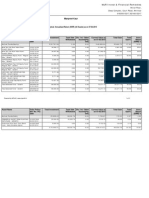

- EOI Pool Selections Table Aug-25-2022Document37 pagesEOI Pool Selections Table Aug-25-2022Rumki SarkarNo ratings yet

- MJR Invest & Financial Remedies Annualised ReturnsDocument2 pagesMJR Invest & Financial Remedies Annualised Returnsmaakabhawan26No ratings yet

- Employee Benefits (IND AS 19Document28 pagesEmployee Benefits (IND AS 19S Bharhath kumarNo ratings yet

- Explore career opportunities at ICICI BankDocument9 pagesExplore career opportunities at ICICI Bankswatidadheech7No ratings yet

- IB - Course OutlineDocument4 pagesIB - Course OutlineChaitanya JethaniNo ratings yet

- Financial Management On Catfish Farms (PDFDrive)Document61 pagesFinancial Management On Catfish Farms (PDFDrive)AmiibahNo ratings yet

- Down Dog Corporation Statement of Affairs June 30, 2014 Book Value AssetsDocument11 pagesDown Dog Corporation Statement of Affairs June 30, 2014 Book Value AssetsEirolNo ratings yet

- Universiti Teknologi Mara Final Examination: This Examination Paper Consists of 6 Printed PagesDocument6 pagesUniversiti Teknologi Mara Final Examination: This Examination Paper Consists of 6 Printed PagesAnisah NiesNo ratings yet

- Traveleasy LTD Management Accounts Profit and Loss StatementDocument5 pagesTraveleasy LTD Management Accounts Profit and Loss StatementSitakanta AcharyaNo ratings yet

- Lecture 5-Audit MaterialityDocument3 pagesLecture 5-Audit Materialityakii ramNo ratings yet

- Transaction Procedures Purchase Sblc-Lloyds Bank LTDDocument2 pagesTransaction Procedures Purchase Sblc-Lloyds Bank LTDMANOJ VIJAYANNo ratings yet

- Loan Sanction_LetterDocument2 pagesLoan Sanction_LetterDaMoN0% (1)

- Soon After Beginning The Year End Audit Work On March 10Document2 pagesSoon After Beginning The Year End Audit Work On March 10M Bilal SaleemNo ratings yet

- Z LKQ EV2 Gaw 58 Cwya 9 M5 Elnqc Diy 7 K KX SF BR SW4 FKDocument1 pageZ LKQ EV2 Gaw 58 Cwya 9 M5 Elnqc Diy 7 K KX SF BR SW4 FKMark RerichaNo ratings yet

- Yes Bank Mainstreaming Development Into Indian BankingDocument20 pagesYes Bank Mainstreaming Development Into Indian Bankinggauarv_singh13No ratings yet

- Namma Kalvi 12th Accountancy Loyola Guide em 219220 PDFDocument75 pagesNamma Kalvi 12th Accountancy Loyola Guide em 219220 PDFBharath JawaharNo ratings yet

- SR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDocument2 pagesSR No Fee Head Fees : Fee Schedule For Portfolio Investment Scheme - Nri CustomersDesikanNo ratings yet

- Topic 1: & Overview of Financial SystemDocument71 pagesTopic 1: & Overview of Financial SystemSarifah SaidsaripudinNo ratings yet

- Merchant Request Letter Direct Debit Mandate FormDocument1 pageMerchant Request Letter Direct Debit Mandate FormStena NadishaniNo ratings yet

- Capstone Project NBFC Loan Foreclosure PredictionDocument48 pagesCapstone Project NBFC Loan Foreclosure PredictionAbhay PoddarNo ratings yet

- Solved From The Trial Balance of Girtie Lillis Attorney at Law Given inDocument1 pageSolved From The Trial Balance of Girtie Lillis Attorney at Law Given inAnbu jaromiaNo ratings yet

- Financial Analysis of SBI Bank PROJECT (MANSI)Document110 pagesFinancial Analysis of SBI Bank PROJECT (MANSI)manan88% (8)

- Gonzales CompanyDocument1 pageGonzales CompanyLako Lako FindsNo ratings yet

- Test Bank For Small Business Management Entrepreneurship and Beyond 6th Edition DownloadDocument38 pagesTest Bank For Small Business Management Entrepreneurship and Beyond 6th Edition DownloadBenjaminWilsongaco100% (18)

- T24 Money Market-Roy Updated EdsDocument76 pagesT24 Money Market-Roy Updated EdsRizky Bayu PratamaNo ratings yet

- YMO - Hand Book PDFDocument90 pagesYMO - Hand Book PDFashu jessyNo ratings yet

- Ch18 SolutionsDocument8 pagesCh18 Solutionschaplain80No ratings yet

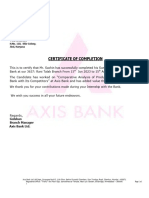

- CertificateDocument4 pagesCertificateMilap NaiduNo ratings yet

- SYNTDocument4 pagesSYNTMervidelle0% (1)

- Credit Card ReportDocument136 pagesCredit Card Reportjoe_inbaNo ratings yet

- AuditingDocument626 pagesAuditingAbdulrehman567No ratings yet