Professional Documents

Culture Documents

Lease Summary 2013 Edition FSUU Accounting

Lease Summary 2013 Edition FSUU Accounting

Uploaded by

Robert CastilloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lease Summary 2013 Edition FSUU Accounting

Lease Summary 2013 Edition FSUU Accounting

Uploaded by

Robert CastilloCopyright:

Available Formats

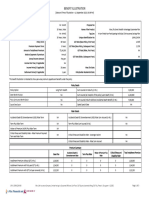

SUMMARY OF ACCOUNTING FOR FINANCE LEASE

TRANSACTION LESSOR

LESSEE DIRECT FINANCING SALES TYPE

a. payment of initial direct cost Property xx Property xx Initial direct cost xx

(depending on who pays) Cash xx Cash xx Cash xx

effect: increase depreciation but not part of effect: give rise to the computation of a effect: added to Cost of sales in

lease liability reduced implicit interest rate determining the gross income

using interpolation process

added to the cost of property to deter-

mine the net investment

b. recording of lease Property xx Lease receivable xx Lease receivable xx

Lease liability xx Property xx Sales xx

computation: Unearned interest in. xx Unearned interest in. xx

Fair value of property computations: Cost of sales xx

LOWER Inventory xx

PV of Min, lease payment (assuming perpetual)

a. rental payments Direct financing Sales type

b. bargain purchase option * Gross investment (GI) Gross rentals ---same----

1. sufficiently lower Residual value (guaranteed or

2. reasonably certain unguaranteed)

c. guaranteed residual value Bargain purchase option

discounted using:

1. rate implicit in the lease * Net investment (NI) Cost of asset + Initial direct PV of Gross Investment

2. lesee's incremental borrowing rate costs

* Unearned interest income (UII) GI - NI GI - NI

Cost or net investment xx * Sales N/A Lower of Net investment or

Less: PV of RV xx Fair value of asset

Amount to be recovered from rent xx * Cost of Sales (COS) N/A Cost of asset + initial direct cost

divided by applicable PV factor xx * Gross profit (GP) N/A Sales - COS

Annual rental xx * Residual value

a. will revert

1. guaranteed PV is deducted from cost of the PV is included in sales because the lessor

Note 1 : if the asset will not revert to the lessor, the residual value is asset or NI for the computation knows that the entire asset has been sold

completely ignored, meaning not included in the computation of the of annual rental (p428) (p448)

gross investment (since all the risks and rewards has already

been transferred)

SUMMARY OF ACCOUNTING FOR LEASE

TRANSACTION LESSOR

LESSEE DIRECT FINANCING SALES TYPE

2. unguaranteed ------ same ------- Gross profit is computed as follows:

Sales( excluding PV of

unguaranteed residual value) xx

COS (excluding PV of

unguaranteed residual value) (xx)

Gross profit xx

b. if will not revert (refer to Note 1)

c. receipt of rentals If payable at the end

Interest expense xx Cash xx

Lease liabilty xx Lease receivable xx ------- same ----------

Cash xx Unearned int inc xx

If payable in advance Interest inc xx

Lease liabilty xx

Cash xx

(1st payment applicable all to principal)

Interest expense xx

Accrued int pay xx

(at the end of the period)

Accrued int pay xx

Lease liability xx

Cash xx

(next payments)

d. receipt of contingent rents Rent expense xx Cash xx ------- same ----------

Cash xx Rent income xx

e. payment of executory costs Repairs & main xx ------- same ---------- ------- same ----------

Cash xx

f. Bargain purchase option (BPO)

1. If exercised Lease liability xx Cash xx ------- same ----------

Cash xx Lease receivable xx

2. If not exercised Acc.deprn xx Property xx (same except for the use of "Inventory"

Lease liability xx Loss on finance lease xx account instead of "Property")

If payable in advance: Loss on fin lease xx Lease receivable xx

Lease liability xx Property xx (lower of the fair value and bargain

Acc int pay xx purchase option)

(The amount is equal to the BPO at the end of the lease term)

TRANSACTION LESSOR

LESSEE DIRECT FINANCING SALES TYPE

g. Return of property

1. with GRV

a. FV ≥ GRV Acc deprn xx Property xx (same except for the use of "Inventory"

Lease liability xx Lease receivable xx account instead of "Property")

Property xx

b. FV ‹ GRV Acc deprn xx Cash xx

Lease liability xx Property xx

Property xx Lease receivable xx

Loss on finance lease xx

Cash xx

2. with UGRV Acc deprn xx a. FV ≥ GRV (same except for the use of "Inventory"

Property xx Property xx account instead of "Property")

Lease receivable xx

Note 2: UGRV is not included in the computation of lease b. FV ‹ GRV

liability and ignored in the computation of depreciation Loss on finance lease

Property xx

h. year end adjustments Leae receivable xx

Depreciation Depreciation xx

Acc deprn xx

Transfer of title useful life

BPO

75% of economic life

90% of fair value shorter of useful life and lease term

Prepared by:

Anbert Angelo C. Cayna, CPA FSUU, Butuan City

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Massey Questions 1-4Document4 pagesMassey Questions 1-4Samir IsmailNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Conceptual Foundations of Balanced ScorecardDocument37 pagesConceptual Foundations of Balanced ScorecardApple LucinoNo ratings yet

- The Balanced Scorecard CabreraDocument10 pagesThe Balanced Scorecard CabreraApple LucinoNo ratings yet

- GE 119 Living in An IT ERADocument57 pagesGE 119 Living in An IT ERAApple LucinoNo ratings yet

- Example 1Document6 pagesExample 1Apple LucinoNo ratings yet

- Process Selection and Facility LayoutDocument40 pagesProcess Selection and Facility LayoutApple LucinoNo ratings yet

- Ia Vol 1 Valix 2019 Answer Key PDFDocument232 pagesIa Vol 1 Valix 2019 Answer Key PDFApple LucinoNo ratings yet

- Financial AnalysissDocument22 pagesFinancial AnalysissChristian Jake RespicioNo ratings yet

- Gf&ar RajasthanDocument258 pagesGf&ar RajasthanNishant ThapaNo ratings yet

- Use of HLARA For Moratorium Based LoansDocument5 pagesUse of HLARA For Moratorium Based LoansRakesh KushwahaNo ratings yet

- Week 1 Fundamentals and The Statement of Financial Position - The Balance SheetDocument43 pagesWeek 1 Fundamentals and The Statement of Financial Position - The Balance SheetJohn SmithNo ratings yet

- The Essentials. Our Guide To CreditDocument16 pagesThe Essentials. Our Guide To CreditHands OffNo ratings yet

- Aptitude Test 1Document4 pagesAptitude Test 1vaio23No ratings yet

- Central Bank Digital Currencies For Beginners A Quick Guide Into CbdcsDocument33 pagesCentral Bank Digital Currencies For Beginners A Quick Guide Into CbdcsCarlos Bueno HorcajoNo ratings yet

- Bonds: Prepared By: JESSA O. BARBERODocument12 pagesBonds: Prepared By: JESSA O. BARBEROJessa BarberoNo ratings yet

- Security Analysis - Investment ManagementDocument0 pagesSecurity Analysis - Investment ManagementAru BhartiNo ratings yet

- Solutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 8Document4 pagesSolutions To Problems: Smart/Gitman/Joehnk, Fundamentals of Investing, 12/e Chapter 8Ahmed El KhateebNo ratings yet

- 2-Policy Questions AllDocument134 pages2-Policy Questions Allgolden79034No ratings yet

- FAR - Accounts Receivable DigestDocument3 pagesFAR - Accounts Receivable DigestBernard FernandezNo ratings yet

- Cash Flow HedgeDocument1 pageCash Flow HedgeMichBadilloCalanogNo ratings yet

- Market Risk ManagementDocument10 pagesMarket Risk ManagementAnonymous fSNbc5q1HgNo ratings yet

- Wells Fargo Everyday Checking: Important Account InformationDocument6 pagesWells Fargo Everyday Checking: Important Account InformationMiguel A RevecoNo ratings yet

- 4 Petty Cash FundDocument13 pages4 Petty Cash FundAlyssa Barbara D. Badidles100% (1)

- NEGOTIABLE INSTRUMENT Reviewer For QuizDocument7 pagesNEGOTIABLE INSTRUMENT Reviewer For Quizlicarl benitoNo ratings yet

- 23091400096557KKBK ChallanReceiptDocument2 pages23091400096557KKBK ChallanReceiptbloodushortfilmNo ratings yet

- Deposits and Financing of Islamic BanksDocument12 pagesDeposits and Financing of Islamic BanksAzah Atikah Anwar BatchaNo ratings yet

- Axis April-16 PDFDocument6 pagesAxis April-16 PDFAnonymous akFYwVpNo ratings yet

- Practice Quiz - Chap1Document7 pagesPractice Quiz - Chap1Nada MuchoNo ratings yet

- Bloomberg Assessment Test FlashcardsDocument34 pagesBloomberg Assessment Test FlashcardsCuongNguyenNo ratings yet

- LSCC Part Bill CC FormDocument2 pagesLSCC Part Bill CC FormV Venkata Narayana83% (6)

- Bank Appointment For Currency Exchange Instructions/ChecklistDocument3 pagesBank Appointment For Currency Exchange Instructions/ChecklistLily DuNo ratings yet

- Applied Auditing Audit of InvestmentsDocument2 pagesApplied Auditing Audit of InvestmentsCar Mae LaNo ratings yet

- Comp FNLDocument524 pagesComp FNLSureshkumaryadavNo ratings yet

- Stability in The Banking Industry and Commodity Price Volatility: Perspective From Developing EconomiesDocument25 pagesStability in The Banking Industry and Commodity Price Volatility: Perspective From Developing EconomiesPrasanjit BiswasNo ratings yet

- Nov2006/P2/Q1: For Examiner's UseDocument5 pagesNov2006/P2/Q1: For Examiner's UseAbid faisal AhmedNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet