Professional Documents

Culture Documents

Income Taxation

Uploaded by

Mohammad Raffe GuroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Taxation

Uploaded by

Mohammad Raffe GuroCopyright:

Available Formats

Rationale of Taxation Types of Double Taxation

It allows for the maintenance of the people Direct double taxation – invalid, done by same body

under same jurisdiction.

Tax is the lifeline of the government. Without it, the

government cannot prosper. Indirect double taxation – valid and done by two

governing bodies. Can be mitigated legally

Symbiotic Relationship – the government is obliged to

protect and serve its people, while the people are CONSTITUTIONAL LIMITATIONS(DUP)

obliged to pay taxes

1. Due process clause – taxpayers should be informed

Purpose/s: with the facts and laws on taxation.

Main 2. Uniformity clause – tax system shall accommodate all

To collect revenue for government functions subjects of taxation, treated alike in privileges and

liabilities.

Secondary (RAC)

Redistribute wealth to the needy (ayuda) 3. Progressive system – tax system shall be uniform,

Attract more employment() equitable and uses a graduate system(level by level)

Complement the police power(fund improvements)

Taxpayers’ Suit

Tax Holiday – tax is lowered or eliminated to attract

Requisites:

investors

There must be Illegal disbursement of public funds

Inherent Power of the Government(PET) Petitioner is directly affected by the alleged act

Police Power Life Blood Doctrine

Power of Eminent Domain

Government’s power of taxation emanates from its

Power of Taxation

necessity to protect and serve its people.

Sintax – tax upon vices to protect the health of its

Principles of Sound Tax System(FAT)

citizens

Fiscal Adequacy – in satisfaction only of government

Branches of the Government

expenditure.

Legislative - Writter of bills Congress and Senate Office Administrative Feasibility – enforced effectively

- the law intends that the bills must come from the Theoretical Justice – payable by taxpayers

congress. Although, bills can also be made by Senators

Situs of Taxation

Executive – Enforce and exercises the law

Tax should be paid per establishment of the same

Judicial – Protects the enforcement of law

company. Although, it can be paid at once in one branch

Limits of Tax(PINGT)

Tax is paid only on the area of transaction where there

Public Purpose is a branch. When there is no branch is located at the

International Comity transaction site, then the tax is paid at the main branch

Non-delegation of Power of the company.

Government exemption

Tax Avoidance – legal reduction or elimination of tax by

Territoriality

taxpayer. This is done through methods that are legal,

Taxpayer’s suit – this suit can be filed when a taxpayer’s but the action is illegal in nature.

funds are misused.

Tax Evasion – reduction or elimination of tax through

Requisites:

illegal means. Not paying tax for no reason, paying less

Illegal or improper use of fund

than what is due, not paying lacking amounts.

Directly affected by the acts

Basic Taxation This will result into an Underpayment or Overpayment

of Income tax due. If underpaid, then pay the lacking

A taxpayer is classified if five categories:

and If overpaid, then there are two options:

1. Resident Citizen

1. Refund the Excess

2. Non-resident Citizen

2. Receive a Tax Credit Certificate(TCC) which can

3. Resident Alien

be used in the next taxable year

4. Non-Resident Alien Engaged in Trade and

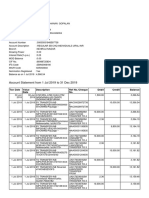

Business Missing:

5. Non-Resident Alien Not Engaged in Trade and

Table on the CITR

Business

Lesson in 1701 – income purely from business or

RC NRC RA NRAE NRANE

profession

Days 365 183 365 180 180

Rate table table table table 25%

Profit In & In In In In

Inclusio out

n

Common Forms used:

BIR form 1700 – Individuals w/ purely compensation

income

BIR form 1701 – Individuals w/ mixed income, business

and profession

BIR form 1701A – Individuals w/ purely from business or

profession income

BIR form 2316 – Individual’s income for the year

In filing Income Tax Return, note the following:

Self Assessment – It will be the taxpayers who

has the obligation to assess his income tax

Pay as you File – Payment of tax should come

with the submission of the ITR

Substituted Filing – employer should file for his

employees their ITR(including payment)

FORM 1700

Format of Calculation

Taxable 750,000

income

Base P30,000

Excess of (400,000) 350,000

Rate 25% 87,500

P117,500

When the taxpayer has two employers, he must file a

Consolidated Income Tax Return(CITR)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- FSA - Assignment-2Document4 pagesFSA - Assignment-2Mohammad Raffe GuroNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- RCC Reviewer 2023Document38 pagesRCC Reviewer 2023Mohammad Raffe GuroNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- L, M, N in RFBT ReviewerDocument15 pagesL, M, N in RFBT ReviewerMohammad Raffe GuroNo ratings yet

- Comprehensive RCC Reviewer 2023Document38 pagesComprehensive RCC Reviewer 2023Mohammad Raffe GuroNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Business Laws and RegulationsDocument3 pagesBusiness Laws and RegulationsMohammad Raffe GuroNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Mandaluyong Corporation Comparative Statement of Financial Position Assets 2022 2021Document4 pagesMandaluyong Corporation Comparative Statement of Financial Position Assets 2022 2021Mohammad Raffe GuroNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- EXAM - IA2 ReviewerDocument17 pagesEXAM - IA2 ReviewerMohammad Raffe GuroNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Strategic Cost ManagementDocument4 pagesStrategic Cost ManagementMohammad Raffe GuroNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Reaction Paper ReorDocument4 pagesReaction Paper ReorBea Claresse TarapeNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- World Credit WhitepaperDocument43 pagesWorld Credit Whitepaper:Lawiy-Zodok:Shamu:-El100% (2)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Legal Profession OutlineDocument47 pagesLegal Profession OutlineBrianStefanovicNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- VSMG2700: Vishay SemiconductorsDocument6 pagesVSMG2700: Vishay Semiconductorssimone_civita_fakeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Lab Exam 1Document3 pagesLab Exam 1Miko F. RodriguezNo ratings yet

- The SAT's Top 1000 Vocabulary Words ADocument2 pagesThe SAT's Top 1000 Vocabulary Words Ayeo pinoNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Best Judgement AssessmentDocument7 pagesBest Judgement AssessmentGautam JayasuryaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Rights Duties of Employees and Employers ReportDocument13 pagesRights Duties of Employees and Employers ReportPipork Bubbles100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Law of Person SoftDocument202 pagesLaw of Person SoftELIZABETH ANOULUWAKITAN ZINSOU92% (12)

- Memorandum People V Franze RamirezDocument19 pagesMemorandum People V Franze RamirezTsi Ming TsoiNo ratings yet

- EMCEEDocument4 pagesEMCEESherree Ann BarberoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Adamson University Faculty and Employees Union. v. Adamson UniversityDocument2 pagesAdamson University Faculty and Employees Union. v. Adamson UniversityMark Anthony ReyesNo ratings yet

- Solved Did DR Moore Have A Duty To Tatiana Tarasoff and DidDocument1 pageSolved Did DR Moore Have A Duty To Tatiana Tarasoff and DidAnbu jaromiaNo ratings yet

- A Study On Role of Salem District Central Cooperative Bank in Agricultural Financing With Special Reference To Crop Loan in Salem DistrictDocument2 pagesA Study On Role of Salem District Central Cooperative Bank in Agricultural Financing With Special Reference To Crop Loan in Salem DistrictNaresh KumarNo ratings yet

- 1 - 6 - 1 - Form For Renewal of Arms LicenseDocument8 pages1 - 6 - 1 - Form For Renewal of Arms LicenseTanmayesh KohliNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Journal From Baptist Teology 8-1 Spring 2011Document136 pagesJournal From Baptist Teology 8-1 Spring 2011Luís Felipe Nunes Borduam100% (1)

- Corporate Budget Circular No 23Document7 pagesCorporate Budget Circular No 23Tesa GDNo ratings yet

- Firm Foundation He Wont Songselect Chart in GDocument2 pagesFirm Foundation He Wont Songselect Chart in GMemeNo ratings yet

- No57 29PA OmarDocument19 pagesNo57 29PA OmarIsidro LodoviceNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Ad 68 17 04 PDFDocument2 pagesAd 68 17 04 PDFBahamas Aviation InstituteNo ratings yet

- Applicationof Qiraat MudrajahDocument10 pagesApplicationof Qiraat MudrajahNot To Be BlackmailedNo ratings yet

- 46 Pleno Vs CADocument13 pages46 Pleno Vs CAdavidNo ratings yet

- 3.a. Full Case. MERALCO vs. CA, G.R. No. L-39019Document2 pages3.a. Full Case. MERALCO vs. CA, G.R. No. L-39019Rene ValentosNo ratings yet

- Auditing Practice Problem 4Document4 pagesAuditing Practice Problem 4Jessa Gay Cartagena TorresNo ratings yet

- SfdsDocument1 pageSfdsRob GrayNo ratings yet

- 1577786160969BcF9eaIss9xkmGva PDFDocument10 pages1577786160969BcF9eaIss9xkmGva PDFGovarthanan GopalanNo ratings yet

- 2307Document16 pages2307Marjorie JotojotNo ratings yet

- Condition of Transgender in IndiaDocument9 pagesCondition of Transgender in IndiaAnupam Kumar YadavNo ratings yet

- Lim-Lua vs. Lua, G.R. No. 175279-80, June 5, 2013Document9 pagesLim-Lua vs. Lua, G.R. No. 175279-80, June 5, 2013Ashley Kate PatalinjugNo ratings yet

- Evolution of The Information Technology Act Genesis and NecessityDocument10 pagesEvolution of The Information Technology Act Genesis and NecessitychiragNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)