Professional Documents

Culture Documents

Act 12-ENTRE

Uploaded by

Void VemOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Act 12-ENTRE

Uploaded by

Void VemCopyright:

Available Formats

Activity 12

1. Explain the importance of business reports.

Business report is a set of information in a business that is usually done on a regular basis. It

helps the business owner and others associate to know what is happening in the company. But

why it is important, simply because it provides valuable data that shows different information

that is vital to a business. It shows how the company develops in a particular period that is

normally on an annual basis but also shows other important data such as potential problems that

might exist in the future that are needed to resolve immediately. Business reports also help the

company attract potential investors as it shows how the company performs that is good for its

reputation. And lastly, it helps the business owner to make a wise decision that is good for the

future development of the company.

2. Explain the various ways to manage the funds of a business enterprise.

Managing the business funds is a must and should always be the top priority as it is the

money or the capital that will be used in the whole business enterprise. And in order for business

to survive, a business owner should know many various ways on how to manage the business

enterprise funds. The first one is by knowing that there are many possible sources of funds, it can

either be their friends, family, banks and other lending institutions that will fund their business. It

is also important that the funds that they will get are budgeted and have an internal control so

that when the time comes that it is needed, it is available. And to help the entrepreneurs and

business owners to manage their funds, the DTI-BSMED enumerated strategic cash management

approach to help them guarantee that whenever he/she needs a money, it is available:

The first one is the Barter; it is an act of exchange of goods without money that benefits not just

the entrepreneur but also the one that he/she exchanges with, in hope for a good return.

Next is Once a week disbursement, which means that the entrepreneur should limit his/her

disbursement to facilitate tracking of both inflow and the exit of funds.

The third one is the Disallowance of prepayment. Paying bills in advance is good as it avoids

the shock of the bills, but as an entrepreneur do not make prepayments in advance as the business

might suffer loss whenever the supply goes off.

The next one is by Taking advantage of non-interest-bearing payables. An entrepreneur

should postpone payment by all means. As the money can be used for income-generating

activities like adding to the business working capital.

Next is Some tricks with regard to issuing a check. It means that the entrepreneurs are allowed

to issue a post -dated check to pay one's debt. In banking, there is such a practice called "playing

the float" or funding the checking account only at the moment of check encashment between or

among different banks. An entrepreneur should take advantage of the period between the time a

check is issued and the moment the creditor will cash it. He/ she can also mail a check to buy

even more time. But keep in mind that the law can penalize issuance of bouncing checks. So,

ensuring that the company has sufficient funds in the bank at the moment of encashment is a

must before issuing a check.

The sixth one is the Concentration banking. The entrepreneur should maintain a "main" bank

account, where all deposits are transferred to facilitate bank consolidation.

Next is the Lock box system, which means renting a post office box (P.O. Box) can help the

entrepreneurs debtors pay their debt if the distance is the issue why they are not paying. By

clustering the debtors into one area and selecting a central office to the closest where they live, it

can help the debtors pay their payments as they can send it in the P.O. Box. The other alternative

is by creating a bank account that is closest to them. The payments made by these customers to

that account will be remitted by the bank to the branch where you maintain your account.

And the last one is the Requirement of down payment. It means that when the customer cannot

pay in full, requiring them to make a down payment can lower the risk you pose to them.

You might also like

- CashflowDocument3 pagesCashflowRuvarasheNo ratings yet

- Business CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersFrom EverandBusiness CreditBuildiBusiness Credit A Comprehensive Guide for Small Business OwnersNo ratings yet

- LM Business Finance Q3 W5 Module 7Document16 pagesLM Business Finance Q3 W5 Module 7Minimi LovelyNo ratings yet

- Project 01Document54 pagesProject 01Chaitanya FulariNo ratings yet

- Arnav KumarDocument4 pagesArnav KumarSimran JaiswalNo ratings yet

- Name Jawad AliDocument17 pagesName Jawad AliWaqas AhmedNo ratings yet

- Ecu302 Financial ManagementDocument5 pagesEcu302 Financial ManagementJack KimaniNo ratings yet

- Commerce 1 GRD 12 ProjectDocument12 pagesCommerce 1 GRD 12 ProjectNeriaNo ratings yet

- Bank and Banking System of BangladeshDocument49 pagesBank and Banking System of BangladeshCONTENT TUBENo ratings yet

- Cash ManagementDocument60 pagesCash ManagementAlif Khan100% (1)

- IGCSE Business Studies Chapter 08 NotesDocument3 pagesIGCSE Business Studies Chapter 08 NotesemonimtiazNo ratings yet

- Working Capital Financing by City Bank LtdDocument16 pagesWorking Capital Financing by City Bank LtdMidul KhanNo ratings yet

- Unit II POEDocument36 pagesUnit II POErachuriharika.965No ratings yet

- Accounting Concepts and Key Financial TermsDocument37 pagesAccounting Concepts and Key Financial TermsAbhay Singh ParmarNo ratings yet

- Auiding FinishDocument51 pagesAuiding Finishdominic wurdaNo ratings yet

- Executive Summary: Various Investment AlternativesDocument53 pagesExecutive Summary: Various Investment AlternativesROSEMARYNo ratings yet

- Fund-managementDocument71 pagesFund-managementJessa IlaoNo ratings yet

- Cash Management FinalDocument15 pagesCash Management Finalapi-3117985510% (1)

- Cash Management - The Importance of Cash ManagementDocument13 pagesCash Management - The Importance of Cash Managementvishwavisa15No ratings yet

- Cash Management ChapterDocument21 pagesCash Management ChapterArfan MehmoodNo ratings yet

- MFRD EssayDocument6 pagesMFRD Essaydoll3kittenNo ratings yet

- Topic 2.1 - Raising Finance Learning Outcome The Aim of This Section Is For Students To Understand The FollowingDocument8 pagesTopic 2.1 - Raising Finance Learning Outcome The Aim of This Section Is For Students To Understand The FollowinggeorgianaNo ratings yet

- Cash Management Cash ManagementDocument60 pagesCash Management Cash ManagementGlenn TaduranNo ratings yet

- Micro LendingDocument4 pagesMicro LendingKeith BalbinNo ratings yet

- Types of Bank Accounts ExplainedDocument8 pagesTypes of Bank Accounts Explainedchaitanya100% (1)

- New Edited Cash ManagementDocument59 pagesNew Edited Cash Managementdominic wurdaNo ratings yet

- ChapterDocument26 pagesChapterHeather NealNo ratings yet

- Chapter 7 Public Financial Management PPA602Document50 pagesChapter 7 Public Financial Management PPA602utopiayet7No ratings yet

- Bba Banking Fin1Document10 pagesBba Banking Fin1kotit35No ratings yet

- RRLDocument2 pagesRRLJOHN AXIL ALEJONo ratings yet

- Managing Financial Resources and DecisionsDocument18 pagesManaging Financial Resources and DecisionsAbdullahAlNomunNo ratings yet

- What is Cash Management and Why is it Important for CompaniesDocument6 pagesWhat is Cash Management and Why is it Important for CompaniesJay ManalotoNo ratings yet

- Business Finance For Video Module 3Document21 pagesBusiness Finance For Video Module 3Bai NiloNo ratings yet

- Assignment of Management of Working Capital On Receivable ManagementDocument6 pagesAssignment of Management of Working Capital On Receivable ManagementShubhamNo ratings yet

- Managing Cash Flow and Working CapitalDocument5 pagesManaging Cash Flow and Working CapitalRonakNo ratings yet

- Managing Cash FlowDocument7 pagesManaging Cash FlowAgustinus SiregarNo ratings yet

- Project On Working CapitalDocument34 pagesProject On Working CapitalRupal HatkarNo ratings yet

- Cash Management ProjectDocument9 pagesCash Management ProjectAli AghaNo ratings yet

- Working Capital Loan: LoansDocument5 pagesWorking Capital Loan: LoansNiharika SharmaNo ratings yet

- Unit - 3 (Notes - Innovation & Entrep.) ..Document11 pagesUnit - 3 (Notes - Innovation & Entrep.) ..Aman PatelNo ratings yet

- Banking and Financial Institutions Module5Document14 pagesBanking and Financial Institutions Module5bad genius100% (1)

- Sources of Finance and Decision MakingDocument34 pagesSources of Finance and Decision MakingWaleed Ahmad100% (1)

- BFN 111 Week 7 - 8Document33 pagesBFN 111 Week 7 - 8CHIDINMA ONUORAHNo ratings yet

- Raising Money For Your BusinessDocument20 pagesRaising Money For Your BusinessPatricia LaguadorNo ratings yet

- Sources of FinanceDocument3 pagesSources of Financealok19886No ratings yet

- Applying For A Business LoanDocument5 pagesApplying For A Business LoanAhmed AlhaddadNo ratings yet

- How to Obtain Funding For Your Start-Up and Loans for Your BusinessFrom EverandHow to Obtain Funding For Your Start-Up and Loans for Your BusinessRating: 4 out of 5 stars4/5 (1)

- Complete FinanceDocument5 pagesComplete FinanceKappala AbhishekNo ratings yet

- Sweet Menu RestaurantDocument13 pagesSweet Menu RestaurantYou VeeNo ratings yet

- Activity 1 - Entre-EntreDocument1 pageActivity 1 - Entre-EntreVoid VemNo ratings yet

- Act 4-EntreDocument2 pagesAct 4-EntreVoid VemNo ratings yet

- Act 13-EntreDocument3 pagesAct 13-EntreVoid VemNo ratings yet

- Act 5-EntreDocument3 pagesAct 5-EntreVoid VemNo ratings yet

- R. Paul Wil - Rico ChetDocument7 pagesR. Paul Wil - Rico ChetJason Griffin100% (1)

- Understanding Customer Loyaltyfor Retail StoreandtheinfluencingfactorsDocument15 pagesUnderstanding Customer Loyaltyfor Retail StoreandtheinfluencingfactorsTanmay PaulNo ratings yet

- Robert Frost BiographyDocument3 pagesRobert Frost Biographypkali18No ratings yet

- Sri Bhavishya Educational AcademyDocument4 pagesSri Bhavishya Educational AcademyAnonymous A6Jnef04No ratings yet

- Slip-System Cal PDFDocument13 pagesSlip-System Cal PDFVanaja JadapalliNo ratings yet

- NOC Status for UPPCB in October 2017Document6 pagesNOC Status for UPPCB in October 2017Jeevan jyoti vnsNo ratings yet

- Grand Caravan Couch BedDocument8 pagesGrand Caravan Couch BedfraniviajeraNo ratings yet

- PDMS JauharManualDocument13 pagesPDMS JauharManualarifhisam100% (2)

- Band Theory of Soids5!1!13Document20 pagesBand Theory of Soids5!1!13Ravi Kumar BanalaNo ratings yet

- Darius Registration Form 201 1623 2nd Semester A.Y. 2021 2022Document1 pageDarius Registration Form 201 1623 2nd Semester A.Y. 2021 2022Kristilla Anonuevo CardonaNo ratings yet

- Stock TakeDocument14 pagesStock Takesafare2222No ratings yet

- Complete Notes On 9th Physics by Asif RasheedDocument82 pagesComplete Notes On 9th Physics by Asif RasheedAsif Rasheed Rajput75% (28)

- Class Record (Science 9) S.Y. 2020-2021Document8 pagesClass Record (Science 9) S.Y. 2020-2021Wilmar EspinosaNo ratings yet

- Azzi, R., Fix, D. S. R., Keller, F. S., & Rocha e Silva, M. I. (1964) - Exteroceptive Control of Response Under Delayed Reinforcement. Journal of The Experimental Analysis of Behavior, 7, 159-162.Document4 pagesAzzi, R., Fix, D. S. R., Keller, F. S., & Rocha e Silva, M. I. (1964) - Exteroceptive Control of Response Under Delayed Reinforcement. Journal of The Experimental Analysis of Behavior, 7, 159-162.Isaac CaballeroNo ratings yet

- 302340KWDocument22 pages302340KWValarmathiNo ratings yet

- Chapter-12 Direct and Inverse ProportionsDocument22 pagesChapter-12 Direct and Inverse ProportionsscihimaNo ratings yet

- Determinants of Excessive Screen Time Among Children Under Five Years Old in Selangor, Malaysia: A Cross-Sectional StudyDocument11 pagesDeterminants of Excessive Screen Time Among Children Under Five Years Old in Selangor, Malaysia: A Cross-Sectional StudyEivor LynNo ratings yet

- IBM Global Business ServicesDocument16 pagesIBM Global Business Servicesamitjain310No ratings yet

- 0000 0000 0335Document40 pages0000 0000 0335Hari SetiawanNo ratings yet

- Media ExercisesDocument24 pagesMedia ExercisesMary SyvakNo ratings yet

- Prueba Final Inglres Robert PalaciosDocument2 pagesPrueba Final Inglres Robert PalaciosCarlos GuerreroNo ratings yet

- Fuji Synapse PACS Quick GuideDocument1 pageFuji Synapse PACS Quick GuideM MNo ratings yet

- PDF 20220814 211454 0000Document6 pagesPDF 20220814 211454 0000Madhav MehtaNo ratings yet

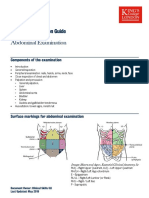

- Abdominal Exam Guide: Palpation, Inspection & Surface MarkingsDocument4 pagesAbdominal Exam Guide: Palpation, Inspection & Surface MarkingsPhysician AssociateNo ratings yet

- Nutrition and Diet Therapy 12Th Edition Roth Solutions Manual Full Chapter PDFDocument30 pagesNutrition and Diet Therapy 12Th Edition Roth Solutions Manual Full Chapter PDFgretchenmilesdxeh3100% (8)

- The Pevearsion of Russian LiteratureDocument8 pagesThe Pevearsion of Russian LiteratureStan MazoNo ratings yet

- Electrode ChemDocument17 pagesElectrode Chemapi-372366467% (3)

- Business PlanDocument8 pagesBusiness PlanyounggirldavidNo ratings yet

- Saht 740 GCPDocument112 pagesSaht 740 GCPJulio SurqueNo ratings yet