Professional Documents

Culture Documents

Pay Slip - 607043 - Jun-22

Uploaded by

Supriya KandukuriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pay Slip - 607043 - Jun-22

Uploaded by

Supriya KandukuriCopyright:

Available Formats

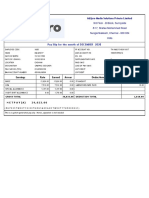

Deloitte Consulting India Private Limited

FLOOR 4, DELOITTE TOWER 1, SURVEY NO. 41, GACHIBOWLI VILLAGE,

RANGA REDDY DISTRICT, HYDERABAD

PAYSLIP FOR THE MONTH OF JUNE 2022

EMP NO : 607043 PF. NO : AP/HY/37885/090321

NAME : Kandukuri Supriya DATE OF JOINING : 24/01/2022

DESIGNATION : XIN-DC Analyst LOCATION : HYDERABAD

UAN : 101508071347 Regime Type : Old Regime

EARNINGS Rs. DEDUCTIONS Rs. COST CENTRE : AMI USI HYD

BASIC PAY 14800.00 PROVIDENT FUND 1800.00 STANDARD DAYS : 30

HOUSE RENT ALLOWANCE 7400.00 PROFESSION TAX 200.00 DAYS WORKED : 30

SPECIAL ALLOWANCE 9573.00 Productivity Ded 12330.00 PAN : HZDPK1745R

LEAVE TRAVEL ALLOWANCE 1480.00 Commute Ded 621.00 GENDER : Female

Differential Allowance 4915.00 Well Being Ded 4702.00

BANK : KOTAK MAHINDRA BANK

Productivity Reimb 12330.00 LTD

Commute Reimb 621.00 A/C No. : 5213564875

Well Being Reimb 4702.00

Total Earnings Rs. 55821.00 Total Deductions Rs. 19653.00 Net Salary Rs. 36168.00

Income Tax Calculation Investment Details

Particulars Cumulative Total Add: Projected Less: Exempted Annual Provident Fund 21600.00

Basic Pay 41700.00 133200.00 0.00 174900.00 Other Declarations

House Rent Allowance 20850.00 66600.00 0.00 87450.00 HRA Rent Paid Details 0.00

Leave Travel Allowance 4170.00 13320.00 0.00 17490.00 CLA Rent Paid Details 0.00

Differential Allowance 13813.00 44235.00 0.00 58048.00 Number of Children for Edu. Rebate 0.00

Bonus 21778.00 0.00 0.00 21778.00

Productivity Reimb 13929.00 0.00 0.00 13929.00

Commute Reimb 621.00 0.00 0.00 621.00

Well Being Reimb 18500.00 0.00 0.00 18500.00

Special Allowance Taxable 112460.00 0.00 0.00 112460.00

Total Income 505176.00

Add: Income received from Previous Employer 0.00

Net Taxable Income 505176.00

Less: Standard Deduction 50000.00

Less: Prof. Tax recovered by Previous Employer 0.00

Less: Prof. Tax recovered by Current Employer 2400.00

Add: Other Taxable Income reported by the employee 0.00

Gross Taxable Income 452776.00

Less : SEC80C - Deduction U/s 80C (Limit Rs.150000/-) 21600.00

Income Chargeable to Tax (Rounded Off) 431180.00

Income Tax Deduction

Income Tax Payable 9059.00

Less : Relief under Section 87 9059.00

Net Income Tax Payable 0.00

Add : Surcharge on Income Tax 0.00

Add : Cess 0.00

Total Income Tax & S/C & Cess Payable 0.00

Less : I. Tax & S/C paid by Prev. Employer 0.00

I.Tax & S/C & Cess to be recovered 0.00

I.Tax & S/C & Cess recovered till JUNE 2022 0.00

Balance I. Tax & S/C & Cess to be recovered 0.00

Avg. Monthly I. Tax & S/C & Cess to be recovered 0.00

Note:

Thu Jun 30 13:34:38 IST 2022

This document contains confidential information. If you are not the intended recipient you are not authorized to use or disclose it in any form.

If you received this in error please destroy it along with any copies and notify the sender immediately.

30/06/2022

You might also like

- Pay Slip - 607043 - Jul-22Document1 pagePay Slip - 607043 - Jul-22Supriya KandukuriNo ratings yet

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaNo ratings yet

- Fortis Hospital February 2019 PayslipDocument1 pageFortis Hospital February 2019 PayslipmkumarsejNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- Payslip 8 2022Document1 pagePayslip 8 2022Md SharidNo ratings yet

- MIOT Hospitals pay slip Oct 2022Document1 pageMIOT Hospitals pay slip Oct 2022jesten jadeNo ratings yet

- Pay Slip Title Under 40 CharactersDocument1 pagePay Slip Title Under 40 CharactersMickey CreationNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- Pushparaj R PayslipDocument3 pagesPushparaj R PayslipHenry suryaNo ratings yet

- Earnings Deductions: B9 Beverages LimitedDocument1 pageEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyNo ratings yet

- Salary SlipsDocument6 pagesSalary SlipsIMSaMiNo ratings yet

- Chola Business Services Pay SlipDocument3 pagesChola Business Services Pay SlipsathyaNo ratings yet

- RAVISH KUMAR SINGH's Pay Slip of March-2023Document1 pageRAVISH KUMAR SINGH's Pay Slip of March-2023ravish singhNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- Payslip 2023 2024 10 05607 VASTUGROUPDocument1 pagePayslip 2023 2024 10 05607 VASTUGROUPNavamani VigneshNo ratings yet

- Payslip 172820180712150142Document1 pagePayslip 172820180712150142LakshmananNo ratings yet

- Slip PDFDocument1 pageSlip PDFAnonymous LVfNCfKuNo ratings yet

- Apoorv - Oct 2022 PayslipDocument1 pageApoorv - Oct 2022 Payslipguda sureshNo ratings yet

- STEAG Energy Services Pay Slip for August 2020Document1 pageSTEAG Energy Services Pay Slip for August 2020Tuhin ChakrabortyNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- Cryoliten India Softwares: A-5 Faizabad Road Near Bhootnath Market Uttar, Pradesh India - 226016Document1 pageCryoliten India Softwares: A-5 Faizabad Road Near Bhootnath Market Uttar, Pradesh India - 226016Rohit raagNo ratings yet

- India Local Monthly130122210312905Document1 pageIndia Local Monthly130122210312905NAGARJUNANo ratings yet

- Centillion Networks PVT LTD: Pay Slip For The Month March 2019Document1 pageCentillion Networks PVT LTD: Pay Slip For The Month March 2019Pruthvi RajuNo ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Document1 pageVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- MABARA MANUFACTURING PAY SLIP FOR JUNE 2022Document2 pagesMABARA MANUFACTURING PAY SLIP FOR JUNE 2022Parveen SainiNo ratings yet

- Techfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032Document1 pageTechfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032manoj mohanNo ratings yet

- Sep2022 STFC PayslipDocument1 pageSep2022 STFC PayslipAjith NandhaNo ratings yet

- Payslip Aug2022Document1 pagePayslip Aug2022Raut AbhimanNo ratings yet

- Amount in Words Is Rupees Eleven Thousand Six OnlyDocument1 pageAmount in Words Is Rupees Eleven Thousand Six OnlyGunaganti MaheshNo ratings yet

- Fe96beed 7a5b 4d7b A5cc C38eecd2b38dDocument1 pageFe96beed 7a5b 4d7b A5cc C38eecd2b38dChandan ShahNo ratings yet

- Pay Slip - 1421107 - Apr-22Document1 pagePay Slip - 1421107 - Apr-22Sachin ChadhaNo ratings yet

- AUGUST PayslipDocument1 pageAUGUST PayslipRakesh MandalNo ratings yet

- Payslip 11260856Document1 pagePayslip 11260856Naga Venkatesh Balijepalli100% (2)

- Payslip For BeginnerDocument1 pagePayslip For BeginnerKhan SahbNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- TarunDocument1 pageTarunUbed QureshiNo ratings yet

- PAY May 2022Document1 pagePAY May 2022Rohit raagNo ratings yet

- CG JUL 2022 46134875 PayslipDocument1 pageCG JUL 2022 46134875 PayslipSoniNo ratings yet

- April 21 PayslipDocument1 pageApril 21 PayslipStephen SNo ratings yet

- Localcube Commerce Private Limited: Payslip For The Month of July 2020Document1 pageLocalcube Commerce Private Limited: Payslip For The Month of July 2020Aswin KumarNo ratings yet

- Salary SlipDocument1 pageSalary SlipPranav Kumar100% (1)

- PAY SLIPDocument1 pagePAY SLIPKFS BANKINGNo ratings yet

- Payslip For The Month of May 2022: VVDN Technologies Private LimitedDocument1 pagePayslip For The Month of May 2022: VVDN Technologies Private LimitedAbinashNo ratings yet

- 498186: Vamsi Krishna Nadella: BSCPL Infrastructure LTDDocument1 page498186: Vamsi Krishna Nadella: BSCPL Infrastructure LTDvamsiNo ratings yet

- Payslip For The Month of March 2015 Earnings DeductionsDocument1 pagePayslip For The Month of March 2015 Earnings Deductionsmadhusudhan N RNo ratings yet

- Salary AugDocument1 pageSalary AugdivanshuNo ratings yet

- Aug - 23 Salary SlipDocument1 pageAug - 23 Salary SlipBack-End MarketingNo ratings yet

- UltraTech Cement Employee PayslipDocument1 pageUltraTech Cement Employee PayslipSaurabh DugarNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Salary January2023Document1 pageSalary January2023AKM Enterprises Pvt LtdNo ratings yet

- N2K Info Systems Private Limited: Payslip For The Month of April - 2019Document1 pageN2K Info Systems Private Limited: Payslip For The Month of April - 2019Munna ShaikNo ratings yet

- This Is My Money. I Earned It by Doing My Best For Our CustomersDocument3 pagesThis Is My Money. I Earned It by Doing My Best For Our CustomersAbzi SyedNo ratings yet

- AISATS Payslip April 2023Document1 pageAISATS Payslip April 2023Sahil shahNo ratings yet

- Pay Slip - 604316 - Nov-22Document1 pagePay Slip - 604316 - Nov-22ArchanaNo ratings yet

- Pay Slip - 604316 - Oct-22Document1 pagePay Slip - 604316 - Oct-22ArchanaNo ratings yet

- Pay Slip - 604316 - Mar-23Document1 pagePay Slip - 604316 - Mar-23ArchanaNo ratings yet

- Supriya Bio DataDocument2 pagesSupriya Bio DataSupriya KandukuriNo ratings yet

- Supriya Bio DataDocument2 pagesSupriya Bio DataSupriya KandukuriNo ratings yet

- Kansupriya@Deloitte - Com f162022 2023Document10 pagesKansupriya@Deloitte - Com f162022 2023Supriya KandukuriNo ratings yet

- Supriya Bio DataDocument2 pagesSupriya Bio DataSupriya KandukuriNo ratings yet

- Supriya Bio DataDocument2 pagesSupriya Bio DataSupriya KandukuriNo ratings yet

- Supriya ResumeDocument1 pageSupriya ResumeSupriya KandukuriNo ratings yet

- CDC Process StepsDocument5 pagesCDC Process StepsSupriya KandukuriNo ratings yet

- Aadhar AnuradhaDocument1 pageAadhar AnuradhaSupriya KandukuriNo ratings yet

- NEFT Mandate FormDocument2 pagesNEFT Mandate FormSupriya KandukuriNo ratings yet

- DTT 23 607043eDocument1 pageDTT 23 607043eSupriya KandukuriNo ratings yet

- Claim FormDocument1 pageClaim FormSupriya KandukuriNo ratings yet

- ReimbursementFormA BDocument5 pagesReimbursementFormA BSupriya KandukuriNo ratings yet

- DTT 23 607043Document1 pageDTT 23 607043Supriya KandukuriNo ratings yet

- DTT 23 607043DDocument1 pageDTT 23 607043DSupriya KandukuriNo ratings yet

- EmploymentDocument1 pageEmploymentSupriya KandukuriNo ratings yet

- Level of Knowledge: Objective:: Syllabus: International Business - Laws and PracticesDocument6 pagesLevel of Knowledge: Objective:: Syllabus: International Business - Laws and PracticesAna Carmela DomingoNo ratings yet

- Acfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxDocument1 pageAcfrogbcb Ms Bu63bgir6a5mzr9iunb2pmzmexmabj 4hj36l0uezc6ewccy1tpcyr7sdn9yzbhtgdvs Eijelsp9pl6tcu7blolcdeipfsa16k 71fyzopeexfd Ewfe3camrxoo Gjz9f BaxHarpreetNo ratings yet

- Profit Per Day: Monday Tuesday Wednesday Thursday Friday 4 6 8Document40 pagesProfit Per Day: Monday Tuesday Wednesday Thursday Friday 4 6 8Maxime Netstat TANTENo ratings yet

- Objectives of FYPs PDFDocument4 pagesObjectives of FYPs PDFRock KrishnaNo ratings yet

- Multinational Financial Management 10th Edition Shapiro Test BankDocument10 pagesMultinational Financial Management 10th Edition Shapiro Test Bankgerald100% (21)

- Worldwide VAT, GST and Sales Tax Guide 2015Document1,072 pagesWorldwide VAT, GST and Sales Tax Guide 2015chandra_sekhar_31No ratings yet

- Afab Quick Statistics 2017.05.31 PDFDocument2 pagesAfab Quick Statistics 2017.05.31 PDFHerojoseNo ratings yet

- Fef - Fiji Mining Sector - Challenges Opportunities - George NiumataiwaluDocument16 pagesFef - Fiji Mining Sector - Challenges Opportunities - George NiumataiwaluIntelligentsiya HqNo ratings yet

- Cons Up TionDocument14 pagesCons Up TionElif TaşdövenNo ratings yet

- Tax invoice detailsDocument1 pageTax invoice detailsAthahNo ratings yet

- Stabilization Adjustment Reform and PrivatizationDocument30 pagesStabilization Adjustment Reform and PrivatizationDannis Anne RegajalNo ratings yet

- Ahmed Al-Shaikh, Maaden - Argus Europe Fertilizer 2017Document19 pagesAhmed Al-Shaikh, Maaden - Argus Europe Fertilizer 2017vzgscribdNo ratings yet

- Gujarat Technological University: InstructionsDocument1 pageGujarat Technological University: InstructionsHansa PrajapatiNo ratings yet

- History of RTGS in India - How Real Time Gross Settlement WorksDocument7 pagesHistory of RTGS in India - How Real Time Gross Settlement WorksDixita ParmarNo ratings yet

- Class 12 CBSE Economics Sample Paper 2023Document8 pagesClass 12 CBSE Economics Sample Paper 2023yazhinirekha4444No ratings yet

- Standard of Living WorksheetDocument1 pageStandard of Living WorksheetMarisa VetterNo ratings yet

- BRACU 501.1 Assignment Spring 2020Document13 pagesBRACU 501.1 Assignment Spring 2020Nabiha AzadNo ratings yet

- Factors Contributed For The Growth of MNCSDocument8 pagesFactors Contributed For The Growth of MNCSSandeepkumar Chennu33% (3)

- IBT MODULE 1 PART 1 and 2Document2 pagesIBT MODULE 1 PART 1 and 2Elaine AntonioNo ratings yet

- Indo China PPT 25Document42 pagesIndo China PPT 25khubhiNo ratings yet

- L-32, International Monetary Fund (IMF)Document17 pagesL-32, International Monetary Fund (IMF)Surya BhardwajNo ratings yet

- Press NoteDocument9 pagesPress NoteRepublic WorldNo ratings yet

- For Non-Account Holder BeneficiaryDocument2 pagesFor Non-Account Holder BeneficiarySP CONTRACTORNo ratings yet

- ForwardRates - January 10 2018Document2 pagesForwardRates - January 10 2018Tiso Blackstar GroupNo ratings yet

- Suryacipta BrochureDocument11 pagesSuryacipta BrochureMaya NarzalinaNo ratings yet

- Indian MSME SectorDocument4 pagesIndian MSME SectorPranav MishraNo ratings yet

- Tourist Arrivals in Subic Freeport Soar to Record Levels 2018-2022Document3 pagesTourist Arrivals in Subic Freeport Soar to Record Levels 2018-2022andreaisabelletalosigNo ratings yet

- c1 Salary BenchmarksDocument44 pagesc1 Salary BenchmarkssnhdnebdhNo ratings yet

- George Yúdice: Free Trade and CultureDocument13 pagesGeorge Yúdice: Free Trade and Cultuream.anliamarysNo ratings yet

- BIMP Eaga B2B Expo 2023 BrochureDocument18 pagesBIMP Eaga B2B Expo 2023 Brochuremeng maxNo ratings yet