Professional Documents

Culture Documents

One Page Write

Uploaded by

ChadwickOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

One Page Write

Uploaded by

ChadwickCopyright:

Available Formats

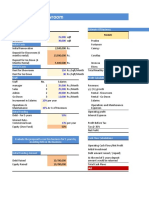

One page write-up for Financial Management

Coursera course

This path starts off evolved via way of means of reviewing the fundamentals of investing,

along with the stability of chance, and going back to forming a portfolio, asset pricing

fashions along with the Capital Asset Pricing Model (CAPM) and the three thing model, and

the Efficient Market Hypothesis. Introducing the 2 additives of inventory returns: dividends

and capital profits. We will provide an explanation for those taxation techniques and the

incentives that real capital profits tax can offer to traders. Examine funding decisions (and

behavioural bias) of members in described contribution (DC) pension plans along with US

401 (k) plans and analyse proof of a person investor`s overall performance in fairness

portfolios. The path concludes via way of means of discussing proof helping the overall

performance of actively controlled funding trusts. Learn approximately the costs that mutual

budget price traders and proof of the connection between the costs charged and the overall

performance of the fund. It additionally indicates segments of a mutual fund portfolio that are

probable to outperform and examples of techniques aimed at “getting alpha”. Novices can

take this path although they've now no longer finished the fundamentals of Investment I:

Performance Assessment. The first module consists of a fundamental funding overview and

regression evaluation so anybody can apprehend it. This path consists of an innovative

creation outdoor studio, a brief module with a 60 countdown that emphasizes what's

blanketed in every module, 4 faculty entered interview sequences with key professors of

finance, and a top-level view of every module. It additionally consists of a few modern

functions and animation

Week 1: Look at the basics of finance, including stability under threats, and look at the

portfolio, asset billing mode, capital asset pricing model (CAPM), three theme models, and

backtracking in building the Green Marketplace hypothesis. please. In addition, we will

discuss inventory return factors: dividends (receipt of coins) and capital gains (fluctuations in

fees after purchase).

• Week 2: Describes individual funding options for a defined contribution (DC) pension plan

consisting of a US 401k plan. Describes the general behavioural bias of DC retirement

recipients. This is because it is important that sound financial decisions in this severance pay

arrangements are no longer plagued by general behavioural bias.

• Week 3: Get a rough idea of the overall performance clues of individual buyers in your

stock portfolio. It is possible to highlight some important behavioural flaws that affect many

people and discuss potential statistics embedded in some additives to individual buyers' stock

portfolios. I can do it.

• Week 4: Get an overview of the overall performance of individual buyers in your equity

portfolio. We can highlight some important behavioural errors that affect many people and

discuss statistics that can be added to an individual buyer's stock portfolio. I could.

You might also like

- Simple 9/30 Moving Average Trading StrategyDocument3 pagesSimple 9/30 Moving Average Trading StrategybhushanNo ratings yet

- Investment Analysis & Portfolio ManagementDocument23 pagesInvestment Analysis & Portfolio ManagementUmair Khan Niazi67% (3)

- CACS Paper 2 Version 2.3Document208 pagesCACS Paper 2 Version 2.3YUE DENGNo ratings yet

- WQU Financial Markets Module 5 Compiled ContentDocument29 pagesWQU Financial Markets Module 5 Compiled Contentvikrant50% (2)

- Formulation of Portfolio Strategy - IMDocument9 pagesFormulation of Portfolio Strategy - IMKhyati KhokharaNo ratings yet

- Intercompany Transactions Bonds LeasesDocument49 pagesIntercompany Transactions Bonds LeasesAndrea Mcnair-West100% (1)

- Basic Finance E-BookDocument140 pagesBasic Finance E-BooksatstarNo ratings yet

- GB550 Course PreviewDocument8 pagesGB550 Course PreviewNatalie Conklin100% (1)

- CH 3 PDFDocument29 pagesCH 3 PDFRefisa JiruNo ratings yet

- Maximize Lead Gen with 40-Char Inbound Marketing TipsheetDocument3 pagesMaximize Lead Gen with 40-Char Inbound Marketing Tipsheetsantosh kumarNo ratings yet

- ADMU Financial Management SyllabusDocument4 pagesADMU Financial Management SyllabusPhilip JosephNo ratings yet

- AC3059 Financial ManagementDocument4 pagesAC3059 Financial ManagementSaad AtharNo ratings yet

- AC3059 Financial ManagementDocument4 pagesAC3059 Financial ManagementJ TNo ratings yet

- MGMG 664 Study Cases in FinanceDocument3 pagesMGMG 664 Study Cases in FinanceBenjy PassamonNo ratings yet

- Investment Analytics PrefaceDocument1 pageInvestment Analytics PrefaceSanjay JagatsinghNo ratings yet

- Fitch Learning Cfa Level I Study PlannerDocument2 pagesFitch Learning Cfa Level I Study PlannerpiyushbmakhijaNo ratings yet

- Corporate Finance Syllabus 2015Document7 pagesCorporate Finance Syllabus 2015SlimBrownNo ratings yet

- Book 6Document7 pagesBook 6gudataaNo ratings yet

- Book 8Document8 pagesBook 8gudataaNo ratings yet

- BAV 3 Credits PGP Aug 2013Document5 pagesBAV 3 Credits PGP Aug 2013tapkeyNo ratings yet

- MBA Required Courses Cover Accounting, Finance, Management and MoreDocument24 pagesMBA Required Courses Cover Accounting, Finance, Management and MoresikandarbatchaNo ratings yet

- Bankers Financial ToolsDocument10 pagesBankers Financial ToolsHongyi-George SongNo ratings yet

- Financial Management Study GuideDocument10 pagesFinancial Management Study GuideMadalina CiupercaNo ratings yet

- Chapter 5 - Financial Management and Policies - SyllabusDocument7 pagesChapter 5 - Financial Management and Policies - SyllabusharithraaNo ratings yet

- Modeling CH 2Document58 pagesModeling CH 2rsh765No ratings yet

- Advanced Corporate Finance PartDocument73 pagesAdvanced Corporate Finance PartYidnekachew AwekeNo ratings yet

- Book 1Document10 pagesBook 1gudataaNo ratings yet

- Unit Information Form (UIF) : Page 1 of 5Document5 pagesUnit Information Form (UIF) : Page 1 of 5Radha ThakurNo ratings yet

- 13MgmtLibrary USDocument3 pages13MgmtLibrary UShdfcblgoaNo ratings yet

- Assignment 3 (Ayush Jain)Document5 pagesAssignment 3 (Ayush Jain)Abhijeet JainNo ratings yet

- Investment SyllabusDocument6 pagesInvestment SyllabusAshish MakraniNo ratings yet

- SAPMDocument7 pagesSAPMRohit RoyNo ratings yet

- SOLVED Business EconomicsDocument15 pagesSOLVED Business EconomicsSolve AssignmentNo ratings yet

- 1.4 An Overview of The Capital Allocation Process: Self-TestDocument1 page1.4 An Overview of The Capital Allocation Process: Self-Testadrien_ducaillouNo ratings yet

- Chapter 2Document31 pagesChapter 2Maryam AlaleeliNo ratings yet

- FinmanDocument52 pagesFinmanErica RamosNo ratings yet

- Regional Mba CurriculumDocument10 pagesRegional Mba CurriculumabozziNo ratings yet

- Instructor-In-Charge: Prof. Niranjan Swain: Niranjanswain@pilani - Bits-Pilani.c.inDocument13 pagesInstructor-In-Charge: Prof. Niranjan Swain: Niranjanswain@pilani - Bits-Pilani.c.inSiddharth MehtaNo ratings yet

- BA (Hons) Applied Accounting Module DescriptionsDocument3 pagesBA (Hons) Applied Accounting Module Descriptionstosh55555100% (2)

- 22PGD202 CFDocument3 pages22PGD202 CFRohit KumarNo ratings yet

- Formulation of Portfolio StrategyDocument9 pagesFormulation of Portfolio StrategyKhyati KhokharaNo ratings yet

- Toulouse Business School: C O U R S E C O N T E N TDocument28 pagesToulouse Business School: C O U R S E C O N T E N TlocoNo ratings yet

- Introcuction To Finance - HandoutsDocument20 pagesIntrocuction To Finance - HandoutsChristos007No ratings yet

- PH.D Thesis Corporate Governance Issues and Performance of Initial Public Offerings AuthorDocument138 pagesPH.D Thesis Corporate Governance Issues and Performance of Initial Public Offerings Authorabhi malikNo ratings yet

- FinMan AE 19 Module 1 Intro To FinManDocument8 pagesFinMan AE 19 Module 1 Intro To FinManMILLARE, Teddy Glo B.No ratings yet

- Financial Management: Deobela Fulo-Fortes, MPADocument41 pagesFinancial Management: Deobela Fulo-Fortes, MPAAxel MendozaNo ratings yet

- Strategic Business Analysis TopicsDocument3 pagesStrategic Business Analysis TopicsLyca MaeNo ratings yet

- Financial Management I Module - 2021Document34 pagesFinancial Management I Module - 2021Yoan EdelweisNo ratings yet

- Modern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank CH 5Document4 pagesModern Portfolio Theory and Investment Analysis 9th Edition Elton Test Bank CH 5HarshNo ratings yet

- Course Title: Advanced Financial Management Course Code: MBA 5061 Credit Hour: 2 Ects: 5 Course DescriptionDocument3 pagesCourse Title: Advanced Financial Management Course Code: MBA 5061 Credit Hour: 2 Ects: 5 Course DescriptionAbdu MohammedNo ratings yet

- Build Optimal Investment PortfoliosDocument67 pagesBuild Optimal Investment PortfoliosSantosh DasNo ratings yet

- Jaipuria Institute of Management, Lucknow Post Graduate Diploma in Management THIRD TRIMESTER (2013-2014)Document6 pagesJaipuria Institute of Management, Lucknow Post Graduate Diploma in Management THIRD TRIMESTER (2013-2014)saah007No ratings yet

- WQU Financial Markets Module 5Document28 pagesWQU Financial Markets Module 5joca12890% (1)

- RFP Program SyllabusDocument5 pagesRFP Program SyllabusSebastian GarciaNo ratings yet

- M14 - Final Exam & RevisionDocument43 pagesM14 - Final Exam & RevisionJashmine Suwa ByanjankarNo ratings yet

- Master of Business Administration - MBA Semester 2 (Book ID: B1134) Assignment Set-1 (60 Marks)Document26 pagesMaster of Business Administration - MBA Semester 2 (Book ID: B1134) Assignment Set-1 (60 Marks)Usman IlyasNo ratings yet

- FINC 3117 - Winter 2023 SyllabusDocument11 pagesFINC 3117 - Winter 2023 Syllabusomar mcintoshNo ratings yet

- Course Outline Business FinanceDocument6 pagesCourse Outline Business FinanceKalonduMakauNo ratings yet

- ACF 361 Chapter 1 To 3Document148 pagesACF 361 Chapter 1 To 3edithyemehNo ratings yet

- CH 02Document23 pagesCH 02Nurhidayati HanafiNo ratings yet

- Case QuestionsDocument10 pagesCase QuestionsJeremy SchweizerNo ratings yet

- Steps Academics Can Take Now to Protect and Grow Their PortfoliosFrom EverandSteps Academics Can Take Now to Protect and Grow Their PortfoliosNo ratings yet

- Week 3Document3 pagesWeek 3ChadwickNo ratings yet

- Trade HistoryDocument7 pagesTrade HistoryChadwickNo ratings yet

- Case Study-3Document1 pageCase Study-3ChadwickNo ratings yet

- Business Canvas of OlaDocument1 pageBusiness Canvas of OlaChadwickNo ratings yet

- Duties On CementDocument28 pagesDuties On CementJai SinghNo ratings yet

- Laws Pertaining To Private Personal and Commercial RelationsDocument10 pagesLaws Pertaining To Private Personal and Commercial RelationsJean TubacNo ratings yet

- 13 Essential Accounting PrinciplesDocument3 pages13 Essential Accounting PrinciplesRae MichaelNo ratings yet

- Pantaloons Loyalty Program Rewards CustomersDocument5 pagesPantaloons Loyalty Program Rewards CustomersSrimon10No ratings yet

- Advertising Strategies of Paint Companies in IndiaDocument131 pagesAdvertising Strategies of Paint Companies in IndiaYash Vasanta100% (1)

- LOPEZ - S - Ass2 - The 3D Wheel of Architect's Services - Module1Document4 pagesLOPEZ - S - Ass2 - The 3D Wheel of Architect's Services - Module1qslmlopezNo ratings yet

- LUMBA FC SyllabusDocument15 pagesLUMBA FC SyllabusAbhyuday VijayNo ratings yet

- La Consolacion College Manila: Finman IiDocument14 pagesLa Consolacion College Manila: Finman Iigerald calignerNo ratings yet

- Economics of Strategy (Rješenja)Document227 pagesEconomics of Strategy (Rješenja)Antonio Hrvoje ŽupićNo ratings yet

- Field inspection plan for structural steel erectionDocument1 pageField inspection plan for structural steel erectionDelta akathehusky100% (1)

- Set up car showroom business planDocument14 pagesSet up car showroom business planshrish guptaNo ratings yet

- HRM PairingDocument8 pagesHRM PairingsyahNo ratings yet

- Importance of Economics to CEOsDocument2 pagesImportance of Economics to CEOsNikoli Franceska JovenNo ratings yet

- Resistant Flooring Solutions For Biscuit Plant: Mondelez - Casablanca, MoroccoDocument2 pagesResistant Flooring Solutions For Biscuit Plant: Mondelez - Casablanca, Moroccobassem kooliNo ratings yet

- LP5 Standard Costing and Variance AnalysisDocument22 pagesLP5 Standard Costing and Variance AnalysisJace Czhristian SantosNo ratings yet

- Fintech and E Commerce in MyanmarDocument34 pagesFintech and E Commerce in MyanmarTHU RA AUNGNo ratings yet

- Schaeffler Vietnam Internship ReportDocument20 pagesSchaeffler Vietnam Internship ReportNghi TrầnNo ratings yet

- WPR Ehsan CVDocument6 pagesWPR Ehsan CVShahid BhattiNo ratings yet

- BSBOPS601 Project PortfolioDocument16 pagesBSBOPS601 Project PortfolioNishchal TimsinaNo ratings yet

- Cuaderno Técnico Schneider Electric N 145 Estudio Térmico de Cuadros EléctricosDocument1 pageCuaderno Técnico Schneider Electric N 145 Estudio Térmico de Cuadros EléctricosisaacingNo ratings yet

- A Study On Consumer Behaviour Towards Bottled Drinking Water With Special Reference To Coimbatore City M. Sangeetha & Dr. K. BrindhaDocument4 pagesA Study On Consumer Behaviour Towards Bottled Drinking Water With Special Reference To Coimbatore City M. Sangeetha & Dr. K. BrindhaAnusha YemireddyNo ratings yet

- RFP For Airoli-Katai Highway ProjectDocument126 pagesRFP For Airoli-Katai Highway ProjectEkta Agrawal100% (1)

- MEDX 58 Total Productive MaintenanceDocument3 pagesMEDX 58 Total Productive Maintenancerajee101No ratings yet

- Sitxccs007 Assessment Task 3Document7 pagesSitxccs007 Assessment Task 3komal sharmaNo ratings yet

- Bustax Chapter 1Document9 pagesBustax Chapter 1Pineda, Paula MarieNo ratings yet

- ENVIRONMENTDocument22 pagesENVIRONMENTNilesh MangwaniNo ratings yet