Professional Documents

Culture Documents

Intacc Ass 2

Uploaded by

Pixie Canaveral0 ratings0% found this document useful (0 votes)

3 views3 pagesOriginal Title

intacc ass 2

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesIntacc Ass 2

Uploaded by

Pixie CanaveralCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

Cañaveral, Rhia Pixie T.

2nd Yr. BS Accountancy

Assignment no.2

Intermediate Accounting 1

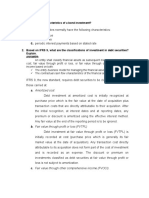

Financial assets at amortized cost (bond investment)

Definition of a bond

Is a formal unconditional promise made under seal to pay a specified sum of money

at a determinable future date, and to make periodic interest payments at a stated rate

until the principal sum is paid.

Initial measurement of bond investment

In accordance with PFRS 9, paragraph 5.1.1, bond investments are recognized initially

at fair value plus transaction costs that are directly attributable to the acquisition.

However, transaction costs attributable to the acquisition of bond investments held

for trading or at fair value through profit or loss are expensed immediately.

Amortization of premium or discount

Investment in bonds shall be measured subsequently at amortized cost. This means

that any premium or discount on the acquisition of long-term investment in bonds

must be amortized. Bond premium or discount is amortized over the remaining life of

the bonds from the date of acquisition to the date of maturity. Amortization may be

made on interest dates or at the end of the reporting period. It is more convenient to

record amortization at the end of the reporting period.

Straight line method of amortization

Provides for an equal amount of premium or discount amortization each accounting

period. Following the straight line method, the annual amortization of discount and

premium as simply computed by dividing the amount of discount and premium by the

life of the bonds.

Bond outstanding method of amortization

Applicable to serial bonds and provides for a decreasing amount of amortization.

Effective interest method

Nominal interest rate

Is the coupon rate or stated rate appearing on the face of the bond.

Refers to the interest rate before taking inflation into account. Nominal can also refer

to the advertised or stated interest rate on a loam, without taking into account any

fees or compounding of interest.

Effective interest rate

Effective interest or scientific method simply requires the comparison between the

interest earned or interest income and the interest received.

Interest rate on a loan or financial product restated from the nominal interest rate and

expressed as the equivalent interest if compound interest was payable annually in

arrears.

Effective interest method of amortization

Is an accounting practice used to discount a bond. This method is used for bonds sold

at a discount or premium; the amount of the bond discount or premium is amortized

to interest expense over the bond’s life.

Bond investment - FVOCI

PFRS 9, paragraph 4.1.2A, provides that a financial asset shall be measured at fair

value through other comprehensive income if both of the following conditions are

met:

a. The business model is achieved both by collecting contractual cash flows

and by selling or trading the financial asset.

b. The contractual cash flows are solely payments of principal and interest on

the principal outstanding.

Fair value option

PRFS 9, paragraph 4.1.5, provides that an entity at initial recognition may irrevocably

designate a financial asset as measured at fair value through profit or loss even if the

financial asset satisfies the amortized cost or FVOCI measurement.

Market price of bonds

The market price of bonds is equal to the present value of the principal plus the

present value of future interest payments using the effective rate.

The present value of an ordinary annuity of 1 us determined for the number of

interest periods using the effective rate.

Reclassification of financial asset

Requirement for reclassification

PFRS 9, paragraph 4.4.1, provides that an entity shall reclassify financial assets only

when it changes the business model for managing the financial assets. Where

reclassification occurs, paragraph 5.6.1 provides that an entity shall apply the

reclassification prospectively from the reclassification date. The entity shall not restate

any previously recognized gains, losses and interest.

Exemptions from reclassification

a) Equity investment held for trading or measured at FVPL cannot be reclassified by

reason of the consequential requirement of PFRS 9.

All equity investment cannot be classified.

b) Equity investment measured at FVOCI by irrevocable election cannot be reclassified

simply because the election is irrevocable.

c) Only debt investment can be reclassified because the change in business model

applies appropriately to debt investment. However, debt investment measured at

FVPL by irrevocable election cannot be reclassified simply because the election is

irrevocable.

Reclassification from FVPL to amortized cost

PFRS 9, paragraph 5.6.3, provides the following if a financial asset is reclassified from FVPL

to amortized cost:

a. The fair value at the reclassification date becomes the new carrying

amount of the financial asset at amortized cost.

b. The difference between the new carrying amount of the financial asset

at amortized cost and the face amount of the financial asset shall be

amortized through profit or loss over the remaining life of the financial

asset using the effective interest method.

c. A new effective interest rate must be determined based on the new

carrying amount or fair value at reclassification.

Reclassification from amortized cost to FVPL

PFRS 9, paragraph 5.6.2, provides that when an entity reclassifies a financial asset from

amortized cost to fair value through profit or loss, the fair value is determined at

reclassification date. The difference between the previous carrying amount and fair value is

recognized in profit or loss.

Reclassification from FVOCI to amortized cost

PFRS 9, paragraph 5.6.5, provides the following if a financial asset is reclassified from FVOCI

to amortized cost:

a. The fair value at reclassification date becomes the new amortized cost

carrying amount.

b. The cumulative gain or loss previously recognized in other

comprehensive income is eliminated and adjusted against the fair

value at reclassification date. As a result, the investment is reverted

back to amortized cost measurement.

c. The original effective rate is not adjusted.

Reclassification from FVPL to FVOCI

PFRS 9, paragraph 5.6.6, provides the following if a financial asset is reclassified from FVPL

to FVOCI:

a. The financial asset continued to be measured at fair value.

b. The fair value at reclassification date becomes the new carrying

amount.

c. A new effective rate must be determined based on the new carrying

amount or fair value at reclassification date.

Reclassification from FVOCI to FVPL

PFRS 9, paragraph 5.6.7, provides the following if a financial asset is reclassified from FVOCI

to FVPL:

a. The financial asset continues to be measured at fair value.

b. The fair value at reclassification date becomes the new carrying

amount.

c. The cumulative gain or loss previously recognized in other

comprehensive income is reclassified to profit or loss at reclassification

date.

You might also like

- Chapter 23: Financial Asset at Fair Value Question 23-1 Multiple Choice (PFRS 9)Document11 pagesChapter 23: Financial Asset at Fair Value Question 23-1 Multiple Choice (PFRS 9)Nana GandaNo ratings yet

- Investment in Debt SecuritiesDocument7 pagesInvestment in Debt SecuritiesRoma Suliguin0% (1)

- Profit & Loss Statement: O' Lites GymDocument8 pagesProfit & Loss Statement: O' Lites GymNoorulain Adnan100% (5)

- 1 IFRS 9 - Financial InstrumentsDocument31 pages1 IFRS 9 - Financial InstrumentsSharmaineMirandaNo ratings yet

- Auditing Problem From Audit of InvestmentDocument61 pagesAuditing Problem From Audit of InvestmentNicole Anne Santiago SibuloNo ratings yet

- AUDITING PROBLEM - From Audit of InvestmentDocument60 pagesAUDITING PROBLEM - From Audit of InvestmentMa. Hazel Donita Diaz100% (1)

- Auditing Fixed Assets and Capital Work in ProgressDocument23 pagesAuditing Fixed Assets and Capital Work in ProgressMM_AKSI87% (15)

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- CPADocument7 pagesCPACaryl Haidee MarcosNo ratings yet

- CIMA F2 Workbook Q PDFDocument79 pagesCIMA F2 Workbook Q PDFshehaniNo ratings yet

- Module 7 - Notes Payable & Debt RestructuringDocument4 pagesModule 7 - Notes Payable & Debt RestructuringLuiNo ratings yet

- Financial Planning and ForecastingDocument16 pagesFinancial Planning and ForecastingAzain UsmanNo ratings yet

- FAR 4309 Investment in Debt Securities 2Document6 pagesFAR 4309 Investment in Debt Securities 2ATHALIAH LUNA MERCADEJASNo ratings yet

- Types of Financial Decisions in Financial ManagementDocument20 pagesTypes of Financial Decisions in Financial ManagementRahul Upadhayaya100% (1)

- #14 Investments in Debt InstrumentsDocument5 pages#14 Investments in Debt InstrumentsMakoy Bixenman100% (1)

- Chapter 19 - Financial Asset at Amortized Cost Bond InvestmentDocument8 pagesChapter 19 - Financial Asset at Amortized Cost Bond InvestmentmercyvienhoNo ratings yet

- Prepare Operational BudgetsDocument25 pagesPrepare Operational Budgetsnahu a din100% (1)

- Chapter 21 - Reclassification of Financial Asset PDFDocument9 pagesChapter 21 - Reclassification of Financial Asset PDFTurksNo ratings yet

- Module 4 - Financial Instruments (Assets)Document9 pagesModule 4 - Financial Instruments (Assets)Luisito CorreaNo ratings yet

- #14 PFRS 9 (Financial Instruments-Summary)Document5 pages#14 PFRS 9 (Financial Instruments-Summary)Zaaavnn Vannnnn100% (1)

- NOTES On PFRS 9 Financial InstrumentsDocument11 pagesNOTES On PFRS 9 Financial Instrumentsjsus22100% (1)

- PFRS 9, Paragraph 4.1.2, Provides That A Financial Asset Shall MeasuredDocument3 pagesPFRS 9, Paragraph 4.1.2, Provides That A Financial Asset Shall MeasuredSwai RosendeNo ratings yet

- Intacc 1 Notes - Financial Assets StartDocument8 pagesIntacc 1 Notes - Financial Assets StartKing BelicarioNo ratings yet

- Philippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Document13 pagesPhilippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Thalia UyNo ratings yet

- Financial Asset at Fair Value Question 31-1 What Are The Classifications of Financial Assets?Document12 pagesFinancial Asset at Fair Value Question 31-1 What Are The Classifications of Financial Assets?jsemlpzNo ratings yet

- Pas 32/Pfrs 9 - Financial Instrument: Classification of Financial AssetsDocument4 pagesPas 32/Pfrs 9 - Financial Instrument: Classification of Financial AssetsAnna AldaveNo ratings yet

- Pas 32 PFRS 9Document110 pagesPas 32 PFRS 9Katzkie Montemayor GodinezNo ratings yet

- Acca SBR 675 685 PDFDocument11 pagesAcca SBR 675 685 PDFYudheesh P 1822082No ratings yet

- 06B Investment in Debt SecuritiesDocument4 pages06B Investment in Debt Securitiesrandomlungs121223No ratings yet

- What Are The Characteristics of A Bond Investment? AnswerDocument4 pagesWhat Are The Characteristics of A Bond Investment? AnswerAllysa Jane FajilagmagoNo ratings yet

- CFAS Review QuestionsDocument3 pagesCFAS Review QuestionsJay-B AngeloNo ratings yet

- Gtal - 2016 Ifrs9 Financial InstrumentsDocument11 pagesGtal - 2016 Ifrs9 Financial InstrumentsErlanNo ratings yet

- 21 Financial Instruments s22 - FINALDocument95 pages21 Financial Instruments s22 - FINALAphelele GqadaNo ratings yet

- APC 403 PFRS For SEs (Section 6)Document7 pagesAPC 403 PFRS For SEs (Section 6)AnnSareineMamadesNo ratings yet

- Substantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial AssetsDocument3 pagesSubstantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial Assetsdianne caballeroNo ratings yet

- PFRS 9 - Financial Instruments (NEW)Document20 pagesPFRS 9 - Financial Instruments (NEW)eiraNo ratings yet

- Ifrs 9 Financial at Fair Value - FVTPL and FvtociDocument2 pagesIfrs 9 Financial at Fair Value - FVTPL and Fvtocironnelson pascual100% (2)

- AE 121 Chapter 21 Summary NotesDocument3 pagesAE 121 Chapter 21 Summary NotesmercyvienhoNo ratings yet

- SodapdfDocument61 pagesSodapdfNicole Anne Santiago SibuloNo ratings yet

- Module 5-InvestmentsDocument27 pagesModule 5-InvestmentsJane Clarisse SantosNo ratings yet

- IFRS 9 SummaryDocument13 pagesIFRS 9 SummaryCharles BarcelaNo ratings yet

- Invesrment in Debt InstrumentsDocument2 pagesInvesrment in Debt InstrumentsElla MontefalcoNo ratings yet

- NC Concept MapDocument3 pagesNC Concept MapMitch MindanaoNo ratings yet

- IA Chap. 19, 20, and 22Document31 pagesIA Chap. 19, 20, and 22Pitel O'shoppeNo ratings yet

- IASB Proposes Amendment To IFRS 9 On Measuring Instruments With Negative Compensation Prepayment FeaturesDocument4 pagesIASB Proposes Amendment To IFRS 9 On Measuring Instruments With Negative Compensation Prepayment Featureseunice chungNo ratings yet

- Borrowing CostDocument2 pagesBorrowing CostAlexander Dimalipos100% (1)

- 2-14-2017 Financial Asset ClassificationDocument2 pages2-14-2017 Financial Asset ClassificationMr. CopernicusNo ratings yet

- Notes Payable and Debt RestructuringDocument14 pagesNotes Payable and Debt Restructuringglrosaaa cNo ratings yet

- Investment NotesDocument12 pagesInvestment NotesLenrey CobachaNo ratings yet

- Iact-1 Rev FinalsDocument50 pagesIact-1 Rev FinalsmickaNo ratings yet

- Investments DiscussionDocument5 pagesInvestments DiscussionKathrine CruzNo ratings yet

- FAR-Lecture 4Document3 pagesFAR-Lecture 4wingsenigma 00No ratings yet

- Pfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4Document8 pagesPfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4d.pagkatoytoyNo ratings yet

- Particulars As Required by The Standards As Presented by The Company Assessment Recognition PrinciplesDocument7 pagesParticulars As Required by The Standards As Presented by The Company Assessment Recognition Principleskiema katsutoNo ratings yet

- Week 05 - 01 - Module 10 - Financial Assets at Fair ValueDocument11 pagesWeek 05 - 01 - Module 10 - Financial Assets at Fair Value지마리No ratings yet

- Accounting For InvestmentsDocument7 pagesAccounting For InvestmentsPaolo Immanuel OlanoNo ratings yet

- Ifrs 9Document4 pagesIfrs 9Elsha MisamisNo ratings yet

- Probiotec Annual Report 2021 6Document8 pagesProbiotec Annual Report 2021 6楊敬宇No ratings yet

- Chapter10 Reviewquestions AnswersDocument2 pagesChapter10 Reviewquestions AnswersEANNA15No ratings yet

- Bonds Payable HandoutDocument3 pagesBonds Payable HandoutJeanieNo ratings yet

- RECEIVABLESDocument14 pagesRECEIVABLESGelyn OlayvarNo ratings yet

- Ifrs 9: Financial Instruments: SourcesDocument7 pagesIfrs 9: Financial Instruments: SourcesPrincess Therese CañeteNo ratings yet

- Ifrs 9 Financial Instruments: Approach To Macro Hedging. Consequently, The Exception in IAS 39 For A Fair ValueDocument13 pagesIfrs 9 Financial Instruments: Approach To Macro Hedging. Consequently, The Exception in IAS 39 For A Fair ValueAira Nhaira MecateNo ratings yet

- ? Management Approach. Chief Operating Decision Maker: Pfrs 8 Q&ADocument8 pages? Management Approach. Chief Operating Decision Maker: Pfrs 8 Q&ALALALA LULULUNo ratings yet

- Financial Instrument - (NEW)Document11 pagesFinancial Instrument - (NEW)AS Gaming100% (1)

- Home Office and Branch AccountingDocument2 pagesHome Office and Branch AccountingPixie CanaveralNo ratings yet

- TX1TX1Document3 pagesTX1TX1Pixie CanaveralNo ratings yet

- IT2 ReviewerDocument2 pagesIT2 ReviewerPixie CanaveralNo ratings yet

- AdvAcctg ReviewerDocument11 pagesAdvAcctg ReviewerPixie CanaveralNo ratings yet

- Accounting Info - 1st SemDocument17 pagesAccounting Info - 1st SemPixie CanaveralNo ratings yet

- Reviewer - IntaccDocument36 pagesReviewer - IntaccPixie CanaveralNo ratings yet

- Fin Mar ReviewerDocument2 pagesFin Mar ReviewerPixie CanaveralNo ratings yet

- Intacc Ass 4Document5 pagesIntacc Ass 4Pixie CanaveralNo ratings yet

- Intacc Ass 3Document2 pagesIntacc Ass 3Pixie CanaveralNo ratings yet

- Reviewer Cfas MidtermsDocument3 pagesReviewer Cfas MidtermsPixie CanaveralNo ratings yet

- Intacc Ass 5Document2 pagesIntacc Ass 5Pixie CanaveralNo ratings yet

- Intacc Ass 7Document7 pagesIntacc Ass 7Pixie CanaveralNo ratings yet

- GovernanceDocument13 pagesGovernancePixie CanaveralNo ratings yet

- Intacc Ass 1Document5 pagesIntacc Ass 1Pixie CanaveralNo ratings yet

- Declining Balance Depreciation Alpha 0.15 N 10Document2 pagesDeclining Balance Depreciation Alpha 0.15 N 10Ysabela Angela FloresNo ratings yet

- PNJ Update 20201207Document7 pagesPNJ Update 20201207Khoa PhamNo ratings yet

- 18 007004 PDFDocument206 pages18 007004 PDFBrenda HerringNo ratings yet

- Report On General TyreDocument21 pagesReport On General TyreTahir KhanNo ratings yet

- Mock BoardsDocument11 pagesMock BoardsRaenessa FranciscoNo ratings yet

- International Flow of FundsDocument25 pagesInternational Flow of FundsNguyễn Thuỳ DungNo ratings yet

- MIS Essentials 4th Edition Kroenke Solutions Manual DownloadDocument14 pagesMIS Essentials 4th Edition Kroenke Solutions Manual DownloadLouise Roth100% (13)

- Investments Background and IssuesDocument9 pagesInvestments Background and Issuespiepkuiken-knipper0jNo ratings yet

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument4 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The Questionfennie ilinah molinaNo ratings yet

- A Dissertation On InvestmentDocument108 pagesA Dissertation On InvestmentPrakash SinghNo ratings yet

- CAPS 2020 Audited Financial Statements ReportDocument16 pagesCAPS 2020 Audited Financial Statements ReportScooter SchaeferNo ratings yet

- Accounting PrudenceDocument11 pagesAccounting PrudenceloyNo ratings yet

- CIT, Kolkata V Smifs SecuritiesDocument4 pagesCIT, Kolkata V Smifs SecuritiesBar & BenchNo ratings yet

- Accounts and Statistics 4Document41 pagesAccounts and Statistics 4BrightonNo ratings yet

- Short-Term Capital Losses & Long-Term Capital LossesDocument5 pagesShort-Term Capital Losses & Long-Term Capital Lossesramkrishna mahatoNo ratings yet

- Accounting EquationsDocument3 pagesAccounting Equationsamitabhkumar1979No ratings yet

- 2607y Maliyyə Hesabatı SABAH (En)Document34 pages2607y Maliyyə Hesabatı SABAH (En)leylaNo ratings yet

- Management of Translation ExposureDocument23 pagesManagement of Translation ExposuresanjayindalNo ratings yet

- Financial Analysis Part2Document15 pagesFinancial Analysis Part2Llyod Francis LaylayNo ratings yet

- Factors Influencing Working and LearningDocument18 pagesFactors Influencing Working and Learningsnreddy85No ratings yet

- FA1-01 - Accounting Framework - 2013 Edition - PortraitDocument5 pagesFA1-01 - Accounting Framework - 2013 Edition - PortraitFloyd Alexis RafananNo ratings yet

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Document4 pagesCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- Accounting Dr. Ashraf Lecture 03 PDFDocument20 pagesAccounting Dr. Ashraf Lecture 03 PDFMahmoud AbdullahNo ratings yet

- Uncertainity in GI & Solvency Issues - PI MajmudarDocument15 pagesUncertainity in GI & Solvency Issues - PI MajmudarRajendra SinghNo ratings yet