Professional Documents

Culture Documents

2 CVP Take Home

Uploaded by

Natalie SerranoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 CVP Take Home

Uploaded by

Natalie SerranoCopyright:

Available Formats

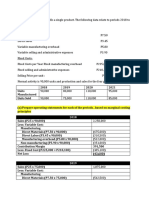

ABC Company manufactures chairs.

Analysis of the firm’s financial records reveals the following

Average Selling Price P 2,000

Variable expenses

Direct Materials P 500

Direct Labor 300

Variable Overhead 200

Annual Fixed Cost

Selling P 500,000

Administrative 1,500,000

Compute for the sales volume ( in units ) needed to

A. Break Even

B. Earn P500,000 Before tax

C. Earn P600,000 After tax, assuming a 20% tax rate

D. Earn 20 percent on sales revenue in pre-tax income

E. Earn 20 percent on sales revenue in after-tax income, assuming a 20% tax rate

What will happen to break even point ( in units ) if

A. Direct Labor Cost increases by P200 per unit

B. Fixed Cost decreases by 20%

Assuming that currently , ABC’s sales is 3,000 chairs and is earning a net income of P1,000,000. What will

be the effect of the following on ABC’s net income ? ( Assume that the following are independent from

one another )

1. Replace a portion of its variable labor with an automated machining process. This would result

in 20% decrease in variable cost per unit , but 15% increase in fixed cost. Sales would remain the

same

2. Spend P 600,000 on a new sales campaign , which would increase sales by 20%

3. Increase the selling price by P250 per unit, which will cause a demand to drop by 10%

4. Add a second manufacturing facility which would double ABC’s fixed cost but would increase

sales by 60%

5. Lower the price by 5% , which would increase sales by 10%

6. Adding new designs that will cost an additional P100 per unit but will increase sales by 20

percent

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Learning Packet 4 EditedDocument7 pagesLearning Packet 4 EditedNatalie SerranoNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- ASYN Rodriguez PN. EssayDocument1 pageASYN Rodriguez PN. EssayNatalie SerranoNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Donations ListDocument5 pagesDonations ListNatalie SerranoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- BUS 227 MA Long Questions Answers Chapter 11Document13 pagesBUS 227 MA Long Questions Answers Chapter 11Natalie SerranoNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Ynbsc Hand GuideDocument259 pagesYnbsc Hand GuideNatalie SerranoNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- YNBSC CL-10 Marcher's Report As of 20 Dec 21Document3 pagesYNBSC CL-10 Marcher's Report As of 20 Dec 21Natalie SerranoNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- E. Other Percentage TaxesDocument49 pagesE. Other Percentage TaxesNatalie SerranoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Last Na NiDocument5 pagesLast Na NiNatalie SerranoNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- AAO JPIA Days Consent Waiver FormDocument2 pagesAAO JPIA Days Consent Waiver FormNatalie SerranoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- B. Introduction To VAT FinalDocument102 pagesB. Introduction To VAT FinalNatalie SerranoNo ratings yet

- Notes Serrano - Overview of The Auditing ProfessionDocument5 pagesNotes Serrano - Overview of The Auditing ProfessionNatalie SerranoNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- D. VAT Registration and Compliance Requirements FinalDocument34 pagesD. VAT Registration and Compliance Requirements FinalNatalie SerranoNo ratings yet

- ACCLAW-4 SyllabusDocument9 pagesACCLAW-4 SyllabusNatalie SerranoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- G4 Research DraftDocument36 pagesG4 Research DraftNatalie SerranoNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Escribano Nadezhda A.1Document3 pagesEscribano Nadezhda A.1Natalie SerranoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Chapter 10 Tabag - Serrano NotesDocument5 pagesChapter 10 Tabag - Serrano NotesNatalie SerranoNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)