Professional Documents

Culture Documents

Atrium Report Notes

Uploaded by

Walpurgis NightOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Atrium Report Notes

Uploaded by

Walpurgis NightCopyright:

Available Formats

■ Effects of crossing a check.

■ Crossing a check relates to the mode of making payment, the drawer intending the

check to be deposited only by the rightful person, i.e., the payee named therein. In order

to preserve the credit worthiness of checks, jurisprudence has pronounced that crossing

of a check should have the following effects:

■ (1) The check may not be encashed but only deposited in the bank;

■ (2) The check may be negotiated only once—to one who has an account with a bank;

and

■ (3) The act of crossing the check serves as warning to the holder that the check has

been issued for a definite purpose so

■ that he must inquire if he has received the check pursuant to that purpose; otherwise, he

is not a holder in due course.1 (Bataan Cigar and Cigarette Factory, Inc. vs. Court of

Appeals, 230 SCRA 643 [1994]; Bank of America, NT & SA vs. Associated Citizens

Bank, 588 SCRA 51 [2009].)

■ A holder, therefore, cannot claim it acted in good faith when it accepted and discounted

post-dated crossed checks from tha payee, when it was all too aware that the subject

checks were crossed and bore restrictions that they were for deposit to payee's account

only; hence, could not be further negotiated to it. (Hi- Cement Corp. vs. Insular Bank of

Asia and America, 534 SCRA 269 [2007].)

■ Note that the law does not absolutely bar a holder who is not a holder in due course from

recovering on the checks. The holder may recover from the party who

indorsed/encashed the checks "if the latter has no valid excuse for refusing payment."

(Ibid.)

Sec. 28. Effect of want of consideration. - Absence or

failure of consideration is a matter of defense as against

any person not a holder in due course; and partial failure

of consideration is a defense pro tanto, whether the failure

is an ascertained and liquidated amount or otherwise.

Sec. 52. What constitutes a holder in due course. - A holder in due

course is a holder who has taken the instrument under the following

conditions: chanroblesvirtuallawlibrary

(a) That it is complete and regular upon its face;

(b) That he became the holder of it before it was overdue, and

without notice that it has been previously dishonored, if such was

the fact;

(c) That he took it in good faith and for value;

(d) That at the time it was negotiated to him, he had no notice of

any infirmity in the instrument or defect in the title of the person

negotiating it.

However, it does not follow as a legal proposition that simply because

petitioner Atrium was not a holder in due course for having taken the

instruments in question with notice that the same was for deposit only

to the account of payee E.T. Henry that it was altogether precluded

from recovering on the instrument. The Negotiable Instruments Law

does not provide that a holder not in due course cannot recover on

the instrument. The disadvantage of Atrium in not being a holder in

due course is that the negotiable instrument is subject to defenses as

if it were non-negotiable. One such defense is absence or failure of

consideration.

This implies that the cheque is payable to the bearer and the property of

the cheque can be transferred by mere delivery.

Payee money to be paid

Payor

Underlying meaning Lourdes is liable even if he is treasure of hi-cement is

because his act is not ultra vires

In the case at bar, Lourdes M. de Leon and Antonio de las Alas as treasurer and Chairman of

Hi-Cement were authorized to issue the checks. However, Ms. de Leon was negligent when she

signed the confirmation letter requested by Mr. Yap of Atrium and Mr. Henry of E.T. Henry for

the rediscounting of the crossed checks issued in favor of E.T. Henry. She was aware that the

checks were strictly endorsed for deposit only to the payee’s account and not to be further

negotiated. What is more, the confirmation letter contained a clause that was not true, that is,

“that the checks issued to E.T. Henry were in payment of Hydro oil bought by Hi-Cement from

E.T. Henry”. Her negligence resulted in damage to the corporation. Hence, Ms. de Leon may be

held personally liable therefor.

You might also like

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Negotiable Instruments Law - Chapter 5: By: Atty. Richard M. Fulleros, CPA, MBADocument39 pagesNegotiable Instruments Law - Chapter 5: By: Atty. Richard M. Fulleros, CPA, MBAjobelle barcellanoNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Roberto Dino vs. Maria Luisa Judal-Loot FactsDocument4 pagesRoberto Dino vs. Maria Luisa Judal-Loot FactsLeeNo ratings yet

- 24.dino VDocument3 pages24.dino VMatt EvansNo ratings yet

- Hi-Cement Corp. V Insular Bank of AsiaDocument7 pagesHi-Cement Corp. V Insular Bank of AsiaJJNo ratings yet

- (Nego Questions FINALS RecitDocument10 pages(Nego Questions FINALS RecitBoomBoom100% (2)

- Business Law Unit-4 NotesDocument16 pagesBusiness Law Unit-4 NotesTushar GaurNo ratings yet

- Comm Transfer and NegotiationDocument6 pagesComm Transfer and NegotiationtamsinpradoNo ratings yet

- Rights of a holder in due courseDocument7 pagesRights of a holder in due courseLui SebastianNo ratings yet

- Final Activity 2Document5 pagesFinal Activity 2Thea BaruzoNo ratings yet

- Supreme Court Rules on Liability of Check Drawer to Holder in Due CourseDocument16 pagesSupreme Court Rules on Liability of Check Drawer to Holder in Due CourseJubsNo ratings yet

- Dispute Over Promissory Note and Dishonored ChecksDocument192 pagesDispute Over Promissory Note and Dishonored CheckskuheDSNo ratings yet

- Nego Cases 15-17 (Digested)Document3 pagesNego Cases 15-17 (Digested)Supply ICPONo ratings yet

- Patrimonio v. GutierrezDocument2 pagesPatrimonio v. GutierrezNikkiZai100% (1)

- Hi CementDocument20 pagesHi CementMariel Ann ManingasNo ratings yet

- Patrimonio VS GutierrezDocument3 pagesPatrimonio VS GutierrezDaniela Erika Beredo InandanNo ratings yet

- Commercial Law Review 2016 Case Doctrines on Negotiable InstrumentsDocument145 pagesCommercial Law Review 2016 Case Doctrines on Negotiable InstrumentsCyr Evaristo FrancoNo ratings yet

- SC rules Atrium not a holder in due course but can still recover on crossed checksDocument2 pagesSC rules Atrium not a holder in due course but can still recover on crossed checkslarcia025No ratings yet

- NegoDocument3 pagesNegoalcelNo ratings yet

- BPI Vs Gregorio RoxasDocument3 pagesBPI Vs Gregorio RoxasIyahNo ratings yet

- BLL15 - Holder in Due Course and Protection To Bankers, CrossingDocument5 pagesBLL15 - Holder in Due Course and Protection To Bankers, Crossingsvm kishore100% (1)

- Dino v. Judal-LootDocument3 pagesDino v. Judal-LootAntonJohnVincentFriasNo ratings yet

- CASE DIGEST - Metrobank vs. CADocument7 pagesCASE DIGEST - Metrobank vs. CAMaria Anna M Legaspi100% (1)

- Dino V Judal-LootDocument2 pagesDino V Judal-LootBeeya EchauzNo ratings yet

- Negotiable Instruments Act GuideDocument7 pagesNegotiable Instruments Act GuideKamlesh TarachandaniNo ratings yet

- State Investment v. CA: Holder in Due Course StatusDocument13 pagesState Investment v. CA: Holder in Due Course StatusMike Zaccahry MilcaNo ratings yet

- Negotiable Instrument (Discharge of Instrument)Document15 pagesNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- Dino Vs Judal LootDocument3 pagesDino Vs Judal LootJohnNicoRamosLuceroNo ratings yet

- Roberto Dino VsDocument2 pagesRoberto Dino VsIyah MipangaNo ratings yet

- STATE INVESTMENT HOUSE, INC. Vs CADocument5 pagesSTATE INVESTMENT HOUSE, INC. Vs CAClaudia Rina LapazNo ratings yet

- 2020 - 10 - 15 NIL NotesDocument50 pages2020 - 10 - 15 NIL NotesJoshua MaulaNo ratings yet

- Commrev DigestDocument4 pagesCommrev DigestGabby PundavelaNo ratings yet

- 01 July AM Remedial LawDocument2 pages01 July AM Remedial LawGNo ratings yet

- Dino - Judal-LootDocument2 pagesDino - Judal-LootmishiruNo ratings yet

- G.R. No. 101163 January 11, 1993 STATE INVESTMENT HOUSE, INC., Petitioner, COURT OF APPEALS and NORA B. MOULIC, Respondents. Bellosillo, J.Document4 pagesG.R. No. 101163 January 11, 1993 STATE INVESTMENT HOUSE, INC., Petitioner, COURT OF APPEALS and NORA B. MOULIC, Respondents. Bellosillo, J.Junaid DadayanNo ratings yet

- Exam Number: 2020-S1-375 Time Started Exam: 1:10 Time Finished Exam: 3:10Document4 pagesExam Number: 2020-S1-375 Time Started Exam: 1:10 Time Finished Exam: 3:10Karl Michael OdroniaNo ratings yet

- Ambot Sa KinabuhiDocument55 pagesAmbot Sa Kinabuhiadonis.orillaNo ratings yet

- Negotiable Instrument Act, 1881Document25 pagesNegotiable Instrument Act, 1881Viney VermaNo ratings yet

- 30) State Investment House vs. Intermediate Appellate Court, Et Al., G.R. No. 72764 July 13, 1989Document2 pages30) State Investment House vs. Intermediate Appellate Court, Et Al., G.R. No. 72764 July 13, 1989AlexandraSoledad100% (2)

- Chapter 6-Presentation For Payment of Negotiable InstrumentsDocument7 pagesChapter 6-Presentation For Payment of Negotiable InstrumentsLorena Joy Aggabao100% (2)

- DLSU COLLEGE OF LAW COMMERCIAL LAW REVIEWDocument3 pagesDLSU COLLEGE OF LAW COMMERCIAL LAW REVIEWArjuna Guevara75% (4)

- Nego Digest For Nov 8 2016Document7 pagesNego Digest For Nov 8 2016Elca JavierNo ratings yet

- NIL - Discharge Cases Negotiable InstrumentsDocument8 pagesNIL - Discharge Cases Negotiable Instrumentsblackphoenix303No ratings yet

- NEGO Gr. 12 - ASIA BREWERY vs. EQUITABLE PCI BANKDocument3 pagesNEGO Gr. 12 - ASIA BREWERY vs. EQUITABLE PCI BANKBiBi JumpolNo ratings yet

- Mercantile Law Preweek NotesDocument35 pagesMercantile Law Preweek NotesDaniel BrownNo ratings yet

- Negotiable Instruments Case Digest 6 PDF FreeDocument50 pagesNegotiable Instruments Case Digest 6 PDF FreeJr MateoNo ratings yet

- NIL.11.2 State Investment House vs. CA, 217 SCRA 32 FACTS: Nora B. Moulic Issued To Corazon Victoriano, As Security For Pieces of JewelryDocument2 pagesNIL.11.2 State Investment House vs. CA, 217 SCRA 32 FACTS: Nora B. Moulic Issued To Corazon Victoriano, As Security For Pieces of JewelryMidzmar KulaniNo ratings yet

- State Investment House, Inc. Vs CADocument5 pagesState Investment House, Inc. Vs CAInez Monika Carreon PadaoNo ratings yet

- ROBERT DINO, vs. MARIA LUISA JUDAL-LOOT, Joined by Her Husband Vicente LootDocument6 pagesROBERT DINO, vs. MARIA LUISA JUDAL-LOOT, Joined by Her Husband Vicente LootPaolo SantillanNo ratings yet

- Gempesaw V CaDocument2 pagesGempesaw V Caבנדר-עלי אימאם טינגאו בתולהNo ratings yet

- Robert Dino, Petitioner, vs. Maria Luisa Judal-LOOT, Joined by Her Husband VICENTE LOOT, RespondentsDocument12 pagesRobert Dino, Petitioner, vs. Maria Luisa Judal-LOOT, Joined by Her Husband VICENTE LOOT, Respondentschristopher1julian1aNo ratings yet

- Midterm Exam Negotiable Instruments LawDocument3 pagesMidterm Exam Negotiable Instruments LawTokie TokiNo ratings yet

- 05 State Investment House, Inc V CA (G.R. No. 10116 - January 11, 1993)Document3 pages05 State Investment House, Inc V CA (G.R. No. 10116 - January 11, 1993)teepeeNo ratings yet

- Far East Realty Investment IncDocument2 pagesFar East Realty Investment IncEdward Kenneth KungNo ratings yet

- Nego DigestsDocument2 pagesNego DigestsKatrina GarinoNo ratings yet

- Negotiable Instruments Case DigestDocument54 pagesNegotiable Instruments Case DigestHoward DinumlaNo ratings yet

- Dishonour of NIDocument36 pagesDishonour of NISugato C MukherjiNo ratings yet

- Sadaya vs. Sevilla accommodation maker rightsDocument4 pagesSadaya vs. Sevilla accommodation maker rightsejNo ratings yet

- G.R. No. 187769 June 4, 2014 Alvin Patrimonio, Petitioner, vs. Napoleon Gutierrez and Octavio Marasigan Iii, Respondents. Brion, JDocument5 pagesG.R. No. 187769 June 4, 2014 Alvin Patrimonio, Petitioner, vs. Napoleon Gutierrez and Octavio Marasigan Iii, Respondents. Brion, JJohnRouenTorresMarzoNo ratings yet

- Urot - CaseDigest 3Document6 pagesUrot - CaseDigest 3Walpurgis NightNo ratings yet

- Urot CaseDigest11Document4 pagesUrot CaseDigest11Walpurgis NightNo ratings yet

- NIL Introduction & ConsiderationsDocument2 pagesNIL Introduction & ConsiderationsWalpurgis NightNo ratings yet

- Cse NotesDocument1 pageCse NotesWalpurgis NightNo ratings yet

- ATRIUM MANAGEMENT CORP v. CADocument2 pagesATRIUM MANAGEMENT CORP v. CAMarife MinorNo ratings yet

- Group 6 - Position PaperDocument10 pagesGroup 6 - Position PaperWalpurgis NightNo ratings yet

- Negotiable Instrument Law - Course Syllabus - USJR 2nd Sem 2020-2021Document7 pagesNegotiable Instrument Law - Course Syllabus - USJR 2nd Sem 2020-2021Walpurgis NightNo ratings yet

- Urot - Promisory Note and Bill of ExchangeDocument2 pagesUrot - Promisory Note and Bill of ExchangeWalpurgis NightNo ratings yet

- Shopzada DraftDocument2 pagesShopzada DraftWalpurgis NightNo ratings yet

- Psychological Statistics Lab ActivityDocument6 pagesPsychological Statistics Lab ActivityWalpurgis NightNo ratings yet

- Breach of Contract Case Between Juan Tamad and Hahaha Online StoreDocument7 pagesBreach of Contract Case Between Juan Tamad and Hahaha Online StoreWalpurgis NightNo ratings yet

- Group 4 Position Paper For Juan D. TamadDocument13 pagesGroup 4 Position Paper For Juan D. TamadWalpurgis NightNo ratings yet

- Group 5 Sales Position Paper For Shopzada Inc.Document17 pagesGroup 5 Sales Position Paper For Shopzada Inc.Walpurgis NightNo ratings yet

- USJ R Position Paper For Sales ShopzadaDocument6 pagesUSJ R Position Paper For Sales ShopzadaWalpurgis NightNo ratings yet

- Sales HaHaHa Online StoreDocument10 pagesSales HaHaHa Online StoreWalpurgis NightNo ratings yet

- DTIDocument2 pagesDTIWalpurgis NightNo ratings yet

- Breach of Contract Case Between Security Guard and Online StoreDocument11 pagesBreach of Contract Case Between Security Guard and Online StoreWalpurgis NightNo ratings yet

- Usufruct & EasementDocument176 pagesUsufruct & EasementWalpurgis NightNo ratings yet

- Online Shopping Dispute Reply Argues Buyer ResponsibilityDocument2 pagesOnline Shopping Dispute Reply Argues Buyer ResponsibilityWalpurgis NightNo ratings yet

- HaHaHa Store Position PaperDocument3 pagesHaHaHa Store Position PaperWalpurgis NightNo ratings yet

- Property Ownership & AccessionDocument137 pagesProperty Ownership & AccessionWalpurgis NightNo ratings yet

- Quieting Co Ownership PossessionDocument84 pagesQuieting Co Ownership PossessionKC Galanida SangcoNo ratings yet

- Urot FinalsDocument3 pagesUrot FinalsWalpurgis NightNo ratings yet

- 2-Notes On Banking Products & Services-Part 1Document16 pages2-Notes On Banking Products & Services-Part 1Kirti GiyamalaniNo ratings yet

- Activity 1 - FS Analysis AnswerDocument6 pagesActivity 1 - FS Analysis AnswerMelvert Alvarez MacaranasNo ratings yet

- EC - MODULE 3-NBFC - PPT - Procedure NBFCDocument10 pagesEC - MODULE 3-NBFC - PPT - Procedure NBFCAnanya ChaudharyNo ratings yet

- NPA in Banks PPT @Document10 pagesNPA in Banks PPT @MadhavNo ratings yet

- Cover Scope Business Insurance SolutionDocument2 pagesCover Scope Business Insurance Solutioncoverscope1No ratings yet

- Final PracticeDocument2 pagesFinal PracticeHuyền TrangNo ratings yet

- Sample Qualified Written Request 2Document5 pagesSample Qualified Written Request 2james j jorissenNo ratings yet

- AT03 02 Introduction To Financial Statement Audit and Pre Engagement ActivitiesDocument2 pagesAT03 02 Introduction To Financial Statement Audit and Pre Engagement ActivitiesLuna VNo ratings yet

- Transfer DeedDocument1 pageTransfer DeedAli BukhariNo ratings yet

- PhonePe Statement Sep2023 Mar2024Document20 pagesPhonePe Statement Sep2023 Mar2024Abhishek SalunkeNo ratings yet

- MFD Exam QuestionsDocument5 pagesMFD Exam QuestionsNidhin VargheseNo ratings yet

- MC12 Matcha Creations: InstructionsDocument2 pagesMC12 Matcha Creations: InstructionsJuanita ChristieNo ratings yet

- Scrapbook 23 AugustDocument18 pagesScrapbook 23 AugustpardyvoraNo ratings yet

- LIST OF YGC and AYALA COMPANIESDocument3 pagesLIST OF YGC and AYALA COMPANIESJibber JabberNo ratings yet

- Customer Statement PDFDocument2 pagesCustomer Statement PDFTrust WalletNo ratings yet

- The Giant Pool of Money NPR TranscriptDocument20 pagesThe Giant Pool of Money NPR Transcript498274929100% (1)

- Jose Calves Realty Year-End Adjustments and Financial StatementsDocument2 pagesJose Calves Realty Year-End Adjustments and Financial StatementsMariecris BatasNo ratings yet

- International Financial Regulation Seminar QuestionsDocument2 pagesInternational Financial Regulation Seminar QuestionsNicu BotnariNo ratings yet

- Partnership - Dissolution Upon Ownership Changes: Problem 2-1Document22 pagesPartnership - Dissolution Upon Ownership Changes: Problem 2-1marieieiemNo ratings yet

- Sanchay Maximizer.Document2 pagesSanchay Maximizer.AvinashNo ratings yet

- M&T Residences - Income & Expence Document DHT ZNDocument2 pagesM&T Residences - Income & Expence Document DHT ZNZuko NdodanaNo ratings yet

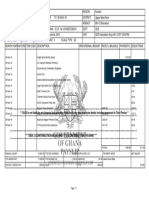

- Eastern Region Nov 2018 payroll report for Upper West Akim DistrictDocument1 pageEastern Region Nov 2018 payroll report for Upper West Akim DistrictLorlortor JuliusNo ratings yet

- Bill of Exchange MaybankDocument3 pagesBill of Exchange MaybankBuayaz GamingNo ratings yet

- 3.bank Reconciliation Statement by NavkarDocument10 pages3.bank Reconciliation Statement by Navkarwnabi20No ratings yet

- Fis AssignmentDocument8 pagesFis AssignmentPriyanka ShahiNo ratings yet

- Ass Aud1Document4 pagesAss Aud1Taehyungiiee KimNo ratings yet

- Pag-Ibig Salary Loan Form PDFDocument3 pagesPag-Ibig Salary Loan Form PDFtandangmark75% (52)

- ReservedDocument121 pagesReservedDEEPESH RAINo ratings yet

- Kisan Credit Card Explained in 40 CharactersDocument6 pagesKisan Credit Card Explained in 40 CharactersAshok RathodNo ratings yet

- Statement of Axis Account No:918010099547443 For The Period (From: 01-10-2020 To: 02-11-2020)Document5 pagesStatement of Axis Account No:918010099547443 For The Period (From: 01-10-2020 To: 02-11-2020)minniNo ratings yet

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- California Employment Law: An Employer's Guide: Revised and Updated for 2024From EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2024No ratings yet

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)