Professional Documents

Culture Documents

Technology and Machinery

Technology and Machinery

Uploaded by

riyasCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Technology and Machinery

Technology and Machinery

Uploaded by

riyasCopyright:

Available Formats

TECHNOLOGY AND MACHINERY

Choices of process technology emerge once the product is finalized. For some complex products,

process know how has to be imported. In such cases agreements for technology transfer should be

made with due care to safeguard interest. A lot of appropriate technology is being developed at

CSIR and Defense Research Labs and some of this technology can now be bought. Indigenously

developed process know-how has intrinsic benefits such as appropriateness and relative

inexpensiveness.

While checking out on a process technology, the following things need to be considered with utmost

care:

1) Whether process requires very high level of skilled workers or complex machines?

2) Whether process requires large quantities of water and/or power?

3) Whether any process or product patent needs to be honored while utilizing the selected

process technology.

4) Any special pollution or environmental regulations.

5) Finally, the appropriateness to the Indian environment and conditions. Machinery and

equipment

One of the major deficiencies in the micro, small and medium enterprises scenario is the prevalence

of outdated production and management methods hindering the efficient operation of micro, small

and medium-scale units. It was also found that the most important reason for the reluctance of the

small industrialists to install modern machinery and equipment was the lack of investible funds.

The main objective of National micro, small and medium enterprises (NMSME) is to provide

machinery and equipment to small industrial units offering them long repayment period with

moderate rate of interest.

NSIC procedures for hire purchase of machinery

1) The hire purchase application is to be made on the prescribed form.

2) The Director of Industries of the State under whose jurisdiction the applicant falls, forwards

the application to the head office of the NSIC at Delhi with his recommendation and

comments.

3) All applications for indigenous or imported machines are considered by acceptance

committees comprising of the representatives of the Chief Controller of Imports,

Development Commissioner, micro, small and medium enterprises and other concerned

departments.

4) Decision of these committees is conveyed to the parties concerned with copies to the

regional offices of the NSIC and the concerned Directorate of Industries.

5) Once all these formalities are completed by the hirer, instructions are sent to the suppliers

to dispatch the consignment (duly insured for transit risk) to the hirer and to send the R/R

or C/R as the case may be, to the regional office

6) The NSIC after ensuring that all dues have been paid by the hirer, releases the R/R or C/R to

him for taking delivery of the machines.

7) In case of imported machines, the procedure is slightly different in as much as the shipping

documents are sent to the clearing agents for clearing the consignment from the Customs

and dispatching it to the hirer.

Value of machines that can be supplied

Rs. 7.5 Lacs, F.O.R. or landed cost as the case may be.

Earnest Money

5% or 10% of the value of machinery depending on whether the equipment is imported or

indigenous. In the case of furnaces and a few other items of equipment, the rate of earnest

money is different. Interest 9 per cent per annum with a rebate of 2 per cent on prompt

payment. This interest is calculated on the value of machines outstanding after deducting

payment of earnest money.

Administrative Charge

2 per cent on the sales value of machines and its recovery by the NSIC is spread over the

total installment period.

Period of Repayment

The value of the machines, after deducting the earnest money received, called the Balance

Value, is payable alongwith interest and administrative charge in 7 years.

- The first installment is payable after one year and six months from the delivery of machines

- The second and subsequent installment are payable half-yearly thereafter.

Gestation Period

In case of certain type of machines which become operative immediately on installation in

the service sector industries and job order establishment, a gestation period of only 6

months shall be allowed both to the new and existing units.

A rebate of 2% per annum is allowed on the interest rates, in case an installment is paid on or

before the due date.

In case the payment of installment is not made within one month of the specified due date, interest

@ 2% per annum over and above the normal rate is charged on the defaulted amount from the date

of default to the date of actual payment. Remission in interests is allowed in case one or more than

one installment is paid in advance of the due date(s).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- BeckwithDocument50 pagesBeckwithLegal CheekNo ratings yet

- Claude-Michel Schonberg - Drink With Me (Les Miserables) PDFDocument2 pagesClaude-Michel Schonberg - Drink With Me (Les Miserables) PDFAlbandiNo ratings yet

- Lifestyle Upper - Intermediate CB 2012 177p PDFDocument177 pagesLifestyle Upper - Intermediate CB 2012 177p PDFMonicaMartirosyan100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Employee Motivation Literature ReviewDocument18 pagesEmployee Motivation Literature Reviewapi-297379255No ratings yet

- Cigre TB 498Document79 pagesCigre TB 498jchinchayNo ratings yet

- Hvac Resume SkillsDocument6 pagesHvac Resume Skillsg1hulikewes2100% (2)

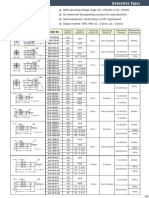

- Outline Dimension Model No .: Output Status Output Method Sensing Distance Mounting MethodDocument2 pagesOutline Dimension Model No .: Output Status Output Method Sensing Distance Mounting MethodAgus YohanesNo ratings yet

- Taller Manuales ANAV Cristian y SimónDocument4 pagesTaller Manuales ANAV Cristian y SimónCalavero Pal RatoNo ratings yet

- Chemtrade LeafletDocument2 pagesChemtrade LeafletbudayaNo ratings yet

- Trainee Staff For Travel AgencyDocument8 pagesTrainee Staff For Travel Agencym_tahir_saeedNo ratings yet

- The Aptitude HandbookDocument295 pagesThe Aptitude HandbookSomesh SharmaNo ratings yet

- 1987 - Spin Trapping - Esr Parameters of Spin AdductsDocument45 pages1987 - Spin Trapping - Esr Parameters of Spin AdductsLili LilithNo ratings yet

- ProcessorsDocument25 pagesProcessorschuck212No ratings yet

- Pichay vs. Querol 11 Phil 386Document2 pagesPichay vs. Querol 11 Phil 386April GonzagaNo ratings yet

- Victron SmartSolar Charge Controller MPPT 250 60 250 100 Datasheet SolartopstoreDocument1 pageVictron SmartSolar Charge Controller MPPT 250 60 250 100 Datasheet SolartopstoreNelson Andres Entralgo Maldonado100% (1)

- FoxMeyer ERP ProjectDocument4 pagesFoxMeyer ERP ProjectJay DaveNo ratings yet

- MDM4U Binomial Distributions WorksheetDocument10 pagesMDM4U Binomial Distributions WorksheetGqn GanNo ratings yet

- International Accounting Standards Board: Structure of IFRSDocument11 pagesInternational Accounting Standards Board: Structure of IFRSHadeel Abdul SalamNo ratings yet

- Law Landmark CasesDocument107 pagesLaw Landmark CasesjayNo ratings yet

- Eco Wrap SBIDocument3 pagesEco Wrap SBIVaibhav BhardwajNo ratings yet

- ROG Overclocking Guide Core For 5960X, 5930K & 5280KDocument7 pagesROG Overclocking Guide Core For 5960X, 5930K & 5280KEzequiel77xNo ratings yet

- Recount Text Anggi 3Document3 pagesRecount Text Anggi 3Farrel AdhipramanaNo ratings yet

- PT. Falcon Prima Tehnik: Permintaan Pengadaan BarangDocument7 pagesPT. Falcon Prima Tehnik: Permintaan Pengadaan BarangGilang Raka Prima FebriantoNo ratings yet

- ACT 1 Scope and NatureDocument2 pagesACT 1 Scope and NatureFreakNo ratings yet

- Internship Report On ChinnamaDocument6 pagesInternship Report On Chinnamadarshan achuNo ratings yet

- Rutter VDR and SVDR Spares ListDocument4 pagesRutter VDR and SVDR Spares ListAkhil ViswanathanNo ratings yet

- Reservists Retirees Affairs ProgramDocument35 pagesReservists Retirees Affairs ProgramSweet Holy Jean DamasoleNo ratings yet

- Make Your Own PCBs Form A To ZDocument17 pagesMake Your Own PCBs Form A To Zbaliza1405No ratings yet

- Nwdpra - Sunken pond-NATARAJ-A2-2side-OK-OK-okDocument17 pagesNwdpra - Sunken pond-NATARAJ-A2-2side-OK-OK-okanbukgiNo ratings yet

- HydraulicDocument10 pagesHydraulicDewan VidanageNo ratings yet