Professional Documents

Culture Documents

IRS Notice Regarding Pending Tax Payment Balance of $3,900 Due by September 9th

Uploaded by

Keller Brown JnrOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRS Notice Regarding Pending Tax Payment Balance of $3,900 Due by September 9th

Uploaded by

Keller Brown JnrCopyright:

Available Formats

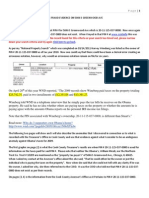

IRS CASE ID: DUE/TAX/0084-22-03

NAME: CONNIE PRECIADO

Date: August 19, 2022

IRS/0084/Tax/2020-01

Ms. Connie Preciado

116 N.washington St,

Tiffin Ohio 44883

United States.

Dear Ma,

RE: PENDING TAX PAYMENT BALANCE DUE

Sequel to our previous letter to you, be inform you that we have received a

reminder from Internal Revenue Service, Central Crime Branch, Ohio

concerning your tax payment balance on the following account held with us:

Account Number: xxxxxxxx1314

Account Name: Connie Preciado

Bank Name: BOA Bank

The tax payment balance of $3,900.00 on the above account have been

found due. However, you have been declared “inactive”. We have received

warnings and obligation statement since your tax payment balance has reflected

on our database. As on date we hereby notify you that your tax payment balance

would yield interest if you do not fulfill your payment, and in order to be free from

all encumbrances we advised to pay up balance. This is a strict order to comply

and abide with, under the law and regulations of IRS in accordance with

publication on criminal investigations that are being initiated on your payment

balance.

We would request you to note that failure to receive the payment on or before

9/9/2022, lien operations would be imposed on the above accounts till further

orders from court.

Regards

for: IRS Authority

Fort Collins

Branch Manager

Ohio branch

Corporate Office:

77 K St NE, Washington,

IRS Office DC 20002

200 N High St, Tel : +1 202-727-4829 Tax and Revenue Office

Columbus, OH 43215 +1 844-545-5640 1101 4th St SW #270,

(844) 545-5640 Web : www.irs.gov Washington, DC 20024

You might also like

- Someone Elses Pay Off I Put The Link Here N A TexDocument3 pagesSomeone Elses Pay Off I Put The Link Here N A Texjulianthacker100% (1)

- Summary of Account Activity Payment InformationDocument4 pagesSummary of Account Activity Payment InformationAnonymous 7DmNfQeSQNo ratings yet

- Miami Dade County Real Estate 24 (TODOS)Document12 pagesMiami Dade County Real Estate 24 (TODOS)OmarVargasNo ratings yet

- Notice Before Collection Action: We Have Not Received All of Your Required PaymentsDocument2 pagesNotice Before Collection Action: We Have Not Received All of Your Required PaymentsjamalsledgeNo ratings yet

- Tax Fraud Evidence On 5046 S Greenwood AveDocument5 pagesTax Fraud Evidence On 5046 S Greenwood Avecharlene cleo eibenNo ratings yet

- 90-Day Past Due LetterDocument2 pages90-Day Past Due LetterRocketLawyer100% (1)

- 01-15-2016 PDFDocument6 pages01-15-2016 PDFAnonymous CuFbT1NswYNo ratings yet

- Your Adv Plus Banking: Account SummaryDocument2 pagesYour Adv Plus Banking: Account SummaryjohanNo ratings yet

- 2019 760 Instructions PDFDocument52 pages2019 760 Instructions PDFLelosPinelos123No ratings yet

- Evolve Bank & TrustDocument2 pagesEvolve Bank & Trust邱建华73% (11)

- FAO Reco Account Payable J285611951Document3 pagesFAO Reco Account Payable J285611951dotaemumNo ratings yet

- Estmt - 2022 11 17Document4 pagesEstmt - 2022 11 17phillip davisNo ratings yet

- Complaint To CFPB Re TransUnion LLC Refused To Provide My Annual Credit Report OnlineDocument4 pagesComplaint To CFPB Re TransUnion LLC Refused To Provide My Annual Credit Report OnlineNeil GillespieNo ratings yet

- Client Setup FormDocument1 pageClient Setup Formhenri e ewaneNo ratings yet

- Pushvisions IncDocument6 pagesPushvisions Inc76xzv4kk5vNo ratings yet

- Oddo Brothers Cpas: William & Regina LittleDocument30 pagesOddo Brothers Cpas: William & Regina Littlebill littleNo ratings yet

- 2017 Form 760 InstructionsDocument56 pages2017 Form 760 InstructionsicanadaaNo ratings yet

- Trump Tax BillDocument2 pagesTrump Tax Billcrainsnewyork100% (2)

- USD Deposit Receipt for Mai-linh DeanDocument2 pagesUSD Deposit Receipt for Mai-linh DeanMai-linh Polero Dean0% (1)

- CP503Document6 pagesCP503rasool mehrjoo100% (1)

- IRS Fines Ron Paul's Campaign For LibertyDocument4 pagesIRS Fines Ron Paul's Campaign For Libertytshoes100% (1)

- Dispute ResultsDocument24 pagesDispute Resultsrichard winfreyNo ratings yet

- Baher Isack Adem 2022 Tax ReturnDocument20 pagesBaher Isack Adem 2022 Tax Returnadammura043100% (1)

- Feb 2012Document8 pagesFeb 2012Donna J ForgasNo ratings yet

- US Internal Revenue Service: p1468Document12 pagesUS Internal Revenue Service: p1468IRSNo ratings yet

- Fee Cancellation Request Form - COVIDDocument3 pagesFee Cancellation Request Form - COVIDAnonymous uMI5BmNo ratings yet

- Presentacion CorporativaDocument16 pagesPresentacion CorporativasaztperuNo ratings yet

- Inv - MISTIDocument1 pageInv - MISTIFloreidNo ratings yet

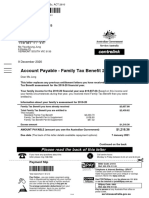

- Customer Reference Number: 208 603 901T: If Not Delivered: Locked Bag 7834 Canberra BC, ACT 2610Document2 pagesCustomer Reference Number: 208 603 901T: If Not Delivered: Locked Bag 7834 Canberra BC, ACT 2610Jacob WoodNo ratings yet

- Your Business Advantage Fundamentals™ Banking: Account SummaryDocument6 pagesYour Business Advantage Fundamentals™ Banking: Account SummaryH.I.M Dr. Lawiy ZodokNo ratings yet

- Tax Deduction Sheet Paid Money in 2021Document6 pagesTax Deduction Sheet Paid Money in 2021rasool mehrjooNo ratings yet

- Your Combined Statement: Freemont Assoc LLC 370 Circle North San Diego Ca 92108Document6 pagesYour Combined Statement: Freemont Assoc LLC 370 Circle North San Diego Ca 92108Alessandro MonteiroNo ratings yet

- Brown POQDocument4 pagesBrown POQJonas GonzalesNo ratings yet

- San Diego County Recorder Offices Locations and Contact InfoDocument8 pagesSan Diego County Recorder Offices Locations and Contact Infodouglas jonesNo ratings yet

- Bill History - Real Estate Account at 85 W HILLSBORO BLVD, CITY of DEERFIELD BEACH - TaxSys - Broward County Records, Taxes & Treasury Div.Document2 pagesBill History - Real Estate Account at 85 W HILLSBORO BLVD, CITY of DEERFIELD BEACH - TaxSys - Broward County Records, Taxes & Treasury Div.My-Acts Of-SeditionNo ratings yet

- Acs Support PDocument9 pagesAcs Support PBrian Petro67% (3)

- Document Instructions: Tax RefundDocument8 pagesDocument Instructions: Tax RefundValentin PonochevniyNo ratings yet

- Statement - NOZTI LTDDocument1 pageStatement - NOZTI LTDMohsinNo ratings yet

- Latest BillDocument2 pagesLatest BillAshley GoodmanNo ratings yet

- Estmt - 2022 04 29Document12 pagesEstmt - 2022 04 29Laura MCG100% (1)

- Statement Aug 2013Document10 pagesStatement Aug 2013berstuck100% (2)

- Overdue Fine: Pay Your Fine Now or Lose Your Licence, Possessions or Money From Your Bank AccountDocument2 pagesOverdue Fine: Pay Your Fine Now or Lose Your Licence, Possessions or Money From Your Bank AccountRohan Dutt SharmaNo ratings yet

- Print FormsDocument2 pagesPrint FormsJulia DrewNo ratings yet

- Adv Firmer Action Warning Letter Mygov 5741076486676Document2 pagesAdv Firmer Action Warning Letter Mygov 5741076486676Justin EllingsenNo ratings yet

- Roediger Title 15-Dissolution Certificate - RedactedDocument2 pagesRoediger Title 15-Dissolution Certificate - RedactedS. SpencerNo ratings yet

- BLMGNF Washington State Registration May 11 2022Document4 pagesBLMGNF Washington State Registration May 11 2022Washington ExaminerNo ratings yet

- Lodgement Receipt - Pay BPAY Bills: Australia and New Zealand Banking Group Limited ABN 11 005 357 522Document1 pageLodgement Receipt - Pay BPAY Bills: Australia and New Zealand Banking Group Limited ABN 11 005 357 522muhammed AlawiNo ratings yet

- DGA LiensDocument11 pagesDGA LiensJeff QuintonNo ratings yet

- HPK3PZDocument7 pagesHPK3PZDiane LeeNo ratings yet

- Barack Obama Foundation Irs Determination Letter July 21 2014Document1 pageBarack Obama Foundation Irs Determination Letter July 21 2014Jerome CorsiNo ratings yet

- Estmt - 2023 01 19Document4 pagesEstmt - 2023 01 19phillip davisNo ratings yet

- Boa Bank StatementDocument7 pagesBoa Bank Statementtieashamassey100% (1)

- HSEF Credit Card Statement Feb 2019Document6 pagesHSEF Credit Card Statement Feb 2019Mike Schmoronoff100% (1)

- Ria Money Transfer DetailsDocument1 pageRia Money Transfer Detailswendtoin sawadogo100% (3)

- 01-14-2016Document6 pages01-14-2016SusanaNo ratings yet

- Estmt - 2024 02 22Document4 pagesEstmt - 2024 02 22DjibzlaeNo ratings yet

- Your Adv Plus Banking: Account SummaryDocument6 pagesYour Adv Plus Banking: Account SummaryOsvaldo Gómez GarciaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- IRS W-2 Form TitleDocument1 pageIRS W-2 Form TitleKeller Brown JnrNo ratings yet

- 2020 Form 1099-MISCDocument1 page2020 Form 1099-MISCKeller Brown JnrNo ratings yet

- Pay Stub - ROY STEPHENDocument6 pagesPay Stub - ROY STEPHENKeller Brown JnrNo ratings yet

- Pod 8697884296Document1 pagePod 8697884296Keller Brown JnrNo ratings yet

- Irs Gov Forms-SignedDocument2 pagesIrs Gov Forms-SignedKeller Brown JnrNo ratings yet

- Letter of Intent To Supply 10,000 Units of Cargo-Jincheng (Rubber) Motorcycles at N300,000 Per UnitDocument1 pageLetter of Intent To Supply 10,000 Units of Cargo-Jincheng (Rubber) Motorcycles at N300,000 Per UnitKeller Brown JnrNo ratings yet

- Davis CheckDocument1 pageDavis CheckKeller Brown JnrNo ratings yet

- LMNTDocument1 pageLMNTKeller Brown JnrNo ratings yet

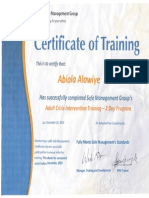

- Certificate of TrainingDocument1 pageCertificate of TrainingKeller Brown JnrNo ratings yet

- CheckimagesDocument2 pagesCheckimagesKeller Brown JnrNo ratings yet

- TSYS Bank Request Change Document-101Document1 pageTSYS Bank Request Change Document-101Keller Brown JnrNo ratings yet

- Poultry Farming Business Plan ExampleDocument27 pagesPoultry Farming Business Plan Examplemetro hydra80% (5)

- Authorization LetterDocument1 pageAuthorization LetterKeller Brown JnrNo ratings yet

- Polisens Blanketter 442-4 EngelskaDocument3 pagesPolisens Blanketter 442-4 EngelskaKeller Brown JnrNo ratings yet

- Utility Bill-Thaman-David9604743118Document1 pageUtility Bill-Thaman-David9604743118Keller Brown Jnr100% (1)

- Invitation Letter AACCDocument1 pageInvitation Letter AACCKeller Brown JnrNo ratings yet

- New New Bank Change Request Go2bankDocument1 pageNew New Bank Change Request Go2bankKeller Brown JnrNo ratings yet

- Moving-Goods Declaration FormDocument2 pagesMoving-Goods Declaration FormKeller Brown JnrNo ratings yet

- DD Form 108, Application For Retired Pay Benefits, July 2002Document2 pagesDD Form 108, Application For Retired Pay Benefits, July 2002Keller Brown JnrNo ratings yet

- Commercial InvoiceDocument2 pagesCommercial InvoiceKeller Brown JnrNo ratings yet

- DD Form 2789, Waiver - Remission of Indebtedness Application, 20140917 DraftDocument6 pagesDD Form 2789, Waiver - Remission of Indebtedness Application, 20140917 DraftKeller Brown JnrNo ratings yet

- SC No 89072676041 Agbonde Afolabi Michael 20-11-09 NaturalizationDocument1 pageSC No 89072676041 Agbonde Afolabi Michael 20-11-09 NaturalizationKeller Brown JnrNo ratings yet

- Dd2656-Data For Payment of Retired PersonnelDocument8 pagesDd2656-Data For Payment of Retired PersonnelKeller Brown JnrNo ratings yet

- Commerce BankDocument8 pagesCommerce Bankmalibu927100% (4)

- Turkish e-Visa Details for Nigeria TravelerDocument1 pageTurkish e-Visa Details for Nigeria TravelerKeller Brown Jnr100% (1)

- Unit 2.0 Biz Plan PDFDocument50 pagesUnit 2.0 Biz Plan PDFAdewole OlagokeNo ratings yet

- Irs Tax Payer Receipt1Document1 pageIrs Tax Payer Receipt1Keller Brown JnrNo ratings yet

- Agbonde Afolabi Michael Seychelles-National-Identity79271098712Document1 pageAgbonde Afolabi Michael Seychelles-National-Identity79271098712Keller Brown JnrNo ratings yet

- TD Bank StatementDocument6 pagesTD Bank StatementCody Best33% (3)