Professional Documents

Culture Documents

MODES OF DIGITAL PAYMENT XI Worksheet 1

Uploaded by

moxfore gamer0 ratings0% found this document useful (0 votes)

21 views3 pagesOriginal Title

MODES OF DIGITAL PAYMENT XI worksheet 1 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views3 pagesMODES OF DIGITAL PAYMENT XI Worksheet 1

Uploaded by

moxfore gamerCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

CH-4 BUSINESS SERVICES

MODES OF DIGITAL PAYMENT

1. NATIONAL ELECTRONIC FUND TRANSFER(NEFT)

• It is an electronic funds transfer system maintained by Reserve Bank of India.

• It enables bank customers in India to transfer funds between any two NEFT-

enabled bank accounts on a one-to-one basis.

• There is no value limit on the transactions of NEFT. For using NEFT, an eleven

digit Indian Financial System code is used.

2. REAL TIME GROSS SETTLEMENT(RTGS)

• RTGS system is maintained and operated by the RBI and provides a means of

efficient and faster funds transfer among banks.

• The RTGS system is primarily meant for large value transactions. The

minimum amount to be remitted through RTGS is RS. 2,00,000 lakh. There is

no upper ceiling for RTGS transactions.

• Real time means the processing of instructions at the time they are received

rather than at some later time.

• Gross settlement means the transactions is settled on one to one basis

without netting with any other transaction.

3. Cash Credit

• It refers to a loan given to a borrower against his current assets like shares,

stocks, bonds etc.

• A credit limit is sanctioned and the amount is credited in his account. The

borrower may withdraw any amount within his credit limit.

• This facility is helpful in meeting day to day working capital needs.

• Interest is charged on the amount actually withdrawn.

4. BHARAT INTERFACE FOR MONEY (BHIM)

• It allows users to make payment using the UPI application.

• The BHIM app can be used by anyone who has a mobile number, debit card

and a valid bank account. Money can be sent to different bank accounts,

virtual addresses or to an Aadhaar number.

5. AADHAR ENABLE PAYMENT SYSTEM (AEPS)

• It can be used for all banking transactions such as balance enquiry, cash

withdrawal, cash deposit, payment transactions.

• All transactions are carried out through a banking correspondent based on

Aadhaar verification.

• There is no need to physically visit a branch, provide a debit or credit cards or

even make a signature on a document.

6. UNIFIED PAYMENT INTERFACE (UPI)

• Under this system, any customer holding any bank account can send and

receive money through a UPI based app.

• The service allows a user to link more than one bank account on a UPI app on

their smart phone to seamlessly initiate fund transfers and make collect

request on 24/7 basis and on all 365 days.

7. UNSTRUCTURED SUPPLEMENTARY SERVICE DATA (USSD)

• It is another type of digital payment without mobile facility.

• Its main aim is to create an environment of inclusion among the underserved

sections of society and to integrate them into mainstream banking

• This service can be used to initiate fund transfers, get a look an bank

statements and make balance queries.

8. MICRO ATM:

• It is a mini version of an ATM. It is like modified point of sales terminals,

which can connect to banking network via GPRS to perform banking

transactions.

• This machine contains card swipe facility and fingerprint scanner. These

machines are carried by bank representative at remote/mobile locations.

• They support the transactions related to deposit, withdrawal, fund transfer

and balance enquiry.

9. MOBILE WALLET

• It is a type of virtual wallet service that is used to keep currency in digital

form.

• It stores bank account information or debit/credit card information in an

encoded format to allow secure payment.

• One can also add money to a mobile wallet in digital form and use the same

to make payments and purchase goods and services. Cash is kept in an

electronic form and smart phone or computer is used to make a financial

transaction.

10. POINT OF SALE (POS)

• There are different types of PoS terminals such as Physical PoS, Mobile PoS

and Virual PoS.

• Physical PoS terminals are the ones that are kept at shops and stores.

• On the other hand, mobile PoS terminals work through a tablet or

smartphone. This is advantageous for small time business owners as they do

not have to invest in expensive electronic registers.

• After the customer makes the payment, the seller may issue a receipt for the

transaction, which is usually printed but is increasingly being dispensed with

or sent electronically.

11. MOBILE BANKING

• It is a system that allows customers to perform banking transactions through

a mobile device.

• It is a quite popular method of banking that fits in well with busy

technologically oriented lifestyle.

• Through mobile banking user can accomplish tasks such as checking account

balances, transferring funds between accounts, bill payment etc.

• To avail mobile banking service, the user needs to have an account with the

bank, a valid mobile connection and handset supporting the services.

12. QUICK RESPONSE CODE (QR CODE)

• It is a two dimensional code, which has a pattern of black squares that are

arranged on a square grid with a white background.

• It secretly contains the details of the Bank account of the merchant. By

scanning the pattern of QR Code in the smartphone, the user can transfer the

desired amount into the receivers bank account.

• QR Code has enabled merchants to accept digital payments without investing

in any hardware such as the point of sale terminal.

You might also like

- Recent in BankingDocument25 pagesRecent in BankingSrividya SNo ratings yet

- Digital Service Provided by Banks.: Benefits of Digital BankingDocument5 pagesDigital Service Provided by Banks.: Benefits of Digital BankingAnonymous ozR9djsTSkNo ratings yet

- Class Vii Fin - Lit.pa IVDocument10 pagesClass Vii Fin - Lit.pa IVSaraswati DhanjaniNo ratings yet

- Banking Products and ServicesDocument5 pagesBanking Products and ServicesAikya GandhiNo ratings yet

- UntitledDocument6 pagesUntitledAparna MohandasNo ratings yet

- Banking Products & Operations: Session3Document63 pagesBanking Products & Operations: Session3Vaidyanathan RavichandranNo ratings yet

- DigitalDocument25 pagesDigitalPrithvi ChadhaNo ratings yet

- E BankingDocument26 pagesE BankingJojo DiazNo ratings yet

- Fmbo CH 5Document17 pagesFmbo CH 5sumedh narwadeNo ratings yet

- On LATEST TRENDS IN BANKING 1Document9 pagesOn LATEST TRENDS IN BANKING 1shyam s dhirajNo ratings yet

- T7 Payment SystemsDocument4 pagesT7 Payment Systemskhongst-wb22No ratings yet

- Presentation Financial ServicesDocument8 pagesPresentation Financial ServicesKashishNo ratings yet

- T-5 Banking TechnologyDocument18 pagesT-5 Banking TechnologyNamanNo ratings yet

- CH 2 - E-Banking ServicesDocument20 pagesCH 2 - E-Banking Serviceschintan vadgamaNo ratings yet

- LPB Team AssignmentDocument26 pagesLPB Team AssignmentMukul PNo ratings yet

- Self Study TopicDocument13 pagesSelf Study TopicRohit SoniNo ratings yet

- Current Digital Payments Method in India: Submitted By: - Vidit Mittal (317/2020)Document4 pagesCurrent Digital Payments Method in India: Submitted By: - Vidit Mittal (317/2020)Pro BroNo ratings yet

- II Sem BOIDocument36 pagesII Sem BOINeha ShuklaNo ratings yet

- Banking in 21st CenturyDocument4 pagesBanking in 21st CenturyDr. Ashish Kumar ChaurasiaNo ratings yet

- Retail 2Document32 pagesRetail 2Pravali SaraswatNo ratings yet

- E BankingDocument19 pagesE BankingramyaNo ratings yet

- UntitledDocument6 pagesUntitledAakritiNo ratings yet

- Recent Trends in Banking ServicesDocument6 pagesRecent Trends in Banking ServicesShereen FathimaNo ratings yet

- Types of Digital Payment Methods in India: Banking Cards: Cards Are Among The Most Widely UsedDocument4 pagesTypes of Digital Payment Methods in India: Banking Cards: Cards Are Among The Most Widely UsedMahimalluru Charan KumarNo ratings yet

- Mobile BankingDocument9 pagesMobile Bankingrajvir tulsyanNo ratings yet

- JCkYb97O4WGdeCKPQcDqHiktd6 kJyUjn v-8d98WJHGu27MD6M4MIsDocument23 pagesJCkYb97O4WGdeCKPQcDqHiktd6 kJyUjn v-8d98WJHGu27MD6M4MIsvasu pradeepNo ratings yet

- Banking TechnologyDocument18 pagesBanking Technologypoojaguptainida1No ratings yet

- Delivery Channels in Retail BankingDocument5 pagesDelivery Channels in Retail BankingSahibaNo ratings yet

- 04.technology in Banking - Unit Iii Part Ii - Prof. Dr. Rajesh MankaniDocument14 pages04.technology in Banking - Unit Iii Part Ii - Prof. Dr. Rajesh MankaniGame ProfileNo ratings yet

- Retail BankingDocument21 pagesRetail BankingHeenu KumariNo ratings yet

- MTN Mobile MoneyDocument41 pagesMTN Mobile MoneyDavid Obuobi Offei KwadwoNo ratings yet

- Banking InnovationsDocument17 pagesBanking InnovationsTanuja SNo ratings yet

- Means of RemittancesDocument39 pagesMeans of RemittancesMADHULIKAANo ratings yet

- E BankingDocument3 pagesE BankingSumedhaa Srivastava 34 Sem-1,CNo ratings yet

- Types of Transactions in BankDocument4 pagesTypes of Transactions in Bankkeerthana anbazhaganNo ratings yet

- Digital Banking 2Document25 pagesDigital Banking 2Saif Ali KhanNo ratings yet

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocument5 pagesInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingSNo ratings yet

- Ecomerce NotesDocument28 pagesEcomerce NotesManageITafricaNo ratings yet

- L5 Electronic Payment SystemsDocument28 pagesL5 Electronic Payment SystemsKenneth Kibet NgenoNo ratings yet

- Digital BankingDocument3 pagesDigital BankingDPC GymNo ratings yet

- E-Banking in India: Services Provided by The Bank ThroughDocument21 pagesE-Banking in India: Services Provided by The Bank ThroughKomal SahuNo ratings yet

- PPT18Document27 pagesPPT18Dev KumarNo ratings yet

- Chapter 3. L3.2. Kinds of Trends in BankingDocument4 pagesChapter 3. L3.2. Kinds of Trends in BankingvibhuNo ratings yet

- CA Project On Internet BankingDocument18 pagesCA Project On Internet BankingTejal KirpekarNo ratings yet

- Unified Payment Interfaces (Upi)Document37 pagesUnified Payment Interfaces (Upi)V.F.MUHAMMED ISMAIL THOUHEEDNo ratings yet

- Unit V: Recent Trends in Indian Banking SectorDocument41 pagesUnit V: Recent Trends in Indian Banking Sectornisha poojariNo ratings yet

- Unit VDocument37 pagesUnit Vsuseelasenthilkumar10No ratings yet

- L-7 Alternate Channels of BankingDocument21 pagesL-7 Alternate Channels of BankingVinay SudaniNo ratings yet

- Chapter 4Document11 pagesChapter 4vivek kumarNo ratings yet

- WHT Is BankDocument13 pagesWHT Is BankBhagyashreeNo ratings yet

- Digital Payments (Simran Ruchi) ViewDocument9 pagesDigital Payments (Simran Ruchi) ViewRuchi SawantNo ratings yet

- Jay Kawathia Tybbi Roll 24 Special Features of Internet BankingDocument5 pagesJay Kawathia Tybbi Roll 24 Special Features of Internet Bankingjay kawathiaNo ratings yet

- CP ReportDocument25 pagesCP ReportAdarsh KumarNo ratings yet

- Banking Latest Trends Class 12 ISC CommerceDocument27 pagesBanking Latest Trends Class 12 ISC CommerceHarshada BarhateNo ratings yet

- Banking ProductsDocument9 pagesBanking Productsbeena antuNo ratings yet

- Electronic BankingDocument3 pagesElectronic BankingTarun GargNo ratings yet

- Project PPT 1Document34 pagesProject PPT 1Manasa P SNo ratings yet

- Online Banking (Or Internet Banking) Allows Customers To Conduct Financial Transactions OnDocument4 pagesOnline Banking (Or Internet Banking) Allows Customers To Conduct Financial Transactions OnJamshed AlamNo ratings yet

- Online Banking (Or Internet Banking) Allows Customers To Conduct Financial Transactions OnDocument9 pagesOnline Banking (Or Internet Banking) Allows Customers To Conduct Financial Transactions OnJamshed AlamNo ratings yet

- Review of Some Online Banks and Visa/Master Cards IssuersFrom EverandReview of Some Online Banks and Visa/Master Cards IssuersNo ratings yet

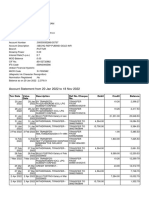

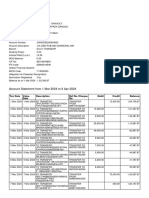

- Bank StatementDocument4 pagesBank Statementvenkatarammana99No ratings yet

- CIBIL Score & Credit ReportDocument3 pagesCIBIL Score & Credit ReportJatt SaabNo ratings yet

- Account Statement From 1 Oct 2019 To 29 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument11 pagesAccount Statement From 1 Oct 2019 To 29 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balancemohammed rafiNo ratings yet

- hdfc1234 PDFDocument1 pagehdfc1234 PDFDEBARAJ MOHAPATRANo ratings yet

- Name: Rohit Anil Kumar Chaubey: Your Savings A/C StatusDocument3 pagesName: Rohit Anil Kumar Chaubey: Your Savings A/C Statusrohitboy123100% (1)

- IBS - MBS - BHIM PNB FAQs - Revised-CompressedDocument13 pagesIBS - MBS - BHIM PNB FAQs - Revised-Compressedemraan KhanNo ratings yet

- Dataset - Apollo Io Scraper - 2024 02 21 - 06 16 56 165Document6 pagesDataset - Apollo Io Scraper - 2024 02 21 - 06 16 56 165Mahesh SharmaNo ratings yet

- 760 Drafts 200 UbsDocument2 pages760 Drafts 200 UbsAlberto SarabiaNo ratings yet

- Internship Report On MCB (PIA Society Branch) 2013 by Azka Sumbel, IBITDocument133 pagesInternship Report On MCB (PIA Society Branch) 2013 by Azka Sumbel, IBITAzka Sumbel QM IbNo ratings yet

- Terms and Conditions of The Loan AgreementsDocument2 pagesTerms and Conditions of The Loan AgreementsCLATOUS CHAMANo ratings yet

- Turkish Central BankDocument12 pagesTurkish Central BankSartaz B. MustafizNo ratings yet

- Products and Services Offered by PMC BankDocument7 pagesProducts and Services Offered by PMC BankVivek GusainNo ratings yet

- Crossing of ChequesDocument5 pagesCrossing of ChequesRavneet KaurNo ratings yet

- Neft FormatDocument2 pagesNeft FormatVinay Kumar100% (1)

- Chapter 1 Audit of Cash and Cash EquivalentsDocument129 pagesChapter 1 Audit of Cash and Cash EquivalentsKez MaxNo ratings yet

- Money and Banking Chapter 12Document8 pagesMoney and Banking Chapter 12分享区No ratings yet

- Completion LetterDocument2 pagesCompletion LetterCharles WheadonNo ratings yet

- MSC - Fi Dar ForecastingDocument5 pagesMSC - Fi Dar ForecastingMoud KhalfaniNo ratings yet

- Account StatementDocument2 pagesAccount StatementDebashis MahantaNo ratings yet

- 07 Time Value of Money - BE ExercisesDocument26 pages07 Time Value of Money - BE ExercisesMUNDADA VENKATESH SURESH PGP 2019-21 BatchNo ratings yet

- Final Project Risk SbiDocument46 pagesFinal Project Risk SbiSara Khan100% (1)

- Structure of Indian BankingDocument12 pagesStructure of Indian BankingYatin DhallNo ratings yet

- Solution Manual For Money Banking and The Financial System 3rd Edition R Glenn Hubbard Anthony Patrick ObrienDocument36 pagesSolution Manual For Money Banking and The Financial System 3rd Edition R Glenn Hubbard Anthony Patrick Obriensugarysestine.fllo5z100% (44)

- Global RemittanceDocument5 pagesGlobal RemittanceShreya RaiNo ratings yet

- G EZWo IZIw WNa RPPNDocument3 pagesG EZWo IZIw WNa RPPNsaikat gangulyNo ratings yet

- Commercial Bank PDFDocument13 pagesCommercial Bank PDFTanhaNo ratings yet

- EXCEL CASE STUdy 3Document11 pagesEXCEL CASE STUdy 3ABCNo ratings yet

- RTGS PDFDocument2 pagesRTGS PDFMuhtasim Muiz100% (1)

- United Commercial Bank & El BancoDocument8 pagesUnited Commercial Bank & El BancoPULKIT CHAUHAN100% (1)

- LANDBANK New MBA FlyerDocument2 pagesLANDBANK New MBA FlyerClinton M. AclibonNo ratings yet