0% found this document useful (0 votes)

331 views66 pagesApple Inc Financial Overview 2023

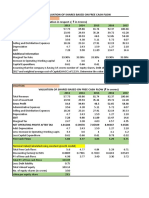

This document contains financial projections for Apple Inc. from 2020 to 2025 including forecasts for revenue, expenses, net profit, and changes in working capital. It also includes a discounted cash flow valuation for Apple that estimates a fair price per share of $140.97, representing an 8.1% upside from the current stock price of $130.46. Additional details provided include Apple's historical income statements, balance sheets, key financial metrics, and assumptions for the valuation model.

Uploaded by

krishnaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

331 views66 pagesApple Inc Financial Overview 2023

This document contains financial projections for Apple Inc. from 2020 to 2025 including forecasts for revenue, expenses, net profit, and changes in working capital. It also includes a discounted cash flow valuation for Apple that estimates a fair price per share of $140.97, representing an 8.1% upside from the current stock price of $130.46. Additional details provided include Apple's historical income statements, balance sheets, key financial metrics, and assumptions for the valuation model.

Uploaded by

krishnaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 66