0% found this document useful (0 votes)

319 views3 pagesM&a Case Study Solution

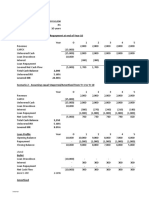

The document provides financial projections for a business over 6 years including revenue, taxes, changes in working capital, capital spending, and free cash flow. It also lists assumptions for pretax operating income, annual change in working capital, capital spending over depreciation, tax rate, growth rates, cost of equity, risk free rate, cost of debt, beta, debt to equity ratio, and target debt to equity ratio. The total discounted free cash flow over the projection period is $2,776,675.47.

Uploaded by

Soufiane EddianiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

319 views3 pagesM&a Case Study Solution

The document provides financial projections for a business over 6 years including revenue, taxes, changes in working capital, capital spending, and free cash flow. It also lists assumptions for pretax operating income, annual change in working capital, capital spending over depreciation, tax rate, growth rates, cost of equity, risk free rate, cost of debt, beta, debt to equity ratio, and target debt to equity ratio. The total discounted free cash flow over the projection period is $2,776,675.47.

Uploaded by

Soufiane EddianiCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as XLSX, PDF, TXT or read online on Scribd

/ 3