Professional Documents

Culture Documents

RR 20180104

Uploaded by

Razul AcoyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RR 20180104

Uploaded by

Razul AcoyCopyright:

Available Formats

Press Release

Auropol India Private Limited (AIPL)

04 January, 2017

Rating Withdrawn

Total Bank Facility Rated * Rs.5.30 Crore

Long Term Rating SMERA B+/Stable

(Withdrawn)

Short Term Rating SMERA A4

(Withdrawn)

*Refer Annexure for details

Rating Rationale

SMERA has withdrawn the long-term rating of ‘SMERA B+’ (read as SMERA B plus) and short-term

rating of ‘SMERA A4’ (read as SMERA A four)on the Rs. 5.30 crore bank facilities of Auropol India

Private Limited (AIPL). The rating stands withdrawn as the rated bank limits of the company have

reduced to less than Rs. 10 crore. The company has submitted a withdrawal request to SMERA along

with a ‘No Objection Certificate’ from the banker.

About the Rated Entity

Auropol India Private Limited (AIPL), incorporated in 1999 is a Kolkata-based company engaged in the

manufacturing of specialty rubber chemicals and plastic additives. The commercial operations

commenced in 2000. The company mainly caters to the rubber industry- both tyre and non-tyre, plastic

and electrical. About 90 per cent of the revenue is generated from rubber and the balance from plastic

additives. The company was promoted by Mr. Biswanath Bhattacharyya and Mr. Arabinda Sekhar

Bhattacharyya.

For FY2016, AIPL reported profit after tax (PAT) of Rs.0.35 crore on total operating income of Rs.16.49

crore, compared with (PAT) of Rs.0.66 crore on total operating income of Rs.14.54 crore in FY2015.

Status of non-cooperation with previous CRA:

None

Any other information:

None

Rating History for the last three years:

Name of Instrument /

Date Term Amount Ratings/Outlook

Facilities

(Rs. Crore)

Cash Credit Long Term 4.20 SMERA B+/Stable

(Assigned)

11-March, Long Term

2017 Term Loan 0.15 SMERA B+/Stable

(Assigned)

Short Term

PC/PCFC 0.25 SMERA A4

(Assigned)

Letter of Credit Short Term 0.70 SMERA A4

(Assigned)

*Annexure – Details of instruments rated:

Name of the Date of Coupon Maturity Date Size of the Ratings/

Facilities Issuance Rate Issue Outlook

(Rs. Crore)

SMERA B+/Stable

Cash Credit NA NA NA 4.20

(Withdrawn)

SMERA B+/Stable

Term Loan NA NA NA 0.15

(Withdrawn)

PC/PCFC SMERA A4

NA NA NA 0.25

(Withdrawn)

Letter of Credit SMERA A4

NA NA NA 0.70

(Withdrawn)

Note on complexity levels of the rated instrument: https://www.smera.in/criteria-complexity-

levels.htm

Contacts:

Analytical Rating Desk

Vinayak Nayak, Varsha Bist

Head –Operations, Sr. Executive

Tel: 022-67141190 Tel: 022-67141160

Email: vinayak.nayak@smera.in Email: varsha.bist@smera.in

Aniruddha Dhar

Rating Analyst,

Tel:033-66201200

Email: aniruddha.dhar@smera.in

ABOUT SMERA

SMERA Ratings Limited is a joint initiative of SIDBI, Dun & Bradstreet Information Services India Private Limited

(D&B) and leading public and private sector banks in India. SMERA is registered with SEBI as a Credit Rating

Agency and accredited by Reserve Bank of India. For more details please visit www.smera.in.

Disclaimer: A SMERA rating does not constitute an audit of the rated entity and should not be treated as a recommendation or

opinion that is intended to substitute for a financial adviser's or investor's independent assessment of whether to buy, sell or hold

any security. SMERA ratings are based on the data and information provided by the issuer and obtained from other reliable

sources. Although reasonable care has been taken to ensure that the data and information is true, SMERA, in particular, makes no

representation or warranty, expressed or implied with respect to the adequacy, accuracy or completeness of the information relied

upon. SMERA is not responsible for any errors or omissions and especially states that it has no financial liability whatsoever for any

direct, indirect or consequential loss of any kind arising from the use of its ratings. SMERA ratings are subject to a process of

surveillance which may lead to a revision in ratings as and when the circumstances so warrant. Please visit our website

(www.smera.in) for the latest information on any instrument rated by SMERA.

You might also like

- IAN Thesis OUTLINEDocument36 pagesIAN Thesis OUTLINERazul AcoyNo ratings yet

- Quiz - Quiz 2 Partnership Dissolution and Liquidation AnswersDocument15 pagesQuiz - Quiz 2 Partnership Dissolution and Liquidation AnswersKent Zirkai CidroNo ratings yet

- Renewal Premium Receipt PDFDocument1 pageRenewal Premium Receipt PDFVikas Aggarwal50% (2)

- Premium Paid CertificateDocument1 pagePremium Paid CertificateEmanuel Cooper46% (13)

- RR 20170130Document3 pagesRR 20170130105vivekthakkar105No ratings yet

- Work Permit SystemDocument5 pagesWork Permit SystemTirth modiNo ratings yet

- Press Release: Refer Annexure For DetailsDocument4 pagesPress Release: Refer Annexure For DetailsANILNo ratings yet

- Laguna Clothing Private Limited: Reaffirmed Facilities Amount (Rs. Crore) RatingsDocument3 pagesLaguna Clothing Private Limited: Reaffirmed Facilities Amount (Rs. Crore) RatingsKabir MahlotraNo ratings yet

- Press Release: Refer Annexure For DetailsDocument6 pagesPress Release: Refer Annexure For Detailslalit rawatNo ratings yet

- Business Banking Credit Application Form (Conventional) - Version 9 4Document12 pagesBusiness Banking Credit Application Form (Conventional) - Version 9 4affuriezNo ratings yet

- GHHJJKRDocument69 pagesGHHJJKRkiransaradhiNo ratings yet

- YFC Projects Private Limited (YPPL) : Rating RationaleDocument2 pagesYFC Projects Private Limited (YPPL) : Rating Rationalelalit rawatNo ratings yet

- NBM Iron and Steel Trading 11dec2019Document5 pagesNBM Iron and Steel Trading 11dec2019Yasien ZaveriNo ratings yet

- TW Niapolicyschedulecirtificatetw 82178650Document3 pagesTW Niapolicyschedulecirtificatetw 82178650pp.prathyushNo ratings yet

- Keventers DRHP - Introduction 1 34Document34 pagesKeventers DRHP - Introduction 1 34Kamalapati BeheraNo ratings yet

- It S1642496 28072022 PDFDocument2 pagesIt S1642496 28072022 PDFSamarth SasaneNo ratings yet

- Consolidated Premium Paid STMTDocument1 pageConsolidated Premium Paid STMTMohan kishoreNo ratings yet

- ICCL CustomersDocument2 pagesICCL CustomersJoseph KimNo ratings yet

- Renewal Receipt For 21882754Document1 pageRenewal Receipt For 21882754Raghu nNo ratings yet

- Angel One ProfileDocument2 pagesAngel One ProfileAyush VermaNo ratings yet

- Ayushman Merchants Private Limited: Summary of Rated InstrumentsDocument6 pagesAyushman Merchants Private Limited: Summary of Rated InstrumentsJeffNo ratings yet

- Daund Sugar Private LimitedDocument5 pagesDaund Sugar Private Limitedkrushna.maneNo ratings yet

- CM A50520152 11052023 PDFDocument1 pageCM A50520152 11052023 PDFHada ArjunNo ratings yet

- Your Account Details Segment'S RegisteredDocument2 pagesYour Account Details Segment'S RegisteredManav GargNo ratings yet

- Application FormDocument9 pagesApplication FormsmecreditNo ratings yet

- PowerFinance31713161 3Document4 pagesPowerFinance31713161 3aman khatriNo ratings yet

- SKP Bearing Industries-03-01-2018Document3 pagesSKP Bearing Industries-03-01-2018Prashant ChourasiyaNo ratings yet

- Mechemco - R-30102017 PDFDocument7 pagesMechemco - R-30102017 PDFflytorahulNo ratings yet

- Vikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument6 pagesVikas Spool Private Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating Actionvinay durgapalNo ratings yet

- Your Account Details Segment'S RegisteredDocument2 pagesYour Account Details Segment'S Registeredlotuslama07No ratings yet

- Customer Private LimitedDocument4 pagesCustomer Private LimitedData CentrumNo ratings yet

- Sanction LetterDocument1 pageSanction LetterVenkataramana SarellaNo ratings yet

- Your Account Details Segment'S RegisteredDocument2 pagesYour Account Details Segment'S Registeredarnav kumarNo ratings yet

- Shri Senthur Velan InfrasDocument5 pagesShri Senthur Velan InfrasraghavendraNo ratings yet

- Renewal Premium Receipt (OMS)Document1 pageRenewal Premium Receipt (OMS)mani bhushan sharmaNo ratings yet

- 15-Mar-2019 CL PDFDocument3 pages15-Mar-2019 CL PDFDarshanNo ratings yet

- RR 20180717Document3 pagesRR 20180717R GautamNo ratings yet

- A-1 Facility and Property Managers Private Limited: Rating RationaleDocument5 pagesA-1 Facility and Property Managers Private Limited: Rating RationaleDeepti JajooNo ratings yet

- CDS - Schedule of Fees Deposits Updated July 2016Document4 pagesCDS - Schedule of Fees Deposits Updated July 2016fpaimranNo ratings yet

- Assets Liabilities Statments F 349 For GuarantorDocument8 pagesAssets Liabilities Statments F 349 For GuarantorPrakash JNo ratings yet

- Lampiran 1.e. Form Pembukaan Deposito Bilingual Ver 01 Nov 2019Document2 pagesLampiran 1.e. Form Pembukaan Deposito Bilingual Ver 01 Nov 2019wahabsiregar86No ratings yet

- Renewal Premium Receipt 15022023Document3 pagesRenewal Premium Receipt 15022023sumanta KMrfgtyhNo ratings yet

- T V Sundram Iyengar-R-16022018Document7 pagesT V Sundram Iyengar-R-16022018AGN YaNo ratings yet

- BFG International Private Limited: Summary of Rated InstrumentsDocument6 pagesBFG International Private Limited: Summary of Rated InstrumentsB Vignesh BabuNo ratings yet

- ITradePrime A55448593 07012024Document2 pagesITradePrime A55448593 07012024ambresh.09No ratings yet

- Renewal Receipt For 24811016Document1 pageRenewal Receipt For 24811016soniyapaliwal903No ratings yet

- For Limited Companies Indicate Name and Stamp or Seal) : Applicable To Term Loans OnlyDocument3 pagesFor Limited Companies Indicate Name and Stamp or Seal) : Applicable To Term Loans Onlyderrick andivaNo ratings yet

- 3B Binani GlassfibreDocument2 pages3B Binani GlassfibreData CentrumNo ratings yet

- Key Fact DocumentDocument7 pagesKey Fact Documentdeepak799sgNo ratings yet

- DRL1 CRDocument3 pagesDRL1 CRpankaj_xaviersNo ratings yet

- Baroda BNP Paribas SIP Form 127Document2 pagesBaroda BNP Paribas SIP Form 127custodian.archiveNo ratings yet

- TW Niapolicyschedulecirtificatetw 57191198Document3 pagesTW Niapolicyschedulecirtificatetw 57191198pp.prathyushNo ratings yet

- Jayashree Polymers Private Limited: Ratings Withdrawn Summary of Rating ActionDocument5 pagesJayashree Polymers Private Limited: Ratings Withdrawn Summary of Rating ActionRahul SharmaNo ratings yet

- Renewal Premium Receipt 27012022Document1 pageRenewal Premium Receipt 27012022Sachin ThakurNo ratings yet

- DocumentDocument15 pagesDocumentRAJESH KUMARNo ratings yet

- 8.50% INDIA INFRASTRUCTURE FINANCE COMPANY LIMITED 12 - Nov - 2033 - The Fixed IncomeDocument4 pages8.50% INDIA INFRASTRUCTURE FINANCE COMPANY LIMITED 12 - Nov - 2033 - The Fixed Incomeqn7b7shm82No ratings yet

- Shree Radhekrushna Ginning - R-11092017Document6 pagesShree Radhekrushna Ginning - R-11092017SuMit PaTilNo ratings yet

- Credit Ratings 2023Document6 pagesCredit Ratings 2023Dinesh kothawadeNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- The Experiences and Challenges Faced of The Public School Teachers Amidst The COVID-19 Pandemic: A Phenomenological Study in The PhilippinesDocument21 pagesThe Experiences and Challenges Faced of The Public School Teachers Amidst The COVID-19 Pandemic: A Phenomenological Study in The PhilippinesDE LOS REYES MARY ZEALANo ratings yet

- Biographical DataDocument5 pagesBiographical DataRazul AcoyNo ratings yet

- Crim Law Part2 PDFDocument34 pagesCrim Law Part2 PDFRazul AcoyNo ratings yet

- ACKNOWLEDGMENTSDocument1 pageACKNOWLEDGMENTSRazul AcoyNo ratings yet

- Table of ContentsDocument7 pagesTable of ContentsRazul AcoyNo ratings yet

- Booc, RRL 2Document9 pagesBooc, RRL 2Razul AcoyNo ratings yet

- CALIPERDocument1 pageCALIPERRazul AcoyNo ratings yet

- Discharged LetterDocument1 pageDischarged LetterRazul AcoyNo ratings yet

- Acoy, R 1bscrimaDocument2 pagesAcoy, R 1bscrimaRazul AcoyNo ratings yet

- BlotterDocument1 pageBlotterRazul AcoyNo ratings yet

- Becares Final2Document20 pagesBecares Final2Razul AcoyNo ratings yet

- Bago ToDocument2 pagesBago ToRazul AcoyNo ratings yet

- AAAAADocument3 pagesAAAAARazul AcoyNo ratings yet

- Razul MDocument1 pageRazul MRazul AcoyNo ratings yet

- Roy AcoyDocument17 pagesRoy AcoyRazul AcoyNo ratings yet

- Assignment (1) Acoy 2BscrimADocument1 pageAssignment (1) Acoy 2BscrimARazul AcoyNo ratings yet

- Activity 3 (Acoy)Document1 pageActivity 3 (Acoy)Razul AcoyNo ratings yet

- Manifest LESSON 1 Introduction To Professional Conduct and Ethical StandardsDocument48 pagesManifest LESSON 1 Introduction To Professional Conduct and Ethical StandardsRazul AcoyNo ratings yet

- Bahrain Police (Acoy)Document8 pagesBahrain Police (Acoy)Razul AcoyNo ratings yet

- ACOY (September 9)Document4 pagesACOY (September 9)Razul AcoyNo ratings yet

- Research Survey QuestionnaireDocument2 pagesResearch Survey QuestionnaireRazul AcoyNo ratings yet

- AppendicesDocument10 pagesAppendicesRazul AcoyNo ratings yet

- Research 2Document2 pagesResearch 2Razul AcoyNo ratings yet

- Research AcoyDocument13 pagesResearch AcoyRazul AcoyNo ratings yet

- Application 2Document1 pageApplication 2Razul AcoyNo ratings yet

- Exercise 3.2 ACOY 2BScrim-ADocument2 pagesExercise 3.2 ACOY 2BScrim-ARazul AcoyNo ratings yet

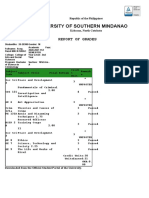

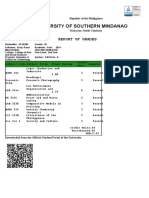

- University of Southern MindanaoDocument2 pagesUniversity of Southern MindanaoRazul AcoyNo ratings yet

- University of Southern MindanaoDocument2 pagesUniversity of Southern MindanaoRazul AcoyNo ratings yet

- Application 1Document2 pagesApplication 1Razul AcoyNo ratings yet

- Natural Resources, Conflict and Growth: Uncovering The Transmission MechanismDocument15 pagesNatural Resources, Conflict and Growth: Uncovering The Transmission MechanismAliza RajaniNo ratings yet

- Justice and FairnessDocument16 pagesJustice and FairnessSherwin Buenavente SulitNo ratings yet

- Muhammad Qaiser HBL ReportDocument21 pagesMuhammad Qaiser HBL Reportm qaiserNo ratings yet

- 19bbl110 FINAL RESEARCH PAPERDocument20 pages19bbl110 FINAL RESEARCH PAPERShubham TejasNo ratings yet

- Module-3 1Document8 pagesModule-3 1Ronald AlmarezNo ratings yet

- Dutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshDocument2 pagesDutch-Bangla Bank Limited Bashundhara Branch K 3/1-C, Jogonnathpur Bashundhara Dhaka BangladeshNur NobiNo ratings yet

- CN 625 007 - GypWall Systems Opening Services at Def HeadDocument1 pageCN 625 007 - GypWall Systems Opening Services at Def HeadconstantonukNo ratings yet

- Abhishek Tiwari Major Research Project Kotak Mahindra BankDocument98 pagesAbhishek Tiwari Major Research Project Kotak Mahindra BankNikhilesh Katare100% (1)

- Tullow Oil PLC 2020 Annual Report and AccountsDocument158 pagesTullow Oil PLC 2020 Annual Report and Accountsforina harissonNo ratings yet

- Press 12may23Document5 pagesPress 12may23Arun SinghNo ratings yet

- Chapter 9Document7 pagesChapter 9Kotryna RudelytėNo ratings yet

- Gratitude in ActionDocument19 pagesGratitude in Actionrg DelacernaNo ratings yet

- Introduction To EnterpreneurshipDocument8 pagesIntroduction To Enterpreneurshipemma moshiNo ratings yet

- Golar - 20-F 2016Document206 pagesGolar - 20-F 2016dmouenNo ratings yet

- Indonesian Codes of Corporate Governance (Mei 2019)Document29 pagesIndonesian Codes of Corporate Governance (Mei 2019)jasmine afrianiNo ratings yet

- Task 1Document5 pagesTask 1Linh Nhật HàNo ratings yet

- Cost Center / Actiivty Typplanned Quantity PriceDocument11 pagesCost Center / Actiivty Typplanned Quantity PriceVijay GopalNo ratings yet

- Function ConvertCurrencyToEnglishDocument8 pagesFunction ConvertCurrencyToEnglishAmit Kumar PaulNo ratings yet

- Web: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Document57 pagesWeb: WWW - Smartinvestment.in: Phone: 079 - 2657 66 39 Fax: 079 - 2657 99 96Luke RobinsonNo ratings yet

- 10 2 Divide Using Partial QuotientsDocument2 pages10 2 Divide Using Partial Quotientsapi-29128774150% (2)

- External Influences On Business Activity YR 13Document82 pagesExternal Influences On Business Activity YR 13David KariukiNo ratings yet

- Voc InstructionsDocument3 pagesVoc Instructionsmalick komlan100% (1)

- Age of Exploration Research PaperDocument6 pagesAge of Exploration Research Paperapi-345742212No ratings yet

- Forex Trading Volume AllocationDocument4 pagesForex Trading Volume AllocationROHAN SHANKPALNo ratings yet

- Book Ing Confi RM A Tion: Flight DetailsDocument2 pagesBook Ing Confi RM A Tion: Flight DetailsMohammad shameer100% (1)

- UNIT (24) 2.08 CONSOLIDATED bALANCE SHEET PROBLEMDocument4 pagesUNIT (24) 2.08 CONSOLIDATED bALANCE SHEET PROBLEMAaryan K MNo ratings yet

- Reaction Paper On The Article: DBM Trims Departments' Budget For COVID FundDocument3 pagesReaction Paper On The Article: DBM Trims Departments' Budget For COVID FundMa YaNo ratings yet

- Empaneled BA ListDocument1 pageEmpaneled BA Listsarbajitsahoo8260No ratings yet

- Methods of International Trade and Payments: The Nigerian Perspective Dr. AGBONIKA Josephine Aladi AchorDocument40 pagesMethods of International Trade and Payments: The Nigerian Perspective Dr. AGBONIKA Josephine Aladi AchorYesyit BerhanuNo ratings yet