Professional Documents

Culture Documents

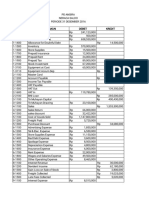

Salem's Travel Agency Financial Statements

Uploaded by

Sophia Criciel GumatayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salem's Travel Agency Financial Statements

Uploaded by

Sophia Criciel GumatayCopyright:

Available Formats

Assets (=) Liabilities (+) Owner's Equity (+) Revenue (-) Expenses Assets (=) Liabilities (+) Owner's

(+) Revenue (-) Expenses Assets (=) Liabilities (+) Owner's Equity (+) Revenue (-) Expenses

Cash Accounts Receivable Equipment Supplies Accounts Payable Spengel, Capital Spengel, Drawings Service Revenue Salaries Expense Office Rent Cash Accounts Receivable

Equipment Supplies Notes Payable Accounts Payable Spengel, Capital Spengel, Drawings Service Revenue Salaries Expense

Office Rent

1 ######## $ 15,000.00 1 15,000 15,000

2 $ (600.00) $ 600.00 2 -600 600

3 $(3,000.00) $ 3,000.00 3 -3,000 3,000

4 $ 700.00 $ 700.00 4 700

5 $ (900.00) ###### 5 -900 900

6 $ 3,000.00 $ 7,000.00 $ 10,000.00 6 3,000 7,000 3,000

7 $ (600.00) $ (600.00) 7 -600 -600

8 $ (500.00) $ (500.00) 8 -500 -500

9 $(2,500.00) $ 2,500.00 9 -2,500 2,500

10 $ 4,000.00 $ (4,000.00) # 4,000 -4,000 4,000

######## $ 3,000.00 $ 3,000.00 ###### $ 200.00 $ 15,000.00 $ (600.00) $ 10,000.00 $ 2,500.00 $ 1,300.00 13,900 3,000 3,000 900 200 15,000 -600 7,000 2,500 600

20,800 = 24,600 - 3,800 20,800 = 21,600 - 3,100

20,800 20,800 20,800 #REF!

Spengel's Travel Agency

Income Statement

For the month of April

Service Revenue $ 10,000.00

Less: Expenses

Office Rent $ 600.00

Advertising Cost $ 700.00

Salaries $ 2,500.00

Net Profit $ 6,200.00

Assets (=) Liabilities (+) Owner's Equity (+) Revenue (-) Expenses

Cash Accounts Receivable Equipment Supplies Notes Payable Accounts Payable Salem, Capital Salem, Drawings

$5,000.00 $ 1,500.00 $ 6,000.00 $ 500.00 $ 4,200.00 $ 8,800.00

1 $1,200.00 $ (1,200.00)

2 ######## $ (2,800.00)

3 $3,000.00 $ 4,500.00 $ 7,500.00

4 $ (400.00) $ 2,000.00 $ 1,600.00

5 ######## $ 3,800.00

6 $ (700.00) $ (700.00)

7 $2,000.00 $ 2,000.00

8 $ 270.00 $ 270.00

$3,500.00 $ 4,800.00 $ 8,000.00 $ 500.00 $ 2,000.00 $ 3,270.00 $ 8,800.00 $ (700.00) $ 7,500.00 $ 4,070.00

16,800 = 20,870 - 4,070

16,800 16,800

INCOME STATEMENT

FOR THE MONTH OF AUGUST

Revenue $ 7,500.00

Less: Expenses $ 4,070.00

Net Income $ 3,430.00

STATEMENT OF CHANGES IN EQUITY

Beginning Balance $ 8,800.00

Add: Net Income $ 3,430.00

Less: Withdrawal $ 700.00

Ending Balance $ 11,530.00

Balance Sheet

Assets

Cash $ 3,500.00

Accounts Receivable $ 4,800.00

Supplies $ 500.00

Equipment $ 8,000.00

Total Asset $ 16,800.00

Liability

Accounts Payable $ 3,270.00

Notes Payable $ 2,000.00

Total Liabilities $ 5,270.00

Owner's Equity

Judi, Capital $ 11,530.00

Total Liability & Owner's Equity $ 16,800.00

INCOME STATEMENT INCOME STATEMENT

FOR THE MONTH OF JUNE 2017 FOR THE MONTH OF JUNE 2017

Revenue $ 6,500.00 Revenue $ 7,400.00

Less: Expenses $ 2,450.00 Less: Expenses $ 2,600.00

Net Income $ 4,050.00 Net Income $ 4,800.00

STATEMENT OF CHANGES IN EQUITY STATEMENT OF CHANGES IN EQUITY

Beginning Balance $ 12,000.00 Beginning Balance $ 12,000.00

Add: Net Income $ 4,050.00 Add: Net Income $ 4,800.00

Less: Withdrawal $ 1,300.00 Less: Withdrawal $ 1,300.00

Ending Balance $ 14,750.00 Ending Balance $ 15,500.00

Balance Sheet Balance Sheet

Assets Assets

Cash $ 10,150.00 Cash $ 10,150.00

Accounts Receivable $ 2,800.00 Accounts Receivable $ 3,700.00

Supplies $ 2,000.00 Supplies $ 2,000.00

Equipment $ 10,000.00 Equipment $ 10,000.00

Total Asset $ 24,950.00 Total Asset $ 25,850.00

Liability Liability

Accounts Payable $ 1,200.00 Accounts Payable $ 1,350.00

Notes Payable $ 9,000.00 Notes Payable $ 9,000.00

Total Liabilities $ 10,200.00 Total Liabilities $ 10,350.00

Owner's Equity Owner's Equity

Godfrey, Capital $ 14,750.00 Godfrey, Capital $ 15,500.00

Total Liability & Owner's Equity $ 24,950.00 Total Liability & Owner's Equity $ 25,850.00

Month Assets (=) Liabilities (+) Owner's Equity (+) Revenue (-) Expenses

May Cash Accounts Receivable Equipment Supplies Notes Payable Accounts Payable Maye, Capital Mayes, Drawings Salaries Expense Advertising Expense Rent Expense

1 $ 7,000.00 $ 7,000.00

2 $ (900.00) $ 900.00

3 $ 600.00 $ 600.00

5 $ (125.00) $ 125.00

9 $ 4,000.00 $ 4,000.00

12 $(1,000.00) $ (1,000.00)

15 $ 5,400.00 $ 5,400.00

17 $(2,500.00) $ 2,500.00

20 $ (600.00) $ (600.00)

23 $ 4,000.00 $ (4,000.00)

26 $ 5,000.00 $ 5,000.00

29 $4,200.00 $ 4,200.00

30 $ (275.00) $ 275.00

######### $ 1,400.00 $4,200.00 $ 600.00 $ 5,000.00 $ 4,200.00 $ 7,000.00 $ (1,000.00) $ 9,400.00 $ 1,175.00

20,800 = 24,600 - 3,800

20,800 20,800

Income Statement

For the month of May

Revenue $ 9,400.00

Less: Expenses

Office Rent $ 900.00

Advertising Cost $ 125.00

Salaries Expense $ 2,500.00

Net Profit $ 5,875.00

Balance Sheet

Assets

Cash $ 14,600.00

Accounts Receivable $ 1,400.00

Supplies $ 600.00

Equipment $ 4,200.00

Total Asset $ 20,800.00

Liability

Accounts Payable $ 4,200.00

Notes Payable $ 5,000.00

Total Liabilities $ 9,200.00

Owner's Equity

Maye, Capital $ 11,600.00

Total Liability & Owner's Equity $ 20,800.00

Holz Disc Golf Course

Journal Entry

Date Accounting Titles PR Debit Credit

March 1 Cash 20,000

Holz, Capital 20,000

To record the initial capital of Golf Course

March 3 Land 12,000

Building 2,000

Equipment 1,000

Cash 15,000

To record the land purchase of Golf Course

March 5 Advertising Expense 900

Cash 900

To record the payment of advertisement

March 6 Insurance Expense 600

Cash 600

To record the insurance expenses for one-year

March 10 Equipments 1,050

Accounts Payable 1,050

To record equipments purchase payable for 30 days

March 18 Cash 1,100

Service Revenue 1,100

To record the revenue from golf fees

March 19 Cash 1,500

Service Revenue 1,500

To record the sales with coupons

March 25 Holzc, Drawing 800

Cash 800

To record the withdrawal for personal use

March 30 Salaries Expense 250

Cash 250

To record the salaries expense

Accounts Payable 1,050

Cash 1050

To record the payment payable for 30 days

March 31 Cash 2,700

Service Revenue 2,700

To record revenue from golf fees

Emily Valley Dentist Emily Valley Dentist Emily Valley Dentist

Journal Entry General Ledger Trial Balance

30-Apr-17

Date Accounting Titles PR Debit Credit Account Cash 001

DATE Description Ref Debit Credit Balance Account Titles Debit Credit

April 1 Cash 20,000 01-Apr Cash Investment of the owner GJ-1 20,000 20,000

Valley, Capital 20,000 02-Apr Rent Expense GJ-1 1,100 18,900

To record cash investment 11-Apr Unearned Service Revenue GJ-1 1000 ###### ## Cash 16,800

20-Apr Service Revenue GJ-1 2100 ###### ## Account Receivables 5,100

Salary Expense 2,800 30-Apr Salaries Payable GJ-1 2800 ###### ## Supplies 4,000

Salary Payable 2,800 30-Apr Accounts Payable 2400 ###### ## Accounts Payable 1,600

To record salary expense for the month of April ###### ## Unearned Service Revenue 1,000

## Owner's capital 20,000

April 2 Rent Expense 1,100 Account Account Receivables 112 ## Service Revenue 7,200

Cash 1,100 DATE Description Ref Debit Credit Balance ## Salaries and Wages Expense 2,800

To record payment for rent expent in cash 20-Apr Service Revenue GJ-1 5,100 5,100 ## Rent Expense 1,100

5,100 29,800 29,800

April 3 Supplies Account 4,000

Acounts Payable - Dazzle Company 4000 Account Supplies 126

To purchase dental supplies on account DATE Description Ref Debit Credit Balance

03-Apr Accounts Payable GJ-1 4,000 4,000

April # Account Receivables 5100 4,000

Service Revenue 5100

To record the services performed to insurance companies Account Accounts Payable 201

DATE Description Ref Debit Credit Balance

April # Cash 1,000 03-Apr Accounts Payable GJ-1 4000 4,000

Unearned Service Revenue 1,000 30-Apr Cash Payment to Dazzle Company 2400 1,600

To record the advance payment of Mataruka for an implant 1,600

April # Cash 2,100 Account Unearned Service Revenue 209

Service Revenue 2,100 DATE Description Ref Debit Credit Balance

To record earned from M. Santos 20-Apr Advance Payment for Implant GJ-1 1000 1,000

1,000

April # Salaries Expense 2800

Cash 2800 Account Owner's Capital 301

To record payment of salaries for the month of April DATE Description Ref Debit Credit Balance

01-Apr Cash Investment of the Owner GJ-1 20,000 20,000

AccountsPayable - Dazzle Company 2,400 20,000

Cash 2,400

To record the payment to Dazzle Company Account Service Revenue 400

DATE Description Ref Debit Credit Balance

10-Apr Account Receivable GJ-1 5100 5,100

20-Apr Cash earned from M. Santos 2,100 7,200

7,200

Account Salaries and Wages Expense 726

DATE Description Ref Debit Credit \

30-Apr Payment of Salaries for the month of April GJ-1 2,800 2,800

2,800

Account Rent Expense 729

DATE Description Ref Debit Credit Balance

02-Apr Rent Expense GJ-1 1,100 1,100

1,100

Maquoketa Services Maquoketa Services

Journal Entry T-Accounts

Trans. Accounting Titles PR Debit Credit

Cash Account Receivables Supplies Equipment

1 Cash 40,000 Debit Credit Debit Credit Debit Credit Debit Credit

Owner's, Capital 40,000 (1) 40,000 (8) 12,000 (6) 420 (4) 30,000

To record cash initial investment 24,000 (3) 3,000(10) (7) 1,500 30,000

10,000 (4) 12,000 3000 1,920

2 No transaction 1,800 (5) 9,000 1,920 Accounts Payable

420 (6) Debit Credit

3 Prepaid Rent 24,000 (8) 8,000 Prepaid Insurance Prepaid Rent 20,000 (4)

Cash 24,000 400 (9) Debit Credit Debit Credit 1,500 (7)

To record cash payment for the first year (10) 3,000 (5) 1,800 (3) 24,000 (9) 400

6,100 (12) 1,800 24,000 380 (11)

4 Equipment 30,000 51,000 42,720 400 21,880

Cash 10,000 8,280 Service Revenue Salaries and Wages Expense 21,480

Accounts Payable 20,000 Debit Credit Debit Credit

To record downpayment for equipments Owner's Capital 20,000 (8) (12) 6,100 Utilities Expense

Debit Credit 20,000 6,100 Debit Credit

5 Prepaid Insurance 1,800 40,000 (1) (11) 380

Cash 1,800 40,000 380

To record payment for insurance on furniture and equip

6 Office Supplies 420

Cash 420 Maquoketa Services

To record the payment for basic office supplies

Trial Balance

7 Office Supplies 1,500

Accounts Payable 1,500

To record purchased office supplies on account Account Titles Debit Credit

8 Cash 8,000

Account Receivable 12,000 Cash 8,280

Service Revenue 20,000 Account Receivables 9,000

To record service revenue Supplies 1,920

Prepaid Insurance 1,800

9 Accounts Payable 400 Prepaird Rent 24,000

Cash 400 Equipment 30,000

To record payment for accounts payable Accounts Payable 21,480

Owner's Capital 40,000

10 Cash 3,000 Service Revenue 20,000

Account Receivables 3,000 Salaries and Wages Expense 6,100

To record payment of account receivables Utilities Expense 380

81,480 81,480

11 Utilities Expense 380

Accounts Payable 380

To record utility bill to be paid next month

12 Salaries and Wages Expense 6,100

Cash 6,100

To record the salaries expense

B.

A. and C. D.

Starr Theater

General Journal Starr Theater Maquoketa Services

General Ledger Trial Balance

Date Accounting Titles Ref Debit Credit

Account: Cash Account No: 101

Date Item Ref Debit Credit Balance

02-Mar Rent Expense 3,500

Cash 1,500 01-Mar

Balance ✓ 3,000 Account Titles Debit Credit

Initial Payment for Rent

Accounts Payable 2,000 02-Mar 1,500 1,500

Revenue from the admissions

To record the rent expense 09-Mar 4,300 5,800 Cash 10,150

10-Mar Payment for movie and Acct Payable 4,100 1,700 Account Receivables 450

03-Mar No transaction 12-Mar Payment for Advertisement 900 800 Land 24,000

20-Mar Payment from the admissions 5,000 5,800 Buildings 10,000

09-Mar Cash 4,300 20-Mar Payment for Rental Fee 2,000 3,800 Equipment 10,000

Service Revenue 4,300 31-Mar Salaries of Employers 3,100 700 Accounts Payable 4,900

To record the revenue from admissions 31-Mar 1/2 payment of Ladd to their rent fee 450 1,150 Owner's Capital 40,000

31-Mar Payment from the admissions 9,000 10,150 Service Revenue 18,300

10-Mar Accounts Payable 4,100 Rent Revenue 900

Cash 4,100 Advertising Expense 900

To record the payment on movies and acct payable on March 1 Account: Account Receivables Account No: 112 Salaries and Wages Expense 3,100

Date Item Ref Debit Credit Balance Rent Expense 5,500

Balance Payment of Ladd

11-Mar No Entry 31-Mar 450 450 64,100 64,100

12-Mar Advertising Expense 900 Account: Land Account No: 140

Date Item Ref Debit Credit Balance

Cash 900

To record the payment for advertisement 01-Mar

Balance ✓ 24,000

20-Mar Cash 5,000 Account: Building Account No: 145

Date Item Ref Debit Credit Balance

Service Revenue 5,000

To record the revenue from admissions 01-Mar

Balance ✓ 10,000

Rent Expense 2,000 Account: Equipment Account No: 157

Date Item Ref Debit Credit Balance

Cash 2,000

To record the payment fo rental fee 01-Mar

Balance ✓ 10,000

31-Mar Salaries Expense 3,100 Account: Accounts Payable Account No: 201

Date Item Ref Debit Credit Balance

Cash 3,100

To record the salary expense 01-Mar

Balance

✓ 7,000

02-Mar For the Rent Expense 2,000 9,000

Cash 450 10-Mar Payment on movies and payable on March 1 4,100 4,900

Account Receivables 450

Rent Revenue 900

To record the payment and balance of Ladd Account: Owner's Capital Account No: 301

Date Item Ref Debit Credit Balance

Cash 9,000 01-Mar

Balance ✓ 40,000

Service Revenue 9,000

To record the payment from customer's admission Account: Service Revenue Account No: 400

Date Item Ref Debit Credit Balance

09-Mar

Revenue from admissions ✓ 4,300 4,300

Revenue from customer's admissions

20-Mar 5,000 9,300

31-Mar Revenue from customer's admissions 9,000 18,300

Account: Rent Revenue Account No: 429

Date Item Ref Debit Credit Balance

Payment of Ladd to their Rent Fees

31-Mar 900 900

Account: Advertising Expense Account No: 610

Date Item Ref Debit Credit Balance

Payment for Advertisement

12-Mar 900 900

Account: Salaries and Wages Expenses Account No: 726

Date Item Ref Debit Credit Balance

Employer's Salary

31-Mar 3,100 3,100

Account: Rent Expense Account No: 729

Date Item Ref Debit Credit Balance

02-Mar Film Rental 3,500 3,500

Payment of Rental Fee

20-Mar 2,000 5,500

Avtar Sandhu Company

Trial Balance

Avtar Sandhu Company

June 30, 2017 Journal Entry

Trans. Accounting Titles PR Debit Credit

Account Titles Debit Credit 1 Account Receivable 580

Cash 580

Cash 3,610 Cash 850

Account Receivables 2,542 Account Receivable 850

Supplies 490 2 Equipments 710

Equipment 3,310 Supplies 710

Accounts Payable 3,000 3 Service Revenue 882

Unearned Service Revenue 1,100 4 Salaries and Wages Expense 700

Owner's Capital 8,000 5 Accounts Payable 360

Owner's Drawing 1,400 Cash 306

Service Revenue 3,362 Accounts Payable 306

Salaries and Wages Expense 3,300 Cash 306

Utilities Expense 810 6 Owner's Drawing 600

15,462 15,462 Salaries and Wages Expenses 600

Adjustments

1. Cash 3,340 + 270 = 3610 dr.

Account Receivable 2,812 - 270 = 2,542 dr.

2. Supplies 1,200 - 710 = 490 dr.

Equipment 2,600 + 710 = 3,310 dr.

3. Service Revenue 2,480 + 882 = 3,362 cr.

4. Salaries and Wages 3,200 + 700 = 3,900 dr.

5. Accounts Payable 3,666 - 666 = 3,000 dr.

Salaries and Wages Expense 3,900 - 600 = 3,300 dr.

Owner's Drawing 800 + 600 = 1,400 dr.

You might also like

- FarDocument9 pagesFarSophia Criciel GumatayNo ratings yet

- Income Statement: IVAN IZO Law OfficeDocument4 pagesIncome Statement: IVAN IZO Law OfficeClaudio AbinenoNo ratings yet

- Project Cost Management Plan Template Download FreeDocument14 pagesProject Cost Management Plan Template Download FreeNdre Itu AkuNo ratings yet

- Project Cost Summary Resource Costs: TotalDocument14 pagesProject Cost Summary Resource Costs: TotalwkNo ratings yet

- Ejercio de ExelDocument18 pagesEjercio de ExelDaysi RoseroNo ratings yet

- Law Office Financial StatementsDocument7 pagesLaw Office Financial StatementsNicolas ErnestoNo ratings yet

- 02 - Cash Flow TemplateDocument2 pages02 - Cash Flow Templateprhipolito22No ratings yet

- Landing On You Travel ServicesDocument4 pagesLanding On You Travel ServicesAngelica EndrenalNo ratings yet

- Cost Overruns: Task Cost Variance Resource Cost VarianceDocument1 pageCost Overruns: Task Cost Variance Resource Cost VarianceAlexandru BaciuNo ratings yet

- Refat Mukmin - Asy 23Document7 pagesRefat Mukmin - Asy 232310102052.refatNo ratings yet

- IC IT Project Cost Benefit Analysis Template 8746Document17 pagesIC IT Project Cost Benefit Analysis Template 8746Karthik HegdeNo ratings yet

- Raportoverbudget PDFDocument1 pageRaportoverbudget PDFAlexandru BaciuNo ratings yet

- Raportoverbudget PDFDocument1 pageRaportoverbudget PDFAlexandru BaciuNo ratings yet

- September 2013 budget, income, and expense trackingDocument12 pagesSeptember 2013 budget, income, and expense trackingMani Falou ÉnigmeNo ratings yet

- Project Budget Template: Labor TaskDocument6 pagesProject Budget Template: Labor TaskTAMILarasuNo ratings yet

- San Ka Punta Travel and TourDocument1 pageSan Ka Punta Travel and TourKevzz EspirituNo ratings yet

- Contoh Family BudgetDocument3 pagesContoh Family BudgetReno VehardianNo ratings yet

- Project Cash Flow TemplateDocument2 pagesProject Cash Flow TemplateMlungisi Ncube MnikwaNo ratings yet

- IC Business Budget Template Updated 8857Document7 pagesIC Business Budget Template Updated 8857Francisco SalazarNo ratings yet

- Business Budget and Services ReportDocument7 pagesBusiness Budget and Services ReportTAMILarasuNo ratings yet

- Solution P6-2Document2 pagesSolution P6-2Frantino M Hutagaol100% (1)

- Analyzing Business Transactions Using ExcelDocument30 pagesAnalyzing Business Transactions Using ExcelPhaelyn YambaoNo ratings yet

- Illustration 1.1: Grande Trek: Account Balances 1 October, 2020Document7 pagesIllustration 1.1: Grande Trek: Account Balances 1 October, 2020J DashNo ratings yet

- Waddell Company Had The Following BalancesDocument6 pagesWaddell Company Had The Following Balanceslaale dijaanNo ratings yet

- Dat e Accounts Ref. Debit Credit: Journal Entries Arai Printing ShopDocument2 pagesDat e Accounts Ref. Debit Credit: Journal Entries Arai Printing ShopSobanah ChandranNo ratings yet

- FABM2 1stQtrDigitalModule 2Document90 pagesFABM2 1stQtrDigitalModule 2ABM-A Hernaez RogelynNo ratings yet

- Setup Costs (Incl GST)Document2 pagesSetup Costs (Incl GST)IswichNo ratings yet

- Google PresentationDocument22 pagesGoogle Presentationcia100% (10)

- TransDocument2 pagesTransRahad Hasan ChyonNo ratings yet

- ChartsDocument1 pageChartselyfrankoNo ratings yet

- Project BudgetDocument6 pagesProject BudgetSaintime AndreusNo ratings yet

- McLol Construction Cash BookDocument6 pagesMcLol Construction Cash BookMaknunNo ratings yet

- Accounts: Debit CreditDocument15 pagesAccounts: Debit CreditKarylle LapigNo ratings yet

- Laurensius Adrian Wahyu Setiaji - 1402204311 - Latihan Soal P4.2Document6 pagesLaurensius Adrian Wahyu Setiaji - 1402204311 - Latihan Soal P4.2Laurensius Adrian Wahyu SetiajiNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument4 pagesCapital Investment Model - NPV IRR Payback: Strictly Confidentialsh munnaNo ratings yet

- Session 4 FSET and SCFDocument9 pagesSession 4 FSET and SCFdone manNo ratings yet

- Animated Key Data Dashboard TemplateDocument12 pagesAnimated Key Data Dashboard TemplatesundecaprioNo ratings yet

- TT01 AnsDocument3 pagesTT01 AnsDuyên Lê Ngọc TriềuNo ratings yet

- Exercise 2-3Document2 pagesExercise 2-3Nick AltmanNo ratings yet

- Balance Sheet and Financial StatementsDocument2 pagesBalance Sheet and Financial StatementsNick AltmanNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentAtka chNo ratings yet

- Personal budget template shows monthly income of $7,257 and expenses of $5,359Document3 pagesPersonal budget template shows monthly income of $7,257 and expenses of $5,359Teresa SirenaNo ratings yet

- Fundamentals of Accounting AssignmentDocument5 pagesFundamentals of Accounting AssignmentFiromsa Ahmednur Tesfaye100% (1)

- Name of The Business: Egreen Shop Nature of Business: Online Grossary ShopDocument7 pagesName of The Business: Egreen Shop Nature of Business: Online Grossary ShopShakil AhsanNo ratings yet

- BP Security ServicesDocument6 pagesBP Security ServicesAnithaNo ratings yet

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- Book 1Document3 pagesBook 1Moetassem billah MikatiNo ratings yet

- TF 10000094Document2 pagesTF 10000094eldhoisaacNo ratings yet

- Latihan Balance SheetDocument10 pagesLatihan Balance SheetULAN BATAWENNo ratings yet

- MWG Revenue 13-Jan 13-Feb 13-Mar 13-Apr 13-May 13-Jun: See Itemization BelowDocument6 pagesMWG Revenue 13-Jan 13-Feb 13-Mar 13-Apr 13-May 13-Jun: See Itemization Belowhung nguyenNo ratings yet

- Project Cost Management Plan TemplateDocument14 pagesProject Cost Management Plan TemplateMohamed LabbeneNo ratings yet

- Project Cost Management Plan Excel TemplateDocument14 pagesProject Cost Management Plan Excel TemplateDessy Lina - Marketing Executive BalikpapanNo ratings yet

- Project Cost Management Plan For Fresh GraduateDocument14 pagesProject Cost Management Plan For Fresh GraduateDessy Lina - Marketing Executive BalikpapanNo ratings yet

- Project Cost Management Plan Template Download FreeDocument14 pagesProject Cost Management Plan Template Download FreeMohamed LabbeneNo ratings yet

- Mónica - Valenzuela - Control 7Document9 pagesMónica - Valenzuela - Control 7Mónica ValenzuelaNo ratings yet

- Name of The Business: Egreen Shop Nature of Business: Online Grossary ShopDocument7 pagesName of The Business: Egreen Shop Nature of Business: Online Grossary ShopShakil AhsanNo ratings yet

- FABMDocument4 pagesFABMDwyth Anne MonterasNo ratings yet

- Finacc 8-3Document5 pagesFinacc 8-3FakerPlaymakerNo ratings yet

- Region ArtDocument1 pageRegion ArtSophia Criciel GumatayNo ratings yet

- LET The Earth BreatheDocument1 pageLET The Earth BreatheSophia Criciel GumatayNo ratings yet

- Journalizing - ExercisesDocument6 pagesJournalizing - ExercisesSophia Criciel GumatayNo ratings yet

- Bank Reconcilation Statement AnalysisDocument12 pagesBank Reconcilation Statement AnalysisSophia Criciel GumatayNo ratings yet

- Transaction Worksheet EXERCISEDocument4 pagesTransaction Worksheet EXERCISESophia Criciel GumatayNo ratings yet

- Izzy Trading - Post Closing and Complete Financial StatementsDocument13 pagesIzzy Trading - Post Closing and Complete Financial StatementsSophia Criciel GumatayNo ratings yet

- PrinciplesDocument4 pagesPrinciplesSophia Criciel GumatayNo ratings yet

- Plant Growth Chart Tracks 3 Plants Over 8 DaysDocument2 pagesPlant Growth Chart Tracks 3 Plants Over 8 DaysSophia Criciel GumatayNo ratings yet

- BusinessCaseAnalysis TanyaDocument2 pagesBusinessCaseAnalysis TanyaSophia Criciel GumatayNo ratings yet

- Musician W/ Inflatable: AudienceDocument2 pagesMusician W/ Inflatable: AudienceSophia Criciel GumatayNo ratings yet

- PLAYBILLDocument2 pagesPLAYBILLSophia Criciel GumatayNo ratings yet

- Anamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionDocument12 pagesAnamdan Manufacturing Company Prepare and Analyses The Cash Flow Statement of The Company? SolutionAbdullah QureshiNo ratings yet

- Employee Benefits AccountingDocument11 pagesEmployee Benefits AccountingNelva Quinio33% (3)

- Chapter 16 Employee BenefitsDocument64 pagesChapter 16 Employee BenefitsEdlyn LiwagNo ratings yet

- Keyman Insurance New InfoDocument10 pagesKeyman Insurance New InfoFreddy Savio D'souzaNo ratings yet

- Final Account Procedures 1st Edition PGguidance 2015Document25 pagesFinal Account Procedures 1st Edition PGguidance 2015Lakshan Priyankara100% (1)

- Potato Chips CompanyDocument48 pagesPotato Chips Companyshani2783% (6)

- Mr. Radhakrishnan's business transactionsDocument11 pagesMr. Radhakrishnan's business transactionsPriyasNo ratings yet

- Admission of A PartnerDocument5 pagesAdmission of A PartnerHigreeve SrudhiNo ratings yet

- Chapter 8 9Document10 pagesChapter 8 9OANH TRẦN THỊ KIMNo ratings yet

- Magpantay-Payroll LocalDocument17 pagesMagpantay-Payroll LocalKate Catherine MatiraNo ratings yet

- Acctg 303Document9 pagesAcctg 303Anonymous IsEZYR1No ratings yet

- Chapter 8 QDocument7 pagesChapter 8 Qabdelrahmanzohairy100% (2)

- This Study Resource Was: ScopeDocument9 pagesThis Study Resource Was: ScopeajejeNo ratings yet

- ch16 SolDocument12 pagesch16 SolJohn Nigz Payee100% (1)

- ExerciseDocument5 pagesExerciseICS TEAMNo ratings yet

- ACCA - FA - 习题课 - 大题练习Document59 pagesACCA - FA - 习题课 - 大题练习mxw0717No ratings yet

- Chapter 1-5 Book 1Document42 pagesChapter 1-5 Book 1Krizel Dixie ParraNo ratings yet

- Classification of Taxable Income Under Various Heads and Computation of Taxable IncomeDocument4 pagesClassification of Taxable Income Under Various Heads and Computation of Taxable IncomeAnkit Kr MishraNo ratings yet

- 1 MW Solar Power Plant EPC Cost With Multi Crystalline ModulesDocument12 pages1 MW Solar Power Plant EPC Cost With Multi Crystalline ModulesWahid Rahman RahmaniNo ratings yet

- Intermediate - Accounts (19.07.2019)Document10 pagesIntermediate - Accounts (19.07.2019)Åådil MirNo ratings yet

- CBE Annual Report 2009-10Document35 pagesCBE Annual Report 2009-10Asteraye Waka0% (2)

- ABD MCQs - Unit 1Document25 pagesABD MCQs - Unit 1Kapil DalviNo ratings yet

- RBI Guidelines on Forward Rate Agreements and Interest Rate SwapsDocument9 pagesRBI Guidelines on Forward Rate Agreements and Interest Rate SwapsAnil PatelNo ratings yet

- 12 Accounts Half YearlyDocument5 pages12 Accounts Half YearlyRahul MajumdarNo ratings yet

- Adjustingtheaccount 1#$Document49 pagesAdjustingtheaccount 1#$mukesh697100% (1)

- Tally ForteDocument100 pagesTally ForteVijay SoniNo ratings yet

- Soal Dan Jawaban Yac SMK Siklus Akuntans PDFDocument43 pagesSoal Dan Jawaban Yac SMK Siklus Akuntans PDFSelvi AmeliaNo ratings yet

- MA1Document9 pagesMA1geminailnaNo ratings yet

- Sriram com-PE CaseDocument12 pagesSriram com-PE CaseSuryansh SinghNo ratings yet

- General Accounting 3 - Express Handling and DeliveryDocument9 pagesGeneral Accounting 3 - Express Handling and DeliveryRheu ReyesNo ratings yet