Professional Documents

Culture Documents

Configure TAXINN tax calculation procedure

Uploaded by

Jitendra Katiyar0 ratings0% found this document useful (0 votes)

21 views14 pagesThe document describes the steps to configure the TAXINN tax calculation procedure for India in SAP. This includes setting up access sequences, condition types, the tax procedure, account keys, and assigning the procedure to India. It also covers configuring pricing procedures for depot, export, factory, and stock transfer sales. The purpose is to support condition-based excise determination for procurement and sales tax calculations in India.

Original Description:

Original Title

Configuration of Tax Calculation Procedure TAXINN

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document describes the steps to configure the TAXINN tax calculation procedure for India in SAP. This includes setting up access sequences, condition types, the tax procedure, account keys, and assigning the procedure to India. It also covers configuring pricing procedures for depot, export, factory, and stock transfer sales. The purpose is to support condition-based excise determination for procurement and sales tax calculations in India.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

21 views14 pagesConfigure TAXINN tax calculation procedure

Uploaded by

Jitendra KatiyarThe document describes the steps to configure the TAXINN tax calculation procedure for India in SAP. This includes setting up access sequences, condition types, the tax procedure, account keys, and assigning the procedure to India. It also covers configuring pricing procedures for depot, export, factory, and stock transfer sales. The purpose is to support condition-based excise determination for procurement and sales tax calculations in India.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 14

Configuration of Tax Calculation Procedure

TAXINN

Purpose

TAXINN is a tax calculation procedure for country version India and it supports condition-based excise

determination. You need to configure this tax calculation procedure.

Process Flow

Execute the following steps in the Implementation Guide to configure the tax calculation procedure TAXINN:

Procurement

1. Set up the following Access Sequences in the the IMG under Financial Accounting → Financial Accounting

Global Settings → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure → Access Sequences:

¡ JTAX

¡ JST1

2. Set up the Condition Types for the following conditions in the IMG under Financial Accounting → Financial

Accounting Global Settings → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure →Define

Condition Types:

○ MM Excise Conditions

§ JMOP IN: BED setoff %

§ JMOQ IN: BED setoff Qty

§ JAOP IN: AED setoff %

§ JAOQ IN: AED setoff Qty

§ JSOP IN: SED setoff %

§ JSOQ IN: SED setoff Qty

§ JMIP IN: BED inventory %

§ JMIQ IN: BED inventory Qt

§ JAIP IN AED inventory %

§ JAIQ IN AED inventory Qty

§ JSIP IN SED inventory %

§ JSIQ IN SED inventory Qty

§ JMX1 IN: A/P BED setoff

§ JAX1 IN: A/P AED setoff

§ JSX1 IN: A/P SED setoff

§ JMX2 IN: A/P BED inventor

§ JAX2 IN: A/P AED inventor

§ JSX2 IN: A/P SED inventor

§ JECP IN:A/P e-cess setoff

§ JECI IN: Eces inventory

§ JEX1 IN: A/P ecs setoffT

§ JEX3 IN: A/P ecs invT

○ LST/CST/VAT Conditions

§ JIPS IN Sales tax setoff

§ JIPC IN Central sales tax invoice

§ JIPL IN Local sales tax invoice

§ JIP5 A/P RM Deductible

○ Service Tax Conditions

§ JSRT A/P Service Tax

§ JEC3 A/P ECS for ST

3. Define the Tax Procedure according to the settings in the figures below.

You can do this in the IMG under Financial Accounting → Financial Accounting Global Settings → Tax on

Sales/Purchases → Basic Settings → Check Calculation Procedure → Define Procedures.

4. Set up the following Account Key in the IMG under Financial Accounting → Financial Accounting Global

Settings → Tax on Sales/Purchases → Basic Settings → Check and Change Settings for Tax Processing.

○ VS6 Input Tax

5. Assign Tax Procedure to the country.

You can do this in the IMG under Financial Accounting → Financial Accounting Global Settings → Tax on

Sales/Purchases → Basic Settings → Assign Country to Calculation Procedure.

Sales

1. Set up the Condition Types for the following conditions in the IMG under Financial Accounting → Financial

Accounting Global Settings → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure →Define

Condition Types:

○ Excise Conditions

§ JASS IN A/R BED

§ JEXP IN A/R BED

§ JEXQ IN A/R BED

§ JEAP IN A/R AED %

§ JEAQ IN A/R AED Qty

§ JESP IN A/R SED %

§ JESQ IN A/R SED Qty

§ JCEP IN A/R CESS %

§ JCEQ IN A/R CESS Qty

§ JEXT IN A/R BED total

§ JEAT IN A/R AED total

§ JEST IN A/R SED total

§ JCET IN A/R CESS total

§ JECT IN A/R ECS total

○ LST/CST/VAT Conditions

§ JCST IN A/R CST

§ JCSR IN A/R CST Surcharge

§ JLST IN A/R LST

§ JLSR IN A/R LST Surcharge

○ Export Conditions

§ JFRE IN Frieght

§ JINS IN Insurance

2. Set up the Access Sequence in the the IMG under Financial Accounting → Financial Accounting Global

Settings → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure → Access Sequences:

3. Set up the following Pricing Procedures according to the settings in the figures below.

You can do this in the IMG under Sales and Distribution → Basic Functions → Pricing → Pricing

Control →Define And Assign Pricing Procedures.

○ JDEPOT (IN:Depot sale with formula)

○ JEXPOR (IN:Export sales with formula)

○ JFACT (IN:Factory sale with formula)

○ JSTKTR (IN:Stock transfer with formula)

s Configuration of Tax Calculation Procedure

TAXINN

Purpose

TAXINN is a tax calculation procedure for country version India and it supports condition-based excise

determination. You need to configure this tax calculation procedure.

Process Flow

Execute the following steps in the Implementation Guide to configure the tax calculation procedure TAXINN:

Procurement

1. Set up the following Access Sequences in the the IMG under Financial Accounting → Financial Accounting

Global Settings → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure → Access Sequences:

¡ JTAX

¡ JST1

2. Set up the Condition Types for the following conditions in the IMG under Financial Accounting → Financial

Accounting Global Settings → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure →Define

Condition Types:

○ MM Excise Conditions

§ JMOP IN: BED setoff %

§ JMOQ IN: BED setoff Qty

§ JAOP IN: AED setoff %

§ JAOQ IN: AED setoff Qty

§ JSOP IN: SED setoff %

§ JSOQ IN: SED setoff Qty

§ JMIP IN: BED inventory %

§ JMIQ IN: BED inventory Qt

§ JAIP IN AED inventory %

§ JAIQ IN AED inventory Qty

§ JSIP IN SED inventory %

§ JSIQ IN SED inventory Qty

§ JMX1 IN: A/P BED setoff

§ JAX1 IN: A/P AED setoff

§ JSX1 IN: A/P SED setoff

§ JMX2 IN: A/P BED inventor

§ JAX2 IN: A/P AED inventor

§ JSX2 IN: A/P SED inventor

§ JECP IN:A/P e-cess setoff

§ JECI IN: Eces inventory

§ JEX1 IN: A/P ecs setoffT

§ JEX3 IN: A/P ecs invT

○ LST/CST/VAT Conditions

§ JIPS IN Sales tax setoff

§ JIPC IN Central sales tax invoice

§ JIPL IN Local sales tax invoice

§ JIP5 A/P RM Deductible

○ Service Tax Conditions

§ JSRT A/P Service Tax

§ JEC3 A/P ECS for ST

3. Define the Tax Procedure according to the settings in the figures below.

You can do this in the IMG under Financial Accounting → Financial Accounting Global Settings → Tax on

Sales/Purchases → Basic Settings → Check Calculation Procedure → Define Procedures.

4. Set up the following Account Key in the IMG under Financial Accounting → Financial Accounting Global

Settings → Tax on Sales/Purchases → Basic Settings → Check and Change Settings for Tax Processing.

○ VS6 Input Tax

5. Assign Tax Procedure to the country.

You can do this in the IMG under Financial Accounting → Financial Accounting Global Settings → Tax on

Sales/Purchases → Basic Settings → Assign Country to Calculation Procedure.

Sales

1. Set up the Condition Types for the following conditions in the IMG under Financial Accounting → Financial

Accounting Global Settings → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure →Define

Condition Types:

○ Excise Conditions

§ JASS IN A/R BED

§ JEXP IN A/R BED

§ JEXQ IN A/R BED

§ JEAP IN A/R AED %

§ JEAQ IN A/R AED Qty

§ JESP IN A/R SED %

§ JESQ IN A/R SED Qty

§ JCEP IN A/R CESS %

§ JCEQ IN A/R CESS Qty

§ JEXT IN A/R BED total

§ JEAT IN A/R AED total

§ JEST IN A/R SED total

§ JCET IN A/R CESS total

§ JECT IN A/R ECS total

○ LST/CST/VAT Conditions

§ JCST IN A/R CST

§ JCSR IN A/R CST Surcharge

§ JLST IN A/R LST

§ JLSR IN A/R LST Surcharge

○ Export Conditions

§ JFRE IN Frieght

§ JINS IN Insurance

2. Set up the Access Sequence in the the IMG under Financial Accounting → Financial Accounting Global

Settings → Tax on Sales/Purchases → Basic Settings → Check Calculation Procedure → Access Sequences:

3. Set up the following Pricing Procedures according to the settings in the figures below.

You can do this in the IMG under Sales and Distribution → Basic Functions → Pricing → Pricing

Control →Define And Assign Pricing Procedures.

○ JDEPOT (IN:Depot sale with formula)

○ JEXPOR (IN:Export sales with formula)

○ JFACT (IN:Factory sale with formula)

○ JSTKTR (IN:Stock transfer with formula)

You might also like

- Configuration of Tax Calculation Procedure TAXINNDocument8 pagesConfiguration of Tax Calculation Procedure TAXINNdharmesh6363No ratings yet

- Configuration of Tax Calculation Procedure TAXINNDocument6 pagesConfiguration of Tax Calculation Procedure TAXINNpawanNo ratings yet

- CINDocument8 pagesCINShahilSinghNo ratings yet

- Difference Between TAXINJ and TAXINN Tax ProceduresDocument4 pagesDifference Between TAXINJ and TAXINN Tax Procedureschaitu121276No ratings yet

- Check Withholding Tax CountriesDocument17 pagesCheck Withholding Tax Countrieswrite2cm2006No ratings yet

- Configuration - Tax Procedure: Creating Condition Type JECS For Education CessDocument8 pagesConfiguration - Tax Procedure: Creating Condition Type JECS For Education CessJayanth MaydipalleNo ratings yet

- Sd1011: SD Taxes V 1.0: India Sap Coe, Slide 1Document57 pagesSd1011: SD Taxes V 1.0: India Sap Coe, Slide 1SUSMITANo ratings yet

- Configure Tax on Sales/Purchases in SAP S/4HANADocument10 pagesConfigure Tax on Sales/Purchases in SAP S/4HANAkalyanNo ratings yet

- Withholding Tax ConfigurationDocument75 pagesWithholding Tax ConfigurationClaudia IonitaNo ratings yet

- SAP SD IMG Configuration Notes 1Document135 pagesSAP SD IMG Configuration Notes 1dhiren1529No ratings yet

- Country India Version (C.I.N) TAXINN FI-CIN Configuration Document V.1.0Document98 pagesCountry India Version (C.I.N) TAXINN FI-CIN Configuration Document V.1.0ShreekumarNo ratings yet

- Activate India Country Version for Tax YearsDocument32 pagesActivate India Country Version for Tax YearsBalakrishna GovinduNo ratings yet

- Tax Procedure Configuration PDFDocument18 pagesTax Procedure Configuration PDFDinbandhu TripathiNo ratings yet

- Reverse Charge Configuration For GSTDocument20 pagesReverse Charge Configuration For GSTAditya Sharma100% (11)

- SAP CIN-MM Customizing for Formula-Based Tax Calculation TAXINNDocument7 pagesSAP CIN-MM Customizing for Formula-Based Tax Calculation TAXINNsreekumarNo ratings yet

- Ganeshtaxinncofigdoc 180214054555Document21 pagesGaneshtaxinncofigdoc 180214054555KumarNo ratings yet

- VAT CONFIGURATION For SADocument28 pagesVAT CONFIGURATION For SAMohammed Nawaz Shariff100% (1)

- As-22 Accounting For Taxes On Income - Brief Note PDFDocument5 pagesAs-22 Accounting For Taxes On Income - Brief Note PDFKaran KhatriNo ratings yet

- Tds NotesDocument15 pagesTds NotesnaysarNo ratings yet

- Create and Configure Withholding Tax in SAPDocument9 pagesCreate and Configure Withholding Tax in SAPPãśhãh ŠháìkhNo ratings yet

- CIN ConfigDocument88 pagesCIN Configgoel45No ratings yet

- BRAZIL MM and SD Manual Steps To CutoverDocument19 pagesBRAZIL MM and SD Manual Steps To CutoverRafa CarrilloNo ratings yet

- Introducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To AskDocument7 pagesIntroducing A New VAT System: Everything You Always Wanted To Know About VAT in SAP But Were Not Aware To Askchandra_kumarbrNo ratings yet

- Withholding Tax: Configuration DocumentDocument19 pagesWithholding Tax: Configuration DocumentMohammed Nawaz ShariffNo ratings yet

- TDS Config in SAPDocument31 pagesTDS Config in SAPvaishaliak2008No ratings yet

- SAP Financials - Tax Collected at Source ManualDocument5 pagesSAP Financials - Tax Collected at Source ManualSurya Pratap Shingh RajputNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Trimex...... Fi Configaration DocumentDocument25 pagesTrimex...... Fi Configaration DocumentDeepakNo ratings yet

- Configuration For ProcurementDocument10 pagesConfiguration For ProcurementJyotiraditya BanerjeeNo ratings yet

- Activate Country Version India For Specific Fiscal Years: ActivitiesDocument32 pagesActivate Country Version India For Specific Fiscal Years: ActivitiesSiva KumarrNo ratings yet

- Resolve error posting GL account to FSOO by assigning country and tax codesDocument3 pagesResolve error posting GL account to FSOO by assigning country and tax codesKundan PatilNo ratings yet

- Chapter 14Document40 pagesChapter 14Ivo_NichtNo ratings yet

- Cut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesFrom EverandCut Your Clients Tax Bill: Individual Tax Planning Tips and StrategiesNo ratings yet

- Finance QusetionnaireDocument41 pagesFinance QusetionnaireShashi ChoudharyNo ratings yet

- Sap FicoDocument36 pagesSap FicoShreekumarNo ratings yet

- TDS OnlineDocument17 pagesTDS OnlineRupang ShahNo ratings yet

- Customizing Guide: Withholding Tax Base Amount Accumulation: - For Classic (Non-Condition-Based) Tax CalculationDocument13 pagesCustomizing Guide: Withholding Tax Base Amount Accumulation: - For Classic (Non-Condition-Based) Tax CalculationBruno MerinoNo ratings yet

- Cin /excise Invoice in Sales and DistributionDocument15 pagesCin /excise Invoice in Sales and DistributionGreg ReyNo ratings yet

- Steps Involved in Filing GST ReturnsDocument9 pagesSteps Involved in Filing GST ReturnssaranistudyNo ratings yet

- CIN Accounting Entries Accounting Entry in Procurement: For Domestic Procurement of Raw MaterialDocument20 pagesCIN Accounting Entries Accounting Entry in Procurement: For Domestic Procurement of Raw MaterialPriyabrata RayNo ratings yet

- Depot Activities - CIN: Header 1 PurposeDocument7 pagesDepot Activities - CIN: Header 1 PurposeKrishna AkulaNo ratings yet

- MM Configuration DocumentDocument34 pagesMM Configuration DocumentVishnu Kumar SNo ratings yet

- Final Accounts ProblemDocument21 pagesFinal Accounts Problemkramit1680% (10)

- Withholding of TaxesDocument26 pagesWithholding of TaxesnalmatirajeshNo ratings yet

- CIN Document ConfigurationDocument11 pagesCIN Document ConfigurationRajuNo ratings yet

- GST in STO ConfigurationDocument6 pagesGST in STO ConfigurationcsremsahilNo ratings yet

- STO Cofiguration in SAPDocument3 pagesSTO Cofiguration in SAPmail_girish20029690No ratings yet

- Guidance On Tax Audit Under Section 44ABDocument5 pagesGuidance On Tax Audit Under Section 44ABSukumar BasuNo ratings yet

- CIN - TAXINN Procedure - An Overview: Transaction Code: OBYZDocument8 pagesCIN - TAXINN Procedure - An Overview: Transaction Code: OBYZNeelesh KumarNo ratings yet

- Tax Law - Penal ProvisionsDocument23 pagesTax Law - Penal ProvisionsArsalan Ahmad100% (1)

- SAP SD CIN ConfigurationDocument18 pagesSAP SD CIN Configurationsatishkr14No ratings yet

- SD Tax ConfigDocument13 pagesSD Tax ConfigRahul DholeNo ratings yet

- CIN 02 DetailsDocument80 pagesCIN 02 DetailsBiranchi MishraNo ratings yet

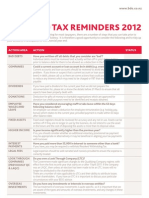

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- Adjusted Gross Income ExplainedDocument4 pagesAdjusted Gross Income ExplainedMarko Zero FourNo ratings yet

- GST Configuration in SAP FICODocument5 pagesGST Configuration in SAP FICOKingpinNo ratings yet

- Taxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchFrom EverandTaxation in Ghana: a Fiscal Policy Tool for Development: 75 Years ResearchRating: 5 out of 5 stars5/5 (1)

- 10 13 Jul Kotak Up FeDocument9 pages10 13 Jul Kotak Up FeJitendra KatiyarNo ratings yet

- Sap FicoDocument36 pagesSap FicoShreekumarNo ratings yet

- Closing Activities Month End in SAP FICODocument3 pagesClosing Activities Month End in SAP FICOJitendra KatiyarNo ratings yet

- 02 07 Jun Hinduja Up FeDocument8 pages02 07 Jun Hinduja Up FeJitendra KatiyarNo ratings yet

- Sap Fico Online Training CourseDocument2 pagesSap Fico Online Training CourseJitendra KatiyarNo ratings yet

- Sap Fico TutorialDocument191 pagesSap Fico TutorialVicky Memon100% (1)

- Asset Management ManualDocument155 pagesAsset Management ManualJitendra KatiyarNo ratings yet

- Asset Direct CapitalizationDocument18 pagesAsset Direct CapitalizationJitendra KatiyarNo ratings yet

- Balance in Local Currency Only & Account - Local Currency Mar 2013Document6 pagesBalance in Local Currency Only & Account - Local Currency Mar 2013Jitendra KatiyarNo ratings yet

- Assessment Vs DistributionDocument2 pagesAssessment Vs DistributionJitendra KatiyarNo ratings yet

- Asset Management ManualDocument155 pagesAsset Management ManualJitendra KatiyarNo ratings yet

- Automatic Period OpeningDocument21 pagesAutomatic Period Openingcdhars100% (1)

- Asset Accounting ConfigurationDocument171 pagesAsset Accounting ConfigurationcolosoderadaNo ratings yet

- Asset Accounting Configuration in SAPDocument57 pagesAsset Accounting Configuration in SAPJitendra KatiyarNo ratings yet

- Fi Aa AleDocument10 pagesFi Aa AledffeNo ratings yet

- Finance Terms in FIDocument4 pagesFinance Terms in FIJitendra KatiyarNo ratings yet

- ASAP Phase 1 and 2 HandoutDocument9 pagesASAP Phase 1 and 2 Handoutantotis sajaNo ratings yet

- AgraDocument2,310 pagesAgraJitendra KatiyarNo ratings yet

- Asset Accounting ConfigurationDocument171 pagesAsset Accounting ConfigurationcolosoderadaNo ratings yet

- Cutoff Chart To Publish2Document22 pagesCutoff Chart To Publish2Jitendra KatiyarNo ratings yet

- Deprec Asset PeriodDocument5 pagesDeprec Asset PeriodJitendra KatiyarNo ratings yet

- SAP ClientDocument2 pagesSAP ClientJitendra KatiyarNo ratings yet

- Bombay Result for 500 DaysDocument19 pagesBombay Result for 500 DaysJitendra Katiyar50% (2)

- SAP StadDocument9 pagesSAP StadJitendra KatiyarNo ratings yet

- Shaw's play about a sculptor and his creationDocument8 pagesShaw's play about a sculptor and his creationEmanuel BurculetNo ratings yet

- Island Arc: LocationDocument7 pagesIsland Arc: LocationBlessing NgonidzasheNo ratings yet

- C++ Classes and ObjectsDocument4 pagesC++ Classes and ObjectsAll TvwnzNo ratings yet

- University Library Management SystemDocument10 pagesUniversity Library Management Systemkochi jerryNo ratings yet

- Questions Answers: Legarda vs. Saleeby: The Real Purpose of The Torrens System Is To Quiet Title To Land To Put A StopDocument19 pagesQuestions Answers: Legarda vs. Saleeby: The Real Purpose of The Torrens System Is To Quiet Title To Land To Put A StopNico RoaNo ratings yet

- Laptops and Desktop-MAY PRICE 2011Document8 pagesLaptops and Desktop-MAY PRICE 2011Innocent StrangerNo ratings yet

- Types of Air Conditioning UnitsDocument10 pagesTypes of Air Conditioning Unitssnowgalvez44No ratings yet

- Circuit Breaker Analyzer & Timer CAT126D: DescriptionDocument7 pagesCircuit Breaker Analyzer & Timer CAT126D: Descriptionkenlavie2No ratings yet

- Daniel Fast Recipes A Couple CooksDocument12 pagesDaniel Fast Recipes A Couple CooksmariamNo ratings yet

- Methanol from Syngas Plant DesignDocument13 pagesMethanol from Syngas Plant DesignKhalidMadaniNo ratings yet

- Electronics, Furniture, Clothing and Home Stores in KalkaDocument4 pagesElectronics, Furniture, Clothing and Home Stores in KalkaMANSA MARKETINGNo ratings yet

- Detecting Voltage Differences Between Two Points With A Phase ComparatorDocument1 pageDetecting Voltage Differences Between Two Points With A Phase ComparatorContract 42154No ratings yet

- Studies on the vertically barred Haplochromis electra from Lake MalawiDocument5 pagesStudies on the vertically barred Haplochromis electra from Lake MalawiCenk Sururi KarabulutNo ratings yet

- Quantum Computing CSDocument101 pagesQuantum Computing CSRaghavNo ratings yet

- Mic520 525 530 eDocument86 pagesMic520 525 530 eMaia Naiara BarrientosNo ratings yet

- Full Download Test Bank For Positive Psychology 4th Edition Lopez PDF Full ChapterDocument36 pagesFull Download Test Bank For Positive Psychology 4th Edition Lopez PDF Full Chaptershaps.tortillayf3th100% (21)

- 3-IBM-RB - Sales - Selling Ibm Innovative SolutionsDocument226 pages3-IBM-RB - Sales - Selling Ibm Innovative Solutionsjusak131No ratings yet

- 1 An Overview of Physical and Phase ChangeDocument5 pages1 An Overview of Physical and Phase ChangeGede KrishnaNo ratings yet

- Knowledge (2) Comprehension (3) Application (4) Analysis (5) Synthesis (6) EvaluationDocument5 pagesKnowledge (2) Comprehension (3) Application (4) Analysis (5) Synthesis (6) EvaluationxtinNo ratings yet

- EPS: Electric Power Steering Components & ModesDocument9 pagesEPS: Electric Power Steering Components & ModesTilahun Worku100% (1)

- MCM SQL PDFDocument8 pagesMCM SQL PDFJeyakumar NarasingamNo ratings yet

- Duoc Dien Duoc Lieu Dai Loan - 3rd - 2019Document639 pagesDuoc Dien Duoc Lieu Dai Loan - 3rd - 2019Hương Nguyễn100% (1)

- Corporate Crime Project FinalDocument32 pagesCorporate Crime Project Finalankita100% (1)

- Build Pulse Oximeter InstructionsDocument3 pagesBuild Pulse Oximeter InstructionsPrabhuDevNo ratings yet

- Spread footing design calculationDocument6 pagesSpread footing design calculationFrancklinMeunierM'ondoNo ratings yet

- Master of Arts (Education) /post Graduate Diploma in Educational Management and Administration (Maedu/Pgdema) Term-End Examination June, 2020Document7 pagesMaster of Arts (Education) /post Graduate Diploma in Educational Management and Administration (Maedu/Pgdema) Term-End Examination June, 2020Shreyashi Santra MitraNo ratings yet

- 1025 (1029) Anaerobic ChamberDocument8 pages1025 (1029) Anaerobic ChamberSoma GhoshNo ratings yet

- THE END - MagDocument164 pagesTHE END - MagRozze AngelNo ratings yet

- Surgical Aspects of Pulmonary Infections: Kibrom Gebreselassie, MD, FCS-ECSA Cardiovascular and Thoracic SurgeonDocument60 pagesSurgical Aspects of Pulmonary Infections: Kibrom Gebreselassie, MD, FCS-ECSA Cardiovascular and Thoracic SurgeonVincent SerNo ratings yet

- Solution:: Ex 3.3 Consider The Following Parallelograms. Find The Values of The Unknowns X, Y, ZDocument9 pagesSolution:: Ex 3.3 Consider The Following Parallelograms. Find The Values of The Unknowns X, Y, ZpadmaNo ratings yet