Professional Documents

Culture Documents

Audit of Receivables Problems and Solutions

Uploaded by

Jai BacalsoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit of Receivables Problems and Solutions

Uploaded by

Jai BacalsoCopyright:

Available Formats

Accountancy Review Center (ARC)

of the Philippines Inc.

One Dream, One Team

STUDENT HANDOUTS

AUDITING — PROBLEMS J. CAYETANO

AP 02 — Audit of Receivables May 2021 CPALE REVIEW

DISCUSSION QUESTIONS

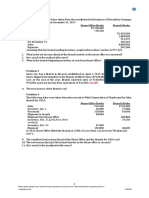

PROBLEM 1 PROBLEM 2

Presented below are unaudited balances of selected The December 31, 2020 statement of financial position of

accounts of Angelica Company as of December 31, 2021 Leon Company showed Accounts receivable balance of

P500,000 and Allowance for Bad Debts of P48,000.

Unadjusted balances,

Following is a summary of accounts receivable transactions

December 31, 2021

recorded by the company in 2021:

Selected accounts Debit Credit

Cash 500,000

Credit sales during the year P 3,120,000

Accounts receivable 1,300,000

Total accounts collected during the year 3,020,160

Allowance for bad debts 8,000

Accounts written off as uncollectible 42,000

Net sales 6,750,000

Recoveries of accounts written off in the 2,160

Additional information are as follows: previous year

• Goods amounting to P50,000 were invoiced for the

accounts of Mang Kanour Store & Company recorded on On December 31, 2021, an aging of accounts receivable

January 2, 2022 with terms of net, 60 days, FOB shipping indicated the following:

point. The goods were shipped to Mang Kanour on

December 30, 2021. % of total Probability of

Age group receivable amount collection

• The bank returned on December 29, 2021, a customer’s

Less than 60 days 60% 99%

check for P15,000 marked “No Sufficient Funds”, but no

Between 61 and 22% 88%

entry was made.

120 days

• Angelica estimates that allowance for uncollectible Between 121 and 15% 45%

accounts should be one and one-half percent on the 180 days

accounts receivable balance as of year-end. No Over 180 days 3% 20%

uncollectible accounts expense has yet been provided

for 2021. Questions: Based on the above and the result of your

audit, answer the following:

Questions: Based on the above and the result of your audit,

answer the following: 1. The adjusted gross balance of accounts receivable is?

a. 560,000 c. 570,000

1. What is the adjusted balance of Accounts Receivable on b. 562,160 d. 604,160

December 31, 2021?

a. 1,365,000 c. 1,335,000 2. The allowance for doubtful accounts as of December

b. 1,350,000 d. 1,315,000 31, 2021 is:

a. 77,484 c. 77,784

2. What is the adjusted balance of Allowance for b. 77,324 d. 77,544

Uncollectible accounts on December 31, 2021?

a. 20,475 c. 20,025 3. The doubtful account expense for the year 2021 is:

b. 20,250 d. 19,725 a. 69,324 c. 69,664

b. 69,624 d. 69,124

3. What is the adjusted amount of 2021 uncollectible

accounts expense? 4. The net realizable value of accounts receivable as of

a. 12,475 c. 28,250 December 31, 2021 is:

b. 28,025 d. 28,475 a. 480,356 c. 482,456

b. 480,516 d. 482,216

4. What is the carrying amount of the Accounts Receivable

to be presented in the statement of financial position as 5. Assuming that the over 180 days account is 100%

of December 31, 2021? uncollectible, how much is the balance of allowance for

a. 1,344,525 c. 1,365,000 uncollectible accounts at year end?

b. 1,357,000 d. 1,329,750 a. 43,244 c. 44,684

b. 64,344 d. 58,924

5. The adjusting journal entry for the check marked “No

sufficient fund” involves:

a. Debit to cash in bank P15,000

b. Debit to accounts receivable P15,000

c. Debit to sales P15,000

d. Debit to bad debt expense P15,000

0961-718-5293; 0936-407-4780; (02)-8376-0405 www.arccpalereview.com Page 1 of 4

AUDITING — PROBLEM | AP.102 —Receivables ARC – ACCOUNTANCY REVIEW CENTER

PROBLEM 3 Customer Dog The invoice for the deliveries

You are auditing the receivable of TZUYU Inc., a supplier of made on December 3, was

office and school supplies in the Northern Luzon region. Your Balance per record: erroneously posted in the

investigation revealed the following general ledger balances P255,000 subsidiary ledger at P55,000.

as of December 31, 2021 before any audit adjustments: The correct invoice amount is

Reply: “Our records P50,000.

Account receivable 1,250,000 indicate that the balance

Allowance for bad debt 38,500 is at P250,000”

The company proves for bad debt expense for interim

reporting purposes using the income statement approach. Customer Elephant Payment of Kat for an

Bad debt expense is provided as 2% of Sales for the first October 20 invoice was

three quarters. Total sales for the first three quarters, from Balance per record: posted against the subsidiary

which the interim provisions were made was at P4,500,000. P160,000 ledger of Elephant.

During the year, P56,000 of the receivables were written off, Reply: “Our records show All outstanding transaction

while P20,000 of previously written off accounts were a bigger balance” with Elephant were made in

recovered. The following aging of accounts receivable November.

schedule was provided by the company accountant:

Accounts receivable age Amount The term of sale is 5/15, n/30. Per the past experience of the

1 – 15 days current 420,000 company, 25% of current customers normally take

16 – 30 days current 240,000 advantage of cash discounts.

1 – 30 days past due 210,000

31 – 60 days past due 250,000 The following are deemed appropriate regarding accounts

More than 60 days 120,000 that are doubtful of collection:

past due

Accounts receivable age Percentage uncollectible

Of the more than 60 days past due account, P30,000 is 1 – 15 days current --

deemed uncollectible thus has to be further written off. You 16 – 30 days current 2%

sent confirmation letters to customers with significant 1 – 30 days past due 10%

balances. 31 – 60 days past due 25%

More than 60 days past 50%

The following is a summary of the confirmation replies: due

Customer’s information Audit Findings Questions: Based on above data and result of your audit,

Customer Apol The difference was due to answer the following:

merchandise return made by

Balance per record: the customer on December 1. What is the correct balance of accounts receivables

P150,000 28. The goods were received before any valuation balance?

on January 2. a. 1,200,000 c. 1,185,000

Reply: “Our records show b. 1,195,000 d. 1,180,000

a balance of P135,000” The related credit memo was

issued and recorded by then, 2. What is the correct allowance for bad debts expense as

the return was for goods of December 31, 2021?

originally delivered and

a. 122,450 c. 127,050

invoiced by the company on

b. 122,550 d. 126,050

October 12.

3. What is the correct carrying amount of accounts

Customer Boi The difference was due to an

error made by the company receivables as of December 31, 2021?

Balance per record: preparing an invoice dated a. 1,082,300 c. 1,057,550

P300,000 November 20. b. 1,087,550 d. 1,052,300

Reply: “Our records show The invoice price used was at 4. What is the correct allowance for sales discount as of

a balance at P290,000” P200/unit whereas the agreed December 31, 2021?

price should have been at a. 5,250 c. 21,000

P190/unit. b. 6,000 d. 16,750

Customer Cat The payment made by Kat for 5. What is the correct bad debts expense for 2021?

an invoice dated October 20 a. 173,950 c. 204,050

Balance per record: was posted erroneously to b. 203,950 d. 174,050

P190,000 the subsidiary ledger of

Elephant.

Reply: “Our records show

a balance at P150,000”

0961-718-5293; 0936-407-4780; (02)-8376-0405 www.arccpalereview.com Page 2 of 4

AUDITING — PROBLEM | AP.102 —Receivables ARC – ACCOUNTANCY REVIEW CENTER

PROBLEM 4 PROBLEM 5

Remix Company included the following in its notes receivable On January 1, 2021, SNSD Company sold land that originally

as of December 31, 2022: cost P400,000 to GG Company. As payment, GG gave SNSD

Company a P600,000 note. The note bears an interest rate of

Notes receivable from sale of land 880,000 4% and is to be repaid in three annual installments of

Notes receivable from consultation 1,200,000 P200,000 (plus interest on the outstanding balance). The first

Notes receivable from sale of equipment 1,600,000 payment is due on December 31, 2021.

The following transaction during 2022 and other information The market price of the land is not reliably determinable. The

relate to the company’s note receivable: prevailing rate of interest for notes of this type is 14% on

January 1, 2021 and 15% on December 31, 2021.

a. On January 1, 2022, Remix Company sold a tract of

land to Future Company. The land, purchased 10 years SNSD made the following entries in relation to the sale of land

ago, was carried on Remix’s books at P500,000. Remix and the related note receivable:

received a noninterest-bearing note for P880,000 from

Future. The note is due on December 31, 2023. There January 1, 2021

was no established exchange price for the land. The Notes receivable 600,000

Land 400,000

prevailing interest rate for this note on January 1, 2022

Gain on sale of land 200,000

was 10%.

December 31, 2021

b. On January 1, 2022, Remix Company received a 5%, Cash 224,000

P1,200,000 promissory note in exchange for the Notes receivable 200,000

consultation services rendered. The note will mature on Interest income 24,000

December 31, 2025, with interest receivable every

December 31. The fair value of the services rendered is SNSD reported the notes receivable in its statement of

financial position at December 31, 2021 as part of trade and

not readily determinable. The prevailing rate of interest

other receivables. The following are the present value factor

for a note of this type was 10% on January 1, 2022. of 14%:

c. On January 1, 2022, Remix sold an old equipment with Periods Present value of 1 Present value of annuity

a carrying amount of P1,600,000, receiving P2,400,000 1 0.8772 0.8772

note. The note bears an interest rate of 4% and is to be 2 0.7695 1.6467

repaid in three annual installments of P800,000 (plus 3 0.6750 2.3216

interest on the outstanding balance). Remix received

Questions:

the first payment on December 31, 2022. There is no

established market value for the equipment. The market 1. The correct gain on sale of land is

interest rate for similar note was 14% on January 1, a. 103,085 c. 120,061

2022. b. 94,868 d. 200,000

Questions: Round off present value factors to four decimal 2. The correct interest income for 2021 is

places and final answers to the nearest hundred: a. 74,230 c. 70,432

b. 72,809 d. 24,000

1. What is the consultation free revenue should be

recognized in 2022? 3. Profit for 2021 is overstated by

a. 1,050,800 c. 901,600 a. 50,483 c. 54,902

b. 1,095,800 d. 1,200,000 b. 31,130 d. 0

2. What should be reported as gain on sale of equipment? 4. The correct carrying amount of the notes receivable at

a. 331,600 c. 412,400 December 31, 2021 is

b. 257,280 d. 800,000 a. 400,000 c. 368,870

b. 345,098 d. 349,517

3. The amount to be reported as noncurrent notes

receivable on December 31 2022 is 5. SNSD’s working capital at December 31, 2021 is

a. 2,605,706 c. 2,494,000 overstated by

b. 1,825,800 d. 2,625,700 a. 235,750 c. 182,476

b. 232,932 d. 0

4. The amount to be reported as current notes receivable

on December 31 2022 is

a. 1,600,000 c. 1,467,200

b. 1,680,000 d. 800,000

5. How much interest income should be recognized in

2022?

a. 464,000 c. 459,500

b. 435,800 d. 156,000

0961-718-5293; 0936-407-4780; (02)-8376-0405 www.arccpalereview.com Page 3 of 4

AUDITING — PROBLEM | AP.102 —Receivables ARC – ACCOUNTANCY REVIEW CENTER

PROBLEM 6 1. What amount of loss on factoring should Soksoksok

Soksoksok Company engaged in the following transactions report for 2019?

with regards to financing of receivables during 2021: a. 400,000 c. 750,000

b. 550,000 d. 600,000

Factoring:

During 2021, Soksoksok Company sold accounts receivable 2. Assuming none of the accounts factored were collected,

with recourse with a face amount of P4,000,000. The factor the loss on factoring of Soksoksok is

charged a service fee of 10% of the accounts factored and a. 400,000 c. 750,000

withheld 5% of the accounts factored as protection against b. 550,000 d. 600,000

customer returns and other adjustments.

3. What is the net proceeds from factoring of accounts

The fair value of the recourse obligation is determined to be receivable?

P150,000. All of the accounts were fully collected by the a. 3,800,000 c. 3,850,000

factor. b. 3,650,000 d. 3,400,000

Discounting: 4. What is the amount of proceeds from discounting the

On June 30, 2021, Soksoksok also discounted a customer’s

note on June 30, 2019?

note with recourse at a bank at a 10% discount rate. The note

is dated May 1, 2021, has a term of 90 days, a face value of a. 6,083,875 c. 6,000,000

P6,000,000 and an interest rate of 9%. Soksoksok Company b. 6,135,000 d. 6,103,875

accounted this transaction as a secured borrowing. The

customer paid the note to the bank on maturity date. 5. What amount should be recognized as interest expense

related to the note discounting?

Questions: a. 51,125 c. 6,125

b. 13,875 d. 0

0961-718-5293; 0936-407-4780; (02)-8376-0405 www.arccpalereview.com Page 4 of 4

You might also like

- AT Preweek (B44)Document7 pagesAT Preweek (B44)Haydy AntonioNo ratings yet

- AT-06 (FS Audit Processs - Pre-Engagement)Document2 pagesAT-06 (FS Audit Processs - Pre-Engagement)Bernadette PanicanNo ratings yet

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoNo ratings yet

- Responsibility Accounting Concepts and CalculationsDocument5 pagesResponsibility Accounting Concepts and CalculationsRenNo ratings yet

- Chapter 05 - Audit Evidence and DocumentationDocument44 pagesChapter 05 - Audit Evidence and DocumentationALLIA LOPEZNo ratings yet

- SW - Code of EthicsDocument1 pageSW - Code of EthicsJudy Ann ImusNo ratings yet

- Aud2 CashDocument6 pagesAud2 CashMaryJoyBernalesNo ratings yet

- Quiz 3 - Business Combination and Consolidated Financial StatementsDocument3 pagesQuiz 3 - Business Combination and Consolidated Financial StatementsMaria LopezNo ratings yet

- Far Eastern University Audit of Cash Auditing C.T.EspenillaDocument13 pagesFar Eastern University Audit of Cash Auditing C.T.EspenillaUn knownNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- ACCY 303 Midterm Exam ReviewDocument12 pagesACCY 303 Midterm Exam ReviewCORNADO, MERIJOY G.No ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- Audit of ReceivablesDocument20 pagesAudit of ReceivablesDethzaida AsebuqueNo ratings yet

- The Professional CPA Review School - Auditing Problems First Preboard ExamDocument18 pagesThe Professional CPA Review School - Auditing Problems First Preboard ExamRodmae VersonNo ratings yet

- Calculate Estate Tax for Married Filipino DecedentDocument14 pagesCalculate Estate Tax for Married Filipino DecedentLea ChermarnNo ratings yet

- Business Combinations ExplainedDocument8 pagesBusiness Combinations ExplainedLabLab ChattoNo ratings yet

- Not For Profit Organization and Government Accounting HandoutDocument6 pagesNot For Profit Organization and Government Accounting HandoutNicoleNo ratings yet

- CL Cup 2018 (AUD, TAX, RFBT)Document4 pagesCL Cup 2018 (AUD, TAX, RFBT)sophiaNo ratings yet

- Direct quotes measure foreign currency exchangeDocument10 pagesDirect quotes measure foreign currency exchangeA PNo ratings yet

- Perez Long Quiz Auditing and Assurance Concepts and ApplicationDocument7 pagesPerez Long Quiz Auditing and Assurance Concepts and ApplicationMitch MinglanaNo ratings yet

- AFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedDocument5 pagesAFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedSophia PerezNo ratings yet

- Far - Pre BoardDocument17 pagesFar - Pre BoardClene DoconteNo ratings yet

- LiabilitiesDocument3 pagesLiabilitiesFrederick AbellaNo ratings yet

- Planning an Audit of Financial StatementsDocument10 pagesPlanning an Audit of Financial StatementsTrixie Pearl TompongNo ratings yet

- ICARE - MAS - PreWeek - Batch 4Document18 pagesICARE - MAS - PreWeek - Batch 4john paulNo ratings yet

- Answer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBDocument8 pagesAnswer: Cost Flow Equation: BB + TI TO + EB Computer Chips: $600,000 + $1,600,000 $1,800,000 + EBkmarisseeNo ratings yet

- Advanced Financial Accounting TopicsDocument16 pagesAdvanced Financial Accounting TopicsNhel AlvaroNo ratings yet

- Nfjpia Nmbe Taxation 2017 AnsDocument10 pagesNfjpia Nmbe Taxation 2017 AnsjaysonNo ratings yet

- PFRS 3 - Business Combination PDFDocument2 pagesPFRS 3 - Business Combination PDFMaria LopezNo ratings yet

- Acquire To Retire Discussion DocumentDocument11 pagesAcquire To Retire Discussion DocumentShrasti VarshneyNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- Chapter 6 Quiz KeyDocument3 pagesChapter 6 Quiz Keymar8357No ratings yet

- Session 3 AUDITING AND ASSURANCE PRINCIPLESDocument29 pagesSession 3 AUDITING AND ASSURANCE PRINCIPLESagent2100No ratings yet

- PDF Cebu Cpar Audit of Inventory DLDocument32 pagesPDF Cebu Cpar Audit of Inventory DLJune KooNo ratings yet

- Multiple Choice Questions: Finance and Investment CycleDocument19 pagesMultiple Choice Questions: Finance and Investment Cyclemacmac29No ratings yet

- Midterm Exam Part 2 Short ProblemsDocument5 pagesMidterm Exam Part 2 Short Problemsdagohoy kennethNo ratings yet

- Auditing Problems Test Banks - PPE Part 2Document5 pagesAuditing Problems Test Banks - PPE Part 2Alliah Mae ArbastoNo ratings yet

- Successor Auditor ResponsibilitiesDocument5 pagesSuccessor Auditor ResponsibilitiesVergel MartinezNo ratings yet

- Audit of Liabilities Exercise 1: SolutionDocument14 pagesAudit of Liabilities Exercise 1: SolutionCharis Marie UrgelNo ratings yet

- Specialized Industries Final ExamDocument8 pagesSpecialized Industries Final Examlois martinNo ratings yet

- Auditing Theories and Problems Quiz WEEK 2Document16 pagesAuditing Theories and Problems Quiz WEEK 2Van MateoNo ratings yet

- AC 3101 Discussion ProblemDocument1 pageAC 3101 Discussion ProblemYohann Leonard HuanNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- ReSA B44 MS First PB Exam Questions Answers - SolutionsDocument13 pagesReSA B44 MS First PB Exam Questions Answers - SolutionsWesNo ratings yet

- Final Exam-Auditing Theory 2015Document16 pagesFinal Exam-Auditing Theory 2015Red YuNo ratings yet

- 1 Afar - Preweek Summary 1 RehDocument16 pages1 Afar - Preweek Summary 1 RehCarlo AgravanteNo ratings yet

- Chapter 16 AnsDocument7 pagesChapter 16 AnsDave Manalo100% (5)

- CHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- Compre 3Document7 pagesCompre 3casio3627No ratings yet

- Theory of Accounts - ReviewerDocument24 pagesTheory of Accounts - ReviewerKristel OcampoNo ratings yet

- Correction of ErrorsDocument5 pagesCorrection of ErrorsJohn Carlo DelorinoNo ratings yet

- Chapter 28 AnsDocument9 pagesChapter 28 AnsDave ManaloNo ratings yet

- Activity Task Business CombinationDocument7 pagesActivity Task Business CombinationCasper John Nanas MuñozNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- ICARE-Preweek-AFAR-Part 1Document6 pagesICARE-Preweek-AFAR-Part 1john paul100% (1)

- Problem 7-1: True or False False: Fact PatternDocument6 pagesProblem 7-1: True or False False: Fact Patternrichmond naragNo ratings yet

- Chapter 10: Cash and Financial InvestmentsDocument13 pagesChapter 10: Cash and Financial Investmentsdes arellanoNo ratings yet

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDocument12 pagesACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNo ratings yet

- Audit Ar With SolutionsDocument14 pagesAudit Ar With Solutionsbobo kaNo ratings yet

- Pup Auditofreceivable1 Bsa4 2Document6 pagesPup Auditofreceivable1 Bsa4 2Makoy BixenmanNo ratings yet

- AT 210 Handout Responding To Assessed Risks 2Document10 pagesAT 210 Handout Responding To Assessed Risks 2Jai BacalsoNo ratings yet

- AT 211 Handout Determining The Extent of TestingDocument13 pagesAT 211 Handout Determining The Extent of TestingJai BacalsoNo ratings yet

- FAR 215 Inventory EstimationDocument8 pagesFAR 215 Inventory EstimationJai BacalsoNo ratings yet

- AT 209 Handout Identifying and Assessing Risks of Material Misstatement (ROMM)Document7 pagesAT 209 Handout Identifying and Assessing Risks of Material Misstatement (ROMM)Jai BacalsoNo ratings yet

- Civil Service Exam ReviewerDocument53 pagesCivil Service Exam ReviewerJai BacalsoNo ratings yet

- Sales Reviewer PDFDocument25 pagesSales Reviewer PDFShaireen Prisco Rojas100% (2)

- Auditing Problem Test Bank 1Document14 pagesAuditing Problem Test Bank 1EARL JOHN Rosales100% (5)

- Civil Service Mock Exam 1Document40 pagesCivil Service Mock Exam 1Leih Anne Quezon AnonuevoNo ratings yet

- Cs Exam Reviewer Day2.PptmDocument150 pagesCs Exam Reviewer Day2.PptmJai Bacalso100% (1)

- Civil Service Exam Complete Reviewer Philippines 2017Document46 pagesCivil Service Exam Complete Reviewer Philippines 2017JJ Torres84% (434)

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- CPALE Syllabi 2018 PDFDocument32 pagesCPALE Syllabi 2018 PDFLorraine TomasNo ratings yet

- Final Exam FarDocument7 pagesFinal Exam FarReyna Joy SebialNo ratings yet

- Report On A Digital Euro: October 2020Document55 pagesReport On A Digital Euro: October 2020jan2No ratings yet

- Risk Management in BanksDocument29 pagesRisk Management in BanksKovida GunawardanaNo ratings yet

- Multiple ChoiceDocument2 pagesMultiple ChoiceCarlo ParasNo ratings yet

- Applied Economics ModuleDocument63 pagesApplied Economics ModuleAngelo Rey NavaNo ratings yet

- Introduction Session2Document12 pagesIntroduction Session2Swati PathakNo ratings yet

- KSA Part A - Draft 1.2 With AppendicesDocument233 pagesKSA Part A - Draft 1.2 With Appendicesahmadgce04No ratings yet

- Uae CompaniesDocument801 pagesUae CompaniesgilbyNo ratings yet

- Role of Bajaj Finance in consumer durable salesDocument71 pagesRole of Bajaj Finance in consumer durable salesRajdip MandalNo ratings yet

- Chap 2 Cost of Capital MainDocument33 pagesChap 2 Cost of Capital Maintemesgen yohannesNo ratings yet

- National income and aggregate demand concepts explainedDocument22 pagesNational income and aggregate demand concepts explainedHarsh Kumar SainiNo ratings yet

- Revenue Recognition - Long-Term Construction Contracts (Part 2)Document6 pagesRevenue Recognition - Long-Term Construction Contracts (Part 2)CaliNo ratings yet

- GenMath LAS Q2W2 M11GM-IIa-b-1Document8 pagesGenMath LAS Q2W2 M11GM-IIa-b-1Celine Mary Damian100% (2)

- How to Start Trading Crypto Signals in 7 StepsDocument8 pagesHow to Start Trading Crypto Signals in 7 Stepsaditya suranaNo ratings yet

- Practice Exercise - 3: HO: 95B, 2 Floor, Siddamsetty Complex, Secunderabad - 500 003Document5 pagesPractice Exercise - 3: HO: 95B, 2 Floor, Siddamsetty Complex, Secunderabad - 500 003Charlie GoyalNo ratings yet

- Napier - Identifying Market Inflection Points CFADocument9 pagesNapier - Identifying Market Inflection Points CFAAndyNo ratings yet

- Greenlam 2021 DP CompressedDocument143 pagesGreenlam 2021 DP CompressedTanu GuptaNo ratings yet

- Land Development ProcessDocument4 pagesLand Development ProcessNick AguavivaNo ratings yet

- K. J. Somaiya Juniour College of Arts and Commerce: S.Y.J.CDocument10 pagesK. J. Somaiya Juniour College of Arts and Commerce: S.Y.J.CSWAPNIL JADHAVNo ratings yet

- Name: Maria Guadalupe Papacetzi Andrade Number: Course: ProfessorDocument3 pagesName: Maria Guadalupe Papacetzi Andrade Number: Course: Professorlupita andradeNo ratings yet

- CSPA, BPI Report On Boston Property Tax DeclineDocument11 pagesCSPA, BPI Report On Boston Property Tax DeclineBoston 25 DeskNo ratings yet

- Chhattisgarh: Economic and Human Development IndicatorsDocument2 pagesChhattisgarh: Economic and Human Development IndicatorsAnup RahangdaleNo ratings yet

- Illustration Cash and Cash EquivalentsDocument2 pagesIllustration Cash and Cash EquivalentsRiyhu DelamercedNo ratings yet

- Sri Lanka Concludes Initial Restricted Discussions With Ad Hoc Group of BondholdersDocument19 pagesSri Lanka Concludes Initial Restricted Discussions With Ad Hoc Group of BondholdersAdaderana OnlineNo ratings yet

- Overview of Brazilian Standardization for StructuresDocument50 pagesOverview of Brazilian Standardization for StructuresaantceNo ratings yet

- Overtime Records for Construction DepartmentDocument10 pagesOvertime Records for Construction DepartmentAbdulrahman MagondacanNo ratings yet

- EU Commission raises no objections to State aid casesDocument16 pagesEU Commission raises no objections to State aid casesjaimeNo ratings yet

- IDPR Corruption and SMEs Participation in The Oil and Gas IndustryDocument22 pagesIDPR Corruption and SMEs Participation in The Oil and Gas IndustryLewis BlagogieNo ratings yet

- Business Studies - Business Studies Form 3 - Question PaperDocument10 pagesBusiness Studies - Business Studies Form 3 - Question PapershiklemeNo ratings yet

- 2 Why Do Nation TradeDocument4 pages2 Why Do Nation TradeAfrina JannatNo ratings yet