Professional Documents

Culture Documents

92 Mas First Preboard Examination Solution

Uploaded by

john paulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

92 Mas First Preboard Examination Solution

Uploaded by

john paulCopyright:

Available Formats

lOMoARcPSD|2538575

92 MAS First Preboard Examination - Solution

Advanced Financial Accounting and Reporting (University of San Carlos)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by John Paul Arroza (johnpaul.arroza@gmail.com)

lOMoARcPSD|2538575

CPA REVIEW SCHOOL OF THE PHILIPPINES

Manila

MANAGEMENT ADVISORY SERVICES

First Pre-board Examination Solutions

1. C

2. D

3. D

4. B [(FC+VC) / 80% / Units]; [(120K+80K)/80%]/20K units SP = P12.50

5. A Y = [(3,125 x 3) + (0.65 x 3,600); y = 11,715

6. C

7. B

8. B

9. A

BEP=FC*/UCM ** (150k/6) = 25k units

*FC is squeezed from ABEV format (3 per unit x production of 50k units) = 150k

AC net income P120,000

FC in beg. Inventory 0

FC in end. Inventory (10k units x 3) 30,000

VC net income P90,000

**UCM is squeezed from CVP Format Income Statement (NI+FC/units sales) (150+90k)/40k units = 6 per unit

10. D

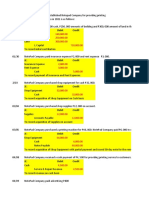

11. B

NORMAL TOP-OF-THE-LINE

Direct material 50,000 60,000

Direct labor (40k x 3) 120,000 30,000 (10k x 3)

Overhead (800k/50k x 40k) 640,000 160,000 (800k/50k x 10k)

Total cost 810,000 250,000

Units produced 10,000 units 5,000 units

Unit cost P81.00 P50.00

Markup 140% 140%

Selling price P113.40 P70.00

12. B

NORMAL TOP-OF-THE-LINE

Direct material 50,000 60,000

Direct labor (40k x 3) 120,000 30,000 (10k x 3)

Overhead:

Quality control (300k/500 x 100) 60,000 240,000 (300k/500 x 400)

Machine set-ups (400k/200 x 80) 160,000 240,000 (400k/200 x 120)

Others (100k/50k x 40k) 80,000 20,000 (100k/50k x 10k)

Total cost 470,000 590,000

Units produced 10,000 units 5,000 units

Unit cost P47.00 P118.00

Mark-up 140% 140%

Selling price P65.80 P165.20

13. A

14. A FC / WAUCM (30K X 12)/30 = 12,000

15. D (FC/FC RATE)/WASP x 25%; (360k/50%-10%)/60 = 15,000 units x 25% = 3,750 units

16. A

17. A

January February March

B.I 56,000 42,000 50,400

PURCHASES (SQUEEZE) 126,000 113,400 137,200

COST OF SALES 140,000 105,000 126,000

E.I (40% M1) 42,000 50,400 61,600

1|Page

Downloaded by John Paul Arroza (johnpaul.arroza@gmail.com)

lOMoARcPSD|2538575

18. B

January February March

Credit Sales 200,000 150,000 180,000

40% M0 80,000 60,000 72,000

50% M1 - 100,000 75,000

Collections 80,000 160,000 147,000

19. D

20. C

21. B

22. B

23. C

(90,000* lbs. / 2) = 45,000 units

*(30,000/3**) + 80,000

**(6 per unit/ 2 lbs.)

24. B

25. B

SALES (3.2K units x P50) P160,000

COST OF SALES (3.2K x P(22+8)) (96,000)

GROSS PROFIT 64,000

OPERATING EXPENSES:

VARIABLE OPEX (3.2K x P4.5) (14,400)

FIXED OPEX (10,000)

NET INCOME BEFORE VARIANCES 39,600

VOLUME VARIANCE (40K – (8K units x P8)) (8,000)

NET INCOME P31,600

26. D

SALES (3.2K unit x P50) P160,000

VARIABLE COSTS (3.2K x P26.5) (84,800)

CONTRIBUTION MARGIN 75,200

FIXED COSTS (40K + 10K) (50,000)

NET INCOME P25,200

27. A

FIXED COST RATIO: (WACMR – OI RATIO) (50% - 10%) = 40%

TOTAL REQUIRED SALES = (600,000 / 40%) = 1,500,000

TOTAL REQUIRED UNITS = (REQUIRED SALES / WASP) (1,500,000/21.6) = 69,444 units

REQUIRED UNITS: DELUXE (69,445 units x 40%) = 27,778 units;

SUPREME (69,444 units x 60%) 41,667 units

28. A

BEP (units) = (FC/WAUCM) (600,000/10.8) = 55,556 units

BEP (units) [PESOS] DELUXE (55,556 units x 40%) = 22,222 units [P266,667];

SUPREME (55,556 units x 60%) = 33,333 units [P933,333]

29. A

January February March

B.I 45,000 37,800 50,400

PURCHASES (SQUEEZE) 62,800 75,600 67,200

COST OF SALES (70%) (70,000) (63,000) (84,000)

E.I (60% M1) 37,800 50,400 33,600

2|Page

Downloaded by John Paul Arroza (johnpaul.arroza@gmail.com)

lOMoARcPSD|2538575

30. A

CASH BUDGET

CASH RECEIPTS:

January February March

CREDIT SALES P100,000 P90,000 P120,000

40% M0 40,000 36,000 48,000

60% M1 40,000 60,000 54,000

CASH RECEIPTS 80,000 96,000 102,000

CASH DISBURSEMENTS:

January February March

CREDIT PURCHASES 62,800 75,600 67,200

55% M0 34,540 41,580 36,960

45% M1 40,000 28,260 34,020

DISBURSEMENT ON PURCH. 74,540 69,840 70,980

TOTAL FC (100% M0) 7,000 7,000 7,000

TOTAL DISBURSEMENTS 81,540 76,840 77,980

NET MOVEMENT IN CASH (1,540) 19,160 24,020

(BEG. BAL 35,000 33,460 52,620

END. BAL 33,460 52,620 76,640

CASH 76,640

ACCOUNTS RECEIVABLE (120,000 X 60%) 72,000

INVENTORY 33,600

PLANT, NET (50,000 – (3,000 X 3)) 41,000

TOTAL ASSETS 223,240

31. B

32. B

33. C

34. C

Vc/unit: [(10,000 – 8,000) ÷ (4,000 – 2,000)] = 1.00

Total QUARTERLY fixed costs = P6,000

Total MONTHLY fixed costs (6,000 ÷ 3) = P2,000

35. B Total cost: (P6,000 x 4) + (10,000 x 1.00) = P34,000

36. D

36,000 = 4a + 11,500b

106,500,000 = 11,500a + 35,250,000b

103,500,000 = 11,500a + 33,062,500b

3,000,000 = 2,187,500b

b = 1.37

a = P5,061.25

37. A CMR = Increase in fixed costs ÷ increase in BEP (P50,000 ÷ P200,000) = 25%; Thus, VCR is 75%.

38. B

Contribution margin [(P70 – 30) x 10,000 units 400,000

Fixed costs 120,000

Operating income 280,000

Tax (30%) 84,000

Net income 196,000

39. D

Contribution margin [(P70 – 30) x 15,500 units (squeeze) 620,000

Fixed costs 120,000

Operating income 500,000

Tax (30%) 150,000

Net income 350,000

40. B

41. C

42. D

3|Page

Downloaded by John Paul Arroza (johnpaul.arroza@gmail.com)

lOMoARcPSD|2538575

43. A

Absorption Variable

Sales (17,500 x P400) P7,000,000 P7,000,000

Less CGS/VC:

CGS (17,500 x P170);

VC(17,500 x P115) P2,975,000 P2,012,500

Var. S & A (17,500 x P45) - 787,500

Total CGS/VC P2,975,000 P2,800,000

GP/CM P4,025,000 P4,200,000

Less OE/Fixed Costs:

Var. S & A P 787,500 -

Fixed S & A 2,330,000 P2,330,000

Fixed manufacturing

overhead - 1,100,000

Total OE/Fixed costs P3,117,500 P3,430,000

INCOME P 907,500 P 770,000

44. B

Standard rate [(P4,500 ÷ (8,000 hrs. – 7,500 hrs.)] = P9.00 per hour

DL rate variance [(P67,000 – (8,000 x 9.00)] = P5,000 favorable

45. A

x + 0.60x = P200,000 (x is the prime cost A.K.A. the combined material and labor cost).

x = P125,000; Direct labor cost is (P125,000 – P50,000) = P75,000.

46. B [(48,363) - (28,200 gallons x 1.5875)] = 3,596 UF

47. A [(28,200 gallons x 1.5875) – (43,656)] = 1,111 UF

48. C [(32,500) – (3,250 hours x 10.33)] = 1,083 F

49. A [(3,250 hours x 10.33) – (31,000)] = 2,583 UF

50. B

[P108,500 – (17,200 hours x 6)] = P5,300 UF

*6 is the standard VOH rate and computed as P135,000 x 80% divided by the denominator activity expressed

in hours (9,000 units x 2 standard hours per unit)

51. C

52. C

53. B

54. C

55. D The activity is outside relevant range, thus the cost formula is not valid.

56. D

Absorption costing net income [(P90,000 + (5,000 units x 2)] P100,000

Fixed costs in beginning inventory -

Fixed costs in ending inventory (2,500 units x 2) (5,000)

Variable costing net income P95,000

57. A

Fixed FOH P100,000

Variable office expense (25,000 units x 4) 100,000

Fixed selling expense 40,000

Total period costs (variable costing) P240,000

58. A

Direct labor (30,000 units x 5) P150,000

Variable FOH (30,000 units x 2) 60,000

Fixed FOH 100,000

Variable office expense (25,000 units x 4) 100,000

Fixed selling expense 40,000

Total period costs (variable costing) P450,000

59. B

Fixed FOH (100,000 x 25,000 units ÷ 30,000 units) P83,333

Fixed selling expense 40,000

Total fixed cost expensed in income statement P123,333

4|Page

Downloaded by John Paul Arroza (johnpaul.arroza@gmail.com)

lOMoARcPSD|2538575

60. B [(540,000 + 150,000) ÷ 75%] ÷ 45,000 units = 20.44

61. C

62. C

Income before tax (P75,000 ÷ 60%) P125,000

Total fixed costs 250,000

Total contribution margin 375,000

Unit sales ÷ 125,000

Unit contribution margin P3.00

Target unit variable cost (P6.00 – P3.00) P3.00

63. C

Break-even point in peso sales P65,875

Break-even point in units ÷ 15,500

Selling price P4.25

Unit contribution margin (P47,275 ÷ 15,500 units) (3.05)

Variable cost per unit P1.20

64. B

Cash sales – September (P800,000 x 30%) P240,000

Collections from sales on account:

From the month of July (P600,000 x 70% x 25%) 105,000

From the month of August (P650,000 x 70% x 50%) 227,500

From the month of September (P800,000 x 70% x 20%) 112,000

Total cash receipts P684,500

65. A [P314,000 – (80,000 x P4)] = P6,000 favorable

66. B

Conversion cost efficiency variance is the combined amount of variable overhead and labor efficiency variance.

Variable overhead efficiency variance [(18,900 x P2.50) – (18,720 X P2.50)] P450 unfavorable

Labor efficiency variance [(5,900 x P6) – (3,900 units x 1.50 x P6)] P300 unfavorable

Conversion cost efficiency variance P750 unfavorable

67. D

Fixed overhead non-controllable variance pertains to volume variance

[(19,000 hours x P3) – (3,900 units x 4.8 hours per unit x P3)] = P840 unfavorable

68. C

69. B

70. A [(2 feet per unit ÷ 80%) x P3 per foot] = P7.50 per unit

- END -

5|Page

Downloaded by John Paul Arroza (johnpaul.arroza@gmail.com)

You might also like

- 6966 - Biological AssetDocument2 pages6966 - Biological Assetjohn paulNo ratings yet

- CPAR Sale or Exchange of Property (Batch 89) HandoutDocument7 pagesCPAR Sale or Exchange of Property (Batch 89) Handoutjohn paulNo ratings yet

- 91-Aud First Pb-AudDocument12 pages91-Aud First Pb-Audjohn paulNo ratings yet

- AFAR PROBLEMS QUIZZER With AnswersDocument26 pagesAFAR PROBLEMS QUIZZER With Answersjohn paulNo ratings yet

- Afar Quizzer On Consolidation (Ifrs 10)Document9 pagesAfar Quizzer On Consolidation (Ifrs 10)john paul100% (1)

- 6959 - PAS 1 - Presentation of Financial StatementsDocument7 pages6959 - PAS 1 - Presentation of Financial Statementsjohn paulNo ratings yet

- 6951 Accounting ProcessDocument4 pages6951 Accounting Processjohn paulNo ratings yet

- CPAR Intro To Income Tax and Tax On Individuals Batch 91 HandoutDocument33 pagesCPAR Intro To Income Tax and Tax On Individuals Batch 91 Handoutjohn paulNo ratings yet

- Ap 9101 2 SheDocument5 pagesAp 9101 2 Shejohn paulNo ratings yet

- 91 02 Individual TaxDocument10 pages91 02 Individual Taxjohn paulNo ratings yet

- ICARE Preweek RFBT Preweek 3Document14 pagesICARE Preweek RFBT Preweek 3john paulNo ratings yet

- ICARE Preweek FAR by Sir RainDocument13 pagesICARE Preweek FAR by Sir Rainjohn paulNo ratings yet

- ICARE Preweek RFBT Preweek 4Document14 pagesICARE Preweek RFBT Preweek 4john paulNo ratings yet

- ICARE Preweek RFBT Preweek 2Document12 pagesICARE Preweek RFBT Preweek 2john paulNo ratings yet

- ICARE Preweek AT Preweek LectureDocument15 pagesICARE Preweek AT Preweek Lecturejohn paulNo ratings yet

- ICARE Preweek TaxationDocument17 pagesICARE Preweek Taxationjohn paulNo ratings yet

- CH 06 Intercompany Transfers of Services and Noncurrent AssetsDocument41 pagesCH 06 Intercompany Transfers of Services and Noncurrent Assetsjohn paulNo ratings yet

- ICARE Preweek APDocument15 pagesICARE Preweek APjohn paulNo ratings yet

- ICARE Preweek RFBT Preweek 1Document12 pagesICARE Preweek RFBT Preweek 1john paulNo ratings yet

- ICARE - TAX - PreWeek - Batch 4Document17 pagesICARE - TAX - PreWeek - Batch 4john paulNo ratings yet

- ICARE-Preweek-FAR - TOA (SME and SE)Document4 pagesICARE-Preweek-FAR - TOA (SME and SE)john paulNo ratings yet

- ICARE Preweek MASDocument16 pagesICARE Preweek MASjohn paulNo ratings yet

- ICARE - MAS - PreWeek - Batch 4Document18 pagesICARE - MAS - PreWeek - Batch 4john paulNo ratings yet

- ICARE-Preweek-AFAR-Part 1Document6 pagesICARE-Preweek-AFAR-Part 1john paul100% (1)

- ICARE - AFAR - PreWeek - Batch 4Document14 pagesICARE - AFAR - PreWeek - Batch 4john paulNo ratings yet

- ICARE - AT - PreWeek - Batch 4Document19 pagesICARE - AT - PreWeek - Batch 4john paulNo ratings yet

- ICARE RFBT Preweek (2) - Batch4Document15 pagesICARE RFBT Preweek (2) - Batch4john paulNo ratings yet

- ICARE - FAR - PreWeek - Batch 4Document15 pagesICARE - FAR - PreWeek - Batch 4john paulNo ratings yet

- ICARE RFBT Preweek (4) - Batch4Document21 pagesICARE RFBT Preweek (4) - Batch4john paul100% (3)

- Icpa - Ia1Document26 pagesIcpa - Ia1john paulNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Iffi - 20190410152 - Analysis of RasioDocument2 pagesIffi - 20190410152 - Analysis of RasioNabilaNo ratings yet

- Assignment 7Document10 pagesAssignment 7Jerickho JNo ratings yet

- Accounting For Long Term Construction PRDocument12 pagesAccounting For Long Term Construction PRShigure KousakaNo ratings yet

- 5110u1-Financial TRDocument4 pages5110u1-Financial TRapi-372394631No ratings yet

- Project Financial Appraisal - NumericalsDocument5 pagesProject Financial Appraisal - NumericalsAbhishek KarekarNo ratings yet

- F7 June 2013 BPP Answers - LowresDocument16 pagesF7 June 2013 BPP Answers - Lowreskumassa kenya100% (1)

- Case StudyDocument12 pagesCase StudyJerome MogaNo ratings yet

- 11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Document9 pages11 Accountancy Notes Ch08 Financial Statements of Sole Proprietorship 02Anonymous NSNpGa3T93100% (1)

- Utopia Corporation Law Reviewer 2008Document171 pagesUtopia Corporation Law Reviewer 2008Tristan Lindsey Kaamiño AresNo ratings yet

- Bourse Takes A Breather: KUALA LUMPUR: Share Prices OnDocument6 pagesBourse Takes A Breather: KUALA LUMPUR: Share Prices OnJason GooiNo ratings yet

- Tecnic Group Berhad ("Company") Memorandum of UnderstandingDocument4 pagesTecnic Group Berhad ("Company") Memorandum of UnderstandingShafia LatiNo ratings yet

- NJHZ Ilkhdhw NTSPF Fs Epiyak Elhj JK : Conducted by Field Work Centre, ThondaimanaruDocument12 pagesNJHZ Ilkhdhw NTSPF Fs Epiyak Elhj JK : Conducted by Field Work Centre, ThondaimanaruSharomyNo ratings yet

- GameDev Friendly Investors List From ACHIEVERS HUBDocument7 pagesGameDev Friendly Investors List From ACHIEVERS HUBSarahNo ratings yet

- BUSFIN FinancialRatios PDFDocument6 pagesBUSFIN FinancialRatios PDFTermin CheeseNo ratings yet

- Ramco Cements LimitedDocument20 pagesRamco Cements Limitedshubham loyaNo ratings yet

- Companies Rules Volume VDocument699 pagesCompanies Rules Volume VPlatonicNo ratings yet

- Financial Management FormulaeDocument15 pagesFinancial Management FormulaeAsAd MehƏiNo ratings yet

- Disadvantage and Advantage of PartnershipDocument9 pagesDisadvantage and Advantage of PartnershipErick MeguisoNo ratings yet

- Comprehensive Problem-Analysis of TransactionDocument43 pagesComprehensive Problem-Analysis of TransactionJoanna DandasanNo ratings yet

- Week 03 - Accounts ReceivablesDocument4 pagesWeek 03 - Accounts ReceivablesPj ManezNo ratings yet

- UntitledDocument69 pagesUntitledJonathan OngNo ratings yet

- Financial Budget: Reporter: Katherine MiclatDocument57 pagesFinancial Budget: Reporter: Katherine MiclatMavis LunaNo ratings yet

- Chapter 14: Financial Ratios and Firm PerformanceDocument43 pagesChapter 14: Financial Ratios and Firm Performancebano0otaNo ratings yet

- Itc Limited Technical AnalysisDocument27 pagesItc Limited Technical AnalysisrajdeeplahaNo ratings yet

- Business Math 205 Case Study Angeli Razada, Mia Zhao, John Michael Reyes, Ardel Dela CruzDocument13 pagesBusiness Math 205 Case Study Angeli Razada, Mia Zhao, John Michael Reyes, Ardel Dela Cruzsum pradhanNo ratings yet

- Corporate Finance ProjectDocument13 pagesCorporate Finance ProjectShailesh KumarNo ratings yet

- Test Bank Financial Accounting 6E by Libby Chapter 13Document50 pagesTest Bank Financial Accounting 6E by Libby Chapter 13Ronald James Siruno MonisNo ratings yet

- Fundamental Analysis of Banking SectorDocument17 pagesFundamental Analysis of Banking SectorSivakami SaradaNo ratings yet

- CA. Nitin Goel: CanitinDocument4 pagesCA. Nitin Goel: CanitinSri AssociatesNo ratings yet

- Solutions - Chapter 6Document28 pagesSolutions - Chapter 6Dre ThathipNo ratings yet