Professional Documents

Culture Documents

Piece Wise

Uploaded by

Anonymous qjsSkwF0 ratings0% found this document useful (0 votes)

4 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pagePiece Wise

Uploaded by

Anonymous qjsSkwFCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

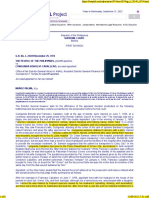

Let m= Annual Income (In NZD)

F(m) = Tax Rate ( In NZD)

0.105( m) ; 0< m≤ 14,000

1,470+0,175(m−14,000) ; 14,000<m ≤ 48,000

7,420+0.30( m−48,000) ; 48,000< m≤ 70,000

f (m) =

14,020+0.33(m−70,000) ; 70,000<m ≤180,000

50,320+0.39( m−180,000) ; m>180,000

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- HasegawaDocument6 pagesHasegawaAnonymous qjsSkwFNo ratings yet

- CHOICEOFLAWDocument36 pagesCHOICEOFLAWAnonymous qjsSkwFNo ratings yet

- 51 People vs. RiveraDocument2 pages51 People vs. RiveraAnonymous qjsSkwFNo ratings yet

- Bir Process On Tax AssessmentDocument8 pagesBir Process On Tax AssessmentAnonymous qjsSkwF50% (2)

- 35 People vs. UribeDocument7 pages35 People vs. UribeAnonymous qjsSkwFNo ratings yet

- 52 People vs. Boholst-CaballeroDocument8 pages52 People vs. Boholst-CaballeroAnonymous qjsSkwFNo ratings yet

- (PDF) Nego Law-Reviewer-Aquino and Agbayani - Compress PDFDocument74 pages(PDF) Nego Law-Reviewer-Aquino and Agbayani - Compress PDFAnonymous qjsSkwF100% (1)

- Quilala V Alcantara PDFDocument1 pageQuilala V Alcantara PDFAnonymous qjsSkwFNo ratings yet

- Bayugan Agusan Del Sur: City/Municipality: Province Of: Region XIIIDocument15 pagesBayugan Agusan Del Sur: City/Municipality: Province Of: Region XIIIAnonymous qjsSkwFNo ratings yet

- E Outline-20180625220426Document20 pagesE Outline-20180625220426Anonymous qjsSkwFNo ratings yet

- QM R13 01 PDFDocument2 pagesQM R13 01 PDFAnonymous qjsSkwFNo ratings yet

- Calibration Activity For Qms Secretariat and Document ControllerDocument64 pagesCalibration Activity For Qms Secretariat and Document ControllerAnonymous qjsSkwFNo ratings yet

- TranspoDocument4 pagesTranspoAnonymous qjsSkwFNo ratings yet

- Castro Vs MonDocument3 pagesCastro Vs MonAnonymous qjsSkwFNo ratings yet

- Land Bank of The Philippines V PerezDocument1 pageLand Bank of The Philippines V PerezAnonymous qjsSkwFNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)