Professional Documents

Culture Documents

Reply-Gst G S

Uploaded by

Zaheer MalikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reply-Gst G S

Uploaded by

Zaheer MalikCopyright:

Available Formats

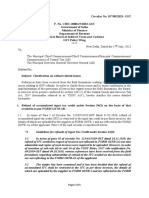

Tel 91-591-2482952 FAX: 91-591-2481320

91-591-2484176 91-591-2482594

91-591-2435849 accounts@gsexpo.net

shipping@gsexpo.net

G & S EXPORTS CORPORATION

MAJHOLA,DELHI ROAD

MORADABAD-244001

(U.P.) INDIA

GSTIN: 09AALFG9118J2ZW

Date: 06.09.2022

To,

The Deputy Commissioner,

Goods and Service Tax,

Sector-5,

Moradabad-244001

Dear Sir

Sub: Reply to show notice Number ZD090822105573E dated

30.08.2022 for rejection of refund claim (RFD 08)

It is humble submitted that the applicant had claimed the gst refund for the month

of May and June 2022 vide ARN AA090822091049X dated 19.08.2022. In this

connection the applicant has received above said notice to submit the

clarifications regarding the refund. In response of the said notice the applicant is

submitting clarification pointwise are as under:

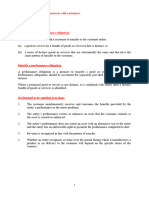

1. It is submitted that the computation of claimed of gst refund in the

statement 3A was done on the basis of prescribed formula given in the gst

law and as per section 89(4) of the CGST act 2017, which is also

mentioned in point number 1 in the said notice. To verify the calculation of

claimed gst refund copy of RFD-01 (refund application) is enclosing

herewith for your kind consideration.

2. It is submitted that input tax credit availed on goods or services or both of

the relevant period used in making such exports and its used in the course

of furtherance of business.

3. It is submitted that computation of gst refund is done as per section 54 and

has been followed the provisions of section17 (1) of the CGST Act. As the

goods and services or both are used in the course of furtherance of the

business only.

4. It is submitted that the no ITC is populating in GSTR-2A for the relevant

period under section 17 (5) of the CGST Act 2017, hence there is no in

eligible ITC for the said period as per section of 17 (5) of the CGST act

2017.

5. It is submitted that the applicant is filing its gst returns within the stipulated

period and has no kind of any tax, penalty and interest is due with the

applicant.

6. It is submitted that the goods and services are used in making such

exports and used in the course of furtherance of the business hence gst

refund claimed followed of provisions of the section 54(8) of the CGST act

2017.

7. It is submitted that the applicant has claimed gst refund amount of ITC as

per those invoices are uploaded by the supplier in theirs form GSTR-1 and

are reflecting in our form GSTR 2A/2B for the relevant period.

8. It is submitted that all the shipping bill and export general manifest are

verified with the ice gate portal regarding the exports of goods for the

relevant period.The copy of details of EGM from ice gate portal is

enclosing herewith for your kind consideration,.

The applicant requested that the reply filed by the applicant is within time cited in

the notice and not time barred hence needs to be accepted without any laches.

Further keeping the above facts and attached the annexures, the applicant

requested to kindly set aside the said notice and refund remaining the gst refund

for the tax period of May and June 2022

Thanking you

Yours truly

For G & S Export Corporation

Mohit Agarwal

Partner

You might also like

- Entertainment Law Outline Winter 2008Document129 pagesEntertainment Law Outline Winter 2008downsowf100% (1)

- Problem Areas in Legal Ethics TamondongDocument5 pagesProblem Areas in Legal Ethics TamondongSirGen EscalladoNo ratings yet

- FABM-2 LAS Quarter 3Document84 pagesFABM-2 LAS Quarter 3Rudelyn AlcantaraNo ratings yet

- Homework #2 - CourseraDocument8 pagesHomework #2 - Courserainbarexy67% (6)

- Some MCQ in NegoDocument6 pagesSome MCQ in NegoHonorio Bartholomew ChanNo ratings yet

- SMEs (Students Guide)Document11 pagesSMEs (Students Guide)Erica CaliuagNo ratings yet

- 146.lacson v. PosadasDocument3 pages146.lacson v. PosadasAnonymous AUdGvYNo ratings yet

- Drop-Servicing EbookDocument30 pagesDrop-Servicing Ebookpradeepkgj60% (5)

- Refund of IGST On Export of Goods PDFDocument7 pagesRefund of IGST On Export of Goods PDFCA Rahul ModiNo ratings yet

- Aino Communique 108th EditionDocument12 pagesAino Communique 108th EditionSwathi JainNo ratings yet

- GST Weekly Update - 36-2022-23Document5 pagesGST Weekly Update - 36-2022-232480054No ratings yet

- CompliancecalendarjanDocument24 pagesCompliancecalendarjanDsp VarmaNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Faiqa HamidNo ratings yet

- Aino Communique-109EditionDocument12 pagesAino Communique-109EditionSwathi JainNo ratings yet

- Independence Day Edition: Adv. (CA) Ranjan MehtaDocument10 pagesIndependence Day Edition: Adv. (CA) Ranjan MehtaCA Ranjan MehtaNo ratings yet

- PRADIPDocument7 pagesPRADIPGovindNo ratings yet

- Action For Difference in ITC Between 3B and 2ADocument46 pagesAction For Difference in ITC Between 3B and 2Aphani raja kumarNo ratings yet

- Payment of Tax @icmaifamilyDocument9 pagesPayment of Tax @icmaifamilypriyababu4701No ratings yet

- CBEC Press Release 29.11.2017 GST RefundDocument2 pagesCBEC Press Release 29.11.2017 GST Refundkumar45caNo ratings yet

- PO - Upkeeping Mota Dahisara 236-2018Document17 pagesPO - Upkeeping Mota Dahisara 236-2018Vivek DekavadiyaNo ratings yet

- Invoicing Under GSTDocument53 pagesInvoicing Under GSTkomal tanwaniNo ratings yet

- Highlights of Key Changes in GST W.E.F January 01, 2022Document5 pagesHighlights of Key Changes in GST W.E.F January 01, 2022sumathiravirajNo ratings yet

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- Returns: FAQ'sDocument25 pagesReturns: FAQ'smun1barejaNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Compliance Calendar NovDocument23 pagesCompliance Calendar NovDsp VarmaNo ratings yet

- Circular CGST 197Document5 pagesCircular CGST 197Jaipur-B Gr-2No ratings yet

- Director General of Anti-Profiteering, Central Board of Indirect, Taxes & Customs, Versus M - S. Nani Resorts and Floriculture Pvt. LTD., - 2022 (8) TMI 211 - NATIONAL ANTI-PROFITEERING AUTHORITYDocument7 pagesDirector General of Anti-Profiteering, Central Board of Indirect, Taxes & Customs, Versus M - S. Nani Resorts and Floriculture Pvt. LTD., - 2022 (8) TMI 211 - NATIONAL ANTI-PROFITEERING AUTHORITYSrichNo ratings yet

- RefundDocument34 pagesRefunddhruv MahajanNo ratings yet

- Circular Refund 137 7 2020Document3 pagesCircular Refund 137 7 2020Shirish JainNo ratings yet

- AAR - ITC On Capital Goods in Case of Taxable + Exepmt SupplyDocument3 pagesAAR - ITC On Capital Goods in Case of Taxable + Exepmt SupplyJigar MakwanaNo ratings yet

- My Tax Espresso Newsletter Apr2023Document18 pagesMy Tax Espresso Newsletter Apr2023Claudine TanNo ratings yet

- UntitledDocument2 pagesUntitleddtNo ratings yet

- 2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsDocument5 pages2f762 Article On Tax or GST Treatment To Be Given in Case of Cancelled FlatsvinodNo ratings yet

- Circular Refund 147-1.5 Times RefundDocument5 pagesCircular Refund 147-1.5 Times Refundbanerjeeankita13No ratings yet

- Aino Communique 100th Edition - Feb 2022 PDFDocument22 pagesAino Communique 100th Edition - Feb 2022 PDFSwathi JainNo ratings yet

- Circular CGST 193Document4 pagesCircular CGST 193Jaipur-B Gr-2No ratings yet

- GST Updates-45th Council MeetingDocument5 pagesGST Updates-45th Council Meetinghimesh amibrokerNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Composition Scheme Under GSTDocument13 pagesComposition Scheme Under GSTSejal GuptaNo ratings yet

- Skyline Pipes para WiseDocument4 pagesSkyline Pipes para WiseAjay SinghNo ratings yet

- GSTDocument11 pagesGSTvamshi9686No ratings yet

- Summary of Notifications Issued by CBIC Dated March 31 2023 PDFDocument14 pagesSummary of Notifications Issued by CBIC Dated March 31 2023 PDFclareson serraoNo ratings yet

- ST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesDocument9 pagesST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesTaruna BajajNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Analysis of 10 Important Changes in GST From 1st October 2022 - Taxguru - in PDFDocument4 pagesAnalysis of 10 Important Changes in GST From 1st October 2022 - Taxguru - in PDFPawan AswaniNo ratings yet

- Due Date Calendar Oct 22Document1 pageDue Date Calendar Oct 22Kushal DabhadkarNo ratings yet

- Circular No.60Document4 pagesCircular No.60Hr legaladviserNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- CAF I Nal GST & Customs Amendments For Dec 2021 Exams by Ca Brindavan Giri (BG S I R)Document50 pagesCAF I Nal GST & Customs Amendments For Dec 2021 Exams by Ca Brindavan Giri (BG S I R)Meet DalalNo ratings yet

- Aino Communique PDFDocument14 pagesAino Communique PDFSwathi JainNo ratings yet

- Chapter 7 Input Tax Credit Under GSTDocument28 pagesChapter 7 Input Tax Credit Under GSTDR. PREETI JINDALNo ratings yet

- GST Changes Effective From January 01, 2022Document9 pagesGST Changes Effective From January 01, 2022p.kunduNo ratings yet

- FCI - GST - Manual On Returns and PaymentsDocument30 pagesFCI - GST - Manual On Returns and PaymentsAmber ChaturvediNo ratings yet

- GST 12 To 18 EDDocument3 pagesGST 12 To 18 EDcivtect indiaNo ratings yet

- GST Automated NoticesDocument6 pagesGST Automated NoticesMaunik ParikhNo ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- Aino Communique May 2023 115th Edition PDFDocument14 pagesAino Communique May 2023 115th Edition PDFSwathi JainNo ratings yet

- Dec22 - Compliance CalendarDocument4 pagesDec22 - Compliance CalendarArman KhanNo ratings yet

- Circular No.45Document5 pagesCircular No.45Hr legaladviserNo ratings yet

- Chapter 11 GST ReturnsDocument18 pagesChapter 11 GST ReturnsDR. PREETI JINDALNo ratings yet

- In Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalDocument20 pagesIn Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalAshish AgarwalNo ratings yet

- Latest Updates in GSTDocument6 pagesLatest Updates in GSTprathNo ratings yet

- Record Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Document16 pagesRecord Notebook Faculty of Arts & Commerce Department of Cost & Management Accounting (Cma)Sha dowNo ratings yet

- GST Update124Document6 pagesGST Update124suhani singhNo ratings yet

- Notifications Gist Upto 30.09.2020Document2 pagesNotifications Gist Upto 30.09.2020NishthaNo ratings yet

- Claim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022Document3 pagesClaim of ITC As GSTR-2B Is Mandatory W.E.F. 01.01.2022ravindra kumar jainNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Thai Politics, Economy and Foreign PolicyDocument27 pagesThai Politics, Economy and Foreign PolicyHario Akhmad RifaiNo ratings yet

- Great Pacific Life Insurance Corp Vs CADocument7 pagesGreat Pacific Life Insurance Corp Vs CALeigh BarcelonaNo ratings yet

- Role Description For SubwardensDocument3 pagesRole Description For Subwardensgio477No ratings yet

- 7925-2005-Bir Ruling No. 009-05Document4 pages7925-2005-Bir Ruling No. 009-05Alexander Julio Valera100% (1)

- Docusign: Customer Success Case Study SamplerDocument7 pagesDocusign: Customer Success Case Study Samplerozge100% (1)

- ESSAY OUTLINE Can Violence Be A Solution To TerrorismDocument3 pagesESSAY OUTLINE Can Violence Be A Solution To Terrorismh1generalpaperNo ratings yet

- Physics Motion Law MCQDocument5 pagesPhysics Motion Law MCQAlok TiwaryNo ratings yet

- AFFIDAVIT (Rs. 10/-Stamp Paper Language) Attested by Notary PublicDocument1 pageAFFIDAVIT (Rs. 10/-Stamp Paper Language) Attested by Notary PublicRupali ChadhaNo ratings yet

- Partnership Final Accounts: Tar EtDocument40 pagesPartnership Final Accounts: Tar EtVenkatesh Ramchandra100% (3)

- Ghauker Khandsari Sugar Mills VDocument5 pagesGhauker Khandsari Sugar Mills VHarsh GargNo ratings yet

- Worksheet - Must or Mustn't Andres Franco y Luis SolorzanoDocument2 pagesWorksheet - Must or Mustn't Andres Franco y Luis SolorzanoCRISTIAN ANDRES RODRIGUEZ FRANCONo ratings yet

- Tutorial 10 Revenue (A)Document11 pagesTutorial 10 Revenue (A)fooyy8No ratings yet

- Law Society and Others V KordowskiDocument37 pagesLaw Society and Others V KordowskiTarik ProlazNo ratings yet

- Handout 2 - BUSINESS ETHICS AND SOCIAL RESPONSIBILITYDocument4 pagesHandout 2 - BUSINESS ETHICS AND SOCIAL RESPONSIBILITYLaila Mae PiloneoNo ratings yet

- Application For Order To Administer Property (Form-Pppr-6)Document6 pagesApplication For Order To Administer Property (Form-Pppr-6)Benne JamesNo ratings yet

- Joint Affidavit of ArrestDocument2 pagesJoint Affidavit of ArrestFang HaoNo ratings yet

- The Abington Journal 07-25-2012Document24 pagesThe Abington Journal 07-25-2012The Times LeaderNo ratings yet

- Price LIst QSPUsa Apr11 LowResDocument70 pagesPrice LIst QSPUsa Apr11 LowRescalligariscollectionNo ratings yet

- F-A-M-, AXXX XXX 992 (BIA Jan. 26, 2017)Document4 pagesF-A-M-, AXXX XXX 992 (BIA Jan. 26, 2017)Immigrant & Refugee Appellate Center, LLC100% (1)

- Registration ReportDocument1 pageRegistration Reportsethyashis456No ratings yet

- Neo ClassicismDocument37 pagesNeo ClassicismManoj RajahulliNo ratings yet