Professional Documents

Culture Documents

PWC - Uae-Federal-Corporate-Tax-Flyer

Uploaded by

Farouk SarroubOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PWC - Uae-Federal-Corporate-Tax-Flyer

Uploaded by

Farouk SarroubCopyright:

Available Formats

UAE Federal Corporate Tax

Facts Rates

● It was announced on the 31st of January 2022 that the UAE will ● For businesses operating in mainland UAE a 9% CT rate will be

introduce a federal corporate tax (CT) applicable on income exceeding AED 375,000

● CT will be effective for financial years starting on or after ● Free zone businesses will be within the scope of UAE CT and

1 June 2023 required to register and file a CT return, but will continue to

● UAE CT will be applicable across all Emirates and will apply to all benefit from CT holidays / 0% taxation if they comply with all

business and commercial activities alike, except for the extraction of regulatory requirements and do not conduct business with

natural resources, which will continue to be subject to Emirate level mainland UAE

taxation ● A different tax rate will apply to large multinationals that meet

● UAE CT will not apply on employment income or other non-business the criteria under ‘Pillar Two’ of the OECD Base Erosion and

income earned by individuals in their personal capacity. Profit Shifting project (i.e. that have consolidated global

● The UAE CT regime will have transfer pricing (TP) rules and revenues above EUR 750m). We expect this rate to be 15%

documentation requirements in line with the OECD principles

● More details are expected to be published mid 2022

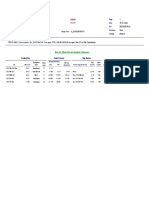

Key timings

01 02 03 04

Now to summer 2022 / 2023 2023 / 2024 2025

● High level impact assessment ● Detailed impact assessment Implementation ● Prepare and submit CT returns and TP

(including quantification) ● Identify potential restructuring opportunities ● Contract review documentation

● Internal team / taskforce ● Identify required systems changes ● Review and implement necessary TP policies

● Systems review ● Identify possible uncertain CT positions ● Implement changes to legal / operational structure

● Implementation plan ● Perform TP risk and opportunity analysis ● Implement systems changes

● Obtain clarifications / tax rulings from tax authorities

● Review tax function and tax governance framework

● Assess tax accounting considerations

Compliance

● Submit elections, applications for tax groups and exemptions

● CT registrations

Timing may depend on when the business becomes subject to CT. For most businesses this would be from 1 January 2024 onwards.

Impact on your businesses

Tax Finance Legal Investment teams Systems & processes

There is more to UAE CT than taxation - this requires close collaboration of all stakeholders, departments and disciplines involved

Organisation and governance impact How PwC can support

Next steps

High level Initial assessment of the anticipated impact

Tax Strategy 01 impact of the introduction of CT and TP based on

assessment the group structure

Governance & Risk Management Detailed Detailed analysis on the impact of UAE CT

analysis and TP on the business. Identify

02 based on restructuring and optimisation opportunities,

legislation required system changes, etc …

Implement necessary changes to legal

Post - documents, TP policies, legal structure,

03 Implementation operating model, capital structure, tax

Organisation People Process Information

function, etc.

Assist with CT registrations and application

04 Implementation for tax groups. Preparation and submission

Technology of CT returns, TP documents.

Specialist Tax programs are being developed by PwC Academy and will

be launching soon

Contact details

For more information please visit our website (Link - https://www.pwc.com/m1/en/services/tax/corporate-income-tax.html)

or email us (MER_tax_legal@pwc.com)

© 2022 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firm, each of which is a separate legal entity. Please see www.pwc.com/structure for further

details. This content is for general information purposes only, and should not be used as a substitute for consultation with professional advisors.

You might also like

- Municipal Health Roadmap 2018Document4 pagesMunicipal Health Roadmap 2018San DeeNo ratings yet

- TRW PresentationDocument44 pagesTRW PresentationAdil Abdul QayyumNo ratings yet

- KPMG - Co.tt: KPMG in Trinidad and TobagoDocument2 pagesKPMG - Co.tt: KPMG in Trinidad and TobagoMuhammed El KhawajaNo ratings yet

- Downstream Implementation OECD Due Diligence Guidance Reponsible Suply Chain Mineral Jan 2013Document88 pagesDownstream Implementation OECD Due Diligence Guidance Reponsible Suply Chain Mineral Jan 2013enrique_herrediaz6279No ratings yet

- Audit Questionnaire June 2013Document21 pagesAudit Questionnaire June 2013erine5995No ratings yet

- Corporate TaxDocument30 pagesCorporate TaxVijay KumarNo ratings yet

- FinancialDocument111 pagesFinancialمحمد سفيان أفغوليNo ratings yet

- Cycle Process Diagram: Your TitleDocument16 pagesCycle Process Diagram: Your TitleSanjay Kaptan100% (1)

- WP Cfo of The Future EmeaDocument9 pagesWP Cfo of The Future EmeaFrancisco AlonsoNo ratings yet

- PwC's Academy Middle EastDocument49 pagesPwC's Academy Middle EastPwCAcademyNo ratings yet

- OrganigramaDocument1 pageOrganigramaVirginia CMNo ratings yet

- Retail BankingDocument21 pagesRetail BankingHeenu KumariNo ratings yet

- Isae 3000Document19 pagesIsae 3000muhammad taufikNo ratings yet

- From Disrupted To Disruptors: The UAE's Small and Medium Consulting FirmsDocument32 pagesFrom Disrupted To Disruptors: The UAE's Small and Medium Consulting FirmsSanjana SinghNo ratings yet

- 2015 Health Care Providers Outlook: United StatesDocument5 pages2015 Health Care Providers Outlook: United StatesEmma Hinchliffe100% (1)

- Global CT Scan Market (2022 - 2027) : ResearchDocument50 pagesGlobal CT Scan Market (2022 - 2027) : ResearchHajar HmNo ratings yet

- Precious Metals Supply Chain Policy v02 - Formio As 1Document5 pagesPrecious Metals Supply Chain Policy v02 - Formio As 1Rafael CristanchoNo ratings yet

- Global Health Care Brochure FinalDocument44 pagesGlobal Health Care Brochure FinalPhunsukh WangduNo ratings yet

- Weekly Economic & Financial Commentary 17junDocument11 pagesWeekly Economic & Financial Commentary 17junErick Abraham MarlissaNo ratings yet

- CAPgemini ITU - Proposal.main.v17Document64 pagesCAPgemini ITU - Proposal.main.v17sumayyaNo ratings yet

- Yes No: Purchase To Pay Programme (P2P) Process MapDocument101 pagesYes No: Purchase To Pay Programme (P2P) Process Maptsy0703No ratings yet

- Oil & Gas Industry in Arabic World 2Document31 pagesOil & Gas Industry in Arabic World 2Suleiman BaruniNo ratings yet

- Course Agenda: Understanding Money LaunderingDocument56 pagesCourse Agenda: Understanding Money LaunderinglarissarovaneNo ratings yet

- Morningstar Financials ExampleDocument12 pagesMorningstar Financials ExampleFranklin ForwardNo ratings yet

- Cbbe Pyramid ColgateDocument1 pageCbbe Pyramid ColgateJersonNo ratings yet

- Habesha Bus ? Management SystemDocument14 pagesHabesha Bus ? Management SystemAbdi KhadirNo ratings yet

- FMP IvDocument119 pagesFMP IvmohamedNo ratings yet

- Procedure - Manual - V2 Edited 2017 ProcuDocument64 pagesProcedure - Manual - V2 Edited 2017 ProcuDarshana Herath LankathilakNo ratings yet

- Digital Ecosystems - Swiss ReDocument40 pagesDigital Ecosystems - Swiss ReDonald OluochNo ratings yet

- BCG Boost Business Resilience by Improving Net Working Capital Nov 2019 - tcm9 233866Document19 pagesBCG Boost Business Resilience by Improving Net Working Capital Nov 2019 - tcm9 2338669980139892No ratings yet

- 2.2 Smaller Version of The Complete Personal Finance DashboardDocument823 pages2.2 Smaller Version of The Complete Personal Finance DashboardVijay YadavNo ratings yet

- Ai Adoption in Indian Financial Services and Related ChallengesDocument36 pagesAi Adoption in Indian Financial Services and Related ChallengesPS SainiNo ratings yet

- Australia Home Healthcare Market Deck by Team 2Document26 pagesAustralia Home Healthcare Market Deck by Team 2Smit SanganiNo ratings yet

- IT Help Desk and Service Management in the CloudDocument10 pagesIT Help Desk and Service Management in the CloudCabsfour SupplyNo ratings yet

- InnovateProcurement1 PDFDocument74 pagesInnovateProcurement1 PDFaguilarjmNo ratings yet

- IT Subway Map Europe 2021Document1 pageIT Subway Map Europe 2021Chandrani GuptaNo ratings yet

- Tax Risk Management StrategiesDocument37 pagesTax Risk Management Strategiesle youtuber classicNo ratings yet

- CA Focused AttachmentsDocument8 pagesCA Focused AttachmentssatishNo ratings yet

- Pristine Financial Modeling BrochureDocument4 pagesPristine Financial Modeling Brochurerns116No ratings yet

- Ey Winds of Change India Fintech Report 2022Document49 pagesEy Winds of Change India Fintech Report 2022sanil mehtaNo ratings yet

- Flipkart Global - Code - of - ConductDocument23 pagesFlipkart Global - Code - of - Conductsaurabh agrawalNo ratings yet

- CITI Research Report On Supply ChainDocument56 pagesCITI Research Report On Supply ChainGanesh LadNo ratings yet

- Staff Augmentation WhitepaperDocument9 pagesStaff Augmentation WhitepaperMarwaNo ratings yet

- Dild SR 2021 Eng PDFDocument125 pagesDild SR 2021 Eng PDFSatrio PrakosoNo ratings yet

- GCC Vat Sap BrochureDocument4 pagesGCC Vat Sap BrochureHiren ThakkarNo ratings yet

- GST: The New Draft Model and Its Impact On Your IndustryDocument6 pagesGST: The New Draft Model and Its Impact On Your IndustryswaroopNo ratings yet

- Chapter 1 - UAE VAT Laws and Procedures CourseDocument68 pagesChapter 1 - UAE VAT Laws and Procedures Coursenagham100% (2)

- Goods and Services Tax in India - DeloitteDocument33 pagesGoods and Services Tax in India - DeloitteAakash MalhotraNo ratings yet

- KPMG DTC 2010 Impact It ItesDocument11 pagesKPMG DTC 2010 Impact It ItesGs ShikshaNo ratings yet

- Real EstateDocument4 pagesReal EstateFilip SlavchevNo ratings yet

- Session 3, 4 Role of CAG in GST Regim FinalDocument30 pagesSession 3, 4 Role of CAG in GST Regim FinalSuresh Kumar YathirajuNo ratings yet

- Developing Your Vat RoadmapDocument2 pagesDeveloping Your Vat RoadmapAli ImranNo ratings yet

- GCC VAT Solution PresentationDocument35 pagesGCC VAT Solution PresentationSandeep Mahindra80% (5)

- Independent Auditors' Report: Basis For OpinionDocument10 pagesIndependent Auditors' Report: Basis For OpiniondeepakNo ratings yet

- PWC DTC Impat Real EstateDocument4 pagesPWC DTC Impat Real EstateGs ShikshaNo ratings yet

- UAE-KSA Double Tax TreatyDocument2 pagesUAE-KSA Double Tax TreatyShahzaib SyedNo ratings yet

- Kerala Road Fund Board invites applications for contract postsDocument5 pagesKerala Road Fund Board invites applications for contract postsvishnuprasad4292No ratings yet

- Emirates Integrated Telecommunications Company PJSC and Its Subsidiaries Consolidated Financial Statements For The Year Ended 31 December 2020Document70 pagesEmirates Integrated Telecommunications Company PJSC and Its Subsidiaries Consolidated Financial Statements For The Year Ended 31 December 2020Vanshita SharmaNo ratings yet

- Resume Vikas Kumar OmarDocument2 pagesResume Vikas Kumar OmarVikas Kumar OmarNo ratings yet

- Lesson Plan 3d Printing - World of Part 1Document3 pagesLesson Plan 3d Printing - World of Part 1api-639942719No ratings yet

- Home Appliances Controlling Using Bluetooth On Android Mobile AbstractDocument2 pagesHome Appliances Controlling Using Bluetooth On Android Mobile AbstractramyaNo ratings yet

- Digest of CIR v. Arnoldus Carpentry (G.R. No. 71122)Document2 pagesDigest of CIR v. Arnoldus Carpentry (G.R. No. 71122)Rafael PangilinanNo ratings yet

- Maharishi Dayanand University, Rohtak Haryana: Project Report OnDocument62 pagesMaharishi Dayanand University, Rohtak Haryana: Project Report OnHitesh Yaduvanshi100% (1)

- GLSL Specification 1.40.08.fullDocument111 pagesGLSL Specification 1.40.08.fullmushakkNo ratings yet

- Liedtka, J. M. (1998) - Strategic Thinking. Can It Be TaughtDocument10 pagesLiedtka, J. M. (1998) - Strategic Thinking. Can It Be TaughtOscarAndresPinillaCarreñoNo ratings yet

- Prog GuideDocument29 pagesProg GuideOmar L'fataNo ratings yet

- 05.10.20 - SR - CO-SUPERCHAINA - Jee - MAIN - CTM-8 - KEY & SOL PDFDocument8 pages05.10.20 - SR - CO-SUPERCHAINA - Jee - MAIN - CTM-8 - KEY & SOL PDFManju ReddyNo ratings yet

- Analysis of CFAR Detection With Multiple Pulses Transmission Case in Pareto Distributed ClutterDocument6 pagesAnalysis of CFAR Detection With Multiple Pulses Transmission Case in Pareto Distributed ClutterZellagui EnergyNo ratings yet

- Communication Barriers - Effects On Employees EfficiencyDocument27 pagesCommunication Barriers - Effects On Employees Efficiencyvanquish lassNo ratings yet

- Applied Energy: Dilip Khatiwada, Bharadwaj K. Venkata, Semida Silveira, Francis X. JohnsonDocument13 pagesApplied Energy: Dilip Khatiwada, Bharadwaj K. Venkata, Semida Silveira, Francis X. JohnsonAdemar EstradaNo ratings yet

- Wiccan - The Basics of Herbs and Herbal Magic and Spells and MagickDocument5 pagesWiccan - The Basics of Herbs and Herbal Magic and Spells and Magickkhalilgib67% (3)

- Silo - Tips Chapter 12 Sonic Logs Lecture Notes For Pet 370 Spring 2012 Prepared by Thomas W Engler PHD PeDocument21 pagesSilo - Tips Chapter 12 Sonic Logs Lecture Notes For Pet 370 Spring 2012 Prepared by Thomas W Engler PHD PeIntanNurDaniaNo ratings yet

- 0076 0265 - Thy Baby Food LicenceDocument2 pages0076 0265 - Thy Baby Food LicenceSreedharanPNNo ratings yet

- BN68-13792A-01 - Leaflet-Remote - QLED LS03 - MENA - L02 - 220304.0Document2 pagesBN68-13792A-01 - Leaflet-Remote - QLED LS03 - MENA - L02 - 220304.0Bikram TiwariNo ratings yet

- Business-to-Business Marketing & Channel StrategyDocument8 pagesBusiness-to-Business Marketing & Channel Strategysuljo atlagicNo ratings yet

- Nikhil ResumeDocument2 pagesNikhil ResumeJaikumar KrishnaNo ratings yet

- Pensándolo Bien Pensé MalDocument41 pagesPensándolo Bien Pensé MalErick Pérez NúñezNo ratings yet

- Enrico vs. Heirs of Sps. Eulogio B. Medinaceli and Trinidad Catli-MedinaceliDocument9 pagesEnrico vs. Heirs of Sps. Eulogio B. Medinaceli and Trinidad Catli-MedinaceliAaron CariñoNo ratings yet

- Nirma Bhabhi ApplicationDocument3 pagesNirma Bhabhi Applicationsuresh kumarNo ratings yet

- Datasheet Hitec HS-311 ServoDocument1 pageDatasheet Hitec HS-311 ServoMilo LatinoNo ratings yet

- EBSM - Arc Flash Summary PDFDocument1 pageEBSM - Arc Flash Summary PDFAV ShrinivasNo ratings yet

- TLB ResumeDocument1 pageTLB Resumeapi-486218138No ratings yet

- Thar Du Kan Calculation Report-13.02.2020 PDFDocument141 pagesThar Du Kan Calculation Report-13.02.2020 PDFZin Ko LinnNo ratings yet

- Bo EvansDocument37 pagesBo EvanskgrhoadsNo ratings yet

- Apply Basic Accessibility StandardsDocument9 pagesApply Basic Accessibility StandardsjohnNo ratings yet

- Submission Registration IX XI For 2022 23 27062022Document23 pagesSubmission Registration IX XI For 2022 23 27062022Karma Not OfficialNo ratings yet

- FINANCE CASES AND TOPICSDocument7 pagesFINANCE CASES AND TOPICSFuzael AminNo ratings yet

- Principles of ManagementDocument7 pagesPrinciples of ManagementHarshit Rajput100% (1)

- 1536923049EtenderingofE T P ChemicalsDocument10 pages1536923049EtenderingofE T P ChemicalsAnshul BansalNo ratings yet