Professional Documents

Culture Documents

Accounting (AC)

Uploaded by

Mubashir Iqbal0 ratings0% found this document useful (0 votes)

15 views2 pagesOriginal Title

ac

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views2 pagesAccounting (AC)

Uploaded by

Mubashir IqbalCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

Accounting (AC) 1

ACCOUNTING (AC) AC 331 Governmental and Not-for-Profit Reporting (3 credits)

Pre-Req: GB 212 or AC 201

Introduces financial and reporting issues related to state and local

AC 115 Financial Reporting and Analysis (3 credits) government and nonprofit organizations. Deals with the preparation,

Pre-Req: at least 12 completed or in progress credits analysis and interpretation of financial statements. The course

This course introduces students to the concepts of financial accounting incorporates a project to enrich the student's classroom experience.

as a tool for effective business decision making. Designed for students Students research, analyze and interpret the financial performance of

with no prior knowledge of accounting, this course explains the purpose, an actual governmental or nonprofit organization. Websites unique to

meaning, interpretation and use of financial accounting data. Emphasis governmental and nonprofit organizations are used in the course.

is placed on evaluating accounting transactions and their impact on the

major financial statements. AC 332 Fraud Examination (3 credits)

Pre-Req: GB 212 or (AC 201 and AC 215)

AC 201 Introduction to Financial Information Professions (3 credits) Fraud Examination introduces concepts and techniques useful for

Pre-Req: AC 115 accountants, managers, business owners and criminal investigators.

AC 215 Performance Measurement (3 credits) The course covers many types of financial fraud, including asset

Pre-Req: AC 115 and (Pre or Co-Req: EMS 104 or EMS 105) misappropriation, money laundering, mail fraud, securities fraud,

This course is designed to introduce students to the basics of measuring electronic fraud, corruption, fraudulent financial statements

and reporting on the performance of business organizations. The course (management fraud), and tax fraud. nature of fraud, who commits

also covers how to collect, analyze, and present performance data while fraud, the fraud triangle, fraud detection, fraud prevention, fraud against

understanding the impact and use of performance measurement in organizations, fraud investigation (theft, concealment and conversion),

businesses and society today. interviewing and resolution of various types of fraud. Guest speakers,

handouts, articles and videos will be used to enhance the real-world

AC 310 Cost Management (3 credits) nature of the course.

Pre-Req: GB 212 or AC 215

This course introduces the concepts of cost management and strategic AC 340 Accounting Information Systems (3 credits)

cost management. Here, the curriculum presents comprehensive Pre-req: GB 212 or AC 215

coverage of principles involved in the determination of the cost of a Prepares students to be effective users, evaluators, designers and

products as well as services. Further, the course covers operational auditors of accounting information systems (AIS). Examines several

budgeting, standard costing, and activity-based costing as tools for typical business processes, such as order entry/sales, billing/accounts

management planning and control. This includes emphasizing analysis, receivable/cash receipts and purchasing/accounts payable/cash

interpretation and presentation of information for management decision- disbursements and their associated AIS. Major themes throughout

making purposes, especially those decisions as they relate to cost the course include oral and written communication, objectives and

management. The curriculum also integrates technological tools into the procedures of internal control, typical business documents and reports,

coursework (e.g., Excel, Tableau, etc.). proper system documentation through flowcharts and other techniques,

systems analysis and design methodologies and assessment of

AC 311 Financial Accounting and Reporting I (3 credits) information processing in support of operational and strategic objectives

Pre-Req: GB 212 or AC 201 in the context of rapidly changing technological advances. Hands-on

First in a two-course sequence of financial accounting courses at experience with the process, risk, and control implications of enterprise

the professional level, this course examines accounting theory and systems coupled with an in-depth field-based business process analysis

concepts which form background for the external financial reporting. It gives students exposure to state-of-the-art AIS.

addresses the U.S. Generally Accepted Accounting Principles (GAAP)

related to the preparation of financial statements, with particular AC 350 Federal Taxation (3 credits)

emphasis on asset valuations, and their relationship to income Pre-Req: GB 212 or AC 201

determination. Addresses skills to record and report the impact of Gives a broad training in federal income tax law and Treasury Department

transactions and events in compliance with GAAP, identify financial regulations. Introduces a broad range of tax philosophy, tax concepts

reporting and measurement alternatives, and determine their effects and types of taxpayers. Emphasizes the role of taxation in a business

on financial statements, and apply professional accounting literature to decision-making environment for all types of entities. Introduces basic

determine the applicable GAAP in a real-world context. skills of tax planning and tax research.

AC 312 Financial Accounting and Reporting II (3 credits) AC 381 International Accounting (3 credits)

Pre-Req: AC 311 Pre-Req: AC 312

This course continues the two-course sequence begun in AC 311 by Provides an overview of the unique accounting problems and issues

exploring accounting theory and concepts which form background posed by an international business environment. Examines the causes

for external financial reporting. It examines the Generally Accepted of international accounting diversity and its implications for financial

Accounting Principles (GAAP) related to the preparation of financial analysis. Presents the external financial reporting and management

statements, with particular emphasis on the equity side of the balance control systems issues faced by multinational enterprises.

sheet. Topics covered include current liabilities, long-term debt, leases,

AC 402 Seminar in Accounting (3 credits)

pensions, stockholders’ equity, earnings per share, accounting for income

Offers opportunity for advanced students to study selected topics in

taxes, accounting changes, and the statement of cash flows.

small groups. Allows repetition for credit

2 Accounting (AC)

AC 412 Advanced Accounting (3 credits) AC 472 Internal Auditing (3 credits)

Pre-Req/Co-Req: AC 312 Pre-Req: AC 340

This course presents the theory and concepts regarding specialized Introduces the duties and responsibilities of the internal auditor and

topics in financial accounting. It examines business combinations, with the role of internal auditing in organizations. Introduces professional

emphasis on consolidated financial statements and elimination of inter- standards and presents readings, case studies, and other opportunities

company transactions. Topics covered also include accounting for for students to learn the steps required to plan, conduct, and report

foreign operations, and financial reporting for partnerships, governmental on common internal audit activities. Additional topics include

and not-for-profit entities. application of appropriate information technology tools as part of the

audit process, and definition of the role of the internal auditor in fraud

AC 421 Internship in Accountancy (3 credits) prevention. Provides a foundation to begin preparation for the Certified

Pre-Req: (GB 212 or AC 201), 2 major courses in accounting and instructor Internal Auditor exam.

permission

Involves each student in an internship of a minimum of 200 hours over AC 475 Information Technology Auditing Principles and Practice (3

8-14 weeks duration in the spring semester of the junior year, the summer credits)

following junior year, or the fall of senior year. Provides the interning Pre-Req: AC 470 or AC 472

student with a valuable experiential learning opportunity. Includes on- Introduces three typical aspects of information technology (IT) audits:

the-job training in either public, corporate or government accounting. the audits of computerized information systems, the computer facility,

Requires the student to work closely with a faculty advisor to develop a and the process of developing and implementing information systems.

term paper and a work summary on the internship experience. Through readings, case studies, exercises and discussion, students

will learn to plan, conduct and report on these three types of IT audits.

AC 440 Design and Control of Data and Systems (3 credits) Additional topics may include challenges posed by emerging information

Pre-Req: AC 340 technologies, advanced audit software, business continuity planning, and

Develops an integrating framework to illustrate the evolving role of the role of the IT auditor as an advisor to management.

current and emerging information technologies in supporting accounting

and business activities. Students explore several current issues, including

data and knowledge management, using contemporary tools to capture,

store, retrieve and analyze data; the design and control of complex

information systems, such as a networked nterorganizational system;

and an overview of assurance services. A group project showing the

integration of all the major business processes in a typical business

provides a capstone experience.

AC 450 Advanced Federal Taxation (3 credits)

Pre-Req: AC 350

Examines tax topics for corporations, partnerships and proprietorships

at a more complex level. Focuses on a life-cycle approach for each of the

entities. Includes, at a basic level, topics of estate and gift tax and tax-

exempt entities. Reinforces tax research and tax planning skills.

AC 455 Strategic Performance Management (3 credits)

Pre-Req: AC 310, AC 311, and FI 307

Modern business professionals need to evaluate the effectiveness of

business strategy, which is reliant on the way companies manage their

internal processes and external opportunities to accomplish strategic

objectives. Students will develop the necessary business analysis skills

and be given the opportunity to apply them to business situations in this

course.

AC 470 Financial Statement Auditing (3 credits)

Pre-Req: AC 311 and AC 340

Develops an understanding and appreciation of the philosophy of the

audit process and its practice. Presents the preparation of audit working

papers supporting an examination of the records and procedures of an

enterprise. Covers the report and opinion of the auditor to management,

stockholders and others. Discusses internal auditing procedures as

opposed to those performed by the independent public accountant.

Considers the ethical and legal responsibilities of the auditor. Includes an

introduction to operational auditing as a tool to increase the efficiency

and effectiveness of a firm's accounting system.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hygienic Chappathi Business Loan ReportDocument13 pagesHygienic Chappathi Business Loan ReportJose PiusNo ratings yet

- Daftar Buku SAP TerbaruDocument22 pagesDaftar Buku SAP TerbaruBanci NgamenNo ratings yet

- Cash & Liquidity Management - FSCMDocument12 pagesCash & Liquidity Management - FSCMMubashir IqbalNo ratings yet

- IELTS Reading Strategies in 40 CharactersDocument3 pagesIELTS Reading Strategies in 40 CharactersDiego NeyraNo ratings yet

- Asset Qns and Ans For Interview Practice PDFDocument15 pagesAsset Qns and Ans For Interview Practice PDFMOORTHYNo ratings yet

- Bank Account & Communication Management - FSCMDocument9 pagesBank Account & Communication Management - FSCMMubashir IqbalNo ratings yet

- Dispute Management FSCMDocument9 pagesDispute Management FSCMMubashir IqbalNo ratings yet

- SAP Project Day-1Document5 pagesSAP Project Day-1Mubashir IqbalNo ratings yet

- LECTURE: ABAP Debugging For Functional Consultants - 1Document9 pagesLECTURE: ABAP Debugging For Functional Consultants - 1SUSMITANo ratings yet

- CHEN JINDOU MS Travel InsuranceDocument3 pagesCHEN JINDOU MS Travel InsuranceMubashir IqbalNo ratings yet

- Rabia Omer: Executive SummaryDocument1 pageRabia Omer: Executive SummaryMubashir IqbalNo ratings yet

- AssignmentShakil Express Quotation-2Document2 pagesAssignmentShakil Express Quotation-2Mubashir IqbalNo ratings yet

- Application Form For The Post of Chief Financial Officer: Serial No.Document3 pagesApplication Form For The Post of Chief Financial Officer: Serial No.Mubashir IqbalNo ratings yet

- IELTS Reading Strategies in 40 CharactersDocument3 pagesIELTS Reading Strategies in 40 CharactersDiego NeyraNo ratings yet

- US Department of State: Diversity Visa Stats For 2016Document6 pagesUS Department of State: Diversity Visa Stats For 2016ABC10No ratings yet

- Zhen Chen MRDocument2 pagesZhen Chen MRMubashir IqbalNo ratings yet

- Introduction To SAP MDG Course Concepts: Data ReplicationDocument1 pageIntroduction To SAP MDG Course Concepts: Data ReplicationMubashir IqbalNo ratings yet

- Zheng Wang MRDocument1 pageZheng Wang MRMubashir IqbalNo ratings yet

- Zhen Chen MRDocument2 pagesZhen Chen MRMubashir IqbalNo ratings yet

- Shakil Express Quotation-2Document1 pageShakil Express Quotation-2Mubashir IqbalNo ratings yet

- Zhen Chen MRDocument2 pagesZhen Chen MRMubashir IqbalNo ratings yet

- AssignmentShakil Express Quotation-2Document2 pagesAssignmentShakil Express Quotation-2Mubashir IqbalNo ratings yet

- Intra Company Sto With Delivery2Document14 pagesIntra Company Sto With Delivery2naveenk143100% (3)

- Production Planning Master Data: EGN 5620 Enterprise Systems Configuration Spring, 2014Document63 pagesProduction Planning Master Data: EGN 5620 Enterprise Systems Configuration Spring, 2014Mubashir IqbalNo ratings yet

- Shakil Express (PVT.) LTD.: The Oldest Family Travel Company Serving Since 1947Document2 pagesShakil Express (PVT.) LTD.: The Oldest Family Travel Company Serving Since 1947Mubashir IqbalNo ratings yet

- Shakil Express Travel Company Bangladesh High Commission Flight ItineraryDocument1 pageShakil Express Travel Company Bangladesh High Commission Flight ItineraryMubashir IqbalNo ratings yet

- Shakil Express (PVT.) LTD.: The Oldest Family Travel Company Serving Since 1947Document1 pageShakil Express (PVT.) LTD.: The Oldest Family Travel Company Serving Since 1947Mubashir IqbalNo ratings yet

- Chen Xuetao MRDocument1 pageChen Xuetao MRMubashir IqbalNo ratings yet

- Shakil Express (PVT.) LTD.: The Oldest Family Travel Company Serving Since 1947Document2 pagesShakil Express (PVT.) LTD.: The Oldest Family Travel Company Serving Since 1947Mubashir IqbalNo ratings yet

- Shakil Express (PVT.) LTD.: The Oldest Family Travel Company Serving Since 1947Document1 pageShakil Express (PVT.) LTD.: The Oldest Family Travel Company Serving Since 1947Mubashir IqbalNo ratings yet

- Payhawk Ebook How To Manage Month End Close Like A ProDocument11 pagesPayhawk Ebook How To Manage Month End Close Like A ProCorneliu Bajenaru - Talisman Consult SRLNo ratings yet

- Annotation On Locus Standi 548 Scra 519Document4 pagesAnnotation On Locus Standi 548 Scra 519Imee CallaoNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- Bài tập chương 4 F.S.A phần QDocument2 pagesBài tập chương 4 F.S.A phần QTử Đằng NguyễnNo ratings yet

- 368 1431 1 PBDocument28 pages368 1431 1 PBJake Ceasar A. DiosanaNo ratings yet

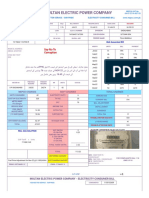

- Multan Electric Power Company: Say No To CorruptionDocument2 pagesMultan Electric Power Company: Say No To CorruptionMehran Ali KhanNo ratings yet

- Cashflow StatementDocument2 pagesCashflow StatementChip choiNo ratings yet

- Actual-Income-And-Expenditures Blank FormatDocument3 pagesActual-Income-And-Expenditures Blank FormatJerome Magno BalaquidanNo ratings yet

- Quiz TaxDocument4 pagesQuiz TaxrocketamberNo ratings yet

- 2012 National BudgetDocument236 pages2012 National BudgetPrince ZhouNo ratings yet

- Fort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012Document3 pagesFort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012GraceNo ratings yet

- Perquisites in Indian Tax SystemDocument5 pagesPerquisites in Indian Tax SystemShreyas DalviNo ratings yet

- BM2308I002689002Document2 pagesBM2308I002689002Dharmendra KumarNo ratings yet

- SPVG Quote SI-95692 Revision 0 PDFDocument4 pagesSPVG Quote SI-95692 Revision 0 PDFherrerafaridcrNo ratings yet

- OBYC v2 15Document131 pagesOBYC v2 15Francisco HerreraNo ratings yet

- Mushak 9.1 UpdatedDocument15 pagesMushak 9.1 UpdatedRakibul HassanNo ratings yet

- Msme Policy FinalDocument47 pagesMsme Policy FinalDeepakNo ratings yet

- Local-Taxes-And-Fees-As-A-Source-Of-Income-To-The-Local-Budget - Content File PDFDocument6 pagesLocal-Taxes-And-Fees-As-A-Source-Of-Income-To-The-Local-Budget - Content File PDFHaini AncutaNo ratings yet

- G.R. No. 148187 April 16, 2008 Philex Mining Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Ynares-Santiago, J.Document6 pagesG.R. No. 148187 April 16, 2008 Philex Mining Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Ynares-Santiago, J.Jhoi MateoNo ratings yet

- Chapter 17 Aggregate Demand and Aggregate Supply (1) - 15-21Document7 pagesChapter 17 Aggregate Demand and Aggregate Supply (1) - 15-21Kayla YuNo ratings yet

- Media Regulation (Lesson 2-5)Document22 pagesMedia Regulation (Lesson 2-5)Mariell PahinagNo ratings yet

- University of Hawai'i PressDocument26 pagesUniversity of Hawai'i PressDaniel LeeNo ratings yet

- Kiplinger's Personal Finance - January 2018 PDFDocument74 pagesKiplinger's Personal Finance - January 2018 PDFjkavinNo ratings yet

- Types of Custom DutyDocument3 pagesTypes of Custom DutyKarina ManafNo ratings yet

- EconomyDocument86 pagesEconomySridhar HaritasaNo ratings yet

- SawekoDocument3 pagesSawekoDanie FizNo ratings yet

- Case Digest - TaxationDocument7 pagesCase Digest - TaxationJane Dela CruzNo ratings yet

- MK Tally PDocument27 pagesMK Tally Ptimepass.10jNo ratings yet

- WF MLP Primer IVDocument156 pagesWF MLP Primer IVAndrew MedvedevNo ratings yet