Professional Documents

Culture Documents

PFRS 14

Uploaded by

ellapot89Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PFRS 14

Uploaded by

ellapot89Copyright:

Available Formats

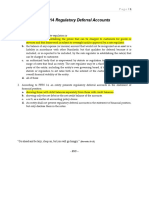

PFRS 14 specifies the financial reporting requirements for regulatory deferral account balances arising

from the sale of goods or services that are subject to rate regulation. Regulatory deferral account

balance is the balance of any expense (or income) account that would not be recognized as an asset or a

liability in accordance with other Standards, but that qualifies for deferral because it is included, or is

expected to be included, by the rate regulator in establishing the rate(s) that can be charged to

customers. It is not presented as current or noncurrent. Instead, they are presented separately from the

sub-totals of assets and liabilities that are presented in accordance with other Standards. It is an

optional standard that is available only to first-time adopters. A first-time adopter continues to apply its

previous GAAP to the recognition, measurement, impairment and derecognition of regulatory deferral

account balances, except for changes in accounting policies and the presentation of regulatory deferral

accounts. Existing PFRS users are prohibited from using PFRS 14. An entity is prohibited from changing

its accounting policy in order to start recognizing regulatory deferral account balances.

You might also like

- Quiz Pfrs 14 Regulatory Deferral AccountsDocument1 pageQuiz Pfrs 14 Regulatory Deferral AccountsFery AnnNo ratings yet

- PFRS 14: Regulatory Deferral AccountsDocument23 pagesPFRS 14: Regulatory Deferral AccountsMeiNo ratings yet

- Conceptual Framework and Accounting Standards: C F A SDocument34 pagesConceptual Framework and Accounting Standards: C F A SG & E ApparelNo ratings yet

- Interim Standard Comprehensive Project 25 April 2013: Accounts Published Accounts IssuedDocument4 pagesInterim Standard Comprehensive Project 25 April 2013: Accounts Published Accounts IssuedJuan TañamorNo ratings yet

- Ifrs 14: Regulatory Deferral AccountDocument4 pagesIfrs 14: Regulatory Deferral AccountAira Nhaira MecateNo ratings yet

- IFRS 14 - Regulatory Deferral AccountsDocument3 pagesIFRS 14 - Regulatory Deferral AccountsMarc Eric Redondo100% (1)

- Pfrs 14: Regulatory Deferral AccountsDocument2 pagesPfrs 14: Regulatory Deferral AccountsElla MaeNo ratings yet

- PFRS 14 - Regulatory Deferral AccountsDocument16 pagesPFRS 14 - Regulatory Deferral Accountsdaniel coroniaNo ratings yet

- Pfrs 14: Regulatory Deferral Accounts: Presentation in Financial StatementsDocument1 pagePfrs 14: Regulatory Deferral Accounts: Presentation in Financial StatementsElla MaeNo ratings yet

- Regulatory Deferral Accounts: International Financial Reporting Standard 14Document13 pagesRegulatory Deferral Accounts: International Financial Reporting Standard 14Tanvir PrantoNo ratings yet

- International Financial Reporting Standard 14: Regulatory Deferral AccountsDocument17 pagesInternational Financial Reporting Standard 14: Regulatory Deferral AccountsMd Raihan SobujNo ratings yet

- Regulatory Deferral AccountsDocument9 pagesRegulatory Deferral AccountsDylan Dela PazNo ratings yet

- Indian Accounting Standard (Ind AS) 8 - Taxguru - inDocument11 pagesIndian Accounting Standard (Ind AS) 8 - Taxguru - inaaosarlbNo ratings yet

- Indian Accounting Standard (Ind AS) 8: Accounting Policies, Changes in Accounting Estimates and ErrorsDocument19 pagesIndian Accounting Standard (Ind AS) 8: Accounting Policies, Changes in Accounting Estimates and ErrorsAnkush GoelNo ratings yet

- MBC Audited FS 2017 PARENTDocument57 pagesMBC Audited FS 2017 PARENTMikx LeeNo ratings yet

- Philippine Financial Reporting StandardsDocument9 pagesPhilippine Financial Reporting StandardsKristan John ZernaNo ratings yet

- IFRS StandardsDocument13 pagesIFRS StandardsmulualemNo ratings yet

- 14-Regulatory Deferral AccountsDocument20 pages14-Regulatory Deferral AccountsChelsea Anne VidalloNo ratings yet

- Lesson 3Document23 pagesLesson 3Lurissa CabigNo ratings yet

- Implementing PFRS 15: Challenges of An Accounting ChangeDocument3 pagesImplementing PFRS 15: Challenges of An Accounting ChangeNathanielNo ratings yet

- Ias No.8Document41 pagesIas No.8rafikaNo ratings yet

- Document 2Document8 pagesDocument 2sohamNo ratings yet

- Accounting Policies Changes in Accounting Estimates and Errors IAS 8Document16 pagesAccounting Policies Changes in Accounting Estimates and Errors IAS 8Akash RanaNo ratings yet

- What Is Section 145Document5 pagesWhat Is Section 145MOUSOM ROYNo ratings yet

- Summary AuditDocument8 pagesSummary AuditMarie Joy ButilNo ratings yet

- Changes in Accounting PoliciesDocument4 pagesChanges in Accounting PoliciesImran FarhanNo ratings yet

- Regulatory Deferral Accounts: IFRS Standard 14Document24 pagesRegulatory Deferral Accounts: IFRS Standard 14Teja JurakNo ratings yet

- Ias8 PDFDocument3 pagesIas8 PDFNozipho MpofuNo ratings yet

- Accounting Policies Changes in Accounting Estimates and Errors - IAS 8Document6 pagesAccounting Policies Changes in Accounting Estimates and Errors - IAS 8Anonymous P1xUTHstHTNo ratings yet

- IAS-8 Accounting Policies, Change in Accounting Estimates and Errors ObjectiveDocument6 pagesIAS-8 Accounting Policies, Change in Accounting Estimates and Errors ObjectiveAbdullah Al Amin MubinNo ratings yet

- IAS Standards IAS 1 Presentation of Financial StatementsDocument23 pagesIAS Standards IAS 1 Presentation of Financial StatementsmulualemNo ratings yet

- Balucan, in Acc Final RequirementDocument95 pagesBalucan, in Acc Final RequirementLuigi Enderez BalucanNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument15 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsPriya JandialNo ratings yet

- Ind As 8Document4 pagesInd As 8Khushi SoniNo ratings yet

- Pfrs 14: Regulatory Deferral AccountsDocument5 pagesPfrs 14: Regulatory Deferral AccountsLALALA LULULUNo ratings yet

- Resume 5Document5 pagesResume 5MariaNo ratings yet

- IAS 8 Accounting Policies, Changes In: Accounting Estimates and ErrorsDocument2 pagesIAS 8 Accounting Policies, Changes In: Accounting Estimates and ErrorsAKINYEMI ADISA KAMORUNo ratings yet

- IAS8Document2 pagesIAS8Atif RehmanNo ratings yet

- To Be Disclosed If Departed in A Prior Period.. Record Effects of Assets and LiabilitiesDocument3 pagesTo Be Disclosed If Departed in A Prior Period.. Record Effects of Assets and LiabilitiesSahil SharmaNo ratings yet

- Accounting Policies, Accounting Estimates and Errors - PSAK 25 Accounting For Assets and Liabilities of Tax Amnesty - PSAK 70Document2 pagesAccounting Policies, Accounting Estimates and Errors - PSAK 25 Accounting For Assets and Liabilities of Tax Amnesty - PSAK 70Alya Khaira NazhifaNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument14 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsSuresh Reddy SannapureddyNo ratings yet

- AAA Exam Kit NotesDocument21 pagesAAA Exam Kit NotesSheda AshrafNo ratings yet

- Chapter 23Document40 pagesChapter 23rameelamirNo ratings yet

- PFRS 14Document14 pagesPFRS 14Princess Jullyn ClaudioNo ratings yet

- IFRS 1 - First Time AdopterDocument9 pagesIFRS 1 - First Time AdopterAkinwumi AyodejiNo ratings yet

- CHAPTER 7 - Notes - Part 1Document7 pagesCHAPTER 7 - Notes - Part 1Aljean Castro DuranNo ratings yet

- Accounting Policy and Estimate IAS 8Document6 pagesAccounting Policy and Estimate IAS 8OLAWALE AFOLABI TIMOTHYNo ratings yet

- Pas 8 Cfas PDFDocument6 pagesPas 8 Cfas PDFAndreaaAAaa TagleNo ratings yet

- Ifrs 1Document10 pagesIfrs 1kadermaho456No ratings yet

- Acctg 112 Pas 7 and 8 ReviewerDocument7 pagesAcctg 112 Pas 7 and 8 ReviewersurbanshanrilNo ratings yet

- LKAS 8 Accounting Policies (New)Document33 pagesLKAS 8 Accounting Policies (New)Kogularamanan NithiananthanNo ratings yet

- Differences Between IAS 39 and IFRS 9Document3 pagesDifferences Between IAS 39 and IFRS 9Anonymous 7CxwuBUJz3No ratings yet

- IFRS 1 First-Time Adoption of International Financial Reporting StandardsDocument30 pagesIFRS 1 First-Time Adoption of International Financial Reporting StandardsGenelle SorianoNo ratings yet

- IAS8Document2 pagesIAS8chehirNo ratings yet

- Updates in Financial Reporting StandardsDocument24 pagesUpdates in Financial Reporting Standardsloyd smithNo ratings yet

- Impact and Implication of PFRS 15Document7 pagesImpact and Implication of PFRS 15Jethermaine BaybayanNo ratings yet

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Document8 pagesIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNo ratings yet

- 4Document2 pages4noneofyourbusinessNo ratings yet

- Module 1A - PFRS For Small Entities NotesDocument16 pagesModule 1A - PFRS For Small Entities NotesLee SuarezNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet