Professional Documents

Culture Documents

Tutorial 3

Uploaded by

MinhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 3

Uploaded by

MinhCopyright:

Available Formats

Copyright

Copyright

c University of New South Wales 2021. All rights reserved.

Economics of Finance

Tutorial 3

1. Suppose there are three possible states of the world in the next period, denoted by good weather

(GW), fair weather (FW) and bad weather (BW). Also, three securities are available on the market

with payoffs in each state listed below.

Bond Stock

GW 20 50

FW 20 30

BW 20 0

The prices of the two securities are: pBond = 19, pStock = 16.5.

(i) Suppose an investor needs to hedge the following payments:

0

c = 0 .

(states×1)

20

Is it possible to perfectly replicate the portfolio? Why?

(ii) Suppose a dealer now offer a European put option on the stock price which expires at period 1.

The strick price of the option is 20. The option is sold at 13, and the dealer does not allow shorting.

Does the option help hedge the payments specified in part (i)?

(iii) In light of your answer to part (ii), the dealer hires you to provide a range of price for the

option. What advice can you give?

(iv) Based on your analysis in part (i)-part (iii), comment on the role of financial engineering and

financial market innovations.

2. Consider the following three bonds that make the coupon payments listed below:

B1 B2 B3

Year 1 100 5 0

Year 2 0 5 0

Year 3 0 105 100

The prices of these bonds are as follows: pB1 = 95, pB2 = 88, pB3 = 75.

(i) Compute the discount factors for Years 1, 2 and 3.

(ii) Suppose an investor wants to receive the following payment vector:

50

c = 10

20

Construct a portfolio of the three bonds that generates this payment vector. What is the

arbitrage-free price of this portfolio?

(iii) Compute the interest rates i(1), i(2) and i(3). Explain in words the interpretation on i(3).

(iv) Compute the duration and the modified duration of the three bonds. How do you interpret

these numbers?

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Start-Up Legal PackDocument24 pagesStart-Up Legal Packzoya100% (1)

- Amazon FbaDocument9 pagesAmazon Fbadata baseNo ratings yet

- Taxation - Final ExamDocument4 pagesTaxation - Final ExamKenneth Bryan Tegerero Tegio100% (1)

- Special Resolution FormatDocument4 pagesSpecial Resolution FormatSanjeev TiwariNo ratings yet

- Playconomics 4 - MacroeconomicsDocument302 pagesPlayconomics 4 - MacroeconomicsMinhNo ratings yet

- Provident Fund Full DetailsDocument5 pagesProvident Fund Full DetailsGaurav VijayNo ratings yet

- SWOT Analysis CandP HomesDocument5 pagesSWOT Analysis CandP HomesRowena CahintongNo ratings yet

- Barangay Agenda For Governance and Development Year 2018-2019Document7 pagesBarangay Agenda For Governance and Development Year 2018-2019Lgu Buenavista100% (3)

- IS3223 Zara Case Study: Zara: IT For Fast FashionDocument27 pagesIS3223 Zara Case Study: Zara: IT For Fast FashionAlex NguyenNo ratings yet

- Tutorial 2 SolutionDocument7 pagesTutorial 2 SolutionMinhNo ratings yet

- Tutorial 3 SolutionDocument5 pagesTutorial 3 SolutionMinhNo ratings yet

- Tutorial 1 SolutionDocument4 pagesTutorial 1 SolutionMinhNo ratings yet

- Financial Accounting: Tools For Business Decision Making: Reporting and Analyzing ReceivablesDocument60 pagesFinancial Accounting: Tools For Business Decision Making: Reporting and Analyzing ReceivablesmikeNo ratings yet

- BIR Form No. 1709 Dec 2020 EncsDocument3 pagesBIR Form No. 1709 Dec 2020 EncsLaurence ElazeguiNo ratings yet

- Cross e of DemandDocument19 pagesCross e of Demandapi-53255207No ratings yet

- DNV Annual Report 2021Document83 pagesDNV Annual Report 2021AlekoNo ratings yet

- Konsep Global Strategi Bisnis R2Document41 pagesKonsep Global Strategi Bisnis R2Ricky NovertoNo ratings yet

- Cost and Management AccountingDocument52 pagesCost and Management Accountings.lakshmi narasimhamNo ratings yet

- Namma Kalvi 12th Business Maths Slow Learners Study Material em 216934 PDFDocument92 pagesNamma Kalvi 12th Business Maths Slow Learners Study Material em 216934 PDFElijah ChandruNo ratings yet

- Game Theory and The Prisoner's Dilemma: An AnalysisDocument5 pagesGame Theory and The Prisoner's Dilemma: An AnalysisPUPT-JMA VP for AuditNo ratings yet

- 1.business Organisation and StakeholdersDocument27 pages1.business Organisation and StakeholdersAli Khan AhmadiNo ratings yet

- Five Year Plan Class PresentationDocument12 pagesFive Year Plan Class PresentationVaishali SinghNo ratings yet

- Components of Industrial EconomyDocument2 pagesComponents of Industrial EconomyEllis ElliseusNo ratings yet

- Linmarr Deed of Absolute Sale PDFDocument2 pagesLinmarr Deed of Absolute Sale PDFMae De GuzmanNo ratings yet

- Tom enDocument29 pagesTom enAbhiraj dNo ratings yet

- Slide 1: Home Affordable Modification ProgramDocument27 pagesSlide 1: Home Affordable Modification ProgramglenhfordNo ratings yet

- EU Understanding Social InnovationDocument8 pagesEU Understanding Social InnovationEva KrokidiNo ratings yet

- The Benefits of Corporate Social ResponsibilityDocument2 pagesThe Benefits of Corporate Social ResponsibilityDavid Stivens CastroNo ratings yet

- Clo Rex Case Study Teaching NoteDocument5 pagesClo Rex Case Study Teaching Noteismun nadhifahNo ratings yet

- FXMD Circular NRB Foreign Investment and Loan MGT Bylaw 2078Document35 pagesFXMD Circular NRB Foreign Investment and Loan MGT Bylaw 2078Anil JayswalNo ratings yet

- Trade UnionismDocument16 pagesTrade UnionismBhavika BaliNo ratings yet

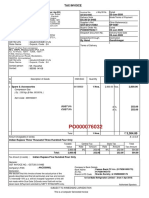

- Tax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Document1 pageTax Invoice: Ice Make Refrigeration Limited - (From 1-Apr-2019)Sunil PatelNo ratings yet

- Value Added Tax 9.6.18Document3 pagesValue Added Tax 9.6.18Monica Carmona RicafrancaNo ratings yet

- Nbmba Lot Business Oportunity and Market ResearchDocument16 pagesNbmba Lot Business Oportunity and Market Researchapi-299852343No ratings yet