Professional Documents

Culture Documents

0 Backtest Stats S&P Ver2 NBA 1week RevDetect

0 Backtest Stats S&P Ver2 NBA 1week RevDetect

Uploaded by

sapphire4uOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0 Backtest Stats S&P Ver2 NBA 1week RevDetect

0 Backtest Stats S&P Ver2 NBA 1week RevDetect

Uploaded by

sapphire4uCopyright:

Available Formats

In [1]: import quandl

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import datetime as datetime

from scipy.signal import savgol_filter

import pywt

import math

import pyfolio as pf

from pyfolio import timeseries

C:\Users\abhid\anaconda3\lib\site-packages\pyfolio\pos.py:26: UserWarning: Module "zip

line.assets" not found; mutltipliers will not be applied to position notionals.

warnings.warn(

In [2]: df_data_NBA = pd.read_csv('output/data_NBA_output_Ver2.csv')

df_data_NBA.index = pd.to_datetime(df_data_NBA['Date'])

df_data_NBA.drop(['Date'], axis=1, inplace=True)

Max_Net_DDThresh = df_data_NBA.loc[df_data_NBA.index[0],'Max_Net_DDThresh']

NBA_Week_len = df_data_NBA.loc[df_data_NBA.index[0],'NBA_Week_len']

#############################################

### Daily Returns Stats

df_data = pd.read_csv('output/data_output_Ver2.csv')

df_data.index = pd.to_datetime(df_data['Date'])

df_data.drop(['Date'], axis=1, inplace=True)

Net Balance Algorithm - Cumulative Gross Returns with Different filters vs S&P Index

returns

In [3]: plt.figure(figsize =(15, 5))

plt.plot(df_data_NBA['Index_GRetCum_pct'], 'k', label = 'Benchmark - S&P Index returns

plt.plot(df_data_NBA['GRetCum_pct'], 'b--', label = 'Raw signal returns - w/o. filteri

plt.plot(df_data_NBA['GRetCum_pct2'], 'g--', label = 'New returns - Exp. filtered sign

plt.plot(df_data_NBA['GRetCum_pct3'], 'm--', label = 'New returns - Sav-Golay filtered

plt.plot(df_data_NBA['GRetCum_pct4'], 'r--', label = 'New returns - DWT filtered signa

plt.plot(df_data_NBA['Alarm'], 'r', label = f'Trade Alarm with Drawdown Threshold = {M

plt.title(f"Unscaled NBA Cum. Gross Returns with S&P Index Data: NBA Length - {NBA_Wee

#plt.ylim([-20000, 20000])

#plt.xlim([datetime.date(2018, 1, 1), datetime.date(2019, 1, 1)])

plt.grid()

plt.legend()

plt.show()

In [ ]:

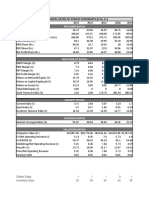

Benchmark stats - S&P Index Returns

In [4]: Benchmark_NRet = pd.Series(df_data['Index_NRet_pct'], name="S&P Index Returns")

pf.show_perf_stats(returns=Benchmark_NRet)

#pf.create_simple_tear_sheet(returns=Benchmark_NRet)

Start date 2013-04-03

End date 2021-04-30

Total months 96

Backtest

Annual return 12.9%

Cumulative returns 166.3%

Annual volatility 17.2%

Sharpe ratio 0.79

Calmar ratio 0.38

Stability 0.94

Max drawdown -33.9%

Omega ratio 1.17

Sortino ratio 1.10

Skew -0.68

Kurtosis 20.39

Tail ratio 0.92

Daily value at risk -2.1%

In [ ]:

Backtest stats (NBA with DWT Filter output)

In [5]: #### Converting NBA returns to equivalent daily returns for tearsheet generation

temp_Daily_NRet = np.zeros(len(df_data))

temp_NBA_Return = np.array(df_data_NBA['NRet_pct4'])

for i in range(0, len(df_data_NBA)):

temp_Daily_NRet[i*NBA_Week_len*5] = temp_NBA_Return[i]

df_data['Analogous_Daily_NRet'] = temp_Daily_NRet

In [6]: Backtest_NRet = df_data['Analogous_Daily_NRet']

pf.create_returns_tear_sheet(returns=Backtest_NRet, benchmark_rets=Benchmark_NRet)

C:\Users\abhid\anaconda3\lib\site-packages\empyrical\stats.py:1527: RuntimeWarning: di

vide by zero encountered in double_scalars

return np.abs(np.percentile(returns, 95)) / \

Start date 2013-04-03

End date 2021-04-30

Total months 96

Backtest

Annual return 45.8%

Cumulative returns 2001.9%

Annual volatility 12.2%

Sharpe ratio 3.15

Calmar ratio 4.83

Stability 0.99

Max drawdown -9.5%

Omega ratio 6.17

Sortino ratio 9.30

Skew 5.60

Kurtosis 69.54

Tail ratio inf

Daily value at risk -1.4%

Alpha 0.46

Beta 0.05

Worst drawdown periods Net drawdown in % Peak date Valley date Recovery date Duration

0 9.49 2020-08-26 2020-09-03 2020-10-23 43

1 5.53 2019-04-30 2019-05-22 2019-06-27 43

2 4.79 2021-01-20 2021-02-11 2021-04-12 59

3 3.85 2018-01-26 2018-01-29 2018-02-05 7

4 2.57 2020-06-09 2020-06-10 2020-07-09 23

You might also like

- DCF ModellDocument7 pagesDCF Modellsandeep0604No ratings yet

- ACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertDocument77 pagesACCA Taxation - Zimbabwe (ZWE) Revision Kit 2022 by T T HerbertTawanda Tatenda Herbert100% (4)

- Industry Analysis RatioDocument79 pagesIndustry Analysis Ratiopratz1996No ratings yet

- (Anand, Arun, Chris, Nirupama, Priyanka, Samhita, Sharat) : Assessment 2 - Business FinanceDocument5 pages(Anand, Arun, Chris, Nirupama, Priyanka, Samhita, Sharat) : Assessment 2 - Business Financearun gopalakrishnanNo ratings yet

- Colgate Palmolive - DCF Valuation Model - Latest - Anurag 2Document44 pagesColgate Palmolive - DCF Valuation Model - Latest - Anurag 2Anrag Tiwari100% (1)

- Awb Petra Machackova To PRGDocument1 pageAwb Petra Machackova To PRGSuloutan IslandNo ratings yet

- REPORT Lesson Learning in Nuclear ConstructionDocument24 pagesREPORT Lesson Learning in Nuclear ConstructionpirotteNo ratings yet

- Technofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialDocument37 pagesTechnofunda Investing Excel Analysis - Version 2.0: Watch Screener TutorialRaman BajpaiNo ratings yet

- Tubes and PipesDocument1 pageTubes and PipesLLNo ratings yet

- Bank ReconciliationDocument43 pagesBank ReconciliationKenisha KhatriNo ratings yet

- Fraud Analytics Using Descriptive, Predictive, and Social Network Techniques: A Guide to Data Science for Fraud DetectionFrom EverandFraud Analytics Using Descriptive, Predictive, and Social Network Techniques: A Guide to Data Science for Fraud DetectionNo ratings yet

- Homework 4 SolDocument4 pagesHomework 4 SolLin FengNo ratings yet

- Tutorial On How To Use The DCF Model. Good Luck!: DateDocument9 pagesTutorial On How To Use The DCF Model. Good Luck!: DateTanya SinghNo ratings yet

- Oil Export IndonesiaDocument12 pagesOil Export IndonesiaRifky Kurniawan100% (1)

- KimlolDocument9 pagesKimlolMorello SiméonNo ratings yet

- Kim's Trade Summary and StatisticsDocument10 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Kim's Trade Summary and StatisticsDocument25 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Kim'S Trade Summary and Statistics: Link Jingjang TraderDocument4 pagesKim'S Trade Summary and Statistics: Link Jingjang TraderMorello SiméonNo ratings yet

- Kim's Trade Summary and StatisticsDocument11 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Lab 3Document4 pagesLab 3Muhammad SalmanNo ratings yet

- Analisis FinancieroDocument124 pagesAnalisis FinancieroJesús VelázquezNo ratings yet

- Week 15.2 - Six Sigma CalculationsDocument13 pagesWeek 15.2 - Six Sigma CalculationsHanzla ZubairNo ratings yet

- Kim's Trade Summary and StatisticsDocument4 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Financial Time Series Analisys For Raizen CompanyDocument19 pagesFinancial Time Series Analisys For Raizen CompanyVictor HugoNo ratings yet

- Empirical Finance ProjectDocument16 pagesEmpirical Finance ProjectJiayuan DongNo ratings yet

- Kim's Trade Reviews +161 50, +150 22 Aft Comm, 3 TradesDocument4 pagesKim's Trade Reviews +161 50, +150 22 Aft Comm, 3 TradesMorello SiméonNo ratings yet

- Valuation SheetDocument7 pagesValuation SheetHarsh MaheshwariNo ratings yet

- BT - Flexible Backtesting For Python - BT 0.2.10 DocumentationDocument9 pagesBT - Flexible Backtesting For Python - BT 0.2.10 DocumentationSomeoneNo ratings yet

- Chap 3 - The Cost of CapitalDocument37 pagesChap 3 - The Cost of Capitalrafat.jalladNo ratings yet

- VelociGrid - 3 - 14 - 761 - Fix CADJPY 2014 2020 M15 DD866Document60 pagesVelociGrid - 3 - 14 - 761 - Fix CADJPY 2014 2020 M15 DD866JeroNo ratings yet

- Trabajo MasterDocument12 pagesTrabajo MasterAlvaroNo ratings yet

- Saurabh Verma 9919102005Document11 pagesSaurabh Verma 9919102005Yogendra pratap Singh100% (1)

- Ts NotebookDocument22 pagesTs NotebookDanilo Santiago Criollo Chávez100% (1)

- Ratio Analysis of Bata IndiaDocument2 pagesRatio Analysis of Bata IndiaSanket BhondageNo ratings yet

- Kim's Trade Summary and StatisticsDocument3 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- Kim's Trade Summary and StatisticsDocument8 pagesKim's Trade Summary and StatisticsSiméon MorelloNo ratings yet

- ValueResearchFundcard IDFCInfrastructureFund RegularPlan 2019may17Document4 pagesValueResearchFundcard IDFCInfrastructureFund RegularPlan 2019may17ChittaNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Business Analytics-1: STR (Crew - Data)Document16 pagesBusiness Analytics-1: STR (Crew - Data)Nikhil MalhotraNo ratings yet

- ValueResearchFundcard RelianceTaxSaver 2010dec24Document6 pagesValueResearchFundcard RelianceTaxSaver 2010dec24Kumar DeepanshuNo ratings yet

- Fundcard: HSBC Brazil FundDocument4 pagesFundcard: HSBC Brazil FundChittaNo ratings yet

- Portfolio Performance EvaluationDocument8 pagesPortfolio Performance EvaluationSrikar RenikindhiNo ratings yet

- Tata Motors: Previous YearsDocument5 pagesTata Motors: Previous YearsHarsh BansalNo ratings yet

- Exp 01-B Feature Selection and ExtractionDocument12 pagesExp 01-B Feature Selection and ExtractionR J SHARIN URK21CS5022No ratings yet

- 4Document17 pages4M SiddiqNo ratings yet

- A Case Study On COkeDocument6 pagesA Case Study On COkeDulon DuttaNo ratings yet

- Discounted Cash Flow-Model For ValuationDocument9 pagesDiscounted Cash Flow-Model For ValuationPCM StresconNo ratings yet

- Modelo BMDocument5 pagesModelo BMRafael CombitaNo ratings yet

- Paper GTL Rika Dan SeptiadiDocument109 pagesPaper GTL Rika Dan SeptiadiRika Budi NoviawatiNo ratings yet

- Portfolio 5l Mon Thur FriDocument285 pagesPortfolio 5l Mon Thur FriPranat BajajNo ratings yet

- CCS G4Document14 pagesCCS G4Harshit AroraNo ratings yet

- DCF ModellDocument7 pagesDCF ModellziuziNo ratings yet

- Appendix 1 Conservative Approach: (In FFR Million)Document6 pagesAppendix 1 Conservative Approach: (In FFR Million)Sarvagya JhaNo ratings yet

- Period Start Time PLMN Name: Voice Call Setup SR (Rrc+Cu) CSSR Ps NRT RrcblockingcongestioncsDocument44 pagesPeriod Start Time PLMN Name: Voice Call Setup SR (Rrc+Cu) CSSR Ps NRT Rrcblockingcongestioncsdenoo williamNo ratings yet

- DCF ModellDocument7 pagesDCF ModellVishal BhanushaliNo ratings yet

- Assignment 2Document5 pagesAssignment 2Niharika Pradhan I H21O32No ratings yet

- Post Task 3, Question 1Document4 pagesPost Task 3, Question 1SHARMAINE CORPUZ MIRANDANo ratings yet

- Excel Workings ITE ValuationDocument19 pagesExcel Workings ITE Valuationalka murarka100% (1)

- Major IndicatorsDocument1 pageMajor IndicatorsShrestha Photo studioNo ratings yet

- Model Answer - DCF (Revised)Document10 pagesModel Answer - DCF (Revised)gourabkumar.mondal23-25No ratings yet

- RatioDocument10 pagesRatioRamana VaitlaNo ratings yet

- Wacc Calculation: All Fig. in Crore (RS) 2006 2007 PAT DEP NWC Inwc CapexDocument65 pagesWacc Calculation: All Fig. in Crore (RS) 2006 2007 PAT DEP NWC Inwc CapexNeeraj BhardwajNo ratings yet

- Ansys, Inc.: Price, Consensus & SurpriseDocument1 pageAnsys, Inc.: Price, Consensus & Surprisederek_2010No ratings yet

- Hoàng Lê Hải Yến-Internal AuditDocument3 pagesHoàng Lê Hải Yến-Internal AuditHoàng Lê Hải YếnNo ratings yet

- Economic and Financial Modelling with EViews: A Guide for Students and ProfessionalsFrom EverandEconomic and Financial Modelling with EViews: A Guide for Students and ProfessionalsNo ratings yet

- 10.1007@s11096 005 6953 6Document5 pages10.1007@s11096 005 6953 6sapphire4uNo ratings yet

- 4 Book Research Methods in Business Studies ADocument45 pages4 Book Research Methods in Business Studies Asapphire4uNo ratings yet

- 1 s2.0 S0739885920301979 MainDocument12 pages1 s2.0 S0739885920301979 Mainsapphire4uNo ratings yet

- Libfile Repository Content Holman, N Holman Effective Strategy Implementation 2013 Holman Effective Strategy Implementation 2012Document33 pagesLibfile Repository Content Holman, N Holman Effective Strategy Implementation 2013 Holman Effective Strategy Implementation 2012sapphire4uNo ratings yet

- Positive Leak Individual Testing Tool - GoodwayDocument2 pagesPositive Leak Individual Testing Tool - GoodwayDedy setiawanNo ratings yet

- Doosan Control Valve (708) (Union)Document14 pagesDoosan Control Valve (708) (Union)Ahsan HaseebNo ratings yet

- 2017 Indonesia Hotel Industry - Survey of OperationsDocument164 pages2017 Indonesia Hotel Industry - Survey of OperationsMyra BomaNo ratings yet

- JPM Guide To Market Q1 2021Document86 pagesJPM Guide To Market Q1 2021Soren K. GroupNo ratings yet

- Kiss Catalog February 2020 WebDocument13 pagesKiss Catalog February 2020 WebSalvador Escobar LopezNo ratings yet

- Datar 17e Accessible Fullppt 05Document29 pagesDatar 17e Accessible Fullppt 05giofani22aktpNo ratings yet

- A Time-Space Dynamic Panel Data Model With Spatial Moving Average Errors PDFDocument53 pagesA Time-Space Dynamic Panel Data Model With Spatial Moving Average Errors PDFGustavo MalagutiNo ratings yet

- ENG 101 Summarizing Practice (LK) (AutoRecovered)Document4 pagesENG 101 Summarizing Practice (LK) (AutoRecovered)moussa772vbixenNo ratings yet

- Typical RC Column Design Calculation SheetDocument1 pageTypical RC Column Design Calculation SheetINIMFON JAMESNo ratings yet

- Quiz Study Unit 9 PDFDocument2 pagesQuiz Study Unit 9 PDFVinny HungweNo ratings yet

- Al Hamra Firdous Tower, Kuwait BMC 6Document23 pagesAl Hamra Firdous Tower, Kuwait BMC 6marmik dholakia100% (1)

- Bill of Quantities Watershed Civil WorksDocument161 pagesBill of Quantities Watershed Civil WorksMolapo HlasoaNo ratings yet

- PSEZsDocument5 pagesPSEZsinfooncoNo ratings yet

- Chapter 14 Practice QuestionsDocument12 pagesChapter 14 Practice QuestionsAbigail CubasNo ratings yet

- Executive Branch Personnel Public Financial Disclosure Report (OGE Form 278e)Document18 pagesExecutive Branch Personnel Public Financial Disclosure Report (OGE Form 278e)Washington ExaminerNo ratings yet

- February 7, 2020: Republic of The Philippines City Government of Kabankalan City Legal Office 6111, Negros OccidentalDocument3 pagesFebruary 7, 2020: Republic of The Philippines City Government of Kabankalan City Legal Office 6111, Negros OccidentalfortunecNo ratings yet

- Cost HeetDocument4 pagesCost HeetYuvnesh KumarNo ratings yet

- Investment Banking ProjectDocument29 pagesInvestment Banking ProjectAkshay BoteNo ratings yet

- Finishing Section SOPDocument3 pagesFinishing Section SOPAbdul AzizNo ratings yet

- C2006-002 AnnexBDocument2 pagesC2006-002 AnnexBBAUTISTA, ALLAN LESTHER L.No ratings yet

- Accounting - Partnership - and - Investing Bsa11111Document4 pagesAccounting - Partnership - and - Investing Bsa11111Koleen LalapNo ratings yet

- bl.117930956 204130348 BAN 11292023033355.outputDocument5 pagesbl.117930956 204130348 BAN 11292023033355.outputTony GarciaNo ratings yet

- Cable Termincal Brass Lugs Brass Sheet Terminal Jumper Cables CatalogueDocument79 pagesCable Termincal Brass Lugs Brass Sheet Terminal Jumper Cables Catalogueomarmendozaespacio10No ratings yet

- Impacts of Rail Transit Access On Land and Housing Values in China A Quantitative SynthesisDocument18 pagesImpacts of Rail Transit Access On Land and Housing Values in China A Quantitative SynthesisAditya PitaleNo ratings yet

- Ks 409 - Itc Kohenur Mar-24Document1 pageKs 409 - Itc Kohenur Mar-24laxmanrana9985No ratings yet