Professional Documents

Culture Documents

The Commissioner of Income Tax Vs Darabsha Nasarwanji Mehta On 22 August 1934

Uploaded by

ShafeyAliKhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Commissioner of Income Tax Vs Darabsha Nasarwanji Mehta On 22 August 1934

Uploaded by

ShafeyAliKhanCopyright:

Available Formats

The Commissioner Of Income-Tax vs Darabsha Nasarwanji Mehta on 22 August, 1934

Bombay High Court

The Commissioner Of Income-Tax vs Darabsha Nasarwanji Mehta on 22 August, 1934

Equivalent citations: (1935) 37 BOMLR 112, 159 Ind Cas 41

Author: K John Beaumont

Bench: J Beaumont, Kt., Sen

JUDGMENT John Beaumont, Kt., C.J.

1. This is a reference made by the Commissioner of Income-tax on his motion under Section 66(1) of

the Indian Income-tax Act, 1922, in which he raises two questions, the first one being, in effect,

whether Section 24B, which was added to the Indian Income-tax Act by the Indian Income-tax

(Second Amendment) Act of 1933, has retrospective effect so as to apply to the case of a person

dying before the Amendment Act was passed, and, secondly, whether, if the Amendment Act has

retrospective effect, the Commissioner was justified in taking action against the assessee under

Section 34 of the Indian Income-tax Act.

2. It was held by this Court in Commissioner of Income-tax v. Reid (1930) I.L.R. 55 Bom. 312 : S.C.

33. Bom. L.R. 388 (Proctor's case), which was decided at the end of the year 1930, that where a

person dies after the commencement of the financial year, but before his income has been assessed

for the purpose of income-tax, his estate is not liable to pay the tax. The Amendment Act was passed

on September 11, 1933, no doubt, with a view to removing the difficulties pointed out in that case.

3. In the present case the only material facts are that on April 20, 1932, a notice was served on Bai

Avabai N. Mehta under Section 22 (2) of the Indian Income-tax Act requiring her to make a return

in respect of her income for the year 1932-33. She died on May 6, 1932, before any return had been

made, and the question which arises is whether her estate is liable for the tax in respect of the year

1932-33 under the provisions of the Amendment Act, she having died before the Act was passed.

Section 11 of the Amendment Act provides that after Section 24 of the principal Act, "the following

sections shall be inserted, namely." Of the section so inserted, Section 24B is the material one for the

present purpose. That provides in Sub-section (1) that-

Where a person dies, his executor, administrator or other legal representative shall be liable to pay

out of the estate of the deceased person to the extent to which the estate is capable of meeting the

charge the tax assessed as payable by such person, or any tax which would have been payable by

'him under this Act if he had/ not died.

4. Then Sub-sections (2) and (3) deal with methods of assessment, and for the present purpose it is

only necessary to notice that each sub-section commences with the words, "Where a person dies".

The view taken by the Commissioner is that the principal Act charges tax upon the deceased, and

that the Amendment Act merely provides the machinery for making the charge effective, so that

once the machinery is there, the tax charged can be collected, whatever the date of the death of the

deceased. It is, I think, correct to say that Section 3 of the principal Act charges the tax upon every

one coming within the purview of the Act who was alive at the beginning of the financial year, but in

the case of a person dying before assessment, that liability was inchoate only, and crystallized into

an enforceable liability for the first time on the passing of the Amendment Act. It is, therefore, not

Indian Kanoon - http://indiankanoon.org/doc/276591/ 1

The Commissioner Of Income-Tax vs Darabsha Nasarwanji Mehta on 22 August, 1934

quite accurate to say that the Amendment Act merely deals with machinery ; it does for the first time

impose an enforceable liability. The principle which must always be applied in construing a taxing

Act is that the Government must show that the tax sought to be recovered has been imposed in

language which admits of no reasonable doubt. The opening words of each sub-section to Section

24B, "Where a person dies", though the use of the present tense is not altogether appropriate on any

reading of the Act, seem to me more appropriate to future than to past deaths. If the Legislature had

intended the Act to have a retrospective effect, it would have been very easy to have said, "dies

whether before or after the passing of this Act". Inconvenience and hardship might be caused by

making the tax payable put of an estate which has been distributed on the basis of the then existing

law. The Advocate General has relied on Section 19 of the Amendment Act, which introduces into

the principal Act Section 49B, under which a refund may be claimed by the personal representative

of a deceased person who was entitled to such refund, and he suggests that Sections 24B and 49B

should be read together and both given retrospective effect. But even if the latter section applies to a

death before the Act came into force, it does not, I think, follow that we should give a similar

meaning to Section 24B. In my opinion the Legislature has not shown with sufficient clearness an

intention to make Section 24B retrospective, and I think, therefore, we must answer the first

question in that sense.

5. The second question in terms does not arise, but as the subject has been discussed in argument,

and the Advocate General has invited the Court to give some guidance upon it to the Commissioner,

I would say that had I been of opinion that Section 24B was retrospective, I should still have thought

that Section 34 had no application in the present case. Sub-section (7) of Section 24B makes the

estate of a deceased person liable for tax under two heads, first, for tax assessed as payable by such

person, and, secondly, for any tax which would have been payable by him under the Indian

Income-tax Act if he had not died. It is not easy to see what tax falls under that second head, because

the deceased would not have become liable for tax merely by continuing to live ; it would have been

necessary to make an assessment of his income. However, whatever the meaning of Sub-section (1)

may be, the construction of Sub-sections (2) and (3) (to my mind presents no difficulty. Sub-section

(2) deals with the case of the deceased person not having been served with a notice under sub-s, (2)

of Section 22, or Section 34, as the case may be, the latter section coming into operation where there

has been an assessment upon the deceased under Section 22(2), but some income has escaped

assessment, so that if the deceased had lived he would have received a notice under Section 34. In

either of those events the sub-section in effect provides that the Income-tax Officer can serve the

appropriate notice on the personal representative, and then proceed to assess the total income of the

deceased person as if such representative were the assessee. Then Sub-section (3) ; deals with the

case in which a notice has been served on the deceased under Sub-section (2) of Section 22, and the

notice has either not been complied with at all, or has been complied with imperfectly. In either of

those events the Income-tax Officer can make an assessment of the total income of the deceased

person, and determine the tax payable by him on the basis of such assessment, and he can call for

the production of accounts and documents or other evidence from the personal representative. That

is the sub-section which would have applied to this case if we had thought that the Act had

retrospective effect, because the deceased had been served with a notice under Sub-section (2) of

Section 22 and had not complied with it. But if the estate of the deceased is assessed either under

Sub-section (2) or Sub-section (3) of Section 24B, I do not myself follow how, at any rate in a normal

Indian Kanoon - http://indiankanoon.org/doc/276591/ 2

The Commissioner Of Income-Tax vs Darabsha Nasarwanji Mehta on 22 August, 1934

case, there is any occasion to introduce the provisions of Section 34, because the estate has not

escaped assessment, but has been assessed under the Amendment Act.

6. We, therefore, answer Question No. 1 by declaring that the provisions of Section 24B introduced

by the Amendment Act apply only to cases in which death took place later than midnight on

September 1C), 1933. Question No. 2 does not arise. There will be no order as to costs. I have

assumed that the reference in the Commissioner's questions to Section 24B(2) was a slip, and that it

was intended to refer to Section 24B.

Sen, J.

7. It seems to me that the questions referred to us have not been accurately framed. The provisions

of Sub-section (2) of Section 24B do not appear applicable to the facts of this case. Here admittedly

the deceased was served with a notice before she died, and Sub-section (2) provides for the case in

which a person dies before he is served with a notice under Sub-section (2) of Section 22 or Section

34, as the case may be. It is true that after Avabai's death action purporting to be under Section 34

has been taken by the Income-tax authorities, and that no notice was sent to Avabai under Section

34, but I am of opinion that in the circumstances of this case no action under Section 34 was called

for. It, therefore, seems that this was a case falling under sub-s, (3) of Section 24B, which provides

for the case in which a person dies without having furnished a return which he has been required to

furnish under the provisions of Sub-section (2) of Section 22. This Court has already held in the case

of Commissioner of Income-tax, Bombay Presidency v. The National Mutual Life Association of

Australasia, Ltd. (1931) I.L.R. 55 Bom. 637 : S.C. 33 Bom. L.R. 807, that the High Court has power

under Section 66(5) to amend questions asked by the Commissioner, and after raising the real

question to answer it. We accordingly substitute Section 24B for Section 24B(2) in the two questions

referred to us. Question No. 1 referred to us amounts to this. Does Section 24B apply to the estate of

a person who died prior to the date of the enactment of the said section, viz., September 11, 1933, in

other words, has the new section retrospective operation ? It was held in Commissioner of

Income-tax v. Reid (1930) I.L.R. 55 Bom. 312 : S.C. 33 Bom. L.R. 388 that if in a case of this nature a

charge was created on the income under Section 3 of the Act, the requisite machinery for assessment

and collection of the tax charged was wanting in the Act. The new section has apparently been

enacted with the object of providing such machinery. It purports to create a liability to pay the

charges arising under Section 3. It is a well-settled rule of law that all charges upon the subject must

be imposed by clear and unambiguous language, though such an Act is not to be so construed as to

furnish a chance of escape and means of evasion : see Maxwell on Interpretation of Statutes, 7th

Edn., pp. 246 and 248. The liability to pay created by the new section must be construed as a new

"charge upon a subject" ; and it does not appear to me that the language of Section 24B is altogether

free from ambiguity. All the sub-sections of the said section begin with the words, "Where a person

dies". This is capable of meaning, " where a person has died before the date of this amendment or

shall die thereafter" as well as "Where a person shall die on this section becoming part of the Act". It

was held in In re Amumney [1898] 2 Q.B. 547 (p. 555) :-

Perhaps no rule of construction is more firmly established than this-that a retrospective operation is

not to be given to a statute so as to impair an existing right or obligation, otherwise than as regards

Indian Kanoon - http://indiankanoon.org/doc/276591/ 3

The Commissioner Of Income-Tax vs Darabsha Nasarwanji Mehta on 22 August, 1934

matter of procedure, unless that effect cannot be avoided without doing violence to the language of

the enactment. If the enactment is expressed in language which is fairly capable of either

interpretation, it ought to be construed as prospective only.

8. This rule applies to statutes. The new section was inserted into the Act by an amending Act, but I

see no reason why the same rule should not apply to an amending Act. It seems to me that if the

Legislature had intended that the new section should have a retrospective operation, it would have

taken care to indicate such intention in express terms. In my view, therefore, the new section has no

retrospective effect, and the answer to Question No. 1 will be : the provisions of Section 24B of the

Act apply only to those cases in which the person, the liability of whose executor, administrator or

other legal representative is in question, has died when Section 24B came into operation or at any

time thereafter.

9. In view of the above answer, Question No. (2) does not arise, but I may point out that the learned

Commissioner himself is doubtful whether it can be said that any income escaped assessment within

the meaning of Section 34 of the Act. The year concerns the financial year 1932-33 after a notice had

been issued to Avabai under Section 22(2) of the Act calling upon her to submit a return of income

showing her income for the preceding year. She died on May 6, and the administrator of her estate

furnished a return of income. In view of the decision in The Commissioner of Income-tax, Bombay

v. Reid, the Income-tax Officer dropped further proceedings. It seems to me quite clear that this was

not a case of escape from assessment; it was a case of non-assessment, but the assessee or the

administrator did nothing to escape assessment.

Indian Kanoon - http://indiankanoon.org/doc/276591/ 4

You might also like

- P L D 1993 Supreme Court 473 (Nawaz Sharif Vs Presidient of PakistanDocument435 pagesP L D 1993 Supreme Court 473 (Nawaz Sharif Vs Presidient of PakistanShafeyAliKhanNo ratings yet

- 2015 P T D (TribDocument28 pages2015 P T D (TribShafeyAliKhanNo ratings yet

- PLJ 1996 SC 831Document26 pagesPLJ 1996 SC 831ShafeyAliKhanNo ratings yet

- Income Tax Act 1922Document520 pagesIncome Tax Act 1922ShafeyAliKhanNo ratings yet

- Jmacgreg,+journal+manager,+4296 Vol018 003Document9 pagesJmacgreg,+journal+manager,+4296 Vol018 003ShafeyAliKhanNo ratings yet

- High Gloss Catalogue High ResDocument42 pagesHigh Gloss Catalogue High ResShafeyAliKhanNo ratings yet

- Table of Standards: Approvals / CertificationsDocument4 pagesTable of Standards: Approvals / CertificationsShafeyAliKhanNo ratings yet

- Past Papers AnalysisDocument2 pagesPast Papers AnalysisShafeyAliKhanNo ratings yet

- Member List: S.No. Name Tenure Party ProvinceDocument4 pagesMember List: S.No. Name Tenure Party ProvinceShafeyAliKhanNo ratings yet

- Supplement To The Auditing FrameworkDocument4 pagesSupplement To The Auditing FrameworkShafeyAliKhanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Thunderbird Pilipinas Hotels V CIR (CTA 7902, July 18 2012)Document29 pagesThunderbird Pilipinas Hotels V CIR (CTA 7902, July 18 2012)Firenze PHNo ratings yet

- Sources of Taxation LawDocument14 pagesSources of Taxation LawTabinda SeherNo ratings yet

- Basic Concepts: Direct Tax Indirecttax GST Customs Miscellaneous Other Taxes Income TaxDocument227 pagesBasic Concepts: Direct Tax Indirecttax GST Customs Miscellaneous Other Taxes Income TaxRaj DasNo ratings yet

- 13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestDocument1 page13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestHarleneNo ratings yet

- 12 Chapter 4Document102 pages12 Chapter 4Anonymous reIq4DHr2No ratings yet

- Bengzon Vs Senate Blue Ribbon CommitteeDocument16 pagesBengzon Vs Senate Blue Ribbon CommitteeDon DenamarcaNo ratings yet

- Chapter 8 VDocument28 pagesChapter 8 VAdd AllNo ratings yet

- Tax Planning Opportunities in 2012Document1 pageTax Planning Opportunities in 2012api-159688575No ratings yet

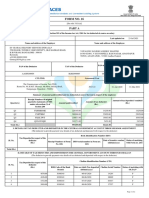

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Amit KumarNo ratings yet

- O o o o o O: Who Are Required To File Income Tax Returns?Document8 pagesO o o o o O: Who Are Required To File Income Tax Returns?Aliyah SandersNo ratings yet

- 2020 PTD 1662Document4 pages2020 PTD 1662Riaz HafeezNo ratings yet

- Project Topics 2019Document4 pagesProject Topics 2019sourabh rajpurohitNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- Assignment On Income From House PropertyDocument17 pagesAssignment On Income From House PropertySandeep ChawdaNo ratings yet

- Fifth Semester Papers (Three Papers Are Compulsory and Two Electives From Any One of The Groups I.E. Either From Marketing or HRM or Finance)Document30 pagesFifth Semester Papers (Three Papers Are Compulsory and Two Electives From Any One of The Groups I.E. Either From Marketing or HRM or Finance)Sanjeev PratapNo ratings yet

- BComCS Syll 06onwardsDocument27 pagesBComCS Syll 06onwardsJagadesh BabuNo ratings yet

- MBA Project TOCDocument3 pagesMBA Project TOCAnuj SecondNo ratings yet

- Module 2 - Income Taxes For Individuals - Lecture NotesDocument52 pagesModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- Lecture-3 On Classification of IncomeDocument14 pagesLecture-3 On Classification of Incomeimdadul haqueNo ratings yet

- Taxation ProjectDocument15 pagesTaxation ProjectTanya SinglaNo ratings yet

- Corporate Income TaxationDocument3 pagesCorporate Income TaxationKezNo ratings yet

- Fin 623 Quiz # 04 Mega File Solved by AfaaqDocument35 pagesFin 623 Quiz # 04 Mega File Solved by AfaaqShahaan Zulfiqar100% (2)

- Doc. Code: SLSU-QF-IN01-B Revision: 00 Date: 29 July 2019Document13 pagesDoc. Code: SLSU-QF-IN01-B Revision: 00 Date: 29 July 2019Erna Mae AlajasNo ratings yet

- Income Tax CalculatorDocument8 pagesIncome Tax CalculatorbabulalseshmaNo ratings yet

- Acca TX Uk Fa 2021 Manual Notes.Document65 pagesAcca TX Uk Fa 2021 Manual Notes.Max Lino PayyampallilNo ratings yet

- Who Are Required To File Income Tax ReturnsDocument2 pagesWho Are Required To File Income Tax ReturnsJieLexie NollorNo ratings yet

- ACCA Paper F6 (UK) : NotesDocument60 pagesACCA Paper F6 (UK) : NotesJean d'Amour FurahaNo ratings yet

- Lex in MotionDocument2 pagesLex in MotionMark Jeff Cleofe0% (1)

- Minutes of Board of Directors Meeting 2Document3 pagesMinutes of Board of Directors Meeting 2Multiplan RINo ratings yet

- Up Taxation Law Reviewer 2017 PDFDocument267 pagesUp Taxation Law Reviewer 2017 PDFManny Aragones100% (3)