Professional Documents

Culture Documents

Ac - Far Module 03

Uploaded by

Julieann FavoritoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ac - Far Module 03

Uploaded by

Julieann FavoritoCopyright:

Available Formats

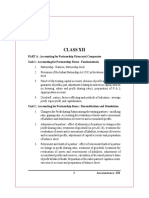

MODULE Accounting for Partnership

03

Overview Learning Outcomes

This module tackles the different requirements

At the end of this module, the student should be able

needed to form a partnership. Also, it covers the

to:

measurements and valuations of partners’ initial

3.1 Discuss the requirements in the partnership

investments to the partnership. This module

formation

discusses how to account the partnership

3.2 Discuss the accounting for partners’ initial

formation given the different cases and scenarios.

investments in a partnership

It also covers the accounting for capital shares that

3.3 Discuss the accounting for partner’s assets

is more than or less than the capital contributed

contribution that has attached liabilities

by the partner.

3.4 Discuss how to account the partnership

formation in different scenarios.

3.5 Discuss the accounting for capital share different

from capital contribution

Requirements

Partnership Contract – The written agreement between or among the partners

governing the formation, operation and dissolution of the partnership is referred to as Learning Outcomes

the Articles of Co-Partnership.

3.1 Discuss the

The Articles of Co-Partnership contains the following: requirements in the

1. The name of the partnership partnership formation

2. The names and addresses of the partners, classes of partners, stating whether the

partner is general or limited partner

3. The effective date of the contract

4. The purpose or purposes and principal office of the business

5. The capital of the partnership stating the contributions of individual partners, their description and agreed values

6. The right and duties of each partner

7. The manner of dividing net income or loss among the partners, including salary allowance and interest on capital

8. The conditions under which the partners may withdraw money or other assets for personal use

9. The manner of keeping the books of accounts

10. The causes for dissolution

11. The provision for arbitration in settling disputes

Organizing a partnership – Before a partnership can operate legally, it has to comply first with certain registration

requirements which is summarized as follows:

1 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

Place of Registration Requirements for Registration Certificates Issued

Securities and Exchange Articles of Co-Partnership SEC Certificate

Commission Filled SEC Registration form

Department of Trade and Articles of Co-Partnership Certificate of Registration of Business Name

Industry SEC Certificate

City or Municipal Mayor’s Certificate of Registration of Mayor’s Permit and License to Operate

Office Business Name

Bureau of Internal Articles of Co-Partnership BIR registration No.

Revenue SEC Certificate Partnership’s Tax Identification Number

Registration of books, invoices, and official receipts

Social Security System Filled SSS Application form SSS Certificate of Membership

List of employees SSS Employer ID Number

Philippine Health SEC Registration PhilHealth Employer Number

Insurance Corporation Employer Data Record PhilHealth Certificate of Registration

Business Permit or License PhilHealth Identification Number

Member Data Record

Pag-IBIG Fund Articles of Co-Partnership Pag-IBIG Fund Certificate of Membership

SEC Certificate Pag-IBIG Fund Employer ID Number

Initial Investments

1. Amount of contribution – The amount of contribution shall be based on the

Learning Outcomes

partners’ agreement.

3.2 Discuss the

a. With agreement on individual contribution accounting for

Example 1: On July 1, 2020, A and B form a partnership with a total agreed partners’ initial

capitalization of P100,000 to be contributed in cash of 60% and 40% by A and B, investments in a

respectively.

To record the contribution of each partner

GENERAL JOURNAL

Page: GJ-01

Date Particulars PR Debit Credit

July 01 Cash Php 60,000.00

A, Capital Php 60,000.00

To record the initial investment of A

01 Cash 40,000.00

B, Capital 40,000.00

To record the initial investment of B

NOTE that there is a separate capital account as well as withdrawal account for each partner. The journal entries are

the same as journal entries for the investment by a sole proprietorship

b. Without agreement on individual partner’s contribution

Example 2: On July 1, 2020, A and B form a partnership with a total agreed capitalization of P100,000 to be

contributed in cash.

2 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

To record the contribution of each partner

GENERAL JOURNAL

Page: GJ-01

Date Particulars PR Debit Credit

July 01 Cash Php 50,000.00

A, Capital Php 50,000.00

To record the initial investment of A

01 Cash 50,000.00

B, Capital 50,000.00

To record the initial investment of B

NOTE that in the absence of any agreement, it shall be contributed equally.

2. Valuation of partners’ contribution

a. Cash contribution – If the contribution is in the form of cash, the amount to be recognized is the FACE VALUE of

cash

b. Non-cash contribution – If the contribution is in the form of property, it shall be recorded at AGREED VALUE for

the property; otherwise, it shall be recorded at the FAIR VALUE of the property to effect fair and equitable

valuation

NOTE that industry contribution is recorded in memorandum entry from.

Assets Contribution with Attached Liabilities

a. Liabilities to be assumed by the partnership

Example 3: C and D decided to formed a partnership on July 1, 2020. C contributed assets and liabilities agreed to be

assumed by the partnership, as follows:

COST AGREED VALUE FAIR VALUE Learning Outcomes

Machine Php 200,000 Php 180,000

3.3 Discuss the accounting

Furniture and fixtures 100,000 Php 140,000

for partner’s assets

Notes payable 50,000 50,000

contribution that has

To record the contribution of C. attached liabilities

GENERAL JOURNAL

Page: GJ-01

Date Particulars PR Debit Credit

July 01 Machine Php 180,000.00

Furniture and fixture 140,000.00

Notes payable Php 50,000.00

C, Capital 270,000.00

To record the initial investment of C

Observe that the liability together with the assets is recorded by the partnership.

3 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

b. Liabilities not assumed by the partnership

Example 4: C and D decided to formed a partnership on July 1, 2020. C contributed assets but liabilities agreed not

to be assumed by the partnership, as follows:

COST AGREED VALUE FAIR VALUE

Machine Php 200,000 Php 180,000

Furniture and fixtures 100,000 Php 140,000

Notes payable 50,000 50,000

To record the contribution of C.

GENERAL JOURNAL

Page: GJ-01

Date Particulars PR Debit Credit

July 01 Machine Php 180,000.00

Furniture and fixture 140,000.00

C, Capital Php 320,000.00

To record the initial investment of C

Observe that the liability is no longer recorded because the partnership does not assume or does not agreed to pay

this liability.

Accounting for Partnership Formation

a. Individuals Without Existing Business – This formation of partnership Learning Outcomes

composing two or more individuals who does not have existing businesses. To

account this formation, simply record their individual investments to the 3.4 Discuss how to account the

partnership just like the previous examples. partnership formation in

different scenarios.

b. Conversion of Sole Proprietorship to Partnership – This formation of partnership is composed of one sole proprietor

or individual who has an existing business, and an individual.

This is accounted for by following the procedures:

1. Close the nominal accounts of the sole proprietorship business.

2. Record the adjustments of the assets and liabilities directly to the proprietor’s capital account

3. Close the books of the sole proprietorship.

4. Open the new set of partnership books by recording the partners’ contribution.

Example 5: E and F formed a partnership on July 1, 2020, wherein E is to contribute cash while F is to transfer the

assets and liabilities of his business. Account balances on the books of F are as follows:

Debit Credit

Cash 30,000

Accounts receivable 45,000

Inventories 24,000

Accounts payable 9,000

F, capital 90,000

4 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

The partners agreed on the following conditions:

1. An allowance for uncollectible accounts of Php 2,200 is to be established.

2. The inventories are to be valued at their current replacement cost of Php 27,000.

3. Prepaid expenses of Php 1,200 and accrued expenses of Php 500 are to be recognized.

4. F is to be credited for an amount equal to the net assets transferred.

5. E is to contribute sufficient cash to have an equal interest in the partnership.

Step 1: Adjust and close the books of the proprietor F to agreed values.

GENERAL JOURNAL

Page: GJ-10

Date Particulars PR Debit Credit

July 01 F, Capital Php 2,200.00

Allowance for uncollectible accounts Php 2,200.00

01 Inventories 3,000.00

F, Capital 3,000.00

01 Prepaid expenses 1,200.00

Accrued expenses 500.00

F, Capital 700.00

01 F, Capital 91,500.00

Accrued expenses 500.00

Accounts payable 9,000.00

Allowance for uncollectible accounts 2,200.00

Cash 30,000.00

Accounts receivable 45,000.00

Inventories 27,000.00

Prepaid expenses 1,200.00

To close the books of F

Observe that just for illustration, the explanations are ignored for those adjusting entries. Also, the capital balance of

F after the three adjusting entries amounted to Php 91,500.

Step 2: Record the investments of the partners to the new books.

GENERAL JOURNAL

Page: GJ-10

Date Particulars PR Debit Credit

July 01 Cash Php 30,000.00

Accounts receivable 45,000.00

Inventories 27,000.00

Prepaid expenses 1,200.00

Allowance for uncollectible accounts Php 2,200.00

Accounts payable 9,000.00

Accrued expenses 500.00

F, Capital 91,500.00

5 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

To record the investment of F

Cash 91,500.00

E, Capital 91,500.00

To record the investment of E

c. Two or More Sole Proprietorship Forming Partnership – This formation of partnership is composed of two or more

individuals both having separate existing businesses. To account this formation, follow the procedures mentioned

above on conversion of sole proprietorship to partnership.

Example 6: G and H are both owners of an existing single proprietorship business. They agreed to combine their

businesses into a partnership. They agreed to start with a total capitalization of Php 400,000 to be contributed

equally. They agreed to the following valuation of their business noncash assets:

a. Their receivables are 95% collectible.

b. The inventory has realizable value of Php 30,000.

c. The equipment has a fair value of Php 50,000.

They will invest additional cash if needed to complete their agreed contribution.

The account balances of the sole proprietorship businesses upon formation of GH Partnership is as follows:

G Business H Business

Cash Php 20,000 Php 5,000

Accounts receivable 60,000 45,000

Inventory 25,000

Store equipment 120,000

Accumulated depreciation 30,000

Accounts payable 70,000

G, capital 50,000

G, drawings 5,000

H, capital 125,000

Income summary (debit) (10,000) 15,000

Step 1: Close the nominal accounts of the sole proprietorship business.

Books of G Books of H

G, capital 15,000 Income summary 15,000

G, drawings 5,000 H, capital 15,000

Income summary 10,000

Step 2: Adjust and close the books of the G and H to agreed values.

Books of G Books of H

Inventory 5,000 H, capital 42,250

Accounts receivable 3,000 Accounts receivable 2,250

G, capital 2,000 Accum. Depreciation 40,000

6 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

Books of G Books of H

G, capital 37,000 H, capital 97,750

Accounts payable 70,000 Accum. Depreciation 70,000

Cash 20,000 Cash 5,000

Accounts receivable 57,000 Accounts receivable 42,750

Inventory 30,000 Store equipment 120,000

Step 3: Record the investments of the partners to the new books.

New Books of the Partnership

Cash 183,000

Accounts receivable 57,000

Inventory 30,000

Accounts payable 70,000

G, capital 200,000

To record the investment of G

Cash 107,250

Accounts receivable 42,750

Store equipment 50,000

G, capital 200,000

To record the investment of G

Capital Share Different from Capital

Contribution

Prior to the recording partners’ initial contributions to the partnership, partners must first agree not only on the valuation

of the net asset contributions but also on their capital share. The capital share of each partner is the percentage of equity

that each partner will have in the net assets of the newly formed partnership. Generally, the capital share of each partner

is equal to their capital contribution. However, partners may agree to a division of capital that is not proportionate to their

capital contribution. This is to recognize the intangible factors such as partner’s special expertise, establishing clientele or

necessary business connections. This situation will give rise to allowing bonus on initial investments.

Example 7: I and J formed a partnership by contributing Php 50,000 and Php 60,000, respectively. To record the investment

of the partners under two approaches are as follows:

Learning Outcomes

a. Full investment approach or Actual investment method

Cash Php 110,000 3.5 Discuss the accounting

I, capital Php 50,000 for capital share

J, capital 60,000 different from capital

b. Bonus approach contribution

Using Example 7, assume the partners agreed to have equal capital in the partnership.

Cash Php 110,000

I, capital Php 55,000

J, capital 55,000

In this case, J’s cash contribution amounts to Php 60,000 yet his capital balance equals to Php 55,000. Therefore, he

gives a Php 5,000 bonus to I.

7 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

References

• Advanced Financial Accounting and Reporting, Part 1 (2017). Milan, Z.V. Baguio City: Bandolin Enterprise

• Accounting for Partnership & Corporation (2011). Baysa, G.T., et al.Mandaluyong City: Millenium Books, Inc.

• Valencia, E. (2005). Partnership & Corporation Accounting. Mandaluyong City: Millennium Books, Inc.

Learning Activities

Exercise 1: Discussion Questions

1. Why is it preferable to have a written contract of partnership? What are the contents of a typical partnership

contract?

2. What is the major difference between a general and a limited partnership? How can they be distinguished? When a

partnership is a limited partnership, does the characteristic of “unlimited liability” still apply? Why or why not?

3. Why are capital accounts and drawing accounts opened for each partner?

4. Why is the Accumulated Depreciation account not carried over to the new books of the partnership?

5. Why is the Allowance for Uncollectible Accounts account carried over to the new books of the partnership? How

does this differ from the Accumulated Depreciation?

Exercise 2: Lynleen Co.

Lyn, the owner of a successful fertilizer business felt that it is time to expand operations. Lyn offered to form a

partnership with Leen, the owner of a nearby warehouse. The partnership would be called Lynleen Co. Leen accepted

Lyn’s offer and the partnership was formed on July 1, 2020.

The assets and liabilities of Lyn’s Fertilizer and their agreed valuation on June 30,2020 before the formation of the

partnership are given below:

Book Value Agreed Valuation

Cash Php 229,500 Php 229,500

Accounts receivable 2,103,000 2,103,000

Allowance for doubtful accounts 117,000 167,500

Inventory 1,012,500 900,000

Prepaid rent 29,250 0

Store equipment 390,000 300,000

Accumulated depreciation 97,500 0

Notes payable 330,000 330,000

Accounts payable 505,500 505,500

The partners agreed to share profits and losses equally and decided to invest an equal amount in the partnership. Lyn and

Leen agreed that Leen’s land is worth P500,000 and his building is P1,450,000. Both properties will be contributed by Leen

to the partnership. Leen will also invest additional cash sufficient to make his capital equal to Lyn. The partnership will use

a new set book.

Requirements:

1. Give the adjusting journal entries in books of Lyn.

2. Give the journal entries to record the investment of the partners in the partnership books.

3. Prepare Lynleen Co.’s Statement of Financial Position as of July 1, 2020.

8 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

Exercise 2: JC Partnership

On August 1, 2020, Jon and Christian formed a partnership. Jon is to invest certain business assets at values which are yet

to be agreed upon. He is to transfer business liabilities and is to contribute sufficient cash to bring his total capital to

P210,000, which is 70% of the total capital as had been agreed upon.

Details regarding the book values of Jon’s business assets and liabilities and their corresponding valuation follows:

Book Values Agreed Valuation

Accounts receivable Php 58,000 Php 58,000

Allowance for doubtful accounts 4,200 5,000

Merchandise inventory 98,400 107,000

Store equipment 32,000 32,000

Accumulated depreciation-Store equipment 19,000 16,400

Office equipment 27,000 27,000

Accumulated depreciation-Office equipment 14,200 8,600

Accounts payable 56,000 56,000

Ira agrees to invest cash of 42,000 and merchandise valued at current market price.

Requirements:

1. Give the adjusting journal entries in books of Jon.

2. Give the journal entries to record the investment of the partners in the partnership books.

3. Prepare JC Partnership’s Statement of Financial Position as of August 1, 2020.

Self-Evaluation

What have I learned from this module?

What areas or topics I am having difficulties to understand or comprehend?

What are the questions I have formed after reading this module?

What are the answers to my questions formed above?

9 AC_FAR -FINANCIAL ACCOUNTING AND REPORTING

You might also like

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- (ACC 003 - Fundamentals of Accounting Part 2) Lesson Title: Accounting For Partnerships Lesson Objectives: ReferencesDocument2 pages(ACC 003 - Fundamentals of Accounting Part 2) Lesson Title: Accounting For Partnerships Lesson Objectives: ReferencesRochelle Joyce CosmeNo ratings yet

- Parcor ActgDocument7 pagesParcor Actgoneddd439No ratings yet

- CHP 12Document59 pagesCHP 12Usmän Mïrżä100% (1)

- ACCT 1103: Key Concepts of Partnership FormationDocument6 pagesACCT 1103: Key Concepts of Partnership FormationcooperNo ratings yet

- Bbe 1203 (Intermediate Accounting) - Online Lecture Note On Accounting For Partnerships (Volume 1)Document10 pagesBbe 1203 (Intermediate Accounting) - Online Lecture Note On Accounting For Partnerships (Volume 1)SAMSON OYOO OTUKENENo ratings yet

- Partnership Accounting EssentialsDocument34 pagesPartnership Accounting EssentialsAGBA NJI THOMAS100% (1)

- Partnership Review Mats Lpu No AnswerDocument13 pagesPartnership Review Mats Lpu No Answerjames VillanuevaNo ratings yet

- Partnerships Formation - RevisedDocument10 pagesPartnerships Formation - RevisedBerhanu ShancoNo ratings yet

- Partnership Operations P1Document7 pagesPartnership Operations P1Kyut KoNo ratings yet

- Bonus Ch15Document34 pagesBonus Ch15Yonica Salonga De BelenNo ratings yet

- Chapter 5Document10 pagesChapter 5yosef mechalNo ratings yet

- Chapter 2 - (Philoid-IN)Document47 pagesChapter 2 - (Philoid-IN)Munmun KumarNo ratings yet

- Partnership Accounting BasicsDocument53 pagesPartnership Accounting BasicsPathan KausarNo ratings yet

- Accounting 2 PrelimsDocument3 pagesAccounting 2 PrelimsJohn Alfred Castino100% (1)

- Partnership profit distributionDocument19 pagesPartnership profit distributionpayal sachdevNo ratings yet

- 1 Accounting For Partnership - Basic Cionsiderations and FormationDocument83 pages1 Accounting For Partnership - Basic Cionsiderations and FormationJean Rae RemiasNo ratings yet

- Partnership Accounting BasicsDocument51 pagesPartnership Accounting BasicsJackson SidharthNo ratings yet

- Partnership Accounting: Learning ObjectivesDocument31 pagesPartnership Accounting: Learning ObjectivesnuggsNo ratings yet

- Partnership OperationsDocument16 pagesPartnership OperationsobaldefrenchNo ratings yet

- PartnershipDocument447 pagesPartnershipSajid Ali100% (2)

- Financial Acccounting 1-1 PartnershipDocument26 pagesFinancial Acccounting 1-1 PartnershipIvan De QuirosNo ratings yet

- TS - Grewal - DEBK - Class - XII - Vol. - 1 - NPO - and - Partnership - Chapter - 2 - Fundamentals 3 PDFDocument100 pagesTS - Grewal - DEBK - Class - XII - Vol. - 1 - NPO - and - Partnership - Chapter - 2 - Fundamentals 3 PDFVinay Naraniwal100% (3)

- Accounting For Partnership: Basic ConceptsDocument47 pagesAccounting For Partnership: Basic Concepts12B 25 Ribhav SethiNo ratings yet

- Advacc 1Document11 pagesAdvacc 1Jasmine PeraltaNo ratings yet

- Partnership Accounting ModuleDocument45 pagesPartnership Accounting ModuleRonalie Alindugan100% (3)

- Partnership Theories - OperationsDocument90 pagesPartnership Theories - OperationsBrIzzyJ100% (1)

- CPU - Financial Acctg & Reporting II - CHAPTER 2Document25 pagesCPU - Financial Acctg & Reporting II - CHAPTER 2Princess Jonabelle BaylonNo ratings yet

- Partnerships: Formation, Operation and Ownership ChangesDocument17 pagesPartnerships: Formation, Operation and Ownership ChangesSyifa MuthmainnahNo ratings yet

- Accounting For PartnershipDocument59 pagesAccounting For Partnershipanaveed605_4256569110% (1)

- Accounting For Partnership: Basic ConceptsDocument51 pagesAccounting For Partnership: Basic ConceptsVijay ShekarNo ratings yet

- Partnership Accounting BasicsDocument83 pagesPartnership Accounting BasicsLheia Micah De CastroNo ratings yet

- AA Chap1 Basic ConsiderationsDocument60 pagesAA Chap1 Basic ConsiderationsArly Kurt TorresNo ratings yet

- MODULE 2 - Partnership AccountingDocument14 pagesMODULE 2 - Partnership AccountingEdison Salgado CastigadorNo ratings yet

- Partnership Accounting ModuleDocument15 pagesPartnership Accounting ModuleMon RamNo ratings yet

- Accounting for PartnershipDocument302 pagesAccounting for Partnershipaddicted aNo ratings yet

- Chap 1 PDFDocument302 pagesChap 1 PDFRhayden Doguiles100% (1)

- 12 Accountancy Eng SM 2024 PDFDocument464 pages12 Accountancy Eng SM 2024 PDFShivansh JaiswalNo ratings yet

- Accounting for partnershipsDocument51 pagesAccounting for partnershipsKhyla De LaraNo ratings yet

- Partnership Accounting Chapter SummaryDocument31 pagesPartnership Accounting Chapter SummaryJason Cabrera0% (1)

- Accountancy 12 English Main PDFDocument173 pagesAccountancy 12 English Main PDFAshu SinghNo ratings yet

- 01 PartnershipDocument27 pages01 PartnershipEarl ENo ratings yet

- Accounting for Partnership FundamentalsDocument101 pagesAccounting for Partnership FundamentalsHeer SirwaniNo ratings yet

- Partnership - I: "Your Online Partner To Get Your Title"Document10 pagesPartnership - I: "Your Online Partner To Get Your Title"Arlene Diane OrozcoNo ratings yet

- Chapter 2Document51 pagesChapter 2prathibakb0% (1)

- Advacc NotesDocument11 pagesAdvacc Notesthirdyear83No ratings yet

- Afar NotesDocument6 pagesAfar NotesGio BurburanNo ratings yet

- PARTNERSHIPDocument7 pagesPARTNERSHIPoneddd439No ratings yet

- Partnership FormationDocument46 pagesPartnership FormationBerna MortejoNo ratings yet

- Special TransactionsDocument3 pagesSpecial TransactionsTracy AguirreNo ratings yet

- 2-Ch. (Partnership Firm-Basic Concepts (Ver.-5)Document51 pages2-Ch. (Partnership Firm-Basic Concepts (Ver.-5)VP SengarNo ratings yet

- Accounting For Partnership: Part 2Document15 pagesAccounting For Partnership: Part 2Lady Fe DielNo ratings yet

- Partnership Accounting BasicsDocument35 pagesPartnership Accounting BasicsERICK MLINGWA50% (4)

- 2. Accounting for Partnership Firms - Fundamentals (2)Document107 pages2. Accounting for Partnership Firms - Fundamentals (2)Neerja KaushikNo ratings yet

- Mod 1 FullDocument42 pagesMod 1 FullZAIL JEFF ALDEA DALENo ratings yet

- Module 1 - Advacc 1Document10 pagesModule 1 - Advacc 1Andrea Lyn Salonga CacayNo ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet