Professional Documents

Culture Documents

REYES v. ALMANZOR (TAX)

REYES v. ALMANZOR (TAX)

Uploaded by

Bernice DumaoangCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

REYES v. ALMANZOR (TAX)

REYES v. ALMANZOR (TAX)

Uploaded by

Bernice DumaoangCopyright:

Available Formats

JOSE B. L. REYES and EDMUNDO A. REYES vs.

PEDRO ALMANZOR

196 SCRA 322

FACTS:

Petitioners Edmundo and Milagros Reyes are owners of parcels of land situated in Manila, which are

leased to tenants who pay monthly rentals not exceeding P300. In, 1972, PD 20 amended R.A. No.

6359 by making absolute the prohibition to increase monthly rentals below P300, among others.

Consequently, the Reyeses, were precluded from raising the rentals. In 1973, City Assessor of Manila

re-classified and reassessed the value of Reyeses’ properties. The revision entailed an increase in the

corresponding tax rates prompting petitioners to file a Memorandum of Disagreement with the Board of

Tax Assessment Appeals. They averred that the reassessments made were "excessive, unwarranted,

inequitable, confiscatory and unconstitutional" considering that the taxes imposed upon them greatly

exceeded the annual income derived from their properties. They argued that the “income approach”

should have been used in determining the land values instead of the “comparable sales approach”. The

Board of Tax Assessment Appeals, however, considered the assessments valid. The Central Board of

Assessment Appeals affirmed the decision.

ISSUE:

Whether or not the Board erred in adopting the "comparable sales approach" method in fixing the

assessed value of appellants' properties

HELD:

Yes. While respondent Board admits that the “income approach’ is used in determining land values, it

maintains that when income is affected by some sort of price control, the same is rejected in the

consideration and study of land values, for they do not project the true market value in the open market.

Thus, respondents opted instead for the "Comparable Sales Approach".

Ironically, not even the factors determinant of the assessed value of subject properties under the

"comparable sales approach" were presented by the public respondents, namely: (1) that the sale must

represent a bonafide arm's length transaction between a willing seller and a willing buyer and (2) the

property must be comparable property. Nothing can justify their view as it is of judicial notice that for

properties covered by P.D. 20 especially during the time in question, there were hardly any willing

buyers. As a general rule, there were no takers so that there can be no reasonable basis for the

conclusion that these properties were comparable with other residential properties.

Taxes are the lifeblood of the government and so should be collected without unnecessary hindrance.

However, such collection should be made in accordance with law as any arbitrariness will negate the

very reason for government itself. It is therefore necessary to reconcile the apparently conflicting

interests of the authorities and the taxpayers so that the real purpose of taxations, which is the

promotion of the common good, may be achieved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Retainer or EmploymentDocument1 pageRetainer or EmploymentBernice DumaoangNo ratings yet

- Nature of Client-RelationshipDocument1 pageNature of Client-RelationshipBernice DumaoangNo ratings yet

- Limitations On Right To CriticizeDocument1 pageLimitations On Right To CriticizeBernice DumaoangNo ratings yet

- A Lawyer Shall Not Invite Judicial InterferenceDocument1 pageA Lawyer Shall Not Invite Judicial InterferenceBernice DumaoangNo ratings yet

- Trial & JudgmentDocument27 pagesTrial & JudgmentBernice DumaoangNo ratings yet

- IPRA LawDocument34 pagesIPRA LawBernice DumaoangNo ratings yet

- Conflict of Laws Notes Main Reference AgDocument40 pagesConflict of Laws Notes Main Reference AgBernice DumaoangNo ratings yet

- Republic Act No. 7610 Amended by 7658 and 9231, and Art 137-138.Document10 pagesRepublic Act No. 7610 Amended by 7658 and 9231, and Art 137-138.Bernice DumaoangNo ratings yet

- Agrarian Law ReviewerDocument6 pagesAgrarian Law ReviewerBernice DumaoangNo ratings yet

- GGHDocument39 pagesGGHAlinaida MKNo ratings yet

- Dangerous Drugs CasesDocument22 pagesDangerous Drugs CaseseibasNo ratings yet

- InvestigationDocument95 pagesInvestigationPAULOMI DASNo ratings yet

- La Paz Ice Plant v. John BordmanDocument1 pageLa Paz Ice Plant v. John BordmanRuby SantillanaNo ratings yet

- Interpretation ProjectDocument16 pagesInterpretation ProjectAnjali SinhaNo ratings yet

- W.P. No.4736 of 22 Election ICT 638074110840046402Document16 pagesW.P. No.4736 of 22 Election ICT 638074110840046402Khawaja BurhanNo ratings yet

- John P. Reddington v. Otis R. Bowen, 825 F.2d 408, 4th Cir. (1987)Document3 pagesJohn P. Reddington v. Otis R. Bowen, 825 F.2d 408, 4th Cir. (1987)Scribd Government DocsNo ratings yet

- Potot Vs People DigestDocument1 pagePotot Vs People DigestMary Grace SevillaNo ratings yet

- United States v. Elliott Kahaner, Antonio Corallo and James Vincent Keogh, 317 F.2d 459, 2d Cir. (1963)Document34 pagesUnited States v. Elliott Kahaner, Antonio Corallo and James Vincent Keogh, 317 F.2d 459, 2d Cir. (1963)Scribd Government DocsNo ratings yet

- Central Bank of The Philippines v. CA (G.R. No. 88353)Document2 pagesCentral Bank of The Philippines v. CA (G.R. No. 88353)crisNo ratings yet

- Answer To Civil ComplaintDocument5 pagesAnswer To Civil ComplainthazelpugongNo ratings yet

- 2 21 12 063341 Young's Motion To Strike Fugitive Document Re Coughlin 2 15 12 Pre-Trial Motions 0204Document7 pages2 21 12 063341 Young's Motion To Strike Fugitive Document Re Coughlin 2 15 12 Pre-Trial Motions 0204DoTheMacaRenoNo ratings yet

- Applegate v. Lexington & Carter County Mining Co., 117 U.S. 255 (1886)Document10 pagesApplegate v. Lexington & Carter County Mining Co., 117 U.S. 255 (1886)Scribd Government DocsNo ratings yet

- The Ford Pinto CaseDocument65 pagesThe Ford Pinto Casewaynefloyd1No ratings yet

- Saudi Arabian Airlines vs. CA, G.R. No. 122191 (1998) - Case DigestDocument3 pagesSaudi Arabian Airlines vs. CA, G.R. No. 122191 (1998) - Case DigestJeffrey MedinaNo ratings yet

- Union of India UOI and Ors Vs Virpal Singh Chauhan0322s960864COM442632Document21 pagesUnion of India UOI and Ors Vs Virpal Singh Chauhan0322s960864COM442632Satyam MishraNo ratings yet

- Judgement Fixing in IndiaDocument116 pagesJudgement Fixing in IndiaNagaraja Mysore RaghupathiNo ratings yet

- Cuenco vs. SecretaryDocument2 pagesCuenco vs. SecretaryBelteshazzarL.CabacangNo ratings yet

- Peoria County Booking Sheet 01/18/14Document7 pagesPeoria County Booking Sheet 01/18/14Journal Star police documents0% (1)

- (HC) Crawley v. Kramer Et Al - Document No. 5Document2 pages(HC) Crawley v. Kramer Et Al - Document No. 5Justia.comNo ratings yet

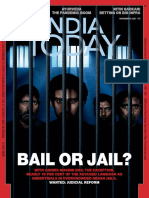

- Bail or Jail?: Espionage Isi Honey Traps Ayurveda The Pandemic Boom Nitin Gadkari Betting On Big InfraDocument130 pagesBail or Jail?: Espionage Isi Honey Traps Ayurveda The Pandemic Boom Nitin Gadkari Betting On Big InfrahariNo ratings yet

- Babubhai Bokhiria Acquittal JudgmentDocument28 pagesBabubhai Bokhiria Acquittal JudgmentkartikeyatannaNo ratings yet

- Serana Vs SandiganbayanDocument18 pagesSerana Vs SandiganbayanSORITA LAWNo ratings yet

- People v. PadamaDocument1 pagePeople v. PadamaApple CaluzaNo ratings yet

- Specpro AssignedDocument9 pagesSpecpro AssignedDave AureNo ratings yet

- 2008 Manual For Prosecutors Part 1Document163 pages2008 Manual For Prosecutors Part 1Patty Salas - PaduaNo ratings yet

- 2011 KeywordsDocument8 pages2011 Keywordsjoel gabacNo ratings yet

- ConCom, Impeachment, OmbudsmanDocument3 pagesConCom, Impeachment, Ombudsmanprinsesa0810No ratings yet

- 2022 Tzhcced 1Document60 pages2022 Tzhcced 1Clarence MhojaNo ratings yet

- People v. Taperla Case DigestDocument2 pagesPeople v. Taperla Case DigestStef BernardoNo ratings yet