Professional Documents

Culture Documents

Brazil Small Caps Portfolio

Uploaded by

Elidiel BarrosoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Brazil Small Caps Portfolio

Uploaded by

Elidiel BarrosoCopyright:

Available Formats

BTG Pactual Global Research

Banco BTG Pactual S.A.

Strategy Note

Brazil Small Caps Portfolio 03 October 2022

Analysts

October Small Caps

Carlos Sequeira, CFA

New York – BTG Pactual US Capital LLC

Our revamped Small Caps portfolio, now with 10 stocks carlos.sequeira@btgpactual.com

Please find below our revamped Small Caps portfolio. We decided to increase our +1 646 924 2479

Small Caps portfolio to 10 stocks, from 5, as the number of listed small cap options

have increased materially over the past couple of years. We believe that by increasing Osni Carfi

Brazil – Banco BTG Pactual S.A.

the number of stocks we offer our clients a more diversified and comprehensive osni.carfi@btgpactual.com

portfolio. +55 11 3383 2634

The newcomers Guilherme Guttilla

Brazil – Banco BTG Pactual S.A.

Fleury and Grupo Soma are the newcomers this month.

guilherme.guttilla@btgpactual.com

+55 11 3383 9684

Who stays and who leaves

Intelbras, Desktop, 3R Petroleum, Locaweb, Cury, Vamos, Santos Brasil and Burger

King keep their positions, while Sinqia and Blau leave.

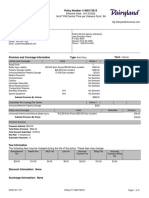

Table 1: Brazil Small Caps Portfolio for October 2022

Company Ticker Weight Rating Mkt Cap ADTV EV/EBITDA P/E P/BV

(R$ mn) (R$ mn) 2022E 2023E 2022E 2023E 2022E 2023E

Vamos VAMO3 10% Buy 13,908 47 10.7x 7.9x 24.8x 17.2x 3.7x 3.2x

Grupo Soma SOMA3 10% Buy 10,453 77 15.1x 11.8x 27.5x 18.6x 1.4x 1.3x

Intelbras INTB3 10% Buy 9,678 27 17.8x 13.4x 19.6x 15.2x 4.2x 3.5x

3R Petroleum RRRP3 10% Buy 7,214 154 7.0x 2.5x n.a. 2.9x 1.8x 1.0x

Santos Brasil STBP3 10% Buy 6,597 31 7.4x 6.1x 19.0x 11.4x 2.8x 2.6x

Fleury FLRY3 10% Neutral 5,607 29 6.9x 6.5x 15.9x 14.5x 3.1x 3.0x

Locaweb LWSA3 10% Buy 5,305 91 17.6x 10.7x 39.9x 28.8x 1.7x 1.6x

Cury CURY3 10% Buy 3,447 24 7.0x 6.0x 9.4x 7.2x 4.8x 3.9x

Burger King BKBR3 10% Buy 1,860 16 6.8x 2.5x n.a. 27.4x 1.3x 1.2x

Desktop DESK3 10% Buy 888 3 6.4x 4.8x 17.0x 7.8x 0.9x 0.9x

Source: BTG Pactual estimates, Economatica

ANALYST CERTIFICATION AND REQUIRED DISCLOSURES BEGIN ON PAGE 7

Banco BTG Pactual S.A. does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could

affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. Any U.S. person receiving this report and wishing to effect any

transaction in a security discussed in this report should do so with BTG Pactual US Capital, LLC at 212-293-4600, 601 Lexington Avenue. 57th Floor, New York NY 10022

Brazil Small Caps Portfolio BTG Pactual Global Research

Strategy Note - 03 October 2022 Banco BTG Pactual S.A.

A summary of our October picks

Santos Brasil: After a positive Q2 result, we remain bullish on the name based on a

strong earnings momentum, favored by a supportive pricing environment and a

volume pickup. Our LT view reflects: (i) better regulatory environment in port industry;

(ii) better competitive dynamics at Santos, creating favorable pricing conditions for

SBTP; (iii) positive port/infrastructure sector outlook; and (iv) solid balance sheet,

supported by its net cash position. In the ST, we also see SBTP sustaining healthy

margins in the container terminal business, helped by resilient volumes at Santos.

Towards year-end, market focus should shift to a major contract renewal with a big

client (~60% of volumes), which we expect to be a positive event for the stock.

Trading at 13% real IRR, we see the investment case becoming even more attractive.

Desktop: The leading internet service provider (ISP) in São Paulo, Brazil’s wealthiest

state. Desktop is moving fast. In fact, since private equity fund H.I.G became

controlling shareholder in Feb/20, it has made big and bold moves by buying large

and high-quality operations that are a perfect match with its own operations. At 4.8x

EV/EBITDA 2023E, Desktop trades at a big discount to global ISPs (10x) and global

integrated telcos (6x), which aren’t growing. Compared to the other two listed ISPs,

the stock trades at a discount to Brisanet (5.9x) and at a premium to Unifique (4.1x).

Vamos: Our bullish call reflects the blue ocean market opportunity for Vamos and the

company’s key economic moats. We are constructive on the name, mainly due to: (i)

yields are consistently improving, reflecting Vamos’ ability to pass through higher cost

of capital and a better client mix; (ii) solid dealership momentum, sustaining a low

double-digit EBITDA margin; (iii) competition in truck rental market remains weak and

(iv) a healthier balance sheet after the pricing of a follow-on offer and factoring of

receivables (~R$2bn), bringing firepower to fund continued growth going forward.

Besides results, we expect investors to keep monitoring: (i) leverage; (ii)

normalization of vehicle shortage; (iii) fleet expansion; and (iv) improving competitive

dynamics. Trading at 7.9x EV/EBITDA23, we are BUYers.

Cury: Cury is superbly well-positioned to benefit from recent changes in the CVA

program (the government recently announced some increase in subsidies that should

drive an increase in sale price of new homes and boost sales speed), since the

company is delivering high margins and has a strong pipeline of projects to be

launched in 2H23. The stock is also our preferred pick in the housing segment, due

to: (i) its flawless execution; (ii) recent positive revisions to CVA program are tailwinds

for its operations; (iii) strong operating growth, with best-in-class ROE; and (iv)

attractive valuation (~6x P/E 2023E), therefore, we are maintaining Cury to our small-

cap portfolio.

Locaweb: We see the stock trading at a huge discount to VTEX, Shopify and

BigCommerce, even though Locaweb grows at a similar pace. The current stock

price of R$9 is a nice entry point, and with margins starting to recover, we feel now

could be the time to buy. The company is delivering on growth (in fact, it has never

underdelivered), and we believe the stock will respond nicely once margins start to go

up.

Brazil Small Caps Portfolio Page 2

Brazil Small Caps Portfolio BTG Pactual Global Research

Strategy Note - 03 October 2022 Banco BTG Pactual S.A.

Burger King: In 2020, in the early days of Covid, we said that while the Brazilian

QSR sector was highly fragmented vs. other mature markets, a consolidation trend

should accelerate as the sector reopened. But ST noise, given mobility restrictions,

was huge. With a recovery in place for restaurant retailers, despite inflation pressure,

we see better momentum for BKBR in 2022, with four main highlights: (i) faster

growth (BKBR plans to open 70-90 stores this year); (ii) digital learning curve

(including own delivery platform) and investments in CRM (+100 stores operating

with own delivery, 5mn loyalty program members and 30% of all sales identified); (iii)

more rational market scenario among main peers; and (iv) cost hikes due to ST

inflation and commodity prices, albeit at a slower pace than past Qs, boosting

operating leverage. BKBR3 trades at 2.5x EV/EBITDA 2023 (a major discount to

international peers), with an EBITDA 2022-26 CAGR of 16%.

3R Petroleum: We’re maintaining it in our portfolio. In recent months, we've heard

lots of pushback from investors related to the fact that RRRP still needed to conclude

several of its acquisitions, along with skepticism surrounding the funding for Potiguar.

We think those criticisms are overblown, particularly after the company raised more

than half of the amount that it needs to fund the acquisition via a term loan and

started operating two more clusters in the last two weeks. Yes, Papa-Terra and

Potiguar are important assets (more than 50% of pro-forma output) that are yet to

come online, but the stage is set for the stock to better respond to its fundamentals.

And its fundamentals are very supportive. The valuation is undemanding (below 2.5x

and 1.5x EBITDA for 2023 and 2024, respectively), execution risks look well

balanced, and we see the stock pricing in Brent prices below US$60/bbl from next

year onward, which sounds unlikely at this point.

Intelbras: The stock combines growth and value. In 2010, net revenue barely topped

R$300mn, but surpassed R$3bn in 2021, up 9.5x. In the past decade, average

annual revenue growth was 21%, staying in double digits every year (even in tough

years of lower GDP). Equally impressive is strong, consistent profitability and

shareholder returns. It is trading at 14x earnings 2023E, a very attractive valuation for

a company consistently growing and with high ROIC and ROE.

Soma: Since buying Hering (~40% of sales), Grupo Soma identified several

opportunities to improve operations, with five main initiatives in 2022: (i) restructuring

product development department (with new executives from Renner and C&A); (ii)

new commercial planning department (and compiling and connecting data from

Hering channels); (iii) supply chain and production structure changes; (iv) digital

investments; and (v) store openings. They divided their Hering integration and

optimization approach into two strategies: (i) ST plan focused on operating

improvements, e.g. better commercial planning and improving the supply chain,

involving implementation of a push-and-pull platform for own stores and franchises,

aiming to increase sales at full price and reduce the focus on long-tail items; and (ii)

LT plan focused on enhancing brand value perception by tweaking the branding

strategy, product development and store formats (100 stores under a bigger

500-600sqm format, to be opened in the next 5-6 years, and potential to open 300

Hering Light format stores by 2026). From a top-down perspective, despite a tough

macro scenario for Hering ś niche, Grupo Soma’s value proposition of efficiently

managing various brands and its exposure to higher-income consumers offers higher

pricing power and more inflation protection than most peers. Trading at 18x P/E

2023, and with 31% consolidated EPS CAGR 2022-25, valuation still offers upside.

Brazil Small Caps Portfolio Page 3

Brazil Small Caps Portfolio BTG Pactual Global Research

Strategy Note - 03 October 2022 Banco BTG Pactual S.A.

Fleury: Fleury's valuation is cheap, with the stock trading at ~6.5x EV/EBITDA 2023.

We believe that the company has a positive earnings momentum, and that the stock

could go through a rerating process as synergies related to the deal with Pardini are

captured.

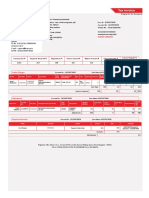

Table 2: Small Caps changes (September vs. October)

September Small Caps October Small Caps

Sector Company Ticker Weight Sector Company Ticker Weight

Technology Intelbras INTB3 10% Technology Intelbras INTB3 10%

Real Estate Cury CURY3 10% Real Estate Cury CURY3 10%

Oil & Gas 3R Petroleum RRRP3 10% Oil & Gas 3R Petroleum RRRP3 10%

Infrastructure Santos Brasil STBP3 10% Infrastructure Santos Brasil STBP3 10%

Technology Locaweb LWSA3 10% Technology Locaweb LWSA3 10%

Rental Vamos VAMO3 10% Rental Vamos VAMO3 10%

Healthcare Blau BLAU3 10% Healthcare Fleury FLRY3 10%

Retail Burger King Brasil BKBR3 10% Retail Burger King Brasil BKBR3 10%

Technology Sinqia SQIA3 10% Retail Grupo Soma SOMA3 10%

Telecom Desktop DESK3 10% Telecom Desktop DESK3 10%

Source: BTG Pactual

September Small Caps™ performance

Monthly performance

In September, our Small Caps portfolio was up 1.2%, outperforming the Ibovespa

(+0.5%) and the SMLL (-1.8%), as shown in the chart below.

Chart 1: September 2022 relative performance

Source: BTG Pactual and Economatica

Brazil Small Caps Portfolio Page 4

Brazil Small Caps Portfolio BTG Pactual Global Research

Strategy Note - 03 October 2022 Banco BTG Pactual S.A.

Chart 2: September 2022 stock performance

Source: BTG Pactual and Economatica

Performance YTD

Since 31 December 2021, our Small Caps portfolio is up 17.1%, versus 5.0% for the

Ibovespa and -8.1% for the SMLL. The CDI interbank lending rate is up +8.9% in the

period.

Chart 3: Performance YTD

Source: BTG Pactual and Economatica

Brazil Small Caps Portfolio Page 5

Brazil Small Caps Portfolio BTG Pactual Global Research

Strategy Note - 03 October 2022 Banco BTG Pactual S.A.

Historical performance

Since July 2010, when Carlos E. Sequeira took over managing the Small Caps

portfolio, the Small Caps is up 2,639.0%, versus 80.6% for the Ibovespa and 91.3%

for the SMLL.

Chart 4: Performance since July 2010

Source: BTG Pactual and Economatica

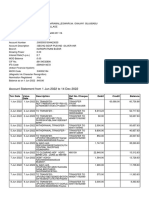

Table 3: Historical monthly performance

Ibov

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Year Accum. Ibov.

Accum.

2010 14.7% 9.0% 8.6% 18.6% 6.8% 1.3% 74.3% 74.3% 13.7% 13.7%

2011 -3.3% 0.5% 7.3% 11.5% 2.9% -1.8% -3.1% 1.2% -4.1% 8.6% 12.2% 0.0% 34.7% 134.8% -18.1% -6.9%

2012 4.2% 11.9% -1.8% 3.0% -4.1% 5.4% 10.0% 12.8% 2.0% 4.7% 2.3% 10.7% 79.0% 320.2% 7.4% 0.0%

2013 4.2% -3.0% 3.3% -5.0% -1.7% -10.6% 1.0% -3.5% 4.8% 2.0% 4.7% -2.6% -7.4% 289.0% -15.5% -15.5%

2014 -10.2% 5.2% 5.9% 2.8% 5.3% 9.0% -1.5% 9.0% -8.1% 0.2% 6.1% 0.7% 24.9% 385.9% -2.9% -17.9%

2015 -22.5% 0.0% 1.5% 6.4% -2.4% 0.2% 0.5% -5.5% 9.5% 4.1% -3.0% -2.2% -16.0% 308.3% -13.3% -28.9%

2016 -2.1% -1.4% 0.5% 6.3% -2.3% 2.6% 12.9% -1.6% 3.0% 2.8% -8.2% -1.6% 9.8% 348.1% 38.9% -1.2%

2017 7.7% 4.1% -5.6% 9.0% 1.2% 6.4% 11.9% 2.8% 4.6% 1.2% -3.8% 14.8% 67.1% 648.6% 26.9% 25.4%

2018 5.9% 4.8% -0.5% 1.0% -10.6% -8.2% 9.0% -7.7% -6.9% 20.9% 6.8% 4.4% 15.5% 764.4% 15.0% 44.2%

2019 5.6% -5.3% 1.4% 1.5% 5.9% 8.2% 12.5% 3.1% 2.4% 3.0% 2.3% 15.6% 70.5% 1374.1% 31.6% 89.8%

2020 4.0% -14.0% -33.9% 20.3% 2.1% 27.4% 18.1% -0.3% 0.2% 3.6% 14.8% 11.2% 44.4% 2028.8% 2.9% 95.3%

2021 20.8% -9.7% 3.5% 8.7% 8.4% 7.5% -1.4% -9.9% 3.2% -17.8% -9.6% 12.9% 9.9% 2239.5% -11.9% 72.0%

2022 6.7% 0.4% 1.6% -2.8% -1.4% -12.4% 9.0% 16.1% 1.2% 17.1% 2639.0% 5.0% 80.6%

Source: BTG Pactual and Economatica

Brazil Small Caps Portfolio Page 6

Brazil Small Caps Portfolio BTG Pactual Global Research

Strategy Note - 03 October 2022 Banco BTG Pactual S.A.

Disclosures

Required Disclosure

This report has been prepared by Banco BTG Pactual S.A.

The figures contained in performance charts refer to the past; past performance is not a reliable indicator of future results.

Analyst Certificate

Each research analyst primarily responsible for the content of this investment research report, in whole or in part, certifies that:

(i) all of the views expressed accurately reflect his or her personal views about those securities or issuers, and such recommendations were elaborated independently, including

in relation to Banco BTG Pactual S.A. and/or its affiliates, as the case may be;

(ii) no part of his or her compensation was, is, or will be, directly or indirectly, related to any specific recommendations or views contained herein or linked to the price of any of

the securities discussed herein.

Research analysts contributing to this report who are employed by a non-US Broker dealer are not registered/qualified as research analysts with FINRA and therefore are not

subject to the restrictions contained in the FINRA rules on communications with a subject company, public appearances, and trading securities held by a research analyst

account.

Part of the analyst compensation comes from the profits of Banco BTG Pactual S.A. as a whole and/or its affiliates and, consequently, revenues arisen from transactions held by

Banco BTG Pactual S.A. and/or its affiliates.

Where applicable, the analyst responsible for this report and certified pursuant to Brazilian regulations will be identified in bold on the first page of this report and will be the first

name on the signature list.

Company Disclosures

1. Within the past 12 months, Banco BTG Pactual S.A., its affiliates or subsidiaries has received compensation for investment banking services from this company/entity.

2. Banco BTG Pactual S.A, its affiliates or subsidiaries expect to receive or intend to seek compensation for investment banking services and/or products and services other than

investment services from this company/entity within the next three months.

4. This company/entity is, or within the past 12 months has been, a client of Banco BTG Pactual S.A., and investment banking services are being, or have been, provided.

6. Banco BTG Pactual S.A. and/or its affiliates receive compensation for any services rendered or presents any commercial relationships with this company, entity or person,

entities or funds which represents the same interest of this company/entity.

18. As of the end of the month immediately preceding the date of publication of this report, neither Banco BTG Pactual S.A. nor its affiliates or subsidiaries beneficially own 1% or

more of any class of common equity securities

19. Neither Banco BTG Pactual S.A. nor its affiliates or subsidiaries have managed or co-managed a public offering of securities for the company within the past 12 months.

20. Neither Banco BTG Pactual S.A. nor its affiliates or subsidiaries engaged in market making activities in the subject company's securities at the time this research report was

published.

21. Banco BTG Pactual S.A. or its affiliates or subsidiaries have not received compensation for investment banking services from the companies in the past 12 months

22. Banco BTG Pactual S.A. or its affiliates or subsidiaries do not expect to receive or intends to seek compensation for investment banking services from the companies within

the next 3 months.

Intelbras INTB3.SA Buy R$29.54/US$5.46 2022-10-03

Global Disclaimer

This report has been prepared by Banco BTG Pactual S.A. (“BTG Pactual S.A.”), a Brazilian regulated bank. BTG Pactual S.A. is the responsible for the distribution of this report

in Brazil. BTG Pactual US Capital LLC (“BTG Pactual US”), a broker-dealer registered with the U.S. Securities and Exchange Commission and a member of the Financial

Industry Regulatory Authority and the Securities Investor Protection Corporation is distributing this report in the United States. BTG Pactual US is an affiliate of BTG Pactual S.A.

BTG Pactual US assumes responsibility for this research for purposes of U.S. law. Any U.S. person receiving this report and wishing to effect any transaction in a security

discussed in this report should do so with BTG Pactual US at 212-293-4600, 601 Lexington Ave. 57th Floor, New York, NY 10022.

This report is being distributed in the United Kingdom and elsewhere in the European Economic Area (“EEA”) by BTG Pactual (UK) Limited (“BTG Pactual UK”), which is

authorized and regulated by the Financial Conduct Authority of the United Kingdom. BTG Pactual UK has not: (i) produced this report, (ii) substantially altered its contents, (iii)

changed the direction of the recommendation, or (iv) disseminated this report prior to its issue by BTG Pactual US. BTG Pactual UK does not distribute summaries of research

produced by BTG Pactual US.

BTG Pactual Chile S.A. Corredores de Bolsa (“BTG Pactual Chile”), formerly known as Celfin Capital S.A. Corredores de Bolsa, is a Chilean broker dealer registered with

Comisión para el Mercado Financiero (CMF) in Chile and responsible for the distribution of this report in Chile and BTG Pactual Perú S.A. Sociedad Agente de Bolsa (“BTG

Pactual Peru”), formerly known as Celfin Capital S.A. Sociedad Agente e Bolsa, registered with Superintendencia de Mercado de Valores (SMV) de Peru is responsible for the

distribution of this report in Peru. BTG Pactual Chile and BTG Pactual Peru acquisition by BTG Pactual S.A. was approved by the Brazilian Central Bank on November 14th,

2012.

BTG Pactual S.A. Comisionista de Bolsa (“BTG Pactual Colombia”) formerly known as Bolsa y Renta S.A. Comisionista de Bolsa, is a Colombian broker dealer register with the

Superintendencia Financeira de Colombia and is responsible for the distribution of this report in Colombia. BTG Pactual Colombia acquisition by BTG Pactual S.A. was approved

by Brazilian Central Bank on December 21st, 2012.

BTG Pactual Argentina is a broker dealer (Agente de Liquidación y Compensación y Agente de Negociación Integral ) organized and regulated by Argentinean law, registered

with the Exchange Commission of Argentina (Comisión Nacional de Valores) under license Nro. 720 and responsible for the distribution of this report in Argentina. Additionally,

the Brazilian Central Bank approved the indirect controlling participation of Banco BTG Pactual S.A. in BTG Pactual Argentina on September 1st, 2017.

References herein to BTG Pactual include BTG Pactual S.A., BTG Pactual US Capital LLC, BTG Pactual UK, BTG Pactual Chile and BTG Pactual Peru and BTG Pactual

Colombia and BTG Pactual Argentina as applicable. This report is for distribution only under such circumstances as may be permitted by applicable law. This report is not

directed at you if BTG Pactual is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. You should satisfy yourself before

reading it that BTG Pactual is permitted to provide research material concerning investments to you under relevant legislation and regulations. Nothing in this report constitutes a

representation that any investment strategy or recommendation contained herein is suitable or appropriate to a recipient’s individual circumstances or otherwise constitutes a

personal recommendation. It is published solely for information purposes, it does not constitute an advertisement and is not to be construed as a solicitation, offer, invitation or

inducement to buy or sell any securities or related financial instruments in any jurisdiction. Prices in this report are believed to be reliable as of the date on which this report was

issued and are derived from one or more of the following: (i) sources as expressly specified alongside the relevant data; (ii) the quoted price on the main regulated market for the

security in question; (iii) other public sources believed to be reliable; or (iv) BTG Pactual's proprietary data or data available to BTG Pactual. All other information herein is

believed to be reliable as of the date on which this report was issued and has been obtained from public sources believed to be reliable. No representation or warranty, either

express or implied, is provided in relation to the accuracy, completeness or reliability of the information contained herein, except with respect to information concerning Banco

BTG Pactual S.A., its subsidiaries and affiliates, nor is it intended to be a complete statement or summary of the securities, markets or developments referred to in the report. In

all cases, investors should conduct their own investigation and analysis of such information before taking or omitting to take any action in relation to securities or markets that are

analyzed in this report. BTG Pactual does not undertake that investors will obtain profits, nor will it share with investors any investment profits nor accept any liability for any

investment losses. Investments involve risks and investors should exercise prudence in making their investment decisions. BTG Pactual accepts no fiduciary duties to recipients

of this report and in communicating this report is not acting in a fiduciary capacity. The report should not be regarded by recipients as a substitute for the exercise of their own

judgment. Opinions, estimates, and projections expressed herein constitute the current judgment of the analyst responsible for the substance of this report as of the date on

which the report was issued and are therefore subject to change without notice and may differ or be contrary to opinions expressed by other business areas or groups of BTG

Pactual as a result of using different assumptions and criteria. Because the personal views of analysts may differ from one another, Banco BTG Pactual S.A., its subsidiaries and

affiliates may have issued or may issue reports that are inconsistent with, and/or reach different conclusions from, the information presented herein. Any such opinions,

estimates, and projections must not be construed as a representation that the matters referred to therein will occur. Prices and availability of financial instruments are indicative

only and subject to change without notice. Research will initiate, update and cease coverage solely at the discretion of BTG Pactual Investment Bank Research Management.

Brazil Small Caps Portfolio Page 7

Brazil Small Caps Portfolio BTG Pactual Global Research

Strategy Note - 03 October 2022 Banco BTG Pactual S.A.

The analysis contained herein is based on numerous assumptions. Different assumptions could result in materially different results. The analyst(s) responsible for the preparation

of this report may interact with trading desk personnel, sales personnel and other constituencies for the purpose of gathering, synthesizing and interpreting market information.

BTG Pactual is under no obligation to update or keep current the information contained herein, except when terminating coverage of the companies discussed in the report. BTG

Pactual relies on information barriers to control the flow of information contained in one or more areas within BTG Pactual, into other areas, units, groups or affiliates of BTG

Pactual. The compensation of the analyst who prepared this report is determined by research management and senior management (not including investment banking). Analyst

compensation is not based on investment banking revenues, however, compensation may relate to the revenues of BTG Pactual Investment Bank as a whole, of which

investment banking, sales and trading are a part. The securities described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. Options,

derivative products and futures are not suitable for all investors, and trading in these instruments is considered risky. Mortgage and asset-backed securities may involve a high

degree of risk and may be highly volatile in response to fluctuations in interest rates and other market conditions. Past performance is not necessarily indicative of future results.

If a financial instrument is denominated in a currency other than an investor’s currency, a change in rates of exchange may adversely affect the value or price of or the income

derived from any security or related instrument mentioned in this report, and the reader of this report assumes any currency risk. This report does not take into account the

investment objectives, financial situation or particular needs of any particular investor. Investors should obtain independent financial advice based on their own particular

circumstances before making an investment decision on the basis of the information contained herein. For investment advice, trade execution or other enquiries, clients should

contact their local sales representative. Neither BTG Pactual nor any of its affiliates, nor any of their respective directors, employees or agents, accepts any liability for any loss or

damage arising out of the use of all or any part of this report. Notwithstanding any other statement in this report, BTG Pactual UK does not seek to exclude or restrict any duty or

liability that it may have to a client under the “regulatory system” in the UK (as such term is defined in the rules of the Financial Conduct Authority). Any prices stated in this report

are for information purposes only and do not represent valuations for individual securities or other instruments. There is no representation that any transaction can or could have

been effected at those prices and any prices do not necessarily reflect BTG Pactual internal books and records or theoretical model-based valuations and may be based on

certain assumptions. Different assumptions, by BTG Pactual S.A., BTG Pactual US, BTG Pactual UK, BTG Pactual Chile and BTG Pactual Peru and BTG Pactual Colombia and

BTG Pactual Argentina or any other source, may yield substantially different results. This report may not be reproduced or redistributed to any other person, in whole or in part,

for any purpose, without the prior written consent of BTG Pactual and BTG Pactual accepts no liability whatsoever for the actions of third parties in this respect. Additional

information relating to the financial instruments discussed in this report is available upon request. BTG Pactual and its affiliates have in place arrangements to manage conflicts

of interest that may arise between them and their respective clients and among their different clients. BTG Pactual and its affiliates are involved in a full range of financial and

related services including banking, investment banking and the provision of investment services. As such, any of BTG Pactual or its affiliates may have a material interest or a

conflict of interest in any services provided to clients by BTG Pactual or such affiliate. Business areas within BTG Pactual and among its affiliates operate independently of each

other and restrict access by the particular individual(s) responsible for handling client affairs to certain areas of information where this is necessary in order to manage conflicts of

interest or material interests. Any of BTG Pactual and its affiliates may: (a) have disclosed this report to companies that are analyzed herein and subsequently amended this

report prior to publication; (b) give investment advice or provide other services to another person about or concerning any securities that are discussed in this report, which

advice may not necessarily be consistent with or similar to the information in this report; (c) trade (or have traded) for its own account (or for or on behalf of clients), have either a

long or short position in the securities that are discussed in this report (and may buy or sell such securities), with the securities that are discussed in this report; and/or (d) buy

and sell units in a collective investment scheme where it is the trustee or operator (or an adviser) to the scheme, which units may reference securities that are discussed in this

report.

United Kingdom and EEA: Where this report is disseminated in the United Kingdom or elsewhere in the EEA by BTG Pactual UK, this report is issued by BTG Pactual UK only

to, and is directed by BTG Pactual UK at, those who are the intended recipients of this report. This report has been classified as investment research and should not be

considered a form of advertisement or financial promotion under the provisions of FSMA 2000 (Sect. 21(8)).This communication may constitute an investment recommendation

under the Market Abuse Regulation 2016 (“MAR”) and, as required by MAR, the investment recommendations of BTG Pactual personnel over the past 12 months can be found

by clicking on https://www.btgpactual.com/research/. Please also consult our website for all relevant disclosures of conflicts of interests relating to instruments covered by this

report. While all reasonable effort has been made to ensure that the information contained is not untrue or misleading at the time of publication, no representation is made as to

its accuracy or completeness and it should not be relied upon as such. Past performances offer no guarantee as to future performances. All opinions expressed in the present

document reflect the current context and which is subject to change without notice.

Dubai: This research report does not constitute or form part of any offer to issue or sell, or any solicitation of any offer to subscribe for or purchase, any securities or investment

products in the UAE (including the Dubai International Financial Centre) and accordingly should not be construed as such. Furthermore, this information is being made available

on the basis that the recipient acknowledges and understands that the entities and securities to which it may relate have not been approved, licensed by or registered with the

UAE Central Bank, Emirates Securities and Commodities Authority or the Dubai Financial Services Authority or any other relevant licensing authority or governmental agency in

the UAE. The content of this report has not been approved by or filed with the UAE Central Bank or Dubai Financial Services Authority.

United Arab Emirates Residents: This research report, and the information contained herein, does not constitute, and is not intended to constitute, a public offer of securities in

the United Arab Emirates and accordingly should not be construed as such. The securities are only being offered to a limited number of sophisticated investors in the UAE who

(a) are willing and able to conduct an independent investigation of the risks involved in an investment in such securities, and (b) upon their specific request. The securities have

not been approved by or licensed or registered with the UAE Central Bank or any other relevant licensing authorities or governmental agencies in the UAE. This research report

is for the use of the named addressee only and should not be given or shown to any other person (other than employees, agents or consultants in connection with the

addressee's consideration thereof). No transaction will be concluded in the UAE and any enquiries regarding the securities should be made with BTG Pactual CTVM S.A. at +55

11 3383-2638, Avenida Brigadeiro Faria Lima, 3477, 14th floor, São Paulo, SP, Brazil, 04538-133.

Statement of Risk

Intelbras. [BRINTB] - Our TP for Latin TMT companies are DCF-derived, based on long-term enterprise cash flow. Besides volatile equity markets and notable macroeconomic

risks in LatAm, the companies in general also face risks from regulation, competition and technology change.

Valuation Methodology

Intelbras. [BRINTB] - Our target price is DCF-derived with future cash flows being discounted at a WACC rate of 9% in BRL nominal terms.

Brazil Small Caps Portfolio Page 8

You might also like

- Banking Terminology - A To ZDocument29 pagesBanking Terminology - A To ZSandip Tech0% (1)

- Aswath Damodaran Valuation ClassDocument295 pagesAswath Damodaran Valuation ClassArjan NoordermeerNo ratings yet

- Reservation Confirmation LetterDocument1 pageReservation Confirmation LetterAn-Noor OmaerNo ratings yet

- Allard, Sebastien: SubscriberDocument3 pagesAllard, Sebastien: SubscriberDanielle YoderNo ratings yet

- Your auto insurance payment scheduleDocument4 pagesYour auto insurance payment scheduleYenny VidalNo ratings yet

- Managerial Accounting Tools For Business Decision Making 8th Edition Weygandt Solutions ManualDocument49 pagesManagerial Accounting Tools For Business Decision Making 8th Edition Weygandt Solutions Manualjamesclarkeewnsciybzf100% (13)

- Tax Invoice: Charge DetailsDocument3 pagesTax Invoice: Charge DetailsRohit SharmaNo ratings yet

- Method 1Document3 pagesMethod 1mike currieNo ratings yet

- Action Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELDocument5 pagesAction Required - Dairyland® Insurance Policy 11408173515 For LUIS LANDAETA WETTELJulu EmimaryNo ratings yet

- Rate Route Confirmation 613303 1 bc5b23f990Document1 pageRate Route Confirmation 613303 1 bc5b23f990OTD DISPATCH TEAMNo ratings yet

- MCQ - BasicDocument22 pagesMCQ - BasicLalitNo ratings yet

- 6905 Ruthette Court - NRHDocument3 pages6905 Ruthette Court - NRHTanner LeggettNo ratings yet

- 46927-Folio BaymontDocument1 page46927-Folio BaymontOctavio ChableNo ratings yet

- KeyCorp-FNFG Branch Consolidations 2016 07-11 Fact Sheet - FINALDocument8 pagesKeyCorp-FNFG Branch Consolidations 2016 07-11 Fact Sheet - FINALAndrew Poirier100% (1)

- Sale Comp - Summary Report: 5825 Charlotte Hwy - Tractor SupplyDocument29 pagesSale Comp - Summary Report: 5825 Charlotte Hwy - Tractor SupplyjasontyhNo ratings yet

- In N OutDocument3 pagesIn N OutJenna AmatulliNo ratings yet

- Invoice - Zoya Ali Traders LLC 2023-02-02Document2 pagesInvoice - Zoya Ali Traders LLC 2023-02-02Bahar AliNo ratings yet

- National Australia Bank AR 2002Document200 pagesNational Australia Bank AR 2002M Kaderi KibriaNo ratings yet

- Hardship: Blake A Brewer 1904 West 75Th Place Davenport Ia 52806Document4 pagesHardship: Blake A Brewer 1904 West 75Th Place Davenport Ia 52806Blake BrewerNo ratings yet

- NFT INT Statement of InfoDocument2 pagesNFT INT Statement of InfoGMG EditorialNo ratings yet

- Bud APAC - Prospectus PDFDocument506 pagesBud APAC - Prospectus PDFtaixsNo ratings yet

- Mitchell Board of Education Agenda 6-13Document28 pagesMitchell Board of Education Agenda 6-13Erik KaufmanNo ratings yet

- HomeCredit Loan Payment ScheduleDocument2 pagesHomeCredit Loan Payment ScheduleKylyn JynNo ratings yet

- Two Wheeler Insurance Policy SummaryDocument7 pagesTwo Wheeler Insurance Policy SummaryAswini Kumar PaloNo ratings yet

- E-Receipt: Page 1 of 1Document1 pageE-Receipt: Page 1 of 1Vipul DahiyaNo ratings yet

- GPDocument3 pagesGPHarshitNo ratings yet

- Sinqia: A Christmas Gift - Acquisition of NewconDocument4 pagesSinqia: A Christmas Gift - Acquisition of NewconRenan Dantas SantosNo ratings yet

- Us5012 Quarterly-Dailydata-Usd Stocksweight 20210331Document45 pagesUs5012 Quarterly-Dailydata-Usd Stocksweight 20210331ZZ ZZNo ratings yet

- AAR Corp. ReportDocument15 pagesAAR Corp. Reportakr200714No ratings yet

- MAPFRE Insurance Terms and Conditions PDFDocument3 pagesMAPFRE Insurance Terms and Conditions PDFSarah MccoyNo ratings yet

- Edzel AberiaDocument1 pageEdzel AberiaEdz carl AberiaNo ratings yet

- Invoice Act May 2022Document2 pagesInvoice Act May 2022Pavan kumarNo ratings yet

- Atlantis Compatibilty Chart 519Document3 pagesAtlantis Compatibilty Chart 519KJ ChaeNo ratings yet

- Stelco Holdings Inc.: Repurchasing Another Chunk of Its S/ODocument9 pagesStelco Holdings Inc.: Repurchasing Another Chunk of Its S/OForexliveNo ratings yet

- E Shore DR, Willis, TX 77318-6634, Montgomery County: Multiple Building Property SummaryDocument6 pagesE Shore DR, Willis, TX 77318-6634, Montgomery County: Multiple Building Property SummaryBot makerNo ratings yet

- Manage Beneficiaries TIAA BankDocument2 pagesManage Beneficiaries TIAA BankAbdy Fernando SanchezNo ratings yet

- Receipt PDFDocument2 pagesReceipt PDFPramod ChavanNo ratings yet

- Bid DocumentDocument32 pagesBid DocumentTriangle Syscom Private LimitedNo ratings yet

- Teleapp Final July 2017Document4 pagesTeleapp Final July 2017Jomar TenezaNo ratings yet

- Insurance Acknowledgment ReceiptDocument2 pagesInsurance Acknowledgment ReceiptArman PenalosaNo ratings yet

- JM Fy2019Document35 pagesJM Fy2019Krishna ParikhNo ratings yet

- Receipt 1688825325151Document1 pageReceipt 1688825325151ganeshauzee1No ratings yet

- Weekly Capital Market OutlookDocument8 pagesWeekly Capital Market Outlookradhika sambhashivamNo ratings yet

- DUG6989708Document1 pageDUG6989708Ganesh NandNo ratings yet

- 15dec2022102228 ShipperDocument1 page15dec2022102228 ShipperDISPATCH GROUPNo ratings yet

- Monthly Services: Included at No Extra CostDocument1 pageMonthly Services: Included at No Extra CostRajnish VermaNo ratings yet

- Full Vehicle ReportDocument5 pagesFull Vehicle ReportvoltprinterNo ratings yet

- Hexoskin Patent PDFDocument34 pagesHexoskin Patent PDFSayantan RahaNo ratings yet

- Os SS 27Document1 pageOs SS 27Nard CruzNo ratings yet

- 2022-23 San Antonio Spurs RosterDocument1 page2022-23 San Antonio Spurs RosterDavid IbanezNo ratings yet

- Jeep AutocheckDocument6 pagesJeep AutocheckLindsey HudsonNo ratings yet

- 2017 Bronze Anvil ResultsDocument9 pages2017 Bronze Anvil ResultsyvbgorbbNo ratings yet

- Agenda JPMorgan Healthcare Conference 2013Document4 pagesAgenda JPMorgan Healthcare Conference 2013behnamin_rahmaniNo ratings yet

- NF7EANTYWUTZ7VHC0623 ETicketDocument3 pagesNF7EANTYWUTZ7VHC0623 ETicketUddhava Priya DasNo ratings yet

- Invoice FebDocument2 pagesInvoice FebSadashiv RahaneNo ratings yet

- Daily Report: News & UpdatesDocument3 pagesDaily Report: News & UpdatesМөнхбат ДоржпүрэвNo ratings yet

- 4008 524 0311 04 Layout Da Cobranca Bradesco Versao InglesDocument60 pages4008 524 0311 04 Layout Da Cobranca Bradesco Versao InglesThiago Holanda CavalcanteNo ratings yet

- Refund EnglishDocument2 pagesRefund EnglishAdama FrakNo ratings yet

- Vanguard FTSE All-World UCITS ETF: (USD) Distributing - An Exchange-Traded FundDocument4 pagesVanguard FTSE All-World UCITS ETF: (USD) Distributing - An Exchange-Traded FundFranco CalabiNo ratings yet

- State Data - OPTNDocument2 pagesState Data - OPTNDrew KnightNo ratings yet

- ImranDocument1 pageImransakhawat aliNo ratings yet

- AutoCheck Vehicle History ReportDocument5 pagesAutoCheck Vehicle History ReportSUHIMAN SALMANNo ratings yet

- Department of Workforce ServicesDocument1 pageDepartment of Workforce ServicesJonna CaballeroNo ratings yet

- Renew your car insurance for lower premiumDocument2 pagesRenew your car insurance for lower premiumManasa SeshuNo ratings yet

- BTG Pactual Research HealthcareDocument8 pagesBTG Pactual Research HealthcareBruno LimaNo ratings yet

- Renewal of Your Optima Restore Individual Insurance PolicyDocument3 pagesRenewal of Your Optima Restore Individual Insurance Policypriyank singhNo ratings yet

- Competitive Strategy of Digital Financial ServicesDocument5 pagesCompetitive Strategy of Digital Financial ServicesAfiful IchwanNo ratings yet

- Soneri Bank PresentationDocument9 pagesSoneri Bank PresentationAsadNo ratings yet

- Amendments To The N and P Regulations of The Manual of Regulations For Non-Bank Financial InstitutionsDocument9 pagesAmendments To The N and P Regulations of The Manual of Regulations For Non-Bank Financial InstitutionsKat GuiangNo ratings yet

- Statement - 50291311034 - 20230529 - 123959 (4) ADITIDocument12 pagesStatement - 50291311034 - 20230529 - 123959 (4) ADITIRajeev kumar AgarwalNo ratings yet

- Starbucks vs Caribou Coffee Company AnalysisDocument17 pagesStarbucks vs Caribou Coffee Company AnalysisJake FavreNo ratings yet

- Govt. of West Bengal Transport Department Grips Echallan: (Identifiction No)Document1 pageGovt. of West Bengal Transport Department Grips Echallan: (Identifiction No)Monojit MondalNo ratings yet

- Fabm3 M3Document23 pagesFabm3 M3Jolina GabaynoNo ratings yet

- Interoffice MemorandumDocument2 pagesInteroffice Memorandumnioriatti8924No ratings yet

- Basic Accounting Adjusting Entry - Accruals and DeferralsDocument5 pagesBasic Accounting Adjusting Entry - Accruals and DeferralsKenneth TallmanNo ratings yet

- Total Monthly Income and Expenses BreakdownDocument43 pagesTotal Monthly Income and Expenses BreakdownpachukumarNo ratings yet

- CBR 7 GXZ MDBa 5 B GWDocument6 pagesCBR 7 GXZ MDBa 5 B GWvaraprasadNo ratings yet

- Risk Management: Atty. Fernando S. PeñarroyoDocument48 pagesRisk Management: Atty. Fernando S. PeñarroyoEmmanuel CaguimbalNo ratings yet

- Day1 Home Assignment Abhay SrivastavaDocument2 pagesDay1 Home Assignment Abhay SrivastavaAbhay SrivastavaNo ratings yet

- WR1 Naveed AslamDocument3 pagesWR1 Naveed AslamMuhammad NaveedNo ratings yet

- Noel Bergonia's Accounting Policies and Estimates GuideDocument8 pagesNoel Bergonia's Accounting Policies and Estimates GuideMika MolinaNo ratings yet

- Wells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 2Document2 pagesWells Technical Institute (WTI), A School Owned by Tristana Wells, Provides Training To Individuals Who Pay Tuition Directly To The School. Part 2Fanny SosrosandjojoNo ratings yet

- Capital BudgetingDocument22 pagesCapital BudgetingvikramtambeNo ratings yet

- PFRS For SMEs QADocument21 pagesPFRS For SMEs QAleovanne andre romaNo ratings yet

- General Awareness: Salient FeaturesDocument144 pagesGeneral Awareness: Salient FeaturesShubham SaindreNo ratings yet

- PassbookstmtDocument4 pagesPassbookstmtAshmika RajNo ratings yet

- Investment Banking Course NotesDocument44 pagesInvestment Banking Course NotesPenn CollinsNo ratings yet

- Platinum Transaction Program GuideDocument47 pagesPlatinum Transaction Program GuideSSGFL10% (1)

- Intacc Quiz1Document15 pagesIntacc Quiz1Armina BagsicNo ratings yet

- Money Market Instruments and ParticipantsDocument16 pagesMoney Market Instruments and Participantssonaiya software solutionsNo ratings yet