Professional Documents

Culture Documents

Footprint Script

Uploaded by

tornadozakuraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Footprint Script

Uploaded by

tornadozakuraCopyright:

Available Formats

FootPrint Script by RoughTrader | Strategies and Methods

Foreword:

The Footprint is enjoying growing popularity, but is often misinterpreted and misrepresented. This

eBook is intended to change this and be the first eBook to provide a well-founded approach to the

Footprint, as well as the correct way of looking at and approaching it. I hope you enjoy reading this

book and I am always available for questions via my website www.footprint-trading.com .

Table of contents:

1) What is the Footprint and what does it show?

2) What conclusions can be drawn from it?

3) Context from both chapters

4) Delta and Delta Divergences

5) Stop Runs - High volume per second

6) Key Points / Points of Interest

7) Strategies

8) Conclusion

Chapter 1 - What is the Footprint?

The Footprint is an invention of the company MarketDelta™, the idea behind it was to "save" the so-

called "recent orders" and make them visible for the later session. The display can be different,

depending on the setting. The minute-based setting is very common in Germany, but in my opinion it

is not up to date. How do I come to this conclusion? Quite simply, the Footprint saves the recent

orders from the Orderbook (DOM, Price Ladder, Global Orderbook - all the same) and displays them.

The display of recent orders is therefore time-independent! Why then should Footprint Bars be set to

minutes? So it is completely illogical to do this! In the following I give two pictorial examples of the

origin and a comparison between minute representation and range.

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

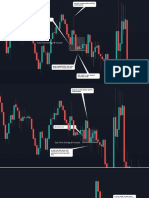

The upper picture shows the S&P500 Future Chart in a 5 minute display, so each candle has a

duration of 5 minutes until a new candle appears. It looks very confusing at first glance. The lower

picture shows the same market, but with a setting of "8 Range", i.e. after the 9th price a new bar is

formed. Please pay attention to the clearly visible differences! The structure of the market is

clearer!

As you can see on the picture, the upward movement is clearly visible. The market forms classically

higher highs and higher lows! So for now it is an unbroken trend for Long!

This example shows the advantage over the representation of a bar with minutes, the structure

and/or the candle size is always the same. The focus is therefore not on the size of the bar, but on

the traded contracts. The next example shows the development of the Footprint Bar compared to

the Orderbook:

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

The columns to the left and right of the price show the recent orders for the entire day, which at first

glance are not easy to read. This type of trading requires enormous experience and is not easy to

learn. But it is important to understand that the order book is the origin of every price movement in

the chart, no candle is formed because a moving average says or indicates it. The orderbook is the

representation of the auction that happens and takes place daily in the market. The lower picture

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

shows the section of the footprint and shows the comparison with the DOM

impressively:

Here it is quite possible to recognize patterns in the market, the high and low points of the market

are visible. The setting in this picture is also the 8 range chart, a new price is only formed when the

9th price of the range bar is finished. If you trade the footprint, it is always advisable to take a look at

the orderbook, especially in this example it is very advantageous, because you have seen how the

distribution - recognizable between 2873.75 - 2877.50 was rejected. So the price was no longer

accepted here and had to look for new buyers, this happened further down with lower prices. It is

important to understand that market participants never buy at the high for long, they are usually

already much lower at lower prices in position so that the maximum profit can be realized. But

"reading" these big market players is very difficult and you never understand exactly how they are

positioned - that's not our job either! It is an attempt to name a stranger so that the trader has a

safer feeling, but that is a deceptive illusion! No institutional market participant will send a postcard

when entering and/or exiting a position!

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

Chapter 2 - What conclusions can be drawn from this?

The conclusions drawn from the graphically stored recent orders are manifold, but certainly of great

advantage. It is possible to create a very precise analysis, since it is possible for us to see where and

at what time how much was dealt with. The only thing that ultimately counts is, roughly speaking,

the following: "Who buys when and how much? The normal candle chart is not able to provide this

representation. We have no insight into the contracts per price or other internal market processes. It

is therefore a clear strategic disadvantage to rely on a candle chart! The experienced traders who

have been trading the "Price Action" for years have such a trained eye that they can see from the

candle where an absorption or an exhaustion took place, whereas the inexperienced trader is hardly

in a position to do so, because he always relies on indicators that ultimately only show the past. But

it is important not to fall into a "left to right syndrome"! I mean too long and too intensive research!

It is important to look at the past, because we will never know the future, but looking at candle

patterns or formations from recent years will not bring any advantage in the real market and in live

operation. Unfortunately, humans are very visually structured and thus seek security in the

unknown. Please believe me, it makes more sense to look at the Footprint and the Orderbook one

hour per day than to study 5 hours of candle formations in the dead chart!

Chapter 3 - Context from both chapters

The context from chapters 1 and 2 is very simple and does not take long. I formulate it very clearly

and unambiguously without long excesses. Please learn to understand the price and the reaction,

otherwise you will have enormous problems executing even a single positive trade! Do not rely on

indicators or software that promises you a system that professionals use! A chart that looks like a

"blinking Christmas tree" is a nice PR gag, but will only bring two groups of money: the software

developer and the one who sells you this great system! The only thing that will lead you to lasting

success is Screentime and study the movement of the price. The other "great tools" just distract you

and you will give up at some point, unnerved, although you could probably have had a lasting success

with simple means. Please don't misunderstand me, trading is not easy! But the biggest hurdle is you

yourself and not the market itself. You have to understand the reaction of the price and this is best

done by reading this eBook several times and using it daily. I can't promise you to become a

successful trader, nobody can do that beforehand. But this eBook will help you, because it comes

from the practice and from many thousands of hours of observation and experience, furthermore

from many hours of private mentoring with my students, which ALL have gone this way, until the

success has adjusted.

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

I am currently trying to acquire the rights to the image to use it permanently for the script,

until then please go to the website and view the image. The caricature can also be found

under the keyword "buy sell caricatur" in every search engine, published among others in

the Economist. The artist is called Kali Cartoons, it should be very easy to find.

The upper caricature illustrates the daily problem of trading: When the herd instinct begins and the

trend has formed, it is usually too late. It's an illusion to believe that a breakout is permanent, long or

short. Please have a look at this picture and think about your own trading for a moment.

Chapter 4 - Delta and Delta Divergences

The Delta is unfortunately very often misinterpreted, just like the Footprint itself. The general

opinion of the delta is based on "market orders", which would be shown here as a number or candle.

However, it is exactly the same as with the Footprint that all orders that are executed on the Bid or

the Ask are included in the calculation! In plain language this means that the limit orders executed on

the bid or ask are also included in the calculation, but they do not move the price up or down a single

tick as described above! The delta is a very simple and not really difficult calculation, everybody with

normal education can calculate it in his head. The calculation is very simple: ALL contracts on the ask

minus ALL contracts on the bid per price. The negative delta on the bid is therefore, if you look only

at the limit side, a passive buy and the positive delta on the ask is, if you look only at the limit side, a

sell. The following picture makes this circumstance very clear:

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

In the upper picture you see a chart of the S&P500 futures, clearly visible are the high negative delta

bars of the profile. The market has seen these imbalance zones as support, as a large number of

contracts were apparently executed with an overhang on the bid. It is unlikely that these are market

sell orders, as otherwise the price would have gone lower. As can be seen here, the limit on the bid

side was passively served and thus bought. If you see these zones in a profile that is set to Delta,

please always note the reaction of the price. These imbalances are a natural zone of the market

formed by large participants, who often do not intend the price to go significantly lower. These zones

are often used as re-purchase zones so that the average price is lower and the profit is higher at the

end.

The same example, based on the Ask with a passive sale, shows the following graph:

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

In this example you see the same as in the previous picture, only on the Ask page. The big imbalances

on the Ask page are near or very often near the day high or an old high. The same is true for the bid

on the bottom. In this context, please remember a very good saying: "A buyer needs a seller to go

long and a seller needs a buyer to go short!

This simple saying reflects the fulfilment of the actual limit and should NEVER be underestimated.

Delta Divergences

The delta can form a divergence, resulting in an unequal distribution between bid and ask. To the

best of my knowledge, it is very little known in Germany and is generally referred to as a "warning

signal", which in very simple terms merely reflects the trader's ignorance. Delta divergence occurs

when buying or selling against a limit stops and the auction is over. I would like to try to list in order

how the delta divergence occurs.

We take a fictitious price of 3000, buyers a tick below this price at 2999.75 try to lift the limit on the

Ask side at 3000 with aggressive market orders (buy market). There are 800 contracts executed in the

footprint at 3000 at this time, but the limit on the Ask side at 3000 still has 2100 contracts. Buyers at

2999.75 now have no more contracts to buy and stop spontaneously. So the price at 3000 cannot be

overcome and the buyers immediately switch to sell (short): The price falls like a stone. The bar

closes negative at this moment but with the increased contracts on the Ask at 3000 the delta is

indicated as positive. This results in a so-called "delta price divergence" for a short, since the buyers

are trapped and no longer have enough strength to buy the price up. The whole thing is called

"trapped buyers". The same situation also happens on the bid side and it would then be "trapped

sellers". But the principle is also the same. Below you can see an example of a delta price divergence

and the further price development:

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

The red background is a delta divergence for trapped buyers and the blue background for trapped

sellers. It is a further aid but also unfortunately no "Holy Grail", especially in collection zones it

happens very often that every bar has a delta divergence and thus the meaningfulness goes towards

zero. The divergences, on the other hand, usually work very well at striking points such as VWAP,

daily high, daily low and the previous day's highs and lows. I use as software SierraChart™, here you

can make Delta divergences visible with a simple Excel formula and show them graphically as a

highlight. If the software you use does not have this function, you should definitely train your eye to

recognize these divergences at the mentioned points! The divergences are not seldom the end of a

movement and you would be annoyed if you overlook this fact and the profit thereby is smaller!

Chapter 5 - Stop Runs - High volume per second

A stop run occurs several times a day and offers the trader a very good reversal opportunity if he

recognizes it correctly. It is almost impossible to trade the stop run in motion, as the order is either

executed with a slippage or the limit you place is simply not served. These stop runs all have one

thing in common: they occur violently and quickly, very often at old highs and lows in the market!

The volume per second will increase by leaps and bounds and the footprint will provide the following

picture as in the following example:

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

Please pay attention to the lower box and take a close look at the volume per second, it continues to

rise like a wave and then decreases again at the low point. The arrows in the current movement

show price points that did not have a traded Ask price! This does not mean that there was no Ask

Limit in the orderbook - technically this is not possible, as every price is quoted with a minimum

quote and this quote is always "1" in the USA markets! This means that 1 contract per price MUST be

in the book; market makers are responsible for this. There are unprofessional explanations which say

that there was no limit there - but this contradicts the rules of the stock exchange. If one imagines

the example from chapter 4 with the delta divergence, something similar happened here, but in the

direction of the stop run - there was simply an enormous selling with large numbers, so that the price

could not simply be traded on the Ask! The participant probably got a slippage, but the overriding

interest for a lower price prevailed. As you could see later, the complete stop run was countered and

the price is again at the exit of the movement. The reason for this is easy to explain, but remains

hidden from most people, because they simply do not look closely or do not deal with the subject as

it should be - namely as a profession and not as a hobby! The rules of the CME say indirectly that

every participant must have the possibility to get an execution. Since no contract was executed on

the Ask, the price returns to the Ask to execute the remaining contracts. It is nothing more than a

"rebalance" because the market was no longer in balance before. The increased volume per second

can also occur at News (please do not trade) and at Swing Highs and Lows. The intention is no other

than to get the stops of the retail traders, who unfortunately often put the stops according to market

technique or chart technique and are therefore an easy victim for professionals. Please familiarize

yourself with the charting software and check if the software offers the function to display "high

volume per second". It would be a waste of points if the software did not provide this simple

function. In the course of the day there are several nested high and low points, which often have no

great significance with regard to the stop runs, the so-called "OTF traders" (other time frame) usually

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

only pay attention to the swing high and low of the higher levels, usually from 30 minutes upwards.

In SierraChart and many other chart programs there is a simple but effective solution to display these

automatically: The so-called "ZigZag indicator". This indicator does nothing other than display the

high and low points in the market according to a predefined formula. The software SierraChart offers

many possibilities and I would like to show an example in the 30 minutes chart (for the

overview):

Please turn your attention to the 15.8. and look at the low that was broken on the 14.8. The lines are

automatically generated and will remain until the price has traded them. The following picture shows

the beginning of the stop run in the footprint in the 8R display - please look at the volume per second

in the box!

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

The Stop Run starts here due to the above mentioned OTF traders. They wanted lower prices for

reasons that only they themselves know. The following picture shows the further course with a

balancing of the stop run with the following counter of the complete movement:

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

In the upper picture you see the prices with the already mentioned print, with the 0 on the Ask; here

you clearly see that enormous pressure has occurred for the short direction. Please also note the

delta in the box and see how it slowly decreases with further falling prices! This is an indication that

a) the stop run is about to end and b) the sellers who are serving the bid market in this case are

slowly losing "power". I really hope that you have been able to pull something out of this chapter for

your own trading - it is extremely important that you understand the market as it is. There is no

added value in the long run if you fall into old patterns and draw fictitious trend lines that have no

meaning at the end. I recommend that you rely on information provided by the market and not on

some technique that worked super 20 years ago.

The last picture of this chapter shows the further price development after the Stop Run. It should be

clear that this type of trading is not only suitable for short-term traders, but also for intraday swing

traders. It only takes some time to adapt this method and perspective! If you review the time you

have invested in trading so far, you will surely be able to spend this time, because here you have

something that works

sustainably!

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

Chapter 6 - Key Points / Points of Interest

The key points or key points of the market are seen very differently by traders, but they often have

no well-founded market opinion. I personally only trade the US index markets S&P500 and

NASDAQ100. These markets have two advantages:

1) They correlate through the existing stocks

2) You have almost the same Key Points

So what is a key point of the market now? It's easier than you think! The key points are yesterday's

high and yesterday's low, and for the US index markets the overnight high (ONH) and overnight low

(ONL), as well as the prior settlement. You will probably not know the terms ONH and ONL as well as

p-settle, so I will explain these points in detail:

The ONH is the high point of the session before 15:30, calculated from the start of the electronic

session. The ONH is important, because there are often stops and this is the first possibility and

chance after opening to place a reverse trade. The same applies to the ONL. It makes sense to either

have these points automatically drawn into the chart or to insert them manually into the chart. If the

ONL or ONH was not taken out in the main session at 15:30 (09:30 New York Time), the day either

had a large range in the pre-session, or the traders have no intention today for higher or lower

prices, but this occurs extremely rarely and is just before and on US holidays the case.

The prior settlement or simply "p-settle" is one of the most important points. The settlement price is

quasi the conclusion of the day of the US - session and is formed between 22:14:30-22:15:00. The

settlement price is formed during this time from the VWAP, so you take in these 30 seconds the

VWAP and the resulting price is the closing price of the day. It is often the case that the price in the

pre-session trades above or below the settlement price and returns there after the US opening at

15:30:00 to symbolically close the gap. The settlement price is of great importance for institutions

that are oriented towards this price in the long term. The small rule for settlement is the following:

Rising settlement prices = long and falling settlement prices = short . It serves as orientation for

intraday trading and should not be lost sight of, because orientation is one of the most important

things, otherwise you will lose yourself in the chart very quickly. If the charting software you are

using does not automatically display the settlement price, you can also go to the CME Group website

and view the settlement price in the "Contract Specifications" under "Volume".

You will already notice that trading does not have to consist of 100 lines, because it is sufficient to

simply orient yourself to those traders who move the price with the derivatives and options. No

indicator will be able to display these movements and intentions, no matter how much you want

them to! It's just good advice, learn to read the market and listen to it!

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

Chapter 7 - Strategies

If, as I hope, you have read this book from the beginning to this chapter, then one thing will surely

have become clear to you: there is really no strategy according to the principle "if this then that" -

unfortunately this is also the case in practice! You have to be aware that a strategy is always based

on patterns of the past, that can be sound or not. I would like to give you some food for thought here

and leave this in the air just like that. It is up to you how you deal with it.

Who would have ever thought that only a single tweet of the acting US President Donald Trump

could have more weight than the "holy" fundamental news or the assessments of the analysts?

If you read the press and media carefully, you will quickly understand what I mean. The markets are

changing their dress "faster than the bird in the moult". I have heard very often that the S&P500 is no

longer tradable because it is simply too fast. That's because the trader hasn't learned to reflexively

adjust to the market. The internal market events are not taken into account because they are simply

not known, whether out of ignorance or ignorance - the former probably affecting the majority. I

strongly warn against following a guru or a "great" system. There are no gurus in this business, the

only difference is that there are people who understand how the market moves and people who do

not. The retail market is flooded with so-called trainings and everyone is "outdoing" each other, but

in the end all participants are very dissatisfied, because they don't work in the long run. It's hard to

admit your own mistakes, but please don't lie to yourself!

After this important prologue I would like to come to the strategies I trade every day, but first the

procedure for my start into the day:

1) The overview on a higher time unit - starting from M30 (I use M30 )

2) Orientation in Footprint 8R according to striking imbalances (delta or stop runs)

3) Drawing of these points

4) Wait for these points to be started and then show the following reactions

Strategy 1 - Trend Continuation

The idea behind this strategy is that a trend continues. This is not always easy, because often in the

pre-session points for orientation are missing. I recommend that you only trade this setup if you have

prominent points in front of you and therefore a clear goal. If this is not the case, please keep your

hands off it and do not trade it as "tempting" as a supposed trend might be!

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

This picture shows an unaccepted price on the first arrow, recognizable by the 5|0. The auction is

over here for the short, because nobody wanted to sell into the bid anymore and therefore no

interaction took place. The VWAP was the orientation here. The price leaves the VWAP and the bar

with the unaccepted price, this bar is our reference bar, on which we orientate ourselves. The second

arrow on the top and bottom of the candle shows an unfinished auction, recognizable by the fact

that orders were traded on both numbers. The third arrow shows a finished auction at the low of the

candle, but the VPOC of the blue candle is lower than the one in the candle with the second arrow!

Please do not act! The VPOCs of the candle are an important indication. Rising VPOCs signal that the

buyers are in control, falling VPOCs signal that the sellers have the upper hand. The last arrow shows

a bar with a closed auction at the low and a higher VPOC - so the range has been left. The entry

should take place in the next bar when the candle touches or takes out the VPOC. It makes sense to

go "market long" here, since a limit in the current movement is often not filtered and you therefore

only "watch". The stop in this example is very difficult to set, a recommendation from me would be

below the bar with the fourth arrow. The Take Profit, as described before, if there is a prominent

spot in front of you - otherwise not!

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

Strategy 2 - Reversal

Personally, I mainly deal in reversals because I know two factors here, namely the stop and the profit.

Reverse trading is not easy on trend days and you will probably have the biggest problems with it.

Give yourself time and wait for the opportunity. If you didn't have a trade or weren't sure, you

haven't lost anything, which is

positive.

In this picture you see a reversal, which is very valid and occurs several times a day. The first arrow

shows an unfinished auction at the top of the bar, recognizable by Bid and Ask at the top. The retest

shows a completed auction in the second arrow! This is recognizable by the 0|148 and also the

VWAP is lower, which means that the sellers are in control! The entry should take place as early as

possible, preferably after the cluster on the bid with a market order. The stop is to be set above the

completed auction, it makes no sense to take a larger stop here. The take profit is set here on the

blue line, the VWAP of the day. Please familiarize yourself with the VWAP, it is not a pointless thing,

it serves the executing trader as an average of the day. In my opinion it is disgraceful not to focus on

the VWAP or to ignore it!

I hope you are not disappointed that you did not get a fund of 10 strategies, but I assure you this: The

more strategies you have, the harder it will be to decide to place a trade! It doesn't make sense to

have multiple strategies or setups intraday because the market is constantly changing. I can only

mention again that you have to listen to the market! Determine the possible trend based on the large

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

chart (higher timeframe - M30) or pay attention to the swing high and low points and wait for the

chance - it will come! Never fall into actionism, the price is simply too high! You must learn to trade

the market as it is. Note the DOM and look at the speed of interaction. Learn to judge whether the

market is fast or slow. The Footprint is one of the best aids, but ultimately someone else decides if

the course does what you imagined it would do. If you're not sure if the trade is right or wrong, leave

it! Watch the live market and not the dead chart (candlestick, OHLC bar, etc.)!

Chapter 8 - Conclusion

I would like to keep this conclusion very short, because I think I have already said enough about my

views in this book. It is very important to me that this book will hopefully give you a different view of

the markets. Don't let it unsettle you, go this way with all ups and downs! Trading is not a profession

that you learn in 6 months, it is rather a process that sometimes takes years. It will not help you any

indicator of the world, no system and no 5-fold mentoring.

My only thanks go to my wife, who always stood by my side and still stands today, and to two

traders, whom I greatly appreciate and who have accompanied me on my path. Another big thank

you goes to the participants of my mentoring, who showed me new perspectives and enabled me to

take a different look at certain things. I am happy that so many of them have already made it and

that many will still make it.

Thank you

Peter Becker

Footprint Script by RoughTrader www.footprint-trading.com All rights reserved 2019©

You might also like

- Strategize Your Investment In 30 Minutes A Day (Steps)From EverandStrategize Your Investment In 30 Minutes A Day (Steps)No ratings yet

- Stock Trading: BUY LOW SELL HIGH: The Definitive Guide For Beginner Traders In The Stock MarketFrom EverandStock Trading: BUY LOW SELL HIGH: The Definitive Guide For Beginner Traders In The Stock MarketNo ratings yet

- PRICE ACTION PROTOCOL SifuDocument283 pagesPRICE ACTION PROTOCOL SifuMuhammad Khairul Anwar100% (3)

- TriaDocument15 pagesTriasadeqNo ratings yet

- The Most Comprehensive Guide To Volume Price Analysis In Forex Trading: Learn The Hidden Secret Of Highly Profitable Forex TradersFrom EverandThe Most Comprehensive Guide To Volume Price Analysis In Forex Trading: Learn The Hidden Secret Of Highly Profitable Forex TradersRating: 1 out of 5 stars1/5 (1)

- Guppy Trading: Essential Methods for Modern TradingFrom EverandGuppy Trading: Essential Methods for Modern TradingRating: 4 out of 5 stars4/5 (1)

- The Encyclopedia Of Technical Market Indicators, Second EditionFrom EverandThe Encyclopedia Of Technical Market Indicators, Second EditionRating: 3.5 out of 5 stars3.5/5 (9)

- How to Become a Successful Trader: The Trading Personality Profile: Your Key to Maximizing Profit with Any SystemFrom EverandHow to Become a Successful Trader: The Trading Personality Profile: Your Key to Maximizing Profit with Any SystemNo ratings yet

- Trading Regime Analysis: The Probability of VolatilityFrom EverandTrading Regime Analysis: The Probability of VolatilityRating: 3 out of 5 stars3/5 (1)

- Bible of Supply & Demand Trading for complete BeginnersFrom EverandBible of Supply & Demand Trading for complete BeginnersRating: 1 out of 5 stars1/5 (2)

- Trading Forex like a Wall $treet Bank for Beginners: Brand New Day Traders Learning Series, #1From EverandTrading Forex like a Wall $treet Bank for Beginners: Brand New Day Traders Learning Series, #1No ratings yet

- Trend Qualification and Trading: Techniques To Identify the Best Trends to TradeFrom EverandTrend Qualification and Trading: Techniques To Identify the Best Trends to TradeRating: 2 out of 5 stars2/5 (1)

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketFrom EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketNo ratings yet

- Renko Forex strategy - Let's make money: A stable, winnig Forex strategyFrom EverandRenko Forex strategy - Let's make money: A stable, winnig Forex strategyNo ratings yet

- Fx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerFrom EverandFx Insider: Investment Bank Chief Foreign Exchange Trader with More Than 20 Years’ Experience as a MarketmakerRating: 4 out of 5 stars4/5 (3)

- For Ex Box ProfitDocument29 pagesFor Ex Box Profitnhar15No ratings yet

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthFrom EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNo ratings yet

- Order Flow TradingDocument15 pagesOrder Flow TradingOUEDRAOGO RolandNo ratings yet

- Supply and Demand Trading Strategies for Commodities, Forex, Futures and StocksFrom EverandSupply and Demand Trading Strategies for Commodities, Forex, Futures and StocksRating: 3.5 out of 5 stars3.5/5 (4)

- Mastering Forex Fundamentals: A Comprehensive Guide in 2 HoursFrom EverandMastering Forex Fundamentals: A Comprehensive Guide in 2 HoursRating: 5 out of 5 stars5/5 (1)

- The Nasdaq100 Index Subtle Alchemy: Let's smash it together, #1From EverandThe Nasdaq100 Index Subtle Alchemy: Let's smash it together, #1Rating: 4 out of 5 stars4/5 (1)

- MP KepplerDocument35 pagesMP KepplerBzasri Rao100% (1)

- TradeZilla 2.0 - Discover Your Trading EdgeDocument2 pagesTradeZilla 2.0 - Discover Your Trading EdgeAyesha MariyaNo ratings yet

- Quotex Success Blueprint: The Ultimate Guide to Forex and QuotexFrom EverandQuotex Success Blueprint: The Ultimate Guide to Forex and QuotexNo ratings yet

- Point and Figure Charting: The Essential Application for Forecasting and Tracking Market PricesFrom EverandPoint and Figure Charting: The Essential Application for Forecasting and Tracking Market PricesRating: 5 out of 5 stars5/5 (1)

- A Complete Guide To Volume Price Analysis Read The Book Then Read The Market by Anna Coulling (Z-Lib - Org) (241-273)Document33 pagesA Complete Guide To Volume Price Analysis Read The Book Then Read The Market by Anna Coulling (Z-Lib - Org) (241-273)Getulio José Mattos Do Amaral FilhoNo ratings yet

- Master Traders: Strategies for Superior Returns from Today's Top TradersFrom EverandMaster Traders: Strategies for Superior Returns from Today's Top TradersNo ratings yet

- Order Flow TradingDocument5 pagesOrder Flow TradingWesley SilvaNo ratings yet

- The Nature of Trends: Strategies and Concepts for Successful Investing and TradingFrom EverandThe Nature of Trends: Strategies and Concepts for Successful Investing and TradingNo ratings yet

- Binary Option Trading: Introduction to Binary Option TradingFrom EverandBinary Option Trading: Introduction to Binary Option TradingNo ratings yet

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeFrom EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeNo ratings yet

- High-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingFrom EverandHigh-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingRating: 4 out of 5 stars4/5 (1)

- Traderathome The Golden Posts Collection, v6Document45 pagesTraderathome The Golden Posts Collection, v6Miroslav Mickey LazarevicNo ratings yet

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformFrom EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformNo ratings yet

- Easy ForexDocument4 pagesEasy ForextornadozakuraNo ratings yet

- Corporate Powerpoint PresentationDocument13 pagesCorporate Powerpoint PresentationtornadozakuraNo ratings yet

- The Modern Entrepreneur PDFDocument74 pagesThe Modern Entrepreneur PDFtornadozakuraNo ratings yet

- Viola Music Sheet NotationDocument2 pagesViola Music Sheet NotationChris FunkNo ratings yet

- Piano Notes ChartDocument1 pagePiano Notes CharttornadozakuraNo ratings yet

- Group 1 Kim Jubilee Casencia Flordeliza Nanoy Irish Cayao Erman Dave Sabuya Edrian Carejon Jelyn Paredes Jessica GajetoDocument18 pagesGroup 1 Kim Jubilee Casencia Flordeliza Nanoy Irish Cayao Erman Dave Sabuya Edrian Carejon Jelyn Paredes Jessica GajetoPrincess Di BaykingNo ratings yet

- Arens14e ch25 PPTDocument37 pagesArens14e ch25 PPTLouis ValentinoNo ratings yet

- C.v... - Eman MahmoudDocument5 pagesC.v... - Eman Mahmoudeman mahmoudNo ratings yet

- Kuliah 11 Cash Flow Estimation and Risk AnalysisDocument39 pagesKuliah 11 Cash Flow Estimation and Risk AnalysisMutia WardaniNo ratings yet

- BBA 5th Sem - Business Ethics-Pre Board QuestionDocument6 pagesBBA 5th Sem - Business Ethics-Pre Board Questiontech proNo ratings yet

- Onshore Maintenance Fiber Optic Cable InstallationDocument15 pagesOnshore Maintenance Fiber Optic Cable InstallationAdil IjazNo ratings yet

- The Central Park Apartment Owners Association - Memorandum of AssociationDocument7 pagesThe Central Park Apartment Owners Association - Memorandum of Associationkjacobgeorge124288% (8)

- Short Selling Comes Under Fire - AgainDocument1 pageShort Selling Comes Under Fire - AgainSUNLINo ratings yet

- National Teachers College ManilaDocument6 pagesNational Teachers College ManilaJeline LensicoNo ratings yet

- Payal Pharma SolutionDocument1 pagePayal Pharma SolutionAkhil NarangNo ratings yet

- How-To Configure Mailbox Auto Remediation For Office 365 On Cisco SecurityDocument13 pagesHow-To Configure Mailbox Auto Remediation For Office 365 On Cisco SecurityCark86No ratings yet

- 6.supply Chain Technology - Managing Information FlowsDocument14 pages6.supply Chain Technology - Managing Information Flowssaikumar selaNo ratings yet

- Cultural Difference Management, WalmartDocument6 pagesCultural Difference Management, WalmartMbugua Wa IrunguNo ratings yet

- KPMG CommentsDocument14 pagesKPMG CommentsAli salamehNo ratings yet

- Tinitoc Revenue ProjectionDocument11 pagesTinitoc Revenue ProjectionadvitNo ratings yet

- Abbott Diagnostics Cell Dyn Emerald Operating Manual PDFDocument298 pagesAbbott Diagnostics Cell Dyn Emerald Operating Manual PDFAhmedMoussa0% (1)

- Refrence Material 1 - Unit I-IIIDocument120 pagesRefrence Material 1 - Unit I-IIIFROSTOPNo ratings yet

- Module - 1 Working Capital Management: MeaningDocument30 pagesModule - 1 Working Capital Management: MeaningumeshrathoreNo ratings yet

- Google Adwords Fundamental Exam Questions & AnswersDocument21 pagesGoogle Adwords Fundamental Exam Questions & AnswersAvinash VermaNo ratings yet

- Desktop Surveillance: National Accreditation Board For Testing and Calibration Laboratories (NABL)Document8 pagesDesktop Surveillance: National Accreditation Board For Testing and Calibration Laboratories (NABL)anupriya mittalhy6No ratings yet

- How To Cancel A MortgageDocument23 pagesHow To Cancel A MortgageCairo Anubiss100% (1)

- Promis-E V8i User GuideDocument828 pagesPromis-E V8i User Guideyongcv100% (4)

- Lecture 1 and 2 Summary: Material Flow, Cargo Classification, Packaging, Warehousing and Material HandlingDocument9 pagesLecture 1 and 2 Summary: Material Flow, Cargo Classification, Packaging, Warehousing and Material HandlingAdyashaNo ratings yet

- SolverDocument32 pagesSolverARCHIT KUMARNo ratings yet

- Name: - Section: - Schedule: - Class Number: - DateDocument7 pagesName: - Section: - Schedule: - Class Number: - DateChristine Nicole BacoNo ratings yet

- ColregDocument2 pagesColregtedungNo ratings yet

- 5UOM StudyGuide PDFDocument173 pages5UOM StudyGuide PDFAfia LynchNo ratings yet

- Literature @jun-2020 MODIFIEDDocument26 pagesLiterature @jun-2020 MODIFIEDEng-Mukhtaar CatooshNo ratings yet

- PICE ManualDocument128 pagesPICE ManualJustin GarciaNo ratings yet

- Dwnload Full Horngrens Accounting Volume 1 Canadian 10th Edition Nobles Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Accounting Volume 1 Canadian 10th Edition Nobles Solutions Manual PDFduongnujl33q100% (11)