Professional Documents

Culture Documents

Oil and Gas Tax Guide Updated FINAL

Uploaded by

jjones99040348Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oil and Gas Tax Guide Updated FINAL

Uploaded by

jjones99040348Copyright:

Available Formats

CIcbaI DiI and Cas

Tax Cuide

2010

Preface

1he C|ooa| C|| anc Cas 1ax Cu|ce summarizes Lhe oil and gas

corporaLe Lax regimes in 57 counLries and also provides a direcLory

ol oil and gas Lax conLacLs. 1he conLenL is based on inlormaLion

currenL Lo 1 January 2010, unless oLherwise indicaLed in Lhe LexL

ol Lhe chapLer.

Tax inIormation

1his publicaLion should noL be regarded as ollering a compleLe

explanaLion ol Lhe Lax maLLers relerred Lo and is sub|ecL Lo changes

in Lhe law and oLher applicable rules. Local publicaLions ol a more

deLailed naLure are lrequenLly available, and readers are advised Lo

consulL Lheir local LrnsL & Young prolessionals lor more inlormaLion.

LrnsL & Young produces guides on personal Lax and immigraLion

sysLems lor execuLives and on value added Lax {VA1) and goods and

services Lax {CS1) sysLems. LrnsL & Young also produces Lhe annual

wor|cw|ce Cororate 1ax Cu|ce.

Directory

Ollice addresses, Lelephone numbers and lax numbers, as well as

names and email addresses ol oil and gas Lax conLacLs, are provided

lor Lhe LrnsL & Young member lirms in each counLry. 1he lisLing lor

each Lax conLacL includes an ollice Lelephone number, which is a

direcLdial number, il available.

1he inLernaLional Lelephone counLry code is lisLed in each counLry

heading. 1elephone and lax numbers are presenLed wiLh Lhe ciLy or

area code and wiLhouL Lhe domesLic prelix {1, 9 or 0) someLimes

used wiLhin a counLry.

Internet site

FurLher inlormaLion concerning LrnsL & Young's oil and gas services

may be lound aL www.ey.ccm/ciIandcas.

LrnsL & Young

AugusL 2010

i

1his publicaLion conLains inlormaLion in summary lorm

and, Lherelore, is inLended lor general guidance only.

lL is noL expecLed Lo be a subsLiLuLe lor deLailed research

or Lhe exercise ol prolessional |udgmenL. NeiLher LYCM

LimiLed nor any oLher member ol Lhe LrnsL & Young

organizaLion can accepL any responsibiliLy lor loss

occasioned Lo any person acLing or relraining lrom

acLion as a resulL ol any maLerials in Lhis publicaLion.

On any specilic maLLer, relerence should be made Lo

Lhe appropriaLe advisor.

About Ernst & Young's Clobal Cil & Cas Center

1he oil and gas indusLry is consLanLly changing. lncreasing

regulaLory pressures, price llucLuaLions and geopoliLical

complexiLies all presenL signilicanL challenges. LrnsL

& Young's Clobal Oil & Cas CenLer brings LogeLher a

worldwide Leam ol prolessionals Lo help you achieve

your poLenLial a Leam wiLh deep Lechnical experience

in providing assurance, Lax, LransacLion and advisory

services. 1he CenLer works Lo anLicipaLe markeL Lrends,

idenLily Lhe implicaLions and develop poinLs ol view on

relevanL indusLry issues. UlLimaLely iL enables us Lo help

you meeL your goals and compeLe more ellecLively. lL's

how LrnsL & Young makes a dillerence.

2010 LYCM LimiLed

All RighLs Reserved.

ii

Ccntents

Angola ..........................................................................................1

ArgenLina ....................................................................................10

AusLralia .....................................................................................16

Azerbai|an ...................................................................................28

Bahrain .......................................................................................3^

Brazil ..........................................................................................38

Cameroun ...................................................................................56

Canada .......................................................................................61

Chad ...........................................................................................68

China ..........................................................................................75

Colombia .....................................................................................82

CLe d'lvoire ..............................................................................103

Denmark ...................................................................................109

Lcuador ....................................................................................119

LquaLorial Cuinea ......................................................................126

LgypL ........................................................................................131

Cabon .......................................................................................138

Chana .......................................................................................1^3

lndia .........................................................................................151

lndonesia ..................................................................................160

lraq ...........................................................................................165

lreland ......................................................................................169

KazakhsLan ...............................................................................177

KuwaiL ......................................................................................186

Libya .........................................................................................196

Malaysia ....................................................................................20^

Mexico ......................................................................................209

Mozambique ..............................................................................223

Namibia ....................................................................................228

1he NeLherlands ........................................................................236

New Zealand .............................................................................2^1

Nigeria ......................................................................................250

iii

Ccntents

Norway .....................................................................................258

Oman ........................................................................................263

PakisLan ....................................................................................267

Papua New Cuinea .....................................................................279

Peru..........................................................................................291

Philippines.................................................................................305

OaLar ........................................................................................310

Romania ...................................................................................31^

Russia .......................................................................................323

Saudi Arabia ..............................................................................330

Senegal .....................................................................................333

Singapore .................................................................................338

SouLh Alrica ..............................................................................3^6

Spain ........................................................................................353

Syria .........................................................................................359

1anzania ...................................................................................365

1hailand ....................................................................................370

1rinidad and 1obago...................................................................377

Uganda .....................................................................................383

UniLed Arab LmiraLes .................................................................391

UniLed Kingdom .........................................................................393

UniLed SLaLes ol America ............................................................^03

UzbekisLan ................................................................................^19

Venezuela .................................................................................^25

VieLnam ....................................................................................^31

Foreign currency ........................................................................^36

lndex ol oil and gas Lax conLacLs .................................................^38

iv

1 Angola

AnccIa

Country code 244

Luanda CMT +1

Ernst & Ycunc, S.A.

Avenida da RepbIica

90 3 Andar

Lisbcn

19-4024

PcrtucaI

TeI + 351 21 791 2000

Fax + 351 21 795 7590

DiI and cas ccntacts

Jchn Mackey

J]ka\]flafDakZgf!

TeI + 351 21 791 215

jchn.mackeypt.ey.ccm

Antcnic Neves

J]ka\]flafDakZgf!

TeI + 351 21 791 2249

antcnic.nevespt.ey.ccm

A. At a glance

Fiscal regime

1here are Lwo Lypes ol conLracLs, each wiLh dillerenL Lax regimes:

1. ProducLion sharing agreemenL {PSA) Lhe mosL common lorm

ol arrangemenL

2. ParLnership applicable only Lo cerLain parLnerships seL up in Lhe 1960s

and 1970s, such as Block 0 and FS/FS1

1axes applicable Lo all oil Lax regimes:

PeLroleum income Lax {Pl1) 507 {PSA) and 65.757 {parLnership)

Surlace lee {SF) USS300 per square kilomeLer {km)

1raining Lax conLribuLion {11C) USS0.15 per barrel/USS100,000 Lo

USS300,000 {a)

1axes applicable exclusively Lo parLnerships:

PeLroleum producLion Lax {PP1) 207 {b)

PeLroleum LransacLion Lax {P11) 707

{a) Annual conLribuLion ol USS100,000 or USS300,000 only applicable

belore producLion phase

{b) May be reduced Lo 107

lnvesLmenL incenLives U

1

B. Fiscal regime

1he Lax regime applies Lo all enLiLies, wheLher Angolan or loreign, wiLhin Lhe

Angolan Lax |urisdicLion LhaL perlorm exploraLion, developmenL, producLion,

sLorage, sale, exporLaLion, processing and LransporLaLion ol crude oil and

naLural gas, as well as ol naphLha, parallins, sulphur, helium, carbon dioxide

and saline subsLances lrom peLroleum operaLions.

1he currenL oil and gas LaxaLion regime applies Lo concessions granLed on or

alLer 1 January 2005, as well as Lo proliLs or capiLal gains lrom assignmenL

ol an inLeresL in an earlier concession.

A PSA is a conLracL beLween a conLracLing group and Lhe sLaLe concessionaire

under which Lhe conLracLing group bears all expendiLures lor exploraLion and

exLracLion ol subsLances in Lhe conLracL area LogeLher wiLh relaLed losses

and risks.

1 U: u||ft on ceve|oment exenc|ture uncer |nvestment a||owance.

2 Angola

1he sLaLe concessionaire is a disLincL deparLmenL ol Sonangol {Lhe Angolan

naLional oil company {NOC), Lhrough which Lhe CovernmenL manages iLs oil

and gas properLies and iLs conLracLual relaLionships wiLh oLher oil companies.

ProliL oil, under a PSA, is Lhe dillerence beLween Lhe LoLal oil produced and

oil lor cosL recovery {cosL oil). CosL oil is Lhe share ol oil produced LhaL is

allocaLed lor recovery ol exploraLion, developmenL, producLion and

adminisLraLion and service expendiLures.

ProliL oil is shared beLween Lhe sLaLe concessionaire and iLs parLners based

on Lhe accumulaLed producLion or on Lhe conLracLing group raLe ol reLurn

{prelerred meLhod).

1he compuLaLion ol Lax charges lor each peLroleum concession is carried ouL

on a compleLely independenL basis.

ln a PSA, Lhe assessmenL ol Laxable income is independenL lor each area

covered by Lhe PSA, excepL lor Lhe expenses provided lor in ArLicle 23,

subparagraph 2 {b) ol Law nr. 13/0^, daLed 2^ December, Lo which Lhe

rules in Lhe preceding paragraph apply {generally, exploraLion expendiLure).

Common revenues and cosLs associaLed wiLh disLincL developmenL areas and

concessions are allocaLed proporLionally based on Lhe annual producLion.

For Lhe purposes ol assessing Laxable income, crude oil is valued aL Lhe markeL

price calculaLed on Lhe lree on board {FOB) price lor an arm's lengLh sale Lo

Lhird parLies.

Bonuses may be due lrom Lhe conLracLing group Lo Lhe sLaLe concessionaire

in compliance wiLh Lhe PeLroleum AcLiviLies Law and cannoL be recovered or

amorLized. FurLhermore, a price cap excess lee may also be payable under

a PSA whenever Lhe markeL price per oil barrel exceeds Lhe price lixed by

Lhe minisLer ol oil. ln boLh cases, Lhe amounLs are ulLimaLely due Lo Lhe

Angolan sLaLe.

A conLracLing group may also be requesLed Lo make conLribuLions lor social

pro|ecLs Lo improve communiLy living condiLions {such as hospiLals, schools

and social housing), which also cannoL be recovered or amorLized.

LnLiLies engaged in business acLiviLies in Angola and noL sub|ecL Lo Lhe oil and

gas LaxaLion regime are sub|ecL Lo indusLrial Lax on business proliLs. 1his Lax

is noL dealL wiLh in Lhis guide. Moreover, Lhis guide does noL cover Lhe specilic

Lax regimes LhaL apply Lo mining acLiviLies, as well as Lhe incenLives available

under privaLe invesLmenL law such as exempLions lrom cusLoms duLies,

indusLrial Lax, dividends wiLhholding Lax and properLy Lransler Lax. Since a

special regime is in lorce lor Lhe LNC pro|ecL, we also ouLline below Lhe main

leaLures ol said regime.

PIT

Pl1 is levied on Lhe Laxable income assessed in accordance wiLh Lhe Lax law

lrom any ol Lhe lollowing acLiviLies:

LxploraLion, developmenL, producLion, sLorage, sale, exporLaLion,

processing and LransporLaLion ol peLroleum

Wholesale Lrading ol any oLher producLs resulLing lrom

Lhe above operaLions

OLher acLiviLies ol enLiLies primarily engaged in carrying ouL Lhe above

operaLions, resulLing lrom occasional or incidenLal acLiviLy, provided

LhaL such acLiviLies do noL represenL a business

Pl1 does noL apply Lo Lhe receipLs ol Lhe sLaLe concessionaire, premiums,

bonuses and Lhe price cap excess lee received by Lhe sLaLe concessionaire

under Lhe Lerms ol Lhe conLracLs.

Pl1 is compuLed on accounLing neL income ad|usLed in accordance wiLh Lhe Lax

law. 1ax law provides deLailed guidelines on Laxable revenues, deducLible cosLs

and nondeducLible cosLs.

3 Angola

Under a PSA, LaxdeducLible cosLs should comply wiLh Lhe lollowing

general rules:

CosL oil is limiLed Lo a maximum percenLage ol Lhe LoLal amounL ol oil

produced in each developmenL area, in accordance wiLh Lhe respecLive

PSA {generally 507, buL may be increased up Lo 657 il developmenL

expendiLures are noL recovered wiLhin lour or live years lrom Lhe beginning

ol commercial producLion or lrom Lhe year cosLs are incurred, whichever

occurs laLer)

LxploraLion expendiLures are capiLalized and are recognized up Lo Lhe

amounL ol cosL oil {limiLed as above) noL uLilized in Lhe recovery ol direcL

producLion and developmenL expenses as well as indirecL adminisLraLion

and service expenses

DevelopmenL expendiLures are capiLalized and Lhe amounL is increased

by Lhe invesLmenL allowance {uplilL) delined in Lhe respecLive PSA and

amorLized aL an annual raLe ol 257 up Lo Lhe cosL oil amounL, lrom Lhe year

incurred or upon commencemenL ol oil exporLaLion, whichever occurs laLer

ProducLion expendiLures are expensed up Lo Lhe cosL oil amounL

AdminisLraLion and service expendiLures are eiLher capiLalized and

amorLized {similar Lo developmenL expenses) or immediaLely expensed

up Lo Lhe cosL oil amounL being allocaLed Lo exploraLion, developmenL and

producLion expenses

lnvenLory is allocaLed Lo exploraLion, developmenL, producLion and

adminisLraLion and service acLiviLies in proporLion Lo iLs uLilizaLion or

consumpLion wiLhin oil operaLions

SLraLegic spare parLs are allocaLed Lo exploraLion, developmenL,

producLion and adminisLraLion and service expenses in accordance

wiLh Lhe respecLive PSA

CosLs incurred in assignmenL ol a parLicipaLing inLeresL {Lhe dillerence

beLween acquisiLion price and recoverable cosLs plus Lhe neL value ol

remaining asseLs goodwill) are considered developmenL expenses

{buL do noL beneliL lrom uplilL), provided such dillerence has been

Laxed aL Lhe level ol Lhe Lransleror

Should Lhe cosL oil amounL noL be enough Lo recover allowable expenses,

Lhe balance can be carried lorward wiLhin Lhe same concession.

1axable income is lixed by an assessmenL commiLLee on Lhe basis ol Lhe

Lax reLurn submiLLed. 1he commiLLee validaLes Lhe amounLs reporLed and

deLermines Lhe Laxable income. 1he Laxpayer may challenge Lhe amounL

deLermined by Lhe commiLLee.

ll Lhe company operaLes under a PSA, Lhe Lax raLe is 507, oLherwise Lhe Lax

raLe is 65.757.

For parLnerships and risk service conLracLs {RSC), LaxdeducLible cosLs should

comply wiLh Lhe lollowing general rules:

CosLs incurred in exploraLion operaLions, drilling cosLs ol developmenL

wells, cosLs incurred lor producLion, LransporLaLion and sLorage laciliLies,

as well as cosLs incurred wiLh Lhe assignmenL ol a parLicipaLing inLeresL

{Lhe dillerence beLween Lhe acquisiLion price and Lhe capiLalized cosLs plus

Lhe neL value ol remaining asseLs goodwill, provided Lhis dillerence has

been Laxed aL Lhe level ol Lhe Lransleror), are recognized aL an annual raLe

ol 16.6667 as ol Lhe beginning ol Lhe year in which Lhey are incurred, or

Lhe year in which oil is lirsL commercially produced, whichever occurs laLer

CosLs incurred belore producLion are capiLalized and recognized over

a louryear period {257 per year) lrom Lhe lirsL year ol producLion

ll Lhe cosLs exceed Lhe revenues in a given year, Lhe excess can be carried

lorward up Lo live years

PPT

PP1 is compuLed on Lhe quanLiLy ol crude oil and naLural gas measured aL Lhe

wellhead and on oLher subsLances, less Lhe oil used in producLion as approved

by Lhe sLaLe concessionaire.

4 Angola

1he Lax raLe is 207. 1his raLe may be reduced by up Lo 107 by Lhe CovernmenL

and upon peLiLion by Lhe sLaLe concessionaire in specilic siLuaLions, such as

oil exploraLion in marginal lields, ollshore depLhs exceeding 750 meLers or

onshore areas LhaL Lhe CovernmenL has previously delined as dilliculL Lo reach.

1his Lax is deducLible lor Lhe compuLaLion ol Pl1.

PP1 is noL imposed under a PSA.

PTT

P11 is compuLed on Laxable income, which Lakes inLo accounL several

ad|usLmenLs in accordance wiLh Lhe Lax law. 1he Lax raLe is 707. 1his Lax

is deducLible lor Lhe compuLaLion ol Pl1.

DeducLion ol a producLion allowance and an invesLmenL allowance is possible

on Lhe basis ol Lhe concession agreemenL. PP1, SF, 11C and linancing cosLs

are noL deducLible Lo compuLe Lhe Laxable basis.

P11 is noL imposed under a PSA.

5F

SF is compuLed on Lhe concession area or on Lhe developmenL areas whenever

provided lor in Lhe applicaLion agreemenL ol DecreeLaw No. 13/0^.

1he surcharge is equivalenL Lo USS300 per km and is due by parLners ol Lhe

sLaLe concessionaire. 1his surcharge is deducLible lor Pl1 purposes.

TTC

1his levy is imposed on oil and gas exploraLion companies as well as producLion

companies, as lollows:

USS0.15 per barrel lor producLion companies as well as companies

engaged in relinery and processing ol peLroleum

USS100,000 a year lor companies owning a prospecLion license

USS300,000 a year lor companies engaged in exploraLion

1he levy is also imposed on service companies LhaL conLracL wiLh Lhe above

enLiLies lor more Lhan one year.

1he levy lor service companies is compuLed on Lhe gross revenue lrom any Lype

ol conLracL, aL Lhe raLe ol 0.57. ll a clear disLincLion exisLs beLween goods and

services, iL may be possible Lo exempL Lhe porLion relaLing Lo Lhe goods and, in

some circumsLances, iL may also be possible Lo exempL parL ol Lhe services lor

work enLirely perlormed abroad.

1he same 0.57 also applies Lo Lhe revenue obLained by enLiLies engaged in Lhe

sLorage, LransporL, disLribuLion and Lrading ol peLroleum.

C. Capital allowances

lnvesLmenL allowances {uplilL on developmenL expenses) may be granLed by

Lhe CovernmenL upon requesL made Lo Lhe minisLers ol oil and linance. 1he

amounL and condiLions are described in Lhe concession agreemenL. UplilL may

range beLween 307 and ^07, based on Lhe proliLabiliLy ol Lhe block.

ProducLion allowances exisL lor cerLain blocks, which allow lor Lhe Lax

deducLion ol a lixed US dollar amounL per barrel produced in all developmenL

areas in commercial producLion lrom a predelined daLe. 1his deducLion is

available up Lo Lhe unused balance ol cosL oil.

D. Incentives

1he CovernmenL may granL an exempLion lrom oil indusLryrelaLed Laxes,

a reducLion ol Lhe Lax raLe or any oLher modilicaLions Lo Lhe applicable rules,

whenever |usLilied by economic condiLions. 1his provision may also be exLended

Lo cusLoms duLies and oLher Laxes.

1he PSA enLered inLo beLween Lhe CovernmenL and Lhe oil company may

override Lhe general LaxaLion regime and may seL lorLh specilic LaxaLion

rules and raLes.

5 Angola

E. Withholding taxes

For companies operaLing in Lhe oil and gas indusLry, no wiLhholding Lax is levied

on dividends.

lnLeresL is normally sub|ecL Lo 157 invesLmenL income wiLhholding Lax.

RoyalLies are sub|ecL Lo 107 invesLmenL income wiLhholding Lax.

lndusLrial wiLhholding Lax applies Lo service paymenLs. 1he sLandard ellecLive

raLe is 5.257, which can be reduced Lo 3.57 lor consLrucLion, improvemenLs

and repairs ol immovable lixed asseLs.

No branch proliLs remiLLance Lax applies in Angola.

F. Financing considerations

1here are no Lhin capiLalizaLion rules in Angola. However, linance expenses are

noL deducLible lor Pl1, excepL lor borrowings wiLh banks locaLed in Angola upon

auLhorizaLion by Lhe minisLers ol linance and oil.

C. Transactions

ProliLs or capiLal gains, wheLher accounLed lor or noL, on Lhe sale ol oil and gas

inLeresLs are included in Lhe calculaLion ol Laxable proliL.

No Lax is levied on Lhe share capiLal ol oil and gas companies.

OLher income is generally included in Lhe Laxable basis lor Lhe Pl1 compuLaLion.

H. Indirect taxes

Consumption tax

ConsumpLion Lax is levied on goods produced or imporLed inLo Angola, and also

on Lhe consumpLion ol waLer, energy, LelecommunicaLion services and Lourism

indusLry services {hoLels and resLauranLs). 1he general raLe is 107, buL iL may

vary beLween 27 and 307 depending on Lhe naLure ol Lhe goods or service.

1he raLe is 57 lor waLer, energy and LelecommunicaLion services.

Customs duties

CusLoms duLies are levied on imporLed goods, including equipmenL. 1he raLes

vary beLween 27 and 307, according Lo Lhe goods Larill classilicaLion.

1he oil and gas indusLry has a special cusLoms regime LhaL provides an

exempLion lrom cusLoms duLies and consumpLion Lax on Lhe imporLaLion ol

goods Lo be used exclusively in oil and gas operaLions {alLhough sLamp duLy

sLill applies). 1he lisL ol goods may be added Lo upon a peLiLion Lo Lhe

minisLer ol linance. 1he imporLer should presenL Lo Lhe cusLoms auLhoriLies a

declaraLion sLaLing LhaL Lhe goods are Lo be exclusively used in such operaLions.

A Lemporary imporL regime granLing an exempLion lrom cusLoms duLies and

consumpLion Lax is also available lor goods LhaL are exporLed wiLhin one year

{general regime) or Lwo years {oil and gas indusLry regime); Lhis may be

exLended upon peLiLion. A Lemporary exporLaLion regime is also available lor

goods shipped abroad lor repairs, provided Lhe goods are reimporLed wiLhin a

oneyear period.

1he exporLaLion ol oil produced in each concession belore or alLer processing is

exempL lrom duLies, excepL lrom sLamp duLy on cusLoms clearance documenLs,

Lhe sLaLisLical Lax ol 0.17 ad valorem and oLher lees lor services rendered.

5tamp duty

SLamp duLy is levied on a wide range ol operaLions, including:

CollecLion ol paymenLs as a resulL ol LransacLions aL 17

Lease ol equipmenL aL 0.57

lmporLaLion ol goods and equipmenL aL 0.57

Bank guaranLees aL 0.37

lnsurance premiums beLween 17 and 107

Angola

1he Lransler ol shares in an oil company should noL be sub|ecL Lo sLamp duLy;

however, Lhe Lransler ol oil and gas asseLs may be duLiable properLy.

1he raLes vary beLween 0.17 and 307, buL may also be a nominal amounL,

depending on Lhe operaLion.

Emoluments

Ceneral cusLoms emolumenLs aL Lhe raLe ol 27 ol Lhe cusLoms value ol Lhe

goods are also chargeable on Lhe imporLaLion ol goods.

1ransporL expenses also apply and may vary depending on Lhe means ol

LransporL used and Lhe weighL ol Lhe goods.

I. LNC Proiect

Angola LNC Pro|ecL {Lhe Pro|ecL) meaning all acLiviLies and insLallaLions

aimed aL receiving and processing gas in Angola, producLion in Angola ol LNC

and NCL as well as respecLive commercializaLion has been considered ol

public inLeresL, hence special incenLives lor Lax, cusLoms and exchange conLrols

have been granLed under DecreeLaw No. 10/07.

1he Pro|ecL is sub|ecL Lo Lhe laws applicable Lo peLroleum acLiviLies, namely,

1he PeLroleum AcLiviLies Law, Lhe PeLroleum AcLiviLies 1axaLion Law and Lhe

cusLoms regime law applicable Lo Lhe oil secLor, as complemenLed and amended

by Lhe menLioned DecreeLaw.

Angola LNC LimiLed is Lhe main enLiLy responsible lor execuLing Lhe Pro|ecL,

Lhrough which Lhe promoLing companies hold Lheir invesLmenL and righLs.

OLher companies, such as Sociedade Operacional Angola LNC and Sociedade

Operadora dos CasoduLos de Angola, acL in represenLaLion ol Angola LNC

LimiLed. PromoLing companies, which are Lhe original shareholders ol Angola

LNC LimiLed, include Cabinda Cull Oil Company LimiLed, Sonangol Cas NaLural

LimiLada, BP LxploraLion {Angola) LimiLed and 1oLal Angola LNC LimiLed.

PIT

1axable proliL ol Angola LNC LimiLed is sub|ecL Lo Pl1 compuLed considering

Lhe rules sLaLed in DecreeLaw No. 10/07 and oLher relaLed legislaLion.

1ax losses can be carried lorward lor live years.

1axable proliL is impuLed Lo Lhe promoLing companies under a sorL ol Lax

Lransparency regime. 1he applicable Pl1 raLe is 357.

PromoLing companies en|oy a Lax crediL during 1^^ monLhs as lrom Lhe

commercial producLion daLe againsL Lhe Pl1 liabiliLy, deLermined as per

DecreeLaw No. 10/07.

An exempLion lrom Pl1 applies Lo inLeresL and dividends obLained by alliliaLes

{ol promoLing companies) LhaL hold a parLicipaLing inLeresL in a block Lhrough

which a producLion conLracL is enLered inLo wiLh Sonangol.

TTC

Angola LNC LimiLed is sub|ecL Lo 11C ol USS0.15 per LNC barrel, increased by

USS0.02 per each mmbLu ol LNC sold.

Cas surcharge

Angola LNC LimiLed is sub|ecL Lo Lhe paymenL ol a gas surcharge, on a

quarLerly basis, as lrom Lhe lirsL LNC exporL.

Industrial tax

Any income obLained by Angola LNC LimiLed, Lhe promoLing companies and

Lheir alliliaLes, relaLed wiLh Lhe commercial acLiviLies and LransacLions realized

under Lhe Pro|ecL, beneliLs lrom an indusLrial Lax exempLion.

ProliLs obLained by Sociedade Operacional Angola LNC and Sociedade

Operadora dos CasoduLos de Angola are sub|ecL Lo indusLrial Lax, alLhough

specilic rules apply.

7 Angola

PaymenLs made by Angola LNC LimiLed Lo Sociedade Operacional Angola LNC

and Sociedade Operadora dos CasoduLos de Angola, as well as Lhe paymenLs

beLween Sociedade Operacional Angola LNC and Sociedade Operadora dos

CasoduLos de Angola, concerning Lhe execuLion ol any service conLracL, are noL

sub|ecL Lo indusLrial Lax wiLhholdings.

Concerning service conLracLs {including Lhe supply ol maLerials) enLered inLo

by Angola LNC LimiLed, Sociedade Operacional Angola LNC and Sociedade

Operadora dos CasoduLos de Angola, Lhese companies are noL required Lo

perlorm indusLrial Lax wiLhholdings. 1his exempLion only applies during a

specilic Lime lrame. 1his is also applicable Lo Lhe enLiLies conLracLed and

subconLracLed and Lo Lhe subconLracLs aimed aL Lhe rendering ol services

or works {including Lhe supply ol maLerials) lor Lhe Pro|ecL.

Investment income tax

lnLeresL income derived lrom shareholder loans or oLher loans made by Lhe

promoLing companies, respecLive alliliaLes and Lhird parLies, lor Lhe beneliL ol

Angola LNC LimiLed, Sociedade Operacional Angola LNC, Sociedade Operadora

dos CasoduLos de Angola or oLher companies Lhey have incorporaLed, will be

exempL lrom invesLmenL income Lax. A similar exempLion, under cerLain

condiLions, may apply on inLeresL derived lrom loans made beLween Lhe

promoLing companies.

PromoLing companies and Lheir alliliaLes are exempL ol invesLmenL income Lax

on dividends received lrom Angola LNC LimiLed, Sociedade Operacional Angola

LNC and Sociedade Operadora dos CasoduLos de Angola.

Angola LNC LimiLed, Sociedade Operacional Angola LNC, Sociedade Operadora

dos CasoduLos de Angola or any oLher company incorporaLed by Lhem are noL

required Lo wiLhhold invesLmenL income Lax in relaLion Lo paymenLs under

cerLain lease conLracLs, Lransler ol knowhow, and inLellecLual and indusLrial

properLy righLs. 1his exempLion only applies during a specilic Lime lrame.

Cther tax exemptions

lncome obLained by Sonangol lrom paymenLs lor Lhe use ol Lhe associaLed gas

pipelines neLwork, made by Angola LNC LimiLed under Lhe invesLmenL conLracL,

are exempL lrom all Laxes and levies. Angola LNC LimiLed should noL perlorm

any wiLhholdings on such paymenLs.

Angola LNC LimiLed, Sociedade Operacional Angola LNC, Sociedade Operadora

dos CasoduLos de Angola, promoLing companies and Lheir alliliaLes are exempL

lrom all oLher Laxes and levies LhaL are noL specilied in DecreeLaw No. 10/07,

namely: PP1, P11, urban properLy Lax, properLy Lransler Lax, invesLmenL

income Lax and sLamp duLy {under cerLain condiLions). NoLwiLhsLanding,

Lhese companies are sub|ecL Lo Lhe sLandard adminisLraLive surcharges

or conLribuLions due in relaLion Lo commercial acLiviLies and LransacLions

associaLed wiLh Lhe Pro|ecL, provided such surcharges and conLribuLions are

generically applicable Lo Lhe remaining economic agenLs operaLing in Angola.

1he Lransler ol shares in Angola LNC LimiLed, Sociedade Operacional Angola

LNC and Sociedade Operadora dos CasoduLos de Angola, wiLhouL a gain,

should be exempL lrom all Laxes and levies. Moreover, no Laxes or levies are

imposed on Lhe shares ol Lhe menLioned companies, including increases and

decreases ol capiLal and sLock spliLs.

No Laxes or levies are imposed Lo Lhe Lranslers or remiLLances ol lunds Lo

make any paymenL Lo Lhe promoLing companies, Lheir alliliaLes or Lhird parLies

making loans LhaL are exempL lrom income Lax or wiLhholding Lax, as per

DecreeLaw No. 10/07, including Lhe reimbursemenL ol capiLal and paymenL

ol inLeresL in relaLion Lo shareholder loans and oLher loans as well as Lhe

disLribuLion ol dividends in accordance wiLh Lhe above DecreeLaw.

8 Angola

Customs regime

ln accordance wiLh Lhe Pro|ecL's regime, Lhe cusLoms procedure applicable Lo

Lhe operaLions and acLiviLies is LhaL esLablished lor companies in Lhe cusLoms

regime law applicable Lo Lhe oil indusLry, wiLh Lhe changes and ad|usLmenLs

sLaLed in DecreeLaw No. 10/07.

1his cusLoms regime is applicable Lo Angola LNC LimiLed, Sociedade

Operacional Angola LNC, Sociedade Operadora dos CasoduLos de Angola

and oLher enLiLies LhaL carry ouL operaLions or acLiviLies relaLed Lo Lhe

Pro|ecL on behall ol Angola LNC LimiLed, Sociedade Operacional Angola

LNC or Sociedade Operadora dos CasoduLos de Angola.

ln addiLion Lo Lhe goods lisLed in Lhe cusLoms regime law applicable Lo Lhe oil

indusLry, are also exempLed lrom cusLoms duLies various oLher producLs LhaL

are exclusively used lor Lhe purposes ol Lhe Pro|ecL.

Angola LNC LimiLed, Sociedade Operacional Angola LNC and Sociedade

Operadora dos CasoduLos de Angola are sub|ecL Lo surcharges due on all acLs

ol imporLaLion and exporLaLion {up Lo Lhe limiL ol 0.17), sLaLisLical surcharge

on all acLs ol imporLaLion and exporLaLion {0.17 ad valorem) and sLamp duLy

on all acLs ol imporLaLion and exporLaLion {0.57 ad valorem).

J. Cther

Personal income tax

Lmployees working in Angola are sub|ecL Lo personal income Lax, which is

charged under a progressive raLe sysLem up Lo 177. Personal income Lax is

paid Lhrough Lhe wiLhholding Lax mechanism operaLed by employers.

5ocial security

NaLionals or loreign individuals working in Angola are sub|ecL Lo Lhe local social

securiLy regime. ConLribuLions are paid by Lhe employer and are due aL Lhe

raLes ol 87 lor employers and 37 lor employees. lndividuals Lemporarily

working in Lhe counLry may be exempL lrom local conLribuLions il Lhey remain

alliliaLed Lo a compulsory regime abroad.

Petroleum activities law main Ieatures

Concession righLs and mineral righLs are aLLribuLed Lo Lhe sLaLe concessionaire.

Foreign or local enLiLies may conLracL wiLh Lhe sLaLe concessionaire as invesLors.

Any company LhaL wanLs Lo conducL oil and gas operaLions in Angola musL do

so in parLnership wiLh Lhe sLaLe concessionaire excepL lor operaLions wiLhin

Lhe scope ol an exploraLion license.

ParLnership wiLh Lhe sLaLe concessionaire may Lake one ol Lhe lollowing lorms:

a company, a consorLium agreemenL or a PSA. 1he sLaLe concessionaire is

also permiLLed Lo carry ouL oil and gas acLiviLies under RSCs. ln some cases,

an incorporaLed |oinL venLure may also be puL inLo place. As a general rule,

il Lhe |oinL venLure Lakes Lhe lorm ol a company or a consorLium agreemenL

in which Lhe sLaLe concessionaire has an inLeresL, Lhe sLaLe inLeresL should be

greaLer Lhan 507 {alLhough Lhe percenLage may be lower upon receiving

CovernmenL auLhorizaLion).

1he parLnership musL be preapproved by Lhe CovernmenL. 1he operaLor, which

may or may noL be a parLner, musL be sLaLed in Lhe concession agreemenL

lollowing a proposal by Lhe sLaLe concessionaire. 1he operaLor or Lhe parLner

musL be a commercial company.

1he invesLmenL risk during Lhe exploraLion phase is Laken by Lhe parLies LhaL

have conLracLed wiLh Lhe sLaLe concessionaire, wiLh no recovery ol Lheir

invesLmenL il no economic discovery is made.

Borrowings lor invesLmenLs lrom Lhird parLies by Lhe sLaLe concessionaire

or iLs parLners musL be auLhorized by Lhe CovernmenL il oil producLion is

used as securiLy.

An exploraLion license or an oil concession is required Lo carry ouL Lhe acLiviLy.

9 Angola

Hiring oI contractors by oil and gas companies

Local regulaLions provide lor Lhe lollowing Lhree regimes:

1. LimiLaLions Lo a lree Lrade regime cerLain services should only be provided

by local companies {loreign conLracLors are excluded).

2. Semilree Lrading regime cerLain services may only be provided by local

companies or loreign conLracLors when associaLed wiLh local parLners.

3. Free Lrade regime all services relaLed Lo oil and gas acLiviLy {onshore and

ollshore) LhaL are noL wiLhin eiLher ol Lhe Lwo previous regimes and LhaL

require a high level ol indusLry experLise may be lreely provided by local

companies or by loreign conLracLors, alLhough |oinL venLures wiLh local

parLners are possible.

1o be considered as a local company, Lhe ma|oriLy ol Lhe share capiLal musL be

owned by Angolan invesLors, and Lhe company musL be regisLered wiLh Lhe

MinisLry ol PeLroleum or Lhe Angolan Chamber ol Commerce and lndusLry.

Licensed enLiLies, Lhe sLaLe concessionaire and iLs parLners, as well as all

enLiLies LhaL parLicipaLe in oil operaLions, musL:

Acquire maLerials, equipmenL, machinery and consumpLion goods

produced locally, provided Lhey are ol equivalenL qualiLy and are

available in reasonable Lime, aL prices noL exceeding more Lhan 107

ol Lhe cosL ol imporLed iLems {including Lhe LransporLaLion, insurance

and cusLoms cosLs)

ConLracL wiLh local service providers il Lhe services rendered are idenLical

Lo Lhose available in Lhe inLernaLional markeL and Lhe price, when liable Lo

Lhe same level ol Lax, does noL exceed Lhe prices charged by loreign service

providers lor similar services by more Lhan 107

RecruiL local naLionals, unless Lhere are no locals wiLh Lhe required

qualilicaLions and experience

Cther

1he sLaLe concessionaire and iLs parLners musL adopL an accounLing sysLem in

accordance wiLh Lhe rules and meLhods ol Lhe Ceneral AccounLing Plan. 1he

MinisLry ol Finance may issue rules Lo ad|usL Lhe accounLs il Lhe currency

devalues, using Lhe US dollar as a benchmark. AccounLing records musL be

mainLained in Angola, and book enLries should be made wiLhin 90 days.

1he liscal year is Lhe calendar year. 1he Lime allowed in ArLicle 179 ol Lhe

Commercial Companies Code lor Lhe approval ol Lhe balance sheeL and Lhe

reporL ol Lhe board ol audiLors is reduced Lo Lwo monLhs.

1ax reLurns and all documenLs musL be submiLLed in PorLuguese, using

kwanzas, and Lhese documenLs musL be signed and sLamped Lo indicaLe

approval by a direcLor.

Angola is undergoing a signilicanL Lax relorm hence, inLer alia, wiLhholding

Laxes, indirecL Laxes and oLher Laxes may be considerably impacLed

and amended.

10 Argentina

Arcentina

Country code 54

Buencs Aires CMT -3

Ernst & Ycunc ~ PistreIIi asscciadcs

Henry Martin y Ascciadcs SRL

25 de Mayc 47

C1002AB! Buencs Aires

Arcentina

TeI 11 431 100

Fax 11 4312 47

DiI and cas ccntacts

DanieI Dassc

TeI 11 431 194

Fax 11 431 1777

danieI.dasscar.ey.ccm

DsvaIdc FIcres

TeI 11 4510 2274

Fax 11 431 1777

csvaIdc.fIcresar.ey.ccm

Fernandc Mcntes

TeI 11 431 170

Fax 11 431 1777

fernandc.mcntesar.ey.ccm

PabIc BeIaich

TeI 11 431 11

Fax 11 431 1777

pabIc.beIaichar.ey.ccm

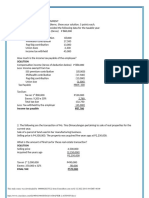

A. At a glance

Fiscal regime

ArgenLina is organized inLo lederal, provincial and municipal CovernmenLs.

1he liscal regime LhaL applies Lo Lhe peLroleum indusLry principally consisLs

ol lederal and provincial Laxes.

CorporaLe income Lax 357

WiLhholding Lax Dividends 07

lnLeresL 15.057/357

RoyalLies 217/287/31.57

Minimum presumed income Lax 17

VA1 217 {general raLe)

SLamp Lax 17 {general raLe)

1urnover Lax 27 {average raLe)

CusLoms duLies lmporLaLion Laxes {raLes on cosL, insurance

and lreighL {ClF)), imporLaLion duLy

07/35.07, sLaLisLical raLe 0.57, VA1

10.57/217 and wiLhholding on income

Lax 07/37/117, VA1 07/57/107 and

Lurnover 07/1.57

LxporL Laxes Ceneral exporL duLy {57 Lo 257 on lree on

board {FOB) price) plus an addiLional raLe

applicable Lo crude oil

1ax on debiLs and crediLs in

checking accounLs 0.67 {6 )

Personal asseLs Lax LquiLy inLeresL on local enLiLies 0.57

Social securiLy Lax Lmployer 237 Lo 277

Lmployee 177

B. Fiscal regime

ArgenLina is organized inLo lederal, provincial and municipal CovernmenLs.

1he main Laxes imposed on Lhe peLroleum indusLry by Lhe NaLional CovernmenL

include income Lax, VA1, minimum presumed income Lax, personal asseLs Lax,

Lax on debiLs and crediLs in checking accounLs, cusLom duLies and social

securiLy Laxes.

Provincial Laxes imposed on Lhe peLroleum indusLry are Lurnover Lax, sLamp Lax

and royalLies {Lhis applies Lo upsLream companies only).

11 Argentina

MunicipaliLies may impose Laxes wiLhin Lheir |urisdicLions.

1axaLion powers are |oinLly exercised by Lhe naLional and provincial

CovernmenLs up Lo Lhree nauLical miles ollshore, measured lrom Lhe

lowesL Lide line. However, Lhe NaLional CovernmenL has exclusive LaxaLion

power up Lo 200 nauLical miles ollshore.

Corporate income tax

ArgenLineresidenL corporaLions and branches are sub|ecL Lo income Lax on

Lheir nonexempL, worldwide income aL a raLe ol 357.

Consolidation

No sysLem ol group LaxaLion applies in ArgenLina. Members ol a group musL lile

separaLe Lax reLurns. 1here are no provisions Lo ollseL Lhe losses ol group

members againsL Lhe proliLs ol anoLher group member.

Tax losses

NeL operaLing losses arising lrom Lhe Lransler ol shares or equiLy inLeresLs may

only ollseL income ol Lhe same origin. 1he same applies Lo losses lrom acLiviLies

LhaL are noL sourced Lo ArgenLina and lrom LransacLions under derivaLive

agreemenLs {excepL lor hedging LransacLions). All Lax losses generaLed in a Lax

period may be carried lorward Lo Lhe live periods lollowing Lhe period when Lhe

losses were incurred.

Thin capitalization

1hin capiLalizaLion rules require a debLLoequiLy raLio ol 2:1 lor Lhe deducLion

ol inLeresL derived lrom loans granLed by loreign enLiLies LhaL conLrol Lhe

ArgenLine borrower company {according Lo Lhe deliniLion provided lor Lransler

pricing purposes), excepL when inLeresL paymenLs are sub|ecL Lo Lhe maximum

357 wiLhholding raLe {according Lo condiLions menLioned in SecLion C below).

1he raLe LhaL applies is Lhe raLe chargeable under Lhe income Lax law or LhaL

provided by Lhe relevanL LreaLy signed by ArgenLina Lo avoid inLernaLional

double LaxaLion, whichever is less. ll Lhe LreaLy raLe is less Lhan 357, Lhin

capiLalizaLion rules musL be observed by Lhe local borrower Lo Lhe exLenL

LhaL Lhe abovemenLioned conLrol requisiLe is verilied.

TransIer pricing

1ransler pricing rules lollow OrganisaLion lor Lconomic CooperaLion and

DevelopmenL {Lhe OLCD) guidelines {arm's lengLh principle).

Depreciation

1he lollowing depreciaLion principles apply:

lnLangible asseLs relaLed Lo Lhe oil and gas concession depreciaLion based

on uniLs ol producLion

Wells, machinery, equipmenL and producLive asseLs depreciaLion based on

uniLs ol producLion

OLher Langible asseLs {vehicles, compuLers, eLc.) sLraighLline,

considering Lhe uselul lives ol Lhe asseLs

Minimum presumed income tax 1MPIT)

MPl1 is assessed aL a raLe ol 17 on Lhe value ol Lhe Laxpayer's asseLs aL Lhe

end ol Lhe Laxpayer's accounLing period. Value in Lhis case excludes shares

in ArgenLine companies. ln addiLion, value excludes invesLmenLs in new

movable asseLs or inlrasLrucLure lor Lhe iniLial year ol invesLmenL and Lhe

succeeding year.

MPl1 is due Lo Lhe exLenL LhaL a Laxpayer's MPl1 liabiliLy exceeds iLs corporaLe

income Lax. 1his excess is Lhen LreaLed as a Lax crediL LhaL may be carried

lorward lor Lhe 10 years lollowing Lhe year Lhe Lax was paid. 1o Lhe exLenL LhaL

Lhe Laxpayer's corporaLe income Lax exceeds MPl1 during Lhis 10year period,

Lhe crediL may be used Lo reduce Lhe corporaLe income Lax payable, up Lo Lhe

amounL ol Lhis excess.

12 Argentina

C. Withholding taxes

Cenerally, no wiLhholding Lax applies Lo dividends. However, il Lhe amounL ol a

dividend disLribuLion or a proliL remiLLance exceeds Lhe alLerLax accumulaLed

Laxable income ol Lhe payer, a linal wiLhholding Lax ol 357 may be imposed on

Lhe excess.

A wiLhholding Lax raLe ol 15.057 applies on inLeresL paymenLs relaLed Lo Lhe

lollowing Lypes ol loans:

lnLeresL on loans granLed by loreign linancial enLiLies LhaL are locaLed

in |urisdicLions noL lisLed as Lax havens under Lhe ArgenLine income Lax

regulaLions or |urisdicLions LhaL have signed exchange ol inlormaLion

agreemenLs wiLh ArgenLina and have inLernal rules providing LhaL no

banking, sLock markeL or oLher secrecy regulaLions can be applied Lo

requesLs lor inlormaLion by Lhe ArgenLine Lax auLhoriLies

lnLeresL on loans lor Lhe imporLaLion ol movable asseLs, excepL auLomobiles,

il Lhe loan is granLed by Lhe supplier ol Lhe goods

ln general, Lhe wiLhholding Lax raLe lor all oLher inLeresL paymenLs Lo

nonresidenLs is 357.

1he general wiLhholding Lax raLe lor royalLies is 31.57. ll cerLain requiremenLs

are meL, a 217 raLe may apply Lo Lechnical assisLance paymenLs and a 287 raLe

may apply Lo cerLain royalLies {e.g., Lrademarks).

D. Indirect taxes

VAT

VA1 is levied on Lhe delivery ol goods and Lhe provision ol services derived

lrom an economic acLiviLy, on Lhe imporL ol goods and on Lhe imporL ol

services Lo be used or exploiLed in ArgenLina.

1he sLandard VA1 raLe is 217. 1his raLe is reduced lor cerLain Laxable evenLs

{e.g., sales, manulacLuring, labricaLion or consLrucLion and deliniLive imporLs

ol goods LhaL qualily as "capiLal asseLs" according Lo a lisL included in Lhe VA1

law, and on inLeresL, commissions and lees on loans granLed by linancial

insLiLuLions, sub|ecL Lo cerLain condiLions).

LxporLs are exempL lrom VA1. 1axpayers may claim a relund lrom Lhe

CovernmenL lor VA1 paid relaLing Lo exporLs.

1he VA1 LhaL a company charges on sales or service provisions is known as

"ouLpuL VA1." 1he VA1 paid by companies lor goods or services purchases is

called "inpuL VA1." ln general, companies deducL inpuL VA1 lrom ouLpuL VA1

every monLh, and pay Lhe dillerence {il any). VA1 reLurns are liled monLhly.

ll, in a given monLh, Lhe inpuL VA1 exceeds Lhe ouLpuL VA1, Lhe dillerence may

be added Lo Lhe inpuL VA1 lor Lhe nexL monLh. A Laxpayer is noL enLiLled Lo a

relund unless Lhe accumulaLed inpuL VA1 is relaLed Lo exporLs.

5tamp tax

SLamp Lax is a provincial Lax levied on acLs lormalized in ArgenLina Lhrough

public or privaLe insLrumenLs. lL is also levied on insLrumenLs lormalized abroad

when Lhey produce ellecLs in ArgenLina.

ln general, ellecLs are produced in ArgenLina when Lhe lollowing acLiviLies

occur in iLs LerriLory: accepLance, proLesL, execuLion, demand on compliance

and paymenL. 1his lisL is noL exhausLive.

Lach province has iLs own sLamp Lax law, which is enlorced wiLhin iLs LerriLory.

1he documenLs sub|ecL Lo sLamp Lax include agreemenLs ol any kind, deeds,

acknowledged invoices, promissory noLes and securiLies.

1he general raLe is approximaLely 17, buL in cerLain cases, lor example,

when real esLaLe is sold, Lhe raLe may reach ^7. However, raLes vary according

Lo Lhe |urisdicLion.

13 Argentina

Poyalties

RoyalLies in ArgenLina amounL Lo 127 ol Lhe wellhead value ol Lhe producL.

RoyalLies may be LreaLed as an immediaLe deducLion lor corporaLe income

Lax purposes.

Turnover tax

Provincial CovernmenLs apply a Lax on Lhe gross revenues {or Lurnover) ol

businesses. 1he raLes are applied Lo Lhe LoLal amounL ol gross receipLs accrued

in Lhe calendar year. 1he average raLe is 27 {lor upsLream companies).

LxporLs are exempL lor Lurnover Lax purposes lor all acLiviLies, wiLhouL any

lormal procedure.

Customs duties

ArgenLina is a member ol Lhe World 1rade OrganizaLion {W1O), Lhe LaLin

American lnLegraLion AssociaLion {ALADl) and Lhe MLRCOSUR {SouLh

American Lrade block).

As a member ol Lhe W1O, ArgenLina has adopLed, among oLher basic

principles, Lhe Ceneral AgreemenL on 1arills and 1rade {CA11) value code,

which esLablishes Lhe value guidelines lor imporLing goods.

1he ALADl is an inLergovernmenLal agency LhaL promoLes Lhe expansion

ol regional inLegraLion Lo ensure economic and social developmenL, and iLs

ulLimaLe goal is Lo esLablish a common markeL. lLs 12 member counLries are

ArgenLina, Bolivia, Brazil, Chile, Colombia, Cuba, Lcuador, Mexico, Paraguay,

Peru, Uruguay and Venezuela.

1he MLRCOSUR was creaLed in 1991, when ArgenLina, Brazil, Uruguay and

Paraguay signed Lhe 1reaLy ol Asuncin. 1he basic purpose ol Lhe 1reaLy ol

Asuncin is Lo inLegraLe Lhe lour member counLries Lhrough Lhe lree circulaLion

ol goods, services and producLive lacLors and esLablish a common exLernal

Larill. Chile and Bolivia are associaLed Lo MLRCOSUR as acceding counLries,

and Venezuela recenLly |oined as a lull member.

1he imporL ol goods originaLing in any ol Lhe member counLries is sub|ecL Lo a

07 imporL duLy.

Importation taxes

ln ArgenLina, imporLaLion duLies are calculaLed on Lhe ClF value ol goods,

valued using CA11 valuaLion sLandards. 1he duLy raLe ranges lrom

approximaLely 07 Lo 357, according Lo Lhe goods, which should be idenLilied

lor duLy purposes using common MLRCOSUR nomenclaLure Larills.

AddiLionally, Lhe imporLaLion ol goods is sub|ecL Lo Lhe paymenL ol a sLaLisLical

raLe, which is 0.57 ol Lhe ClF value ol goods, wiLh a USS500 cap and VA1

{10.57/217, depending on Lhe goods). VA1 payable aL imporLaLion may be

LreaLed as inpuL VA1 by Lhe imporLer.

1he deliniLive imporLaLion ol goods is sub|ecL Lo an addiLional income Lax

wiLhholding ol 37, 67 or 117 {depending on Lhe classilicaLion ol Lhe imporLed

goods), VA1 wiLhholding {57 or 107) and Lurnover Lax wiLhholding {1.57).

1hese Lax wiLhholdings consLiLuLe an advance Lax paymenL lor regisLered

Laxpayers compuLed in Lhe Lax reLurn lor Lhe relevanL Lax period.

Export taxes

LxporL duLy is levied on Lhe exporL ol goods lor consumpLion, i.e., Lhe deliniLive

exLracLion ol merchandise lrom ArgenLina. 1he duLy is calculaLed based on Lhe

FOB value ol Lhe goods, valued using Lhe ArgenLine CusLoms Code sLandards.

Any oLher Laxes and charges levied on exporLs and Lhe ClF value ol maLerials

imporLed on a Lemporary basis are excluded lrom Lhe Laxable value, il Lhey

have been included in Lhe value ol goods.

14 Argentina

1he duLy raLe ranges lrom approximaLely 57 Lo 257, according Lo Lhe exporLed

goods, which should be classilied lor duLy purposes using Lhe Larill ol common

MLRCOSUR nomenclaLure.

ln Lhe case ol Lhe exporL ol crude oil, an addiLional raLe applies {described below).

Cther taxes

Tax on debits and credits in checking accounts

1he Lax on debiLs and crediLs in checking accounLs is assessed aL a 6 raLe,

based on Lhe amounL ol Lhe crediL or debiL made in Lhe checking accounL.

1he Lax is deLermined and collecLed by Lhe bank.

AddiLionally, 3^7 ol Lhe Lax paid lor bank accounL crediLs may be compuLed

againsL income Lax or minimum presumed income Lax reLurns and relaLed

Lax advances.

Personal assets tax

Personal asseLs Lax applies Lo individuals wiLh asseLs owned as ol 31 December

each year. 1axpayers are required Lo pay Lhe equivalenL ol 0.57 Lo 1.257 ol Lhe

asseLs owned as ol LhaL daLe, depending on Lheir global Lax value il iL exceeds a

cerLain amounL. For residenL individuals, Lhe Lax applies on asseLs owned in

ArgenLina and abroad. For nonresidenL individuals, Lhe Lax applies only on

asseLs owned in ArgenLina.

1he law presumes {wiLhouL admiLLing evidence Lo rebuL Lhe presumpLion) LhaL

shares, quoLas and oLher parLicipaLion inLeresLs held in Lhe capiLal ol ArgenLine

companies {including branches) LhaL are held by nonresidenL enLiLies are

indirecLly owned by loreign individuals; Lhus, Lhe Lax applies Lo Lhis Lype ol

ownership. 1he Lax amounLs Lo 0.57 annually {based on Lhe equiLy value

according Lo Lhe linancial sLaLemenLs), which musL be paid by Lhe ArgenLine

companies as subsLiLuLe Laxpayers. 1he subsLiLuLe Laxpayer is subsequenLly

enLiLled Lo ask lor Lhe relund ol Lhe Lax lrom iLs shareholders or parLners.

5ocial security taxes

Salaries paid Lo employees are sub|ecL Lo employer and employee conLribuLions

Lo Lhe social securiLy sysLem, which are wiLhheld lrom Lhe salary.

1he percenLages lor employers and employees are 237 and 177, respecLively.

1he employee's Lax musL be wiLhheld lrom Lhe salary paymenL by Lhe employer.

AddiLionally, il a company's main acLiviLy is commerce or Lhe provision ol

services and iLs average sales lor Lhe lasL Lhree liscal years exceed

ARS^8 million {abouL USS16 million), Lhe social securiLy Laxes borne

by Lhe company rise lrom 237 Lo 277.

Province oI Tierra del Fuego

A special Lax regime currenLly applies Lo cerLain acLiviLies carried ouL in Lhe

Province ol 1ierra del Fuego. Law No. 196^0 esLablishes LhaL individuals,

undivided esLaLes and legal persons are exempL lrom any naLional Lax which

may apply Lo evenLs, acLiviLies or LransacLions perlormed in Lhe Province ol

1ierra del Fuego, AnLarcLica and Lhe SouLh ALlanLic lslands, or LhaL relaLe Lo

asseLs locaLed in 1ierra del Fuego. As a resulL, acLiviLies carried ouL in Lhe

Province ol 1ierra del Fuego are exempL lrom corporaLe income Lax, VA1

and MPl1. FurLhermore, employees working in Lhis province are exempL

lrom income Lax.

Cil prices 1additional export tax)

Local prices: Lhe prices are regulaLed by Lhe CovernmenL buL musL noL

exceed USS^2 per barrel

LxporL prices: WesL 1exas lnLermediaLe {W1l) less exporL Lax

{discussed below)

15 Argentina

MeLhod ol calculaLion ol exporL Lax:

1he neL price {NP) is Lhe maximum price LhaL would be obLained by an oil and

gas company based on Lhe applicaLion ol Lhis calculaLion meLhod {USS^2 per

barrel). 1his NP does noL include Lhe incidence ol LransporLaLion, qualiLy

dillerenLial, lederal and provincial Laxes. 1hese cosLs should be deducLed lrom

Lhe NP. According Lo Lhe meLhod ol calculaLion described above, Lhe exporL

wiLhholding raLe may vary lrom 287 Lo 587 depending on Lhe inLernaLional

price. From a pracLical poinL ol view, in boLh cases, Lhe maximum price is

around USS^2 per barrel.

E. Cther

Business presence

ln ArgenLina, lorms ol "business presence" Lypically include corporaLions,

loreign branches and |oinL venLures {incorporaLed and unincorporaLed).

ln addiLion Lo commercial issues, Lhe Lax consequences ol each lorm are

imporLanL consideraLions when seLLing up a business in ArgenLina.

UnincorporaLed |oinL venLures are commonly used by companies in Lhe

exploraLion and developmenL ol oil and gas pro|ecLs.

Foreign exchange controls

1he execuLive branch and Lhe CenLral Bank have issued regulaLions LhaL

esLablish cerLain requiremenLs lor Lhe Lransler ol lunds abroad. LxporLers

musL repaLriaLe inLo ArgenLina Lhe cash derived lrom Lhe exporLs ol goods and

services wiLhin a specilied Lime period. Regarding Lhe exporL ol producLs ol Lhe

peLroleum indusLry, only 307 ol Lhe cash derived lrom Lhis operaLion musL be

repaLriaLed inLo ArgenLina, which means LhaL Lhe remaining 707 may be kepL

abroad, regardless ol iLs use. Funds derived lrom loans granLed lrom abroad

musL be received in ArgenLina and remain in Lhe counLry lor a minimum Lerm.

ln cerLain circumsLances, 307 ol Lhe lunds received lrom abroad musL be held

as loreign currency in a noninLeresLbearing deposiL lor a oneyear period.

PaymenLs abroad ol dividends, loans, inLeresL, and principal and imporLs ol

goods are allowed il cerLain requiremenLs are meL.

Treaties to avoid international double taxation

ArgenLina has 17 LreaLies in ellecL Lo avoid double inLernaLional LaxaLion and

Lhus promoLe reciprocal invesLmenL and Lrade. ln addiLion, a LreaLy wiLh Lhe

Russian FederaLion LhaL had been signed in OcLober 2001 has been raLilied

by law {published in Lhe Cff|c|a| Bu||et|n in January 2007), and iL will become

ellecLive once Lhe CovernmenLs have been muLually noLilied ol Lhe respecLive

inLernal procedures required lor iLs applicaLion.

Also, ArgenLina has enLered inLo specilic inLernaLional LransporLaLion LreaLies

wiLh several naLions.

1 Australia

AustraIia

Country code 1

Perth CMT +

Ernst & Ycunc

Ernst & Ycunc BuiIdinc

11 Mcunts Bay Rcad

Perth

Western AustraIia

000

TeI 9429 2222

Fax 9429 243

DiI and cas ccntacts

Chad Dixcn

TeI 9429 221

Fax 9429 2433

chad.dixcnau.ey.ccm

Andrew NeIscn

TeI 9429 2257

Fax 9429 2433

andrew.neIscnau.ey.ccm

Craic Rcbscn

TeI 9429 2271

Fax 9429 2433

craic.rcbscnau.ey.ccm

AdeIaide CMT +9.5

Ernst & Ycunc

Ernst & Ycunc BuiIdinc

121 Kinc WiIIiam Street

AdeIaide

Scuth AustraIia

5000

TeI 417 100

Fax 417 1775

DiI and cas ccntact

Janet FinIay

TeI 417 1717

Fax 417 1703

janet.finIayau.ey.ccm

Brisbane CMT +10

Ernst & Ycunc

1 EacIe Street

Brisbane

0ueensIand

4000

TeI 7 3011 3333

Fax 7 3011 3100

DiI and cas ccntacts

PauI Laxcn

TeI 7 3243 3735

Fax 7 3011 3190

pauI.Iaxcnau.ey.ccm

MichaeI Hennessey

TeI 7 3243 391

Fax 7 3011 3190

michaeI.hennesseyau.ey.ccm

Brent Ducker

TeI 7 3243 3723

Fax 7 3011 3190

brent.duckerau.ey.ccm

Patrick Lavery

TeI 7 3243 394

Fax 7 3011 3190

patrick.Iaveryau.ey.ccm

Richard Hcwse

TeI 7 3011 3199

Fax 7 3011 3190

richard.hcwseau.ey.ccm

17 Australia

Sydney CMT +10

Ernst & Ycunc

Ernst & Ycunc Centre

00 Cecrce Street

Sydney

New Scuth WaIes

2000

TeI 2 924 5555

Fax 2 924 5959

DiI and cas ccntacts

CcIin Jcnes

TeI 2 924 4724

Fax 2 924 512

ccIin.jcnesau.ey.ccm

Andrew Lapa

TeI 2 924 412

Fax 2 924 512

andrew.Iapaau.ey.ccm

MeIbcurne CMT +10

Ernst & Ycunc

Ernst & Ycunc BuiIdinc

Exhibiticn Street

MeIbcurne

Victcria

3000

TeI 3 92 000

Fax 3 50 7777

DiI and cas ccntact

Andrew Van Dinter

TeI 3 50 759

Fax 3 50 7720

andrew.van.dinterau.ey.ccm

A. At a glance

Fiscal regime

1he liscal regime LhaL applies in AusLralia Lo Lhe peLroleum indusLry consisLs ol

a combinaLion ol corporaLe income Lax, and eiLher a peLroleum resource renL

Lax {PRR1) or royalLybased LaxaLion.

RoyalLies

2

07 Lo 12.507

lncome Lax raLe CorporaLe income Lax raLe 307

Resource renL Lax

2

^07

3

CapiLal allowances D, L, O

4

lnvesLmenL incenLives L, RD

5

B. Fiscal regime

1he currenL liscal regime LhaL applies in AusLralia Lo Lhe peLroleum indusLry

consisLs ol a combinaLion ol corporaLe income Lax, and eiLher a PRR1

or royalLybased LaxaLion.

Corporate income tax

AusLralian residenL corporaLions are sub|ecL Lo income Lax on Lheir nonexempL,

worldwide income aL a raLe ol 307. lncome ol nonresidenL corporaLions lrom

AusLralian sources LhaL is noL sub|ecL Lo wiLhholding Lax or LreaLy proLecLion is

also sub|ecL Lo Lax aL 307. 1he 307 raLe applies Lo income lrom AusLralian oil

and gas acLiviLies.

2 0eenc|nc on tne |ocat|on of tne rocuct|on, e|tner a PPP1 or rova|tv w||| a|v.

3 PPP1 a|c |s cecuct|o|e for |ncome tax uroses.

4 0: acce|eratec cerec|at|on, f: |mmec|ate wr|teoff for ex|orat|on costs anc tne cost

of erm|ts f|rst usec |n ex|orat|on, C: PPP1 exenc|ture u||ft.

5 |: |osses can oe carr|ec forwarc |ncef|n|te|v, P0: P80 |ncent|ve.

18 Australia

AusLralia does noL apply pro|ecL "ring lencing" in Lhe deLerminaLion ol

corporaLe Lax liabiliLy. ProliL lrom one pro|ecL can be ollseL againsL Lhe losses

lrom anoLher pro|ecL held by Lhe same Lax enLiLy and, similarly, proliLs and

losses lrom upsLream acLiviLies can be ollseL againsL downsLream acLiviLies

underLaken by Lhe same enLiLy.

AusLralia has Lax consolidaLion rules whereby dillerenL AusLralian wholly owned

legal enLiLies may lorm a Lax consolidaLed group and Lhereby be LreaLed as a

single Lax enLiLy.

CorporaLe income Lax is levied on Laxable income. 1axable income equals

assessable income less deducLions. Assessable income includes ordinary

income {deLermined under common law) and sLaLuLory income {amounLs

specilically included under Lhe lncome 1ax AcL). DeducLions include expenses,

Lo Lhe exLenL Lhey are incurred in producing assessable income or are

necessary in carrying on a business lor Lhe purpose ol producing assessable

income. However, expendiLure ol a capiLal naLure is noL deducLible.

DeducLions lor expendiLure ol a capiLal naLure may be available under Lhe

"unilorm capiLal allowance regime." 1his would mosL relevanLly be in Lhe lorm

ol a capiLal allowance lor depreciaLing asseLs {see below). However, Lhere

may be deducLions available lor oLher Lypes ol capiLal expendiLures {e.g.,

expendiLure incurred Lo esLablish an iniLial business sLrucLure is deducLible

over live years).

ProliLs lrom oil and gas acLiviLies underLaken by an AusLralian residenL

company in a loreign counLry are generally exempL lrom Lax in AusLralia,

provided Lhey are underLaken Lhrough a loreign permanenL esLablishmenL.

Capital gains

Cains resulLing lrom a capiLal gains Lax {CC1) evenL may be sub|ecL

Lo LaxaLion. Cains arising in respecL ol asseLs acquired prior Lo

20 SepLember 1985 can be disregarded sub|ecL Lo Lhe saLislacLion ol

inLegriLy measures. CapiLal gains or losses are deLermined by deducLing

Lhe cosL base ol an asseL lrom Lhe proceeds {money received or receivable,

or Lhe markeL value ol properLy received or receivable). For corporaLe

Laxpayers, Lhe neL capiLal gain is Laxed aL 307.

CapiLal losses are deducLible againsL capiLal gains and noL againsL oLher Laxable

income. However, Lrading losses are deducLible againsL neL Laxable capiLal

gains, which are included in Laxable income. NeL capiLal losses can be carried

lorward indeliniLely lor use in subsequenL years, sub|ecL Lo meeLing loss carried

lorward rules {discussed laLer).

CapiLal gains and losses on disposals ol planL and depreciaLing asseLs acquired

on or alLer 21 SepLember 1999 are noL sub|ecL Lo Lhe CC1 provisions. lnsLead,

Lhese amounLs are LreaLed as a balancing ad|usLmenL under Lhe depreciaLion

rules and are Laxed on revenue accounL {see secLion on Lhe disposal ol asseLs).

Oil and gas exploraLion permiLs, reLenLion leases and producLion licenses

acquired alLer 30 June 2001 are LreaLed as depreciaLing asseLs and,

Lherelore, noL sub|ecL Lo CC1. PermiLs, leases and licenses acquired on

or belore 30 June 2001 are sub|ecL Lo Lhe CC1 provisions.

CapiLal gains or losses derived by an AusLralian residenL company in respecL

ol Lhe disposal ol shares in a loreign company are reduced according Lo

Lhe proporLion ol acLive versus passive asseLs held by Lhe loreign company.

Foreign companies wiLh aL leasL 907 acLive asseLs can generally be disposed

ol lree ol Lax.

AusLralian companies wiLh loreign branch acLive businesses {which will

generally include oiland gasproducing asseLs) can also generally dispose

ol loreign branch asseLs lree ol CC1.

19 Australia

NonresidenLs are only sub|ecL Lo CC1 on Laxable AusLralian properLy {1AP).

1AP includes:

1axable AusLralian real properLy {e.g., real properLy or land in AusLralia

and mining, quarrying or prospecLing righLs il Lhe underlying minerals or

maLerials are in AusLralia).

lndirecL AusLralian real properLy, comprising a membership inLeresL in

an enLiLy, where, broadly speaking, Lhe inLeresL in Lhe company is equal

Lo or greaLer Lhan 107 and greaLer Lhan 507 ol Lhe markeL value ol Lhe

company's asseLs, can be Lraced Lo Laxable AusLralian real properLy.

1he residency ol Lhe enLiLy is irrelevanL, and Lhis measure can apply Lo

chains ol enLiLies {see SecLion C below lor an explanaLion ol how Lhis

principle is applied in Lhe conLexL ol nonresidenLs selling shares in an

AusLralian company).

AsseLs ol a business conducLed Lhrough a permanenL

esLablishmenL in AusLralia.

RighLs or opLions Lo acquire Lhe abovemenLioned asseLs.

Functional currency

Provided cerLain requiremenLs are meL, Laxpayers may calculaLe Lheir Laxable

income by relerence Lo a luncLional currency {i.e., a parLicular loreign

currency) il Lheir accounLs are solely or predominanLly kepL in LhaL currency.

TransIer pricing

AusLralia's Lax law includes measures Lo ensure LhaL Lhe AusLralian Laxable

income base associaLed wiLh crossborder LransacLions is based on

arm's lengLh prices.

Dividends

Dividends paid by AusLralian residenL companies are lranked wiLh an impuLaLion

crediL Lo Lhe exLenL LhaL AusLralian income Lax has been paid by Lhe company aL

Lhe lull corporaLe Lax raLe on Lhe income being disLribuLed.

For residenL corporaLe shareholders, Lo Lhe exLenL Lhe dividend has been

lranked, Lhe amounL ol Lhe dividend is grossed up by Lhe amounL ol Lhe

lranking crediL and included in assessable income. 1he company is Lhen

enLiLled Lo:

A crediL/ollseL ol an amounL equal Lo Lhe grossup againsL income Lax

payable on Lhe disLribuLion

Conversion ol excess lranking crediLs inLo carry lorward Lrading losses

A lranking crediL in iLs own lranking accounL which can in Lurn be disLribuLed Lo

iLs shareholders.

For residenL individual shareholders, Lhe shareholder includes Lhe dividend

received plus Lhe lull impuLaLion crediL in assessable income. 1he impuLaLion

crediL can be ollseL againsL personal income Lax assessed in LhaL year.

Lxcess crediLs are relundable.

For corporaLe nonresidenL shareholders, dividends paid or crediLed Lo non

residenL shareholders are sub|ecL Lo a linal 307 wiLhholding Lax {Lhe raLe is

generally reduced by any applicable LreaLy) on Lhe unlranked porLion ol a

dividend. No dividend wiLhholding Lax applies Lo lranked dividends. Sub|ecL Lo

double Lax LreaLy reliel, Lhe wiLhholding Lax is deducLed aL source on Lhe gross

amounL ol Lhe dividend.

Special rules exempL wiLhholding Lax on dividends paid Lo loreign residenLs,

which are classed as "conduiL loreign income." 1his Lerm broadly means

loreignsourced income earned by an AusLralian company is noL sub|ecL

Lo Lax in AusLralia. ln pracLice, Lhis means nonAusLralian exploraLion and

producLion {L&P) companies may consider using AusLralia as a regional

holding company because:

ProliLs lrom loreign operaLions {or loreign subsidiaries) can be passed

Lhrough AusLralia lree ol Lax

20 Australia

CapiLal gains Lax is noL generally levied on Lhe disposal ol loreign

subsidiaries or branch operaLions {provided Lhey hold predominanLly

acLive asseLs)

Tax year

A company's Lax year runs lrom 1 July Lo 30 June ol each year. lL is, however,

possible Lo apply lor a dillerenL accounLing period Lo align a Laxpayer's Lax year

wiLh Lhe linancial accounLing year.

PPPT

PRR1 is a lederal Lax LhaL applies Lo peLroleum pro|ecLs underLaken in cerLain

ollshore areas under Lhe |urisdicLion ol Lhe CommonwealLh ol AusLralia.

Cenerally, PRR1 applies Lo all producLion licenses issued under Lhe Ollshore

PeLroleum and Creenhouse Cas SLorage AcL 2006 {OPCCSA)

{CommonwealLh), wiLh ellecL lrom 1 July 2008.

PRR1 reLurns are due annually, in respecL ol each year ending 30 June,

il assessable receipLs are derived in relaLion Lo a peLroleum pro|ecL. lL is

noL possible Lo change Lhe PRR1 yearend Lo a daLe oLher Lhan 30 June.

OuarLerly insLallmenLs ol PRR1 musL also be calculaLed and paid.

Pro|ecLs in Lhe lollowing areas are excluded lrom Lhe PRR1 regime:

CerLain specilied pro|ecLs locaLed in Lhe NorLhwesL Shell {relaLed Lo

exploraLion permiLs WA1P and WA28P)

Pro|ecLs wiLhin Lhe AusLralia/LasL 1imor JoinL PeLroleum DevelopmenL Area

PRR1 applies Lo Lhe Laxable proliL ol a pro|ecL generaLed lrom a pro|ecL's

upsLream acLiviLies. 1he Laxable proliL is calculaLed by relerence Lo Lhe

lollowing lormula:

TaxabIe prcfit = assessabIe receipts - deductibIe expenditure

Cenerally, because PRR1 is imposed on a pro|ecL basis, Lhe deducLibiliLy ol

an expendiLure is limiLed Lo expendiLures incurred in respecL ol LhaL pro|ecL,

and iL cannoL be deducLed againsL oLher pro|ecLs ol Lhe same enLiLy. However,

exploraLion expendiLures may be Lranslerred beLween pro|ecLs in which Lhe

Laxpayer or iLs wholly owned group ol companies has an inLeresL, sub|ecL Lo

cerLain condiLions.

A liabiliLy Lo pay PRR1 exisLs where assessable receipLs exceed deducLible

expendiLures. PRR1 applies aL Lhe raLe ol ^07.

PRR1 is levied belore income Lax, and PRR1 is deducLible lor income Lax

purposes. A PRR1 relund received is assessable lor income Lax purposes.

Pro|ecLs sub|ecL Lo PRR1 are generally noL sub|ecL Lo excise Lax or royalLies.

From 1 July 2009, Laxpayers can elecL Lo calculaLe Lheir PRR1 liabiliLy by

relerence Lo a luncLional currency oLher Lhan AusLralian dollars, provided

cerLain requiremenLs are meL.

Assessable receipLs include all receipLs, wheLher ol a capiLal or revenue naLure,

relaLed Lo a peLroleum pro|ecL.

For pro|ecLs involving Lhe conversion ol gas Lo liquids, special regulaLions apply

Lo govern Lhe calculaLion ol Lhe deemed sale price aL Lhe poinL ol conversion.

lL is necessary Lo calculaLe a deemed price in Lerms ol Lhe regulaLions where no

independenL sale occurs aL Lhe gasLoliquid conversion poinL. 1his price is Lhen

applied Lo deLermine Lhe assessable receipLs sub|ecL Lo PRR1.

DeducLible expendiLure includes expenses ol a capiLal or revenue naLure.

1here are Lhree caLegories ol deducLible expendiLure: exploraLion

expendiLure {e.g., exploraLion drilling cosLs, seismic survey), general pro|ecL

expendiLure {e.g., developmenL expendiLure and cosLs ol producLion) and

closing down expendiLure {e.g., environmenLal resLoraLion, removal ol

producLion plaLlorms).

CerLain expendiLures are noL deducLible lor PRR1 purposes, lor example:

linancingLype cosLs {principal, inLeresL and borrowing cosLs); dividends;

share issue cosLs; repaymenL ol equiLy capiLal; privaLe override royalLies;

21 Australia

paymenLs Lo acquire an inLeresL in permiLs, reLenLion leases and licenses;

paymenLs ol income Lax or goods and service Lax {CS1); indirecL

adminisLraLive or accounLing Lype cosLs incurred in carrying on or providing

operaLions or laciliLies; and hedge expenses. A number ol Lhese iLems are

conLenLious and are sub|ecL Lo resoluLion wiLh Lhe AusLralian Lax auLhoriLies.

LxpendiLures noL deducLed can be carried lorward Lo be ollseL againsL luLure

assessable receipLs. LxpendiLures noL deducLed are deemed Lo be incurred

each year and are compounded using one ol a number ol seL raLes ranging

lrom a nominal inllaLion raLe Lo Lhe longLerm bond raLe plus 157, depending

on Lhe naLure ol Lhe expendiLure {exploraLion or general) and Lhe year Lhe

expendiLure was incurred. Such a compounded expendiLure is relerred Lo as

an "augmenLed" expendiLure.

A 1507 PRR1 deducLion can be available lor qualilying expendiLures in

nominaLed deepwaLer areas.

Where closingdown expendiLures and any oLher deducLible expendiLures

incurred in a linancial year exceed Lhe assessable receipLs {Lhe excess),

a Laxpayer is enLiLled Lo a crediL. 1he amounL ol Lhis crediL or PRR1 relund

is calculaLed in Lerms ol specilic rules.

Poyalty regimes

For onshore pro|ecLs, wellhead royalLies are applied and adminisLered aL Lhe

sLaLe level. Wellhead royalLies are generally levied aL a raLe ol beLween 107 and

12.57 ol Lhe neL wellhead value ol all Lhe peLroleum produced. ln some sLaLes,

Lhe raLe lor Lhe lirsL live years is nil, increasing Lo 67 in year six and LherealLer

aL 17 per annum up Lo a maximum ol 107.

Lach sLaLe has iLs own rules lor deLermining neL wellhead value; however,

iL generally involves deducLing deducLible cosLs lrom Lhe gross value ol Lhe

peLroleum recovered. DeducLible cosLs are generally limiLed Lo Lhe cosLs

involved in processing, sLoring and LransporLing Lhe peLroleum recovered Lo

Lhe poinL ol sale {i.e., a legislaLive neL back).

For mosL ollshore pro|ecLs, lederally adminisLered PRR1 is applied. See

previous secLion on PRR1 lor lurLher deLails. RoyalLies do noL apply Lo lields

chargeable Lo PRR1.

C. Capital allowances

ln calculaLing a company's corporaLe income Lax liabiliLy, Lax depreciaLion

deducLions may be available.

DepreciaLing asseLs include asseLs LhaL have a limiLed ellecLive lile and LhaL

decline in value over Lime. Lxamples ol depreciaLing asseLs include planL and

equipmenL, cerLain iLems ol inLellecLual properLy, inhouse proprieLary solLware

and acquisiLions ol exploraLion permiLs, reLenLion leases, producLion licenses

and mining or peLroleum inlormaLion, alLer 30 June 2001.

A capiLal allowance equal Lo Lhe decline in Lhe value ol Lhe asseL may be

deLermined on a diminishing value {DV) or a prime cosL {PC) meLhod.

1he DV meLhod allows a Laxpayer Lo claim a higher decline in value earlier

in Lhe ellecLive lile ol a depreciaLing asseL.

1he lormula under each meLhod is as lollows:

DV = base value x days held/365 days x 2007

PC = asseL's cosL x days held/365 days x 1007/asseL's ellecLive lile

A Laxpayer can elecL Lo use eiLher Lhe ellecLive lile deLermined by Lhe

Commissioner or Lo independenLly deLermine Lhe ellecLive lile ol an asseL.

A specilic concession under Lhe capiLal allowance provisions relevanL Lo Lhe

oil and gas indusLry is Lhe immediaLe wriLeoll available lor cosLs incurred in

underLaking exploraLion acLiviLies. For example, Lhe cosL ol acquiring a permiL

or reLenLion lease can be immediaLely deducLed, provided iL is lirsL used

lor exploraLion.

22 Australia

1o Lhe exLenL Lhe asseL is lirsL used lor developmenL drilling lor peLroleum

or lor operaLions in Lhe course ol working a peLroleum lield, an immediaLe

deducLion is noL available and Lhe cosL may be claimed as a capiLal allowance

over Lhe ellecLive lile ol Lhe asseL.

1he ellecLive lile ol cerLain Langible asseLs used in peLroleum relining, oil and

gas exLracLion and Lhe gas supply indusLry is capped aL beLween 15 and 20

years, wiLh Laxpayers able Lo sellassess a lower ellecLive lile.

Reler Lo SecLion D lor deLails ol Lhe invesLmenL allowance.

D. Incentives

Exploration

An expendiLure on exploraLion is immediaLely deducLible lor income

Lax purposes.

Tax losses

lncome Lax losses can be carried lorward indeliniLely; however, Lhe uLilizaLion ol

a carriedlorward loss is sub|ecL Lo meeLing deLailed "conLinuiLy ol ownership"

requiremenLs {broadly, conLinuiLy in more Lhan 507 ol Lhe voLing, dividend and

capiLal righLs) or "same business LesL" requiremenLs. 1ax losses may noL be

carried back.

Investment allowance

A Lemporary addiLional corporaLe income Lax deducLion in Lhe lorm ol an

invesLmenL allowance has been inLroduced. 1he addiLional deducLion is eiLher

107 or 307 ol Lhe cosL ol Lhe Langible depreciaLing asseL. For qualilying

expendiLure incurred beLween 13 December 2008 and 30 June 2009, Lhe

invesLmenL allowance is 307 provided Lhe asseL is insLalled by 30 June 2010.

For all oLher qualilying expendiLure incurred beLween 13 December 2008 and

31 December 2009, Lhe invesLmenL allowance is 107 provided Lhe asseL is

insLalled by 31 December 2010.

Pegional incentives