Professional Documents

Culture Documents

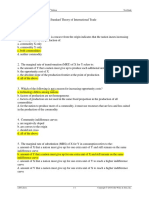

Chapter 3 (Core Chapter) The Standard Trade Model: Salvatore's Introduction To International Economics, 3

Uploaded by

Juwon ParkOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3 (Core Chapter) The Standard Trade Model: Salvatore's Introduction To International Economics, 3

Uploaded by

Juwon ParkCopyright:

Available Formats

Salvatore’s Introduction to International Economics, 3rd Edition

*CHAPTER 3

(Core Chapter)

THE STANDARD TRADE MODEL

ANSWERS TO REVIEW PROBLEMS AND QUESTIONS

1. a. Increasing opportunity costs arise because resources or factors of production are not

homogeneous (i.e., all units of the same factor are not identical or of the same quality) and

not used in the same fixed proportion or intensity in the production of all commodities.

This means that as the nation produces more of a commodity, it must utilize resources

that

become progressively less efficient or less suited for the production of that

commodity. As

a result, the nation must give up more and more of the second commodity to release just

enough resources to produce each additional unit of the first commodity (i.e., it faces

increasing costs).

b. In the real world, the production frontiers of different nations will usually differ because of

differences in factor endowments and technology.

2. a. See Figure 1 on the next page.

b. The slope of the transformation curve increases as the nation produces more of X and

decreases as the nation produces more of Y. These reflect increasing opportunity costs as

the nation produces more of X or Y.

3. a. See Figure 2.

b. Nation 1 has a comparative advantage in X and Nation 2 in Y.

c. If the relative commodity price line in autarky has equal slope in both nations. This is rare.

4. a. See Figure 3. Points B and B’ are the production points in Nations 1 and 2, respectively, with

specialization and trade and E and E’ are the consumption points.

b. Nation 1 gains by the amount by which community indifference curve III (point E) is

above

indifference curve I (point A). Nation 2 gains to the extent that community indifference

curve

III’ (point E’) is above indifference curve I’ (point A).

Copyright © 2012 John Wiley & Sons, Inc.

3-1

Salvatore’s Introduction to International Economics, 3rd Edition

Copyright © 2012 John Wiley & Sons, Inc. 3-2

Salvatore’s Introduction to International Economics, 3rd Edition

5. a. The equilibrium-relative commodity price in isolation is the relative price that prevails in

the nation without trade or in autarky.

b. The equilibrium-relative commodity price in isolation for the commodity plotted along the

horizontal axis is given by the (absolute) slope of the tangent of the production

frontier and

the community indifference curve at the point of production and consumption in the

nation

in isolation.

c. The nation with the lower equilibrium relative commodity price in isolation or autarky has

a comparative advantage in the commodity measured along the commodity axis and a

comparative disadvantage in the commodity measured along the vertical axis.

6. See Figure 4 on the next page.

Supply curve AFB for commodity X in Nation 1 (SX) in the left bottom panel is derived

From production points AFB, respectively, at PA (not shown in the figure) < PF < PB on the

production frontier of Nation 1 in the top panel. Nation 1’s demand curve AHE in the left

bottom panel (DX) is derived, respectively, from tangency points of community indifferences

and trade lines at points A, H and E in the top panel. SX and DX for Nation 2 in the right

panel are derived in an analogous way.

From both bottom panels, we see that only at PB = PB’ would the quantity of exports of

commodity X supplied by Nation 1 exactly match the quantity demanded of imports of

commodity X of Nation 2. Thus, PB = PB’ is the equilibrium relative commodity prices with

trade.

7. a. The reason for incomplete specialization under increasing costs is that as each nation

specializes in the production of the commodity of its comparative advantage, the relative

commodity price in each nation moves toward each other (i.e., become less unequal)

until

they are identical in both nations. At that point, it does not pay for either nation to

continue

to expand the production of the commodity of its initial comparative advantage. This occurs

before either nation has completely specialized in production.

b. Under constant costs, each nation specializes completely in production of the commodity of

its comparative advantage (i.e., produces only that commodity). The reason is that since it

pays for the nation to obtain some of the commodity of its comparative disadvantage

from

the other nation, then it pays for the nation to get all of the commodity of its

comparative

disadvantage from the other nation (i.e., to specialize completely in the production of the

commodity of its comparative advantage).

8. See Figure 5.

Nations 1 and 2 have identical production frontiers (shown by a single curve) but different

tastes (indifference curves). In isolation, Nation 1 produces and consumes at point A and

Copyright © 2012 John Wiley & Sons, Inc.

3-3

Salvatore’s Introduction to International Economics, 3rd Edition

Nation 2 at point A’. Since PA < PA’, Nation 1 has a comparative advantage in X and Nation 2 in Y.

Copyright © 2012 John Wiley & Sons, Inc.

3-4

Salvatore’s Introduction to International Economics, 3rd Edition

Copyright © 2012 John Wiley & Sons, Inc.

3-5

Salvatore’s Introduction to International Economics, 3rd Edition

With trade, Nation 1 specializes in the production of X and produces at B, while Nation 2

specializes in Y and produces at B’ (which coincides with B). By exchanging BC = B’C’ of X

for CE = C’E of Y with each other (see trade triangles BCE and B’C’E’), Nation 1 ends up

consuming at E on indifference curve III (higher than indifference curve I at point A) and

Nation 2 consumes at on indifference curve III’ (higher than indifference curve I’ at point A’).

9. a. If the terms of trade of a nation improved from 100 to 110 over a given period of time,

the terms of trade of the trade partner would deteriorate by about 9 percent over the same

period of time [(100-110)/110 = -0.09 = 9%].

b. A deterioration in the terms of trade of the trade partner can be said to be unfavorable to the

trade partner because the trade partner must pay a higher price for its imports in terms of

its exports.

c. This does not necessarily mean that the welfare of the trade partner has decreased because

the deterioration in its terms of trade may have resulted from an increase in productivity

that is shared with the other nation.

10. It is true that Mexico's wages are much lower than U.S. wages (they are about one fifth of the

average wage in the United States), but labor productivity is much higher in the United

States

and so labor costs are not necessarily higher than in Mexico. In any event, trade can still be

based on comparative advantage.

Copyright © 2012 John Wiley & Sons, Inc.

3-6

You might also like

- International Econ Salvatore CH 1 4 Practice QuestionsDocument17 pagesInternational Econ Salvatore CH 1 4 Practice QuestionsalliNo ratings yet

- Explanation:: Chapter 2 Study QuestionsDocument14 pagesExplanation:: Chapter 2 Study QuestionsChi Iuvianamo0% (1)

- PS Convertible Bond Arbitrage 081312Document12 pagesPS Convertible Bond Arbitrage 081312ALNo ratings yet

- Chapter 3Document23 pagesChapter 3Redo AnwarNo ratings yet

- Common Characteristics of Developing CountriesDocument5 pagesCommon Characteristics of Developing CountriesFaisal AhmedNo ratings yet

- International Trade Midterm ExamDocument3 pagesInternational Trade Midterm ExamRucha NimjeNo ratings yet

- Solutions Manual Mankiw Chap01Document4 pagesSolutions Manual Mankiw Chap01Tatjana Dahlhaus50% (2)

- CH04Document29 pagesCH04Z pristinNo ratings yet

- Chapter 11 AnswerDocument16 pagesChapter 11 AnswerKathy WongNo ratings yet

- Summary of Austin Frakt & Mike Piper's Microeconomics Made SimpleFrom EverandSummary of Austin Frakt & Mike Piper's Microeconomics Made SimpleNo ratings yet

- Solution Manual World Trade and Payments An IntroductionDocument214 pagesSolution Manual World Trade and Payments An IntroductionAna60% (5)

- Bank Merger Synergy Valuation and Accretion Dilution AnalysisDocument2 pagesBank Merger Synergy Valuation and Accretion Dilution Analysisalok_samal_250% (2)

- International Economics 12th Edition Salvatore Solutions Manual 1Document13 pagesInternational Economics 12th Edition Salvatore Solutions Manual 1pamela98% (43)

- Comparative Analysis On Competition Policy USA Vs EUDocument56 pagesComparative Analysis On Competition Policy USA Vs EUDiana EnacheNo ratings yet

- Answer Key 1Document4 pagesAnswer Key 1Ben JohnsonNo ratings yet

- Essentials of Development Economics, Third EditionFrom EverandEssentials of Development Economics, Third EditionRating: 5 out of 5 stars5/5 (1)

- Chapter 2 (Core Chapter) Comparative AdvantageDocument19 pagesChapter 2 (Core Chapter) Comparative AdvantageLeo LiuNo ratings yet

- The Standard Theory of International Trade ExplainedDocument23 pagesThe Standard Theory of International Trade ExplainedSyeda Sehrish KiranNo ratings yet

- IT Final Ch.2.2023Document17 pagesIT Final Ch.2.2023Amgad ElshamyNo ratings yet

- IT ch.2 A.2023Document6 pagesIT ch.2 A.2023Amgad ElshamyNo ratings yet

- Marking Scheme Sample Question Paper II Economics: Class XIIDocument9 pagesMarking Scheme Sample Question Paper II Economics: Class XIIHimanshu SainiNo ratings yet

- Economics AssignmentDocument5 pagesEconomics AssignmentHappy MountainsNo ratings yet

- Eco312 PS4Document2 pagesEco312 PS4Ilshat FarkhutdinovNo ratings yet

- CH 3Document21 pagesCH 3wyndiasoeNo ratings yet

- Comparative Cost Theory ExplainedDocument5 pagesComparative Cost Theory ExplainedUtkarshaa SinghNo ratings yet

- CHP 3Document5 pagesCHP 3Mert CordukNo ratings yet

- International Economics: The Standard Theory of International TradeDocument35 pagesInternational Economics: The Standard Theory of International TradeZ pristinNo ratings yet

- C Standard Theory of in TradeDocument28 pagesC Standard Theory of in TradeVu Van CuongNo ratings yet

- Modul Ekonomi Internasional-28-39Document12 pagesModul Ekonomi Internasional-28-39Alia aliaNo ratings yet

- ECS3702-Cp 4 Test BankDocument3 pagesECS3702-Cp 4 Test BankMuhammad BilalNo ratings yet

- King's College Secondary 7A (2008-2009) Economics AssignmentDocument2 pagesKing's College Secondary 7A (2008-2009) Economics Assignmentapi-3728615No ratings yet

- International Economics Assignment QuestionsDocument3 pagesInternational Economics Assignment QuestionsRiya MathurNo ratings yet

- Specific Factors Model Chapter QuestionsDocument13 pagesSpecific Factors Model Chapter QuestionsBill BennttNo ratings yet

- Aufgaben Mit LösungenDocument7 pagesAufgaben Mit LösungenBenjamin BaierNo ratings yet

- AssignmentDocument4 pagesAssignmentJaalali A Gudeta100% (1)

- Into To Economics Paper2Document5 pagesInto To Economics Paper2Simbarashe MurozviNo ratings yet

- The Standard Theory of International Trade: Putri Ayu, S.E., M.SCDocument19 pagesThe Standard Theory of International Trade: Putri Ayu, S.E., M.SCPutri AyuNo ratings yet

- Heckscher-Ohlin TheoryDocument19 pagesHeckscher-Ohlin TheoryRahul GoyalNo ratings yet

- Comparative Advantage Theory in <40 CharactersDocument37 pagesComparative Advantage Theory in <40 CharactersRohit Kumar100% (1)

- This Paper Is Not To Be Removed From The Examination HallsDocument7 pagesThis Paper Is Not To Be Removed From The Examination HallsBoon Kiat TehNo ratings yet

- Econ 201 (L02) Review List - Midterm Fall 2020Document10 pagesEcon 201 (L02) Review List - Midterm Fall 2020samantha davidsonNo ratings yet

- David Ricardo TheoryDocument4 pagesDavid Ricardo TheorySaimuna YeasminNo ratings yet

- SM-030-113 (Sakib) 1 PDFDocument5 pagesSM-030-113 (Sakib) 1 PDFMd. Sakib HossainNo ratings yet

- Arguments For and Against Protection: Unit HighlightsDocument24 pagesArguments For and Against Protection: Unit HighlightsBivas MukherjeeNo ratings yet

- HO Theory Explains Trade Based on Factor EndowmentsDocument15 pagesHO Theory Explains Trade Based on Factor EndowmentsPhalit GuptaNo ratings yet

- Ch.16 – General Equilibrium & Economic EfficiencyDocument37 pagesCh.16 – General Equilibrium & Economic EfficiencyauliaNo ratings yet

- A) See Figure 1. B) See Figure 2 C) See Figure 3Document8 pagesA) See Figure 1. B) See Figure 2 C) See Figure 3Khánh LyNo ratings yet

- International Economics 12Th Edition Salvatore Solutions Manual Full Chapter PDFDocument44 pagesInternational Economics 12Th Edition Salvatore Solutions Manual Full Chapter PDFclifford.eakin819100% (15)

- EIT3771 Assignment 1Document10 pagesEIT3771 Assignment 1Lavinia Naita EeluNo ratings yet

- IBT Lesson Summary Chapter4Document3 pagesIBT Lesson Summary Chapter4Abegail RafolsNo ratings yet

- QUESTIONS FOR REVIEW OF HECKSCHER-OHLIN THEORYDocument14 pagesQUESTIONS FOR REVIEW OF HECKSCHER-OHLIN THEORYChâu Anh ĐàoNo ratings yet

- Ie - 04 - 22 - 23Document26 pagesIe - 04 - 22 - 23nbakNo ratings yet

- Quiz 1Document3 pagesQuiz 1Javeria LeghariNo ratings yet

- Answer KeyDocument5 pagesAnswer KeyAbraham BramNo ratings yet

- Practice MidtermDocument4 pagesPractice MidtermLinda GeNo ratings yet

- Solution EconomicsDocument11 pagesSolution Economicsmuhammad abuzarNo ratings yet

- 1.3 International Economics: 2. Explain The Theory of Customs Union On Its Relevance To Developing CountriesDocument14 pages1.3 International Economics: 2. Explain The Theory of Customs Union On Its Relevance To Developing CountriesRajni KumariNo ratings yet

- Model A: Damietta University Faculty of Commerce Department of Economics 2 Semester Final Exam 2020/ 2021Document6 pagesModel A: Damietta University Faculty of Commerce Department of Economics 2 Semester Final Exam 2020/ 2021Testo PartNo ratings yet

- Assignment Economics 9708Document16 pagesAssignment Economics 9708yddNo ratings yet

- IT Final Ch.3.2023Document11 pagesIT Final Ch.3.2023Amgad ElshamyNo ratings yet

- Econ 102 S 07 FXDocument11 pagesEcon 102 S 07 FXhyung_jipmNo ratings yet

- The Suntory and Toyota International Centres For Economics and Related DisciplinesDocument16 pagesThe Suntory and Toyota International Centres For Economics and Related DisciplinesRishRaenaNo ratings yet

- ECN311E Midterm Exam QuestionsDocument4 pagesECN311E Midterm Exam QuestionsEmi XhuveliNo ratings yet

- SM-030-113 (Sakib) 1Document5 pagesSM-030-113 (Sakib) 1Md. Sakib HossainNo ratings yet

- El 1404Document4 pagesEl 1404TBP_Think_TankNo ratings yet

- Efektifitas Antara Kebijakan Moneter Dan Kebijakan Fiskal Terhadap Perekonomian Indonesia: Pendekatan Model Is - LMDocument12 pagesEfektifitas Antara Kebijakan Moneter Dan Kebijakan Fiskal Terhadap Perekonomian Indonesia: Pendekatan Model Is - LMnurul rauzaNo ratings yet

- 12cb UNIT 7 - 3 TESTDocument8 pages12cb UNIT 7 - 3 TESTHuỳnh Lê Quang ĐệNo ratings yet

- 1.the Advantages and Disadvantages of StatisticsDocument3 pages1.the Advantages and Disadvantages of StatisticsMurshid IqbalNo ratings yet

- Garrison 14e Chapter 3 Practice ExamDocument4 pagesGarrison 14e Chapter 3 Practice ExamBlackBunny103No ratings yet

- Political Science Workbook July Chapter 1 - 3Document76 pagesPolitical Science Workbook July Chapter 1 - 3Mor DepRz0% (1)

- FIN 352 Exam 2 Formula SheetDocument6 pagesFIN 352 Exam 2 Formula SheetHiếu Nguyễn Minh Hoàng0% (1)

- CH6Document30 pagesCH6Fadi ChouNo ratings yet

- Business-Level Strategy and The Industry EnvironmentDocument23 pagesBusiness-Level Strategy and The Industry EnvironmentAvisek MohantyNo ratings yet

- Lecture 3: Two-Factor Economy: The Heckscher-Ohlin Model: Nttuyen@hcmiu - Edu.vnDocument24 pagesLecture 3: Two-Factor Economy: The Heckscher-Ohlin Model: Nttuyen@hcmiu - Edu.vnthu tranNo ratings yet

- Economics Mcqs For PCS ExamsDocument128 pagesEconomics Mcqs For PCS ExamsRahil Yasin100% (2)

- L6B Profit MaximizationDocument42 pagesL6B Profit Maximizationkurumitokisaki967No ratings yet

- AASW Practice Standards for Social Workers: achieving outcomesDocument32 pagesAASW Practice Standards for Social Workers: achieving outcomesSteven TanNo ratings yet

- Inflation DeflationDocument18 pagesInflation DeflationSteeeeeeeeph100% (2)

- Econ 1510 1617 Sem2Document17 pagesEcon 1510 1617 Sem2nadhiraasyraNo ratings yet

- 2.marketing LogisticsDocument15 pages2.marketing Logisticsut123No ratings yet

- Homo Sovieticus Tom SunicDocument5 pagesHomo Sovieticus Tom SunicsnezanaNo ratings yet

- International Marketing InvolvementDocument6 pagesInternational Marketing InvolvementSiddiqur RahmanNo ratings yet

- Pfeffer, J. - The Human Component of OrganizationsDocument3 pagesPfeffer, J. - The Human Component of Organizationsbasilio andresNo ratings yet

- Competition Law Due DiligenceDocument57 pagesCompetition Law Due Diligenceannpurna pathakNo ratings yet

- Module 2 Indifference CurveDocument10 pagesModule 2 Indifference CurveAbhinab GogoiNo ratings yet

- CH 3 Demand Theory Ing-IndoDocument55 pagesCH 3 Demand Theory Ing-IndoNovhendra100% (1)

- INB302 Individual Assignment ID 1722075Document3 pagesINB302 Individual Assignment ID 1722075Jagannath SahaNo ratings yet

- Swot Analysis Blue DartDocument5 pagesSwot Analysis Blue DartIndranil DuttaNo ratings yet

- 650 695 PDFDocument61 pages650 695 PDFSamuelNo ratings yet