Professional Documents

Culture Documents

Illustration 1

Illustration 1

Uploaded by

Anil BhatiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration 1

Illustration 1

Uploaded by

Anil BhatiCopyright:

Available Formats

Illustration 1 From the following information taken from the books of A Ltd, compute the operating cycle days:

Period covered Average period of credit allowed by suppliers Average debtor outstanding Raw materials consumption Total production cost Total cost for sales Sales for the year Value of average stock maintained: Raw materials Work in progress Finished goods Solution: (i) Raw material ( R ) Average Raw material Raw material consumed 3200 44000 (ii) = 27 days Work in progress (W) Average Work in progress Total Cost of Production 3500 100000 = 13 days Finished goods (F) Average Stock Total cost sales 3200/3500/2600/44000/100000/105000/160000/2500/4800/365 days 16 days

(iii)

2500 105000 = (iv) Debtors (D) Average Debtors Credit Sales 4800 160000 = 11 days The credit allowed by creditors = 16 days O=R+W+F+D-C = 27 + 13 + 9 + 11 - 16 = 44 days Illustration 2 The following information is preparing to B LTD. Prepare the operating cycle for each of the two years: Year 2(Rs in 000) Particulars Year 1 Stock Raw materials 2000 2700 Work in Progress 1400 1800 Finished goods 2100 2400 Purchases 9600 13500 Cost of goods sold 14000 18000 Sales 16000 20000 Debtors 3200 5000 Creditors 1600 1800 Assume that 360 days per year is for the purpose of this example comment on the increase or decrease. Solution: Operating Cycle(o) for Year 1: (i) Raw Material held in stock (R) Average stock of raw material Average Consumption per day 20000 9600 = 75 days Note: purchases have been considered as consumption in the absence of information. 9days

(ii)

Work in progress (W) Average Work in progress Average Cost of production per day 1400 14000 = 36 days Finished goods (F) Average Finished goods Maintained Average Cost of Goods Sold per days 2100 14000 = 54 days Debt Collection (D) Average Total Outstanding Debtors Average Credit Sales per day 3200 16000 = 72 days

(iii)

(iv)

Credit Period Allowed by Creditors (C) Average Total Creditors Average Credit Purchases per day 1600 9600 = 60 days Operating Cycle (O) = R + W + F + D C = 75 + 36 + 54 + 72 60 = 177 days Operating cycle for year 2 (i) Raw Material (R) 2700 13500 = 72 days Work in Progress (W)

(ii)

(iii)

(iv)

(v)

1800 18000 = 36 days Finished goods (F) 2400 18000 = 48 days Debtors (D) 5000 20000 = 90 days Creditors (C) 1800 13500 = 48 days

Operating Cycle (O) = R + W + F + D C = 72 + 36 + 48 + 90 48 = 198 days The operating Cycle period has increased by (198-177) 21 days in year 2 when compared to year 1.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Essentials of Treasury Management Essentials of ...Document30 pagesEssentials of Treasury Management Essentials of ...kumarv1k67% (3)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Adjusting Account, WORK SHEET-FINALDocument43 pagesAdjusting Account, WORK SHEET-FINALChowdhury Mobarrat Haider Adnan100% (1)

- Accounting - UEB - Mock Test 2 - STDDocument14 pagesAccounting - UEB - Mock Test 2 - STDTiến NguyễnNo ratings yet

- Ratio AnalysisDocument15 pagesRatio Analysiskidhur faizal rifoyNo ratings yet

- MODULE 4 Recover - f2fDocument13 pagesMODULE 4 Recover - f2fShiena mae IndacNo ratings yet

- Dispute ResultsDocument12 pagesDispute Resultsrichard winfreyNo ratings yet

- KDCC InternshipDocument96 pagesKDCC Internshipsweetharshi1004No ratings yet

- FE Review - EconomyDocument26 pagesFE Review - EconomylonerstarNo ratings yet

- Time Value of Money Notes & ConceptsDocument11 pagesTime Value of Money Notes & Conceptsrupasree deyNo ratings yet

- ICDS IX Borrowing Cost AnnotatedDocument15 pagesICDS IX Borrowing Cost AnnotatedAtul VarunNo ratings yet

- Deferred Tax Lecture SlidesDocument38 pagesDeferred Tax Lecture Slidesmd salehinNo ratings yet

- Redemption of Preference SharesDocument19 pagesRedemption of Preference SharesAshura ShaibNo ratings yet

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaNo ratings yet

- Part II Partnerhsip CorporationDocument101 pagesPart II Partnerhsip CorporationKhrestine ElejidoNo ratings yet

- Lease Practice QuestionsDocument4 pagesLease Practice QuestionsAbdul SamiNo ratings yet

- Individual AssignmentDocument6 pagesIndividual AssignmentWei Ern AngNo ratings yet

- Partnership Formation and OperationDocument41 pagesPartnership Formation and OperationJay Ann DomeNo ratings yet

- Section 4 - Joint and Solidary ObligationsDocument10 pagesSection 4 - Joint and Solidary ObligationsExequielCamisaCrusperoNo ratings yet

- Larong Aihzel G. Ast Long Quiz 1Document5 pagesLarong Aihzel G. Ast Long Quiz 1Mitch Tokong MinglanaNo ratings yet

- Fs ExerciseDocument6 pagesFs ExerciseDIVINE GRACE ROSALESNo ratings yet

- TEST Bank Chapter 22Document19 pagesTEST Bank Chapter 22Rhea llyn BacquialNo ratings yet

- Lesson 1-3: Statement of Financial PositionDocument11 pagesLesson 1-3: Statement of Financial PositionGreah Fay MordenoNo ratings yet

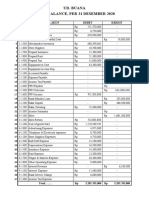

- Jawaban Buku Besar UD. BUANA P3Document10 pagesJawaban Buku Besar UD. BUANA P3HusniBaroqNo ratings yet

- Operational Guidelines On GSI - IndividualsDocument10 pagesOperational Guidelines On GSI - IndividualsshittuidNo ratings yet

- R PDFDocument2 pagesR PDFmariana tkachNo ratings yet

- Study Text ADocument733 pagesStudy Text Akashan.ahmed1985No ratings yet

- Higher Education Loan Program (HELP) 553: TransactionsDocument3 pagesHigher Education Loan Program (HELP) 553: TransactionsStuart BryanNo ratings yet

- Cox Vs HickmanDocument2 pagesCox Vs HickmanNanoo Mishra100% (2)

- Long Form Audit Report: Ca. Rupal Garg 9634414555Document51 pagesLong Form Audit Report: Ca. Rupal Garg 9634414555itr purposeNo ratings yet

- ACCT10002 Tutorial 2 Exercises, 2020 SM1Document6 pagesACCT10002 Tutorial 2 Exercises, 2020 SM1JING NIENo ratings yet