Professional Documents

Culture Documents

Harrison Fa Ifrs 11e Ch09 SM

Uploaded by

AshleyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Harrison Fa Ifrs 11e Ch09 SM

Uploaded by

AshleyCopyright:

Available Formats

Chapter 9

Liabilities

Short Exercises

(10 min.) S 9-1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Sept. 30 Inventory…………………………………….. 4,000

Note Payable, Short-Term…………….. 4,000

Purchased inventory by issuing a note

payable

20X1

June 30 Interest Expense ($4,000 × .08 × 9/12)…. 240

Interest Payable………………………… 240

Accrued interest expense.

Sept. 30 Note Payable, Short-Term………………... 4,000

Interest Payable……………………………. 240

Interest Expense ($4,000 × .08 × 3/12)…. 80

Cash………………………………………. 4,320

Paid note payable and interest at

maturity.

605 Chapter 8 Liabilities

(5-10 min.) S 9-2

Req. 1

Balance Sheet

June 30, 20X1

ASSETS LIABILITIES

Current liabilities:

Note payable, short-term… $4,000

Interest payable

($4,000 × .08 × 9/12)….. 240

Income Statement

Year Ended June 30, 20X1

Revenues:

Expenses:

Interest expense ($4,000 × .08 × 9/12)…………….. $ 240

Req. 2

The 20X2 income statement will report:

Interest expense ($4,000 × .08 × 3/12)………. $80

606 Financial Accounting 9/e Solutions Manual

(10 min.) S 9-3

Req. 1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Cash ($485,000 × .30)…………………..….. 145,500

Notes Receivable ($485,000 − $145,500).. 339,500

Sales Revenue…………………………… 485,000

To record cash sales and sales on

account.

Warranty Expense ($485,000 × .06)……… 29,100

Provision for Warranty Repairs………. 29,100

To accrue warranty expense.

Provision for Warranty Repairs………..... 18,000

Cash…………………………………….…. 18,000

To pay warranty claims.

Req. 2

Provision for Warranty Repairs

Bal. 11,000

18,000 29,100

Bal. 22,100

607 Chapter 8 Liabilities

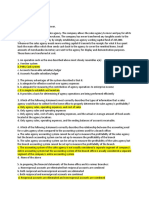

(5-10 min.) S 9-4

Warranty expense = $29,100

The matching principle addresses this situation.

The warranty expense for the year does not necessarily equal

the year’s cash payments for warranties. Cash payments for

warranties do not determine the amount of warranty expense

for that year. Instead, the warranty expense is estimated and

matched against revenue during the period of the sale,

regardless of when the company pays for warranty claims.

Note that the relevance qualitative characteristic also applies. If

warranty costs are not expensed at the same period as revenue

generated, it reduces the predictive value of the financial

information produced.

Student responses may vary.

608 Financial Accounting 9/e Solutions Manual

(5-10 min.) S 9-5

1. When it is probable that OC Petroleum Inc. will be liable to

pay for the damage caused by the rig incident, and the

damage can be estimated reliably, it will have to recognize a

provision instead of a contingent liability.

2. The company would have to recognize an expense in

accordance with the provision. This has the effect of

increasing the amount of liabilities on its balance sheet, and

decreasing the net income for the year.

609 Chapter 8 Liabilities

(5-10 min.) S 9-6

a. $303,000 ($ 400,000 × .7575)

b. $411,000 ($ 400,000 × 1.0275)

c. $378,000 ($ 400,000 × .9450)

d. $418,000 ($ 400,000 × 1.0450)

(5 min.) S 9-7

a. Discount

b. Par (face) value

c. Discount

d. Premium

610 Financial Accounting 9/e Solutions Manual

(5-10 min.) S 9-8

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

a. July 1 Cash…………………………………………… 70,000

Bond Payable…………………………….. 70,000

To issue bond payable at par.

b. Dec. 31 Interest Expense ($70,000 × .065 × 6/12) 2,275

Interest Payable………………………….. 2,275

To accrue interest expense.

20X1

c. Jan. 1 Interest Payable…………………………….. 2,275

Cash……………………………………….. 2,275

To pay semiannual interest on bond

payable.

20Z5

d. July 1 Bond Payable………………………………... 70,000

Interest Expense…………………………….. 2,275

Cash………………………………………... 72,275

To pay final interest payment and to

redeem bond at maturity.

611 Chapter 8 Liabilities

(10-15 min.) S 9-9

(PV of $1 = $0.390; PV Annuity of $1 = $15.247)

1. Amortization table

A B C D E

Period Interest Interest Discount Discount Bond

Payment Expense Amortization Account Carrying

Balance Amount

(c% x

(i% x E) (B - A) (D-C) (Maturity - D)

Maturity)

0 0 13,730 46,271

1 1,500 1,851 351 13,379 46,621

2 1,500 1,865 365 13,014 46,986

3 1,500 1,879 379 12,634 47,366

2.

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Mar. 31 Cash …………… 46,271

Discount on Bonds Payable…… 13,730

Bonds Payable………………… 60,000

Sept. 30 Interest Expense…………………. 1,851

Discount on Bonds Payable… 351

Cash…………………………….. 1,500

612 Financial Accounting 9/e Solutions Manual

(10 min.) S 9-10

1. Borrowed $46,271

Pay back $60,000 at maturity

2. Pay cash interest of $1,500 each six months.

3. Interest expense:

Sept. 31, 20X0…………….. $1,851

Mar. 31, 20X1………………. $1,865

Interest expense increases because the bond carrying amount

increases as the bonds move toward maturity. An increasing

bond carrying amount produces an increasing amount of

interest expense each period.

613 Chapter 8 Liabilities

(10 min.) S 9-11

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

a. July 1 Cash ($520,000 × 0.377 + 0.04 x 520,000 455,250

x 12.462)………………………

Discount on Bonds Payable……………... 64,750

Bonds Payable…………………………... 520,000

To issue bonds at a discount.

b. Dec. 31 Interest Expense ($455,250 x 0.10 x 6/12) 22,763

……………………………

Discount on Bonds Payable 1,963

Interest Payable ($520,000 × .08 × 6/12) 20,800

To accrue interest and amortize bonds.

20X1

c. Jan. 1 Interest Payable…………………………….. 20,800

Cash……………………………………….. 20,800

To pay semiannual interest.

614 Financial Accounting 9/e Solutions Manual

(10 min.) S 9-12

Lease 1 – Operating Lease

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

a. Jan 1 -

b. Dec. 31 Interest Expense 15,000

Cash 15,000

To record first operating lease payment.

Lease 2 – Capital Lease

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

a. Jan 1 Lease Asset (15,000 x 4.329) 64,935

Lease Liability 64,935

To record Capital Lease.

b. Dec. 31 Lease Liability 11,753

Interest Expense (64,935 x 5%) 3,247

Cash 15,000

To record first capital lease payment.

615 Chapter 8 Liabilities

(10-15 min.) S 9-13

Plan A Plan B

Borrow $3,500,000 Issue $3,500,000

at 8% of Common Shares

Net income before expansion……………….. $300,000 $300,000

Project income before interest

and income tax……………………………... $500,000 $500,000

Less interest expense ($3,500,000 × .08)….. (280,000 -0-

Project income before income tax………….. 220,000 500,000

Less incremental income tax expense (35%) (77,000 (175,000

Project net income…………………………….. 143,000 325,000

Total company net income…………………… $443,000 $625,000

Earnings per share including expansion:

Plan A ($443,000 / 100,000 shares)……… $4.43

Plan B ($625,000 / 200,000 shares)……… $3.13

Recommendation: To increase earnings per share,

Speedtown Marina should borrow the

money.

616 Financial Accounting 9/e Solutions Manual

(5-10 min.) S 9-14

Times-interest- Operating income $5.2

= = = 3.3 times

earned ratio Interest expense $1.6

This means that for every dollar of interest expense, Kermit

Plumbing earned $3.30 of operating income.

Based on this ratio, the authors would be willing to lend $1

billion to Kermit Plumbing. In 20X0, Kermit Plumbing was able

to cover its existing interest expense 3.3 times with operating

income.

Students’ conclusions may vary.

617 Chapter 8 Liabilities

(10 min.) S 9-15

LIABILITIES

Current:

Accounts payable……………………….. $ 35,000

Current portion of bonds payable……. 50,000

Interest payable………………………….. 2,000

Total current liabilities………………. $ 87,000

Non-current:

Notes payable, long-term………………. 320,000

Bonds payable…………………………… $402,000

Less: Discount on bonds payable……. (11,000 391,000

Total liabilities………………………………. $798,000

618 Financial Accounting 9/e Solutions Manual

Exercises

Group A

(5-15 min.) E 9-16A

Errata: During 20X0, the business paid $5,000 to satisfy the

warranty claims, not $54,000. Please note we have used the

correct value for the computation of the solution and will

update the print book.

Req. 1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Warranty Expense (12,000 + 3,000 – 10,000

5,000)

Provision for Warranty Repairs….. 10,000

Provision for Warranty Repairs…..….. 5,000

Cash…………………………………… 5,000

Req. 2

INCOME STATEMENT

Warranty Expense……………………………… 10,000

BALANCE SHEET

Current liabilities

Provision for Warranty Repairs $12,000

Req. 3

Provision for Warranty Repair, a current liability, will cause a

619 Chapter 8 Liabilities

company’s current ratio to decrease.

620 Financial Accounting 9/e Solutions Manual

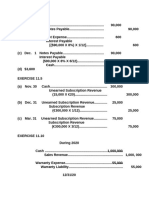

(10-15 min.) E 9-17A

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Oct. 1 Cash…………………………………………. 1,620

Unearned Subscription Revenue……. 1,500

Sales Tax Payable ($1,500 × .08)…….. 120

Nov. 15 Sales Tax Payable………………………… 120

Cash………………………………………. 120

Dec. 31 Unearned Subscription Revenue………. 375

Subscription Revenue ($1,500 × 3/12) 375

BALANCE SHEET

Current liabilities:

Unearned subscription revenue ($1,500 − $375). $1,125

621 Chapter 8 Liabilities

(10 min.) E 9-18A

INCOME STATEMENT

Expenses:

Payroll expense………………………………………. $220,000

Payroll tax expense ($220,000 × .08)…………… 17,600

BALANCE SHEET

Current liabilities:

Salary payable……………………………………… $ 8,200

Payroll tax payable…………………………………... 700

622 Financial Accounting 9/e Solutions Manual

(5-10 min.) E 9-19A

Req. 1

Interest to

accrue at = $85,000 × .06 × 8/12 = $3,400

Dec. 31,

20X0

Req. 2

Final payment

= $85,000 + ($85,000 × .06) = $90,100

on May 1, 20X1

Req. 3

Interest expense for:

20X0 = $85,000 × .06 × 8/12 = $3,400

20X1 = $85,000 × .06 × 4/12 = $1,700

623 Chapter 8 Liabilities

(10-15 min.) E 9-20A

Sandara’s balance sheet

at December 31, 20X1, reported:

Income tax payable…………………………………... $298,000*

Sandara’s 20X1 income statement reported:

Income tax expense ($1,300,000 × .36)…………… $468,000

_____

* Beginning income tax payable………………… $190,000

+ Income tax expense (and payable) for the year

($1,300,000 × .36)……………………………… 468,000

− Income tax payments during the year………… (360,000)

= Ending income tax payable……………………… $298,000

624 Financial Accounting 9/e Solutions Manual

(10-20 min.) E 9-21A

Req. 1

Accounts payable are amounts owed to suppliers for products or

services that have been purchased on account.

Accrued expenses are expenses that the company has incurred but

not paid. They are liabilities for expenses such as interest and

income taxes.

Employee compensation and benefits are amounts owed to

employees for salaries and other payroll-related expenses.

Current portion of long-term debt is the portion of the long-term

debt that is due within next year.

Long-term debt is the amount of long-term notes and bonds

payable that the company expects to pay after the coming year.

Postretirement benefits are the company’s liabilities for providing

benefits — mainly health care — to retirees.

The other liabilities are a catch-all group of liabilities that do not fit

one of the more specific categories and are not significant enough

to have a category of their own. The other liabilities are long-term,

as shown by the fact that they are not listed among the current

liabilities.

625 Chapter 8 Liabilities

(continued) E 9-21A

Req. 2

Total assets = $3,995 million, the sum of total liabilities and

shareholders’ equity

Total liabilities ($3,995 million − $2,027 million)*

Debt ratio = = 0.49

Total assets ($3,995 million)

A debt ratio of 49% is satisfactory.

____

*Or, $340 + $1,494 + $122 + $12 = $1,968

626 Financial Accounting 9/e Solutions Manual

(5-10 min.) E 9-22A

Req. 1

Rupert Security Systems should report this situation in a note

to the financial statements. The note should convey essentially

the same message given in Note 14.

Req. 2

Rupert would report:

INCOME STATEMENT

Estimated loss (or expense)……………… $1,800,000

BALANCE SHEET

Estimated liability…………………………… $1,800,000

Note 14 -

Same as above.

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Estimated Loss (or Expense)…... 1,800,000

Estimated Liability……………. 1,800,000

627 Chapter 8 Liabilities

(15-20 min.) E 9-23A

Boni Electronics

Balance Sheet (partial)

June 30, 20X0

Current liabilities:

a. Estimated warranty payable

[$35,000 + $168,000 − $52,000]……… $151,000

b. Current portion of long-term note payable……... 14,000

Interest payable ($56,000 × .06 × 1/12)…………… 280

c. Unearned sales revenue ($135,000 − $75,000)…. 60,000

d. Employee withheld income tax payable………… 33,000

FICA tax payable ($270,000 × .0765)……………… 20,655

Total current liabilities………………………….. $278,935

Non-current liabilities:

Note payable ($56,000 − $14,000)……………... $42,000

628 Financial Accounting 9/e Solutions Manual

(10-15 min.) E 9-24A

(PV of $1 = 0.610; PV Annuity of $1 = 15.589)

A B C D E

Perio

Interest Interest Premium Premium Bond

d

Payment Expense Amortization Account Carrying

Balance Amount

(c% x

(i% x E) (A - B) (D-C) (Maturity + D)

Maturity)

0 0 1,165,050 16,165,050

1 450,000 404,126 45,874 1,119,176 16,119,176

2 450,000 402,979 47,021 1,072,155 16,072,155

3 450,000 401,804 48,196 1,023,959 16,023,959

4 450,000 400,599 49,401 974,558 15,974,558

Req 1, 2, and 3

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Jan. 31 Cash …………… 16,165,050

Premium on Bonds Payable 1,165,050

Bonds Payable…………… 15,000,000

July. 31 Interest Expense…………………. 404,126

Premium on Bonds Payable… 45,874

Cash…………………………….. 450,000

Dec. 31 Interest Expense…………………. 335,816*

Premium on Bonds Payable….. 39,184

Interest Payable…………….. 375,000*

*5/6 x 402,979 = 335,816

** 5/6 x 40,659 = 39,184

629 Chapter 8 Liabilities

***5/6 x 0.03 x 15,000,000 = 375,000

630 Financial Accounting 9/e Solutions Manual

(10-15 min.) E 9-25A

1. Cash received = $600,000 × 1.03 = $618,000

2. Principal……………………………………………………… $600,000

Interest ($600,000 × .07 × 20)…………………….............. 840,000

Total cash paid……………………………………………… $1,440,000

3. Total cash paid……………………………………………… $1,440,000

Less: Cash received……………………………………... (618,000

Difference = Total interest expense……………………... $822,000

4. If straight-line amortization is used, the interest rate will be equal for

each period and a multiplication of the interest expense by 20 will equal

to the amount calculated in requirement 3.

Interest expense (822,000 / 20) = $ 41,100

631 Chapter 8 Liabilities

(15-20 min.) E 9-26A

(PV of $1 = 0.312; PV Annuity of $1 = 11.470)

Req. 1 (amortization table)

A B C D E

INTEREST

EXPENSE

INTEREST (6% OF DISCOUNT

PAYMENT PRECEDING ACCOUNT BOND

SEMIANNUAL (5% OF BOND DISCOUNT BALANCE CARRYING

INTEREST MATURITY CARRYING AMORTIZATION (PRECEDING AMOUNT

DATE VALUE) AMOUNT) (B – A) D – C) ($2,500,000 – D)

Dec. 31, 20X0 $286,250 $2,213,750

June 30, 20X1 $125,000 $132,825 $ 7,825 278,425 2,221,575

Dec. 31, 20X1 125,000 133,295 8,295 270,130 2,229,870

June 30, 20X2 125,000 133,792 8,792 261,338 2,238,662

Dec. 31, 20X2 125,000 134,320 9,320 252,018 2,247,982

632 Financial Accounting 9/e Solutions Manual

(continued) E 9-26A

Req. 2

Journal

DATE ACCOUNT TITLES AND DEBIT CREDIT

EXPLANATION

20X0

Dec. 31 Cash……………………………….. 2,213,750

Discount on Bonds Payable…… 286,250

Bonds Payable……………….. 2,500,000

To issue bonds at a discount.

20X1

June 30 Interest Expense 132,825

Cash 125,000

Discount on Bonds Payable 7,825

To pay semiannual interest and

amortize discount on bond payable.

20X1

Dec. 31 Interest Expense 133,295

Cash 125,000

Discount on Bonds Payable 8,295

To pay semiannual interest and

amortize bonds.

633 Chapter 8 Liabilities

(15-20 min.) E 9-27A

(PV of $1 = 0.305; PV Annuity of $1 = 34.761)

Req. 1 (amortization table)

A B C D E

Period Interest Interest Premium Premium Bond

Amortizatio

Payment Expense Account Carrying

n

Balance Amount

(c% x

(i% x E) (A - B) (D-C) (Maturity + D)

Maturity)

0 0 147,921 997,921

1 21,250 19,958 1,292 146,629 996,629

2 21,250 19,933 1,317 145,312 995,312

3 21,250 19,906 1,344 143,968 993,968

4 21,250 19,879 1,371 142,597 992,597

Req. 2 (amortization table)

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Jun. 30 Cash …………… 997,921

Premium on Bonds Payable 147,921

Bonds Payable…………… 850,000

Dec. 31 Interest Expense…………. 19,958

Premium on Bonds Payable… 1,292

Cash……………………………. 21,250

20X1

Jun. 30 Interest Expense…………. 19,933

Premium on Bonds Payable… 1,317

634 Financial Accounting 9/e Solutions Manual

21,250

Cash……………………………..

635 Chapter 8 Liabilities

(15-20 min.) E 9-28A

(PV of $1 = 0.386; PV Annuity of $1 = 6.145)

A B C D E F

Bond

Interest Interest Discount Discount Carrying

Date Payment Expense Amortization Balance Amount

Jan. 1, 20X0 $13,464 $96,536

Dec. 31, 20X0 $8,800 $9,654 $ 854 12,610 97,390

Dec. 31, 20X1 8,800 9,739 939 11,671 98,329

Dec. 31, 20X2 8,800 9,833 1,033 10,638 99,362

Dec. 31, 20X3 8,800 9,936 1,136 9,502 100,498

Dec. 31, 20X4 8,800 10,050 1,250 8,252 101,748

Dec. 31, 20X5 8,800 10,175 1,375 6,877 103,123

Dec. 31, 20X6 8,800 10,312 1,512 5,365 104,635

Dec. 31, 20X7 8,800 10,464 1,664 3,701 106,299

Dec. 31, 20X8 8,800 10,630 1,830 1,871 108,129

Dec. 31, 20X9 8,800 10,671 1,871 0 110,000

Note: Computer-generated solutions may contain slight

rounding differences.

636 Financial Accounting 9/e Solutions Manual

(15-20 min.) E 9-29A

Req. 1

Period Begin LL Payment Interest Principal End LL

A B C D E

(0.1*A) (B-C) (A-D)

1 79,250* 25,000 7,925 17,075 62,175

2 62,175 25,000 6,218 18,782 43,393

3 43,393 25,000 4,339 20,661 22,732

4 22,732 25,000 2,268** 22,732 0

25,000 x 3.170 = 79,250

** Slight rounding difference

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Dec. 31 Lease Liability………………………. 17,075

Interest Expense............................... 7,925

Cash 25,000

Req. 2

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Dec. 31 Lease Expense……………………. 25,000

Cash 25,000

Req 3

An Operating Lease is treated like rental agreements between the

lessor and lesse, while a Capital Lease is treated like a sale.

Therefore, the treatment for both types of leases is different.

637 Chapter 8 Liabilities

(20-25 min.) E 9-30A

Amounts in millions or billions

Company Company Company

Ratio A N S

Current Total current assets $430 ¥5,943 €170,150

= =

ratio Total current liabilities $196 ¥2,198 € 72,420

= 2.19 = 2.70 = 2.35

A N S

Debt Total liabilities $196 + $139 ¥2,198 + ¥2,350 €72,420 + €110,757

= =

ratio Total assets $430 + $138 ¥5,943 + ¥48 €170,150 + €45,324

= 0.59 = 0.76 = 0.85

A N S

Times-

interest- Operating income $291 ¥222 €5,581

= =

earned Interest expense $42 ¥31 €671

ratio

= 6.92 times = 7.16 times = 8.32 times

Based on these ratio values, Company N looks the least risky.

*N has the best current ratio and middle of the range debt and times

interest earned ratios; whereas both A and S have at least one ratio

where they are the worst of the pack.

(15-20 min.) E 9-31A

Req. 1

638 Financial Accounting 9/e Solutions Manual

PLAN B

PLAN A ISSUE

BORROW $900,000

$900,000 OF COMMON

AT 10% SHARES

Net income before expansion…………………….. $600,000 $600,000

Project income before interest and income tax.. $800,000 $800,000

Less interest expense ($900,000 × .10)…………. 90,000 -0-

Project income before income tax………………. 710,000 800,000

Less income tax expense (25%)…………………. 177,500 200,000

Project net income………………………………….. 532,500 600,000

Total company net income……………………. $1,132,500 $1,200,000

Earnings per share including new project:

Plan A ($1,132,500 / 200,000 shares)………. $5.66

Plan B ($1,200,000 / 425,000 shares)………… $2.82

639 Chapter 8 Liabilities

(continued) E 9-31A

Req. 2

MEMORANDUM

TO: Board of Directors of First Bank Financial Services

FROM: [Student Name]

SUBJECT: Financing plan to expand operations

Plan A (borrowing) results in much higher earnings per share.

Plan A also allows the existing shareholders to retain control of

the company because the company issues no new shares. But

Plan A also creates more financial risk because borrowing

obligates the company to pay the interest and the principal of

the debt. On balance, I prefer Plan A, assuming the company’s

level of debt is not already too high.

Students can defend either plan based on their preferences for

control of the business, avoidance of risk, and higher earnings

per share.

640 Financial Accounting 9/e Solutions Manual

Exercises

Group B

(5-15 min.) E 9-32B

Req. 1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Warranty Expense ….. 13,000

Provision for Warranty Repairs….. 13,000

Provision for Warranty Repairs…..….. 5,000

Cash…………………………………… 5,000

Req. 2

INCOME STATEMENT

Warranty expense………………………………… 13,000

BALANCE SHEET

Current liabilities

Provision for Warranty Repairs………….… 12,000

Req. 3

Provision for Warranty Repairs, a current liability, will cause a

company’s current ratio to decrease.

641 Chapter 8 Liabilities

(10-15 min.) E 9-33B

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Oct. 1 Cash…………………………………………. 1,526

Unearned Subscription Revenue……. 1,400

Sales Tax Payable (1,400 × .09)…….. 126

Nov. 15 Sales Tax Payable………………………… 126

Cash………………………………………. 126

31 Unearned Subscription Revenue………. 350

Subscription Revenue (1,400 × 3/12) 350

BALANCE SHEET

Current liabilities:

Unearned subscription revenue (1,400 − 350)…… 1,050

642 Financial Accounting 9/e Solutions Manual

(10 min.) E 9-34B

INCOME STATEMENT

Expenses:

Payroll expense………………………………………. 180,000

Payroll tax expense (180,000 × .09)……………… 16,200

BALANCE SHEET

Current liabilities:

Salary 7,800

payable…………………………………………

Payroll tax payable…………………………………... 750

643 Chapter 8 Liabilities

(5-10 min.) E 9-35B

Req. 1

Interest to

accrue at = 80,000 × .05 × 10/12 = 3,333

Dec. 31, 20X0

Req. 2

Final payment

= 80,000 + (80,000 × .05) = 84,000

on March 1, 20X1

Req. 3

Interest expense for:

20X0 = 80,000 × .05 × 10/12 = 3,333

20X1 = 80,000 × .05 × 2/12 = 667

644 Financial Accounting 9/e Solutions Manual

(10-15 min.) E 9-36B

Sybil’s balance sheet

at December 31, 20X1, reported:

Income tax payable…………………………………... 250,000*

Sybil’s 20X0 income statement reported:

Income tax expense (1,600,000 × .25)…………… 400,000

_____

* Beginning income tax payable………………… 160,000

+ Income tax expense (and payable) for the year

(1,600,000 × .25)……………………………… 400,000

− Income tax payments during the year………… (310,000)

= Ending income tax payable……………………… €250,000

645 Chapter 8 Liabilities

(10-20 min.) E 9-37B

Req. 1

Accounts payable are amounts owed to suppliers for products or

services that have been purchased on account.

Accrued expenses are expenses that the company has incurred but

not paid. They are liabilities for expenses such as interest and

income taxes.

Employee compensation and benefits are amounts owed to

employees for salaries and other payroll-related expenses.

Current portion of long-term debt is the portion of the long-term

debt that is due within next year.

Long-term debt is the amount of long-term notes and bonds

payable that the company expects to pay after the coming year.

Postretirement benefits are the company’s liabilities for providing

benefits — mainly health care — to retirees.

The other liabilities are a catch-all group of liabilities that do not fit

one of the more specific categories and are not significant enough

to have a category of their own. The other liabilities are long-term,

as shown by the fact that they are not listed among the current

liabilities.

646 Financial Accounting 9/e Solutions Manual

(continued) E 9-37B

Req. 2

Total assets = €3,998 million, the sum of total liabilities and

shareholders’ equity

Total liabilities (€3,998 million − 2,030 Million)*

Debt ratio = = 0.49

Total assets (€3,998 million)

A debt ratio of 49% is satisfactory

____

*Or, €340 + 1,488 + 129 + 11 = 1,968

647 Chapter 8 Liabilities

(5-10 min.) E 9-38B

Req. 1

Edward Security Systems should report this situation in a note

to the financial statements. The note should convey essentially

the same message given in Note 14.

Req. 2

Edward would report:

INCOME STATEMENT

Estimated loss (or expense)……………… €2,300,000

BALANCE SHEET

Estimated liability…………………………… €2,300,000

Note 14 -

Same as above.

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Estimated Loss (or Expense)…... 2,300,000

Estimated Liability……………. 2,300,000

648 Financial Accounting 9/e Solutions Manual

(15-20 min.) E 9-39B

Hi-Tech Electronics

Balance Sheet (partial)

September 30, 20X0

Current liabilities:

a. Estimated warranty payable

[34,000 + 112,500 − 57,000]……… 89,500

b. Current portion of long-term note payable……... 11,000

Interest payable (44,000 × .04 × 1/12)…………… 147

c. Unearned sales revenue (100,000 − 85,000)…. 15,000

d. Employee withheld income tax payable………… 30,000

FICA tax payable (250,000 × .0765)……………… 19,125

Total current liabilities………………………….. 164,772

Non-current liabilities:

Note payable (44,000 − 11,000)……………... 33,000

649 Chapter 8 Liabilities

(10-15 min.) E 9-40B

(PV of $1 = 0.744; PV Annuity of $1 = 8.530)

A B C D E

Period Interest Interest Discount Discount Bond

Payment Expense Amortization Account Carrying

Balance Amount

(c% x

(i% x E) (B - A) (D-C) (Maturity - D)

Maturity)

0 0 513,000 11,487,000

1 300,000 344,610 44,610 468,390 11,531,610

2 300,000 345,948 45,948 422,442 11,577,558

3 300,000 347,327 47,327 375,115 11,624,885

4 300,000 348,747 48,747 326,368 11,673,632

Req. 1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

a. Jan. 31 Cash …………… 11,487,000

Discount on Bonds Payable………… 513,000

Bonds Payable…………………… 12,000,000

To issue bonds at a discount.

b. July 31 Interest Expense 344,610

Cash ($11,000,000 × .05 × 6/12) 300,000

Discount on Bonds Payable 44,610

To pay interest and amortize discount

on bond payable.

c. Dec 31 Interest Expense 287,175*

Interest Payable…………………....... 250,000**

Discount on Bonds Payable

37,175***

To accrue interest and amortize

650 Financial Accounting 9/e Solutions Manual

bonds.

*344,610 x 5/6 = 287,175

**300,000 x 5/6 = 250,000

***287,175 – 250,000 = 37,175

651 Chapter 8 Liabilities

(10-15 min.) E 9-41B

1. Cash received = 400,000 × 1.04 = €416,000

2. Principal……………………………………………………… 400,000

Interest (400,000 × .09 × 20)…………………….............. 720,000

Total cash paid……………………………………………… €1,120,000

3. Total cash paid……………………………………………… €1,120,000

Less: Cash received……………………………………... (416,000

Difference = Total interest expense……………………... $704,000

4. Market interest rate = 8.58%

Interest expense for:

20X0 = 416,000 × .0858 = 35,672

20X1 = 415,672 × .0858 = 35,644

*Note: Market interest rate needs to be computed to attempt this

question. Interest expense will gradually decrease over the life of the

bond. The sum of the total interest expense will equal to the amount

calculated in requirement 3.

If straight-line amortization is used, the interest rate will be equal for

each period and a multiplication of the interest expense by 20 will

equal to the amount calculated in requirement 3.

652 Financial Accounting 9/e Solutions Manual

(15-20 min.) E 9-42B

(PV of $1 = 0.377; PV Annuity of $1 = 12.462)

Req. 1 (amortization table)

A B C D E

Period Interest Interest Discount Discount Bond

Amortizatio

Payment Expense Account Carrying

n

Balance Amount

(c% x

(i% x E) (B - A) (D-C) (Maturity - D)

Maturity)

0 0 52,256 787,744

1 37,800 39,387 1,587 50,669 789,331

2 37,800 39,467 1,667 49,002 790,998

3 37,800 39,550 1,750 47,252 792,748

4 37,800 39,637 1,837 45,415 794,585

653 Chapter 8 Liabilities

(continued) E 9-42B

Req. 2

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Dec. 31 Cash 787,744

Discount on Bonds Payable 52,256

Bonds Payable 840,000

To issue bonds at a discount.

20X1

June 30 Interest Expense 39,387

Cash 37,800

Discount on Bonds Payable 1,587

To pay semiannual interest and

amortize discount on bond payable.

20X1

Dec. 31 Interest Expense 39,467

Cash 37,800

Discount on Bonds Payable 1,667

To pay semiannual interest and

amortize bonds.

654 Financial Accounting 9/e Solutions Manual

(15-20 min.) E 9-43B

(PV of $1 = 0.415; PV Annuity of $1 = 13.008)

Req. 1 (amortization table)

A B C D E

Period Interest Interest Premium Discount Bond

Payment Expense Amortization Account Carrying

Balance Amount

(c% x (i% x E) (A - B) (D-C) (Maturity +

Maturity) D)

0 0 222,360 3,622,360

1 170,000 163,006 6,994 215,366 3,615,366

2 170,000 162,691 7,309 208,057 3,608,057

3 170,000 162,363 7,637 200,420 3,600,420

4 170,000 162,019 7,981 192,439 3,592,439

655 Chapter 8 Liabilities

(continued) E 9-43B

Req. 2 (journal entries)

Journal

DATE ACCOUNT TITLES AND DEBIT CREDIT

EXPLANATION

20X0

June 30 Cash ……….. 3,622,360

Bonds Payable………………… 3,400,000

Premium on Bonds Payable… 222,360

To issue bonds at a premium.

Dec. 31 Interest Expense……………………. 163,006

Premium on Bonds Payable……… 6,994

Cash ………………………………. 170,000

To pay semiannual interest and amortize bond

premium.

20X1

June 30 Interest Expense……………………. 162,691

Premium on Bonds Payable.……... 7,309

Cash……………………………….. 170,000

To pay semiannual interest and amortize bonds.

656 Financial Accounting 9/e Solutions Manual

(15-20 min.) E 9-44B

(PV of $1 = 0.322; PV Annuity of $1 = 5.650)

A B C D E F

Bond

Interest Interest Discount Discount Carrying

Date Payment Expense Amortization Balance Amount

Jan. 1, 20X0 42,375 707,625

Dec. 31, 20X0 82,500 84,915 2,415 39,960 710,040

Dec. 31, 20X1 82,500 85,205 2,705 37,255 712,745

Dec. 31, 20X2 82,500 85,529 3,029 34,226 715,774

Dec. 31, 20X3 82,500 85,893 3,393 30,833 719,167

Dec. 31, 20X4 82,500 86,300 3,800 27,033 722,967

Dec. 31, 20X5 82,500 86,756 4,256 22,777 727,223

Dec. 31, 20X6 82,500 87,267 4,767 18,010 731,990

Dec. 31, 20X7 82,500 87,839 5,339 12,671 737,329

Dec. 31, 20X8 82,500 88,479 5,979 6,692 743,308

Dec. 31, 20X9 82,500 89,192 6,692 0 750,000

*Note: Computer-generated solutions may contain slight

rounding differences.

657 Chapter 8 Liabilities

(15-20 min.) E 9-45B

Req. 1

Period Begin LL Payment Interest Principal End LL

A B C D E

(0.08*A) (B-C) (A-D)

1 59,616* 18,000 4,796 13,231 46,385

2 46,385 18,000 3,711 14,289 32,096

3 32,096 18,000 2,568 15,432 16,664

4 16,664 18,000 1,336** 16,664 0

18,000 x 3.312 = 59,616

** Slight rounding difference

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Dec. 31 Lease Liability………………………. 13,231

Interest Expense............................... 4,769

Cash 18,000

Req. 2

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Dec. 31 Lease Expense……………………. 18,000

Cash 18,000

Req 3

An Operating Lease is treated like rental agreements between the

lessor and lesse, while a Capital Lease is treated like a sale.

Therefore, the treatment for both types of leases is different.

(20-25 min.) E 9-46B

658 Financial Accounting 9/e Solutions Manual

Amounts in millions or billions

Company Company Company

Ratio F L V

Current Total current assets $435 ¥5,422 €147,398

= =

ratio Total current liabilities $227 ¥2,248 €72,620

= 1.92 = 2.41 = 2.03

F L V

Debt Total liabilities $227 + $109 ¥2,248 + ¥2,320 €72,620 + €110,927

= =

ratio Total assets $435 + $135 ¥5,422 + ¥740 €147,398 + €61,173

= 0.59 = 0.74 = 0.88

F L V

Times-

interest- Operating income $294 ¥229 €5,627

= =

earned Interest expense $43 ¥29 €687

ratio

= 6.84 times = 7.90 times = 8.19 times

Based on these ratio values, Company L looks the least risky.

*L has the best current ratio and middle of the range debt and times

interest earned ratios; whereas both F and V have at least one ratio

where they are the worst of the three.

659 Chapter 8 Liabilities

(15-20 min.) E 9-47B

Req. 1

PLAN B

PLAN A ISSUE

BORROW €650,000

€650,000 OF COMMON

AT 5% SHARES

Net income before expansion…………………….. €400,000 €400,000

Project income before interest and income tax.. 550,000 550,000

Less interest expense (650,000 × .05)…………. 32,500 -0-

Project income before income tax………………. 517,500 550,000

Less income tax expense (40%)…………………. 207,000 220,000

Project net income………………………………….. 310,500 330,000

Total company net income……………………. 710,500 730,000

Earnings per share including new project:

Plan A (710,500 / 100,000 shares)…………... 7.11

Plan B (730,000 / 200,000 shares)…………... 3.65

660 Financial Accounting 9/e Solutions Manual

(continued) E 9-47B

Req. 2

MEMORANDUM

TO: Board of Directors of First Federal Financial

Services

FROM: [Student Name]

SUBJECT: Financing plan to expand operations

Plan A (borrowing) results in much higher earnings per share.

Plan A also allows the existing shareholders to retain control of

the company because the company issues no new shares. But

Plan A also creates more financial risk because borrowing

obligates the company to pay the interest and the principal of

the debt. On balance, I prefer Plan A, assuming the company’s

level of debt is not already too high.

Students can defend either plan based on their preferences for

control of the business, avoidance of risk, and higher earnings

per share.

661 Chapter 8 Liabilities

Challenge Exercises

(10-15 min.) E 9-48

Total current assets $324,700

Current ratio = = = 1.68

Total current liabilities $193,400

Pratt Marketing Services should pay off $88,360* of current

liabilities. Then the current ratio will be:

$324,700 − $105,867 $218,833

= 2.5

$193,400 − $105,867 $87,533 =

_____

*Computation:

Let X = amount of current liabilities to pay in order to achieve

a current ratio of 2.5.

$324,700 − X

= 2.5

$193,400 − X

$324,700 − X = 2.5 ($193,400 − X)

−X = $483,500 − 2.5X −

$324,700

1.5X = $158,800

X = $105,867

662 Financial Accounting 9/e Solutions Manual

(20-25 min.) E 9-49

Req. 1

Millions

Bonds Payable, 5 3/4%…………………………… 150

Bonds Payable, 11%……………………….. 85

Cash…………………………………………... 10

Gain on Retirement of Bonds Payable….. 55

Req. 2 (Dollar amounts in millions)

Old Bonds New Bonds

$150 × .0575 $85 × .11

Annual interest expense…..

= $8.63 = $9.35

Req. 3

Possible reasons for the debt refinancing:

1. To decrease annual interest expense: No, because annual

interest expense on the old bonds is a less ($720,000) than

interest expense on the new bonds.

2. To increase net income: Yes, because the gain on

retirement of bonds payable added $55 million to net

income (less the $720,000 incremental interest expense).

3. To decrease the debt ratio: Yes, as follows:

(Dollar amounts in millions) Before Refinancing After Refinancing

Debt Total liabilities $357 $357 − $150 + $85

= =

ratio Total assets $497 $497 − $10

= 0.72 = 0.60

663 Chapter 8 Liabilities

(20-30 min.) E 9-50

Req. 1

20X0

Mar. 15 Cash ($800,000 × .945)……………… 756,000

Discount on Bonds Payable……….. 44,000

Bonds Payable……………………. 800,000

Holiday Corporation issued the bonds payable to bondholders

in order to borrow $756,000 ($800,000 × 0.945) from the

bondholders. Holiday Corporation received the cash that the

bondholders paid.

Req. 2

$48,000 ($800,000 × 0.12 × 6/12)

664 Financial Accounting 9/e Solutions Manual

(continued) E 9-50

Req. 3

Initial carrying amount of notes ($800,000 × $756,000

0.945)

x Semiannual market interest rate 6.5%

Semiannual interest expense $49,140

*Note: Market interest rate needs to be computed to attempt

this question.

Req. 4

Effective-interest amortization method (amounts in thousands):

A B C D E

BOND

INTEREST INTEREST DISCOUNT CARRYING

PAYMENT EXPENSE BALANCE AMOUNT

SEMIANNUAL ($700,000

(0.06 × (0.065 × DISCOUNT

INTEREST − D)

$700,000) E) AMORTIZATION D − C)

DATE

Mar. 15, 20X0 $44,000 $756,000

Sept. 15 $48,000 $49,140 $1,140 42,860 757,140

Mar. 15, 20X1 48,000 49,214 1,214 41,646 758,354

Sept. 15 48,000 49,293 1,293 40,353 759,647

Mar. 15, 20X2 48,000 49,377 1,377 38,976 761,024

Interest exp. for yr. 1: $98,354 ($49,140 + $49,214)

yr. 2: $98,670 ($49,293 + $49,377)

Interest expense is greater in the second year because the

bond carrying amount increases as the bonds are amortized

toward their maturity value.

665 Chapter 8 Liabilities

Quiz

Q9-51 d

Q9-52 d

Q9-53 d

Q9-54 a

Q9-55 d

Q9-56 c [($450,000 + $750,000) × .06] − $3,150 − $30,000

= $38,850

Q9-57 a

Q9-58 b

Q9-59 e

Q9-60 c

Q9-61 b

Q9-62 e Under effective interest amortization method, the

interest expense is different every year

Q9-63 Interest Expense (192,000 x 0.125 x

9/12)………………………. 18,000

Interest Payable ($200,000 × .12 × 9/12) 18,000

*Note: Implied market interest rate for a price of 96 is

12.73%. Using a market rate of 12.5% will yield an

interest expense similar to cash interest payable, which

result in zero amortization.

Q9-64 Interest Payable………………………........ 18,000

Interest Expense…………………………… 6,000

Cash ($200,000 × .12)…………………... 24,000

Q9-65 e [($275,695 x .07) = $19,299]

Q9-66 a

Q9-67 b

Q9-68 a

Q9-69 c

666 Financial Accounting 9/e Solutions Manual

Problems

Group A

(15-20 min.) P 9-70A

a. Sales tax payable ($140,000 × .05)............................. $7,000

b. Note payable, short-term............................................ $85,000

Interest payable ($87,000 × .04 × 4/12)...................... 1,160

c. Unearned service revenue ($2,700 × 4/6).................. $1,800

d. Estimated warranty payable

($11,800 + $34,400 − $34,800) $11,400

e. Portion of long-term note payable due

within one year....................................................... $30,000

Interest payable ($60,000 × .12)................................. 7,200

667 Chapter 8 Liabilities

(30-40 min.) P 9-71A

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Mar. 3 Inventory 72,000

Note Payable, Short-term 72,000

May 31 Cash 75,000

Note Payable, Short-term 15,000

Note Payable, Long-term 60,000

Sept. 3 Note Payable, Short-term 72,000

Interest Expense ($72,000 × .04 × 6/12) 1,440

Cash 73,440

Dec. 31 Warranty Expense ($192,000 × .03) 5,760

Provision for Warranty Repairs 5,760

31 Interest Expense ($75,000 × .05 × 7/12) 2,188*

Interest Payable 2,188

20X1

May 31 Note Payable, Short-term 15,000

Interest Payable 2,188

Interest Expense ($75,000 × .05 × 5/12)….. 1,562*

Cash 18,750

*Rounded off to the nearest whole number.

668 Financial Accounting 9/e Solutions Manual

(20-25 min.) P 9-72A

Req. 1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

a. May 31 Cash ($8,000,000 × 1/2)…………... 4,000,000

Bonds Payable…………………. 4,000,000

To issue bonds at par.

b. Nov. 30 Interest Expense…………………... 200,000

Cash ($4,000,000 × .10 × 6/12). 200,000

To pay interest on bonds.

c. Dec. 31 Interest Expense

($4,000,000 × .10 × 1/12)………….. 33,333*

Interest Payable………………... 33,333

To accrue interest.

20X1

d. May 31 Interest Payable…………………… 33,333

Interest Expense

($4,000,000 × .10 × 5/12)………….. 166,667*

Cash ($4,000,000 × .10 × 6/12). 200,000

To pay interest on bonds.

*Rounded off to the nearest whole number.

669 Chapter 8 Liabilities

(continued) P 9-72A

Req. 2 (reporting the liabilities on the balance sheet at

December 31, 20X0)

Current liabilities:

Interest payable $ 33,333

Non-current liabilities:

Bonds payable $4,000,000

(30-40 min.) P 9-73A

Req. 1

The 8% bonds issued when the market interest rate is 7% will

be priced at a premium. They are relatively attractive in this

market, so investors will pay a price above par value to acquire

them.

Req. 2

The 8% bonds issued when the market interest rate is 9% will

be priced at a discount. They are relatively unattractive in this

market, so investors will pay less than par value to acquire

them.

670 Financial Accounting 9/e Solutions Manual

(continued) P 9-73A

(PV of $1 = 0.503; PV Annuity of $1 = 14.212)

Req. 3

A B C D E

Period Interest Interest Premium Premium Bond

Amortizatio

Payment Expense Account Carrying

n

Balance Amount

(c% x

(i% x E) (A - B) (D-C) (Maturity + D)

Maturity)

0 0 57,184 857,184

1 32,000 30,001 1,999 55,185 855,185

2 32,000 29,931 2,069 53,116 853,116

3 32,000 29,859 2,141 50,975 850,975

4 32,000 29,784 2,216 48,759 848,759

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

a. Feb. 28 Cash 857,184

Premium on Bonds Payable 57,184

Bonds Payable 800,000

To issue bonds at a premium.

b. Aug. 31 Interest Expense 30,001

Premium on Bonds Payable 1,999

Cash 32,000

To pay interest and amortize bonds.

c. Dec. 31 Interest Expense……………………….. 19,954

Premium on Bonds Payable 1,379

Interest Payable………….……….. 21,333

671 Chapter 8 Liabilities

To accrue interest and amortize bonds.

20X1

d. Feb. 28 Interest Payable (from Dec. 31)………. 21,333

Interest Expense 9,977

Premium on Bond Discount 690

Cash 32,000

To pay interest and amortize bonds.

672 Financial Accounting 9/e Solutions Manual

(continued) P 9-73A

Req. 4 (reporting the liabilities on the balance sheet at

December 31, 20X0)

Current liabilities:

Interest payable………………………… $ 21,333

Non-current liabilities:

Bonds payable…………………………. $800,000

Add: Premium on bonds payable….. 53,806*

853,806

*57,184 – 1,999 – 1,379 = 53,806

673 Chapter 8 Liabilities

(30-40 min.) P 9-74A

(PV of $1 = 0.456; PV Annuity of $1 = 13.590)

A B C D E

Period Interest Interest Premium Premium Bond

Amortizatio

Payment Expense Account Carrying

n

Balance Amount

(c% x

(i% x E) (A - B) (D-C) (Maturity + D)

Maturity)

0 0 405,300 6,405,300

1 270,000 256,212 13,788 391,512 6,391,512

2 270,000 255,660 14,340 377,172 6,377,172

3 270,000 255,087 14,913 362,259 6,362,259

4 270,000 254,490 15,510 346,749 6,346,749

Req. 1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Jan. 1 Cash 6,405,300

Premium on Bond Payable 405,300

Bonds Payable……………………. 6,000,000

To issue bonds at a premium.

July 1 Interest Expense 256,212

Premium on Bond Payable 13,788

Cash 270,000

To pay interest and amortize bonds.

Dec 31 Interest Expense 255,660

Premium on Bond Payable 14,340

Interest Payable 270,000

674 Financial Accounting 9/e Solutions Manual

To accrue interest and amortize bonds.

20X1

Jan. 1 Interest Payable 270,000

Cash 270,000

To pay interest.

2020

Jan. 1 Bonds Payable 6,000,000

Cash 6,000,000

To pay bonds at maturity.

675 Chapter 8 Liabilities

(continued) P 9-74A

Req. 2

Carrying amount at December 31, 20X0 = 6,377,172

Req. 3

a. Interest expense = $256,212

b. Cash interest paid = $270,000

The interest expense is lower than the cash interest paid

because the bond was issued at a premium and the company

must pay back the full face value of the bonds at maturity.

Amortization of the bond premium over the life of the bond

causes the amount of cash interest paid to exceed the interest

expense on the bonds.

676 Financial Accounting 9/e Solutions Manual

(30-45 min.) P 9-75A

Req. 1

a. Maturity value is $3,500,000

b. Annual cash interest payment is $245,000

($3,500,000 × .07)

c. Carrying amount is $3,337,635

Req. 2 (amortization table)

(PV of $1 = 0.630; PV Annuity of $1 = 4.623)

A B C D E

INTEREST

EXPENSE

INTEREST (8% OF DISCOUNT

PAYMENT PRECEDING ACCOUNT BOND

ANNUAL (7% OF DISCOUNT CARRYING

BOND BALANCE

INTEREST MATURITY CARRYING AMORTIZATION (PRECEDING AMOUNT

DATE VALUE) (B – A) ($3,500,000–D)

AMOUNT) D – C)

Dec. 31, Yr. 1 $162,365 $3,337,635

Dec. 31, Yr. 2 $245,000 $267,011 $22,011 140,354 3,359,646

Dec. 31, Yr. 3 $245,000 268,772 23,772 116,582 2,283,418

Dec. 31, Yr. 4 $245,000 270,673 25,673 90,909 3,409,091

Dec. 31, Yr. 5 $245,000 272,727 27,727 63,182 3,436,818

Interest expense for the year ended December 31, Year 4, is

$270,673.

677 Chapter 8 Liabilities

(continued) P 9-75A

Req. 3 (reporting the liabilities at December 31, Year 4)

Current liabilities:

Current installment of notes payable…….. $ 55,000

Non-current liabilities:

Bonds payable………………………………... $3,500,000

Less: Discount on bonds payable………. ( 90,909) 3,409,091

Notes payable………………………………… 275,000

678 Financial Accounting 9/e Solutions Manual

(40-50 min.) P 9-76A

Req. 1

IAS 17 states that if the terms of the lease meet any of the following

conditions, it will be recognized as a capital lease*:

1. The lease transforms substantially all risks and rewards of the

asset to the lessee.

2. The lease transfers ownership of the asset to the lessee at the

end of the lease.

3. The lease term represents a substantial part of the asset’s useful

life.

4. The present value of the lease payments represents a substantial

part of the fair value of the asset.

Based on the lease terms, fair value for the lease is 55,000 x 3.170

= 174,350. Since this is very close to the fair market value of the

asset at $180,000, this will be classified as a finance lease.

*Note that the U.S. GAAP recognizes a different set of criteria from

IAS 17 when it comes to classifying the lease. For instance, under

the U.S. GAAP, if the term of the lease exceeds 75% of the asset’s

useful life, and the present value of the lease payments exceeds

90% of the asset’s fair value, it will be classified as a capital lease.

Req 2

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Dec. 31 Lease Asset………………………. 174,350

20X0 Lease Liability............................. 174,350

679 Chapter 8 Liabilities

To record capital lease.

Dec. 31 Lease Expense…………………… 17,435

20X1 Lease Liability……………………. 37,565

Cash………………………... 55,000

680 Financial Accounting 9/e Solutions Manual

(20-30 min.) P 9-77A

Req. 1

TO: Management of Viola Sporting Goods

FROM: [Student Name]

SUBJECT: Advantages and disadvantages of borrowing

versus issuing shares to raise cash for

expansion

Raising money by borrowing has at least two advantages over

issuing common shares. Borrowing does not change the

present ownership of the business. It enables the present

owners to keep their proportionate interests in the business

and to carry out their plans without interference from a new

group of shareholders. Under normal conditions, borrowing

results in a higher earnings per share of common shares

because the interest expense on the debt is tax-deductible. And

higher earnings per share usually lead to higher share prices

for company owners.

The main disadvantage of borrowing is that the debt increases

the financial risk of the company. The principal and the related

interest expense must be paid whether the company is earning

a profit or not. If times get sufficiently bad, the debt burden

could threaten the ability of the business to continue as a going

concern.

681 Chapter 8 Liabilities

(continued) P 9-77A

The main advantage of issuing shares is that owners avoid the

burden of making interest and principal payments on the debt.

Issuing shares creates no liability to pay anything to the

owners. If the directors consider it necessary, they can refuse

to pay dividends in order to conserve cash. Therefore, it is

safer to issue shares.

One disadvantage of issuing shares is dilution of the

ownership interests of existing shareholders if the purchasers

of new shares are outsiders. The new shareholders may have

different ideas about how to manage the business and that may

pose difficulties for the original shareholder group. Another

disadvantage of issuing shares is that earnings per share are

usually lower because of (1) the greater number of shares of

shares outstanding, and (2) the non-tax-deductibility of

dividends paid on the shares.

There is insufficient information available upon which to make

a decision. Viola Sporting Goods’ management must prepare

budgets which indicate the impact of the new stores in terms of

net income and cash flow. Management must also estimate the

cost of borrowing the funds.

Student responses may vary.

682 Financial Accounting 9/e Solutions Manual

(20-30 min.) P 9-78A

Req. 1

Quinzel Foods, Inc.

Partial Balance Sheet

December 31, 20X0

PPE: Current liabilities:

Equipment $745,000 Mortgage note

Accumulated payable, current $ 94,000

depreciation (164,000) Bonds payable,

current portion 400,000

Interest payable 72,000*

Total current liabilities $566,000

Non-current liabilities:

Mortgage note payable

Long-term… $ 319,000

Bonds payable. $1,200,000

Discount on bonds

payable……. (27,000)* 1,173,000

Net Pension liability 60,000**

Total non-current liabilities $1,552,000

Notes:

* The order of listing current liabilities and non-current liabilities is optional.

However, Discount on Bonds Payable should come immediately after Bonds

Payable. Also, it is customary to report Interest Payable after the related

liability accounts, Mortgage Note Payable and Bonds Payable, Current

Portion.

** Computation of pension liability:

Accumulated pension benefit obligation…………….……............ $465,000

Less: Pension plan assets, at market value………………............ (405,000)

Net Pension liability to be reported on the balance sheet……… $ 60,000

683 Chapter 8 Liabilities

(continued) P 9-78A

Req. 2

a. Carrying amount of bonds payable:

Current portion……………………………… $ 400,000

Long-term portion ($1,200,000 − $27,000)… 1,173,000

Carrying amount……………………………….. $1,573,000

b. Interest payable is the amount of interest that Quinzel

owes at year end. Interest expense is the company’s

cost of borrowing for the full year.

Req. 3

Operating income $ 400,000

Times-interest-earned ratio = =

Interest expense $ 222,000

= 1.80 times

684 Financial Accounting 9/e Solutions Manual

Problems

Group B

(15-20 min.) P 9-79B

a. Sales tax payable (€120,000 × .08) €9,600

b. Note payable, short-term €81,000

Interest payable (€81,000 × .04 × 4/12) 1,080

c. Unearned service revenue (€1,500 × 4/6) €1,000

d. Estimated warranty payable

(€11,400 + €31,200 − €34,600) €8,000

e. Portion of long-term note payable due

within one year €24,000

Interest payable (€88,000 × .10) 8,800

685 Chapter 8 Liabilities

(30-40 min.) P 9-80B

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Mar. 3 Inventory…………………………………… 35,000

Note Payable, Short-term……………. 35,000

May 31 Cash…………………………………………. 75,000

Note Payable, Short-term……………. 15,000

Note Payable, Long-term…………….. 60,000

Sept. 3 Note Payable, Short-term……………….. 35,000

Interest Expense (35,000 × .10 × 6/12). 1,750

Cash……………………………………... 36,750

Dec. 31 Warranty Expense (198,000 × .015)….. 2,970

Provision for Warranty Repairs 2,970

Dec. 31 Interest Expense

(75,000 × .08 × 7/12)…………………….. 3,500

Interest Payable……………………….. 3,500

20X1

May 31 Note Payable, Short-term……………….. 15,000

Interest Payable…………………………… 3,500

Interest Expense (75,000 × 0.08 × 5/12).. 2,500

Cash [15,000 + (75,000 × .08)]..…... 21,000

686 Financial Accounting 9/e Solutions Manual

(20-25 min.) P 9-81B

Req. 1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

a. May 31 Cash 2,000,000

Bonds Payable 2,000,000

To issue bonds at par.

b. Nov. 30 Interest Expense………………... 80,000

Cash (2,000,000 × .08 × 6/12)… 80,000

To pay interest on bonds.

c. Dec. 31 Interest Expense

(2,000,000 × .08 × 1/12) 13,333

Interest Payable 13,333

To accrue interest.

20X1

d. May 31 Interest Payable 13,333

Interest Expense

(2,000,000 × .08 × 5/12) 66,667

Cash ………………………….. 80,000

To pay interest on bonds.

687 Chapter 8 Liabilities

(continued) P 9-81B

Req. 2 (reporting the liabilities on the balance sheet at

December 31, 20X0)

Current liabilities:

Interest payable……………………………. € 13,333

Non-current liabilities:

Bonds payable……………………………... €2,000,000

(30-40 min.) P 9-82B

Req. 1

The 6% notes issued when the market interest rate is 5% will be

priced at a premium. They are relatively attractive in this

market, so investors will pay a price above par value to acquire

them.

Req. 2

The 6% notes issued when the market interest rate is 7%will be

priced at a discount. They are relatively unattractive in this

market, so investors will pay less than par value to acquire

them.

688 Financial Accounting 9/e Solutions Manual

(continued) P 9-82B

(PV of $1 = 0.372; PV Annuity of $1 = 25.103)

Req. 3

A B C D E

Period Interest Interest Premium Premium Bond

Amortizatio

Payment Expense Account Carrying

n

Balance Amount

(c% x

(i% x E) (A - B) (D-C) (Maturity + D)

Maturity)

0 0 187,635 1,687,635

1 45,000 42,191 2,809 184,826 1,684,826

2 45,000 42,121 2,879 181,947 1,681,947

3 45,000 42,049 2,951 178,996 1,678,996

4 45,000 41,975 3,025 175,971 1,675,971

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

a. Feb. 28 Cash………………………… 1,687,635

Preimum on Bonds Payable…………… 187,635

Bonds Payable……………………………….. 1,500,000

To issue bonds payable at a premium.

b. Aug. 31 Interest Expense…………………………………. 42,191

Premium on Bonds Payable………………. 2,809

Cash……………… 45,000

To pay interest and amortize bonds payable.

c. Dec. 31 Interest Expense (42,121 x 4/6)……………. 28,081

Premium on Bonds Payable (2,879 x 4/6).... 1,919

Interest Payable ($45,000 4/6)……………. 30,000

To accrue interest and amortize bonds payable.

20X1

d. Feb. 28 Interest Payable (from Dec. 31)………………… 30,000

689 Chapter 8 Liabilities

Interest Expense(42,121-28,081)…………….. 14,040

Premium on Bonds Payable(2,879-1,919).... 960

Cash ($1,800,000 × .06 × 6/12)………………. 45,000

To pay interest and amortize bonds payable.

690 Financial Accounting 9/e Solutions Manual

(continued) P 9-82B

Req. 4 (reporting the liabilities on the balance sheet at

December 31, 20X0)

Current liabilities:

Interest payable € 30,000

Non-current liabilities:

Notes payable €1,500,000

Add: Premium on notes payable 182,907*

1,682,907

*187,635 – 2,809 – 1,919 = 182,907

691 Chapter 8 Liabilities

(30-40 min.) P 9-83B

(PV of $1 = 0.554; PV Annuity of $1 = 14.877)

Req. 1

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

20X0

Jan. 1 Cash 2,149,390

Premium on Bonds Payable 149,390

Bonds Payable 2,000,000

To issue bonds at a premium.

July 1 Interest Expense 64,482

Premium on Bonds Payable 5,518

Cash 70,000

To pay interest and amortize bonds.

Dec. 31 Interest Expense 64,316

Premium on Discount Bond………. 5,684

Interest Payable…… 70,000

To accrue interest and amortize bonds.

20X1

Jan. 1 Interest Payable……………………… 70,000

Cash………………………………… 70,000

To pay interest.

2020

Jan. 1 Bonds Payable……………………… 2,000,000

Cash……………………………… 2,000,000

To pay off bonds at maturity.

692 Financial Accounting 9/e Solutions Manual

(continued) P 9-83B

Req. 2

Carrying amount at December 31, 20X0 = 2,138,188*

*2,149,390 − 5,518 − 5,684

Req. 3

a. Interest expense = $64,482

b. Cash interest paid = $70,000

The interest expense is lower than the cash interest paid

because the bond was issued at a premium and the company

must pay back the full face value of the bonds at maturity.

Amortization of the bond premium over the life of the bond

causes the amount of cash interest paid to exceed the interest

expense on the bonds.

693 Chapter 8 Liabilities

(30-45 min.) P 9-84B

Req. 1

a. Maturity value is €6,500,000.

b. Annual cash interest payment is 260,000 (6,500,000 × .04).

c. Carrying amount is €6,168,760.

Req. 2 (amortization table)

(PV of $1 = 0.746; PV Annuity of $1 = 5.076)

A B C D E

INTEREST

EXPENSE

INTEREST (5% OF DISCOUNT

PAYMENT PRECEDING ACCOUNT BOND

ANNUAL (4% OF BOND DISCOUNT BALANCE CARRYING

INTEREST MATURITY CARRYING AMORTIZATION (PRECEDING AMOUNT

DATE VALUE) AMOUNT) (B – A) D – C) ($6,500,000 – D)

Dec. 31, Yr. 1 €331,240 €6,168,760

Dec. 31, Yr. 2 260,000 308,438 €48,438 282,802 6,217,198

Dec. 31, Yr. 3 260,000 310,860 50,860 231,942 6,268,058

Dec. 31, Yr.4 260,000 313,403 53,403 178,539 6,321,461

Dec. 31, Yr.5 260,000 316,073 56,073 122,466 6,377,534

Interest expense for the year ended December 31, Year 4 is

€313,403.

694 Financial Accounting 9/e Solutions Manual

(continued) P 9-84B

Req. 3 (reporting the liabilities at December 31, Year 4)

Current liabilities:

Current portion of notes payable € 60,000

Non-current liabilities:

Bonds payable €6,000,000

Less: Discount on bonds payable € (178,539) €6,321,461

Notes payable

(360,000 − 60,000) €300,000

695 Chapter 8 Liabilities

(40-50 min.) P 9-85B

Req. 1

IAS 17 states that if the terms of the lease meet any of the following

conditions, it will be recognized as a capital lease:

1. The lease transforms substantially all risks and rewards of the

asset to the lessee.

2. The lease transfers ownership of the asset to the lessee at the

end of the lease.

3. The lease term represents a substantial part of the asset’s useful

life.

4. The present value of the lease payments represents a substantial

part of the fair value of the asset.

Based on the lease terms, fair value for the lease is €34,000 x 4.623

= €157,182. Since this is very close to the fair market value of the

asset at €160,000, this will be classified as a finance lease.

*Note that the U.S. GAAP recognizes a different set of criteria from

IAS 17 when it comes to classifying the lease. For instance, under

the U.S. GAAP, if the term of the lease exceeds 75% of the asset’s

useful life, and the present value of the lease payments exceeds

90% of the asset’s fair value, it will be classified as a capital lease.

Req 2

Journal

DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT

Dec. 31 Lease Asset………………………. 157,182

20X0 Lease Liability............................. 157,182

696 Financial Accounting 9/e Solutions Manual

To record capital lease.

Dec. 31 Lease Expense…………………… 12,575

20X1 Lease Liability……………………. 21,425

Cash………………………... 34,000

697 Chapter 8 Liabilities

(15-30 min.) P 9-86B

TO: Management of Veronica Sporting Goods

FROM: [Student Name]

SUBJECT: Advantages and disadvantages of borrowing

versus issuing shares to raise cash for

expansion

Raising money by borrowing has at least two advantages over

issuing common shares. Borrowing does not change the

present ownership of the business. It enables the present

owners to keep their proportionate interests in the business

and to carry out their plans without interference from a new

group of shareholders. Under normal conditions, borrowing

results in a higher earnings per share of common shares

because the interest expense on the debt is tax-deductible. And

higher earnings per share usually lead to higher share prices

for company owners.

The main disadvantage of borrowing is that the debt increases

the financial risk of the company. The principal and the related

interest expense must be paid whether the company is earning

a profit or not. If times get sufficiently bad, the debt burden

could threaten the ability of the business to continue as a going

concern.

698 Financial Accounting 9/e Solutions Manual

The main advantage of issuing shares is that owners avoid the

burden of making interest and principal payments on the debt.

Issuing shares creates no liability to pay anything to the

owners. If the directors consider it necessary, they can refuse

to pay dividends in order to conserve cash. Therefore, it is

safer to issue shares.

One disadvantage of issuing shares is dilution of the

ownership interests of existing shareholders if the purchasers

of new shares are outsiders. The new shareholders may have

different ideas about how to manage the business and that may

pose difficulties for the original shareholder group. Another

disadvantage of issuing shares is that earnings per share are

usually lower because of (1) the greater number of shares of

shares outstanding, and (2) the non-tax-deductibility of

dividends paid on the shares.

There is insufficient information available upon which to make

a decision. Veronica’s management must prepare budgets

which indicate the impact of the new stores in terms of net

income and cash flow. Management must also estimate the

cost of borrowing the funds.

Student responses may vary.

699 Chapter 8 Liabilities

(20-30 min.) P 9-87B

Req. 1

Isley Foods, Inc.

Partial Balance Sheet

December 31, 20X0

PPE: Current liabilities:

Equipment….. €746,000 Bonds payable

Accumulated current portion………… € 500,000

depreciation. (165,000) Mortgage note payable

581,000 current portion……….. 95,000

Interest payable…………. 72,000*

Total current liabilities…… 667,000

Non-current liabilities:

Mortgage note payable… 313,000

Bonds payable. 200,000

Discount on bonds

payable……. 23,000* 177,000

Net Pension liability…… 50,000**

Total non-current liabilities 540,000

_____

Notes:

* The order of listing non-current liabilities is optional. However, Discount on

Bonds Payable should come immediately after Bonds Payable. Also, it is

customary to report Interest Payable after the related liability accounts.

** Computation of pension liability:

Accumulated pension benefit obligation…………………….. €460,000

Less: Pension plan assets, at market value…………………. (410,000)

Net Pension liability to be reported on the balance sheet… 50,000

700 Financial Accounting 9/e Solutions Manual

(continued) P 9-87B

Req. 2

a. Carrying amount of bonds payable:

Current portion..................................................... € 500,000

Long-term portion (200,000 - 23,000)................. 177,000

Carrying amount.................................................. €677,000

b. Interest payable is the amount of interest that Isley owes at

year-end. Interest expense is the company’s cost of

borrowing for the full year.

Req. 3

Operating income 360,000

Times-interest-earned ratio = =

Interest expense 224,000

= 1.6 times

701 Chapter 8 Liabilities

Decision Cases

(15-20 min.) Decision Case 1

Req. 1

As After Including the

Reported Special-Purpose Entities

Total liabilities $54,033 $54,033 + $7,300

Debt ratio = =

Total assets $65,503 $65,503 − $800 + $500

= 0.82 = 0.94

Operating

Times-interest- Income $1,953 $1,953

= =

earned ratio Interest $ 838 $838 + ($7,300 × .10)

expense

= 2.3 times = 1.2 times

Req. 2

It appears that Enron excluded the special-purpose-entities

(SPEs) from its financial statements in order to hide their debt

from Enron’s investors and creditors. The purpose was to

understate Enron’s liabilities. We would view Enron as much

more risky after including the SPEs in Enron’s financial

statements. So did their banks, which is why they stopped

lending money to them, causing them to have to file for

bankruptcy.

702 Financial Accounting 9/e Solutions Manual

(30-40 min.) Decision Case 2

Req. 1 (Analysis of financing plans)

PLAN A PLAN B PLAN C

ISSUE $3.75

ISSUE NONVOTING

BORROW COMMON PREFERRED

AT 6% SHARES SHARES

Net income before expansion $3,500,000 $3,500,000 $3,500,000

Project income before interest

and income tax $1,500,000 $1,500,000 $1,500,000

Less interest expense

($6,000,000 × .06) 360,000 -0- -0-

Project income before income tax 1,140,000 1,500,000 1,500,000

Less income tax expense (35%) 399,000 525,000 525,000

Project net income 741,000 975,000 975,000

Less preferred dividends

(100,000 × $3.75) -0- -0- 375,000

Additional net income available

to common shareholders 741,000 975,000 600,000

Total company net income $4,241,000 $4,475,000 $4,100,000

Earnings per share including new

project:

Plan A

($4,241,000 / 1,000,000 shares) $ 4.24

Plan B

($4,475,000 / 1,100,000 shares) $ 4.07

Plan C

($4,100,000 / 1,000,000 shares) $ 4.10

703 Chapter 8 Liabilities

(continued) Decision Case 2

Req. 2 (Recommendation)

The best choice appears to be Plan A — borrowing at 6% —

because:

(1) Borrowing allows the family to maintain control of the

business;

(2) EPS is higher under borrowing than under issuing preferred

shares (which would also maintain family control); and

(3) EPS under borrowing is higher than it would be if common

shares were issued. Also, cash flow under Plan A

(borrowing) may be almost as good as under Plan B

(issuing common shares) after considering shareholders’

demands for dividends.

704 Financial Accounting 9/e Solutions Manual

Ethical Issue 1

Req. 1

A company would prefer not to disclose its contingent

liabilities because they cast a shadow on the business and

create a negative impression. Contingent liabilities relating to

defending legal suits may be taken as admission of legal

responsibility when disclosed.

Req. 2 and 3

The potential parties and economic consequences of the

decision not to disclose contingent liabilities are:

1. The bank and its shareholders: With misleading

information, they might extend additional funds to the borrower

assuming a better ability to pay back the funds than actually

exists. A contingent liability creates risk for a company. If the

contingent liability is not reported, the bank may view the

company as low-risk. This may lead the bank to loan money at

low interest rates and with easy payment terms. With

knowledge of the contingent liability, the bank might not have

made the loan at all. Or the bank might have required a higher

interest rate or more stringent payment terms. Making loans on

too-easy terms expropriate the bank’s owners of their money.

705 Chapter 8 Liabilities

(continued) Ethical Issue 1

2. The company seeking the loan: Might become overextended

in its borrowing and risk default on debt in the future.

Req. 3 Economic, legal, and ethical consequences

Banks have legal requirements to keep certain ratios of assets

and liabilities on their books or risk default. Failure of a

company to report its contingent liabilities to a bank requesting

this disclosure could subject the company to a lawsuit later on.

From an ethical standpoint, reporting a contingent liability

requires a delicate balancing act. Ethics require that outsiders’

interests be protected. The company must disclose enough

information to give outsiders a reasonable basis for making

informed decisions about the company. At the same time, the

company should avoid giving away secrets that could damage

its owners’ investment in the business. This dilemma is clear

when a defendant fears losing an important lawsuit. Fortunately

for accountants, most companies settle out of court those

lawsuits that they expect to lose. In such cases, there are no

contingent liabilities to disclose.

706 Financial Accounting 9/e Solutions Manual

Ethical Issue 2

1. The ethical issue is whether to structure this lease to avoid

its having to be disclosed as a capital lease. The company will

do that if it is possible. It appears that Gocker and Moran have

some flexibility in setting the life of the lease (4-6 years). If they

set the term of the lease at 4 years, it will be only 66 2/3 percent

of the economic life of the asset (6 years). Thus, the lease will

fail all of the mechanical tests for the lease to be treated as a

capital lease, and by default, it will be treated as an operating

lease, and Gocker can avoid capitalizing the asset and

including the liability on her financial statements. If they set

the term of the lease at 5 or 6 years, it will exceed 75% of the

economic life of the asset, and thus the lease will have to be

capitalized.

2. The stakeholders are Gocker, the lessee; Morgan, the lessor;

and Last National Bank, Gocker’s present creditor. The

potential consequences to the stakeholders are:

a. economic: If the lease is structured as a capital lease,

Gocker

will violate its long-term loan covenant with Last National Bank.

As a result, the bank might demand immediate payment of their

707 Chapter 8 Liabilities

(continued) Ethical Issue 2

loan. This may damage Gocker’s credit rating and create

difficulty getting future bank loans. Alternatively, Last National

Bank may waive the loan covenant in exchange for a higher

interest rate or more stringent repayment terms. This too could

cause Gocker financial difficulties. Morgan is not affected

economically, because Morgan will receive its payments on the

leased property regardless of how the transaction is disclosed.

b. legal: If we assume that GAAP substitutes for legal

requirements, if Gocker is careful to structure the lease terms

so that it avoids the requirements for a capital lease, there

should be no problem stating that the lease agreement

complies with GAAP.

c. ethical: The substance of a capital lease is one that

transfers the risks and rewards of ownership to the lessee. If in

fact, the substance of the terms of this lease do that, the

equipment should be capitalized by the lessee regardless of the

form of the lease terms. To use mechanical rules to avoid

recognizing assets and liabilities hardly seems like a truthful

way to do business. Nevertheless, U.S. GAAP presently allow

it!

708 Financial Accounting 9/e Solutions Manual

(continued) Ethical Issue 2

3. Student responses will vary on this question. Some will say

that, if the rules allow it, then why not engineer the transaction

in such as way as to benefit Gocker by keeping the asset, and