Professional Documents

Culture Documents

Transactions

Uploaded by

Tracy Reign FortitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transactions

Uploaded by

Tracy Reign FortitCopyright:

Available Formats

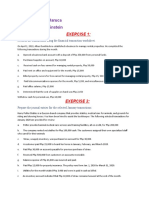

HW4

A. Simple journal entry F. Compound journal entry K. Account titles

B. Journalizing G. Account L. Recording Process

C. Debit H. Peso M. Permanent accounts

D. Credit I. Historical cost N. Temporary accounts

E. Rules of debit and credit J. Journals O. Posting reference

G 1. An accounting device used in recording, classifying, and summarizing the business

transactions

O 2. Evidence of completed posting

E 3. All debits have credits of equal amounts, or vice-versa

C 4. To enter an amount on the left side of an account

D 5. To enter an amount on the right side of an account

J 6. Books of original entry

B 7. The process of recording the transaction in a journal

A 8. Journal entry that involves one debit and one credit account

F 9. Journal entry that involves more than two accounts

H 10. Unit of measurement used in recording and reporting financial data

M 11. Balance sheet accounts

N 12. Income statement account

I 13. Accepted basis of valuing assets and benefits acquired, and liabilities incurred

ASSETS LIABILITIES CAPITAL DRAWINGS INCOME EXPENSES

A debit credit

B credit debit

C debit credit

D debit credit

E debit credit

F credit debit

G debit credit

H credit debit

I debit credit

J debit credit

K debit credit

L debit credit

M credit debit

N debit credit

O credit debit

P credit debit

Q credit debit

CORRECT ANSWER:

ASSETS LIABILITIES CAPITAL DRAWINGS INCOME EXPENSES

A debit credit

B credit debit

C debit credit

D debit/credit debit

E debit/credit

F debit/credit

G debit debit credit

H credit debit

I debit credit

J credit debit

K credit debit

L debit/credit

M credit debit

N debit credit

O credit debit

P debit credit

Q credit debit

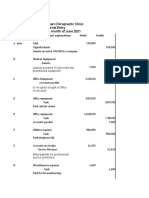

DEBIT CREDIT

ACCOUNT TITLE AMOUNT ACCOUNT TITLE AMOUNT

A cash P 150,000 Luis Vergara, capital P 150,000

B Store Equipment (Repair P 75,000 Cash P 25,000

equipment)

Accounts Payable P 50,000

C Store Equipment (shop P 13,500 Cash P 13,500

tools)

D Rent Expense P 14,000 Cash P 14,000

E Cash P 4,350 Service Revenue P 4,350

F Accounts Payable P 20,000 Cash P 20,000

G Cash P 7,000 Unearned Revenue P 7,000

H Store Equipment P 120,000 Depreciation P 120,000

I Cash P 15,000 Luis Vergara, withdrawals P 15,000

J Salary Expense P 12,000 Cash P 12,000

K Notes Payable P 3,000 Cash P 3,000

L Cash P 200 Sales Revenue P 200

M Cash P 150 Equipment P 800

Loss on disposal P 650

434,850 434,850

CORRECT ANSWER:

DEBIT CREDIT

ACCOUNT TITLE AMOUNT ACCOUNT TITLE AMOUNT

A cash P 150,000 Luis Vergara, capital P 150,000

B Store Equipment (Repair P 75,000 Cash P 25,000

equipment)

Accounts Payable P 50,000

C Store Equipment (shop P 13,500 Cash P 13,500

tools)

D Rent Expense P 14,000 Cash P 14,000

E Cash P 4,350 Service Revenue P 4,350

F Accounts Payable P 20,000 Cash P 20,000

G Accounts Receivable P 7,000 Service Revenue P 7,000

H Delivery Equipment P 120,000 Vergara, Capital P 120,000

I Vergara, drawing P 15,000 Cash P 15,000

J Salary Expense P 12,000 Cash P 12,000

K Accounts Payable P 30,000 Notes Payable P 30,000

L Cash P 200 Miscellaneous Income P 200

M Cash P 150 Tools P 800

Loss on sale of tools P 650

434,850 434,850

You might also like

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Fabm1 L7Document4 pagesFabm1 L7LinNo ratings yet

- Accounting 2Document2 pagesAccounting 2LinNo ratings yet

- Exercise 2-1 Exercise 2-2 Exercise 2-3Document11 pagesExercise 2-1 Exercise 2-2 Exercise 2-3denise ngNo ratings yet

- Advanced Accounting Week 4Document3 pagesAdvanced Accounting Week 4rahmaNo ratings yet

- Funaco1-Problem # 16Document2 pagesFunaco1-Problem # 16Aiza VicedoNo ratings yet

- Complete AccountingDocument4 pagesComplete AccountingLinNo ratings yet

- Accounting Process Practice ProblemDocument23 pagesAccounting Process Practice ProblemRenshey Cordova MacasNo ratings yet

- I) Increase in Utilities Expense J) Decrease in LandDocument3 pagesI) Increase in Utilities Expense J) Decrease in LandRosendo Bisnar Jr.No ratings yet

- Activity2 JLTDocument4 pagesActivity2 JLTfaith fortunNo ratings yet

- Problem #1Document7 pagesProblem #1Micah FlorendoNo ratings yet

- MCQs Exam Review Sheet Variant 1Document6 pagesMCQs Exam Review Sheet Variant 1Majid 1 MubarakNo ratings yet

- DAGUPLO c2 p16 p17Document7 pagesDAGUPLO c2 p16 p17Jane Leona Almosa Daguplo100% (1)

- ASASDASDASDASDASDASDASDDocument1 pageASASDASDASDASDASDASDASDPrince Philip ReyesNo ratings yet

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- Boac Edralyn QuizDocument7 pagesBoac Edralyn QuizEdralyn BoacNo ratings yet

- Recording On T Account and Preparing Trial BalanceDocument8 pagesRecording On T Account and Preparing Trial BalanceLala BoraNo ratings yet

- Account Classification Normal Balance Income Statement / Balance Sheet ColumnDocument13 pagesAccount Classification Normal Balance Income Statement / Balance Sheet ColumnRhoda Claire M. Gansobin86% (7)

- Aaa Services Problem SampleDocument15 pagesAaa Services Problem SampleCheche AmpoanNo ratings yet

- Assignments #14Document3 pagesAssignments #14Soleil AsierNo ratings yet

- Answer Sheet: Mindanao State UniversityDocument14 pagesAnswer Sheet: Mindanao State UniversityNermeen C. AlapaNo ratings yet

- BFAR JournalizingDocument3 pagesBFAR Journalizingangelica joyce caballesNo ratings yet

- Chapter 07Document14 pagesChapter 07Dan ChuaNo ratings yet

- Chart of Accounts - 2Document3 pagesChart of Accounts - 2Balpreet KaurNo ratings yet

- 4 - Dissolution IllustrationDocument14 pages4 - Dissolution IllustrationAlrac GarciaNo ratings yet

- Class Activity, Recording TransactionsDocument28 pagesClass Activity, Recording TransactionskhanNo ratings yet

- BSA 1 13 Group 4 - Exercises 6 1 and 6 2Document10 pagesBSA 1 13 Group 4 - Exercises 6 1 and 6 2vomawew647No ratings yet

- Far AssignmentDocument12 pagesFar AssignmentisadizeNo ratings yet

- Acctg 101 Ass. #15,17,19&21Document8 pagesAcctg 101 Ass. #15,17,19&21Danilo Diniay Jr67% (6)

- AAA Service CenterDocument22 pagesAAA Service CenterKishia Kayth100% (1)

- ACC 200 Quiz #2Document4 pagesACC 200 Quiz #2Idrees ShinwaryNo ratings yet

- MERCHANDISINGDocument30 pagesMERCHANDISINGJerlyn SaynoNo ratings yet

- P 2-47 Entries Debit Credit Types of Account Increase/ DecreaseDocument4 pagesP 2-47 Entries Debit Credit Types of Account Increase/ DecreaseTayaban Van GihNo ratings yet

- Fdnacct 3-18 To 3-19 FS TemplateDocument4 pagesFdnacct 3-18 To 3-19 FS TemplateFAFAFANo ratings yet

- Quiz 1 Introduction To AccountingDocument6 pagesQuiz 1 Introduction To AccountingJustine FigueroaNo ratings yet

- Practice Set 1Document26 pagesPractice Set 1Jarish EnriquezNo ratings yet

- Cambridge IGCSE and O Level Accouting Workbook AnswersDocument107 pagesCambridge IGCSE and O Level Accouting Workbook Answersღ꧁Lizzy X Roxiie꧂ღ100% (1)

- Accounting Workbook Section 1 AnswersDocument24 pagesAccounting Workbook Section 1 AnswersAhmed Zeeshan94% (32)

- Types of Major Accounts: Prepared By: Prof. Jericko Lian Del RosarioDocument14 pagesTypes of Major Accounts: Prepared By: Prof. Jericko Lian Del RosarioJiji CruzNo ratings yet

- Journal Entries For The Month of November: Solutions To Handout # 1: in Class Problem # 1Document8 pagesJournal Entries For The Month of November: Solutions To Handout # 1: in Class Problem # 1simran punjabiNo ratings yet

- (Module 3) ExerciseDocument5 pages(Module 3) ExerciseArriane Dela CruzNo ratings yet

- Liquidation of CorporationDocument15 pagesLiquidation of CorporationMacie MenesesNo ratings yet

- Activity 1 - JournalizingDocument2 pagesActivity 1 - JournalizingJesther Nasa-anNo ratings yet

- Practice For FinalsDocument3 pagesPractice For FinalsStefanie EstilloreNo ratings yet

- T Accounts Trial BalanceDocument7 pagesT Accounts Trial BalanceCamille Pasion100% (1)

- Partnership Q1 To Q3 SolutionsDocument8 pagesPartnership Q1 To Q3 SolutionsJAYARAJALAKSHMI IlangoNo ratings yet

- Module 3 - Caragan, Adriane Ronn B. (CORRESPONDENCE)Document8 pagesModule 3 - Caragan, Adriane Ronn B. (CORRESPONDENCE)WonnNo ratings yet

- PartnershipDocument28 pagesPartnershipVasu JainNo ratings yet

- Chapter 4 - Accounting FundamentalsDocument19 pagesChapter 4 - Accounting Fundamentalsclariza100% (1)

- Abueg Clarence Angela R. Bsa1cDocument8 pagesAbueg Clarence Angela R. Bsa1cAnonnNo ratings yet

- Video Lesson Chapter 7 Fabm2 Journal and LedgerDocument27 pagesVideo Lesson Chapter 7 Fabm2 Journal and LedgerRon louise Pereyra100% (8)

- MJ'S Water Refilling Service: Mary Jane G. AnarnaDocument7 pagesMJ'S Water Refilling Service: Mary Jane G. AnarnaKing Angelo Abeleda100% (1)

- MANLUCOBLyraKaye - IA1 F1 - Assignment5Document5 pagesMANLUCOBLyraKaye - IA1 F1 - Assignment5LYRA KAYE MANLUCOBNo ratings yet

- Accounts Question Paper 1Document4 pagesAccounts Question Paper 1Muskan AgrawalNo ratings yet

- A-Guide in Preparing and Presenting SFPDocument8 pagesA-Guide in Preparing and Presenting SFPalabmyselfNo ratings yet

- Rules in Debit and CreditDocument17 pagesRules in Debit and CreditWenibet SilvanoNo ratings yet

- EXERCISE 1.2 ACCOUNTING CYCLE (No.2) FABM2Document3 pagesEXERCISE 1.2 ACCOUNTING CYCLE (No.2) FABM2Abijane Ilagan DarucaNo ratings yet

- Activity 1Document1 pageActivity 1Cris TineNo ratings yet

- CCTV Proposal Quotation-1 Orine EdutechDocument5 pagesCCTV Proposal Quotation-1 Orine EdutechĄrpit Rāz100% (1)

- A Narrative Comprehensive Report of Student Teaching ExperiencesDocument82 pagesA Narrative Comprehensive Report of Student Teaching ExperiencesEpal Carlo74% (23)

- UntitledDocument4 pagesUntitledapi-223522684No ratings yet

- Lecture - 1 - UNDERGROUND MINE DESIGNDocument59 pagesLecture - 1 - UNDERGROUND MINE DESIGNRahat fahimNo ratings yet

- DiseasesDocument11 pagesDiseasesapi-307430346No ratings yet

- Boot Time Memory ManagementDocument22 pagesBoot Time Memory Managementblack jamNo ratings yet

- IBEF Cement-February-2023Document26 pagesIBEF Cement-February-2023Gurnam SinghNo ratings yet

- Final Exam Tle Grade 8Document4 pagesFinal Exam Tle Grade 8John leo Claus67% (3)

- EHS Audit - Review PaperDocument5 pagesEHS Audit - Review PaperYousef OlabiNo ratings yet

- MBenz SLK350 R171 272 RepairDocument1,922 pagesMBenz SLK350 R171 272 RepairJavier ViudezNo ratings yet

- Screen 2014 Uricchio 119 27Document9 pagesScreen 2014 Uricchio 119 27NazishTazeemNo ratings yet

- Shrutiand SmritiDocument9 pagesShrutiand SmritiAntara MitraNo ratings yet

- Aeroacoustic Optimization of Wind Turbine Airfoils by Combining Thermographic and Acoustic Measurement DataDocument4 pagesAeroacoustic Optimization of Wind Turbine Airfoils by Combining Thermographic and Acoustic Measurement DatamoussaouiNo ratings yet

- XeroxWC 5020DN Service Manual 03.02.2012 PDFDocument432 pagesXeroxWC 5020DN Service Manual 03.02.2012 PDFSergey100% (1)

- Cognitive Benefits of Language LearningDocument11 pagesCognitive Benefits of Language LearningIlhamdi HafizNo ratings yet

- CanagliflozinDocument7 pagesCanagliflozin13201940No ratings yet

- Prakhar Gupta Epics and Empires-Game of Thrones Make Up EssayDocument5 pagesPrakhar Gupta Epics and Empires-Game of Thrones Make Up EssayGat DanNo ratings yet

- Activity 1.1.2 Simple Machine Practice Problems KeyDocument6 pagesActivity 1.1.2 Simple Machine Practice Problems KeyNehemiah GriffinNo ratings yet

- Chemical Equilibrium Chemistry Grade 12: Everything Science WWW - Everythingscience.co - ZaDocument10 pagesChemical Equilibrium Chemistry Grade 12: Everything Science WWW - Everythingscience.co - ZaWaqas LuckyNo ratings yet

- MikroC PRO For DsPIC30Document9 pagesMikroC PRO For DsPIC30ivcal20No ratings yet

- Saes T 633Document6 pagesSaes T 633luke luckyNo ratings yet

- 78EZDM Product Specifications Conector para Cable de 7 OctavosDocument4 pages78EZDM Product Specifications Conector para Cable de 7 OctavosEdwin Santiago QuispeNo ratings yet

- Supplier Accreditation Application-V1 - RevisedDocument8 pagesSupplier Accreditation Application-V1 - RevisedCandiceCocuaco-ChanNo ratings yet

- What Is An Aesthetic Experience?Document11 pagesWhat Is An Aesthetic Experience?geoffhockleyNo ratings yet

- RLA-Grade 6 2023Document4 pagesRLA-Grade 6 2023Catherine Mabini BeatoNo ratings yet

- ART Threaded Fastener Design and AnalysisDocument40 pagesART Threaded Fastener Design and AnalysisAarón Escorza MistránNo ratings yet

- Pasir Ex UD - Am Tes 2024Document8 pagesPasir Ex UD - Am Tes 2024Achmad MaulanaNo ratings yet

- Fish SilageDocument4 pagesFish Silagesooriya_giri100% (1)

- English The Smiles and Tears of RasoolullahDocument130 pagesEnglish The Smiles and Tears of RasoolullahwildqafNo ratings yet