0% found this document useful (0 votes)

2K views13 pagesIncome Statement

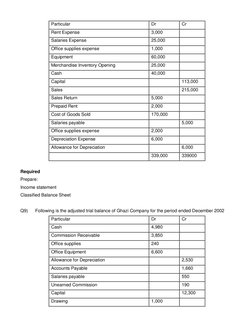

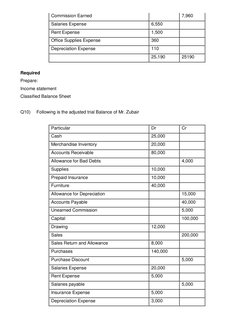

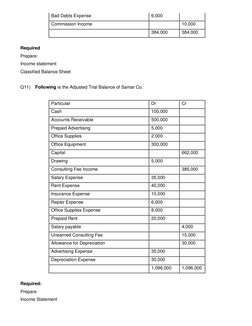

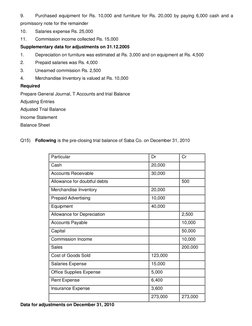

The document contains the adjusted trial balance of Ghazi Company for the period ended December 2002. It lists account titles and their debit or credit balances. The task is to prepare an income statement and classified balance sheet from this trial balance information.

Uploaded by

Shakir IsmailCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

2K views13 pagesIncome Statement

The document contains the adjusted trial balance of Ghazi Company for the period ended December 2002. It lists account titles and their debit or credit balances. The task is to prepare an income statement and classified balance sheet from this trial balance information.

Uploaded by

Shakir IsmailCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

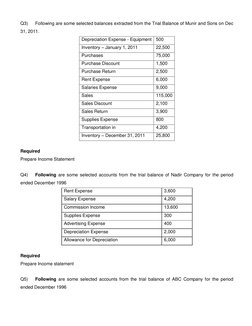

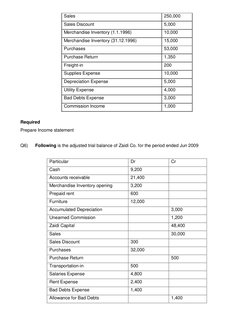

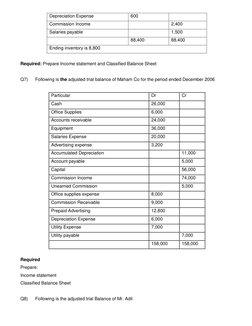

- Income Statement Exercises

- Trial Balance Exercises

- Balance Sheet Preparation

- Data Adjustment and Trial Balance

- Final Exercise on Trial Balances