Professional Documents

Culture Documents

Company 1-Aarti Industries LTD

Uploaded by

Aditi RawatOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company 1-Aarti Industries LTD

Uploaded by

Aditi RawatCopyright:

Available Formats

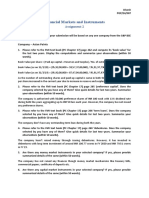

Company 1- Aarti Industries Ltd.

1. Please refer to the FMI text book (PC Chapter 17) page 262 and compute its ‘book value’ for the last two

years. Display the computations and summarize your observations (within 50 words).

Book Value Per Share = (Paid-Up Equity Capital + Reserves and Surplus)/Number of Outstanding

Equity Shares

Reserves and

Paid-Up Capital Outstanding Book Value

FY Surplus (in

(in INR cr.) shares Per Share

INR cr.)

2019-20 87.12 2814.70 174,234,474 166.58

2018-19 43.33 2517.08 86,668,647 295.32

The Book Value per share has decreased by almost 43.6% YoY. This is due to an increase in the

number of outstanding shares even though there is a rise in paid-up equity capital and reserves and surplus

of the company.

2. Please refer to the FMI text book (PC Chapter 17) page 265 ‘preference capital’. Does the company

selected by you have any of them? Give quick details for last two years. Summarize your observations

(within 50 words).

There are no preference capital shares in the company.

3. Please refer to the FMI text book (PC Chapter 17) page 266 ‘term loans’. Does the company selected by

you have any of them? Give quick details for last two years. Summarize your observations (within 50

words).

Yes, Aarti Industries has issued term loans.

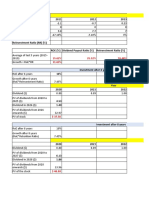

Outstanding Outstanding

Particulars amount in FY20 amount in FY19 Type

(in cr. INR) (in cr. INR)

ECB/Term Loans

from

575.49 725.2 secured

Banks/Financial

Institutions

Vehicle loans from

Banks/Financial 2.09 2.55 secured

Institutions

The company has an outstanding term loan of INR 575.49 cr. in FY20 as opposed to INR 725.2 cr. in

FY19 thus having paid approx. 20.6% of the loan amount YoY. The reduction in term loan is due to

good performance of the company. The term loans are secured by way of Pari Passu Hypothecation

of the Movable Plant & Machinery, Machinery Spares, etc., both present and future. Vehicle loans

from Banks/Financial Institutions are secured by way of hypothecation of respective vehicles.

4. Please refer to the FMI text book (PC Chapter 17) page 269 ‘debentures’. Does the company selected by

you have any of them? Give quick details for last two years. Summarize your observations (within 50

words).

Yes, Aarti Industries has issued Debentures

Outstanding Outstanding

Debentures amount in FY20 amount in FY19 Type

(in INR cr.) (in INR cr.)

Non-Convertible

NIL 80 Secured

Debentures

The company has issued STRPPS Non-Convertible Debentures of INR 200 cr. with a coupon rate of

11.75% p.a. secured by way of First Pari Passu Hypothecation of the Moveable Plant & Machinery,

Machinery Spares, etc., both present and future. NCDs were issued in the year 2014-15 and are

redeemable in five equal installments starting from the end of the 3rd year from the date of allotment.

5. Are there any money market instruments in your selected company? If yes, please provide summarized

details of the same (within 50 words).

There are no money market instruments in the company.

6. Are there any capital market instruments in your selected company? If yes, please provide summarized

details of the same (within 50 words).

There are no capital market instruments in the listed company

7. Please refer to the FMI text book (PC Chapter 18) page 276 ‘initial public offer’. Identify and mention

brief details of how the chosen company raised money (say, nature of the capital market offering, date of

offering, i-bankers involved and such)? Summarize your observations (within 50 words).

Nazara Technologies Ltd. IPO

The company raised Rs. 583 cr. from an Initial Public Offer by selling 5.3 million shares of face

value Rs. 4 each in a price band of Rs. 1,100-1,101 per share in the month of March, 2021. The

market lot size was 13 shares and the IPO was subscribed 176 times. It was a Book Built issue IPO.

Anchor investors involved were 16 foreign investors like GIC, Goldman Sachs, Fidelity, etc. and 8

mutual funds which included SBI, HDFC MF, Kotak MF, etc. The share allotment date was 24th

March, 2021 and company got listed on 30th March, 2021.

8. Please refer to the FMI text book (PC Chapter 18) page 283 ‘follow on public offer’. Provide one

example of a company that has recently gone through the process of issuing FPO. Give quick details.

Summarize your observations (within 50 words).

Yes Bank FPO

Yes Bank had issued an FPO from July 15th – 17th, 2020 with an issue size of Rs. 15,000 cr. The

issue type was Book Built Issue FPO at a price band of Rs. 12 to Rs. 13 per equity share with a

market lot of 1000 shares. SBI Capital Markets committed an underwriting amount of Rs. 3,000 cr.

in the issue. It managed to raise Rs. 14,272 cr. as it was subscribed only 95%. The proceeds collected

were to be utilized for growth and expansion, including enhancing its solvency and capital adequacy

ratio.

9. Please refer to the FMI text book (PC Chapter 18) page 284 ‘rights issue’. Provide one example of a

company that has recently gone through the process of rights issue. Give quick details. Summarize your

observations (within 50 words).

L&T Finance Rights Issue

L&T Finance opened its rights issue of Rs. 2,998.61 cr. on 1st February and closed on 15th February.

The price was fixed at Rs. 65 per fully paid-up share including a premium of Rs. 55 per share of face

value Rs. 10. The issue was oversubscribed by 15% and the rights entitlement ratio was 17:74 (17

equity shares for every 74 shares fully paid-up equity share held by the eligible shareholders). The

funds raised by this rights issue aimed at repayment of commercial papers and redemption of

preference shares issued by company and ither general corporate affairs.

10. Please refer to the FMI text book (PC Chapter 18) page 288 ‘private placement’. Provide one example of

a company that has recently gone through the process of private placement. Give quick details.

Summarize your observations (within 50 words).

Utkarsh Small Finance Bank

The company raised around Rs. 240.47 cr. through a private placement of equity shares in February,

2021. The number of shares allotted were 89,061,647 at a price of Rs. 27 per share. There were 6

investors who took part in this issue - Olympus ACF Pte Ltd, ResponsAbility Participations

Mauritius; Aavishkaar Bharat Fund, Growth Catalyst Partners LLC, Triodos Sicav II - Triodos

Microfinance Fund, Triodos Funds BV. Kotak Mahindra Capital Company was the financial advisor

to the bank during this process.

11. Please refer to the FMI text book (PC Chapter 18) page 290 ‘obtaining a term loan’. Provide one example

of a company that has recently raised money by a term loan. Give quick details. Summarize your

observations (within 50 words).

Wipro Ltd.

Wipro has secured a 1 billion USD funding through a one-year overseas loan to acquire British IT

consultancy Capco. The loan is likely to be issued by a syndicate of banks such as Bank of America,

Citi, HSBC, MUFG and Standard Chartered Bank. The short-term loan will be priced after adding 60

basis points over and above one-month dollar-denominated LIBOR which is yielding 0.11%.

12. Please refer to the FMI text book (PC Chapter 18) page 294 ‘investment banking’. Provide one example

of an investment banker in India. Give quick details. Summarize your observations (within 50 words).

Axis Capital Limited

It is a subsidiary of Axis Bank, previously known as Enam Securities Private Limited. It is one of India’s

leading financial experts that provides customized solutions in Investment Banking and Institutional

Equities. It offers services in the areas of Equity Capital Markets, M&A, Private Equity, Structured

Finance and Institutional Equities. The authorized capital of the company stands at Rs 17,500 lakhs and

has 42.0% paid-up capital which is Rs 7,350 lakhs.

You might also like

- Secret History of The Credit Card T and FalseDocument2 pagesSecret History of The Credit Card T and Falseapi-299736788No ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Contractor's Bill Check List: OthersDocument8 pagesContractor's Bill Check List: OthersPirpasha UjedeNo ratings yet

- View DocumentDocument3 pagesView DocumentAlex PattersonNo ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- Project Report On Indian Banking SystemDocument61 pagesProject Report On Indian Banking Systemhjghjghj75% (172)

- Postpaid Bill 7448440999 838926388Document3 pagesPostpaid Bill 7448440999 838926388Kanth KodaliNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- A Project Report ON Working Capital Management Icici Bank LTDDocument64 pagesA Project Report ON Working Capital Management Icici Bank LTDMukesh Prabhakar67% (3)

- Financial Markets and Instruments: Company - Asian PaintsDocument3 pagesFinancial Markets and Instruments: Company - Asian PaintsdiveshNo ratings yet

- Indian Railway Finance CorporationDocument14 pagesIndian Railway Finance CorporationAmish GangarNo ratings yet

- AIF NewsDocument3 pagesAIF NewsDiksha DuttaNo ratings yet

- NBFC in IndaDocument26 pagesNBFC in Indajuvi_kNo ratings yet

- Edelvise ProjectDocument21 pagesEdelvise ProjectsunitaNo ratings yet

- V GM PJD Dzi Fog 1602141681524Document8 pagesV GM PJD Dzi Fog 1602141681524Shilpi KumariNo ratings yet

- 01 Corporate Finance ExercisesDocument13 pages01 Corporate Finance ExercisesnityaNo ratings yet

- Merger AcquistionDocument37 pagesMerger AcquistionManjari KumariNo ratings yet

- NBFC in IndiaDocument19 pagesNBFC in IndiaBharath ReddyNo ratings yet

- Banking Awareness 2013Document52 pagesBanking Awareness 2013Sunny KumarNo ratings yet

- Paid Up Capital +reserves Surplus No .Of Outstnading Equity Shares B.V.1 B .V - 2Document5 pagesPaid Up Capital +reserves Surplus No .Of Outstnading Equity Shares B.V.1 B .V - 2Harmeet kapoorNo ratings yet

- Moneytimes 10 - 1 AugDocument1 pageMoneytimes 10 - 1 AugManohar BNo ratings yet

- Financial Accounting and Reporting I: Additional Practice QuestionsDocument34 pagesFinancial Accounting and Reporting I: Additional Practice Questionsalia khanNo ratings yet

- Pid6012 MBMDocument4 pagesPid6012 MBMSukumar ManiNo ratings yet

- Capital Structure AnalysisDocument3 pagesCapital Structure AnalysisRahulTiwariNo ratings yet

- Master of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsDocument4 pagesMaster of Business Administration-MBA Semester 2: MB0029 - Financial Management - 3 CreditsjyothishwethaNo ratings yet

- Care LTD: Rating: SubscribeDocument6 pagesCare LTD: Rating: SubscribeSunil KumarNo ratings yet

- 05 s601 SFM - 3 PDFDocument4 pages05 s601 SFM - 3 PDFMuhammad Zahid FaridNo ratings yet

- Final Examination Questions Cover Financial, Treasury and Forex ManagementDocument5 pagesFinal Examination Questions Cover Financial, Treasury and Forex ManagementKaran NewatiaNo ratings yet

- Advanced Accounting UpdatesDocument113 pagesAdvanced Accounting UpdatesYash KediaNo ratings yet

- Personal Notes: Business Finance 19-10-2020 Types of Business Categories 1. Sole ProprietorshipDocument18 pagesPersonal Notes: Business Finance 19-10-2020 Types of Business Categories 1. Sole ProprietorshipHijab ZaidiNo ratings yet

- General Knowledge Today: Last Updated: April 17, 2016 Published By: Gktoday - in Gktoday © 2017 - All Rights ReservedDocument7 pagesGeneral Knowledge Today: Last Updated: April 17, 2016 Published By: Gktoday - in Gktoday © 2017 - All Rights ReservedNaga ChandraNo ratings yet

- Call On Cosmo Films PDFDocument2 pagesCall On Cosmo Films PDFSubham MazumdarNo ratings yet

- Advanced Auditing & Professional Ethics: Master MindsDocument17 pagesAdvanced Auditing & Professional Ethics: Master MindsMaroju RajithaNo ratings yet

- 44956mtpbosicai Final QP p2Document7 pages44956mtpbosicai Final QP p2Shubham SurekaNo ratings yet

- 03 - IntroductionDocument50 pages03 - IntroductionVirendra JhaNo ratings yet

- Auditors Report PROJECTDocument40 pagesAuditors Report PROJECTCarol I. LoboNo ratings yet

- Anamul (Financial Accounting II)Document7 pagesAnamul (Financial Accounting II)Tania SultanaNo ratings yet

- (51,52) SEBI Controlled NBFCsDocument43 pages(51,52) SEBI Controlled NBFCsYadwinder SinghNo ratings yet

- Assignment 3Document4 pagesAssignment 3Nithin VNo ratings yet

- Global Strategy & Investment Consulting: Commercial PapersDocument5 pagesGlobal Strategy & Investment Consulting: Commercial PapersBhoomi AhujaNo ratings yet

- Research: Top of Form ISO-8859-1 Search Top of Form Bottom of FormDocument8 pagesResearch: Top of Form ISO-8859-1 Search Top of Form Bottom of FormSharad ChaturvediNo ratings yet

- History of IDBI BankDocument65 pagesHistory of IDBI BankKumar SwamyNo ratings yet

- SFM RTP Nov 22Document16 pagesSFM RTP Nov 22Accounts PrimesoftNo ratings yet

- Commercial PaperDocument15 pagesCommercial PaperKrishna Chandran Pallippuram100% (1)

- Ismr 2004 CH 2Document22 pagesIsmr 2004 CH 2suraj_prakash66No ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementRajyalakshmi MNo ratings yet

- Intergrated Assignment: By: Suhail JoshuaDocument24 pagesIntergrated Assignment: By: Suhail JoshuaSuhail Alpheus JoshuaNo ratings yet

- IDBI Public Issue of Unsecured BondsDocument138 pagesIDBI Public Issue of Unsecured Bondsrehan44No ratings yet

- FM QB New NewDocument22 pagesFM QB New NewskirubaarunNo ratings yet

- CA Final Paper 2Document32 pagesCA Final Paper 2MM_AKSINo ratings yet

- 12 - 16th September 2008 (160908)Document7 pages12 - 16th September 2008 (160908)Chaanakya_cuimNo ratings yet

- Commentary On Q3 FY19 Financial Results IDFCFIRST BankDocument8 pagesCommentary On Q3 FY19 Financial Results IDFCFIRST BankHimanshu GuptaNo ratings yet

- A Study of Financial Performance of NBFCS: Davinder KaurDocument8 pagesA Study of Financial Performance of NBFCS: Davinder KaurUbaid DarNo ratings yet

- Law T4Document8 pagesLaw T4Badhrinath ShanmugamNo ratings yet

- Research Paper On NBFC in IndiaDocument5 pagesResearch Paper On NBFC in Indiaafnkhqqbzoeckk100% (1)

- Private Equity Is Money Invested in Companies That Are Not: NasdaqDocument10 pagesPrivate Equity Is Money Invested in Companies That Are Not: Nasdaqneha4301No ratings yet

- J8. CAPII - RTP - June - 2023 - Group-IIDocument162 pagesJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNo ratings yet

- FS IndustryDocument6 pagesFS IndustryShams SNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- A Brief Research On Investment Corporation of BangladeshDocument14 pagesA Brief Research On Investment Corporation of BangladeshShakil NaheyanNo ratings yet

- Cash Management Analysis in Sri Angalamman Finance LtdDocument77 pagesCash Management Analysis in Sri Angalamman Finance LtdJayaprabhu PrabhuNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- B1 B4 B5 MergedDocument64 pagesB1 B4 B5 MergedHussein AbdallahNo ratings yet

- FMI Assignment 6: - Adarsh GuptaDocument4 pagesFMI Assignment 6: - Adarsh GuptaAditi RawatNo ratings yet

- Financial Management MCQ and Case Study QuestionsDocument4 pagesFinancial Management MCQ and Case Study QuestionsAditi RawatNo ratings yet

- FMI 7 432 ExcelDocument1 pageFMI 7 432 ExcelAditi RawatNo ratings yet

- Reeby Case 432 7Document2 pagesReeby Case 432 7Aditi RawatNo ratings yet

- Fmi 6 432Document1 pageFmi 6 432Aditi RawatNo ratings yet

- Fmi 5 432Document6 pagesFmi 5 432Aditi RawatNo ratings yet

- FMI - Assignment #7 market orders vs limit ordersDocument2 pagesFMI - Assignment #7 market orders vs limit ordersAditi RawatNo ratings yet

- Fmi Assignment #8: Ind - Ps - Ps - A1 McqsDocument4 pagesFmi Assignment #8: Ind - Ps - Ps - A1 McqsAditi RawatNo ratings yet

- Assignment #5: Please Refer To Sheet Q3' of Attached Excel For WorkingDocument4 pagesAssignment #5: Please Refer To Sheet Q3' of Attached Excel For WorkingAditi RawatNo ratings yet

- Fmi S5Document5 pagesFmi S5Aditi RawatNo ratings yet

- Ind - PS - Bonds - A2: Assignment #6Document3 pagesInd - PS - Bonds - A2: Assignment #6Aditi RawatNo ratings yet

- Financial Markets & Instruments - Assignment 1Document3 pagesFinancial Markets & Instruments - Assignment 1Aditi RawatNo ratings yet

- Assignment - 4: TVM - A1Document4 pagesAssignment - 4: TVM - A1Aditi RawatNo ratings yet

- Amazon investment calculation and bulk carrier NPV analysisDocument3 pagesAmazon investment calculation and bulk carrier NPV analysisAditi RawatNo ratings yet

- Letter To JaneDocument4 pagesLetter To Janeapi-233709694No ratings yet

- LockersDocument1 pageLockersMyderizi ArtanNo ratings yet

- BDBL Scam/ LoanDocument16 pagesBDBL Scam/ LoanAshfek AhamedNo ratings yet

- Role of Banking in The Modern EconomyDocument18 pagesRole of Banking in The Modern Economybackupsanthosh21 dataNo ratings yet

- Financial Mangement Slides Lecture 1Document56 pagesFinancial Mangement Slides Lecture 1Aqash AliNo ratings yet

- WRD PDFDocument2 pagesWRD PDFAdnan SyedNo ratings yet

- Appeal Court Reverses and Remands - A Summary JudgmentDocument8 pagesAppeal Court Reverses and Remands - A Summary Judgment83jjmackNo ratings yet

- Problem 1Document14 pagesProblem 1SyedNo ratings yet

- Classification and Form of Government Accounts of IndiaDocument12 pagesClassification and Form of Government Accounts of IndiaMecho HillNo ratings yet

- Current Affairs Q&A PDF - January 2018 by AffairsCloudDocument199 pagesCurrent Affairs Q&A PDF - January 2018 by AffairsCloudJEE REV RAJAULINo ratings yet

- Muthoga 2019 Commercial BanksDocument66 pagesMuthoga 2019 Commercial Banksvenice paula navarroNo ratings yet

- Islamic Project Finance Structure and Challenges February 2010Document56 pagesIslamic Project Finance Structure and Challenges February 2010Kim HedumNo ratings yet

- International Finance Ass 2Document5 pagesInternational Finance Ass 2Sugen RajNo ratings yet

- Banking Financial Services Management Lesson PlanDocument3 pagesBanking Financial Services Management Lesson PlanRamalingam Chandrasekharan0% (1)

- Problem 9-40 (60 Minutes)Document5 pagesProblem 9-40 (60 Minutes)prasanna100% (1)

- Arts Faculty All MCQ Math & Solution (2019-2017) by Khairul Alam PDFDocument72 pagesArts Faculty All MCQ Math & Solution (2019-2017) by Khairul Alam PDFFazlul Karim AkashNo ratings yet

- Chapter 2 Literature ReviewDocument24 pagesChapter 2 Literature Reviewcoolpeer91No ratings yet

- 06 - CH 7 - General LedgerDocument23 pages06 - CH 7 - General Ledger409005091No ratings yet

- Nature of CreditDocument2 pagesNature of CreditCYRELL ANDREA BUSTARDENo ratings yet

- MR ZulfaDocument14 pagesMR ZulfaHalim Pandu LatifahNo ratings yet

- Purchase Invoice Recapitulation Report - 20231012104743Document6 pagesPurchase Invoice Recapitulation Report - 20231012104743idaayomNo ratings yet

- Online Form Submission Completed for UPSC Exam (Registration-Id: 11604189801Document2 pagesOnline Form Submission Completed for UPSC Exam (Registration-Id: 11604189801Pupun LuluNo ratings yet

- Orion POS - Guide - Accounting Workflow PDFDocument20 pagesOrion POS - Guide - Accounting Workflow PDFcaplusincNo ratings yet

- UntitledDocument14 pagesUntitledNUR FAZLINA BINTI MAKHTAR KPM-GuruNo ratings yet