Professional Documents

Culture Documents

Financial Risk Management Final

Uploaded by

njagimahnOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Risk Management Final

Uploaded by

njagimahnCopyright:

Available Formats

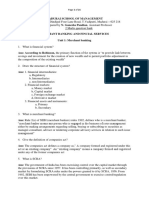

THE CO-OPERATIVE UNIVERSITY COLLEGE OF KENYA (CUCK)

(A Constituent College of Jomo Kenyatta University of Agriculture and Technology)

COURSE OUTLINE

BCOM/BCOB

Course Title: FINANCIAL RISK MANAGEMENT

Course Purpose: To further earners’ skills in financial risk management with reference to the

use of financial and commodity derivatives.

Expected learning Outcomes:

By the end of the course, students should be able to:-

1. Explain the tenets of financial risk

2. Explain the principles of option pay off analysis.

3. Identify financial risk management techniques and tools

4. Value options using Black –Scholes – Merton Model and Binomial Model

5. Describe the assumption of Black –Scholes – Merton Model

6. Value forward contracts and swaps

7. Apply financial derivatives to manage financial risk

8. Develop risk neutral portfolios using financial derivatives

Course content

WEEK TOPIC SUB-TOPICS

1 FACETS OF • Price risk

FINANCIAL RISK • Interest rate risk

• Currency exchange rate risk

• Credit risk

• Review questions

2 RISK • Options markets

MANAGEMENT • Forward contract

TECHNIQUES • Futures market

• Swaps

• Money market hedge

• Review questions

3-5 OPTIONS • Valuation principles

• Valuation using binomial pricing model and Black-

Scholes- Model

• Trading and hedge strategies

• Review questions

6 CAT I

COMPILED BY DR EMMA ANYIKA AND DR A. WEKESA

CUCK is ISO 9001:2008 Certified

7-9 FORWARD • Valuation

CONTRACT AND • Future trading and hedge

FUTURES • Margins

• Options on futures

10 & 11 SWAPS • Theory of swaps

• Valuation of swaps

• Exotic options

12 CAT II

13 CREDIT • Forms of credit derivatives

DERIVATIVES • Applications on interest rates and futures exchange

14 TRADING • Put-call parity

STRATEGIES • Designing risk neutral and immunized porfolios

15 EXAMINATIONS

References

1. Financial Derivatives by S.S.S Kumar

2. Options and Other Derivatives by John Hull

Course Journals

1. Journal of Finance

2. Journal of Accounting and Finance

3. Journal of Banking and Finance

4. Journal of Investment and Portfolio Management.

5. Journal of Finance & Economics

6. Journal of Financial & Quantitative Analysis

Teaching Methods: Lectures and tutorials; group discussion; demonstration; Individual

assignment; Case studies

Assessment

1. Continuous Assessments : 30% ( Two CATS and Assignments)

2. Final Examination : 70%

3. Final marks : 100%

Grading

Score Grade

00- 39 F

40- 49 D

50- 59 C

60- 69 B

70+ A

COMPILED BY DR EMMA ANYIKA AND DR A. WEKESA

CUCK is ISO 9001:2008 Certified

You might also like

- Portfolio Management Professional Certificate: Course InfoDocument2 pagesPortfolio Management Professional Certificate: Course Infojesus penaNo ratings yet

- Banking and Financial Markets - A Risk Management Perspective Syllabus-Preview PageDocument3 pagesBanking and Financial Markets - A Risk Management Perspective Syllabus-Preview Pagejoel wilsonNo ratings yet

- Capital Markets Professional Certificate: Course InfoDocument2 pagesCapital Markets Professional Certificate: Course InfoSanjay S RayNo ratings yet

- T-4 Financial Derivatives - FinalDocument4 pagesT-4 Financial Derivatives - FinalPalash AroraNo ratings yet

- Security Analysis and Portfolio ManagementDocument4 pagesSecurity Analysis and Portfolio ManagementSrinita MishraNo ratings yet

- THREE-5540-Investment and Securities ManagementDocument7 pagesTHREE-5540-Investment and Securities ManagementNabeel IftikharNo ratings yet

- Investment Analysis and Portfolio Management OutlineDocument6 pagesInvestment Analysis and Portfolio Management OutlineHuan EnNo ratings yet

- Subject Outline Financial Risk ManagementDocument6 pagesSubject Outline Financial Risk ManagementDamien KohNo ratings yet

- ECO111&ECO123 OutlinesDocument6 pagesECO111&ECO123 OutlinesangaNo ratings yet

- Finance Elective Syllabus Tri-IV Batch 2021-23Document9 pagesFinance Elective Syllabus Tri-IV Batch 2021-23sanket patilNo ratings yet

- Investment Management V3.5 FinalDocument30 pagesInvestment Management V3.5 FinalhassanhammadNo ratings yet

- Business Finance II B Lecture 1 March 01, 2021Document16 pagesBusiness Finance II B Lecture 1 March 01, 2021AhsanNo ratings yet

- Equity Stock Market Syllabus PPDocument3 pagesEquity Stock Market Syllabus PPdrkodali146No ratings yet

- FNCE480 International Finance Course Outline 2024Document16 pagesFNCE480 International Finance Course Outline 2024Sashina GrantNo ratings yet

- SyllabusDocument6 pagesSyllabusstoryNo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionDocument6 pagesBirla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionArchak SinghNo ratings yet

- Institute of Business Management College of Business Management Department of Accounting and FinanceDocument6 pagesInstitute of Business Management College of Business Management Department of Accounting and Financeace rogerNo ratings yet

- Certification in Integrated Treasury Management SyllabusDocument4 pagesCertification in Integrated Treasury Management Syllabusshubh.icai0090No ratings yet

- Course Outline Alternative Investment Valuation - Muhammad Owais QarniDocument9 pagesCourse Outline Alternative Investment Valuation - Muhammad Owais QarniAsadullah SherNo ratings yet

- T-4 IapmDocument5 pagesT-4 IapmPalash AroraNo ratings yet

- Business & Corporate FinanceDocument5 pagesBusiness & Corporate FinancevivekNo ratings yet

- Course Guide Basic MicroeconomicsDocument4 pagesCourse Guide Basic MicroeconomicsJersey SNo ratings yet

- Bba Sem V Final SyllabusDocument23 pagesBba Sem V Final SyllabusSagarNo ratings yet

- SP6 - Financial Derivatives Specialist Principles: SyllabusDocument8 pagesSP6 - Financial Derivatives Specialist Principles: SyllabusRANJAN THOMASNo ratings yet

- Recent Trends in Valuation: From Strategy to ValueFrom EverandRecent Trends in Valuation: From Strategy to ValueLuc KeuleneerNo ratings yet

- Module - 1: Chartered Market TechnicianDocument45 pagesModule - 1: Chartered Market Technicianprem sagarNo ratings yet

- CMT BookDocument45 pagesCMT BookHannah Denise BatallangNo ratings yet

- CMT BookDocument45 pagesCMT BookTalkTech IncorperatedNo ratings yet

- CMT BookDocument45 pagesCMT Bookprem sagar50% (2)

- Fixed Income Markets - Term-V - Prof. Vivek RajvanshiDocument5 pagesFixed Income Markets - Term-V - Prof. Vivek RajvanshiAcademic Management SystemNo ratings yet

- Security Analysis and Portfolio ManagementDocument3 pagesSecurity Analysis and Portfolio Managementharsh dhuwaliNo ratings yet

- L4M4 Summarised NoteDocument10 pagesL4M4 Summarised NoteMohamed ElsirNo ratings yet

- eFRM CompleteDocument5 pageseFRM CompletePhindile MvelaseNo ratings yet

- Whittle Integrated Strategic Planning: ServicesDocument9 pagesWhittle Integrated Strategic Planning: ServicesEnkhchimeg SarankhuuNo ratings yet

- Security AnalysisDocument5 pagesSecurity Analysistammy a. romuloNo ratings yet

- GSO Syllabus V8a - PDFDocument21 pagesGSO Syllabus V8a - PDFNarenNo ratings yet

- UT Dallas Syllabus For Fin6320.521 06u Taught by Mark Frost (Mfrost)Document6 pagesUT Dallas Syllabus For Fin6320.521 06u Taught by Mark Frost (Mfrost)UT Dallas Provost's Technology GroupNo ratings yet

- Investment Analysis and Portfolio Management: Pre-Requisite: None Course ObjectivesDocument3 pagesInvestment Analysis and Portfolio Management: Pre-Requisite: None Course ObjectivesAmit SrivastavaNo ratings yet

- Syllabus - IPPMDocument3 pagesSyllabus - IPPMSarose ThapaNo ratings yet

- Security Analysis and Portfolio Management: School of CommerceDocument74 pagesSecurity Analysis and Portfolio Management: School of CommerceashishNo ratings yet

- 01-Econ Common TermsDocument4 pages01-Econ Common TermsJB NavarroNo ratings yet

- Security Analysis (Begg) FA2016Document8 pagesSecurity Analysis (Begg) FA2016darwin12No ratings yet

- Fem PPDocument2 pagesFem PPvikashkumarytNo ratings yet

- Crude Oil Trading and Risk Management A4 Programme - 2022Document2 pagesCrude Oil Trading and Risk Management A4 Programme - 2022Abdurahman JumaNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Accounting and Finance NotesDocument2 pagesAccounting and Finance NotesMuzamil MehmoodNo ratings yet

- Management Management Management ManagementDocument94 pagesManagement Management Management Managementalizah khadarooNo ratings yet

- Security Analysis and Portfolio Management: School of CommerceDocument74 pagesSecurity Analysis and Portfolio Management: School of CommerceashishNo ratings yet

- CISI Capital Markets Programme: DerivativesDocument9 pagesCISI Capital Markets Programme: DerivativesShilpi JainNo ratings yet

- Level 2 CisiDocument20 pagesLevel 2 CisiSukruth GupthaNo ratings yet

- Effective Client Management and Treasury SolutionsDocument6 pagesEffective Client Management and Treasury Solutionsssj7cjqq2dNo ratings yet

- Introduction To The Foreign Exchange & Money MarketsDocument3 pagesIntroduction To The Foreign Exchange & Money Marketsssj7cjqq2dNo ratings yet

- Academic Year 2021/22 Term 1 OPIM201 Operations Management: The Lee Kong Chian School of BusinessDocument4 pagesAcademic Year 2021/22 Term 1 OPIM201 Operations Management: The Lee Kong Chian School of BusinessKaryl HongNo ratings yet

- Curriculum Overview: Level I TextsDocument2 pagesCurriculum Overview: Level I TextsAkshat JainNo ratings yet

- Investment ManagementDocument28 pagesInvestment ManagementseemaagiwalNo ratings yet

- BBF316 - 03 Financial DerivativesDocument2 pagesBBF316 - 03 Financial DerivativesldlNo ratings yet

- M&A at Columbia Business School: Program CurriculumDocument6 pagesM&A at Columbia Business School: Program Curriculumveda20No ratings yet

- PAM Outlines 07012021 042154pmDocument7 pagesPAM Outlines 07012021 042154pmzainabNo ratings yet

- IMM105 v2-0 Course Outline 2020-0625 PDFDocument4 pagesIMM105 v2-0 Course Outline 2020-0625 PDFAmzion0% (1)

- Course Code: Course Title: Intermediate Accounting 1 Course Credit: 6 Units Prerequisite (S) /Co-Requisite (S) Course DescriptionDocument5 pagesCourse Code: Course Title: Intermediate Accounting 1 Course Credit: 6 Units Prerequisite (S) /Co-Requisite (S) Course DescriptionTachie SuaveNo ratings yet

- Investment in BondsDocument25 pagesInvestment in BondsnjagimahnNo ratings yet

- Global EnvironmentDocument13 pagesGlobal EnvironmentnjagimahnNo ratings yet

- Investment in StocksDocument22 pagesInvestment in StocksnjagimahnNo ratings yet

- Investment Analysis and Portfoilo ManagementDocument36 pagesInvestment Analysis and Portfoilo ManagementnjagimahnNo ratings yet

- Food Safety StandardsDocument39 pagesFood Safety StandardsnjagimahnNo ratings yet

- HR Management May 2021Document34 pagesHR Management May 2021njagimahnNo ratings yet

- Digital Marketing TrainingDocument38 pagesDigital Marketing TrainingnjagimahnNo ratings yet

- Access To Markets For Agribiz - FinalDocument32 pagesAccess To Markets For Agribiz - FinalnjagimahnNo ratings yet

- SIQ3004 Mathematics of Financial Derivatives: Chapter 7: The Black-Scholes FormulaDocument38 pagesSIQ3004 Mathematics of Financial Derivatives: Chapter 7: The Black-Scholes FormulaFion TayNo ratings yet

- ENISADocument41 pagesENISAioqseNo ratings yet

- Mergers & Acquisitions and Corporate ValuationDocument2 pagesMergers & Acquisitions and Corporate ValuationDreamtech Press0% (1)

- Take Home Exercise No.4: Part ADocument6 pagesTake Home Exercise No.4: Part AHa Chau LeNo ratings yet

- Art InsuranceDocument62 pagesArt InsuranceAnkita DalviNo ratings yet

- Merchant Banking Financial Services Two Marks Question BankDocument21 pagesMerchant Banking Financial Services Two Marks Question BankGanesh Pandian50% (2)

- Mishkin - Chapter 7 - MarkupDocument39 pagesMishkin - Chapter 7 - MarkupJeet JainNo ratings yet

- II Sem Imp Questions All SubjectsDocument17 pagesII Sem Imp Questions All SubjectssaketramaNo ratings yet

- MBA Business Analytics IBMDocument117 pagesMBA Business Analytics IBMVivek Sharma100% (1)

- The Difference Between Financial and Managerial AccountingDocument1 pageThe Difference Between Financial and Managerial AccountingJonna LynneNo ratings yet

- Codigo Configuracion Tradingview v2Document3 pagesCodigo Configuracion Tradingview v2JulianMoraaNo ratings yet

- Corporate Finance 10th Edition Ross Test Bank DownloadDocument47 pagesCorporate Finance 10th Edition Ross Test Bank DownloadJames Netzer100% (22)

- Warren Buffet Value Investing Strategy Toolkit - OverviewDocument37 pagesWarren Buffet Value Investing Strategy Toolkit - OverviewMaria AngelNo ratings yet

- Credit Scoring Alternative Finance MethodsDocument40 pagesCredit Scoring Alternative Finance MethodsBelén NavarroNo ratings yet

- Ch.13 Accounting StandardsDocument33 pagesCh.13 Accounting StandardsMalayaranjan PanigrahiNo ratings yet

- Ac2101 Seminar 1Document3 pagesAc2101 Seminar 1Cheryl ShongNo ratings yet

- ACCT 377 - Valuation For Financial Statement Purposes PDFDocument18 pagesACCT 377 - Valuation For Financial Statement Purposes PDFAlex ChanNo ratings yet

- PitchBook GuideDocument28 pagesPitchBook GuidePei ZiyanNo ratings yet

- Kisoro District Five Year Dev - Plan 2016Document319 pagesKisoro District Five Year Dev - Plan 2016Alex NkurunzizaNo ratings yet

- Thomas Blaisdell CVDocument3 pagesThomas Blaisdell CVtjNo ratings yet

- Fortress Investment GroupDocument8 pagesFortress Investment GroupAishwarya Ratna PandeyNo ratings yet

- Best Practices 1-25Document23 pagesBest Practices 1-25Khai Dinh Tran50% (2)

- EVCA Reporting GuidelinesDocument39 pagesEVCA Reporting GuidelinesZaphod BeeblebroxNo ratings yet

- Government Bonds Bond - IN0020190362 Bond - IN0020170026Document4 pagesGovernment Bonds Bond - IN0020190362 Bond - IN0020170026Arif AhmedNo ratings yet

- VP Institutional Asset Management in Washington DC Resume Lisa DrazinDocument3 pagesVP Institutional Asset Management in Washington DC Resume Lisa DrazinLisaDrazinNo ratings yet

- Oracle Financial Services Liquidity Risk Management Release 2.0 User GuideDocument133 pagesOracle Financial Services Liquidity Risk Management Release 2.0 User GuideAhmed_srour84No ratings yet

- Nov 2018 RTP PDFDocument21 pagesNov 2018 RTP PDFManasa SureshNo ratings yet

- Dept. A Dept.BDocument14 pagesDept. A Dept.BB. Srini VasanNo ratings yet

- 50CDocument65 pages50Cvvikram7566No ratings yet