Professional Documents

Culture Documents

Mutual Funds

Mutual Funds

Uploaded by

Vdo SiaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Funds

Mutual Funds

Uploaded by

Vdo SiaCopyright:

Available Formats

Market Overview

As a result of COVID-19-induced lockdowns, the mutual fund industry's SIP collections fell

by 4% to INR 96,000 crore in FY 2020-2021. This resulted in income uncertainty. Many

investors chose to halt their SIPs as a result of the pandemic. From a peak of Rs 8,641 crore,

the contribution fell for 11 months in a row before breaking through to new highs.

The average assets under management (AAUM) of the Indian Mutual Fund Industry for

February 2022 stood at INR 38,56,140 crore. The industry’s AUM had crossed the milestone

of INR 10 trillion (INR 10 lakh crore) for the first time in May 2014. In around three years,

the AUM increased more than twofold, and in August 2017, it crossed INR 20 trillion (INR

20 lakh crore) for the first time. The AUM size crossed INR 30 trillion (INR 30 lakh crore)

for the first time in November 2020. The industry's AUM was INR 37.56 trillion (INR 37.56

lakh crore) as of February 28, 2022.

The rising digital penetration, smart cities, and increased data speeds also facilitate the drift

of asset shares toward smaller cities and towns. The increased retail contribution through

SIPs shows the level of digital penetration in India.

The total number of accounts (or folios, as per mutual fund parlance) as of February 28,

2022, was 12.61 crore (126.1 million units).

The strong performance of the equity markets and net inflows to equity schemes led to an

increase in the asset size of the mutual fund (MF) industry. For the quarter ended December

31, 2021, the average assets under management (AAUM) of the industry were worth INR

36.17 trillion, registering a growth of nearly 30% over a year.

The value of the assets held by individual investors in mutual funds increased from INR

17.18 lakh crore in February 2021 to INR 21.02 lakh crore in February 2022, an increase of

22.32%. The value of institutional assets increased from INR 15.11 lakh crore in February

2021 to INR 17.54 lakh crore in February 2022, recording an increase of 16.08%.

Owing to the large number of new first-time investors entering the market and the simplicity

of registering SIPs through online fintech portals, the number of SIPs and monthly collections

has increased. However, the average ticket value per SIP has decreased. In December 2021,

the average SIP ticket size fell to INR 2,303 per SIP, down from INR 3,313 in December

2017. Monthly SIP receipts, on the other hand, increased by 77% to INR 11,005 crore in

December 2021, compared to INR 6222 crore in December 2017.

• 1963: Establishment of the Unit Trust of India by the government

• 1964: Launch of the first scheme of UTI-Unit Scheme

• 1987: Entry of public sector fund house. SBI Mutual Fund was the first PSU fund house.

• 1993: Emergence of the private sector fund house. Franklin Templeton (erstwhile Kothari Pioneer)

was the first private sector fund house.

1993-2003: The decade saw many developments. While SEBI took over the regulation of mutual

funds, the industry witnessed several mergers and acquisitions and the establishment of foreign

funds.

• 2009: Removal of entry load

• 2012: A part of the Total Expense Ratio (TER) to be used for investor education. Rajiv Gandhi

Equity Savings Scheme (RGESS) was launched.

• 2013: Securities Transaction Tax (STT) for equity funds was reduced. A direct plan for the mutual

fund schemes was launched.

• 2014: The definition of long-term was changed to 36 months from 12 months for a debt mutual

fund. Section 80C limit exemption was increased to Rs 1.5 lakhs.

2017: Tax benefits of RGESS were discontinued. SEBI recategorized the mutual funds which need to

be implemented by the fund houses.

You might also like

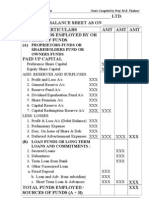

- Vertical Balance SheetDocument6 pagesVertical Balance Sheethaseeb_tankiwalaNo ratings yet

- Your Results For - Multiple Choice QuestionsDocument5 pagesYour Results For - Multiple Choice QuestionsPriyadarshini MahakudNo ratings yet

- Chapter 7 - 12thEDITIONDocument22 pagesChapter 7 - 12thEDITIONHyewon50% (2)

- 07 X07 A Responsibility Accounting and TP Decentralization and Performance EvaluationDocument11 pages07 X07 A Responsibility Accounting and TP Decentralization and Performance EvaluationNora Pasa100% (1)

- SEBI Bulletin - March 2022Document50 pagesSEBI Bulletin - March 2022Kotti XeroxNo ratings yet

- Finance IndustryDocument4 pagesFinance IndustrySmike ToretoNo ratings yet

- Services IndustryDocument13 pagesServices IndustryAbhishek pathangeNo ratings yet

- Article 2b - 2021-22 - FDI in IndiaDocument4 pagesArticle 2b - 2021-22 - FDI in IndiaKiniNo ratings yet

- Financial Service Sector Indian Financial SystemDocument6 pagesFinancial Service Sector Indian Financial SystemMurali Krishna ReddyNo ratings yet

- Reprot On HdiuscsDocument1 pageReprot On HdiuscsVIKASNo ratings yet

- Monthly Digest August 2023 Eng 111695986511507Document31 pagesMonthly Digest August 2023 Eng 111695986511507DruvaNo ratings yet

- Monthly Current Affairs 2023 For August 72Document31 pagesMonthly Current Affairs 2023 For August 72vivekkushwah100No ratings yet

- KSEI Will Fintech Investment Funds Continue To Soar After A 41%Document2 pagesKSEI Will Fintech Investment Funds Continue To Soar After A 41%risaNo ratings yet

- Sector OverviewDocument7 pagesSector OverviewMehak JainNo ratings yet

- Financial ManagementDocument14 pagesFinancial ManagementAnkit SarkarNo ratings yet

- Icici Securities RudraDocument7 pagesIcici Securities RudraSachinShingoteNo ratings yet

- Reorirudch DHDocument3 pagesReorirudch DHVIKASNo ratings yet

- Monthly Digest April 2022 Eng 52Document35 pagesMonthly Digest April 2022 Eng 52KunalShokeenNo ratings yet

- 28th MarchDocument18 pages28th Marchgauravjayantd9458557No ratings yet

- Services Sector India 2020Document2 pagesServices Sector India 2020Amol GodgeNo ratings yet

- Financial Services in India: Sector AnalysisDocument10 pagesFinancial Services in India: Sector AnalysisVIJETA JOGUNo ratings yet

- UntitledDocument37 pagesUntitledAyub ArshadNo ratings yet

- FDI in India Foreign Direct Investment Opportunities PolicyDocument6 pagesFDI in India Foreign Direct Investment Opportunities PolicyMurali Krishna ReddyNo ratings yet

- ROPEMDONNDocument2 pagesROPEMDONNVIKASNo ratings yet

- Financial Services - Sector ReportDocument13 pagesFinancial Services - Sector ReportRajendra BhoirNo ratings yet

- Monthly Current Affairs 2023 For July 26Document30 pagesMonthly Current Affairs 2023 For July 26vivekkushwah100No ratings yet

- Monthly - Digest - December - 2022 ByjusDocument38 pagesMonthly - Digest - December - 2022 ByjusGayathri SukumaranNo ratings yet

- 4 (K) A Studuy On Investors PreferenceDocument16 pages4 (K) A Studuy On Investors PreferenceKanika MaheshwariNo ratings yet

- Assignment On Money and CreditDocument6 pagesAssignment On Money and Creditmaha 709No ratings yet

- Industry ProfileDocument6 pagesIndustry ProfileShams SNo ratings yet

- Bba Monthly Digest April 2022 Eng 44Document34 pagesBba Monthly Digest April 2022 Eng 44AbcNo ratings yet

- Nderstanding Fixed Income Markets IN THE Ndian Context: S. No. Bond/ Security Type Amount (In CR) PercentageDocument5 pagesNderstanding Fixed Income Markets IN THE Ndian Context: S. No. Bond/ Security Type Amount (In CR) PercentageWasp_007_007No ratings yet

- Economic AnalysisDocument19 pagesEconomic AnalysisSaikumar BommaNo ratings yet

- Domestic Investment in IndiaDocument9 pagesDomestic Investment in IndiaMurali Krishna ReddyNo ratings yet

- BANKINGDocument9 pagesBANKINGJoshua heavenNo ratings yet

- Group Assignment Programme: Mba Batch: 2020-2022 Term - IV Bank ManagementDocument28 pagesGroup Assignment Programme: Mba Batch: 2020-2022 Term - IV Bank ManagementComplete AramNo ratings yet

- Monthly Digest February 2023 Eng 44Document34 pagesMonthly Digest February 2023 Eng 44divvyaapNo ratings yet

- Summer Internship Report, Vivek LedwaniDocument61 pagesSummer Internship Report, Vivek LedwaniRishabh PanwarNo ratings yet

- ReportDocument55 pagesReportSwathi JNo ratings yet

- Beepedia Weekly Current Affairs (Beepedia) 1st - 8th August 2023Document44 pagesBeepedia Weekly Current Affairs (Beepedia) 1st - 8th August 2023Mansi SaxenaNo ratings yet

- Icici Securities RudraDocument17 pagesIcici Securities RudraSachinShingoteNo ratings yet

- ECONOMIC ANALYSIS Overview of Indian and Global Economic ScenariosDocument8 pagesECONOMIC ANALYSIS Overview of Indian and Global Economic Scenariossantosh panditNo ratings yet

- Lets Revisit OMDocument10 pagesLets Revisit OMNihar AkunuriNo ratings yet

- Indian Real Estate Market Report 2020Document2 pagesIndian Real Estate Market Report 2020LoganadhanNo ratings yet

- Indian Investments ReportsDocument4 pagesIndian Investments ReportsPuneet GeraNo ratings yet

- 29.11.22 - Morning Financial News UpdatesDocument5 pages29.11.22 - Morning Financial News UpdatesraviNo ratings yet

- Government Initiatives To Encourage Development in Real Estate SectorDocument2 pagesGovernment Initiatives To Encourage Development in Real Estate SectorRupak JanaNo ratings yet

- B.B.A., L.L.B. (Hons.) / Third Semester-2021Document17 pagesB.B.A., L.L.B. (Hons.) / Third Semester-2021Anoushka SudNo ratings yet

- BeedepiaDocument24 pagesBeedepiafolinesNo ratings yet

- Monthly Digest February 2023 Eng 19Document35 pagesMonthly Digest February 2023 Eng 19Ayub ArshadNo ratings yet

- Case Study - Status of Indian Financial Service SectorDocument2 pagesCase Study - Status of Indian Financial Service SectorShashwat AnandNo ratings yet

- Bain Digest India Venture Capital Report 2023Document45 pagesBain Digest India Venture Capital Report 2023HarishNo ratings yet

- Fin An Ce Mi No R PR OjDocument13 pagesFin An Ce Mi No R PR OjVignesh SuryadevaraNo ratings yet

- Module V Recent Trends & DevelopmentsDocument18 pagesModule V Recent Trends & DevelopmentsItisha SinghNo ratings yet

- English বাং লা हिहंदी मराठी Follow UsDocument13 pagesEnglish বাং লা हिहंदी मराठी Follow UsMohammad Khurram QureshiNo ratings yet

- Sapm Project ReportDocument25 pagesSapm Project ReportAdarshNo ratings yet

- Last Updated: July 2013 Financial Services in India-Brief OverviewDocument2 pagesLast Updated: July 2013 Financial Services in India-Brief OverviewPrasanna RathNo ratings yet

- 6 Banking and Financial ServicesDocument5 pages6 Banking and Financial ServicesSatish MehtaNo ratings yet

- A Study On Cash Management Anaiysis in Sri Angalamman Finance LTDDocument77 pagesA Study On Cash Management Anaiysis in Sri Angalamman Finance LTDJayaprabhu PrabhuNo ratings yet

- Mini ProjectDocument5 pagesMini ProjectUd HaCksNo ratings yet

- Financial Services 1 To 30Document50 pagesFinancial Services 1 To 30Urvesh GuravNo ratings yet

- Indian Financial SystemDocument10 pagesIndian Financial SystemsaiyuvatechNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Equity Based CompensationDocument20 pagesEquity Based Compensationhimanshi100% (1)

- Financial Statements Analysis - Ratio AnalysisDocument44 pagesFinancial Statements Analysis - Ratio AnalysisDipanjan SenguptaNo ratings yet

- High-Flying Fund May Bar EntryDocument8 pagesHigh-Flying Fund May Bar EntryamvonaNo ratings yet

- Beaverfinancial DistressDocument26 pagesBeaverfinancial Distressmelinda fahrianiNo ratings yet

- 01 Icai Case Study QuestionDocument16 pages01 Icai Case Study QuestionFAMLITNo ratings yet

- Ifs Tybms Sem Vi Mcqs FinalDocument12 pagesIfs Tybms Sem Vi Mcqs FinalSudhakar Guntuka0% (1)

- Bla18632 ch01Document46 pagesBla18632 ch01Ehsan Ur RehmanNo ratings yet

- Risk Management of Banking Sector: A Critique Review: Wael Moustafa Hassan Mohamed, PHD, MbaDocument10 pagesRisk Management of Banking Sector: A Critique Review: Wael Moustafa Hassan Mohamed, PHD, Mbashumon2657No ratings yet

- Chapter 8 OptionsDocument31 pagesChapter 8 OptionsAthi LuciferNo ratings yet

- FAQs - Additional Surveillance Measure (ASM) - 1Document17 pagesFAQs - Additional Surveillance Measure (ASM) - 1renjithrithvikNo ratings yet

- MSC Global Finance January 2019 IntakeDocument71 pagesMSC Global Finance January 2019 IntakeRobert TruongNo ratings yet

- Bus Com 13Document4 pagesBus Com 13Chabelita MijaresNo ratings yet

- Chapter 1 Introduction Pricing As An Element of The Marketing MixDocument6 pagesChapter 1 Introduction Pricing As An Element of The Marketing MixYonneNo ratings yet

- CH 01Document33 pagesCH 01Salman IshaqNo ratings yet

- Project Synopsis On Mutual Fund - Mahesh RahejaDocument16 pagesProject Synopsis On Mutual Fund - Mahesh RahejaRajiv KumarNo ratings yet

- Final Account GA2Document14 pagesFinal Account GA2Ashwin KushwahNo ratings yet

- Cento Ventures SE Asia Tech Investment FY2020Document30 pagesCento Ventures SE Asia Tech Investment FY2020Ngọc NguyễnNo ratings yet

- On Ethio-UAEDocument20 pagesOn Ethio-UAENuraNo ratings yet

- Engineering Economics CompletedDocument14 pagesEngineering Economics CompletedFa Ti MahNo ratings yet

- 2022 04 16 Ifr AsiaDocument42 pages2022 04 16 Ifr AsiajanuszNo ratings yet

- Financial EnvironmentDocument20 pagesFinancial EnvironmentZahidul Islam SoykotNo ratings yet

- Swam Pneumatics Private Limited RRDocument8 pagesSwam Pneumatics Private Limited RRR VenkateshNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- The Marketing Mix The 7Ps of MarketingDocument13 pagesThe Marketing Mix The 7Ps of MarketingGulmatico Adrian Jos L.No ratings yet

- International Parity Conditions: Multinational Business Finance (2 Edition)Document61 pagesInternational Parity Conditions: Multinational Business Finance (2 Edition)Cong Chinh NguyenNo ratings yet

- Case: AUTOZONE, INC.Document17 pagesCase: AUTOZONE, INC.rzannat94100% (2)