Professional Documents

Culture Documents

Acc 113day 23sasdocx PDF Free

Uploaded by

Mariefel OrdanezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 113day 23sasdocx PDF Free

Uploaded by

Mariefel OrdanezCopyright:

Available Formats

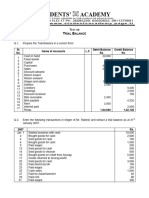

PHINMA Education StudentActivitySheet

Lesson Title: Financial Statements Materials:

Presentation and Accounting for SME Columnar notebook; calculator; textbook

Learning Targets: References:

At the end of the learning session, Millan, Zeus Vernon B.; Accounting for Business

Combinations; 2019 Edition; pp. 1-23

1. I can prepare accounting working papers to accumulate , classify, and arrange

data, including the preparation of Dayag, Antonio J.; Advanced Financial

financial reports and statements.. Accounting and Reporting, 2016 Edition

2. Account business combination and goodwill computation under PFRS for SMEs

Reading of Concept Notes:

The following items should be noted in the worksheet which will lead us to distinguish figures from”

1. Parent’s Separate (Internal) Financial Statements - the financial statements of parent before adjustments and

working paper elimination entries. It is here wherein the cost (initial value) method or equity method are applied.

2. Group/Consolidated Financial Statements - summation of the financial statements of the group members and the

consolidated adjustments. It is wherein adjustments and eliminating entries are reflected.

3. Parent’s (Interest/Equity Interest/Controlling Interest) Financial Statements - the parent figures are then

determined by subtracting the Non-controlling interest from the total consolidated equity (group/consolidated

financial statements)

Relevant provision of the PFRS for SMEs

Section 9 Consolidated and Separate Financial Statements

A parent is required to prepare consolidated financial statements except if:

I. The parent is itself a subsidiary and its ultimate or intermediate parent produces consolidated financial

statements that comply with full PFRSs or the PFRS for SMEs.

II. The subsidiary is acquired with the intention of selling it within one year from the acquisition date.

If the subsidiary is not sold within one year, it must be consolidated by restating all prior period financial

statement, except when the failure to sell is beyond the parent’s control and the parent remains committed to

sell the subsidiary.

Separate Financial Statements

The PFRS for SMEs required a parent to present consolidated financial statements but does not require a parent to

present separate financial statements.

Separate financial statements are a second set of financial statements presented by an entity in addition to any of the

following:

1. Consolidated financial statements prepared by a parent,

2. Financial statements prepared by a parent exempted from preparing consolidated financial statements, or

3. Financial statements prepared by an entity that is not a parent but is an investor in an associate or has a venturer’s

interest in a joint venture.

ACC 113 - Accounting for Business Combination 1

SAS Day 23

PHINMA Education StudentActivitySheet

The PFRS for SMEs does not require combined financial statements to be prepared.

Areas covered in full PFRS but not in PFRS for SMEs include:

1. Subsequent adjustments to assets and liabilities (re-measurement period).

2. Deferred tax recognized after initial purchase accounting.

3. Non-controlling interests.

4. Step acquisitions.

5. A business combination achieved without the transfer of consideration.

6. Indemnification assets.

7. Shared-based payments.

8. Employee benefits.

Guided Practice 1:

Activity 23-1. (30 min.)

Problem: The financial statements for Goody and Carry Company for the year ended December 31, 2019, prior

to Goody’s business combination transaction regarding Carry, follow:

Goody Carry

Revenues P 2,700,000 P 600,000

Expenses

Net Income P P

Retained earnings, Jan. 1 P 2,400,000 P 400,000

Net income 720,000 200,000

Dividends ( 270,000) ( 0)

Retained earnings, Dec. 31 P 2,850,000 P 600,000

Cash P 240,000 P 220,000

Receivables and inventory 1,200,000 340,000

Building (net) 2,700,000 600,000

Equipment (net)

Total assets P P

Liabilities P 1,500,000 P 820,000

Common stock 1,080,000 400,000

Additional paid-in capital 810,000 540,000

ACC 113 - Accounting for Business Combination 2

SAS Day 23

PHINMA Education StudentActivitySheet

Retained earnings

Total liabilities and stockholders’ equity P P

On December 31, 2019, Goody issued P600,000 in debt 30,000 shares of its P10par value common stock to the owners

of Carry to purchase all of the outstanding shares of that company. Goody shares had a fair value of P40 per share.

Goody paid P25,000 to a broker for arranging the transaction. Goody paid P35,000 in stock issuance costs. Carry’s

equipment was actually worth 1,400,000 but its building were only at P560,000.

Requirements: Compute the following

1. Amount of the investment recorded on Goody’s book?

2. Consolidated revenues for 2019.

3. Compute the consolidated expenses for 2019.

4. Consolidated cash account at December 31, 2019.

5. Consolidated buildings (net) account at December 31, 2019.

6. Consolidated goodwill account for December 31, 2019

7. Consolidated common stock account at December 31, 2019 8. Consolidated additional paid-in capital at December

31, 2019

9. Consolidated retained earnings at December 31, 2019.

Answers to Activity 23-1:

1.

Fair value of consideration transferred:

Debt P 600,000

Shares: 30,000 x P40, fair value 1,200,000

P1,800,000

2. Consolidated revenue: P2,700,000.

On the date of acquisition only the parent’s reported revenue and expenses should be reported in the

consolidated statement. The revenue and expenses of the subsidiary are already closed to retained earnings account

on the acquisition date. 3.

Parent’s expenses P1,980,000

Add: Acquisition-related costs (direct costs -costs of arranging) 25,000

Consolidated expenses on the date of acquisition P2,005,000

4 Consolidated Balance Sheet, Date of Acquisition (12/31/19)

Goody’s (parent) cash P 240,000

Carry’s (subsidiary) cash 220,000

Total cash before acquisition P 460,000

Less: Payment to a broker 25,000

Stock issuance cost 35,000

Consolidated cash P 400,000

5, Consolidated Balance Sheet, Date of Acquisition (12/31/19):

Goody’s (parent) building P2,700,000

ACC 113 - Accounting for Business Combination 3

SAS Day 23

PHINMA Education StudentActivitySheet

Carry;s (subsidiary) building 600,000

Total building before consolidation P3,300,000

Add (Deduct): Adjustments to reflect fair value - Building of subsidiary ( 40,000)

Consolidated building (net P3,260,000

6. Fair value of consideration transferred:

Debt P 600,000

Shares: 30,000 x P40, fair value 1,200,000

Fair value of subsidiary P1,800,000

Less: Book value of net assets (stockholders’ equity-

Subsidiary): [(P400,000 + P540,000 + P600,000) x 100%] 1,540,000

Allocated excess P 260,000

Less: Over/undervaluation of Assets and Liabilities: Increase

in equipment (P1,400,000 - P1,200,000) P200,000

Decrease in building (P600,000 - P560,000) 160,000

40,000

Goodwil P 100,000

7. Consolidated Common Stock:

Acquirer (Parent - Goody) P1,080,000

Add: Newly issued shares (30,000 shares x P10) 300,000

Acquiree (Subsidiary-Carry), eliminated in preparing the CBS 0

P1,380,000

8. Consolidated Additional Paid-in Capital:

Acquirer (Parent - Goody) P 810,000

Add: newly issued shares (30,000 shares x (P40 - P10) 900,000

Less: Stock issuance costs ( 35,000)

Acquiree (subsidiary- Carry), eliminated in preparing CBS 0

P1,675,000

9. Consolidated Retained Earnings:

Acquirer (Parent - Goody): (P700,000 + P980,000) P2,850,000

Less: Acquisition-related costs ( 35,000)

Acquiree (Subsidiary - Carry), eliminated in preparing the CBS 0

P2,825,000

Independent Practice 1

ACC 113 - Accounting for Business Combination 4

SAS Day 23

PHINMA Education StudentActivitySheet

Activity 23-2 (40 min.)

Problem. On January 1, 2020, P Corporation and S Corporation and their condensed balance sheet are as follows:

P Corporation S Corporation

Current Assets P 70,000 P 20,000

Non-Current Assets 90,000 40,000

Total Assets P 160,000 P 60,000

Current Liabilities P 30,000 P 10,000

Long-term Debt 50,000 0

Stockholders’ Equity 80,000 50,000

Total Liabilities and Equities P 160,000 P 60,000

On January 2, 2020, P Corporation borrowed P60,000 and used the proceeds to obtain 80% of the outstanding

common shares of S Corporation. The acquisition price was considered proportionate to S’s fair value. The P60,000

debt is payable in 10 equal annual principal payments plus interest, beginning December 21, 2020. The excess fair

value of the investment over the underlying book value of the acquired net assets is allocated to inventory (60%) and

to goodwill (40%).

Requirements: Compute the following consolidated balance accounts as of January 2, 2020:

1. Goodwill using proportionate basis (partial) 2.

Goodwill using full fair value (full/gross-up) basis.

3. Current assets

4. Non-current assets using proportionate basis (partial) in computing goodwill.

5. Non-current assets using full fair value (full/gross-up) in computing goodwill.

6. Current liabilities

7. Non-current liabilities

8. Stockholders’ equity using proportionate (partial goodwill) basis to determine non-controlling interest.

9. Stockholders’ equity using full value (full/gross-up) basis to determine non-controlling interest.

Note: Use your columnar notebook to answer activity 23-2

Independent Practice 2

Activity 23-3 (40 min.)

On January , 2020, P Company acquired 90% of S Company in exchange for 5,400 shares of P10 par common stock

having a market value of P120,600. P and S condensed balance sheet where as follows:

P Company S Company

ASSETS:

Cash P 30,900 P 37,400

Accounts receivable (net0 34,200 9,100

Inventories 22,900 16,100

Equipment 9net) 179,000 40,000

Patents ---- 10,000

ACC 113 - Accounting for Business Combination 5

SAS Day 23

PHINMA Education StudentActivitySheet

Total Assets P267,000 P112,600

LIABILITIES AND STOCKHOLDERS’ EQUITY

Accounts payable P 4,000 P 6,600

Bonds payable, 10% 100,000 ---

Common stock, P10 par 100,000 50,000

Additional paid-in capital 15,000 15,000

Retained earnings 48,000 41,000

Total liabilities and stockholders’ equity P267,000 P112,600

At the date of acquisition, all assets and liabilities of S Company have book value approximately equal to their

respective market values except the following as determined by appraisal as follows:

Inventories (FIFO method) P 17,100

Equipment (net - remaining life - 4 years) 48,000

Patents (remaining life 10 years) 13,000

Goodwill (no impairment)

Requirements: Compute the following:

1. Partial goodwill on Jan. 1, 2020

2. Non-controlling interest (in net assets) on Jan. 1, 2020

3. Consolidated Retained Earnings, Jan. 1, 2020

4. Equity Holders of Parent - Retained Earnings, Jan. 1, 2020

5. In addition to the information, assuming that on Dec. 31, 2020, the following results were given:

Dividends Paid Net Income

P Company P 15,000 P 30,200

S Company 4,000 9,400

Using cost method to record results of operations, compute the Investment balance on Dec. 31, 2020

6. Dividend income for 2020 using cost method.

7. Non-controlling interest in Net Income on Dec. 31, 2020.

8. Non-controlling interest on Dec. 31, 2020.

9. Profit for the period attributable to Equity Holders of Parent on Dec. 31, 2020.

10. Consolidated/Group Net Income on Dec. 31, 2020.

11. Consolidated Retained Earnings, Dec. 31, 2020.

12. Consolidated Total Equity (Stockholders’ Equity) on Dec. 31, 2020.

Note: Use your columnar notebook to answer activity 23-3.

ACC 113 - Accounting for Business Combination 6

SAS Day 23

You might also like

- IR 2 - Mod 6 Bus Combi FinalDocument4 pagesIR 2 - Mod 6 Bus Combi FinalLight Desire0% (1)

- ACCA FR Question Pack on Financial ReportingDocument52 pagesACCA FR Question Pack on Financial ReportingVasileios Lymperopoulos100% (1)

- IA 3 Final Assessment PDFDocument5 pagesIA 3 Final Assessment PDFJoy Miraflor Alinood100% (1)

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- SBLC - Swift Verbiage - Approved Master BlankDocument3 pagesSBLC - Swift Verbiage - Approved Master BlankNasser Cristovao100% (1)

- Final Double Pledge ReportDocument165 pagesFinal Double Pledge ReportDinSFLA100% (13)

- BADVAC1X - MOD 2 Conso FS Date of AcqDocument6 pagesBADVAC1X - MOD 2 Conso FS Date of AcqJopnerth Carl CortezNo ratings yet

- Joint Venture Accounting EntriesDocument8 pagesJoint Venture Accounting EntriesMonica DespiNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- Advanced Financial Accounting and ReportingDocument7 pagesAdvanced Financial Accounting and ReportingMark Domingo MendozaNo ratings yet

- Module 9 and 10Document9 pagesModule 9 and 10French Jame RianoNo ratings yet

- Activity 1 PartnershipDocument4 pagesActivity 1 PartnershipJanet AnotdeNo ratings yet

- Joint ArrangementDocument3 pagesJoint ArrangementAlliah Mae AcostaNo ratings yet

- pdf-topic-no-2-statement-of-cash-flows-pdf_compressDocument3 pagespdf-topic-no-2-statement-of-cash-flows-pdf_compressMillicent AlmueteNo ratings yet

- Basic Accounting - With AnswersDocument12 pagesBasic Accounting - With AnswersMarie MeridaNo ratings yet

- Classroom Exerisises On Presentation of Financial Statements PDFDocument2 pagesClassroom Exerisises On Presentation of Financial Statements PDFalyssaNo ratings yet

- Auditing Problem Assignment Lyeca JoieDocument12 pagesAuditing Problem Assignment Lyeca JoieEsse ValdezNo ratings yet

- Quiz 1.1Document2 pagesQuiz 1.1Annalie Cono0% (1)

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- Intermediate Accounting 3 Handout 1 Total Current AssetsDocument5 pagesIntermediate Accounting 3 Handout 1 Total Current AssetsJane GavinoNo ratings yet

- Exercise 3-9 - Multiple Choice-Determine The Balances (Huang, Aaron)Document11 pagesExercise 3-9 - Multiple Choice-Determine The Balances (Huang, Aaron)Aaron HuangNo ratings yet

- Intermediate Accounting 3 - Statement of Cash Flows ProblemsDocument3 pagesIntermediate Accounting 3 - Statement of Cash Flows ProblemsSARAH ANDREA TORRESNo ratings yet

- Main 3 - Claveria, Jenny PDFDocument18 pagesMain 3 - Claveria, Jenny PDFSheena marie ClaveriaNo ratings yet

- p1 FsDocument2 pagesp1 FsLeika Gay Soriano OlarteNo ratings yet

- Chin Figura - Unit IV Learning ActivitiesDocument7 pagesChin Figura - Unit IV Learning ActivitiesChin FiguraNo ratings yet

- Budgeted Income Statement and Balance SheetDocument5 pagesBudgeted Income Statement and Balance SheetNeil De LeonNo ratings yet

- INVESTMENTS With AnswersDocument3 pagesINVESTMENTS With AnswersShaira BugayongNo ratings yet

- AFAR - CUP 2019 ANSWERSDocument9 pagesAFAR - CUP 2019 ANSWERSTakuriNo ratings yet

- Ia3 Midterm QuizDocument11 pagesIa3 Midterm QuizJalyn Jalando-onNo ratings yet

- Chapter 14Document13 pagesChapter 14VanessaFaithBiscaynoCalunodNo ratings yet

- Joint ArrangementsDocument3 pagesJoint ArrangementsCha EsguerraNo ratings yet

- AFAR 1 Exams 2020Document7 pagesAFAR 1 Exams 2020RJ Kristine DaqueNo ratings yet

- Module 2 Statement of Comprehensive IncomeDocument8 pagesModule 2 Statement of Comprehensive IncomeStella MarieNo ratings yet

- Accounting CycleDocument4 pagesAccounting CycleRommel Angelo AgacitaNo ratings yet

- Acc 110 Practice SetDocument42 pagesAcc 110 Practice SetAndrea Marie P. GarinNo ratings yet

- Robyn Company Financial AnalysisDocument2 pagesRobyn Company Financial AnalysisRandy ManzanoNo ratings yet

- Statement of Cash FlowsDocument12 pagesStatement of Cash Flowsnot funny didn't laughNo ratings yet

- Review MCQDocument2 pagesReview MCQKrista FloresNo ratings yet

- Statement of Financial PositionDocument3 pagesStatement of Financial PositionDJ NicartNo ratings yet

- Acc8fsconso Sdoa2019Document5 pagesAcc8fsconso Sdoa2019Sharmaine Clemencio0No ratings yet

- SEPARATE and CONSOLIDATED STATEMENTSDocument4 pagesSEPARATE and CONSOLIDATED STATEMENTSCha EsguerraNo ratings yet

- Practical Accounting 2.1Document10 pagesPractical Accounting 2.1Chris Aruh BorsalinaNo ratings yet

- Afar 2019Document9 pagesAfar 2019TakuriNo ratings yet

- Cbea FAR 01 Lecture 02Document16 pagesCbea FAR 01 Lecture 02Osirisheen Aizle CubacubNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- Financial Statement Analysis - Financial RatiosDocument2 pagesFinancial Statement Analysis - Financial Ratioshoneyjoy salapantanNo ratings yet

- Icag Nov 2020-Group Discuss...Document6 pagesIcag Nov 2020-Group Discuss...Papa Ekow ArmahNo ratings yet

- Jan David's Accounting Las 4Document9 pagesJan David's Accounting Las 4Cj ArquisolaNo ratings yet

- ULOb - Let's Analyze & in A NutshellDocument5 pagesULOb - Let's Analyze & in A Nutshellemem resuentoNo ratings yet

- Income & Dividends of S Co. Cost vs Equity MethodDocument2 pagesIncome & Dividends of S Co. Cost vs Equity MethodLeonardo MercaderNo ratings yet

- Statement of Financial Position (Balance Sheet) Test BankDocument4 pagesStatement of Financial Position (Balance Sheet) Test BankJhazz100% (1)

- Module 2 - Topic 3 (Notes Receivable)Document7 pagesModule 2 - Topic 3 (Notes Receivable)GRACE ANN BERGONIONo ratings yet

- ACCT2014 Final Exam 2021-2022 - K.Ashman v2Document9 pagesACCT2014 Final Exam 2021-2022 - K.Ashman v2Christina StephensonNo ratings yet

- CORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSDocument5 pagesCORPORATE LIQUIDATION AND JOINT VENTURE SETTLEMENTSjjjjjjjjjjjjjjjNo ratings yet

- First Departmental Examination in AccountingDocument3 pagesFirst Departmental Examination in AccountingJao FloresNo ratings yet

- Dapitan Corporation general ledger trial balance analysisDocument6 pagesDapitan Corporation general ledger trial balance analysisLyka Kristine Jane PacardoNo ratings yet

- W4 - SW1 - Statement of Financial PositionDocument2 pagesW4 - SW1 - Statement of Financial PositionJere Mae MarananNo ratings yet

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- Acco 30103 Partnership Formation and Operations 04-2022Document3 pagesAcco 30103 Partnership Formation and Operations 04-2022Zyrille Corrine GironNo ratings yet

- Calculate net income from financial statement changesDocument2 pagesCalculate net income from financial statement changesSean ThyrdeeNo ratings yet

- Specific Financial Reporting Questions & Answers: Suggested Solution 1Document37 pagesSpecific Financial Reporting Questions & Answers: Suggested Solution 1Tawanda Tatenda Herbert100% (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Final Exam 10 PDF FreeDocument12 pagesFinal Exam 10 PDF FreeMariefel OrdanezNo ratings yet

- Corporate Governance QuizDocument11 pagesCorporate Governance QuizMariefel OrdanezNo ratings yet

- Quiz 6 Fraud Irregularities and Internal ControlDocument2 pagesQuiz 6 Fraud Irregularities and Internal ControlMariefel OrdanezNo ratings yet

- Accounting for Special Transactions ExamDocument8 pagesAccounting for Special Transactions ExamMariefel OrdanezNo ratings yet

- AP AnswerKeyDocument14 pagesAP AnswerKeyShirliz Jane BenitezNo ratings yet

- ACC 112 Pre Final Quiz 2 PDFDocument7 pagesACC 112 Pre Final Quiz 2 PDFMariefel OrdanezNo ratings yet

- Auditing Theory Key Concepts ExplainedDocument12 pagesAuditing Theory Key Concepts ExplainedKevin Ryan EscobarNo ratings yet

- Foundations of Risk ManagementDocument173 pagesFoundations of Risk ManagementTrà Mi NguyễnNo ratings yet

- Bajaj Allianz General Insurance Company LTD.: Declaration by The InsuredDocument1 pageBajaj Allianz General Insurance Company LTD.: Declaration by The InsuredArtiNo ratings yet

- Short-Term Financing: After Studying This Chapter, You Will Be Able ToDocument13 pagesShort-Term Financing: After Studying This Chapter, You Will Be Able ToMohammad Salim HossainNo ratings yet

- 2nd Year Principles of Accounting Guess Paper 2023 Zahid NotesDocument5 pages2nd Year Principles of Accounting Guess Paper 2023 Zahid Notesashfaq4985No ratings yet

- Mergers Acquisitions and Other Restructuring Activities 7th Edition Depamphilis Test BankDocument19 pagesMergers Acquisitions and Other Restructuring Activities 7th Edition Depamphilis Test Banksinapateprear4k100% (34)

- Role of Banks in the Indian EconomyDocument71 pagesRole of Banks in the Indian EconomyPrashant EkalNo ratings yet

- CashDocument16 pagesCashJemson YandugNo ratings yet

- Problems in MAFADocument128 pagesProblems in MAFAHariNo ratings yet

- UCS539Document2 pagesUCS539mehra.harshal25No ratings yet

- Test On Trial BalanceDocument1 pageTest On Trial Balanceamitabhkumar1979No ratings yet

- N CY5 DAwg 4 GQSJ JQuDocument12 pagesN CY5 DAwg 4 GQSJ JQuVinod SharmaNo ratings yet

- Hala Arrabi Managerial Finance Assignment Chapter 3-Part 1 Multiple Choice QuestionsDocument3 pagesHala Arrabi Managerial Finance Assignment Chapter 3-Part 1 Multiple Choice QuestionsMohamad Haytham ElturkNo ratings yet

- Fin 460 REPORTDocument26 pagesFin 460 REPORTMd. Iftekhar RahmanNo ratings yet

- Philippine Infrastructure Financing PotentialDocument21 pagesPhilippine Infrastructure Financing PotentialJoshua ArmeaNo ratings yet

- Conceptual Framework and Financial ReportingDocument50 pagesConceptual Framework and Financial ReportingFirelight ZyNo ratings yet

- White Gold v. PioneerDocument2 pagesWhite Gold v. PioneerWV Gamiz Jr.No ratings yet

- Statistical Annex Tables on the International Banking MarketDocument115 pagesStatistical Annex Tables on the International Banking MarketAli HabibNo ratings yet

- PremiumChart CompleteHealthcareInsurance PDFDocument10 pagesPremiumChart CompleteHealthcareInsurance PDFgrr.homeNo ratings yet

- BSF 2112 - Financial Markets and Institutions - August 2022Document6 pagesBSF 2112 - Financial Markets and Institutions - August 2022SaeedNo ratings yet

- Change of BrokerDocument1 pageChange of BrokerFiniscope - Investment AdvisorsNo ratings yet

- Day1 Home Assignment Abhay SrivastavaDocument2 pagesDay1 Home Assignment Abhay SrivastavaAbhay SrivastavaNo ratings yet

- N28 TU2 Yljhuo PV 7 GDocument15 pagesN28 TU2 Yljhuo PV 7 GVishal BawaneNo ratings yet

- Proposal WMK (Terupdate)Document23 pagesProposal WMK (Terupdate)Sasha OktaviaNo ratings yet

- AMD Stock ValuationDocument2 pagesAMD Stock ValuationEar TanNo ratings yet

- INSTRUCTION: Please Answer All The Problems That Will Be Found in Your Textbook. Put Your Answers OnDocument6 pagesINSTRUCTION: Please Answer All The Problems That Will Be Found in Your Textbook. Put Your Answers OnMary Ann F. MendezNo ratings yet

- Sap Fi - Co Interview QuestionsDocument30 pagesSap Fi - Co Interview QuestionsTirupatirao Bashyam100% (1)

- CompendiumDocument18 pagesCompendiumpranithroyNo ratings yet

- Chapter 2 The Accounting CycleDocument63 pagesChapter 2 The Accounting CycleMULATNo ratings yet