Professional Documents

Culture Documents

Cae05 - Activity 6

Cae05 - Activity 6

Uploaded by

Damayan Xeroxan0 ratings0% found this document useful (0 votes)

7 views2 pagesaccounting chapter 6 solution

Original Title

CAE05 - ACTIVITY 6

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaccounting chapter 6 solution

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesCae05 - Activity 6

Cae05 - Activity 6

Uploaded by

Damayan Xeroxanaccounting chapter 6 solution

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

DIRECTIONS:

Show you solution on POST TEST in good form

Solution 1

Redemption Price (600 x 1,000 x 102%) 612,000

Less: Carrying amount on bonds:

Face Amount (600 x 1,000) 600,000

Unamortized Premium 65,000 665,000

Gain on Retirement ₱53,000

Solution 2

Payment for Liability:

Cash 50,000

Carrying Amount of investment securities 375,000 425,000

Carrying Amount of liability settled:

Principal 500,000

Accrued Interest 75,000

575,000

Gain on Settlement 150,000

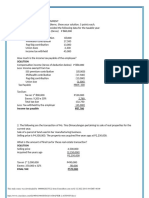

Solution 3

185,000 carrying amount of note – 85,000 carrying amount of land = ₱100,000 gain

Solution 4

28,000 – 25,000 = 3,000

Solution 5

The modification is analyzed as follows:

Terms Old New Terms

Principal 950,000

1,000,000 30,000

Accrued Interest 1 year

40,000

Remaining Term (‘n’)

The present value of the modified liability is computed as follows:

Future Cash Flows PV of 1@ 10%, Present Value

n=1

Principal 950,000 0.90909

863,636

Interest 30,000 0.90909

27,273

Present value of the modified liability

890,908

The difference between the old liability and the new liability is tested for substantiality.

Carrying amount of old liability (1M principal + 40k accrued interest)

1,040,000

Present value of the modified liability

890,908

Difference

149,092

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assignment Gcas03Document2 pagesAssignment Gcas03Damayan XeroxanNo ratings yet

- Midterm Gcas05Document3 pagesMidterm Gcas05Damayan XeroxanNo ratings yet

- Quiz 1 Ecope05Document1 pageQuiz 1 Ecope05Damayan XeroxanNo ratings yet

- Pre - Employment Orientation Seminar: Dannug, Samson Trabado September 24, 2022Document1 pagePre - Employment Orientation Seminar: Dannug, Samson Trabado September 24, 2022Damayan XeroxanNo ratings yet

- Provinces Cities Dialects Tourist Spots: Chapter IV: Literature in Ilocos and Cagayan RegionDocument3 pagesProvinces Cities Dialects Tourist Spots: Chapter IV: Literature in Ilocos and Cagayan RegionDamayan XeroxanNo ratings yet

- Activity 7 Essay Test-Joash SulitDocument1 pageActivity 7 Essay Test-Joash SulitDamayan XeroxanNo ratings yet

- Read and Answer The Following Questions BelowDocument2 pagesRead and Answer The Following Questions BelowDamayan XeroxanNo ratings yet

- Conceptual Framework and Accounting Standards 1 Overview of Accounting (Quiz 1)Document6 pagesConceptual Framework and Accounting Standards 1 Overview of Accounting (Quiz 1)Damayan XeroxanNo ratings yet

- Is Economic Growth Possible Without Economic Development?Document3 pagesIs Economic Growth Possible Without Economic Development?Damayan XeroxanNo ratings yet

- Cbtax01 Chapter 2 ActivityDocument2 pagesCbtax01 Chapter 2 ActivityDamayan XeroxanNo ratings yet

- PAS 2 (Inventories) Use The Following Information For The Next Three QuestionsDocument2 pagesPAS 2 (Inventories) Use The Following Information For The Next Three QuestionsDamayan XeroxanNo ratings yet

- ICCT Colleges Foundation, Inc.: - Activity / AssignmentDocument2 pagesICCT Colleges Foundation, Inc.: - Activity / AssignmentDamayan XeroxanNo ratings yet

- ICCT Colleges Foundation, Inc. Conceptual Framework & Accounting Standard - CBACTG01Document1 pageICCT Colleges Foundation, Inc. Conceptual Framework & Accounting Standard - CBACTG01Damayan XeroxanNo ratings yet

- Certificate of Recognition: Cleo Moselle D. Ruflo & Ma. Gelou Jane S. SuñerDocument15 pagesCertificate of Recognition: Cleo Moselle D. Ruflo & Ma. Gelou Jane S. SuñerDamayan XeroxanNo ratings yet