Professional Documents

Culture Documents

71747bos071022 Inter p8q

Uploaded by

TutulOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

71747bos071022 Inter p8q

Uploaded by

TutulCopyright:

Available Formats

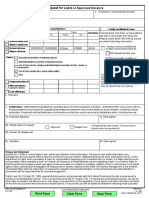

Test Series: September, 2022

MOCK TEST PAPER –1

INTERMEDIATE: GROUP – II

PAPER – 8: FINANCIAL MANAGEMENT & ECONOMICS FOR FINANCE

PAPER 8A: FINANICAL MANAGEMENT

Answers are to be given only in English except in the case of the candidates who have opted for Hindi

medium. If a candidate has not opted for Hindi medium his/ her answers in Hindi will not be valued.

Question No. 1 is compulsory.

Attempt any four questions from the remaining five questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours (Total time for 8A and 8B) Maximum Marks – 60

1. Answer the following:

(a) The capital structure of a Company is given below:

Source of capital Book Value (`)

Equity shares @ ` 100 each 24,00,000

9% Cumulative preference shares @ ` 100 each 4,00,000

11% Debentures 12,00,000

40,00,000

The company had paid equity dividend @ 25% for the last year which is likely to grow @ 5% every

year. The current market price of the company’s equity share is ` 200.

Considering corporate tax @ 30%, you are required to CALCULATE:

(i) Cost of capital for each source of capital.

(ii) Weighted average cost of capital.

(b) Following information is provided relating to SVB Ltd.:

Sales price ` 21 per unit

Variable cost ` 13.50 per unit

Break-even point 30,000 units

You are required to CALCULATE operating leverage at sales volume 37,500 units and 45,000

units.

(c) PI Limited has the following Balance Sheet as on March 31, 2020 and March 31, 2021:

Balance Sheet

Particulars March 31, 2020 March 31, 2021

Sources of Funds:

Shareholders’ Funds 87,500 87,500

Loan Funds 1,22,500 1,05,000

2,10,000 1,92,500

© The Institute of Chartered Accountants of India

Applications of Funds:

Fixed Assets 87,500 1,05,000

Cash and bank 15,750 14,000

Receivables 49,000 38,500

Inventories 87,500 70,000

Other Current Assets 35,000 35,000

Less: Current Liabilities (64,750) (70,000)

2,10,000 1,92,500

The Income Statement of the PI Ltd. for the year ended is as follows:

Particulars March 31, 2020 March 31, 2021

Sales 7,87,500 8,33,000

Less: Cost of Goods sold (7,30,100) (7,38,500)

Gross Profit 57,400 94,500

Less: Selling, General and Administrative expenses (38,500) (61,250)

Earnings before Interest and Tax (EBIT) 18,900 33,250

Less: Interest Expense (12,250) (10,500)

Earnings before Tax (EBT) 6,650 22,750

Less: Tax (1,995) (6,825)

Profits after Tax (PAT) 4,655 15,925

You are required to CALCULATE for the year 2020-21:

(i) Inventory turnover ratio

(ii) Financial Leverage

(iii) Return on Capital Employed (after tax)

(d) Following information is given for WN Ltd.:

Earnings ` 30 per share

Dividend ` 9 per share

Cost of capital 15%

Internal Rate of Return on investment 20%

You are required to CALCULATE the market price per share using-

(i) Gordon’s formula

(ii) Walter’s formula [4 × 5 Marks = 20 Marks]

2. Embros Ltd. is planning to invest in a new product with a project life of 8 years. Initial equipment cost

will be ` 35 crores. Additional equipment costing ` 2.50 crores will be purchased at the end of the third

year from the cash inflow of this year. At the end of 8 th year, the original equipment will have no resale

value, but additional equipment can be sold at 10% of its original cost. A working capital of ` 4 crores

will be needed, and it will be released at the end of 8th year. The project will be financed with sufficient

amount of equity capital.

© The Institute of Chartered Accountants of India

The sales volumes over eight years have been estimated as follows:

Year 1 2 3 4−5 6−8

Units 14,40,000 21,60,000 52,00,000 54,00,000 36,00,000

Sales price of ` 120 per unit is expected and variable expenses will amount to 60% of sales revenue.

Fixed cash operating costs will amount ` 3.60 crores per year. The loss of any year will be set off from

the profits of subsequent year. The company follows straight line method of depreciation and is subject

to 30% tax rate. Considering 12% after-tax cost of capital for this project, you are required to

CALCULATE the net present value (NPV) of the project and advise the management to take appropriate

decision.

PV factors @ 12% are:

Year 1 2 3 4 5 6 7 8

.893 .797 .712 .636 .567 .507 .452 .404

[10 Marks]

3. GT Ltd. is taking into account the revision of its credit policy with a view to increasing its sales and profit.

Currently, all its sales are on one month credit. Other information is as follows:

Contribution 2/5th of Sales Revenue

Additional funds raising cost 20% per annum

The marketing manager of the company has given the following options along with estimates for

considerations:

Particulars Current Position Option I Option II Option III

Sales Revenue (`) 40,00,000 42,00,000 44,00,000 50,00,000

Credit period (in months) 1 1½ 2 3

Bad debts (% of sales) 2 2½ 3 5

Cost of Credit administration (`) 24,000 26,000 30,000 60,000

You are required to ADVISE the company for the best option. [10 Marks]

4. A Ltd. is considering investing in new project with the following details:

Initial capital cost ` 100 Crores

Annual unit sales 1.25 Crores

Selling price ` 100 per unit

Variable cost ` 50 per unit

Fixed cost ` 12.50 Crores per year

Discounting Rate 6%

Considering life of the project as 3 years, you are required to:

(a) CALCULATE the NPV of the project.

(b) COMPUTE the impact on the project’s NPV considering a 5% adverse variance in following

variables:

(i) Selling Price per Unit

(ii) Variable Cost Per Unit

3

© The Institute of Chartered Accountants of India

(iii) Fixed Cost Per Unit

WHICH variable is having maximum effect?

(c) MEASURE the maximum sensitivity of the project to change in the variable (as found in part (b)

above) such that NPV becomes zero.

PV factors @ 6% are:

Year 1 2 3 4 5

PV Factor 0.943 0.890 0.840 0.792 0.747

[10 Marks]

5. (a) Leo Ltd. has a net operating income of ` 21,60,000 and the total capitalisation of ` 120 lakhs. The

company is evaluating the options to introduce debt financing in the capital structure and the

following information is available at various levels of debt value.

Debt value (`) Interest rate (%) Equity Capitalisation rate (%)

0 N.A. 12.00

10,00,000 7.00 12.50

20,00,000 7.00 13.00

30,00,000 7.50 13.50

40,00,000 7.50 14.00

50,00,000 8.00 15.00

60,00,000 8.50 16.00

70,00,000 9.00 17.00

80,00,000 10.00 20.00

You are required to COMPUTE the equity capitalization rate if MM approach is followed. Assume

that the firm operates in zero tax regime and calculations to be based on book values. [8 Marks]

(b) BRIEF OUT the remedies for Over-Capitalisation. [2 Marks]

6. (a) A finance executive of an organisation plays an important role in the company’s goals, policies,

and financial success. WHAT his responsibilities include? [4 Marks]

(b) WHAT is the meaning of Venture Capital Financing. STATE some characteristics of it. [4 Marks]

(c) BRIEF OUT certain sources of finance- Inter Corporate Deposits and Certificate of Deposit.

Or

STATE in brief four features of Plain Vanilla Bond. [2 Marks]

© The Institute of Chartered Accountants of India

PAPER 8B: ECONOMICS FOR FINANCE

Question 1 is compulsory

Students can answer 3 out of the 4 remaining

Maximum Marks – 40

1. (a) How the measurement of national Income in India is done? (2 Marks)

(b) What is the distinction between classical and Keynesian theory in the determination of national

income? (3 Marks)

(c) Calculate the National Income with the help of Income Method and Expenditure Method?

(5 Marks)

Item ` in crores

Net-factor income from abroad 50

Compensation of employees 1000

Net Indirect taxes 150

Rent 500

Profit 700

Private final consumption expenditure 1500

Net domestic capital formation 600

Depreciation 200

Interest 500

Mixed Income of self employed 900

Export 90

Import 60

Government final Consumption expenditure 1200

Operating surplus 1700

Employer’s Contribution to social security Scheme 250

2. (a) What do you understand by Gross Investment? (2 Marks)

(b) Elaborate the Concept of deflationary gap and how this impact the economy? (3 Marks)

(c) Calculate M3 from the following data: (3 Marks)

Components ` in Crore

Currency with the Public 15,000

Demand Deposit with Banks 12,000

Time Deposit with Banks 10,000

Other Deposit with Reserve bank 70,000

(d) Efficiency of market is affected by monopoly power: Comment. (2 Marks)

3. (a) What are the different motive for holding cash according to Keynes? (2 Marks)

(b) What is escalated tariff structure? (2 Marks)

(c) What is the relationship between money multiplier and money supply? (3 Marks)

© The Institute of Chartered Accountants of India

(d) Describe the various interventionist measures adopted by the government? (3 Marks)

4. (a) How do changes in Statutory liquidity ratio impact the economy? (2 Marks)

(b) What is meant by Foreign Portfolio Investment? (2 Marks)

(c) What is the market Outcome of Price Ceiling? (3 Marks)

(d) What is Pump Priming? (3 Marks)

5. (a) Define Public good. Why do you consider national defence as a Public good? (3 Marks)

(b) What role does market Stabilization Scheme (MSS) Play in our Economy? (3 Marks)

(c) What is the distinction between Nominal GDP and Real GDP? (2 Marks)

(d) For an Economy C = 40 + 0.75Y d,

I = 60

G= 75

Transfer Payment = 100

Income Tax = 0.2 y

Calculate the equilibrium of Income (2 Marks)

Or

What is trading Block?

© The Institute of Chartered Accountants of India

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 25 Rules For A Disciplined Forex TraderDocument26 pages25 Rules For A Disciplined Forex TraderΠαναγιώτης Πέρρος100% (6)

- 43 - Republic v. PalacioDocument1 page43 - Republic v. PalacioJoseph DimalantaNo ratings yet

- Thanks For Downloading A Sample Plan: Click Here To Save 50% Off The First Month of Liveplan!Document35 pagesThanks For Downloading A Sample Plan: Click Here To Save 50% Off The First Month of Liveplan!deshanNo ratings yet

- Mba III Services Management (14mbamm303) NotesDocument113 pagesMba III Services Management (14mbamm303) NotesZoheb Ali K100% (14)

- CIR Vs CA Case DigestDocument1 pageCIR Vs CA Case DigestEbbe DyNo ratings yet

- 71746bos071022 Inter P6aDocument10 pages71746bos071022 Inter P6aTutulNo ratings yet

- 71730bos57711 Inter p7qDocument9 pages71730bos57711 Inter p7qTutulNo ratings yet

- 71702bos57680 Inter P5aDocument14 pages71702bos57680 Inter P5aTutulNo ratings yet

- Adv Acc 70%Document17 pagesAdv Acc 70%TutulNo ratings yet

- Balaji ResumeDocument3 pagesBalaji ResumeNaveen KumarNo ratings yet

- 11.08.2020 - F7 - Interpretation of FS - Sept Dec 2019 ExamDocument12 pages11.08.2020 - F7 - Interpretation of FS - Sept Dec 2019 ExamAliNo ratings yet

- Release PPDocument27 pagesRelease PPDaut PoloNo ratings yet

- All SD PacDocument5 pagesAll SD PacPat PowersNo ratings yet

- Internal Auditing.2022Document19 pagesInternal Auditing.2022One AshleyNo ratings yet

- CHAPTER 1 - LatestDocument93 pagesCHAPTER 1 - LatestMOHAMAD ZAIM BIN IBRAHIM MoeNo ratings yet

- Bhimashankar Resume 2021Document3 pagesBhimashankar Resume 2021ashnan7866250No ratings yet

- PDF Installment Sales Reviewer Problems - CompressDocument43 pagesPDF Installment Sales Reviewer Problems - CompressMischievous Mae0% (1)

- Juicio FariasDocument21 pagesJuicio FariasAnibal Vera TudelaNo ratings yet

- Shaw AgreementDocument7 pagesShaw AgreementDennis EnnsNo ratings yet

- Hotel Invoice TemplateDocument2 pagesHotel Invoice TemplateNik RajputNo ratings yet

- Deming's Contribution To TQMDocument7 pagesDeming's Contribution To TQMMythily VedhagiriNo ratings yet

- Request For QuotationDocument4 pagesRequest For QuotationMajestyNo ratings yet

- Personal Statement - JayabayaDocument1 pagePersonal Statement - JayabayaAnang KurniawanNo ratings yet

- Sick Leave Form For Rafiullah PDFDocument1 pageSick Leave Form For Rafiullah PDFRafiullahNo ratings yet

- Project Stakeholder ManagementDocument34 pagesProject Stakeholder ManagementsampathsamudralaNo ratings yet

- IT Skill-2Document58 pagesIT Skill-2Shashwat Chaudhary100% (1)

- SOAL Kuis Materi UAS Inter 2Document2 pagesSOAL Kuis Materi UAS Inter 2vania 322019087No ratings yet

- Service & Support: Lightnin and Plenty MixersDocument8 pagesService & Support: Lightnin and Plenty MixersDima ArfNo ratings yet

- Inventories: By: Herbert B. SumalinogDocument30 pagesInventories: By: Herbert B. Sumalinogmarites yuNo ratings yet

- Academic Writing Task (Diagrams) : How To Analyse A ProcessDocument7 pagesAcademic Writing Task (Diagrams) : How To Analyse A ProcessLogdi JamesNo ratings yet

- MP Topics - IIIDocument1 pageMP Topics - IIIAnjana PriyaNo ratings yet

- Annual Report of Gulf Oil Private Limited.Document152 pagesAnnual Report of Gulf Oil Private Limited.Arun100% (1)

- ANSWER To Karen BritoDocument3 pagesANSWER To Karen BritoKaren Ryl Lozada BritoNo ratings yet

- Kpop in EconomicsDocument3 pagesKpop in EconomicsrengaboyfiesNo ratings yet