Professional Documents

Culture Documents

10 Control Sheet - Deductible Allowances

Uploaded by

Usman Ahmed ManiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Control Sheet - Deductible Allowances

Uploaded by

Usman Ahmed ManiCopyright:

Available Formats

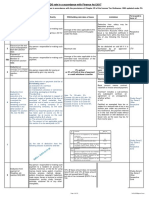

CONTROL SHEET OF DEDUCTIBLE ALLOWANCES

PREPARED BY SIR TARIQ TUNIO THE TAXMAN (ARTT 0332-2130867)

ZAKAT ► A person shall be entitled to deductible allowance for Zakat paid under Zakat and Ushr Ordinance, 1980

► Zakat that has been allowed as deduction under IFOS in respect of POD income shall not be allowed as deductible allowance.

► Deductible allowance for Zakat that is not able to be deducted shall not be refunded, carried forward to a subsequent tax year, or carried back to a preceding tax year.

WWF ► Person shall be entitled to deductible allowance for amount of Workers’ Welfare Fund paid by person under Workers’ Welfare Fund Ordinance, 1971 or under any law relating to the

Workers’ Welfare Fund enacted by Provinces after 18th Constitutional Amendment Act, 2010.

► Deductible Allowance in/res/of Workers’ Welfare Fund paid to Provinces by trans-provincial establishment shall not be allowed. [Trans-provincial means operating in two or more provinces.]

► Note: Deductible Allowance in respect of amount of Workers’ Welfare Fund paid to FBR under Workers’ Welfare Fund Ordinance, 1971 shall be allowed.

WPPF ► Person shall be entitled to deductible allowance for amount of Workers’ Participation Fund paid by person in accordance with provisions of Companies Profit (Workers’ Participation) Act,

DEDUCTIBLE 1968 or under any law relating to the Workers’ Profit Participation Fund enacted by Provinces after 18th Constitutional Amendment Act, 2010.

► Deductible allowance in respect of amount of Workers’ Profit Participation Fund paid to the province by a trans-provincial establishment shall not be allowed.

ALLOWANCE ► Note: Deductible Allowance in respect of amount of Workers’ Profit Participation Fund paid to the province by a trans-provincial establishment shall be allowed.

DEDUCTIBLE Loan Advanced by

ALLOWANCE FOR o Schedule Bank

PROFIT ON DEBT o NBFI regulated by SECP Every individual is

o Government (i.e. Federal) LOAN Deductible Allowance

o Provincial Government equal to lower of

o Local Government

o Statutory Body or

o Public Listed Company Amount of D/Allowance (A) Amount of D/Allowance (B)

- Profit or shall not exceed

- Share in rent & Share in ► 50% of taxable income or

Utilization of Loan

appreciation for value of house ► Rs. 2 million

Utilized by individual for

PAID BY AN INDIVIDUAL WHICHEVER IS LOWER

construction of new house or

acquisition of a house

DEDUCTIBLE Every Individual Which Individual? Either of the parents making payment of the fee

ALLOWANCE FOR Shall be entitled to Subject to Condition that Taxable Income of the Individual for the tax year does not exceed Rs. 1.5 m

EDUCATION EXPENSE

DEDUCTIBLE ALLOWANCE ► Allowed Against tax liability of either of the parents making payment of fee on furnishing NTN or name of educational institution

IN/RES/OF TUITION PAID ► Allowance or part of it allowed under this section that is not able to be deducted shall not be carried forward.

Amount of D/A shall be equal to

lesser of

5% of total tuition 25% of person’s Amount = No. of

fee paid taxable income Children x 60,000

You might also like

- NMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationDocument49 pagesNMIMS - Session 4 - Withholding Taxes TDS and TCS On Sale of Goods Software TaxationSachin KandloorNo ratings yet

- Direct Taxes - I - Unit 1, Unit 2, Unit 3, Unit 5Document23 pagesDirect Taxes - I - Unit 1, Unit 2, Unit 3, Unit 5JayNo ratings yet

- Clubbing of Income Income Tax India AY 2008-09Document5 pagesClubbing of Income Income Tax India AY 2008-09snehal2402No ratings yet

- Exclusions From Gross IncomeDocument5 pagesExclusions From Gross IncomeJade Berlyn AgcaoiliNo ratings yet

- Income Tax TheoryDocument28 pagesIncome Tax Theorynextgensolution44No ratings yet

- Tax Rates 2078-79 - 20210719125127Document17 pagesTax Rates 2078-79 - 20210719125127shankarNo ratings yet

- MasterSheet 08 On DedAllownce, Losses&ExemptionsDocument1 pageMasterSheet 08 On DedAllownce, Losses&ExemptionsabdullahNo ratings yet

- Chapter5TrustandEstate Exerciseslumbera LalusinDocument12 pagesChapter5TrustandEstate Exerciseslumbera Lalusinjay-r Gutierrez100% (1)

- Warm Bodies (Isaac Marion)Document4 pagesWarm Bodies (Isaac Marion)elizabeth angelNo ratings yet

- Tax Fee Cess SurchargeDocument6 pagesTax Fee Cess SurchargevihankaNo ratings yet

- TDS Rate in Nepal FY 79-80-2Document9 pagesTDS Rate in Nepal FY 79-80-2guptapawan23450No ratings yet

- Unit 2 Income From SalariesDocument21 pagesUnit 2 Income From SalariesShreya SilNo ratings yet

- Tax Deduction at Source (TDS)Document15 pagesTax Deduction at Source (TDS)yierbNo ratings yet

- Far Eastern University: An Institute of Accounts Business and FinanceDocument5 pagesFar Eastern University: An Institute of Accounts Business and FinanceAcademic StuffNo ratings yet

- Salary Tax Presentation 22 Aug 2016Document24 pagesSalary Tax Presentation 22 Aug 2016kabirakhan2007No ratings yet

- Salary PDF New 1Document20 pagesSalary PDF New 1NITESH SINGHNo ratings yet

- Salary PDFDocument12 pagesSalary PDFNITESH SINGHNo ratings yet

- Salary PDF New 2Document20 pagesSalary PDF New 2NITESH SINGHNo ratings yet

- Finance Act 2020 Highlights Final LSRDocument6 pagesFinance Act 2020 Highlights Final LSRBarakaNo ratings yet

- Chapter 4 - Co-Ownership, Estates and TrustsDocument8 pagesChapter 4 - Co-Ownership, Estates and TrustsLiRose SmithNo ratings yet

- Quick Super Guide PDFDocument4 pagesQuick Super Guide PDFAnnie LamNo ratings yet

- Deductions From Gross Total IncomeDocument4 pagesDeductions From Gross Total Income887 shivam guptaNo ratings yet

- DTAA Nepal Final PDFDocument17 pagesDTAA Nepal Final PDFSichen UpretyNo ratings yet

- Tax Planning in Respect of Employee's Remuneration ProjrctDocument15 pagesTax Planning in Respect of Employee's Remuneration ProjrctPreyNo ratings yet

- TAX667 - Chap2 - TrustsDocument30 pagesTAX667 - Chap2 - TrustsNFN FaraNo ratings yet

- FABM2 12 Q2 M5 Income and Business Taxation V5 PDFDocument19 pagesFABM2 12 Q2 M5 Income and Business Taxation V5 PDFLady Hara100% (1)

- Lesson 2 (2 Hours) Taxes, Tax Laws and Tax Administration: Knowledge Engineer: Mark John D. Gonzales, Cpa, CTT, CHTS, MPBMDocument7 pagesLesson 2 (2 Hours) Taxes, Tax Laws and Tax Administration: Knowledge Engineer: Mark John D. Gonzales, Cpa, CTT, CHTS, MPBMtayrayrmp68No ratings yet

- Tax 301 Income Taxation Module 4 Co Ownership, Estates and TrustDocument6 pagesTax 301 Income Taxation Module 4 Co Ownership, Estates and TrustKristine hazzel ReynoNo ratings yet

- Tax Rates 2079-80 PDFDocument18 pagesTax Rates 2079-80 PDFKumar SubediNo ratings yet

- Intro Duty To Notify & Register: ST STDocument3 pagesIntro Duty To Notify & Register: ST STAnis AmeeraNo ratings yet

- Last Minute Notes DeductionDocument2 pagesLast Minute Notes DeductionPrincess Helen Grace BeberoNo ratings yet

- Taxation of Residual Income: Cma K.R. RamprakashDocument25 pagesTaxation of Residual Income: Cma K.R. RamprakashShriya JoseincheckalNo ratings yet

- Co-Ownership, Estate and TrustDocument6 pagesCo-Ownership, Estate and TrustRyan Christian Balanquit100% (2)

- Tax Rate For EntityDocument5 pagesTax Rate For EntitySantosh ChhetriNo ratings yet

- Understanding Taxation of Trust in IndiaDocument22 pagesUnderstanding Taxation of Trust in IndiaVipul DesaiNo ratings yet

- Learning Plan FABM 2 3-2 Q2Document11 pagesLearning Plan FABM 2 3-2 Q2Zeus MalicdemNo ratings yet

- Answer: F6 - Taxation - RevisionDocument50 pagesAnswer: F6 - Taxation - RevisionScratchmen ApooNo ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- Notes - Income From SalaryDocument13 pagesNotes - Income From SalarySajan N ThomasNo ratings yet

- Taxation Law Answers in Assignment and QuizDocument9 pagesTaxation Law Answers in Assignment and QuizAngie JosolNo ratings yet

- Income Under The Head Other SourcesDocument2 pagesIncome Under The Head Other Sources887 shivam guptaNo ratings yet

- Taxation Law I: Estates and TrustsDocument13 pagesTaxation Law I: Estates and TrustsLouie EllaNo ratings yet

- Form W-5 Advanced EIC PaymentsDocument3 pagesForm W-5 Advanced EIC PaymentsSami HartsfieldNo ratings yet

- CTP SalariesDocument11 pagesCTP SalariesankushdeshmukhNo ratings yet

- TDS VDS Rate Thorugh FA 2017.pdf 1348997815Document10 pagesTDS VDS Rate Thorugh FA 2017.pdf 1348997815Abu KawcherNo ratings yet

- FBDC Vs CIRDocument41 pagesFBDC Vs CIRGreg PascuaNo ratings yet

- Direct TaxDocument13 pagesDirect TaxUMMYSALMA DAMANIANo ratings yet

- What Is TaxDocument5 pagesWhat Is TaxVenkatesh YerramsettiNo ratings yet

- Chapter 13-BDocument4 pagesChapter 13-BCARINO, GILLE ANNE MAE P.No ratings yet

- Estate Tax: Sample ComputationDocument24 pagesEstate Tax: Sample ComputationMarkein Dael VirtudazoNo ratings yet

- Employee Provident FundDocument4 pagesEmployee Provident Fundhr.prefortuneNo ratings yet

- Interpretation Statement: Is 12/02 Income Tax - Whether Income Deemed To Arise Under Tax Law, But Not Trust Law, Can Give Rise To Beneficiary IncomeDocument28 pagesInterpretation Statement: Is 12/02 Income Tax - Whether Income Deemed To Arise Under Tax Law, But Not Trust Law, Can Give Rise To Beneficiary Income31025442743No ratings yet

- ACC202 Employment Income NotesDocument11 pagesACC202 Employment Income NotesPhebieon MukwenhaNo ratings yet

- Chapter 8 6Document116 pagesChapter 8 6Yogesh SharmaNo ratings yet

- Fabm2 q2 Module 4 TaxationDocument17 pagesFabm2 q2 Module 4 TaxationLady HaraNo ratings yet

- Personal Income TaxDocument73 pagesPersonal Income TaxNhung HồngNo ratings yet

- LMT Jurists TaxDocument24 pagesLMT Jurists TaxAtty. Raffy RoncalesNo ratings yet

- 21 Inclusion and Exclusion of GiDocument15 pages21 Inclusion and Exclusion of GiAlmineNo ratings yet

- Philippine Bank of Communications V CIR Et Al - G.R. No. 119024 - Jan 28, 1999 - DIGESTDocument2 pagesPhilippine Bank of Communications V CIR Et Al - G.R. No. 119024 - Jan 28, 1999 - DIGESTAaron Ariston100% (2)

- IloiloVs PPADocument2 pagesIloiloVs PPACheryl QueniahanNo ratings yet

- Public Finance and Taxation (ch-1)Document26 pagesPublic Finance and Taxation (ch-1)yebegashet50% (2)

- Tridharma Marketing Corporation vs. Court of Tax Appeals, Second Division, 794 SCRA 126, June 20, 2016Document15 pagesTridharma Marketing Corporation vs. Court of Tax Appeals, Second Division, 794 SCRA 126, June 20, 2016j0d3No ratings yet

- Solved Firm L Has 500 000 To Invest and Is Considering TwoDocument1 pageSolved Firm L Has 500 000 To Invest and Is Considering TwoAnbu jaromiaNo ratings yet

- Venue & Time of Filing & PaymentDocument2 pagesVenue & Time of Filing & PaymentLiyana ChuaNo ratings yet

- Reinvigorated RateDocument1 pageReinvigorated RateDayanara CuevasNo ratings yet

- Pre-Midterm Examination - TaxationDocument5 pagesPre-Midterm Examination - TaxationCarla Jane ApolinarioNo ratings yet

- Federal and Fedral Features of Indian ConstitutionDocument7 pagesFederal and Fedral Features of Indian Constitutionurvi solankiNo ratings yet

- Numerical Problems For Module II and IIIDocument6 pagesNumerical Problems For Module II and IIIRiya LalNo ratings yet

- Manila Memorial Park, Inc. and La Funeraria Paz-Sucat, Inc., PetitionersDocument21 pagesManila Memorial Park, Inc. and La Funeraria Paz-Sucat, Inc., PetitionersRyan Jhay YangNo ratings yet

- UPSC Civil Services Examination: UPSC Notes (GS-I) Topic: Permanent Settlement (Modern Indian History Notes For UPSC)Document2 pagesUPSC Civil Services Examination: UPSC Notes (GS-I) Topic: Permanent Settlement (Modern Indian History Notes For UPSC)draxNo ratings yet

- South Sudan Taxation SystemDocument16 pagesSouth Sudan Taxation SystemNoahIssa0% (1)

- Ann Entrepreneurship 2ndDocument15 pagesAnn Entrepreneurship 2ndJudy Ann FaustinoNo ratings yet

- IDT MTP Oct'20Document16 pagesIDT MTP Oct'20Babu GupthaNo ratings yet

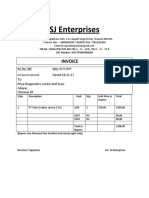

- SJ Enterprises: InvoiceDocument1 pageSJ Enterprises: InvoiceSrividhya ManikandanNo ratings yet

- Income Taxation 01 Chapter 1 SummaryDocument8 pagesIncome Taxation 01 Chapter 1 SummarySha LeenNo ratings yet

- Payment Form: Voluntary Assessment and Payment Program (VAPP)Document2 pagesPayment Form: Voluntary Assessment and Payment Program (VAPP)Joel SyNo ratings yet

- Tax Exempt FormDocument1 pageTax Exempt Formjuan camaneyNo ratings yet

- Manual TAX 1. 2019 20 PDFDocument35 pagesManual TAX 1. 2019 20 PDFkNo ratings yet

- Chapter 3 - From Tin To PetroleumDocument26 pagesChapter 3 - From Tin To PetroleumMeesaa KbaiiNo ratings yet

- Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageCertificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)fernandoNo ratings yet

- Epiphany by The Madras High Court in TRAN-1 Debate: CompendiumDocument6 pagesEpiphany by The Madras High Court in TRAN-1 Debate: CompendiumM.KARTHIKEYANNo ratings yet

- Business Taxation Midterm Quiz 1 2 PhineeeDocument4 pagesBusiness Taxation Midterm Quiz 1 2 PhineeeKaxy PHNo ratings yet

- Evaluate Government Policies To Promote Equity in Terms of Their Potential Positive or Negative Effects On Efficiency in The Allocation of ResourcesDocument3 pagesEvaluate Government Policies To Promote Equity in Terms of Their Potential Positive or Negative Effects On Efficiency in The Allocation of ResourcesHotcurry 26No ratings yet

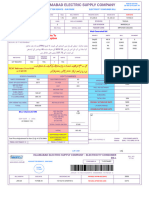

- January BillDocument1 pageJanuary Billy4919952No ratings yet

- Final Presentation Con WorldDocument13 pagesFinal Presentation Con WorldMarjorie O. MalinaoNo ratings yet

- Municipal Assessor'S Office External ServicesDocument10 pagesMunicipal Assessor'S Office External ServicesMarven JuadiongNo ratings yet

- TAXN Module 4Document5 pagesTAXN Module 4Brandon VicarmeNo ratings yet

- Strictissimi Juris Rule On Tax ExemptionsDocument2 pagesStrictissimi Juris Rule On Tax ExemptionsSamantha ReyesNo ratings yet