Professional Documents

Culture Documents

A - Mock PSPM Set 2

Uploaded by

IZZAH NUR ATHIRAH BINTI AZLI MoeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A - Mock PSPM Set 2

Uploaded by

IZZAH NUR ATHIRAH BINTI AZLI MoeCopyright:

Available Formats

ANSWERS

QUESTION 1

(a)

Predetermined OH rate = 𝑅𝑀250,000

𝑅𝑀200,000

X100%

=

125%

(b) Applied MOH for each job

111 222 333

= RM35,000 x 125% = RM65,000 x 125% = RM80,000 x 125%

= RM43,750 = RM81,250 = RM100,000

(c) Total cost for each jobs

111 222 333 Total

(RM) (RM) (RM) (RM)

Direct material 145,000 320,000 55,000 520,000

Direct labour 35,000 65,000 80,000 180,000

Applied MOH 43,750 81,250 100,000 225,000

Total cost 223,750 466,250 235,000 925,000

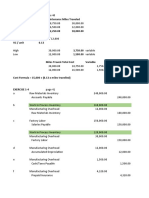

(d) Related journal entries

Date Particulars Dr. Cr.

(RM) (RM)

Work in Process Inventory 520,000

Raw Materials Inventory 520,000

Work in Process Inventory 180,000

Salaries Payable 180,000

Work in Process Inventory 225,000

Manufacturing Overhead 225,000

Manufacturing Overhead 233,000

Expenses payable/Accounts payable/Cash 233,000

Finished Goods Inventory 690,000

Work in Process Inventory 690,000

Cost of Goods Sold 690,000

Finished Goods Inventory 690,000

Accounts Receivable 1,210,000

Sales 1,210,000

(e) Journal entry for under-applied

Date Particulars Dr. Cr.

(RM) (RM)

Cost of Goods Sold 8,000

Manufacturing Overhead 8,000

(225,000 – 233,000)

QUESTION 2

(a)

Pokok Industries Sdn Bhd

Production Cost Report – Processing Department

For the Month Ended 30 April 2021

Physical

Units

QUANTITIES :

Units to account for:

Beginning WIP 8,000

Started 28,000 EQUIVALENT UNITS

Total Units 36,000 Direct Conversion

Units accounted for: Materials Costs

Completed 33,000 33,000 33,000

Ending WIP 3,000 *3,000 **1,500

Total Units 36,000 36,000 34,500

COSTS : Direct Conversion Total

Costs to account for: Materials Costs

(RM) (RM) (RM)

Beginning WIP 11,300 ***16,800 28,100

Cost added during period 33,700 ****128,100 161,800

Total Costs 45,000 144,900 189,900

÷ Equivalent Units ÷36,000 ÷34,500 -

Cost per Equivalent Unit RM 1.25 RM4.20 RM5.45

COST RECONCILIATION SCHEDULE

Costs accounted for: (RM)

Completed and transferred out (33,000 units x RM5.45) 179,850

Ending Work-in-process: (RM)

Direct Materials (3,300 units x RM1.25) 3,750

Conversion Costs (1,500 units x RM4.20) 6,300

Total 10,050

Total Costs 189,900

*3,000 x 100% ***RM 10,800 + RM 6,000

**3,000 x 50% ***RM 70,000 + RM 58,100

(b) Journal entries to record current cost and cost transferred-out.

Date Particulars Dr. Cr.

April 30 Work in Process Inventory: Processing Department 189,900

Raw Materials Inventory 33,700

Salaries Payable 70,000

Manufacturing Overhead 58,100

(To record current costs of Processing Department)

Work in Process Inventory: Packaging Department 179,850

Work in Process Inventory: Processing Department√ 179,850

(To record cost transferred-out from Processing Department)

QUESTION 3

(a)

(i) Absorption Costing:

Direct material cost RM10

Direct labour cost RM8

Variable Overhead cost RM400000

100,000 RM4

Fixed Overhead cost RM800000

100,000 RM8

Total product cost per unit RM30

Al-sejati Sdn. Bhd.

Statement of Comprehensive Income – Absorption Costing

For the year ended 31 December 2021

Sales (RM 60 x 17,000) 1,020,000

Less Cost of goods sold :

Beginning Inventory (RM 30 x 3,000) 90,000

+ Cost of goods manufactured (RM30 x 18,000) 540,000

Cost of Goods available for sales 630,000

–Ending Inventory (RM 30 x 4,000) (120,000)

Cost of goods sold 510,000

Under-applied Manufacturing Overhead 3,000

Adjusted Cost of goods sold (513,000)

Gross profit 507,000

Less Operating expenses:

Fixed selling and administrative 185,000

Variable selling and administrative (RM 8 x 17,000) 136,000 (321,000)

Net profit 186,000

Working:

Absorption costing

Actual variable Overhead (18,000 x 4) RM 72,000

- Variable applied Overhead (18,000 x 4) RM 72,000

Under-applied Variable overhead RM 0

Actual fixed Overhead RM 147,000

- Fixed applied Overhead (18,000 x 8) RM 144,000

Under-applied Fixed overhead RM 3,000

Overall: MOH underapplied RM3,000

(iii) Marginal Costing :

Direct material cost RM10

Direct labour cost RM8

Variable Overhead cost RM4

Total product cost per unit RM 22

(iv)

Al-sejati Sdn. Bhd.

Statement of Comprehensive Income – Marginal Costing

For the year ended 31 December 2021

Sales (RM 60 x 17,000) 1,020,000

Less Variable cost

Variable cost:

Beginning inventory (RM 22 x 3,000) 66,000

+ Cost of goods manufactured(RM 22 x 18,000) 396,000

Cost of goos available for sales 462,000

– Ending Inventory (RM 22 x 4,000) ( 88,000)

Variable cost of goods sold 374,000

+ Variable selling and administrative (RM 8 x 17,000) 136,000

Total Variable cost (510,000)

Contribution margin 510,000

- Fixed cost:

Fixed selling and administrative 185,000

Fixed overhead 147,000 (332,000)

Net profit 178,000

(b)

i) Direct Material

AQ X AP AQ X SP SQ X SP

45,000 x 1.40 (20,000 x 2) x 1.40

67500 =63,000 =56,000

Price variance Quantity variance

4500 (UF) 7,000 (UF)

ii) Direct Labour

AH X AR AH X SR SH X SR

120,000 x 2 (20,000 x 4) X 2

300,000 =240,000 =160,000

Labour price variance Efficiency variance

60,000(UF) 80,000(UF)

QUESTION 4

(a)

(i)

Reject Accept Net income

Increase / Decrease

RM RM

Sales (6,000 x 1.60) 9,600 9,600

(Less) Variable costs

Direct materials 3,540 3,540

(17,550/45,000 + 0.20) x 6,000)

Direct labour (9,450/ 45,000 x 6,000) 1,260 1,260

Variable Manufacturing Overhead 1,800 1,800

(13,500/45,000 x 6,000)

Packed and distributed 900 900

(150 x 6)

Contribution margin 2,100 2,100

Sales unit = 126,000/2.80 = 45,000

(ii) Acceptance of this order will increase company profit RM2,100.

(b)

Make Buy Net Income

Increase/ (Decrease)

RM RM RM

Direct materials 124,000 124,000

(3.10 x 40000)

Direct labour 108,000 108,000

(2.70 x 40000)

Variable manufacturing 24,000 24,000

overhead

(0.60 x 40000)

Fixed manufacturing 100000 86,000 14,000

overhead or or

(0.35 x 40,000) 14,000 -

Buy from outside 288,000 (288,000)

(7.20 x 40000)

Opportunity costs 25,000

Total costs 381,000 374,000 7,000

or or

295,000 288,000

Megah Jaya Sdn Bhd should buy the component from outside to save RM7,000.

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Metrics CGMDocument128 pagesMetrics CGMFrank Galvan100% (1)

- Risk Assessment What Work Excavation Work With Help of JCB Location PM Warehouse Area Contractor Company-Aalanna Project PVT LTDDocument2 pagesRisk Assessment What Work Excavation Work With Help of JCB Location PM Warehouse Area Contractor Company-Aalanna Project PVT LTDhemant yadav0% (1)

- G-6 Manufacture of Phosphoric Acid.Document86 pagesG-6 Manufacture of Phosphoric Acid.Pawan SuvarnaNo ratings yet

- IBT Outline F09Document74 pagesIBT Outline F09emin_karimov100% (3)

- AA025 PYQ 2015 - 2014 (ANS) by SectionDocument4 pagesAA025 PYQ 2015 - 2014 (ANS) by Sectionnurauniatiqah49No ratings yet

- GE CW - Module 1Document25 pagesGE CW - Module 1gio rizaladoNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Accounting & Finance Assignment 1 - Updated 1.0Document15 pagesAccounting & Finance Assignment 1 - Updated 1.0lavania100% (1)

- Accounting & Finance Assignment 1 - Updated 2.0Document15 pagesAccounting & Finance Assignment 1 - Updated 2.0lavania0% (1)

- Cost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7Document7 pagesCost Accounting: 1/4/2010 10:55:09 AM Page 1 of 7meelas123No ratings yet

- SKEMA PSPM 17-18 AA025Document4 pagesSKEMA PSPM 17-18 AA025Dehey KNo ratings yet

- ANSWER PSPM AA025 0708 by SectionDocument6 pagesANSWER PSPM AA025 0708 by SectionRISNATUL UZMA HELMI RIZAL100% (1)

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Jawaban CH 3 (2) Problem 3-43 AKB ASLABDocument5 pagesJawaban CH 3 (2) Problem 3-43 AKB ASLABRantiyaniNo ratings yet

- Acc Assignment Sem 2Document23 pagesAcc Assignment Sem 2Luqman HaqimNo ratings yet

- Budgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Document3 pagesBudgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Yanwar A MerhanNo ratings yet

- Working CapitalDocument2 pagesWorking CapitalPayal bhatiaNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- PCMR Electronics Implements ABC Costing for Two Calculator ModelsDocument1 pagePCMR Electronics Implements ABC Costing for Two Calculator ModelsOrduna Mae Ann0% (1)

- BS230 - Assignment #2Document8 pagesBS230 - Assignment #2Malcolm TumanaNo ratings yet

- 12914sugg_pe2_gp2_1Document33 pages12914sugg_pe2_gp2_1harshrathore17579No ratings yet

- Acc Assign Sem 2Document7 pagesAcc Assign Sem 2xuanylimNo ratings yet

- Brocher Solution Problem 5-51Document5 pagesBrocher Solution Problem 5-51Alif ArmadanaNo ratings yet

- Cost Sheet: (-) Sales of WastageDocument1 pageCost Sheet: (-) Sales of WastageAuras Raj PantaNo ratings yet

- BaenDocument8 pagesBaenBrian ChoiNo ratings yet

- MAF Assignment QuestionDocument13 pagesMAF Assignment QuestionKietHuynhNo ratings yet

- Business Accounting and Finance: QUESTION 1 (P17-2A)Document9 pagesBusiness Accounting and Finance: QUESTION 1 (P17-2A)sang_ratu_1No ratings yet

- Budgeted Statement ExamDocument11 pagesBudgeted Statement ExamNelz KhoNo ratings yet

- Tutorial OverheadDocument6 pagesTutorial OverheadImran FarhanNo ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- Chap 03Document10 pagesChap 03Farooq HaiderNo ratings yet

- Costing Methods and SpoilageDocument8 pagesCosting Methods and SpoilageMichael Christsanto ImanuelNo ratings yet

- Group 2 May 07Document73 pagesGroup 2 May 07princeoftolgate100% (1)

- Tas Bhd Cost Statement AnalysisDocument8 pagesTas Bhd Cost Statement AnalysisbiarrahsiaNo ratings yet

- Tugas-Kasus - 4.12Document3 pagesTugas-Kasus - 4.12niti dsNo ratings yet

- Cost Accounting: Allocation Basis Alpha Beta Gamma TotalDocument6 pagesCost Accounting: Allocation Basis Alpha Beta Gamma TotalShehrozSTNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsDocument12 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting and Reporting First Preboard Examination SolutionsSophia PerezNo ratings yet

- Review of Cost Acctg 1Document9 pagesReview of Cost Acctg 1Shane TorrieNo ratings yet

- Process and Operating CostingDocument20 pagesProcess and Operating CostingBHANU PRATAP SINGHNo ratings yet

- EXERCISES AND PROBLEMSDocument5 pagesEXERCISES AND PROBLEMSSally Ubando Delos ReyesNo ratings yet

- P21-1A Journal Entries for Raw Material, WIP, Factory Overhead, Finished Goods and Cost of Goods SoldDocument8 pagesP21-1A Journal Entries for Raw Material, WIP, Factory Overhead, Finished Goods and Cost of Goods SoldVõ Huỳnh BăngNo ratings yet

- ACCT3203 Contemporary Managerial Accounting: Lecture Illustration Examples With SolutionsDocument10 pagesACCT3203 Contemporary Managerial Accounting: Lecture Illustration Examples With SolutionsJingwen YangNo ratings yet

- Cost Accounting (CC) (Code: 52414404) : AssignmentDocument4 pagesCost Accounting (CC) (Code: 52414404) : AssignmentAnkushNo ratings yet

- Cost Elements BreakdownDocument6 pagesCost Elements BreakdownNed Neddy NeddieNo ratings yet

- Solution DEC 19Document8 pagesSolution DEC 19anis izzatiNo ratings yet

- @ProCA - Inter Contract Costing Past Exam QuestionsDocument10 pages@ProCA - Inter Contract Costing Past Exam QuestionscallbvipinjainNo ratings yet

- Assignment 1 2Document6 pagesAssignment 1 2Elite ProgramNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Calculating manufacturing overhead rate and cost of goods soldDocument7 pagesCalculating manufacturing overhead rate and cost of goods soldOmar SoussaNo ratings yet

- Solutions To Exercises: 2-1. (1) Beginning Direct Materials - 8/1Document8 pagesSolutions To Exercises: 2-1. (1) Beginning Direct Materials - 8/1EfrenNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Revision Question Topic 3,4-AnswerDocument5 pagesRevision Question Topic 3,4-AnswerNur WahidaNo ratings yet

- Quiz Absorption and Variable CostingDocument2 pagesQuiz Absorption and Variable CostingPISONANTA KRISETIANo ratings yet

- P1 Question Bank - CH 1 and 2Document29 pagesP1 Question Bank - CH 1 and 2prudencemaake120No ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- F5 Solution 1 & 2Document2 pagesF5 Solution 1 & 2dy sovathNo ratings yet

- Activity 4 Cost Accounting Answer KeyDocument6 pagesActivity 4 Cost Accounting Answer KeyJamesNo ratings yet

- MPP Acca Icma Model PaperDocument19 pagesMPP Acca Icma Model PaperDev RajNo ratings yet

- Part-A - Strategic Management Accounting: Multiple Choice Questions (MCQS)Document33 pagesPart-A - Strategic Management Accounting: Multiple Choice Questions (MCQS)ARIF HUSSAIN AN ENGLISH LECTURER FOR ALL CLASSESNo ratings yet

- BACC232 .309 MANAGEMENT ACCOUNTING ASSIGNMENT 1 (1)Document13 pagesBACC232 .309 MANAGEMENT ACCOUNTING ASSIGNMENT 1 (1)TarusengaNo ratings yet

- Cost relevant for decision makingDocument2 pagesCost relevant for decision makingIZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Chapter 1 Aa025 KMJDocument12 pagesChapter 1 Aa025 KMJIZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Chapter 3Document7 pagesChapter 3IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- 2016 Global CEO Outlook - Executive Summary - StaticDocument26 pages2016 Global CEO Outlook - Executive Summary - StaticYe PhoneNo ratings yet

- William HalalDocument11 pagesWilliam HalalFarrukh JamilNo ratings yet

- Letter Compendium NO NOA ENDocument9 pagesLetter Compendium NO NOA ENBoban TrpevskiNo ratings yet

- Int Case StudiesDocument195 pagesInt Case StudiesAlexandra MonicaNo ratings yet

- Bgy Appropriations & Commitments Revised .5.8.07Document48 pagesBgy Appropriations & Commitments Revised .5.8.07AnnamaAnnama100% (1)

- Project Profile On Groundnut Oil and Oil Cake Manuafcuring PDFDocument2 pagesProject Profile On Groundnut Oil and Oil Cake Manuafcuring PDFnathaanmani100% (2)

- Microfinance PulseDocument24 pagesMicrofinance PulseNitin GuptaNo ratings yet

- Trade Finance PresentationDocument32 pagesTrade Finance Presentations10032No ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument61 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRamNo ratings yet

- 1991 Indian Economic Crisis and Reforms v4Document20 pages1991 Indian Economic Crisis and Reforms v4Hicham Azm100% (1)

- Draft 2Document61 pagesDraft 2jeyologyNo ratings yet

- Dairy Milk in FranceDocument3 pagesDairy Milk in FrancemeanestNo ratings yet

- NWPC Institutional BrochureDocument2 pagesNWPC Institutional BrochureThoughts and More ThoughtsNo ratings yet

- Ash Utilisation in TATADocument5 pagesAsh Utilisation in TATAUdhayakumar VenkataramanNo ratings yet

- Rise of RobotsDocument9 pagesRise of RobotsPep SS100% (1)

- Solar Powered E-bike System DesignDocument7 pagesSolar Powered E-bike System DesignifyNo ratings yet

- 1final. Nature and Importance of Agriculture2013Document410 pages1final. Nature and Importance of Agriculture2013Mara Jean Marielle CalapardoNo ratings yet

- Management Theory FrameworkDocument3 pagesManagement Theory FrameworkNaveed KhanNo ratings yet

- ch06 IMDocument7 pagesch06 IMlokkk333No ratings yet

- 6globalization and The Asia Pacific and South Asia (27-29)Document3 pages6globalization and The Asia Pacific and South Asia (27-29)Tam Gerald Calzado75% (4)

- FXPrimus EuropeDocument3 pagesFXPrimus EuropeEmil TangNo ratings yet

- City Limits Magazine, January 1979 IssueDocument20 pagesCity Limits Magazine, January 1979 IssueCity Limits (New York)No ratings yet

- Reforming Sri Lanka's Centralized University System Through Liberalization and CompetitionDocument2 pagesReforming Sri Lanka's Centralized University System Through Liberalization and Competitionireshad21No ratings yet

- Notice: Options Price Reporting Authority: Xiiva Holdings, Inc.Document2 pagesNotice: Options Price Reporting Authority: Xiiva Holdings, Inc.Justia.comNo ratings yet